- Fixed Income

- Equities

- Commodities

- Alternative Asset Classes

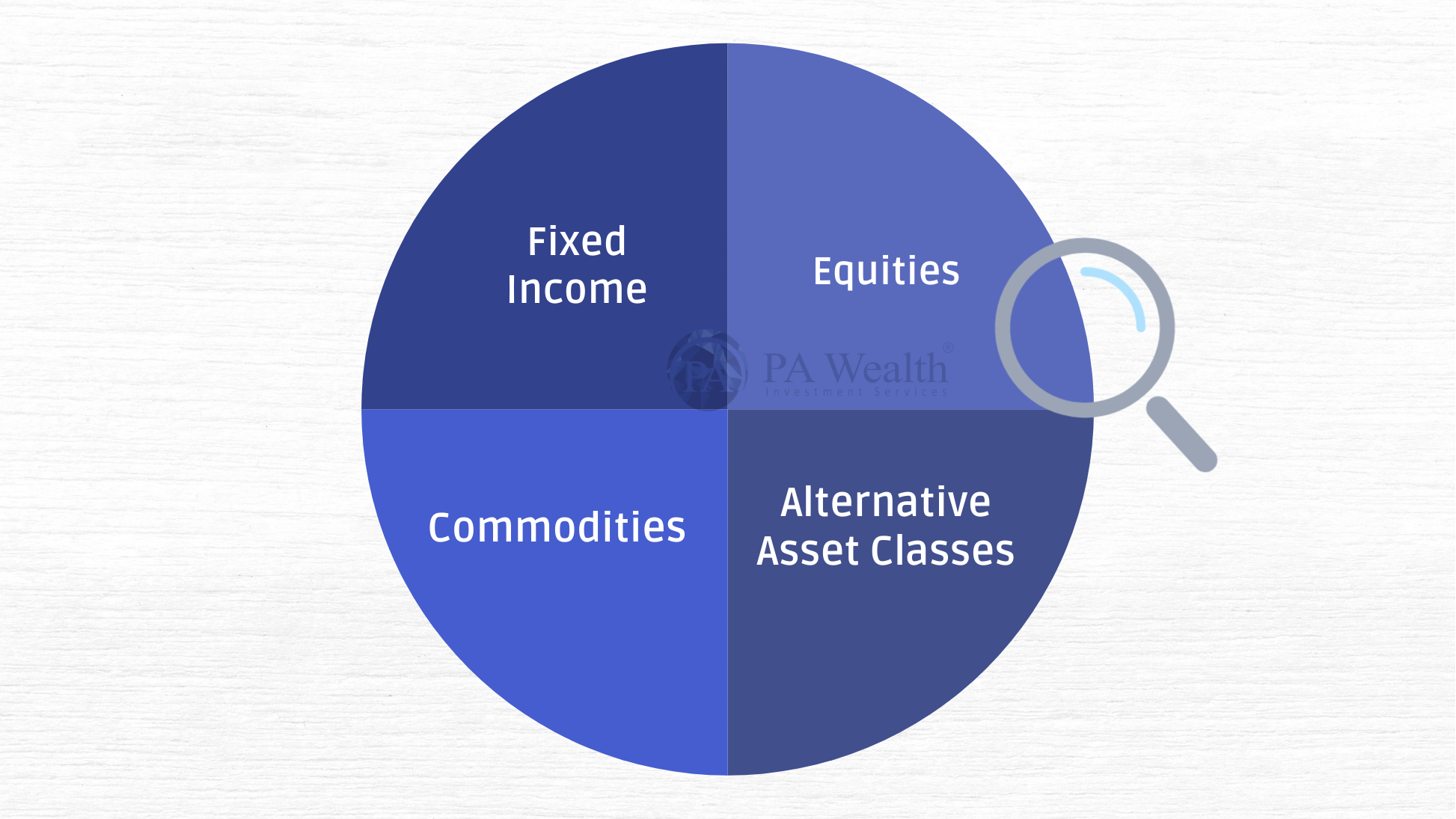

- Diversification: The Key to Reducing Risk

- Conclusion

Asset classes are groups of investments with similar characteristics that behave alike in the market. These classes include stocks, bonds, real estate, and commodities. Financial advisors use them to diversify portfolios and manage risk. Let’s take a closer look at some of the most common asset classes.

(A) Fixed Income

Fixed income investments involve lending money to an entity in exchange for regular interest payments until the maturity date. Government and corporate bonds are common types of fixed income investments. They generally carry less risk than stocks and can provide a steady income stream, which often preserves capital.

(i) Government Bonds:

The government backs these investments, making them relatively safe. The interest rates on government bonds tend to be lower as they carry less risk. Investors often use these for a steady return.

(ii) Corporate Bonds:

These bonds, issued by corporations, are riskier than government bonds but offer larger returns as a compensation. The issuing company’s financial stability determines the risk of a corporate bond. Before making an investment, investors should investigate the company’s credit rating and financial condition.

(B) Equities

Equities, or stocks, indicate ownership in a corporation. When you acquire stocks, you become a shareholder and participate in the company’s profits through dividends and capital appreciation. Investing in shares can yield substantial gains but comes with higher risk. Stock prices can be volatile, driven by factors like corporate performance, market conditions, and economic trends.

Ways to Invest in Equities:

(i) Buying Stocks Directly:

This requires a trading account and a de-mat account. Direct stock investment allows investors to select specific businesses to invest in.

(ii) Exchange-Traded Funds (ETFs):

ETFs are investment baskets that track specific market indices, offering diversification. They trade on stock exchanges like individual equities and investors can purchase and sell them throughout the trading day. ETFs are a popular choice for investors searching for diversity without having to buy specific stocks.

(iii) Mutual Funds:

These funds pool money from multiple investors, and professionals manage them, making investment decisions on behalf of the investors. Mutual funds offer diversification and professional management but come with management fees.

(iv) Portfolio Management Services (PMS):

PMS offer tailored investment management for high-net-worth people. These services provide specialized investment strategies and hands-on management of the investor’s portfolio.

(C) Commodities

Commodities are the physical goods that are traded on exchanges. Commodities include precious metals like gold & silver, power and energy sources like oil & gas, as well as agricultural products like corn and wheat. They act as a hedge against inflation & market fluctuations.

Ways to Invest in Commodities:

(i) Trading Commodities Directly:

Involves buying and selling physical goods. This strategy is often utilized by organizations and professionals with knowledge in the commodities market

(ii) Commodity Futures:

Contracts to buy or sell a commodity at a future date and price. Futures can be used for hedging or speculative purposes. They require a good understanding of the market and can be risky due to their leveraged nature.

(iii) Commodity-Based ETFs:

These funds invest in different commodities and provide an easier way for retail investors to gain exposure to the commodities market. They offer diversity and can be bought and sold like stocks.

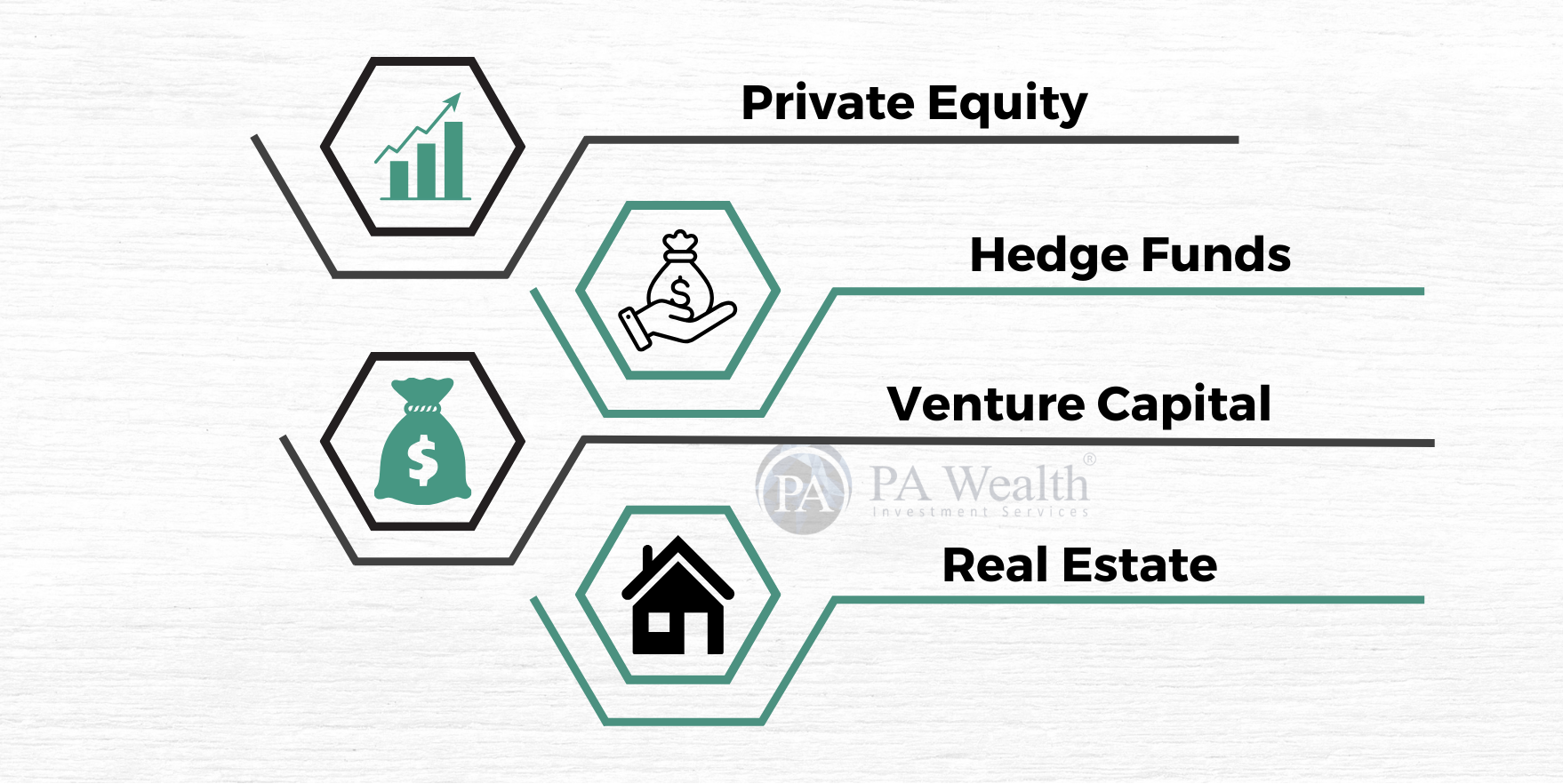

(D) Alternative Asset Classes

Alternative asset classes offer unique investment opportunities outside traditional stocks and bonds. Examples include real estate and venture capital.

(i) Real Estate:

Real estate investments can generate both rental income and capital appreciation. Real estate can be a tangible asset with a consistent income flow and potential for future growth. Investors can buy residential, commercial, and industrial properties.

(ii) Venture Capital:

Investments are made in early-stage enterprises with great growth prospects. Venture capital can generate huge profits if the company succeeds, but it is also considerable risk because many startups fail.

(iii) Investing in Alternative Asset Classes in India:

These funds invest in different commodities and provide an easier way for retail investors to gain exposure to the commodities market. They offer diversity and can be bought and sold like stocks.

Alternative Investment Funds (AIFs):

These funds have three categories, each with its own investment focus and strategy:

- Category 1: Invest in start-ups, small and medium enterprises (SMEs), and social ventures. These funds aim to promote economic growth and development.

- Category 2: Invest in private equity funds and debt funds. These funds target more established companies and provide stable returns.

- Category 3: Invest in hedge funds and private investment in public equity (PIPE) funds. These funds use complex strategies to achieve high returns.

(E) Diversification: The Key to Reducing Risk

Diversification is essential for lowering risk in your investing portfolio. Investing in a variety of asset types allows you to spread risk while potentially increasing profits. Diversification protects your portfolio against market volatility and economic downturns by ensuring that not all of your investments are impacted by the same variables.

(F) Conclusion

Understanding asset classes is essential for developing a diverse investing strategy. By researching various investing options such as fixed income, equities, commodities, and alternative asset classes, you may make informed decisions that match with your financial objectives. Begin creating your diverse portfolio today to gain control of your financial future!

Drop us your query at – info@pawealth.in or Visit pawealth.in

Disclaimer: The report only represents the personal opinions and views of the author. No part of the report should be considered a recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | AMFI registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore