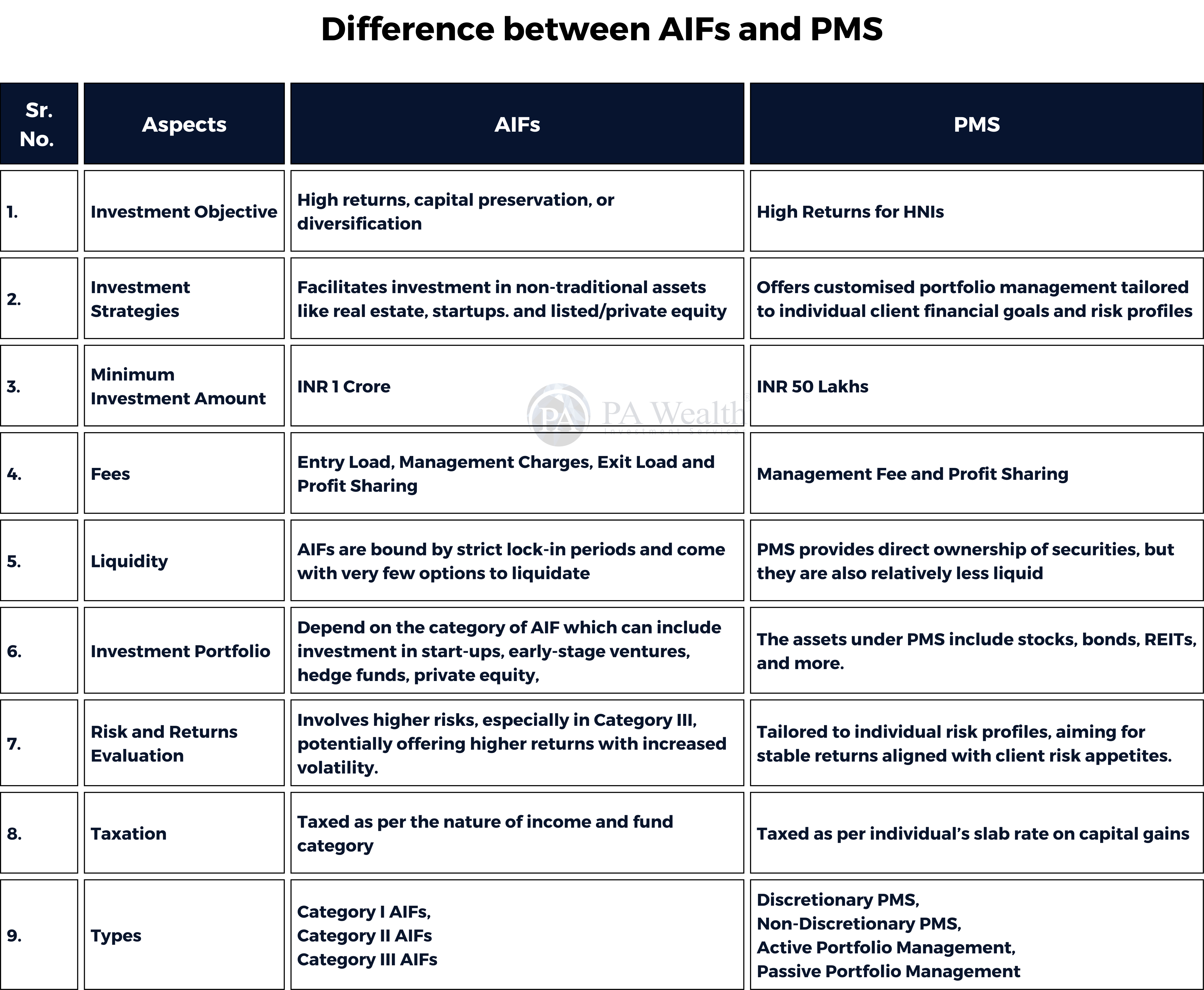

Investors often find themselves confused when choosing between Alternative Investment Funds (AIFs) and Portfolio Management Services (PMS). Both offer unique benefits and cater to specific investment needs, but the differences can be subtle yet significant. This blog aims to clarify these distinctions, providing you with a comprehensive understanding of AIFs and PMS, so you can make an informed decision tailored to your investment goals.

Benefits of Investing in AIFs:

1. Diversification:

AIFs provide a way to invest in diverse types of assets that do not correlate with traditional stocks and bonds. These funds can include investments in areas like real estate, private companies, hedge funds, commodities, and infrastructure, providing a broader range of investment options for diversification.

2. Risk Mitigation:

Fund managers actively manage the fund to reduce risk and enhance performance. This may involve employing hedging techniques, diversifying within the alternative asset class, or utilizing proprietary strategies to minimize downside risk.

3. Access to Non-publicly Listed Investments:

AIFs often invest in projects or companies that are not publicly listed, providing investors with access to exclusive opportunities. These investments might offer attractive returns, but they typically require a longer investment horizon and carry higher liquidity risks.

Benefits of Investing in PMS:

1. Customized Portfolio:

PMS provides Ultra High Net Worth Individuals (UHNIs) with the opportunity to have a personalized investment portfolio designed to align with their specific financial goals, risk tolerance, and investment preferences.

2. Expert opinion on your investment:

The portfolio managers assigned to the client are experts in their field, possessing a deep understanding of how to navigate market volatility. They manage the portfolio efficiently with the goal of increasing the client’s profit margin over time.

3. Regular monitoring:

The portfolio manager closely monitors the performance of each asset and regularly reviews the returns generated. Based on this analysis, they adjust the investment to meet the investor’s financial objectives.

Drawbacks of Investing in AIFs:

1. High Investment Threshold:

AIFs typically have a higher minimum investment threshold compared to traditional mutual funds. This can be a barrier for small retail investors, limiting their access to these investment opportunities.

2. Liquidity risk:

The illiquid nature of certain asset classes can make it challenging to exit investments quickly, and investors may need to hold on to their positions for an extended period to realize potential returns.

3. Limited Transparency:

While AIFs are subject to regulatory oversight, they may not provide the same level of transparency as publicly-traded investments. Investors might not have real-time access to their portfolio holdings, making it challenging to assess the exact value of their investments at any given time.

Drawbacks of Investing in PMS:

1. High Costs:

One of the main drawbacks of PMS is high fees. PMS providers charge an expense ratio anywhere between 2.5% – 5%, depending on the extent of customization. Usually, discretionary services attract higher costs.

2. Market Risk:

PMS investments are subject to market fluctuations and associated risks. While portfolio managers strive to manage risks, there is no guarantee of positive returns, and the portfolio value may decline during market downturns.

Conclusion

In conclusion, both AIFs and PMS cater to different investment needs. AIFs offer access to diverse, high-risk, high-return opportunities, while PMS provides personalized, tailored portfolios. Your choice should depend on your investment goals, risk tolerance, and desire for customization. Understanding these differences will help you make an informed decision that aligns with your financial objectives.

Drop us your query at – info@pawealth.in or Visit pawealth.in

Disclaimer: The report only represents the personal opinions and views of the author. No part of the report should be considered a recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | AMFI registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore