Sequent Scientific is one of the largest players in the animal healthcare market with production facilities in India, the Americas and Europe. With its recent Merger with Viyash, the company may try to establish its foothold in the United States which is the largest companion Animal market.

- About the company

- Industry Overview

- Growth Strategy

- Board Members

- Shareholding Pattern

- Business Segments

- Revenue Segments

- Cost Structure

- Financial Parameters

- Management Key Highlights

- Strengths & Weaknesses

(A) About

Sequent Scientific Limited is India’s largest and one of the top 20 animal health firms worldwide, boasting a combined sales of ₹13.69 billion and a market valuation of around ₹29.33 billion. SeQuent and its subsidiaries are prominent entities in the animal health market, operating in more than 90 countries across five continents. The Company has strategically established seven production facilities in India, Spain, Brazil, and Turkey. These firms have received certifications from regulatory bodies, including the USFDA, EUGMP, WHO, and TGA.

SeQuent, under its specialized animal health brand Alivira Animal Health, provides a broad array of Active Pharmaceutical Ingredients (APIs), final dose formulations (FDF), and thorough analytical services. The Company’s product portfolio caters to the varied requirements of cattle, poultry, and companion animals. It also offer comprehensive laboratory and technical support services.

Sequent Scientific Ltd. (SEQUENT) share has taken a beating over the last few years due to various geopolitical tensions and an inflationary environment which led to a decrease in margins and volatility in profits.

(B) Animal Health Industry Overview | Sequent Scientific Analysis

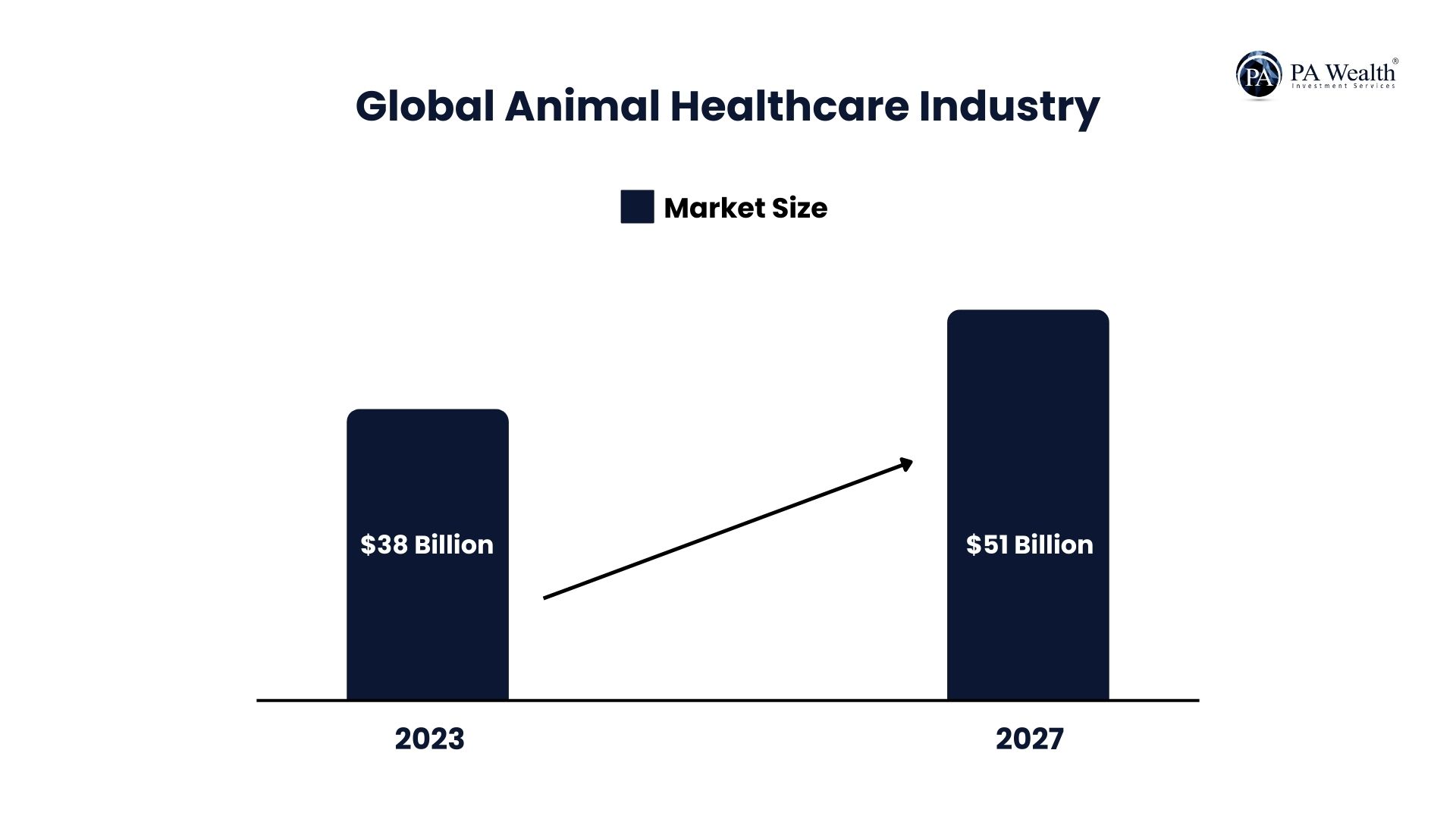

Current Market Size:

- The worldwide animal healthcare industry, estimated at roughly 38 billion in 2023, is projected to attain around 51 billion by 2027.

- The Indian market is currently valued at 1.25 billion (2024) and is anticipated to reach 1.89 billion by 2029.

Growth Rate:

- The worldwide animal healthcare sector is developing at a CAGR of roughly 8%.

- In India, the CAGR is anticipated at 8.63% from 2024 to 2029.

- Companion animal healthcare is expanding quicker, with a CAGR of 9.03%, driven by pet ownership and healthcare advances.

Sector Dynamics and Changes:

- Increased focus on disease prevention and food security has led to breakthroughs in monitoring and controlling animal health, which is crucial for stable food prices and supply.

- Mergers and acquisitions in veterinary sectors are expanding as organizations scale up to meet demand.

- Technological innovations, like smartphone apps for pet owners, vaccine banks, and pet tracking, are fueling market expansion.

- Government backing and alliances with animal welfare organizations are boosting the industry’s expansion.

Regional Highlights:

- North America presently dominates in both production and companion animal healthcare.

- Asia-Pacific, which includes India, is the fastest-growing market due to the burgeoning livestock sector and government backing for animal healthcare projects.

(C) Growth Strategy

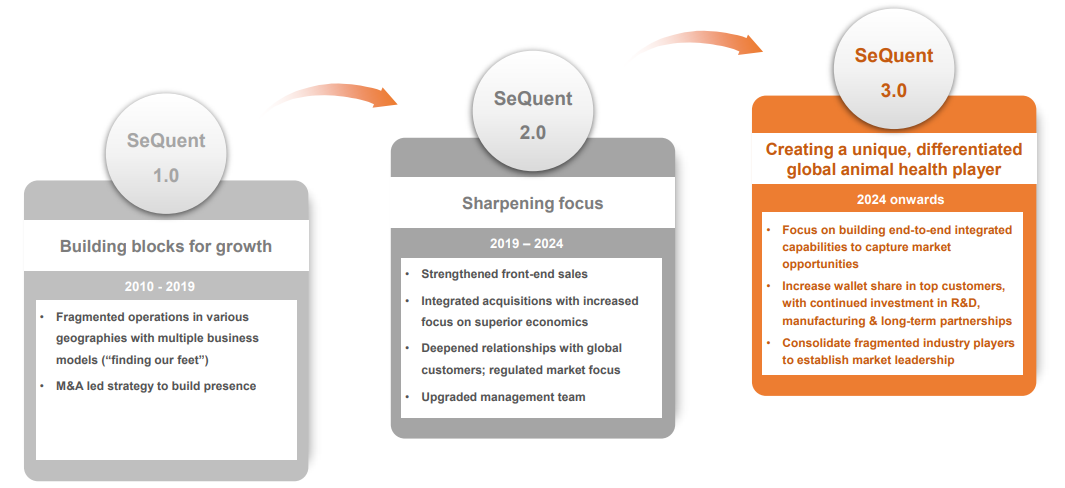

Sequent Scientific has implemented a planned growth strategy, progressing through three important phases. Here’s a breakdown of the stages:

SeQuent 1.0 (2010-2019): Building Blocks of Growth

Sequent’s focus throughout this period was on developing a presence in multiple regions. The strategy was fragmented, with the company trying out several business strategies to “find their feet” in different markets. This phase also relied significantly on mergers and acquisitions to speed growth, broaden geographical reach, and create a presence in new markets.

SeQuent 2.0 (2019-2024): Sharpening Focus

During this time, Sequent sought to improve its operational efficiency and concentrate on regulated markets. The plan involved strengthening front-end sales and integrating acquisitions, with a focus on attaining superior economics. The company also concentrated on strengthening partnerships with worldwide consumers, increasing its footprint in regulated markets. It is also improving its management team to properly drive these activities.

SeQuent 3.0 (2024 onwards): Creating a Unique, Differentiated Global Animal Health Player

Sequent’s future goals include developing a highly integrated, distinctive global animal health platform. The major objectives include creating end-to-end integrated capabilities to capitalize on new market possibilities. Also, it includes combining fragmented industry participants to attain market leadership.

The company intends to increase its proportion of top clients through ongoing expenditures in R&D, manufacturing, and long-term relationships. This phase represents Sequent’s metamorphosis into a one-of-a-kind player with a strong, united strategy for sustaining its worldwide leadership position in the animal health sector.

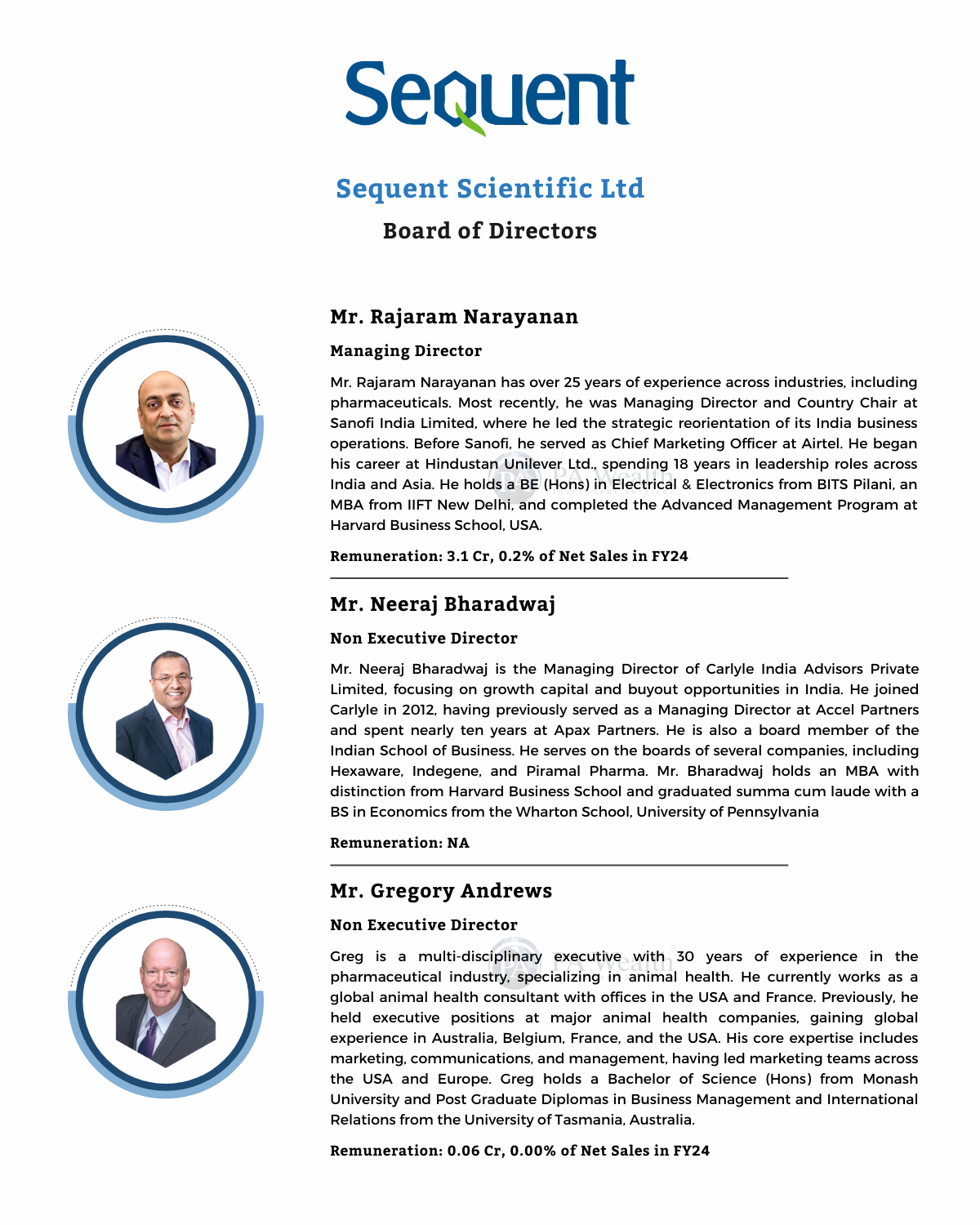

(D) Board of Directors of Sequent Scientific

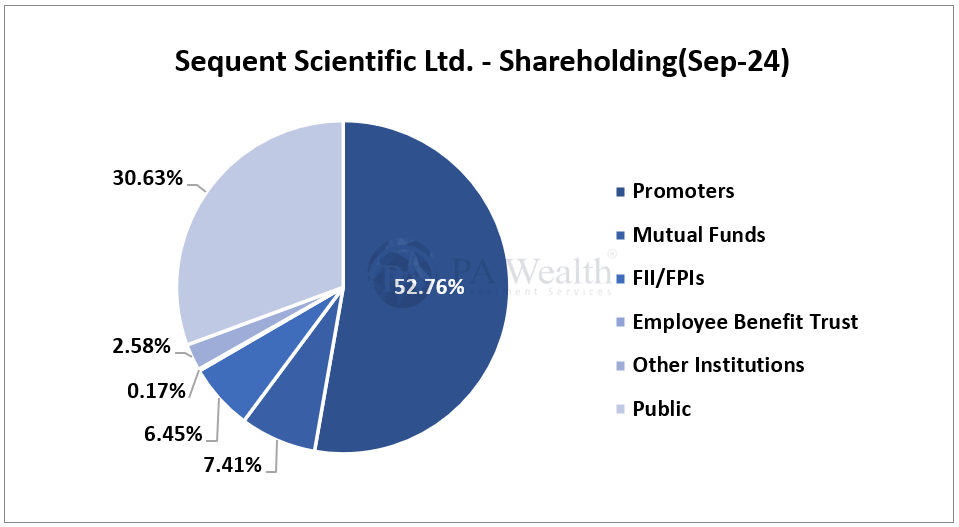

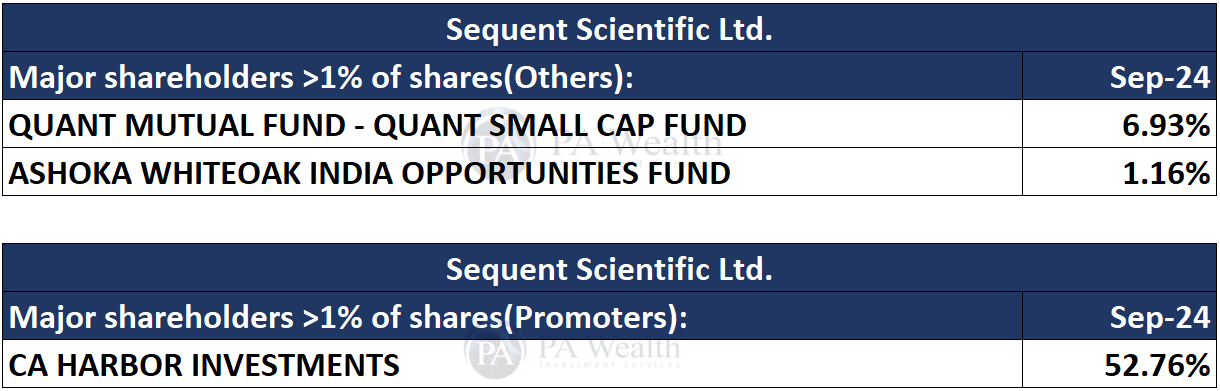

(E) Shareholding Pattern of Sequent Scientific

(F) Business Segments | Sequent Scientific Analysis

Formulations

Sequent Scientific’s formulations segment accounts for a sizable amount of its sales, due to a strong market presence in regulated regions such as Europe and rising markets like India. Key areas include pain management, parasite control, antibiotics, and animal gut health solutions. This segment is supported by multiple manufacturing facilities and four R&D centres. In FY24, the company had significant growth in Europe and Turkey, with strategic expansions in Latin America.

Active Pharmaceutical Ingredients (APIs)

The APIs business serves animal health firms worldwide, with two manufacturing facilities and an R&D centre. Sequent’s focus on efficiency has increased profits, particularly through Project Pragati, which has improved operational performance. Approximately two-thirds of API sales come from regulated markets, and recent approvals in key areas, such as WHO prequalification, are creating new business opportunities. The segment’s competitive edge is strengthened by continued product development in high-demand areas, such as companion animal healthcare.

Analytics Services

Sequent’s subsidiary, SeQuent Research Limited, provides contract research and analytical services from a US FDA-approved laboratory in Mangaluru. This segment provides specialist testing, such as trace elements and genotoxic analysis. This segment is led by a staff of approximately 39 scientists. The analytical services business supports Sequent’s R&D endeavours, improving product quality for Sequent and its clients.

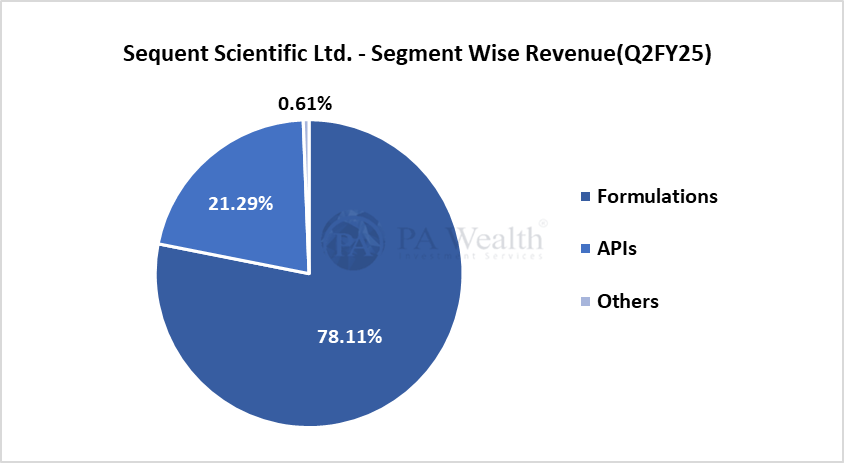

(G) Revenue Segments | Sequent Scientific Analysis

(i) Segment Wise Revenue

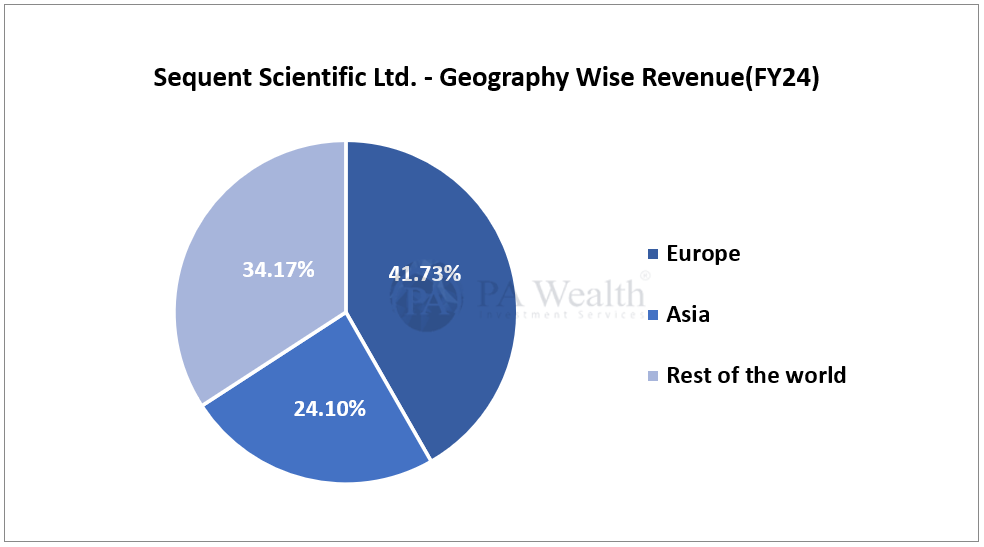

(ii) Geography Wise Revenue

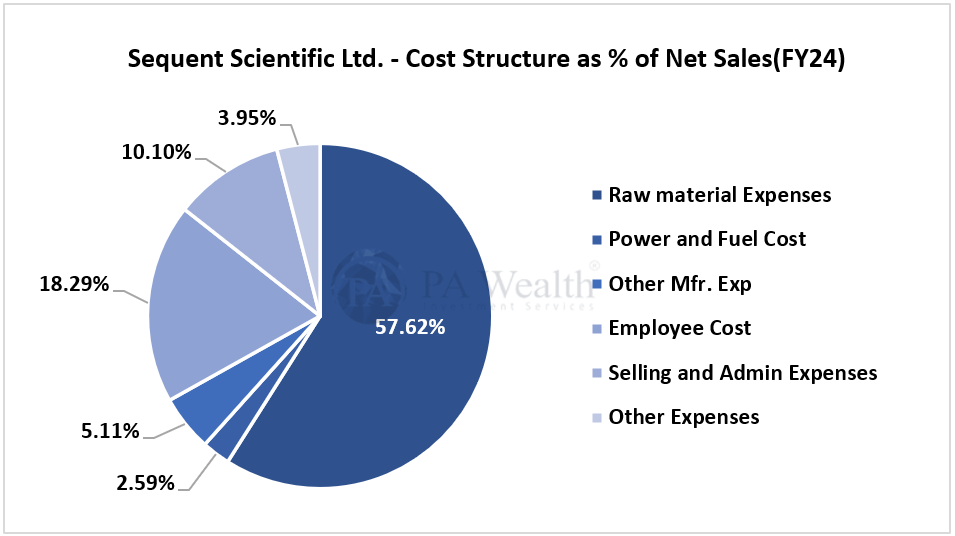

(H) Cost Structure | Sequent Scientific Analysis

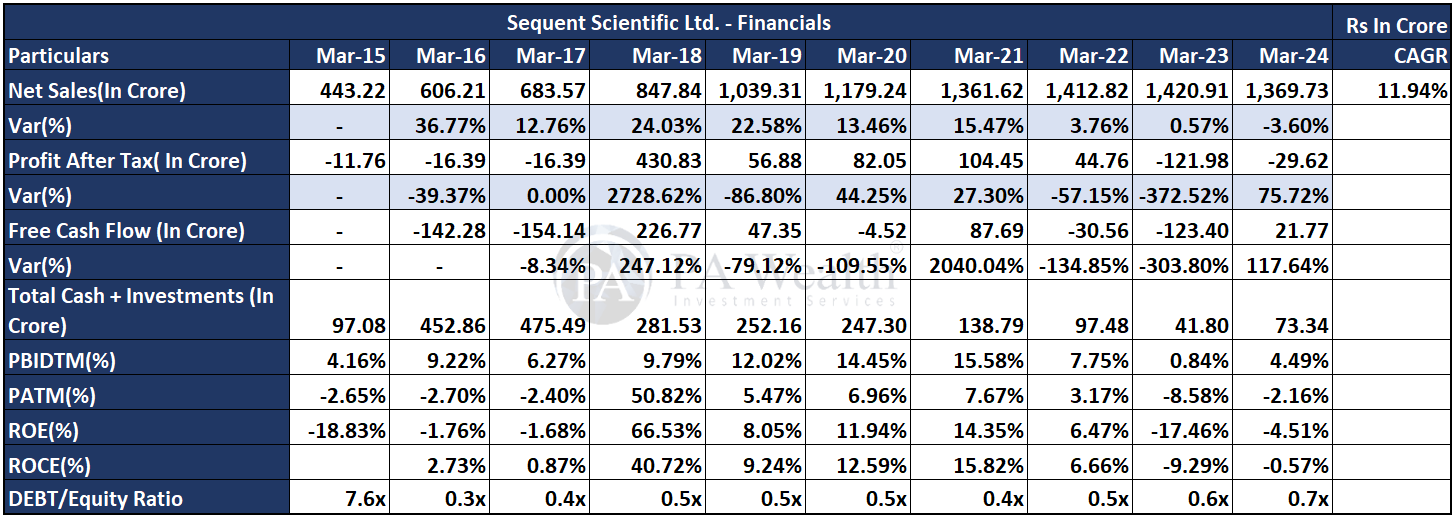

(I) Financials | Sequent Scientific Analysis

The company’s revenue has grown at a CAGR of 10.57% over the past 10 years, increasing from Rs 797 Cr. in FY15 to Rs 2,177 Cr. in FY24. Subsequently, the company’s PAT has also shown growth, rising from Rs 112 Cr. in FY15 to Rs 315 Cr. in FY24 at a CAGR of 10.89%. Furthermore, the company’s ROE has seen a decrease from 30.50% in FY15 to 15.20% in FY24.

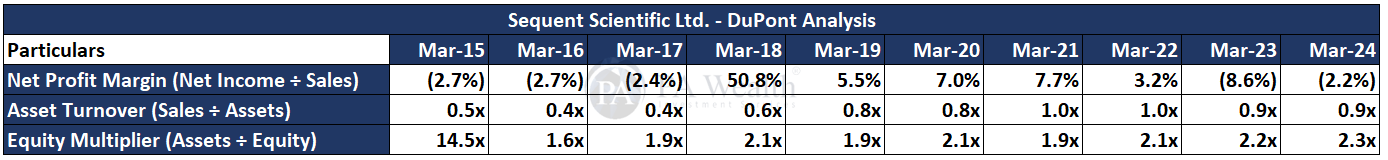

DuPont Analysis

(J) Management Discussion | Sequent Scientific Analysis

Concall Highlights

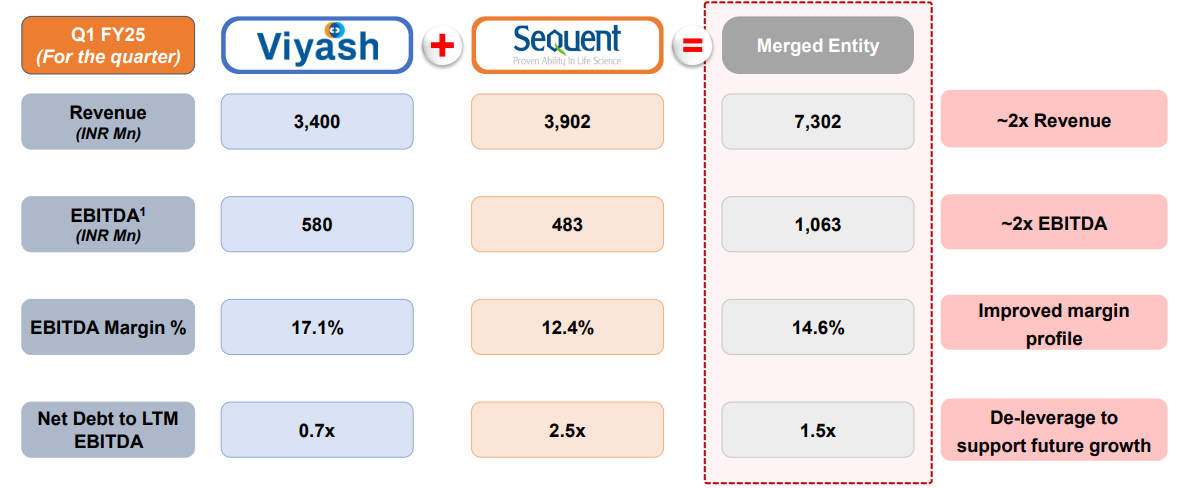

- SeQuent Scientific and Viyash Life Sciences announced a merger on September 27, 2024, to create a stronger platform in animal health and pharmaceuticals.

- The merger is likely to be completed within 12-15 months, subject to regulatory and shareholder clearances.

- The merger will follow a share swap ratio where Viyash shareholders receive 56 SeQuent shares for every 100 Viyash shares.

- The Carlyle Group, as the promoter for both SeQuent and Viyash, fully supports the combination, indicating its commitment to the combined growth of the firms.

Strategic Objectives

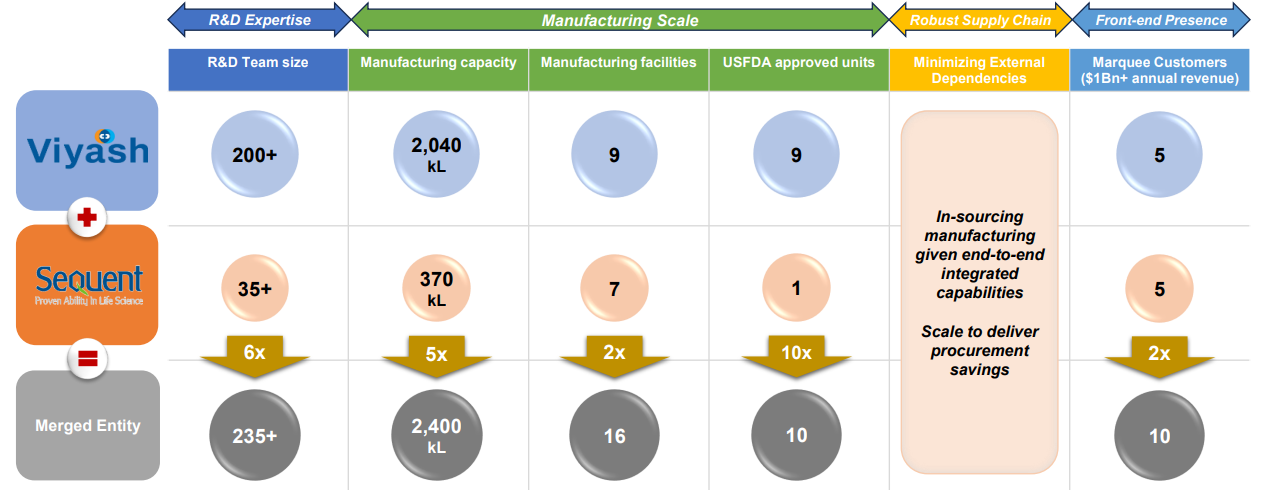

- The SeQuent 3.0 plan, which is crucial to this merger, envisions the company becoming a global leader with end-to-end capabilities, particularly in the animal health industry, while also assuring high regulatory compliance across manufacturing facilities.

- SeQuent intends to establish a leadership position in the animal health market by combining Viyash’s R&D and production capabilities. Viyash brings a strong infrastructure, including nine USFDA-approved manufacturing sites, which is expected to boost SeQuent’s production and R&D capabilities.

- The combined business will operate in over 150 countries, with larger R&D personnel and higher capacity manufacturing facilities.

Synergies and Financial Impact

- This combination is predicted to enhance SeQuent’s revenue growth and profitability from the first year, de-leveraging the balance sheet and giving a 44% discount on current trade multiples.

- Financial synergy involves operational cost reduction through integrated procurement, shared R&D, and manufacturing resources, with expected EBITDA margin improvements by 2027-2028.

- Viyash’s experience in human pharmaceuticals complements SeQuent’s portfolio by linking the needs for animal health and human pharma R&D, especially as the pet care market grows.

- The combined firm predicts better free cash flow, supported by decreased financing costs and improved profitability from streamlined operations. This cash flow will be used for both organic and inorganic growth, concentrating on shareholder returns through sustained profitability and growth.

- Synergies from pooled resources are expected to save on procurement and operating expenses, with anticipated increases of 100-250 basis points in EBITDA margins over the next three years. The companies also seek to optimize intermediate production to serve both human and animal health products.

Growth and Future Outlook

- SeQuent forecasts that by 2027-2028, the amalgamated firm will reach roughly INR 4,000 crore in revenue with a 20% EBITDA margin, leveraging development in animal health, new R&D-driven products, and possible entry into the U.S. market.

Additional development options include participation in U.S. Biosecurity projects, potentially improving SeQuent’s position in regulated markets with high standards in R&D and manufacturing. - While no immediate plans were confirmed, the management showed an interest in researching the U.S. market for animal formulations. This will necessitate a rigorous review of regulatory requirements and cost-benefit analysis before any tangible steps are taken.

- The companies anticipate possible growth prospects from the U.S. Biosecurity Act, which, if implemented, might incentivize sourcing outside of China. The merged firm intends to establish itself as a credible alternative for U.S. pharmaceutical needs, particularly in regulated sectors.

Viyash Lifesciences

- Viyash has a large R&D pipeline with roughly 60 commercial products and approximately 30 new drug applications (NDAs), including high-end APIs (Active Pharmaceutical Ingredients) and complicated formulations. The amalgamated firm will focus on expanding these offerings, which are predicted to provide long-term value in multiple markets.

- Viyash’s present manufacturing capacity utilization sits at roughly 70%, with no major expenditure needed in the short future. The combined firm will optimize current facilities to accept new goods and enhance production capacity as needed, without immediate significant investments.

Merger Rationale provided by the company

- The merger resulted in a combined organization with a 5x greater manufacturing capacity, a 6x larger R&D team, 10x more USFDA-approved facilities, and an 8x higher potential for new product submissions.

- Focused on creating growth in the animal health sector while expanding into the broader global pharmaceutical market. The combined firm will use a marquee customer base internationally, expanding reach and market visibility across numerous geographies.

- With Viyash’s R&D, regulatory, and production capabilities, the merged business may speed product development, delivering a larger range of goods to fulfil customer needs.

- Viyash has over 200 R&D scientists, 175+ patents, and 9 USFDA-approved plants, reinforcing its strong focus on intellectual property and innovation.

- The combination is margin-accretive from day one, with a de-leveraged balance sheet (Net Debt/LTM EBITDA at 1.5x), supporting sustainable growth investments.

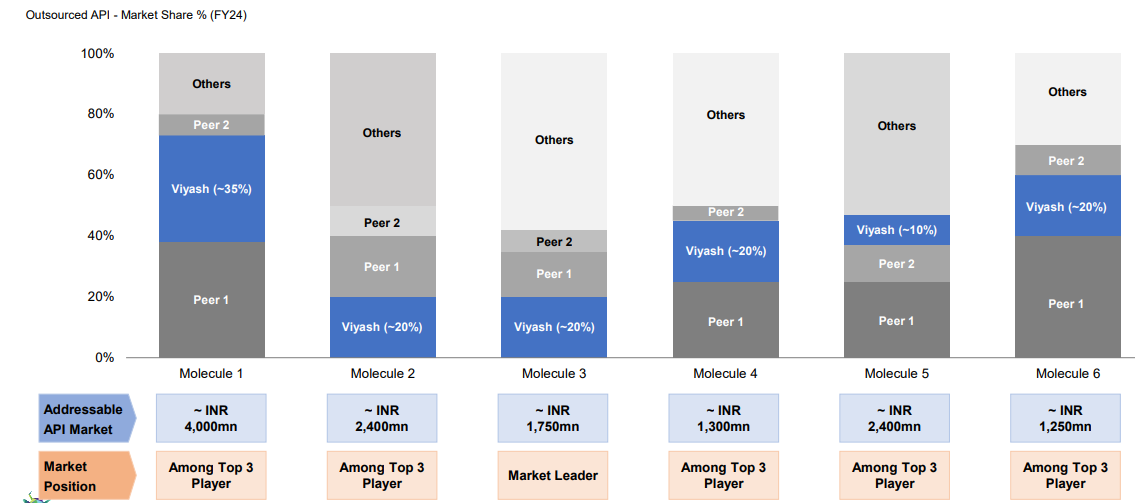

Viyash’s Market Share Outsourced APIs Market

Outlook | Sequent Scientific Analysis

- Approximately 67% of overall sales come from regulated markets, which are usually more stable and have greater margins. Revenue in Europe climbed by 9.5% YoY in constant currency, rising to 28% after accounting for operational shutdowns in Germany and Spain.

- Despite being hindered by forex limitations in H1 FY24, emerging markets returned substantially in the last two quarters.

- SeQuent’s Project Pragati effort resulted in considerable cost savings and operational improvements, which boosted SeQuent’s overall profits

- Despite Turkey’s hyperinflation, SeQuent made strategic pricing modifications and tight expense management, resulting in stable profitability in the market.

- SeQuent optimized its operations in Mexico and other Latin American countries by outsourcing non-core tasks such as logistics and accounting, This cut operational costs, increased efficiency, and improved overall profitability, particularly in Mexico and Brazil.

- The phased shutdown of the Bremer-Pharma facility in Germany between July and December 2023 significantly improved SeQuent’s cash flow and reduced operational costs. By relocating production from Germany to Turkey, SeQuent has optimized its asset utilization and achieved better cost efficiency, with commercial operations in Turkey expected to resume by FY26.

- Cost-cutting and operational efficiency initiatives in LATAM and Turkey contributed to consistent EBITDA margins, which helped to offset economic headwinds.

(K) Strengths & Weaknesses | Sequent Scientific Analysis

Strengths

(i) Diversified Revenue Mix

SSL has a strong business risk profile because of its large and diversified revenue streams across geographies and products. It generated the majority of the consolidated revenue from the formulations business and the balance from the API business. Of the total formulation sales, the regulated markets of Europe, LatAm, Turkey, emerging markets and India. As per management, the recent acquisitions in companion animal segments will also be one of the major drivers in scaling up its operations in the animal health care segment and new product developments.

(ii) Large-Scale of Operations

SSL has four manufacturing facilities in India and 3 overseas, which enabled it to maintain a low production facility level concentration as well. the company expects the growth in the key businesses (formulations and API) to continue, driven by an increase in sales to its vital customers in its key markets of LatAm and India, along with inorganic business expansions.

Weaknesses

(i) Exposure to Regulatory Actions

SSL remains exposed to regulatory risks, as it derives nearly 50% of its revenue from the regulated markets. Any adverse impact due to regulatory actions can result in a sustained increase in the net leverage. However, the diversification of product approvals across manufacturing units somewhat mitigates this risk. Furthermore, SSL’s manufacturing facilities comply with respective regulatory guidance. Given SSL’s exposure to large markets in Europe, Brazil, and India, any change in the regulatory guidelines of pricing/therapies and their consequent impact on SSL’s business profile remain monitorable.

Drop us your query at – info@pawealth.in or Visit pawealth.in

References: Annual Reports, News Publications, Investor Presentations, Corporate Announcements, Management Discussions, Analyst Meets and Management Interviews, Industry Publications.

Disclaimer: The report only represents the personal opinions and views of the author. No part of the report should be considered a recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore