- What are Multi-Asset Allocation Funds?

- Objective

- Who Should Invest?

- Advantages

- Disadvantages

- Taxation

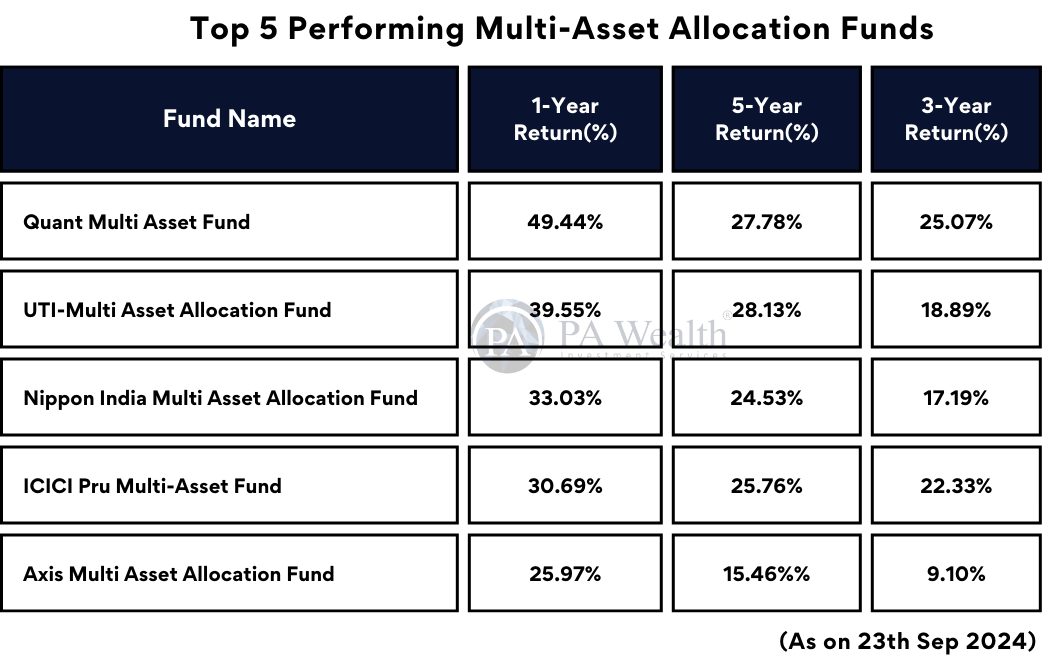

- Top 5 Performing Multi-Asset Allocation Funds

Investing in the stock market can often feel like walking a tightrope, with the potential for high rewards balanced precariously against significant risks. However, for those who seek a more stable yet profitable investment route, Multi-Asset Allocation Funds offer an attractive solution. By spreading investments across various asset classes, these funds provide a balanced approach to achieving steady returns while mitigating risk. Let’s delve into the world of Multi-Asset Allocation Funds, exploring their purpose, benefits, and ideal investors.

What Are Multi-Asset Allocation Funds?

Multi-Asset Allocation Funds represent a versatile investment vehicle designed to diversify holdings across multiple asset classes such as debt, equities, and alternative investments like real estate or gold. Unlike traditional mutual funds that focus on a single asset class, these funds employ sophisticated asset allocation strategies to respond dynamically to changing market conditions. This diversified approach aims to deliver optimal risk-adjusted returns, providing investors with a balanced portfolio in a single investment product.

Objective

The primary objective of Multi-Asset Allocation Funds is to enhance and diversify an investment portfolio by allocating assets across various categories. This diversification strategy serves to cushion the risks associated with investing in a single asset class. By spreading investments, these funds aim to provide a smoother investment experience, reducing the impact of volatility in any one market segment.

Who Should Invest?

Multi-Asset Allocation Funds are particularly suitable for investors with a low-risk appetite who seek steady returns. This investment vehicle is ideal for those who prefer not to concentrate their risk in a single asset class. By investing in these funds, investors can benefit from a balanced portfolio that continues to generate income even when certain asset classes underperform. Furthermore, these funds are ideal for investors who have limited experience in equity investing but still want to participate in market gains while reducing their exposure to risk.

Advantages:

- Diversification of Capital: Multi-Asset Allocation Funds spread investments across various asset classes such as equities, debt, and alternative investments like real estate and gold. This diversification reduces the risk associated with investing in a single asset class. It helps in smoothing out fluctuations in returns, as different asset classes perform differently under various market conditions.

- Steady Returns: These funds aim to provide stable and consistent returns over time. By diversifying across multiple asset classes, these funds reduce the volatility that may arise from fluctuations in any one market segment. This stability is particularly appealing to investors seeking predictable income or moderate growth without exposing their investments to the full volatility of individual asset classes.

- Tax Efficiency: Investors in these funds benefit from tax-efficient structures, especially for long-term investments. Gains up to a specified limit are often tax-exempt, and gains above that threshold are taxed at a lower rate with indexation benefits for debt-oriented funds. This tax advantage helps in maximizing after-tax returns for investors, making these funds attractive from a tax planning perspective.

- Expert Management: Multi-Asset Allocation Funds are managed by experienced fund managers who specialize in asset allocation and portfolio management. These professionals employ sophisticated strategies to allocate assets across different classes based on market conditions, economic outlook, and fund objectives. Their expertise enhances the potential for better risk-adjusted returns compared to individual asset selection.

Disadvantages:

- Short-Term Taxation: Short-term gains from Multi-Asset Allocation Funds, typically held for less than three years, are subject to higher taxation at the investor’s applicable income tax slab rates. Unlike long-term gains, short-term gains do not benefit from indexation benefits, potentially increasing the tax liability for investors who realize gains within a short holding period.

- Performance Variability: The performance of these funds can vary depending on the asset allocation decisions made by the fund manager and prevailing market conditions. Different managers may adopt varying strategies, leading to differences in returns. This variability means that there is no guaranteed level of performance, and investors may experience fluctuations in their investment returns over time.

- Higher Costs: Multi-Asset Allocation Funds generally have higher management fees compared to single-asset class funds. The complexity of managing multiple asset allocations requires additional research, monitoring, and adjustment by fund managers, which contributes to higher expenses. These costs can impact overall returns and reduce the net gains realized by investors, especially during periods of lower market performance.

- Limited Control: Investors in Multi-Asset Allocation Funds have limited control over the specific assets held within the fund. The fund manager or management team makes asset allocation decisions based on the fund’s investment strategy and objectives. This lack of control may not appeal to investors who prefer to customize their investments according to specific asset classes or market sectors based on personal preferences or market views.

Taxation

Understanding the tax implications of Multi-Asset Allocation Funds is crucial for investors. These funds are subject to taxation based on the holding period:

- Short-term capital gains: If the mutual fund units are sold within 2 years from the date of investment, entire amount of gain is added to the investors’ income and taxed according to the applicable slab rate

- Long-term capital gains If the mutual fund units are sold after 2 years from the date of investment, gains are taxed at the rate of 12.5%.

It’s important to note that tax treatment may vary depending on whether the fund is equity-oriented or debt-oriented, affecting the overall tax liability and benefits.

Top 5 Performing Multi-Asset Allocation Funds

In conclusion, Multi-Asset Allocation Funds offer a robust solution for investors seeking diversification, risk mitigation, and steady returns. By combining multiple asset classes into a single fund, these investment vehicles provide a balanced approach to portfolio management. While they come with certain disadvantages, such as higher costs and limited customization, the benefits often outweigh these drawbacks for many investors. Whether you’re a conservative investor or someone looking to stabilize your portfolio amidst market volatility, these funds present a compelling option to consider in your financial journey.

Drop us your query at – info@pawealth.in or Visit pawealth.in

Disclaimer: The report only represents the personal opinions and views of the author. No part of the report should be considered a recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | AMFI registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore