- History- Quant Mutual Fund

- VLRT – A Investment Philosophy

- Overview – Quant Active Fund

- Investment Details

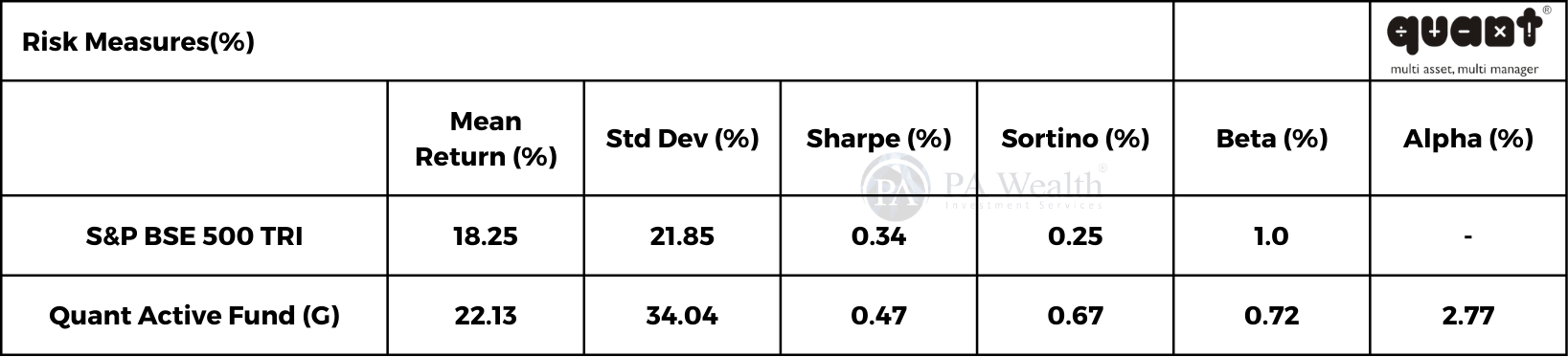

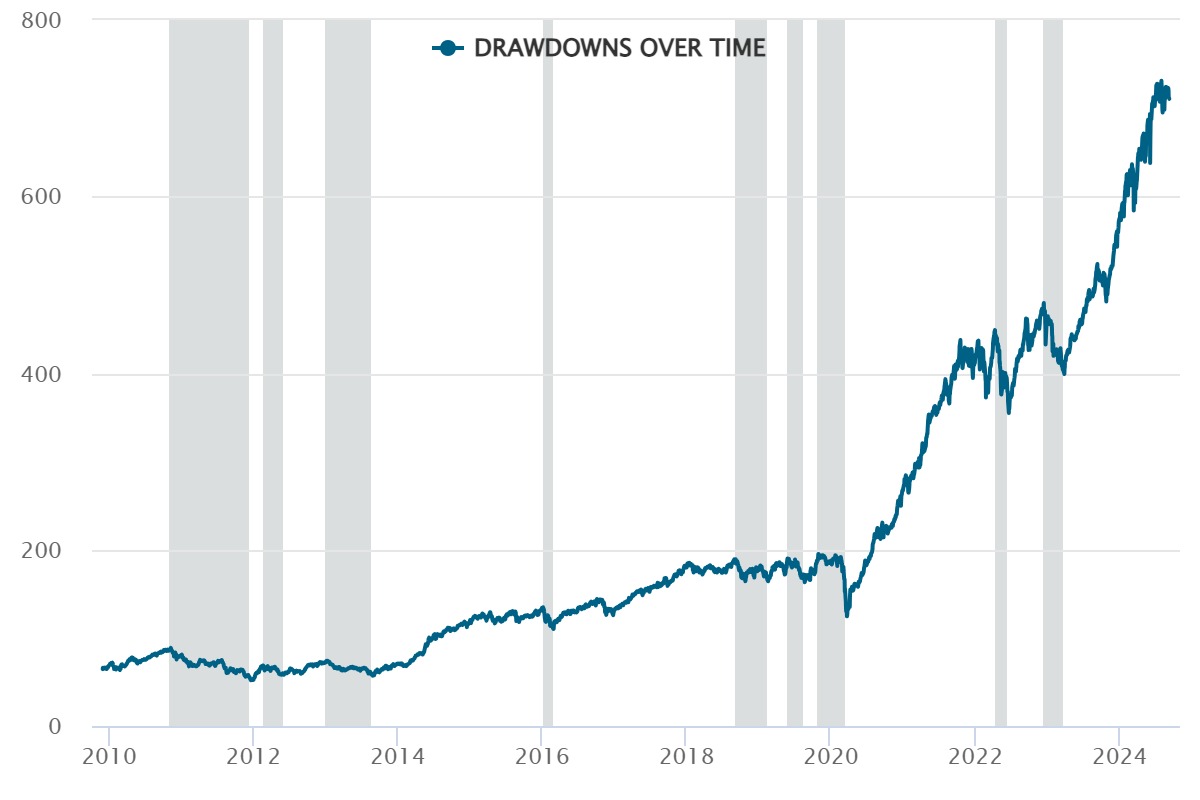

- Risk Analysis

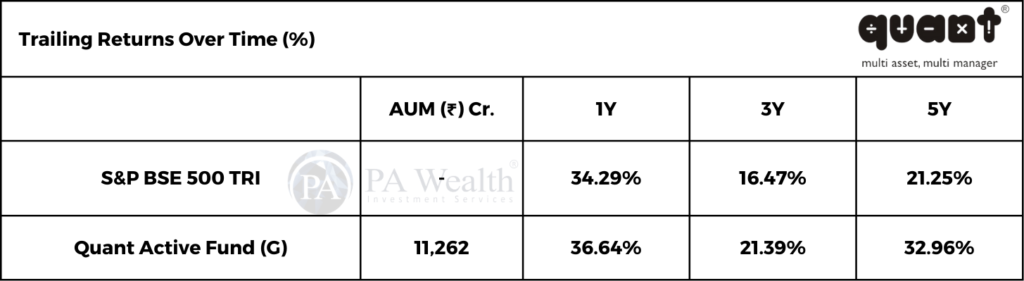

- Performance of the fund

- Asset allocation

- Fund Managers

- Taxability on earnings

(A) A Short & Crisp story of Quant Mutual Fund

Having Discussion on mutual funds, it is not possible that Quant name does not come up! Correct?

But, those who never heard about this fund Name, well, the Quant Fund is one of the leading and strong mutual fund in Indian Mutual Funds Industry.

Basically, Quant Mutual Funds is one of the leading and strong mutual fund House. The Fund was introduced in the 2018 by the fund house Quant Capital which acquired Escorts Mutual Fund. Before Quant Capital, this fund was managed by Escorts Fund which had an AUM of just ₹150cr.

However, After the change in hands, the Fund grew exponentially by almost 35x Times to Rs 5000 Cr.

(B) Investment Philosophy by Quant Fund House

The Quant Active Fund has adopted a Framework called VLRT. VLRT is nothing but “Valuation, Liquidity, Risk and Timing. In simple words, the framework/philosophy tells about the dynamic approach for selecting stocks which is not bound from any terms.

(C) Overview – Quant Active Fund

| Fund House | Quant Mutual Fund |

| Category | Equity: Multi-Cap |

| Launch date | 19-Feb-2001 |

| Type | Open-ended |

| AUM | Rs. 11,262 Cr (As on 01 Aug 2024) |

| Available at NAV of | Rs. 710.68 (As of 09 Sep 2024) |

The Quant Active Fund is a Multi Cap mutual fund. The scheme is offered by the house of Quant Mutual Fund. This fund has been in existence for past 4 yrs, and was launched on 19th Feb 2001.

The primary investment objective of the scheme is to seek to generate capital appreciation & provide long-term growth opportunities by investing in a portfolio of Large Cap, Mid Cap and Small Cap companies. There is no assurance that the investment objective of the Scheme will be realized.

(D) Investment Details

| Quant Active Fund | |

|---|---|

| Application Amount for fresh Subscription | ₹5,000 |

| Min Additional Investment | ₹1,000 |

| Minimum SIP Investment | ₹1,000 |

| Entry Load | Nil |

| Exit load | 1%* |

| Lock In | No |

| Expense Ratio | 1.70% (As on 31 Aug 2024) |

(E) Risk Factors

(i) Valuation Measures

(ii) Top Drawdowns

(F) Returns Generated By The Fund

(G) Classification Portfolio of the fund

(i) Portfolio Mix by Market Cap Size

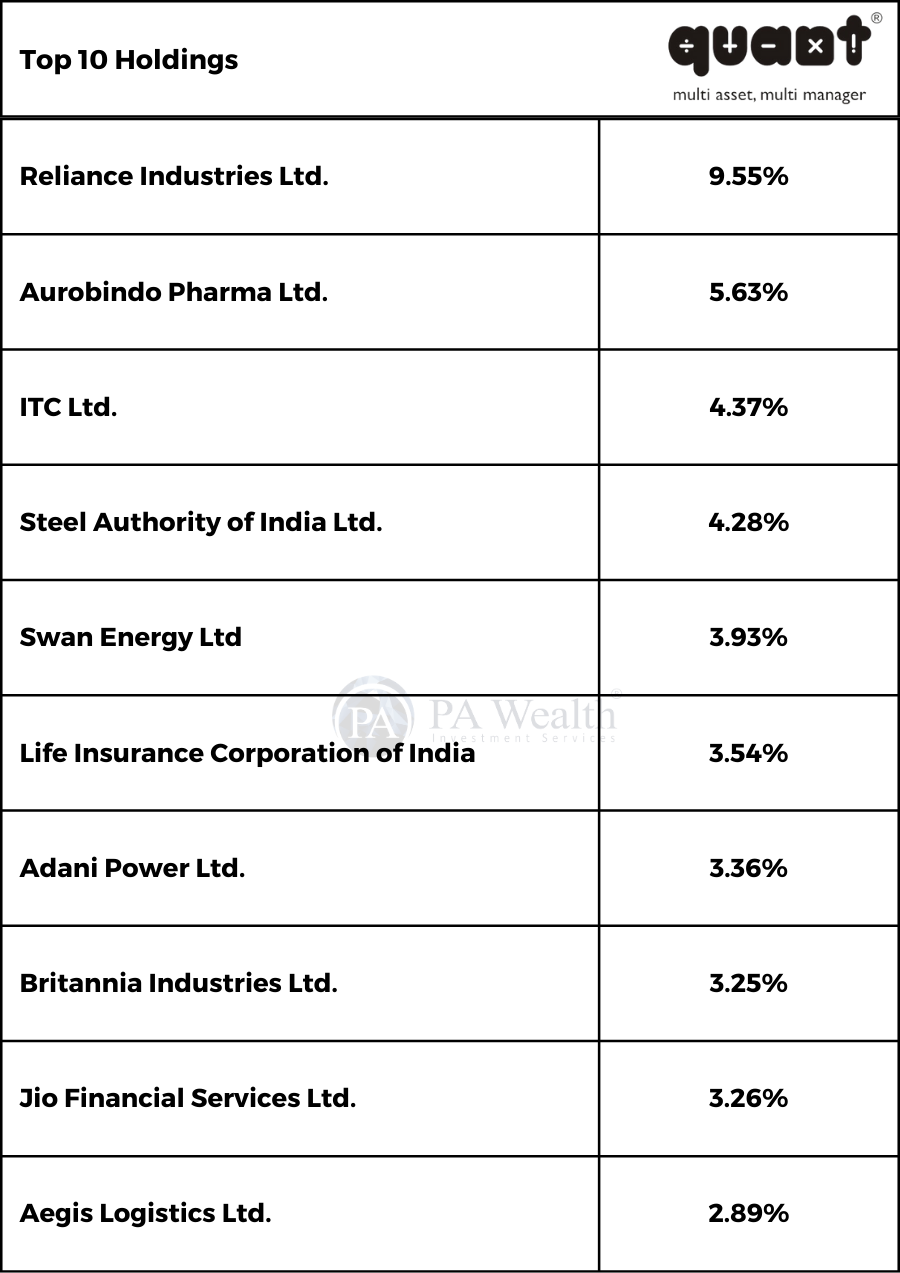

(ii) Top 10 Holdings of the fund

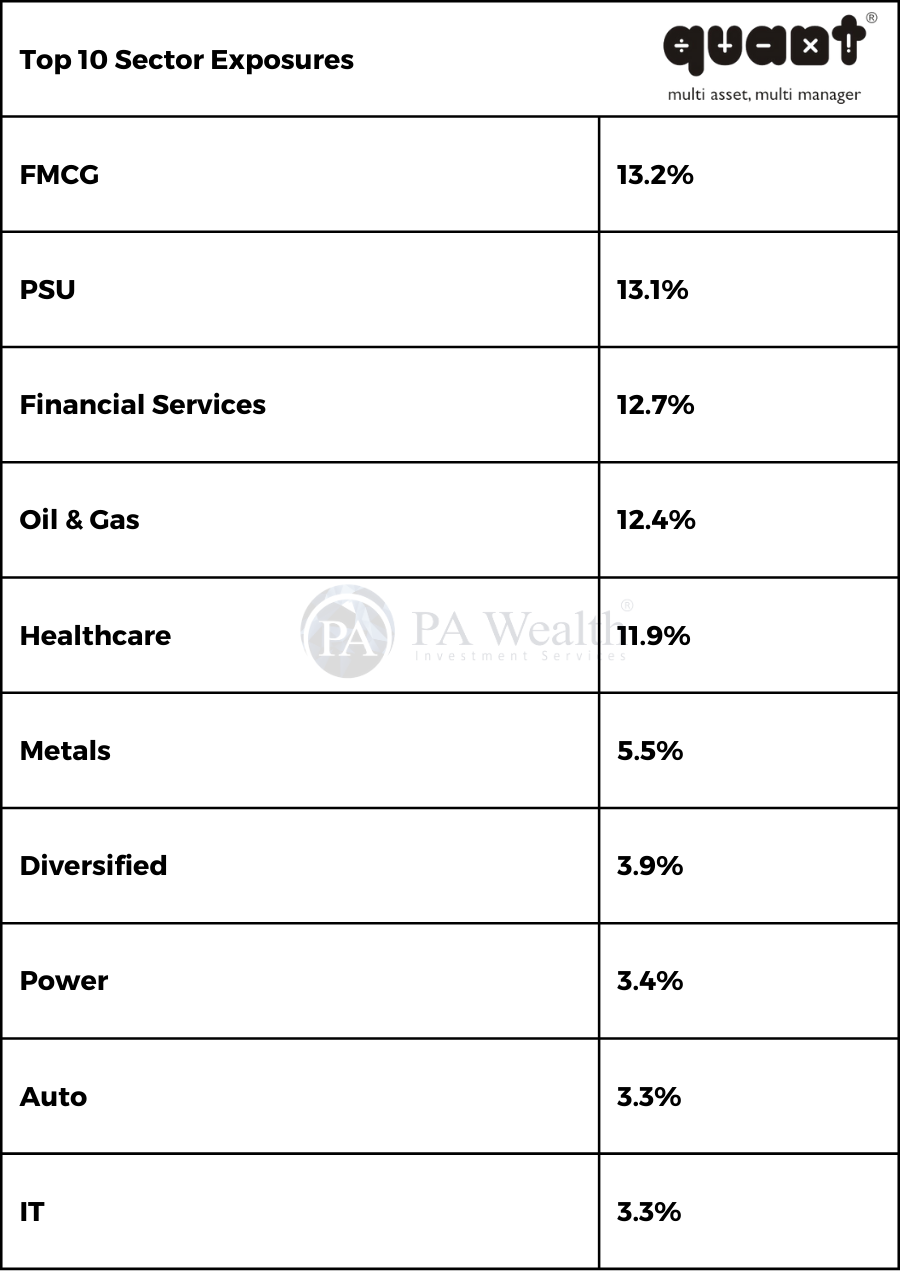

(iii) Top 10 Sectors Exposures

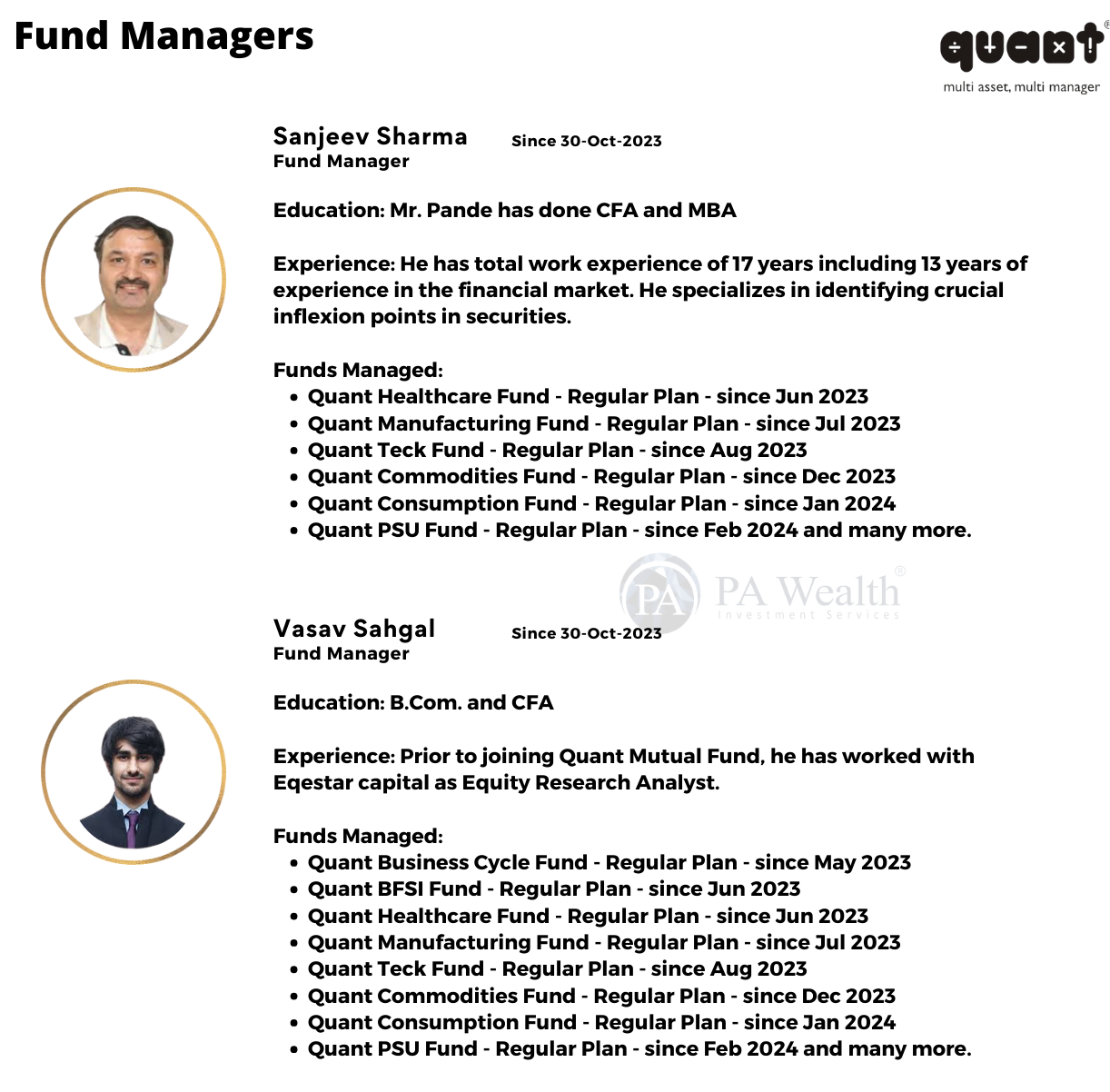

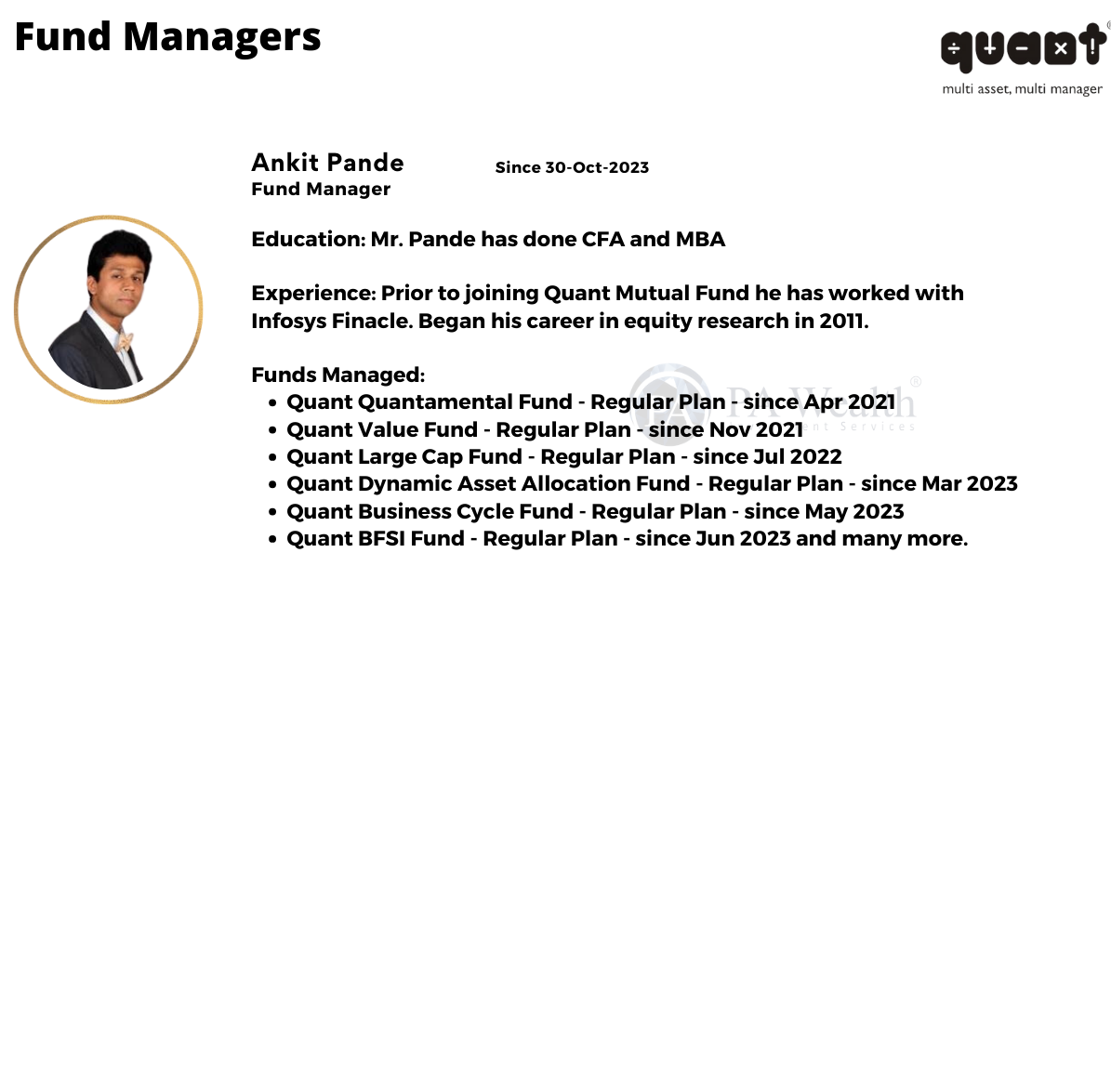

(H) Fund Managers & Tenure of managing the Scheme

(I) Taxability on earnings

Capital Gains Taxation

- If the mutual fund units are sold after 1 year from the date of investment, gains up to Rs 1.25 lakh in a financial year are exempt from tax. Gains over Rs 1.25 lakh are taxed at the rate of 12.5%.

- If the mutual fund units are sold within 1 year from the date of investment, entire amount of gain is taxed at the rate of 20%.

- No tax is to be paid as long as you continue to hold the units.

Dividend Taxation

Dividends are added to the income of the investors and taxed according to their respective tax slabs. Further, if an investor’s dividend income exceeds Rs. 5,000 in a financial year, the fund house also deducts a TDS of 10% before distributing the dividend.

Drop us your query at – info@pawealth.in or Visit pawealth.in

References: valueresearchonline.com, Industry’s Publications, News Publications, Mutual Fund Company.

Disclaimer: The report only represents personal opinions and views of the author. No part of the report should be considered as recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

awesome