Venky’s (India) boasts a nationwide presence, operating in over 20 states as well as ranking among the top 3 integrated poultry players in the country. The poultry sector has been moving towards organised players, and this company have the most to gain from this shift.

- About the company

- Journey Since Inception

- Board Members

- Shareholding Pattern

- Business Segments

- Revenue Segments

- Cost Structure

- Financial Parameters

- Management Key Highlights

- Strengths & Weaknesses

(A) About

Venky’s (India) Limited was incorporated in 1976 and is part of the Pune-based VH Group. Furthermore, The company is engaged in the integrated poultry business. It predominantly deals in the broiler bird segment and the solvent extraction and vegetable oil refinery segments with activities primarily concentrated in the north and north-eastern part of India. Additionally, The VH Group is India’s largest integrated poultry operator covering the entire spectrum of the poultry segment – from pure line breeding to processed chicken.

Venky’s is a prominent supplier to many QSRs as well as International chains like Kentucky Fried Chicken (KFC), Pizza Hut, Tacobell, TGI Friday, Brinkers, Vista Foods, Burger King, McDonald’s etc.

It is also associated with B2B and B2C retail chains to sell Venky’s brand chicken products, like Walmart, Metro Cash and Carry, Star Bazar, ABRL More, Future Retail and regional chains in major cities of India.

(B) Journey of Venky’s (India)

(C) Board of Directors of Venky’s (India)

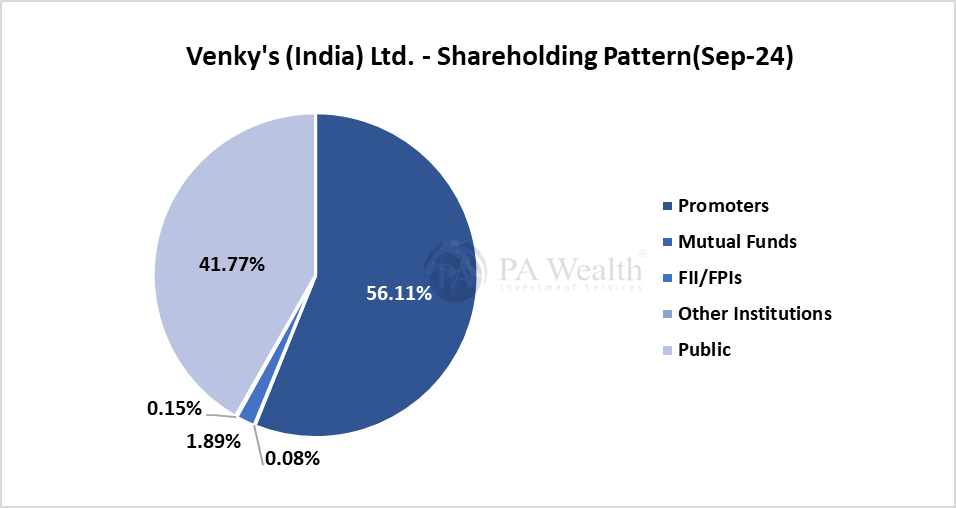

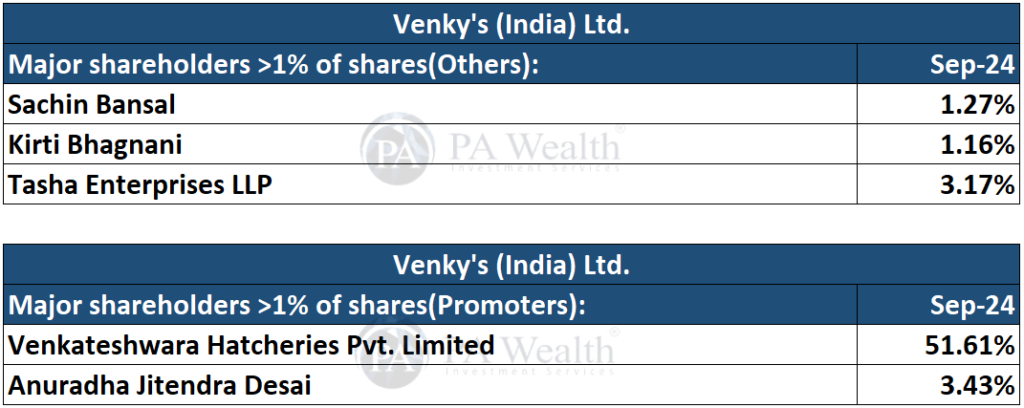

(D) Shareholding Pattern

(E) Business Segments

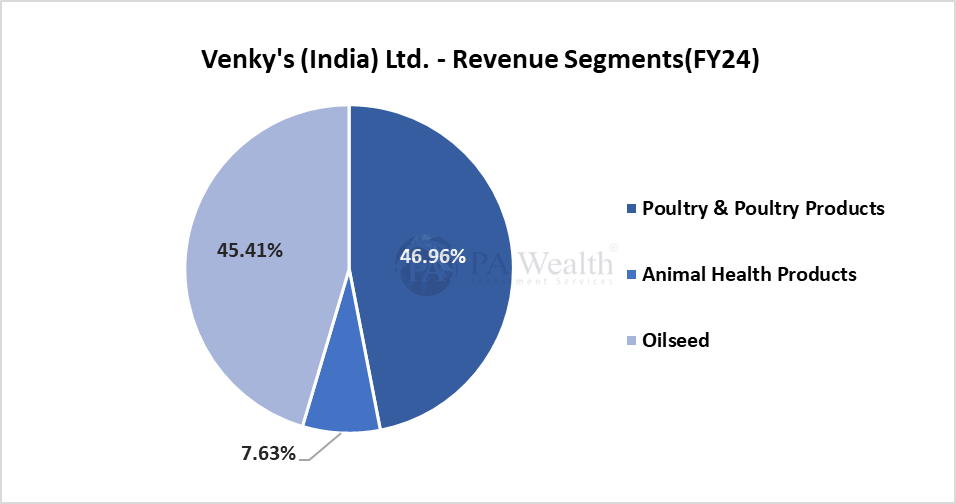

Venky’s operates in three main business segments:

1. Poultry and Poultry Products:

- Production and also the sale of day-old broiler chicks

- Production and also the sale of day-old layer chicks

- Processing of broiler birds

- QSR: Venky’s Xprs (Company-owned restaurants) as well as Chicken Xperience (Franchisee outlets)

- Production of Specific Pathogen-Free (SPF) Eggs

2. Animal Health Products:

- Manufacturing of medicines

- Poultry feed supplements

3. Oilseed:

- Processing of soya

(F) Revenue Segment

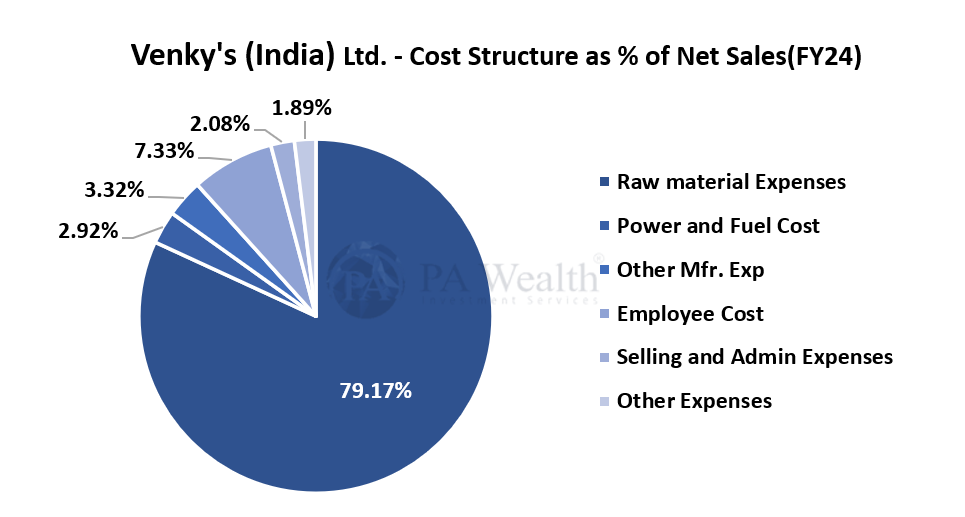

(G) Cost Structure of Venky’s (India)

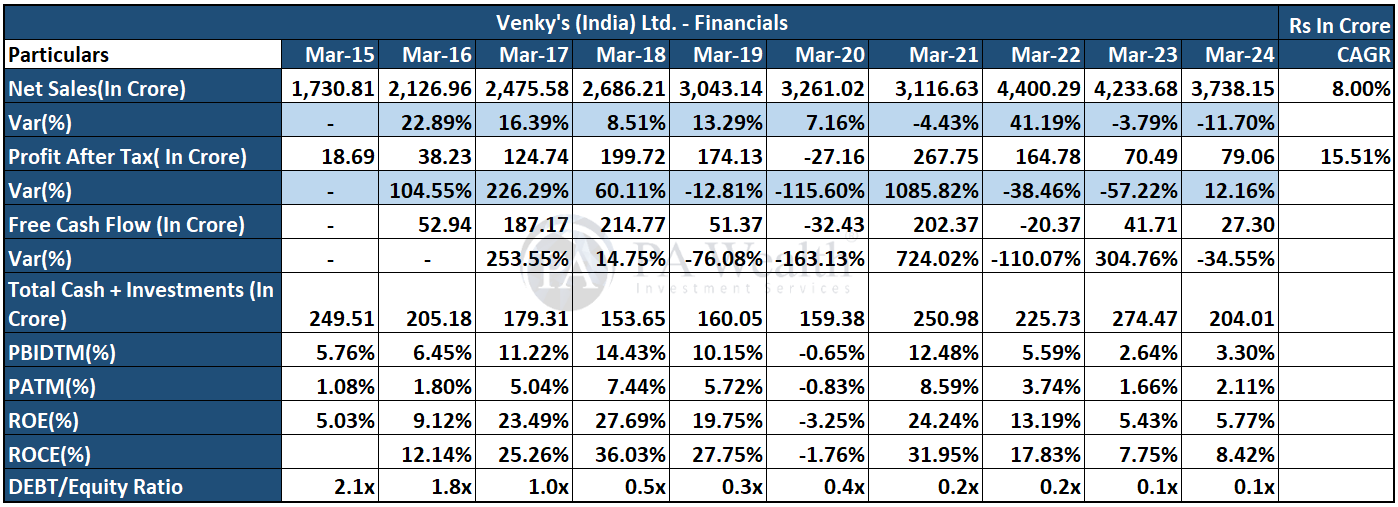

(H) Financials of Venky’s (India)

The company’s revenue has grown at a CAGR of 8% over the past 10 years from Rs 1730.81 Cr. in FY15 to Rs 3738.15 Cr. in FY24. Subsequently, The company’s PAT has grown from Rs 18.69 Cr. in FY15 to Rs 79.06 Cr. in FY24 at a CAGR of 15.51%. However, The company’s ROE has increased from 5.03% in FY15 to 5.77% in FY24.

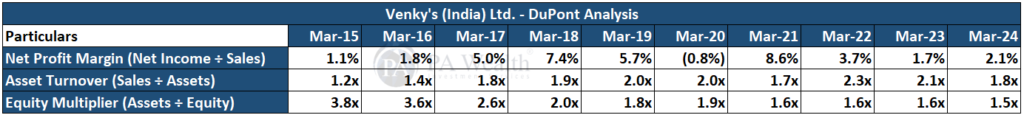

DuPont Analysis

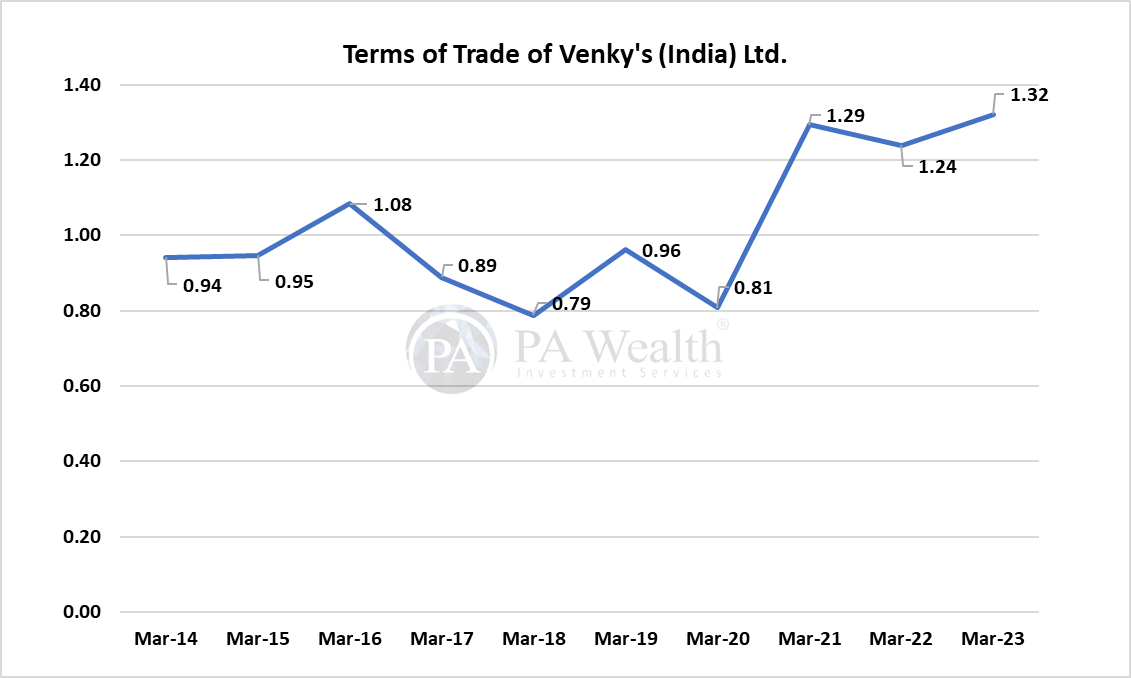

Terms of Trade of Venky’s (India)

(I) Management Discussion & Concall Highlights

- The company’s performance improved in Q4 FY24 compared to the previous quarter. Better realization from the sale of old chicks and broilers, along with lower maize and soya prices, contributed to the profit margins.

- Maize prices for FY24 averaged ₹22.80 per kg (compared to ₹23.90 in FY23). Soya prices for FY24 were ₹47.60 per kg (down from ₹52.80 in FY23). The company expects stable pricing for maize and soya in Q1FY25, contributing to better margins. Feed Prices are expected to remain stable during the current fiscal, however, remain vulnerable to external factors.

- The company’s feed conversion ratio which is a crucial metric in poultry production, has decreased due to better genetics and management which allowed for improvement in realizations.

- The company has revised its volume growth projections for Oilseeds (from 7-10% to flat), Animal Health Products (from 15-17% to 12%), as well as for Poultry & Poultry Products (from 8-10% to flat) in FY25.

- The Company’s capacity utilization for Q2FY24 stands at 74% for Broilers, 57% for Laying capacity, 37% for feed mills, 59% for SPF eggs/SPFX, 90% for animal health products and 62% for Oilseeds.

- Domestic investment in the poultry sector has recently increased, aimed at boosting production capacity. However, further growth in the processed chicken segment hinges on the development of large-scale cold storage facilities.

- With low import barriers for specific edible oils as well as increasing yearly MSP for oilseeds, domestic oilseed production might face challenges in maintaining profit margins.

- The company’s 42% of revenue comes from related party transactions, with the remaining 58% from outside business. The company anticipates an increase in outside business as poultry prices improve, while the receivables, especially from the promoter group, are expected to decrease as the poultry industry recovers.

Realizations

- The average realization for broiler chicks in FY24 was ₹30.38 per chick, compared to ₹27.57 in FY23. The realization for broiler birds in FY24 was ₹84.16 per kg, lower than ₹89.36 per kg in FY23. However, the management expects better realizations in Q1FY25.

- The company’s primary segment saw improved margins due to reduced input costs (maize and soya). Seasonal trends affect body weight and mortality rates. High temperatures in summer result in lower body weights and higher mortality rates in broilers, leading to seasonal variations in yield.

QSR(Quick Service Restaurants)

- The company expects QSRs(Quick Service Restaurant) revenue to have a continuous growth rate of 10% over the next 3 to 5 years.

- The company has 14 Venky’s Express outlets while Venky’s Xpress franchise outlets have grown from 38 to 52, with marketing efforts. and plans to introduce new recipes and products.

Capex

- Most major projects which were started by the company have been completed, and no significant new projects are planned for FY25, except for regular capital expenses of around 40-50Cr. across business units.

- The new plant for the Animal Health Products Segment which was completed in FY24 will provide an additional 15% production capacity and allow the company to increase its sales in the segment by 15% to 20%.

(J) Strengths & Weaknesses

Strengths

(i) Part of VH group which is the largest fully integrated poultry player in India

VH Group operates a wide range of poultry-related activities throughout India, including breeding, processing, as well as retail. Moreover, It is vertically and horizontally integrated and encompasses feed mills, vaccinations, and parent chick rearing. This extensive network, which encompasses more than 20 states, demonstrates the company’s transformation from a modest farm in 1971 to a significant participant in the poultry industry.

(ii) Strong market position of the group with an established brand name and marketing network

The group has a strong brand name of ‘Venky’ in the field of poultry products and has around 14 express outlets for processed chicken under VIL located in various Tier-I as well as Tier-II cities. The group has developed a pan-India presence over the years, with VIL primarily concentrating on the Northern region and also its flagship company – Venkateshwara Hatcheries Private Limited (VHPL) – being concentrated in the Southern region of India. Further, VIL is among Asia’s leading manufacturers of SPF eggs.

Weaknesses

(i) Vulnerability of profits to raw material price movements

Due to its inability to regulate poultry prices and its high raw material expenses (75% of the total), the business is susceptible to fluctuations in the prices of maize and soybeans. Soybeans (30%) and maize (65% of feed) are essential for energy and protein, respectively, but because the poultry industry is a buyers’ market, price increases cannot be entirely passed on, which has a negative impact on profitability (FY23).

(ii) Inherent risks associated with the poultry business such as disease outbreaks

Past epidemics of poultry diseases in India negatively impacted demand and also resulted in inventory losses. However, Geographically dispersed farms, contract farming, and in-house vaccine/biosecurity production are utilized by VIL to mitigate risk. Future occurrences, such as avian influenza, continue to pose a risk to the poultry industry.

Drop us your query at – info@pawealth.in or Visit pawealth.in

References: Annual Reports, News Publications, Investor Presentations, Corporate Announcements, Management Discussions, Analyst Meets and Management Interviews, Industry Publications.

Disclaimer: The report only represents the personal opinions and views of the author. No part of the report should be considered a recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore