Cholamandalam Investment and Finance Company (Chola Finance) is a non-banking financing company (NBFC) providing financial services of

- vehicle financing

- home equity loans

- loan against property (LAP)

- home loans

- SME loans

- Also, investment advisory services, stock broking, distribution of financial products & freight data solutions.

Quick Links. Click to read the detailed paragraph.

- Major Shareholders of Cholamandalam

- Executive Management of Cholamandalam

- Business Activities

- Revenue Analysis of Cholamandalam

- Cost Structure of Cholamandalam

- Assets Under Management of Cholamandalam

- AUM Distribution

- Geographical Distribution of Vehicle Finance

- Disbursements in each segment by Cholamandalam

- Net Income Margin analysis

- Non-Performing Assets of Cholomandalam

- Branch Network of Cholamandalam

- Branch Efficiency Attributes

- Business Tie-Ups of Cholamandalam

- Borrowings Detail

- Significant Ratios of Cholamandalam

- Recent Financial Performance

- Cholamandalam Competitors & Industry Overview with Market Share of lead players

- Managements Discussion Highlights & Future Course of Action

- Opportunities & Risk/Concerns

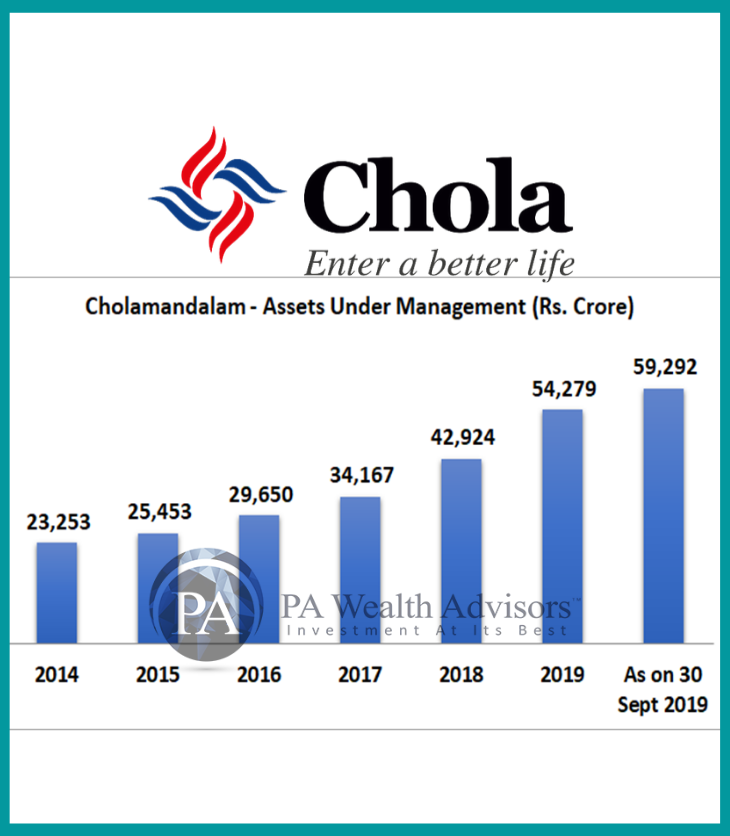

Assets under management (AUM) of the company are INR 59,292 crore on 30th September 2019. Company is promoted by M.A. M Arunachalam, M V Murugappa & M V Subbiah. Company is currently managed by Murugappa family 4th Generation – M M Murugappan & Arun Alagappan.

See detailed group structure of Murugappa Group (Click).

A. Important Company Events

1978:

Muruguppa family members M.A. M Arunachalam, M V Murugappa & M V Subbiah started the company on 17 August 1978 as a leasing company. At that time Chola was the second leasing company in the country.

1986:

Standard Chartered Bank (SCB) acquired 28% stake in the company & later on stake was increased to 30%.

1993:

Standard Chartered Bank changed its strategy & decided on to focus on core banking business. Thus, disinvested its holding in Cholamandalam.

1991-92

Company ventured into auto-finance for cars & commercial vehicles.

1995:

Company came out with a public issue of equity shares in January 1995 at a premium of INR 90 aggregating INR 42.5 crores to partly finance its long-term fund requirements to expand activities.

Further, the company commenced business of mutual funds, securities, trading & risk management through separate subsidiaries/joint ventures. Company incorporated a wholly owned subsidiary Cholamandalam Securities for this purpose.

2003:

The company allotted Right shares in the ratio of 1:2 to its existing shareholders at a premium of INR 25 per equity share.

2004:

After the termination of Joint Venture in Cholamandalam AXA Risk Services Ltd (CARSL) with M/s. AXA France, the company purchased 5 lakh equity shares of CARSL. Consequently CARSL became subsidiary of the company.

Eventually in October 2004, CARSL ceased to be the subsidiary of the company pursuant to a joint venture of CARSL & M/s Mitsui Sumitomo Insurance Company Limited.

2005:

DBS Bank Ltd Singapore (DBS) acquired 20% shareholding through open offer. Company also issued 30 lakh equity shares to DBS Bank Ltd Singapore (DBS) at a premium of Rs 140 per share on a preferential basis.

2006:

The name of the company was changed to Cholamandalam DBS Finance Limited.

Then the company obtained Certificate of Registration from RBI as Non Deposit – Non Banking Financial Company (ND-NBFC) & reclassified as ND-NBFC.

Thus, the company stopped accepting fresh public deposits & renewing public deposits w.e.f 1 November 2006.

2009:

The company restructured its capital involving utilization of Securities Premium Account of INR 323.53 crore for making certain provisions for standard assets, write off of bad debts, loan losses etc. to the extent required & diminution other than temporary in the value of investments.

In addition, Cholamandalam & L&T Finance Ltd signed a MoU for the sale of company’s wholly owned subsidiary DBS Cholamandalam Asset Management Limited (DCAM) for a consideration of INR 45 crore. DCAM had AUM of about INR 2900 crore across 24 schemes. The company sold this business in order to focus on core business.

2010:

Company acquired 3.47 lakh equity shares of Cholamandalam Factoring Ltd (CFACT), a NBFC registered with RBI. Thus, company’s holding in CFACT increased to 95.55%.

In addition, promoter companies, Tube Investments of India Limited & DBS Bank Ltd. (DBS) Singapore entered into an agreement, wherein Murugappa Group will buy the DBS stake of 37.48% in Cholamandalam DBS Finance Ltd. DBS stated that it was done to focus on its main business.

Moreover, Cholamandalam entered into MoU with VE Commercial Vehicles Limited (VECV), a 50-50 joint venture between the Volvo Group & Eicher Motors Limited for financing of Eicher Heavy Duty Trucks & Buses across the country.

2013:

Company’s wholly owned subsidiary Cholamandalam Factoring Ltd. (CFACT) amalgamated with company.

Also, the company allotted 1,05,26,315 equity shares to Qualified Institutional Buyers (QIB) at INR 285 per equity share including INR 275 per equity share as premium. Thus, issue amounted to about INR 300 crore.

2015:

Cognizant, a leading provider of information technology consulting & business process outsourcing services engaged with Cholamandalam to digitally transform company’s vehicle finance business operations.

Also, the company associated with Ola to offer car loans to drivers on Ola’s platform with an option of daily repayment scheme as against EMI.

2016:

Company invested INR 8 crore in White Data Systems India Pvt Ltd. White Data provides freight data solutions. Company’s stake in White Data is 63%.

Further, the company decided not to pursue the Payments bank opportunity. Hence, surrender the in-principle approval granted by RBI to its wholly owned subsidiary Cholamandalam Distribution Services Limited (CDSL) to establish a payments bank in the private sector.

2018:

Cholamandalam issued INR 1,056.90 crore unlisted NCD to Asian Development Bank.

Also, the company tied up with TVS Logistics Services Ltd (TVSLSL) to enhance the business of company’s subsidiary White Data. TVSLSL will invest INR 42.20 crore for 51% stake in White Data. Thus, company’s shareholding will reduce to 31% from 63%.

2019:

Company splits equity shares from face value of INR 10 each to INR 2 each.

Company received $ 222 million debt funds in the form of US dollar bonds. Investors include International Finance Corporation (IFC) ($92 million), First Abu Dhabi Bank ($50 million), MUFG Bank Ltd ($50 million), National Bank of Ras Al-Khaimah PJSC ($20 million) & CTBC Bank Co. Ltd ($10 million).

2020:

The company issued unsecured NCD from INR 400 crore to CDC Group Plc a UK based financial institution.

B. Shareholding Pattern

As on 31-12-2019, Promoter & Promoter Group holding is 52.94%. Institutional shareholding is 38.06% with Mutual Funds holding 18.52%; foreign portfolio investors holding 16.61%. Then, non-institutional holding is 9.00%.

C. About the Executive Management

Mr. M M Murugappan – Chairman & Non-Executive Director (Age 62 years)

He is a 4th generation member of the Murugappa family & the Executive Chairman of the Murugappa Group Corporate Advisory Board. His educational qualification includes a Bachelor’s degree in Chemical Engineering from the AC College of Technology, University of Madras, India; Also, a Master of Science Degree in Chemical Engineering from the University of Michigan, Ann Arbor, Michigan, USA.

Further, he is non-executive chairman of TI Financial Holdings Limited, Cholamandalam MS General Insurance Company Ltd, Coromandel International Limited, Tube Investments of India Limited & Carborundum Universal Limited.

Mr. Arun Alagappan – Managing Director (Age 43 years)

Mr. Arun is a member of the Muruguppa family. Earlier, he served as Executive Director of Cholamandalam since 19 August, 2017. Then, from 15 November 2019, he was appointed as Managing Director of company. He is a Commerce graduate & also holds Masters in Business Administration from Cardiff Business School. He also sits on the Boards of Cholamandalam Home Finance Limited, Lakshmi Machine Works Limited, Roca Bathroom Product Pvt Ltd & few other Murugappa group Companies. His remuneration is INR 3.12 crore for FY19.

D. Business Activities of Chola Finance

C. Revenue from Operations

Revenue from the subsidiaries is not very high at present. Standalone revenue of Chola Finance is INR 6,991.97 crore for FY19 & INR 5,479.23 crore for FY18. Consolidated revenue is INR 7087.62 crore for FY19 and INR 5558.68 crore for FY18.

(i) Revenue as per Business Segments

Vehicle Finance Loans – Loans to customers against purchase of new/used vehicles, tractors, construction equipment & loan to automobile dealers. Home equity – Loans to customer against immovable property.

Other loans – This includes loans given for acquisition of residential property, loan against shares & other unsecured loans.

(ii) Segment wise Profit Contribution

D. Cost Structure

E. Assets under Management

The business Assets Under Management (AUM) denotes the outstanding value of loans advanced by the asset finance company. It includes both on-Balance Sheet loans given & off-Balance Sheet (financing arrangements for which asset/liability not recognised in the books).

AUM of Chola Finanace grew at a CAGR of ~18% over last 5 years. AUM growth in FY19 over FY18 is 26.45%.

F. Breakup of AUM

The remaining 5% of the overall AUM includes majorly Home Loans & lastly SME loans.

G. Geographic Distribution of VF Assets Under Management

H. Disbursements

Disbursements growth in FY19 over FY 18 is 21.25%. YOY growth for half year ended 30-09-2019 is 15%.

Disbursement of the vehicle finance stands at INR 20,540 crore in FY18 and INR 24,807 crore in FY19 (grew by 21%). Home Equity disbursements amount to INR 3,174 crore in FY18 and INR 3,837 crore in FY19 (grew by 21%).

I. Net Income Margin

Net income margin (NIM) is difference between the interest income generated by banks/financial institutions & the amount of interest paid out to lenders relative to the amount of their (interest-earning) assets.

J. Gross NPA /Gross Stage 3 Assets of Chola Finance

As per RBI guidelines all Systemically Important Non-deposit taking NBFCs (NBFCND-SI) and all Systemically Important Deposit Accepting NBFCs are required to provide for Non Performing Assets as per the norms prescribed by RBI which modify from time to time. Currently 90 days norm is prevalent for such NBFCs made mandatory since FY18.

K. Net NPA / Stage 3 (Net of ECL) Assets of Chola Finance

This percentage is calculated after deducting provisions from gross NPA /gross stage 3 assets.

L. Branch Network

Chola Finance has 1029 branches as on 30th September 2019 & the company has target of 1100 branches at the end of the year. Company has nearly doubled its branch network in last five years. Out of total branches, 81% are in rural areas & 13% in semi urban areas (as on 30th September 2019). Moreover, 89% of the total branches of Chola Finance are in Tier-III, Tier-IV, Tier V & Tier-VI towns.

M. Branch Efficiency

N. Business Tie-Ups

O. Borrowings Profile

The total amount of borrowings by Chola Finance as on 31 March 2019 stands to be INR 50,566.74 croreas against INR 38,330.34 crore as on 31 March 2018. As on 30 Sept 2019, total borrowings amount to INR 55,903 crore.

P. Significant Ratios

Q. Financial Performance Highlights

R. Recent Quarter Performance

S. Competitive Advantage

- Company is a part of Muruguppa Group which is in various types of business. Moreover, Chola Finance has a pan India presence which helps in reducing one state risk & open avenues for future business.

- Chola Finance has a diversified portfolio, both in terms of geography & product. It is also expanding into new segments like home loans & MSME financing.

T. Industry & Competitors

Non Banking Finance companies are rapidly gaining prominence as intermediaries in the retail finance space. NBFCs contribute ~18% of the total credit system.

The institutions serve the un-banked customers by pioneering into retail asset-backed lending, lending against securities & micro-finance. Further, NBFCs aspire to emerge as one-stop shop for all financial services.

They operate at higher yields mainly because they cater to under served markets. Their operating cost as well as bad debt expenditure is lower compared to banks due to

- Better risk appreciation and management.

- Lower cost due to lean and focused business models.

- Moreover, Better service through faster response & personalized approach.

Further, NBFCs are expected to raise their share to 19-20% by 2020 end through recapitalization program for public sector.

Asset Finance Companies – Key Players

The players providing asset financing services include both NBFCs and banks. Amongst banks, HDFC Bank has the highest market share. followed by SBI , IndusInd Bank and Axis Bank.

Amongst NBFCs, Shriram Transport Finance (STFC) has the highest loan portfolio followed by M&M Financial Services , Chola Finance and Sundaram Finance.

U. Controversy

The controversy begins with the death of third generation member of Muruguppa family, M V Murugappan in 2017, leaving no male heirs. Valli Arunachalam, the elder daughter of deceased said that the other family members are against her appointment on the Ambadi Investments (holding company of Muruguppa group).

Traditionally, Muruguppa family does not encourage their family women to participate in business. Therefore. after not seeking support from the family members, she said that only remaining option available to her is to sell 8.15% stake in Ambadi Investments if the company does not give seat in company’s board.

In November 2019, Ambadi Investments board meeting takes no decision on both requests. Thus, Valli said she would continue her fight against the seven remaining branches of the Murugappa family (Each having position on the board).

V. Management Discussion Highlights

The highlights from concall held for the half year ended 31 September 2019:

- Disbursed 152k vehicle finance contracts in 2QFY20 v/s 120k contracts in 2QFY19, led by higher growth in 2Ws). Also, disbursed 3,040 home equity loans in 2QFY20 v/s 2,300 loans in 2QFY19 (5,900 in 1HFY20 v/s 4,700 in 1HFY19).

- 5,000 employees are on the company’s rolls. Chola Finance currently has 8,000 collection executives; ~1,800 field personnel were moved to collections as demand was weaker than expected.

- Company decided to exercise the option of new corporate tax rate of 25.17% and accordingly changes have been made in the current/defered tax.

Segment Overview & Outlook

- Vehicle finance business’s disbursements grew by 3% in quarter. Industry slowdown in commercial vehicle impacted the company business & management’s focus is to increase share of refinance & passenger vehicle segments.

- Chola Finance did well in Home Equity business during the quarter & disbursements went up by 17%. PBT for the segment increased by 4%. Growth is led by higher recoveries in NPAs and recoveries improved by leveraging SARFAESI.

- First half is not good for vehicle sales. Thus, company expects spurt in terms of sales other than HCV & LCV from October onwards.

- Home Equity is directly impacted by SME behavior. Expect 15-17% growth in second half year.

- Company is able to pass on cost of funds increase in case of vehicle finance.

- Company is looking for tying up with banks. After that, NIM will look better. Fee income & expenses will grow. Expenses will grow because company is spending for the entire book which is not on their balance sheet.

- Yield on refinanced vehicles is 100-150bp higher than that for a new vehicle. Profitability of this product is much better since yields are higher and opex/credit cost is lower due to repeat customers.

Capital Requirements

- Board is discussing capital raise plans. If Tier I reaches 12% (12.9% currently), company will immediately seek board approval.

- Under asset liability management, company has INR 7000 crore of approved long term loan from 2 leading PSBs which has not been drawn because the company does not want to keep cash. Now only some part is withdrawn. Also got fresh approvals from other banks to the extent of INR 2000 crore.

- Not getting enough NCDs in this market. Will probably take another two quarters for Chola to raise money effectively from the capital markets.

New Addition/Expansion

- Chola Finance has applied for the NHB license from RBI. Thus, then company will start this business through its subsidiary. Company is expanding reach by opening more new branches. Future course of action is to increase financing of 2 wheelers, 3 wheelers & passenger vehicles. Amidst the slowdown the company will focus on refinancing.

Qualified Institutional Placement 27 January 2020:

Chola Finance approved the allotment of 2,81,25,000 Equity Shares of face value Rs. 2 each to eligible qualified institutional buyers at the issue price of Rs. 320 per Equity Share aggregating to INR 900 crores. The allottees who have been allotted more than 5% of the equity shares offered in the issue-

- Government of Singapore – 24.39%

- ICICI Prudential Mutual Fund – 15.56%

- Aditya Birla Sun Life Mutual Fund – 15.56%

- Janchor Partners Opportunities Master Fund II – 10%

- Monetary Authority of Singapore – 5.61%

W. Opportunities & Risks/Concerns

Opportunities

(i) Prospective growth in pre-owned vehicles market

During the lifecycle of a commercial vehicle, 3-4 times ownership changes. The same is true for small vehicle segment as well. Thus pre-owned vehicles segment is an opportunistic segment for the vehicle finance industry specially in the light of recent slow performance of auto OEMs.

(ii) Portfolio Diversification

All the leading players of vehicle finance industry are well diversified in cars, MUV, LCV, HCV, construction equipments, 2 wheelers and others. This gives an opportunity to sail up in few rising vehicle segments while a few of other vehicle segments are facing decline/challenges. So the players can shift towards more growing and more yield generating vehicle segment to improve the ROTA, NIM and assets quality.

(iii) Increase in demand of loans

From past some years the trend of raising money from NBFCs on rise because their norms & rules are simpler as compared to banks. Adding further, Government’s thrust towards doubling farm income, increasing spend towards irrigation, increasing mechanization on farm fields and improving crop productivity is expected to drive growth in long term.

Risks/Concerns

(i) RBI norms and other liquidity pressures

NBFCs follow prudential norms as prescribed from time to time and also the liquidity position is determined by RBI guidelines. Liquidity tightening in certain situations result in credit freeze impacting the profitability. As what happened during IL&FS crises in September 2018 NBFCs significantly got impacted on liquidity distress in the country’s capital markets.

(ii) Dependence on monsoon

Deficient monsoon and emergence of drought situation in key states can strain recovery and asset quality. In FY15-16, two consecutive years of poor monsoon led to a surge in GNPA from 2.4% in FY15 to 4.7% in FY17. Thus, irregularity in monsoon cycle can impact asset quality as well as profitability.

(iii) Sectoral Slowdown

The sales of commercial as well as passenger vehicles industry have suffered sharp dips over last few months of 2018-19. From two-wheelers to cars and heavy duty trucks, all segments of the sector were in the red. Yet, the challenges of transition to stricter emission norm BS-VI from BS-IV and compliance to new safety norms thereby making vehicles costlier are lurking around the sector.

SIAM President, Mr. Rajan Wadhera stated that the sector is expected to start reviving from the second quarter of the next financial year but it will be visible from the third quarter of the fiscal. However, with vehicle cost going up by 8-10 % due to technology ramp up, industry fears that it could further lead volume loss.

Drop us a mail at – info@pawealth.in or Visit pawealth.in

References: Annual Reports, News Publications, Investor Presentations, Corporate Announcements, Management Discussions, Analyst Meets & Management Interviews, Industry’s Publications.

Disclaimer: The report only represents personal opinions and views of the author. No part of the report should be considered as recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

0 Responses