- Understanding and Working of NFOs

- Common Misconceptions about NFOs

- Should You Invest in an NFO?

- Conclusion

Investing in mutual funds can be confusing, especially with so many options available. New Fund Offers (NFOs) frequently attract the attention of investors looking for new opportunities. But what precisely is an NFO? How does it function? And is it advisable to invest in one? This article will explain NFOs in layman’s words, debunk common misconceptions, and help you decide when it’s a good idea to invest in one. By the conclusion, you’ll have a greater knowledge of NFOs and how they might fit into your investment strategy.

(A) Understanding and Working of New Fund Offers (NFOs)

When a mutual fund house or Asset Management Company (AMC) decides to launch a new mutual fund scheme, it launches a New Fund Offer also known as NFO. The process enables the AMC to raise the funds required to purchase stocks or debt securities.

During the NFO period, which typically lasts 10 to 15 days, investors can purchase units for a starting price of roughly Rs. 10 per unit. Once the NFO period is over, the fund begins operations, and investors can trade units on stock exchanges based on their Net Asset Value (NAV). Professional fund managers then allocate the collected capital based on the fund’s objectives, allowing investors to participate in a new fund with a minimal initial contribution. However, before investing, you should conduct research and talk with a financial expert.

(B) Common Misconceptions about NFOs

(1) Mutual fund NFOs are exactly like equity IPOs.

Contrary to popular misconception, NFOs and IPOs have notable distinctions. An IPO may involve generating new capital for the company or selling existing shares (offer for sale). An NFO, on the other hand, is focused on raising new funds with no limit on the amount raised, resulting in an endless supply. Retail investors benefit from special quotas and discounts in IPOs, which are not accessible in NFOs. Furthermore, the IPO price is set by demand and supply forces, but the NFO price remains fixed at Rs. 10.

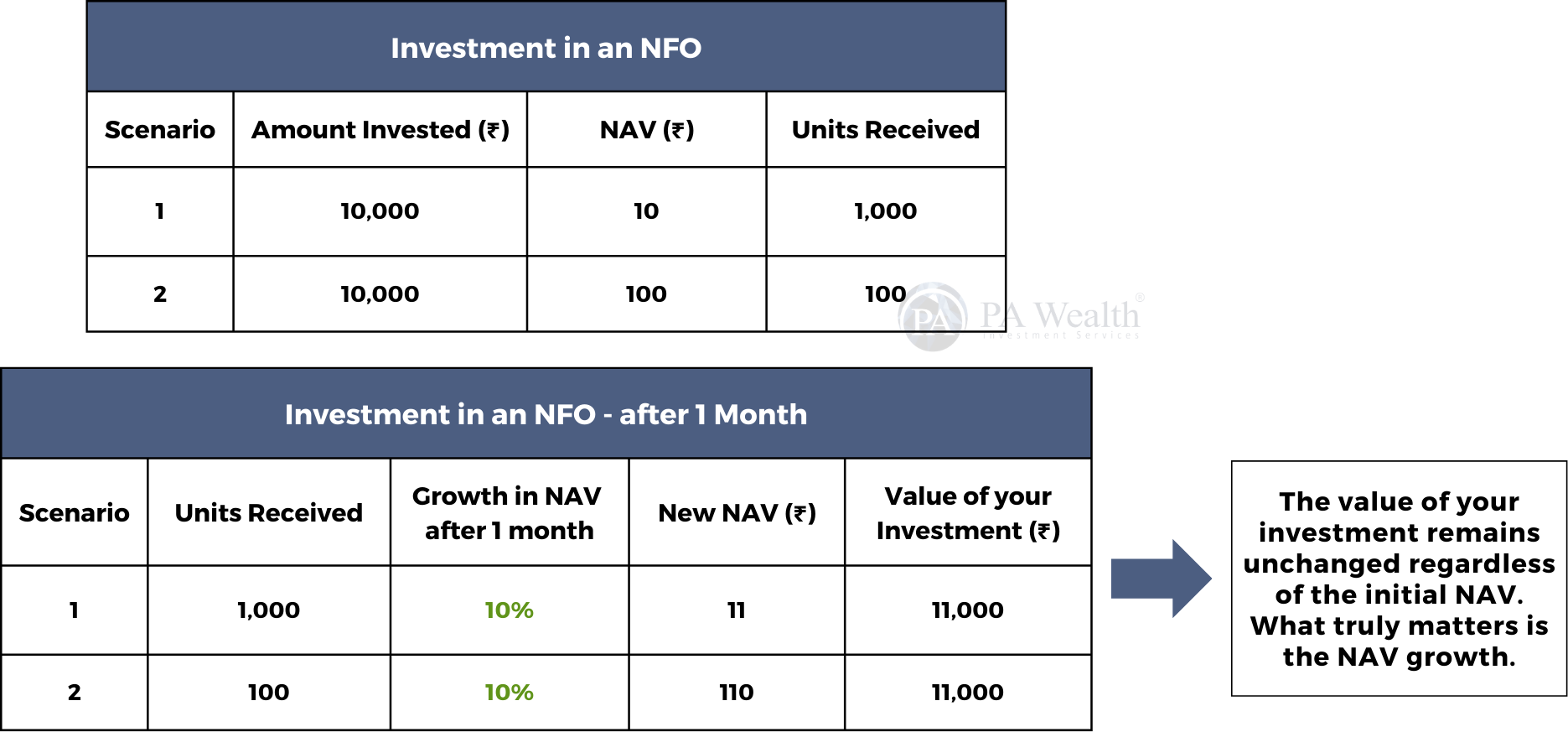

(2) An NFO is better than a secondary market MF as it is available at NAV of Rs. 10

The NAV of an NFO at Rs. 10 is not a deciding factor. What counts most is the market level at which the investment is made, particularly in the case of equity mutual funds. Purchasing an existing mutual fund in the secondary market for a higher NAV can be a wise option if market conditions are favorable, making the NAV insignificant.

(3) An NFO has a lower cost compared to buying existing mutual funds.

The truth is exactly the opposite. The fund house typically spends more on marketing and publicity when a mutual fund scheme is new, which raises expenses. Brokers might also ask for larger commissions in order to disperse the funds. Ultimately, the NAV is debited for these charges, which results in the NFO listing below the par value NAV.

(C) Should You Invest in an NFO?

(i) Why NOT to Invest in an NFO?

NFOs include risks and uncertainties even though they may initially appear attractive. If you want to invest, it is usually advisable to wait and see how the fund performs. Here’s why:

(1) No Track Record:

The absence of a historical record makes it challenging to assess the fund’s performance during several market cycles. An NFO has a greater level of risk compared to a fund that has an established track record.

(2) No Meaningful Differentiation:

It is uncommon to come across an NFO whose strategy is not already accessible through an established fund. Investing in the NFO offers minimal benefit if an established fund is already accessible.

(3) Timing May Not Be Right:

Since fund performance is typically cyclical, NFOs are vulnerable to mean reversion because they are typically introduced to take advantage of recent excellent performance in a certain segment. Frequently, investors get discouraged after purchasing these funds at the incorrect moment.

(ii) Why to Invest in an NFO?

While it is normally advisable to wait and study the fund performance before investing, there are rare occasions where an NFO may be a good opportunity if it fits specified conditions:

(1) Unique Fund Strategy:

The fund can be an opportunity if it employs a distinct technique not seen among similar funds. As an illustration, consider an international equity strategy that diversifies a portfolio.

(2) Experienced Fund Manager:

If the fund is run by an experienced manager with a consistent investment methodology and a long performance track record, it may be worth investing.

(3) Fund Category or Strategy That Benefits from Lower Fund Size:

Tiny fund sizes are beneficial in categories with limited liquidity or high churn. A smaller, recently launched fund with a lower AUM, for instance, might do better than an older, bigger fund in the same class.

(D) Conclusion

NFOs can be exciting but come with major risks and uncertainty. It is normally safer to invest in established funds with proven track records unless the NFO fits specified parameters that align with your investing plan and risk tolerance. Always investigate thoroughly and talk with a financial professional before making any investment decisions.

Drop us your query at – info@pawealth.in or Visit pawealth.in

Disclaimer: The report only represents the personal opinions and views of the author. No part of the report should be considered a recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | AMFI registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore