- About the Metals and Mining Industry

- Composition of Indian metals and mining Industry

- Metals and Mining Industry Segments

- Key Players in the Industry

- Trends of Indian Metals and Mining Industry

- Growth Drivers

- Outlook

- Strengths & Weaknesses

(A) About the Metals and Mining Industry

The metals and mining industry in India is an important sector that contributes significantly to the country’s economic growth. According to the first revised estimates for FY23, the Gross Value Added (GVA) from mining and quarrying was US$37.9 billion. For the same fiscal year, mineral production Projection was of Rs. 1,18,246 crore (US$ 14.37 billion).

The industry witnessed increased growth in Dec 2023 as compared to the previous year:

| Mineral | Production | Growth over 2022 |

| Coal | 929 lakh tonnes | 10.80% |

| Lignite | 40 lakh tonnes | 14.60% |

| Petroleum (crude) | 25 lakh tonnes | |

| Iron ore | 255 lakh tonnes | 1.30% |

| Limestone | 372 lakh tonnes | 12.50% |

| Natural gas (utilized) | 3078 million cubic meters | 6.60% |

| Bauxite | 2,429 thousand tonnes | 6.60% |

| Chromite | 235 thousand tonnes | |

| Copper concentrate | 11 thousand tonnes | 13.70% |

| Lead concentrate | 35 thousand tonnes | 16.50% |

| Manganese ore | 319 thousand tonnes | 4% |

| Zinc concentrate | 148 thousand tonnes | 7.80% |

| Phosphorite | 117 thousand tonnes | |

| Magnesite | 16 thousand tonnes | 83.70% |

| Gold | 122 kg |

The index of mineral production for the mining and quarrying sector in December 2023 was 139.4, up 5.1% YoY. This expansion indicates the industry’s strong performance and crucial position in India’s overall economic development.

(B) Composition of Indian metals and mining Industry

India possesses a diverse and abundant reserve of minerals, with over 95 minerals being mined across the country which are:

- 4 fuel minerals mines

- 10 metallic minerals mines

- 23 non-metallic mineral mines

- 3 atomic minerals mines

- 55 minor minerals mines(including building and other materials)

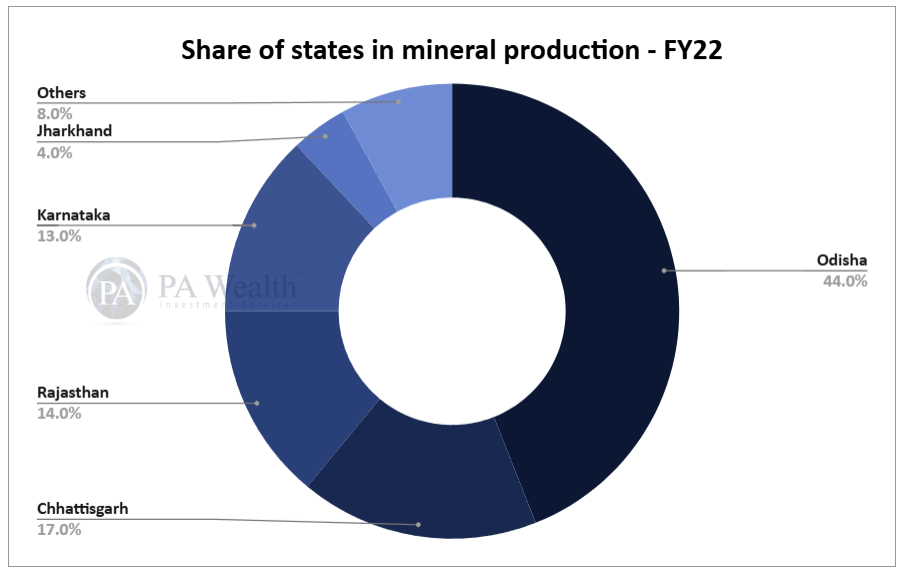

Odisha is the largest mineral producer in India, accounting for 44% of the national market share. While, Chhattisgarh and Rajasthan are the next largest producers in the national market, accounting for 17% and 14% respectively.

The production value of metallic minerals in India has steadily increased from $6.96 billion in FY18 to $12.76 billion in FY23. This represents over 84% growth over a five-year span. However, the production value of non-metallic minerals increased more modestly, growing from $1.16 billion in FY18 to $1.47 billion in FY23P, reflecting a 27% rise over the same period.

(C) Metals and Mining Industry Segments

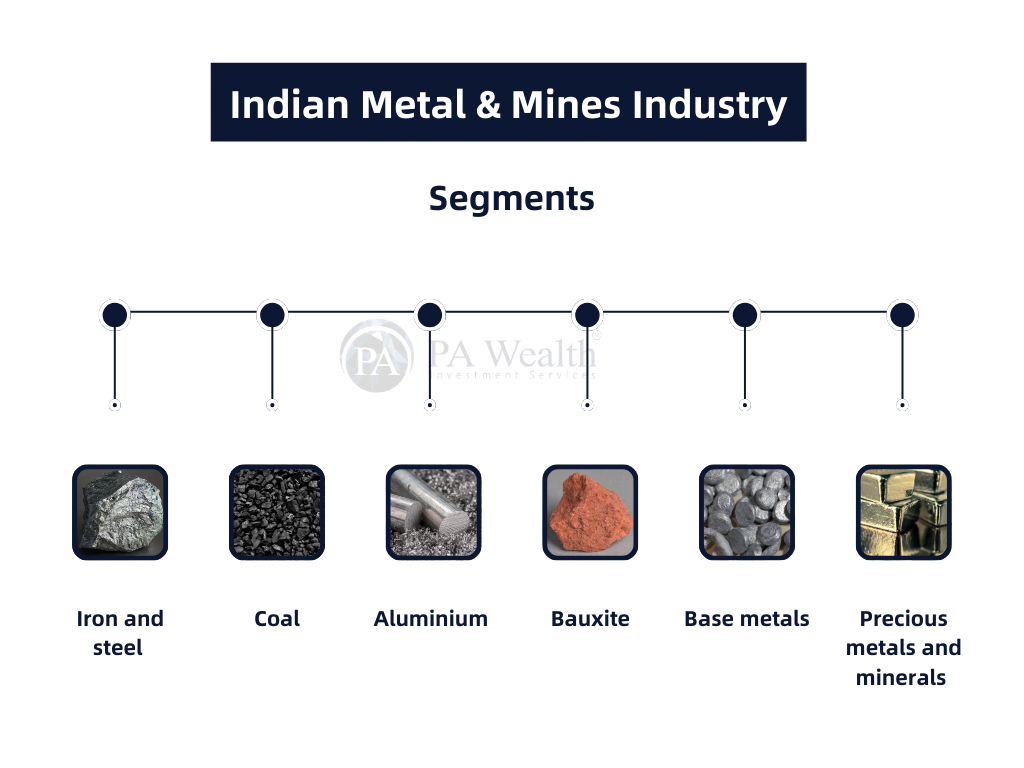

The metals and mining industry in India is divided into several segments:

- Iron and Steel: This segment includes hot rolled parallel flange beams, columns, rails, plates, coils, wire rods, billets, blooms, rounds, and slabs. India is the second-largest crude steel producer globally, with a production capacity of 125.32 million tonnes in FY23.

- Coal: India is one of the world’s largest coal producers, with production reaching 893.08 million tonnes in FY23. The country’s coal sector has seen significant growth, with the Ministry of Coal targeting a production increase to 1.23 billion tonnes by 2024-25.

- Aluminium: India ranks second in the world for aluminium production, with a capacity of around 4.2 million tonnes per annum. In FY23, the production of aluminium was 35.03 lakh tonnes. The share of India in the world production was 5.89% during 2023.

- Bauxite: Bauxite mining is an essential part of the aluminium production process. India produces a significant amount of both tropical and European bauxite. India is ranked fourth in the world in terms of bauxite reserves and has high-quality metallurgical grade bauxite deposits with close to 4 billion ton reserves.

- Base Metals: This includes lead, zinc, copper, nickel, and tin. Each of these metals plays a vital role in various industrial applications, from construction to electronics.

- Precious Metals and Minerals: This segment includes gold, silver, platinum, palladium, rhodium, and diamonds. These materials are critical for jewellery, investment, and industrial purposes.

(D) Key Players in the Indian Metals and Mining Industry

Primary Steel Producers:

- Steel Authority of India Limited: SAIL is one of India’s largest state-owned steel-making firms, noted for producing a wide range of steel products.

- JSW Steel: JSW Steel is a major participant in the Indian steel sector, with a strong market presence and a reputation for innovation and sustainability.

- Tata Steel, one of India’s and the world’s leading steel makers is known for its high-quality products and environmentally conscious methods.

Coal Mining:

- Coal India Limited (CIL): The world’s largest coal-producing firm, CIL is a government-owned entity that accounts for the vast majority of coal production in India.

- NMDC Limited: NMDC is primarily engaged in the exploration and mining of iron ore, but it also has a key role in the coal mining sector.

- MOIL Limited specializes in the manufacture of manganese ore, which is used in steel production and other industrial uses.

Non-ferrous Metals:

- Hindustan Zinc, India’s top zinc producer, is a subsidiary of Vedanta Ltd.

- Vedanta Limited is a diversified natural resource firm that operates in zinc, lead, silver, aluminium, and other metals.

- National Aluminum Company (NALCO): A key player in the aluminium industry, is a public-sector enterprise with a vast integrated aluminium complex.

- Hindalco Industries, part of the Aditya Birla Group, is one of India’s largest aluminium manufacturers and a leading copper producer.

Steel Product Manufacturing:

- APL Apollo Tubes is India’s major manufacturer of steel pipes and tubes, with a diverse product line used in a variety of sectors.

- Surya Roshni is a major player in the steel pipe manufacturing business, with a substantial influence in the lighting industry.

(E) Trends of Indian Metals and Mining Industry

Captive Mining for Coal

- The Indian government’s backing for captive coal mining has resulted in consistent increases in captive coal production. The government’s policy move had allowed the sale of up to 50% of yearly production from existing functioning captive coal mines in the open market. This has encouraged private operators to expand their production capacity.

Longer Duration Lease

- The Indian government’s decision to offer mining leases for longer periods(20-30 Years), has boosted the mineral sector’s growth.

Focus on Domestic Market

The government’s focus on strengthening the domestic market is evident from recent initiatives such as:

- The Ministry of Coal’s successful auctioning of 91 coal mines since the inception of Commercial Coal Mining in 2020.

- In 2023, JSW Group planned to build a steel plant in Andhra Pradesh with an investment of Rs 8,800 Cr.

- In 2021, the Indian state committee recommended the expansion of Vedanta’s Lanjigarh Alumina refinery from 1 MT to 6 MT, involving an investment of Rs 6,483 Cr.

International Collaboration

- The Geological Survey of India (GSI) provide technological insights while Khanij Bidesh India ramps up attempts to get vital minerals from countries such as Australia, Argentina, and Chile.

- In January 2024, India and Argentina struck an agreement to explore and develop five lithium blocks, boosting India’s lithium sourcing ambitions, with KABIL gaining exploration and exclusivity rights to these blocks.

Technology

- Automation and digitization, among other technical developments, have had a significant impact on the mining industry worldwide. ‘Production of Syn-Gas leading to coal gasification,’ was established as part of the NRS linkage auctions.

(F) Growth Drivers of the Metals and Mining Industry

Higher demand for metals

- Growing infrastructure investments are increasing the demand for metals, which are required for building and development projects. In 9MFY24, the combined index of eight cores which include Natural Gas, Steel, Cement, Electricity and Coal industries stood at 156.

Policy Support

- FDI up to 100% is allowed in exploration, mining, minerals processing metallurgy. It also includes the exploration of metal and non-metal ores under the automatic route for all non-fuel and non-atomic minerals.

- Mines and Minerals Development & Regulation Act 2021 led to growth in the production of minerals while also allowing to increase in the pace of exploration of mines. National Mineral Policy 2021 brought more transparency, better regulation, and growth along with sustainable mining practices in the industry.

Innovation

- Increasing Research and Development and Distribution Facilities in India and the use of contemporary technology has led to increased efficiency, lower costs, and increased production in mining and metal processing.

Increasing investment

- Rising levels of foreign direct investment add capital, technology, and knowledge to the industry, propelling it forward. Consequently, Between 2000 and 2023, the metallurgical industry received $17.46 billion in FDI, followed by mining at $ 3.50 billion. While diamond and gold jewellery and coal production is at $1.27 billion and $27.73 million respectively. In FY23, the metals and mining industry saw the third-highest inflows from foreign investors.

(G) Outlook of Indian Metals and Mining Industry

Steel and Iron Sector

- India’s steel production for FY23 stood at 126.26 million tonnes (MT) for crude steel and 122.28 MT for Finished Steel. The consumption for finished steel stook at 119.86 MT.

- National Steel Policy (NSP) which was introduced in 2017 is targeting 300 MT steel-making capacity and aiming for 160 kg per capita steel consumption by 2030-31. Further, It aims to achieve 500 million tonnes of steel production by 2050, up from the current 126.26 MT, driven by rapid capacity expansion in infrastructure.

- Several Recent Developments in the steel sector include Tata Steel’s MoU with the Punjab government for a new 0.75 MnTPA steel plant, SAIL supplying speciality steel for INS Vikrant and Collaboration between IIT Bombay and JSW Group for a state-of-the-art steel manufacturing hub.

- Exports of finished steel were 6.72 MT in FY23 while exports of finished steel from April-January FY24 rose 3.6% year-on-year to 5.52 MT. Government’s removal of export duties on steel products and iron ore to boost exports. Steel demand is expected to grow around 10% due to continued infrastructure focus.

- Steel imports totaled $1.83 billion in December 2023, up 34.8% to 6.7 million tonnes in the first ten months of FY24. Domestic steel demand is predicted to increase by 10-12% in FY23, fueled by infrastructure construction and economic recovery.

Iron Ore Sector

- India’s iron ore production in FY23 was 257.85 million tonnes (MT), up 1.52% from FY22.

- The majority of reserves (>85%) are medium- to high-grade, which is used directly in blast furnaces and DRI plants. Subsequently, Iron ore exports were US$ 1.75 billion in 2022-23, a decrease from US$ 3.18 billion in 2021-22.

- Policy changes, early mine auctions, ease of doing business measures, and increased exploration activity are all examples of reforms aimed at increasing iron ore production.

Coal sector

- Coal production increased to 893.08 million tonnes (MT) in FY23 from 728.72 MT in FY19, a 22.6% increase. Coal production was 784.11 MT from 10MFY24, a 12.18% increase Year on Year.

- For 10MFY24, The power industry dispatched 665.24 MT of coal, an 8.5% Year on Year Increase. Further, Captive/other mines contributed 14.99% of total coal production, up 25.04% year on year in 10MFY24.

- Coal India Limited expects to increase production to 1 billion tonnes by FY26 and 1.5 billion tonnes by FY30.

- The government has encouraged continuous expansion in captive coal production by permitting up to 50% of annual output from active captive mines to be sold on the open market.

- Several key Initiatives by govt. include auctioning coal blocks for commercial mining, allowing foreign direct investment (FDI) through the automated method, expanding existing mines, and establishing new mines.

Aluminium Sector

- Global aluminium output increased to 70 million metric tons (MMT) in 2023 from 68.4 MMT in the previous year.

- India’s share in global aluminium production was 5.89% in 2023. Per capita consumption of aluminium in India is approximately 3.1 kg, much lower than the world average of 12 kg and China’s 31.7 kg.

- Expected growth in Indian aluminium consumption to 9.5 million tonnes by 2030 from 2.6 million tonnes in 2021, mainly driven by increased infrastructure spending.

- India’s production of aluminium was 35.03 lakh tonnes in FY23 while exports were $5.3 billion during April-December FY24.

- Significant investments and initiatives in the sector include the expansion of Vedanta’s Lanjigarh Alumina refinery and collaborations like Hindalco’s MoU with Phinergy for aluminium-air batteries.

- Aluminium consumption in India is expected to grow at a CAGR of over 10%, driven by sectors like electric vehicles, renewables, infrastructure, as well as consumer goods. Additionally, Aluminium demand in India is projected to double by 2025 and reach 9 million metric tonnes by 2033.

(H) Strengths & Weaknesses

Strengths

Increasing Steel Demand in India:

The Indian steel industry will double in size by 2030, due to increased capacity from major firms such as Tata Steel and SAIL. NMDC, a leading iron ore producer, is well-positioned to gain from the surge in demand for iron ore due to increased steel output.

Government Focuses on Infrastructure Development:

The Indian government’s strong emphasis on infrastructure development is driving up demand for metals, notably steel. Subsequently, The metals and mining sector is predicted to have strong growth over the next five years, similar to the capex boom from 2003 to 2008.

Significant reserve and production capacity:

NMDC has considerable iron ore deposits, which ensures long-term production sustainability. The company plans to increase production capacity from 51.8 MT to 100 MT by FY30 through major capex projects such as additional screening units, slurry pipelines, and beneficiation plants.

Favorable Economic Conditions:

The current economic environment, which is characterized by sufficient liquidity, low inflation, and growing commodity prices, is beneficial to the metals and mining sector. These conditions are comparable to those observed between 2003 and 2008 when the sector experienced tremendous development.

Weaknesses

Regulatory and Environmental Challenges:

The industry has considerable legal and environmental obstacles, such as the requirement for several clearances and compliance with environmental standards. Delays in acquiring permissions might impact expansion plans and operating efficiency.

Dependence on Government Policy:

The sector’s expansion is primarily reliant on government regulations governing mining and infrastructural development. Any modifications to these policies may have a negative influence on the industry’s performance and expansion plans.

Volatility in commodity prices:

The metals and mining business is vulnerable to swings in global commodity prices. This volatility can have an impact on profit margins and overall financial stability for enterprises in the sector.

Operational risks and significant capital expenditure:

The industry requires significant capital expenditure for exploration, development, and production activities. High capital expenditure projects have inherent risks, such as project delays and cost overruns, which can have an impact on profitability and return on investment.

Drop us your query at – info@pawealth.in or Visit pawealth.in

References: Annual Reports, News Publications, Investor Presentations, Corporate Announcements, Management Discussions, Analyst Meets and Management Interviews, Industry Publications.

Disclaimer: The report only represents the personal opinions and views of the author. No part of the report should be considered a recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore