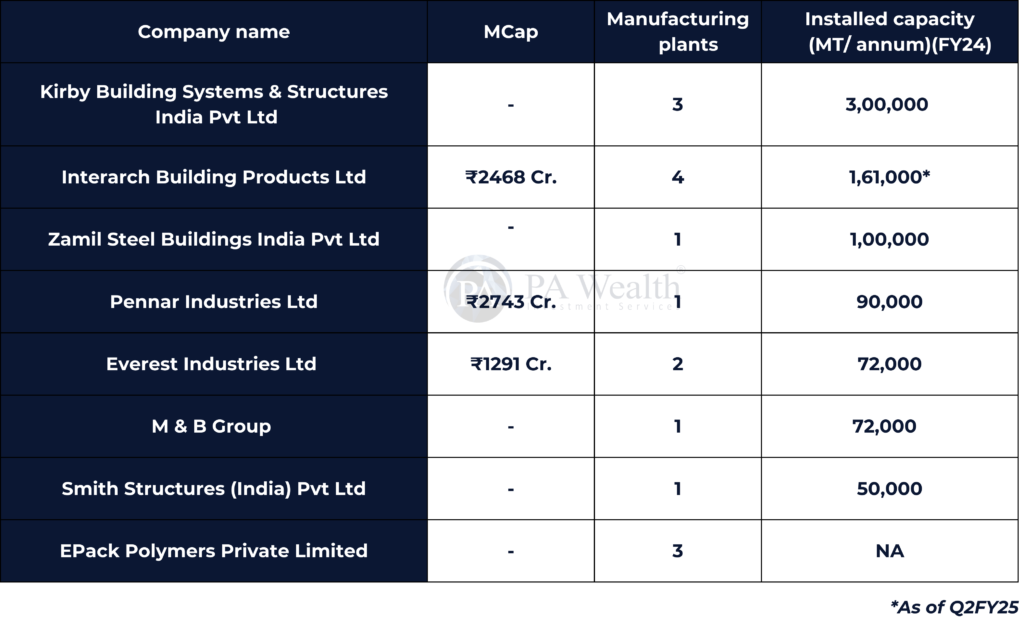

Interarch Building Products is a well-known name in the Pre-Engineered Buildings (PEB) business in India, with over 30 years of expertise. It has the second-largest aggregate installed capacity (161,000 MTPA) among integrated PEB businesses in the country and ranks third in the industry. With a market share of 6.5%, the company successfully executed 677 PEB contracts between FY15 and FY24.

- About the company

- Journey

- Industry Overview

- Board Members

- Shareholding Pattern

- Business Segments

- Peer Comparision

- Revenue Segments

- Cost Structure

- Financial Parameters

- Management Key Highlights

- Strengths & Weaknesses

(A) About

Interarch is a prominent provider of turnkey pre-engineered steel construction solutions in India. Interarch specializes in the installation and erection of pre-engineered steel buildings (PEBs) and has comprehensive capabilities that include design, engineering, manufacture, and on-site project management.

Its PEB solutions are custom-designed, engineered, and fabricated to serve customers in industrial, infrastructure, and building applications and residential, commercial, and non-commercial projects. Interarch has completed projects in various industries, from multi-level warehouses for e-commerce clients to production facilities for paint, FMCG, and cement. Furthermore, They also provide large-span PEBs for indoor stadiums and other infrastructure needs.

The company’s marquee of customers include Ampin Solar, Pepsi Craftsman, Indospace, Welspun, Godrej, and a lot of other well established brands. The company works as an infrastrasture and capital expenditure adjacent player.

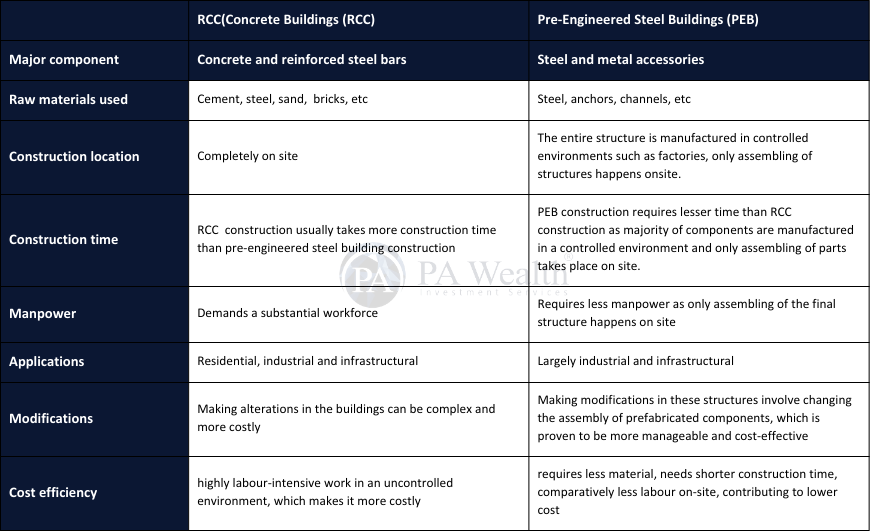

Traditional RCC vs Pre-Engineered Buildings

The Pre Engineered Buildings have a distinct features that can provide significant benefits over the traditional RCC(Concrete Building):

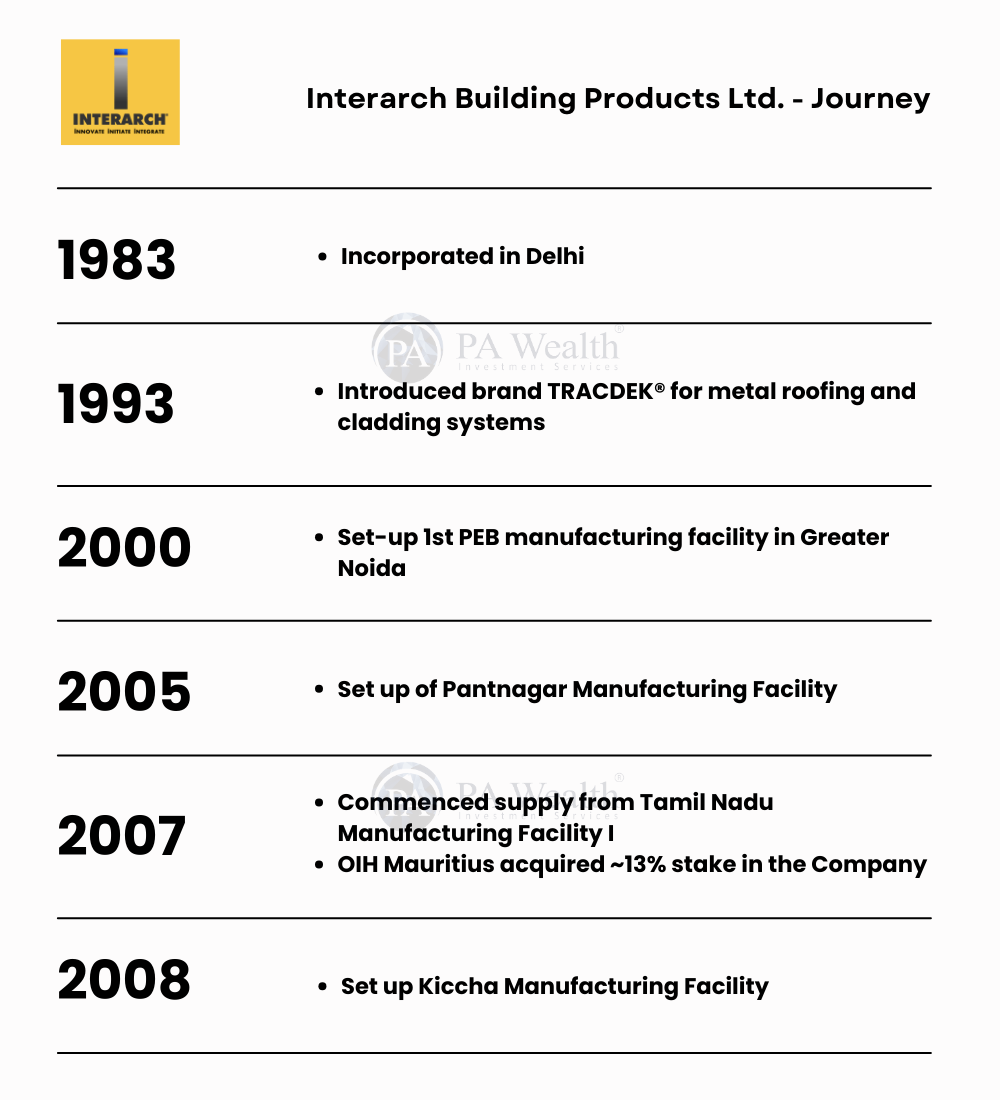

(B) Journey of Interarch Building Products

(C) Industry Overview

Industrial Sector

Construction spends within industrial or manufacturing rose by 6% to 8%. It is expected to remain constant over the next few years. Govt. policies such as Atamnirbhar Bharat, PLI(Performance Linked Incentive) Scheme etc. has been helpful in driving these spends especially in sectors like renewable power, hardware manufacturing, auto components etc.

Steel Industry India

The steel industry’s production capacity which was 91 MT in FY18 increased to 120 MT in FY24 and is expected to further grow signicantly over the next decade. Also, Govt. Policies such as Pradhan Mantri Awas Yojana and PLI Scheme have major influence on expansion drive. India is expected to make additional capital expenditure of 10 Lakh Crores and electricity supply of 27 GW to accomodate the capex.

Pre-Engineered Buildings Industry

Market size of pre-engineered steel buildings in India:

- The industry grew at a CAGR of around 8.5% between 2019 and 2023, from ₹ 130 billion in 2019 to ₹ 180 billion in 2023. Market size will reach ₹195-200 billion in FY24. Furthermore, The industry is expected to grow at a CAGR of 10.5-11.5% between 2023-2028, reaching ₹ 295-310 billion. Moreover, Investments in industrial and infrastructure sectors, including warehouses, logistics, and expressways with amenities and toll plazas will further accelerate the growth.

- Structural steel use cases include metro station, airport, telecommunications, broadcasting, floodlight, and power transmission towers, driving expansion in India’s pre-engineered steel building sector. The Indian government’s focus on infrastructure spending will increase demand for steel construction structures.

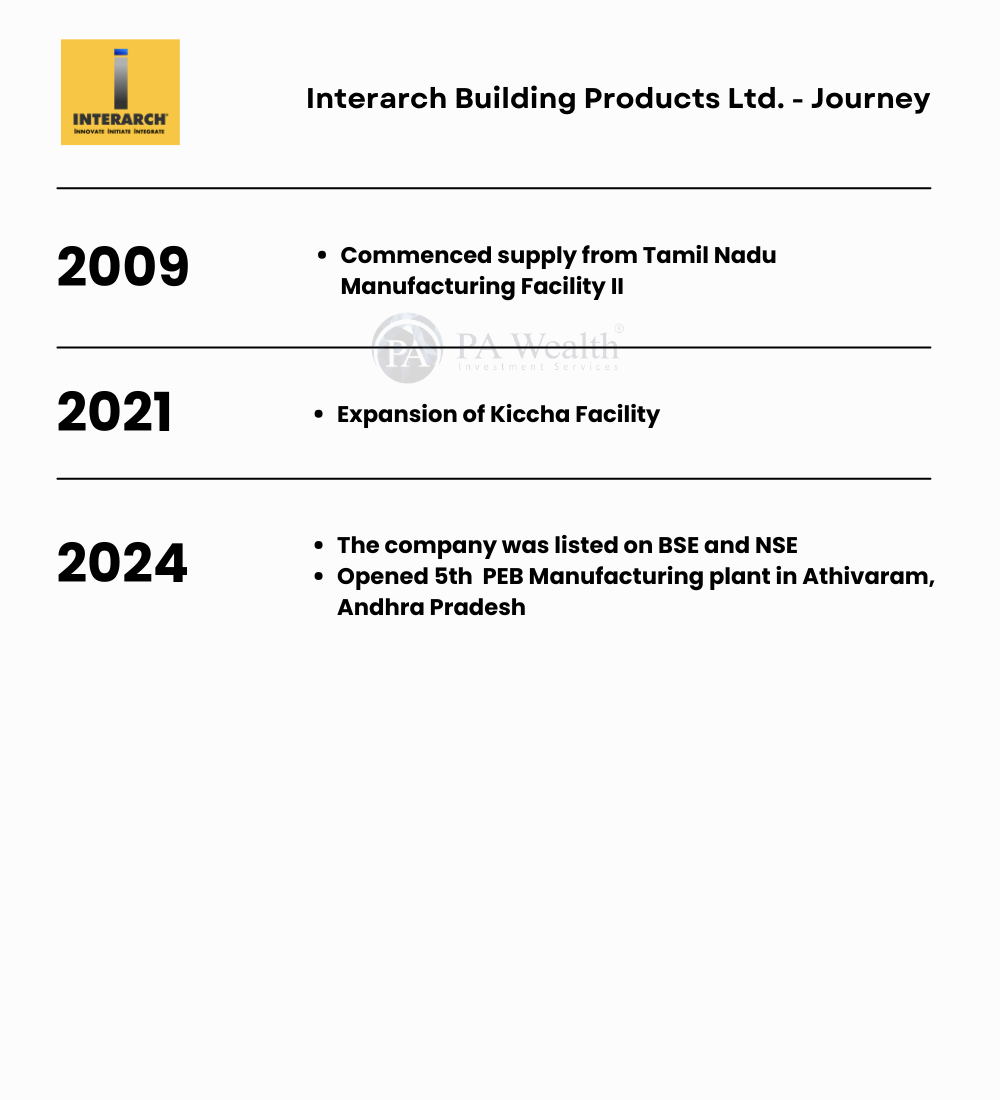

Pre-engineered steel buildings industry segmentation by end user:

- Pre-engineered steel construction is becoming increasingly common in commercial, infrastructure, and industrial sectors, including automobiles, cement, paper, offices, airplane hangars, warehouses, and data centers. Companies often use pre-engineered pieces to speed up the construction process while maintaining quality.

- Pre-engineered construction eliminates uncontrollable external factors like weather, resulting in improved quality control through standardised operations and streamlined processes.

- Pre-engineering reduces construction time for commercial complexes, hospitals, office buildings, and high-rise projects while maintaining quality. Pre-engineered steel structures are commonly used in schools, exposition halls, hospitals, theaters, auditoriums, gymnasiums, and indoor sports courts.

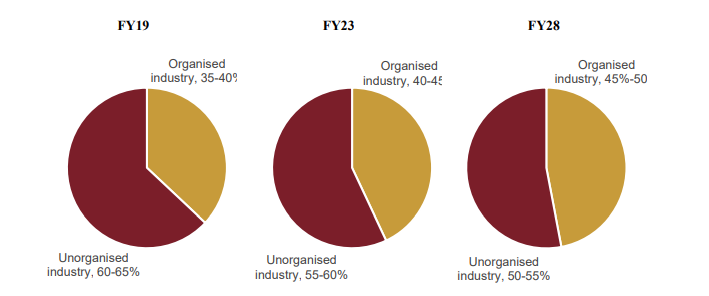

PEB market remains competitive with a big unorganized players:

- As of FY23, the organized industry had a 40-45% revenue market share of the total industry. Interarch Building Products Limited and Kirby Building Systems held 40-50% of the market share in the organized industry.

- In FY23, six main firms control 80-85% of the organized industry, which accounts for 35-40% of the total market. The six important players are Interarch, Kirby, Pennar, Phenix / M&B Engineering, Everest Industries, and Zamil, in no particular order. The remainder is a fragmented, unorganized sector.

- Unorganized industries make up 55-60% of the market due to their low capital investment entry barriers. The organized sector outperforms the unorganized sector in terms of reliability, supply chain skills, and quality engineering services, leading to an increasing shift towards it.

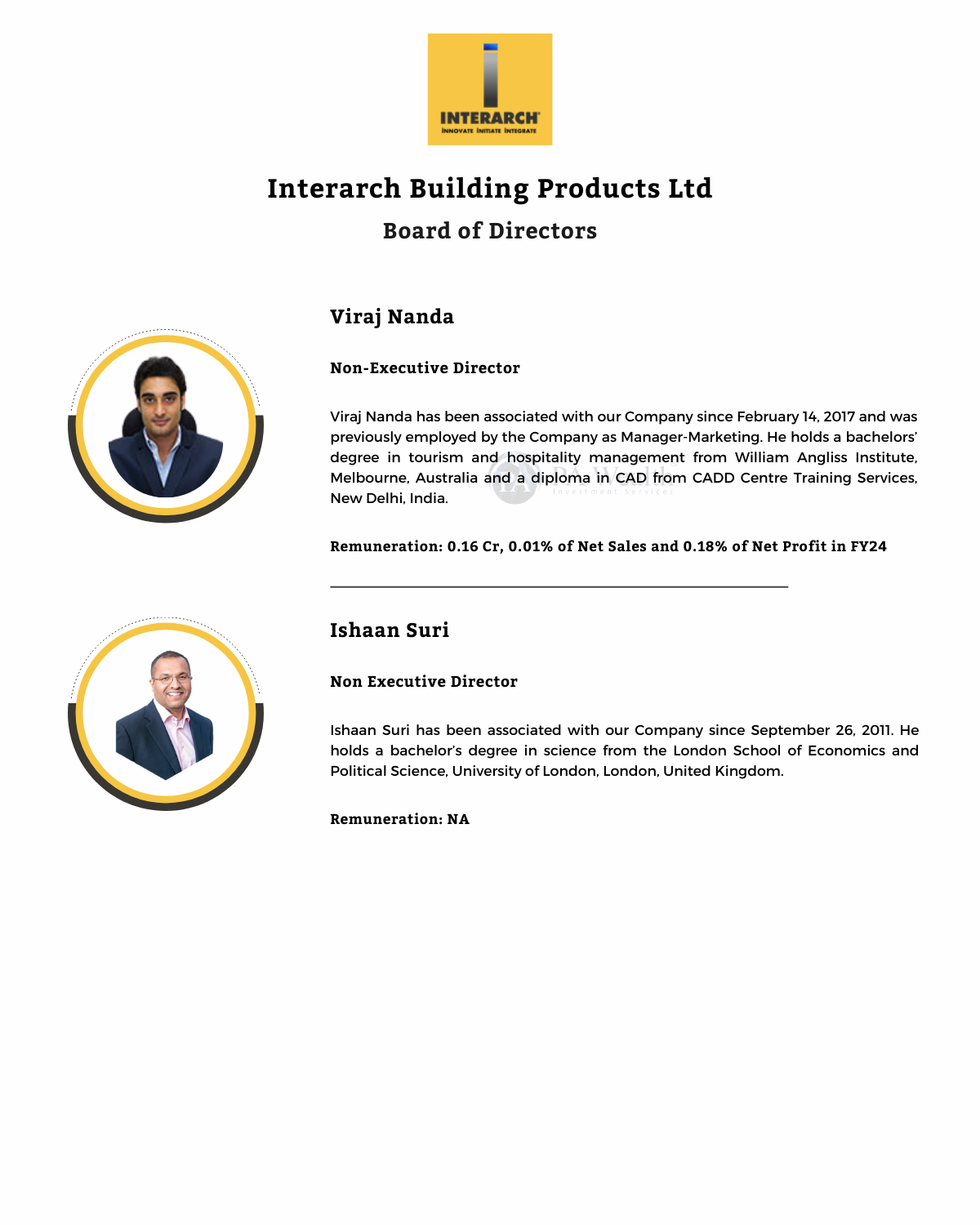

(D) Board of Directors | Interarch Building Products Analysis

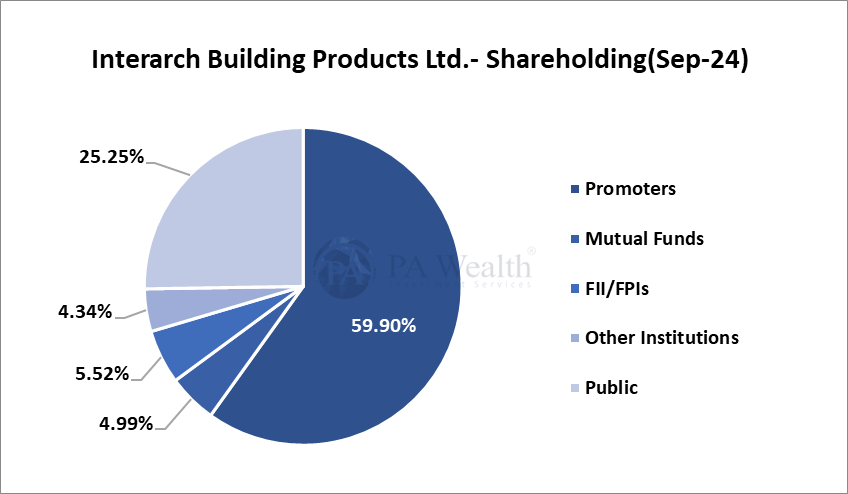

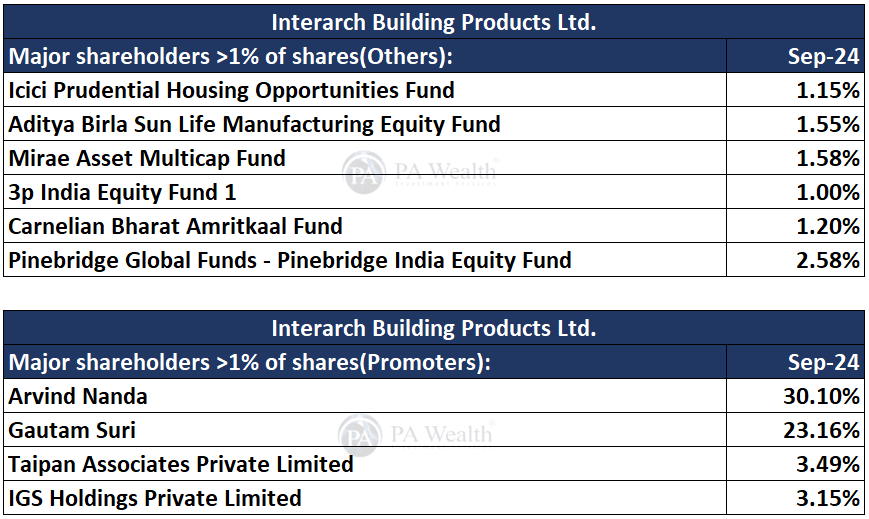

(E) Shareholding Pattern | Interarch Building Products Analysis

(F) Product Segments | Interarch Building Products Analysis

Interarch Building Products’ product segments are divided into three main categories:

1. Metal ceilings and roofing:

- TRAC® Metal Suspended Ceiling Systems are developed to provide efficient ceiling solutions.

- TRACDEK® Metal Roofing & Cladding Systems offers long-lasting roofing and cladding solutions.

- TRACDEK® Bold Rib is a permanent metal decking system used as a shuttering over steel framing that is both structurally stable and easy to install.

2. PEB (Pre-engineered Building) Steel structures:

- Primary framing systems include components such as primary load-bearing frames, end-wall frames, wind bracings, crane brackets, and mezzanine beams and joints to ensure structural integrity.

- Secondary framing systems include roof purlins, wall girts, eave struts, and clips, which add structural support.

- Interarch Life provides entire PEB systems suited to specifications for non-industrial buildings, which are installed with the assistance of third-party builders and erectors.

3. Light Gauge Framing Systems:

This category combines primary and secondary framing systems, as well as metal ceiling and corrugated roofing alternatives, to provide lightweight and durable framing solutions.

(G) Peer Comparison | Interarch Building Products Analysis

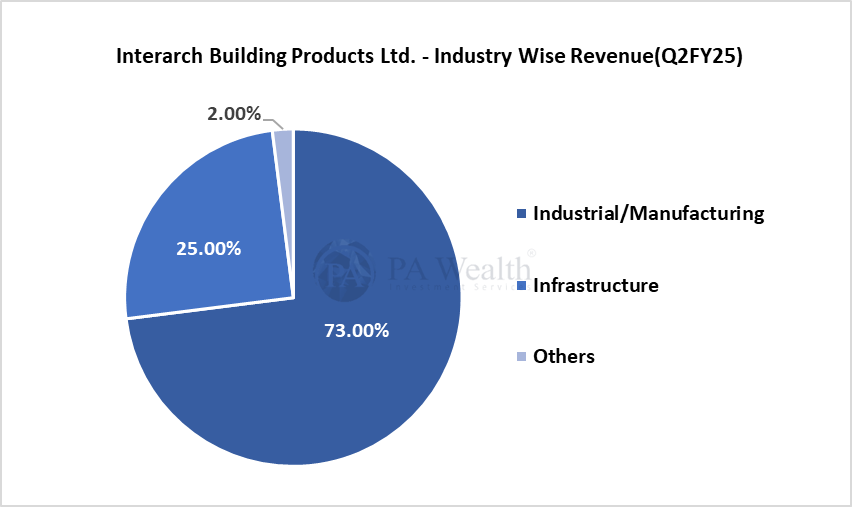

(H) Revenue Segments

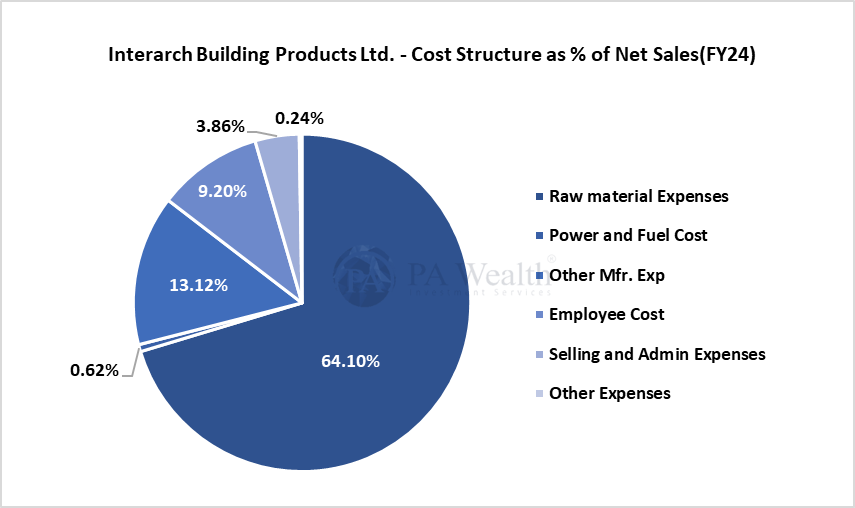

(I) Cost Structure | Interarch Building Products Analysis

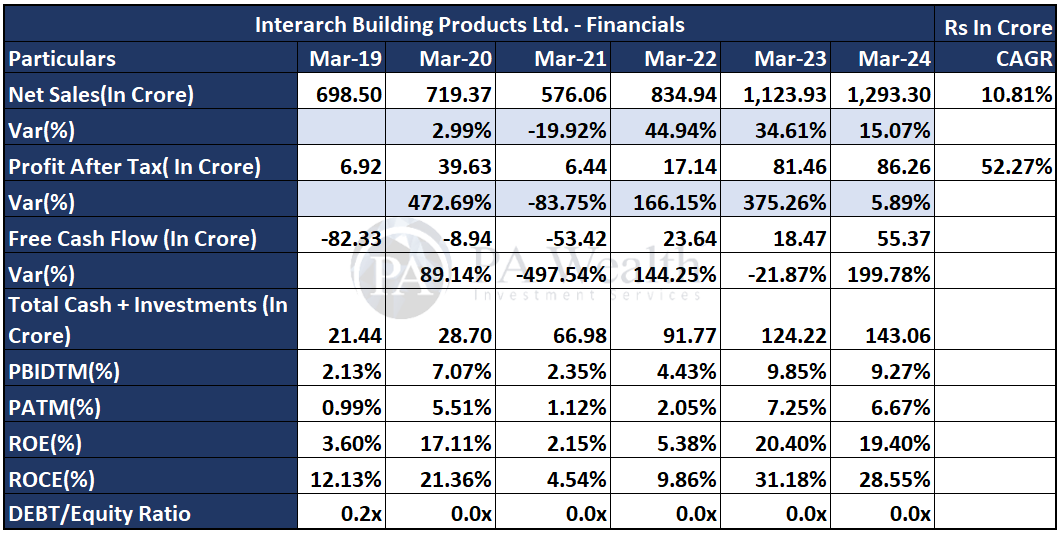

(J) Financials | Interarch Building Products Analysis

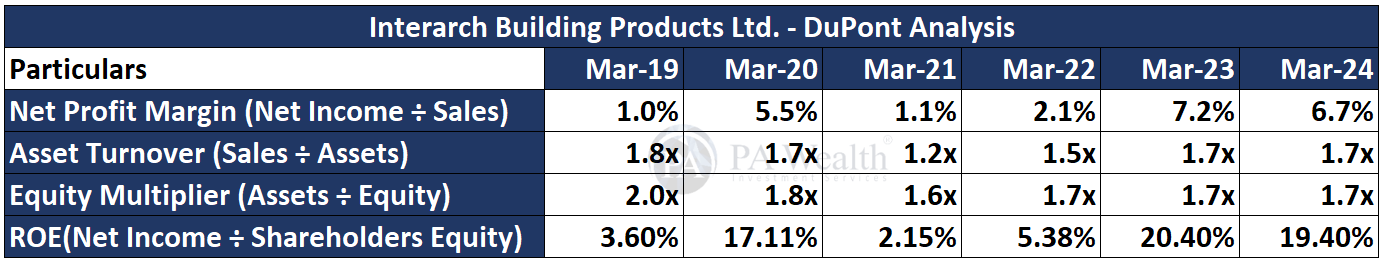

The company’s revenue has grown at a CAGR of 10.81% over the past 6 years, increasing from Rs 698.5 Cr. in FY19 to Rs 1293.3 Cr. in FY24. Subsequently, the company’s PAT has also shown growth, rising from Rs 6.92 Cr. in FY19 to Rs 86.26 Cr. in FY24 at a CAGR of 52.27%. Furthermore, the company’s ROE has seen a decrease from 3.6% in FY19 to 19.4% in FY24.

DuPont Analysis

(K) Management Discussion

Concall Highlights | Interarch Building Products Analysis

- Q2FY25 revenue stood at 323 Cr., up 8.5% YoY while H1 revenue totaled 627 Cr., a 6% growth YoY. The company witnessed 17.6% YoY increase to 26,274 tons in Q2FY25 and for H1FY25 increased by 10.1% YoY to 48,868 tons. Q2FY25 EBITDA margin was 7.8%, while H1FY25 at 8.3%.

- Current order book stands at ₹1,303 Cr., which translates to 9-10 months of sales. Major projects include battery plants, manufacturing facilities, and renewable energy plants.

- The company holds approx. 15% of the organized pre-engineered building market whose value is ₹8,000 crores.

- Interarch plans to establish a new facility in Kheda, Gujarat, which will have the same capacity of its current plants, aiming for a turnover of 500 crores annually. Focused on data centers as a growth area, with bids for projects in Chennai, Noida, and Mumbai reflecting renewed activity in the sector.

- The company has high operational leverage, with higher turnover improving margins. The company’s current targets include achieving 9%-10% EBITDA margin over the next fiscal year.

- The company maintains close involvement from project conception to delivery, positioning itself as a “capital goods partner” rather than just a contractor. It strictly adheres to payment terms with customers, ensuring smooth cash flow and consistent turnover

- Interarch has witnessed growth in demand from industries like renewable energy, battery manufacturing, and new-age sectors such as microchip factories and solar panel manufacturing.

- The company avoids direct government contracts, preferring to work with private sector players to minimize risks associated with payment delays.

- Interarch designs its plants to run at near full capacity, with a threshold of 85%-90% utilization which triggers preparations for new facilities and capacity additions. Its current production facilities have the flexibility to adjust tonnage based on project complexity.

Capex

- Capex for FY25 stands at ₹55 Cr. planned for Andhra Phase II and North India capacity increase/upgrades by March or April 2025.

- The company added 20,000 tons of capacity in Andhra Pradesh in September 2024 with the current utilizable capacity now stands at 127,000 tons. It plans for further capacity upgrades in Andhra and North India with a target of reaching 2,000 crore annual capacity by FY26.

Outlook

- The company achieved a 17.6% volume growth in Q2FY25, surpassing revenue growth due to softening steel prices. Total revenue increased by 8.5% YoY to ₹323 crore in Q2FY25.

- The company’s EBITDA grew by 32% YoY in Q2FY25 while PAT increased by 36% YoY.

- The company anticipates revenue growth of around 10% in FY25, driven by decent volume growth. While it projects revenue growth of 10-15% in FY26, supported by an expanding customer base and capacity.

- Capex of Phase-1 of the 5th Pre-Engineered Building (PEB) manufacturing unit in Athivaram, Andhra Pradesh is ramping up successfully. Also, the Ongoing Expansion of Andhra Pradesh and Kichha capacity expansions are on track.

- The company has acquired land Acquisition in Gujarat for Expanding operational base and it is aimed at boosting production capabilities to meet the growing demand for high-quality PEB solutions.

- The company’s new facilities strengthen geographic reach and reinforce commitment to innovation, quality, and sustainability.

- Interarch Building Products maintains a debt-free balance sheet with net cash positive backed by efficient working capital management.

- The company is targeting to double revenue over the next 3-4 years. While, It is also focusing on building a trusted customer base and maintaining leadership in the PEB sector.

(L) Strengths & Weaknesses

Strengths

(i) Established position in the PEB industry

Interarch Building Products is one of the top players in the Indian PEB industry. Strong market position with established customers such as Grasim Industries , Asian Paints Ltd , Godrej & Boyce Manufacturing Co. Ltd , ITC Ltd and CEAT Ltd, should continue to support business. The company has facilities in North and South India, which helps it maintain geographical diversification in orders as well as cater to clients spreads across pan India.

(ii) Comfortable financial risk profile

Working capital cycle of the company remains comfortable with gross current assets of around 24 days as on March 31, 2024, owing to healthy receivables cycle of around 48 days and inventory period of 65 days. Given the efficient working capital management, TOL/TNW ratio has remained at around 1 time over the past five fiscals.

Weaknesses

(i) Susceptibility to cyclicality in the end-user industry and raw material prices

Integrated Building Products is a relatively mid-sized player with moderate net worth of around Rs 600 crore as of March 31, 2024, restricts the ability to bid for high-value projects. The business is susceptible to economic cycles and capex plans of its clients. Operating margins have been fluctuating over the years largely on account of high fixed costs and the company’s inability to pass the increase in raw material prices to its customers.

Drop us your query at – info@pawealth.in or Visit pawealth.in

References: Annual Reports, News Publications, Investor Presentations, Corporate Announcements, Management Discussions, Analyst Meets and Management Interviews, Industry Publications.

Disclaimer: The report only represents the personal opinions and views of the author. No part of the report should be considered a recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore