Indian tile industry exports have not only expanded rapidly but have also diversified their geographic reach. While Asia remains a significant market, India has successfully penetrated regions like Europe, North America, and the Middle East, demonstrating its ability to cater to diverse customer preferences. This global footprint has solidified India’s position as a major player in the international tile market.

- About the Industry

- Ceramic Tiles Manufacturing Process

- Types of Tiles

- Key Players in the Indian Tile Industry

- Peer Comparison

- Exports

- Outlook

- Growth Drivers

- Strengths & Weaknesses

(A) About

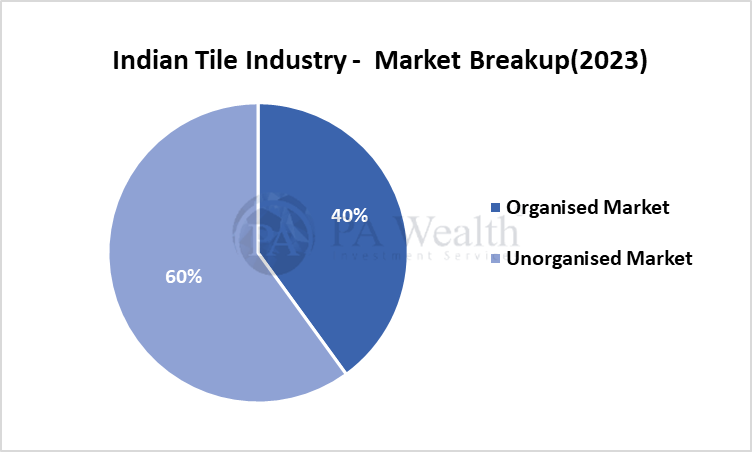

India is the second largest tiles producer in the world with ~14% share and 2550MSM production capacity (CY21). India is also the second largest consumer of ceramic tiles in the world with more than 11% share and 2069MSM consumption annually (CY21) The Indian tiles market grew from Rs270 billion in 2018 to Rs595 billion in 2023, with a CAGR of 17%. The domestic tile industry is expected to grow by 9%/8% in FY24/FY25. Growth will accelerate due to increased home sales, urbanization, higher discretionary spending, and rising demand for tiles in flooring.

In the domestic market, the organized sector expanded at a 35% CAGR between FY18 and FY23, while the unorganized sector grew at a 12% rate. The organized sector will grow at 15% CAGR until 2025, while the unorganized sector will grow at a slower rate of 4%. Leading organized players like Kajaria and Somany, as well as export-oriented, unlisted companies like Simpolo, Qutone, and Varmora, are driving growth by aggressively promoting their brands and capturing market share from unorganized players.

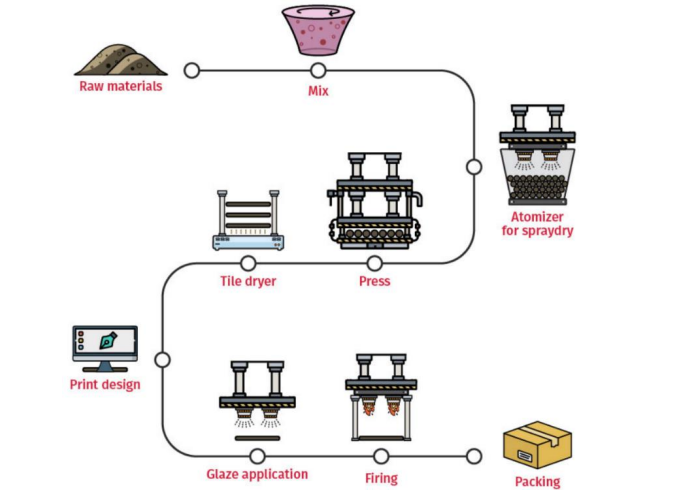

(B) Ceramic Tiles Manufacturing Process

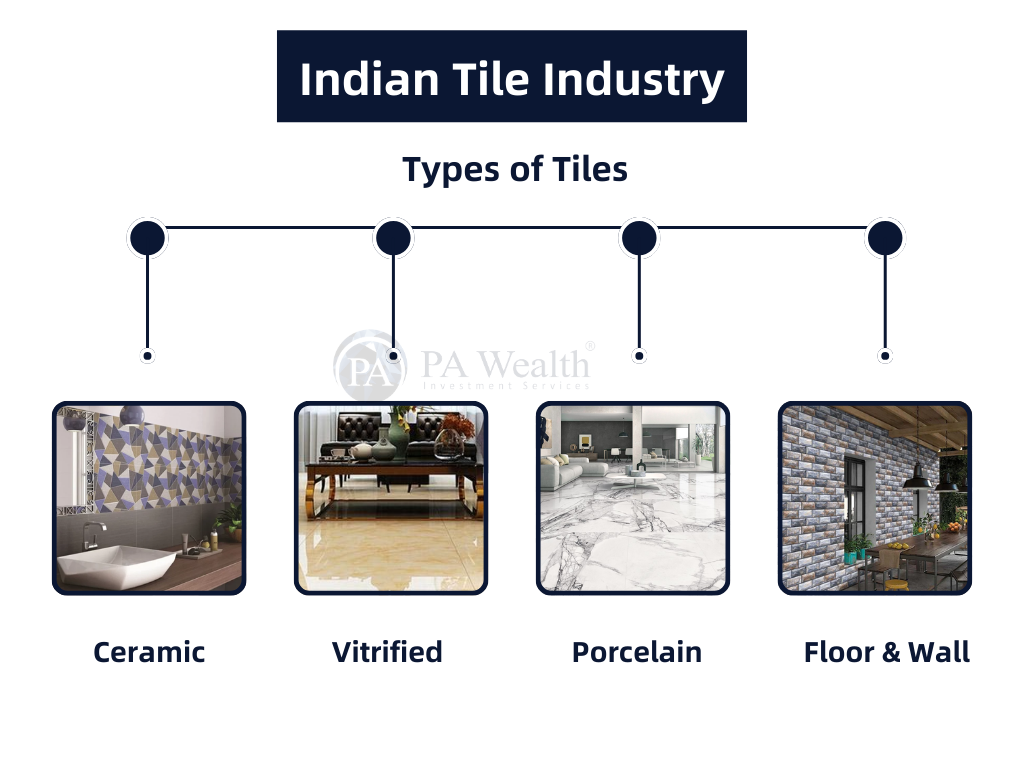

(C) Types of Tiles in the Indian Tile Industry

Ceramic tiles have been a popular flooring and wall-covering option in India for many decades. Today, the Indian tile business has expanded to include a wide range of tile kinds to fulfil the different needs of consumers. From durable porcelain tiles to gorgeous vitrified tiles.

Ceramic Tiles

Ceramic tiles are constructed of clay, sand, and other natural ingredients. They are then burned at high temperatures, resulting in a hard, lasting tile. Ceramic tiles come in a variety of sizes, colours, and patterns, making them an adaptable option for any room. They are an economical choice for flooring and wall coverings.

Vitrified Tiles

Vitrified tiles, created by fusing clay and silica at high temperatures, are denser and less porous than ceramic tiles. These properties make them water and stain-resistant. Vitrified tiles known for their endurance, make them an excellent choice for high-traffic environments.

Porcelain Tiles

Porcelain tiles are manufactured by combining porcelain clay with other materials and firing them at extremely high temperatures. They are highly resistant to water and stains, making them suitable for use in bathrooms and kitchens. Porcelain tiles are also available in a variety of sizes and colours. The factors make them suitable for both flooring and wall coverings.

Floor Tiles and Wall Tiles

Though most tiles can be used for both flooring and wall coverings, some are intended for a single use. Floor tiles are often thicker and more durable than wall tiles, and they are designed to endure high foot activity. In contrast, wall tiles are often lighter and thinner, making them easier to install on vertical surfaces. Floor and wall tiles are available in ceramic, vitrified, and porcelain materials.

(D) Key Players in the Indian Tile Industry

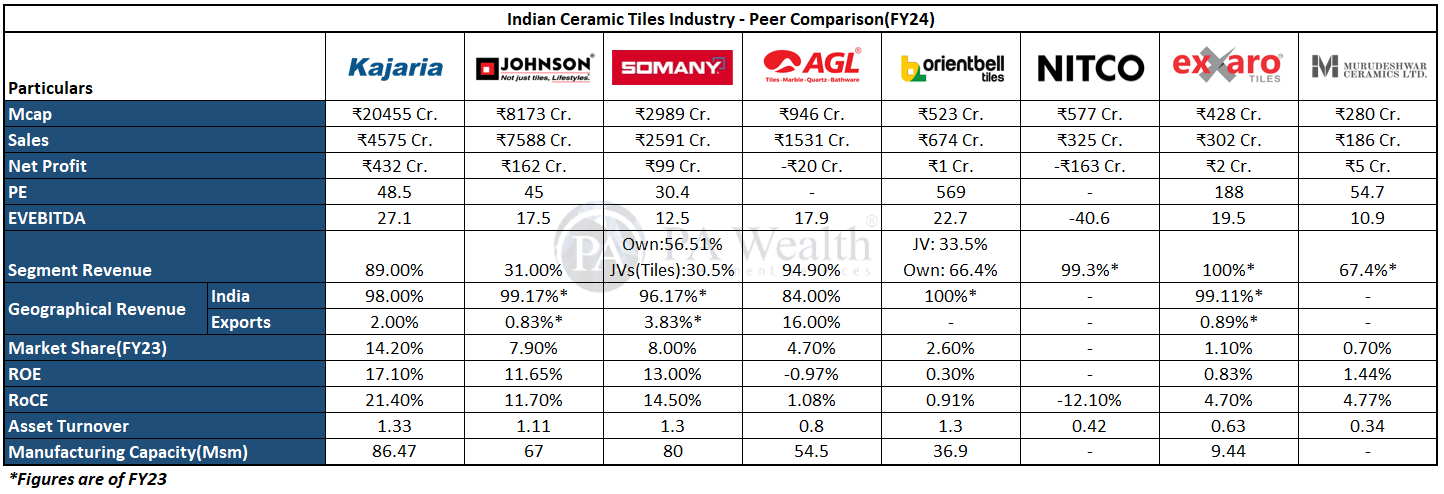

- Kajaria Ceramics – The largest tile manufacturer in India, with a market share of around 14%. The company has 7 plants in India and a total production capacity of 86.47 million square meters.

- Somany Ceramics – The second-largest tile manufacturer in India, with a market share of around 10%. The company has 9 plants in India with a production capacity of ~80 million square meters.

- Prism Johnson – A leading tile manufacturer with a market share of around 12%. The company operates 11 plants in India with a total production capacity of ~67 million square meters.

(E) Peer Comparison of the Indian Tile Industry

(F) Exports

- India’s ceramic tile sector has tremendous export development, and it will become the world’s second-largest exporter by 2023. This supremacy is remarkable, given that India shipped only 55 million sqm of tiles in 2013, placing tenth globally. By 2023, the amount had climbed to 589.5 million square meters, with more than half shipping outside of Asia. The Morbi ceramic cluster in Gujarat, which is a network of smaller enterprises driving growth.

- Traditionally, Asian markets received the biggest share(42.3% of the Total Volumes) of Indian exports. However, the most significant growth is now happening outside Asia. Africa (+68.8% volume yoy, +45.5% value yoy) has emerged as the second-largest export region, followed by North America and Mexico (65.4 million sqm) with 48.8% volume growth year on year as well as 36.6% value growth year on year, and the European Union (~60 million sqm, +75% Volume growth yoy, +60% Value Growth YoY). While Sales to South America and Non-EU Europe have doubled over last year.

- This trend is even more evident over the past decade (2014-2023). The overall exports grew at a CAGR of 21.5%. These include North America, non-EU Europe, European Union, Africa, and South America markets saw the largest growth.

Revenue and Realisations

- Revenue from exports rose from €325 Million in 2014 to €2.25 Billion in 2023 growing at a CAGR of +24%.

- Despite accounting for 42.3% of overall export volume in 2023, Asia is the only area that has seen its export value fall (-2.2%) from 2022. Europe (EU + non-EU) now accounts for roughly 25% of export revenue in 2023, followed by Africa and North America at 15.5% and 13%, respectively.

- In 2023, the average export price per square meter was €3.8, which varies by location. €2.9 per square meter in Africa More than €4.5 per square meter in North America and the EU. €5.3 per square meter in non-EU Europe.

- Average prices remained steady from 2014 and 2021 (about €3.1–3.2/sqm), before peaking at €4.2/sqm in 2022 and falling to €3.8/sqm in 2023. However, North and South America were the only regions with declining average selling prices over the decade.

(G) Outlook

- The unorganized sector accounts for 60% of the industry, with concentrations in Morbi and Rajkot. This fragmentation creates an ideal space for consolidation. Morbi companies, most of which are family-owned, undergo frequent mergers, demergers, and shutdowns. This high churn provides a substantial opportunity for established firms to grow through inorganic means.

- Morbi may experience a significant shakeup, with over 100 minor facilities expected to close owing to tough competition from more advanced competitors such as Simpolo, Varmora, and Kajaria. These well-established organizations are known for their excellent innovation, quality, and technical developments.

- Tile Manufacturers have substantial challenges in terms of freight costs, power availability, and natural gas/propane prices. The industry is actively implementing techniques to increase productivity and minimize energy use. This includes integrating shorter firing cycles, lower firing temperatures, and novel designs for ceramic tunnel kilns. The industry’s future growth depends on readily available raw materials, dependable supply chains, and competitive pricing.

- The implementation of the Goods and Services Tax (GST) has increased transparency and accountability in the industry, resulting in a nearly 50% reduction in cash transactions. However, GST on natural gas will likely benefit manufacturers by allowing them to claim input tax credits which could eventually lead to increased margins.

- The sheer size of the market, combined with razor-thin operating margins of roughly 10-12%, prevents new players from entering this competitive field.

- Natural gas prices have undergone substantial changes In June 2020, the price dropped to USD 1.6 per MMBTU due to the pandemic. while surged to a high of USD 8.79 per MMBTU due to the Ukraine Conflict. This harmed tile player margins for the first nine months of FY23 (9MFY23). Tile companies are likely to gain from a recent lower price trend.

- Tile firms have contract pricing arrangements with gas distributors, so price fluctuations have a delayed impact on their bottom line. The high degree of competition in the tile industry makes it difficult to translate decreased gas prices into increased profit margins.

- Companies that move to alternative fuels such as LPG (propane)or biofuels can further cut their fuel costs which most of the manufacturers do in the Morbi Cluster.

(H) Growth Drivers

- Young and Increasing Population: India has a young population, with a median age of 28, resulting in a larger workforce and an increased need for housing.

- Rise of the Middle Class: A growing middle class with increasing disposable income is driving demand for affordable property priced between Rs. 1.5 and Rs. 3 crore. This category generally uses tiles as a lower-cost alternative to marble. Rapid urbanization is driving demand for new housing, particularly among the middle class, whose preferred flooring option is tile.

- Government’s infrastructure push: Increased government spending on infrastructure, manufacturing, and services is boosting exports and foreign direct investment, which benefits the tile industry.

- Digital transformation: The rise of technology has eased the tile purchasing process for customers, improving their overall experience across all touch points. Manufacturers use sophisticated software to demonstrate numerous tile combinations to consumers remotely.

- Low per-capita consumption: India has a substantially lower per-capita use of tiles than the global average, indicating a huge opportunity for future expansion. Rising living standards, as well as government efforts such as ‘Smart City’ and ‘Pradhan Mantri Awas Yojana’, are expected to drive demand even higher.

- Technological Advancements: New product advancements, such as tile-based kitchen countertops and walls, are gaining popularity among luxury buyers.

- Export Boom: Over the last decade, the Indian tile industry has seen a dramatic increase in exports, thanks in part to other countries’ ‘China+1’ strategies. India’s cost competitiveness and robust cluster model in Morbi provide considerable advantages.

(I) Strengths & Weaknesses

Strengths

- Massive Production Capacity: India has one of the world’s highest tile production capacity, expected to exceed 3.1 billion sqm by 2024. This allows the sector to serve a huge home market while also meeting export requests.

- Government Support: The Indian government has been more supportive of the tile industry, including initiatives such as ‘Make in India’ and infrastructure development projects. This creates a favourable atmosphere for growth.

- Strong Domestic Demand: The Indian market has a strong demand for tiles due to factors such as a growing middle class, urbanization, and lower per capita consumption than the world average. This provides a stable foundation for the industry.

- Abundant Raw Materials: India has a large local supply of raw materials such as clay from various states and feldspar from Rajasthan, which are required for tile manufacture. This decreases dependency on imports while keeping production costs affordable.

Weaknesses:

- Vulnerability to Raw Material Price Variations: External variables such as geopolitical events and export variations can affect raw material prices, such as gas. This might lead to fluctuations in production costs, affecting profitability.

- Trade Barriers: Anti-dumping duties imposed by some export-oriented countries, such as Europe and the United States, might reduce Indian tile competitiveness. The industry must adjust to these challenges and seek alternate markets.

- Cutthroat Competition: The domestic tile industry is extremely competitive, often resulting in price wars. This can reduce margins and limit profitability for players, particularly small businesses.

- Skilled personnel scarcity: The sector is experiencing a scarcity of skilled personnel, notably in design, automation, and quality control. This can reduce productivity and innovation.

Drop us your query at – info@pawealth.in or Visit pawealth.in

References: Annual Reports, News Publications, Investor Presentations, Corporate Announcements, Management Discussions, Analyst Meets and Management Interviews, Industry Publications.

Disclaimer: The report only represents the personal opinions and views of the author. No part of the report should be considered a recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore

One Response