- About the Bank of India Small Cap Fund

- Basic Details

- Classification Portfolio of the fund

- Fund Managers & Tenure of managing the Scheme

- Fund – Investment Details

- Returns Generated

- Risk Factors

- Investment Philosophy

- Taxability of Earnings

(A) About the Bank of India Small Cap Fund

The Bank of India Small Cap Fund is an open-ended equity scheme. This fund falls into the equity category, and more specifically, it’s classified as a Small-Cap Fund. This means it primarily invests in small-cap stocks but has bought into large and mid-cap stocks. The investment objective of the scheme is to generate long term capital appreciation by investing predominantly in equity and equity-related securities of small cap companies.

(B) Basic Details of Bank of India Small Cap Fund

| Fund House | Bank of India Fund |

| Category | Equity: Small cap |

| Launch & Start Date | 19-December-2018 |

| Type | Open-ended |

| AUM | ₹1,422 Cr (As on 31 Aug 2024) |

| Available at NAV of | ₹55.89 (As on 01 Oct 2024) |

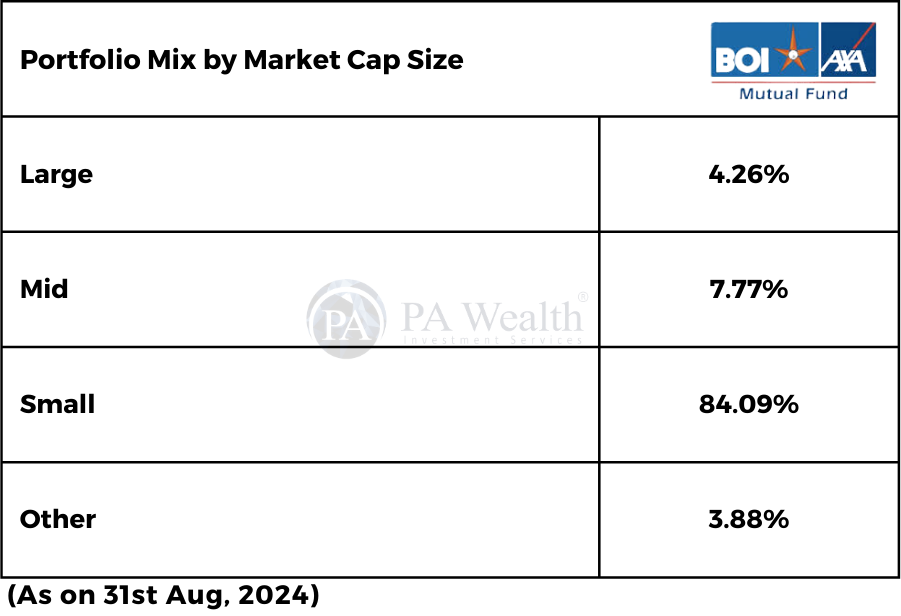

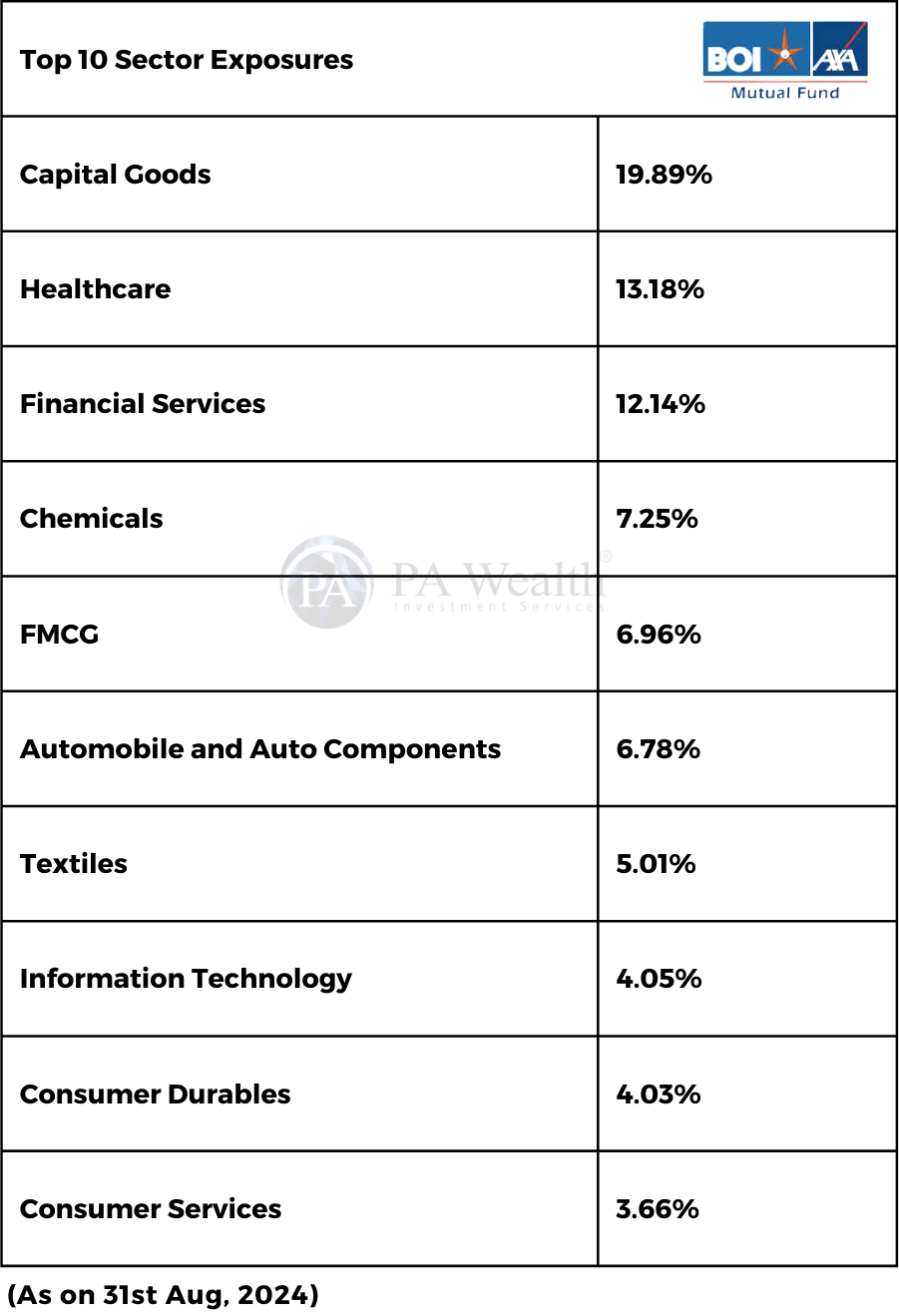

(C) Classification Portfolio of the fund

(i) Portfolio Mix by Market Cap Size

(ii) Top 10 Holdings of the fund

(iii) Top 10 Sectors Exposures

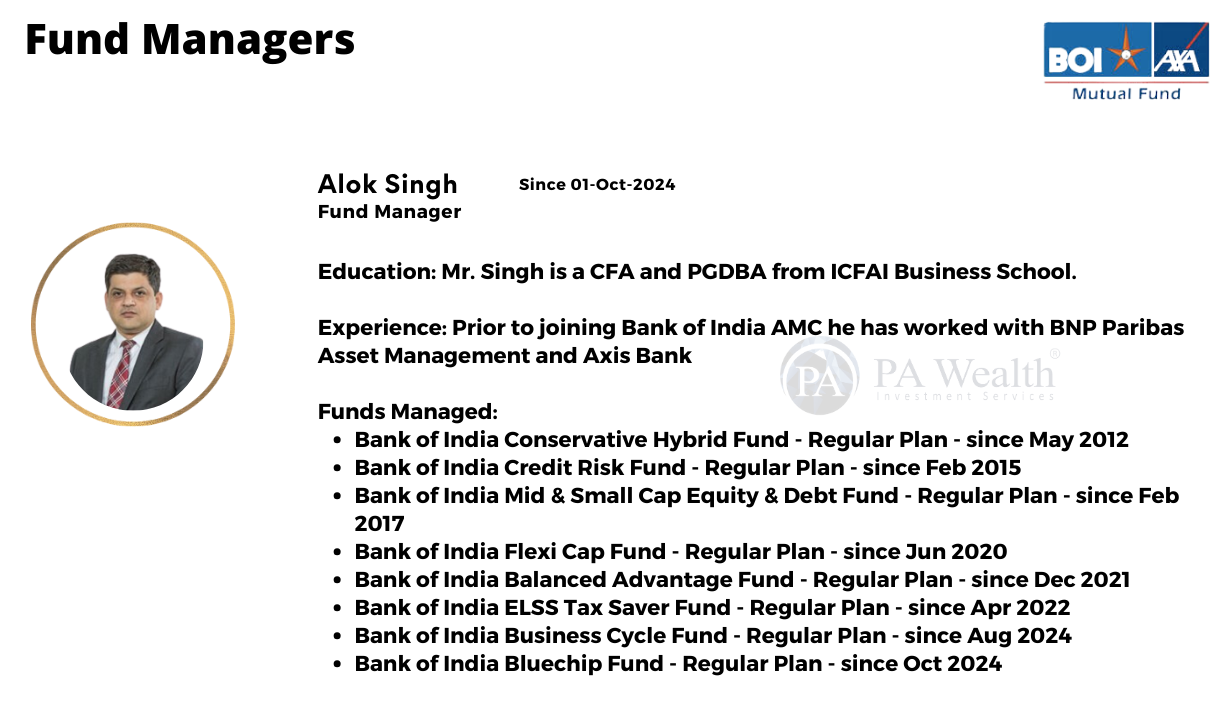

(D) Fund Managers & Tenure of managing the Scheme

(E) Fund – Investment Details

| Bank of India Small Cap Fund | |

|---|---|

| Application Amount for fresh Subscription (Lumpsum) | ₹5,000 |

| Min Additional Investment (SIP) | ₹1,000 |

| Exit load | 1%* |

| Lock In | No |

| Expense Ratio | 2.07% |

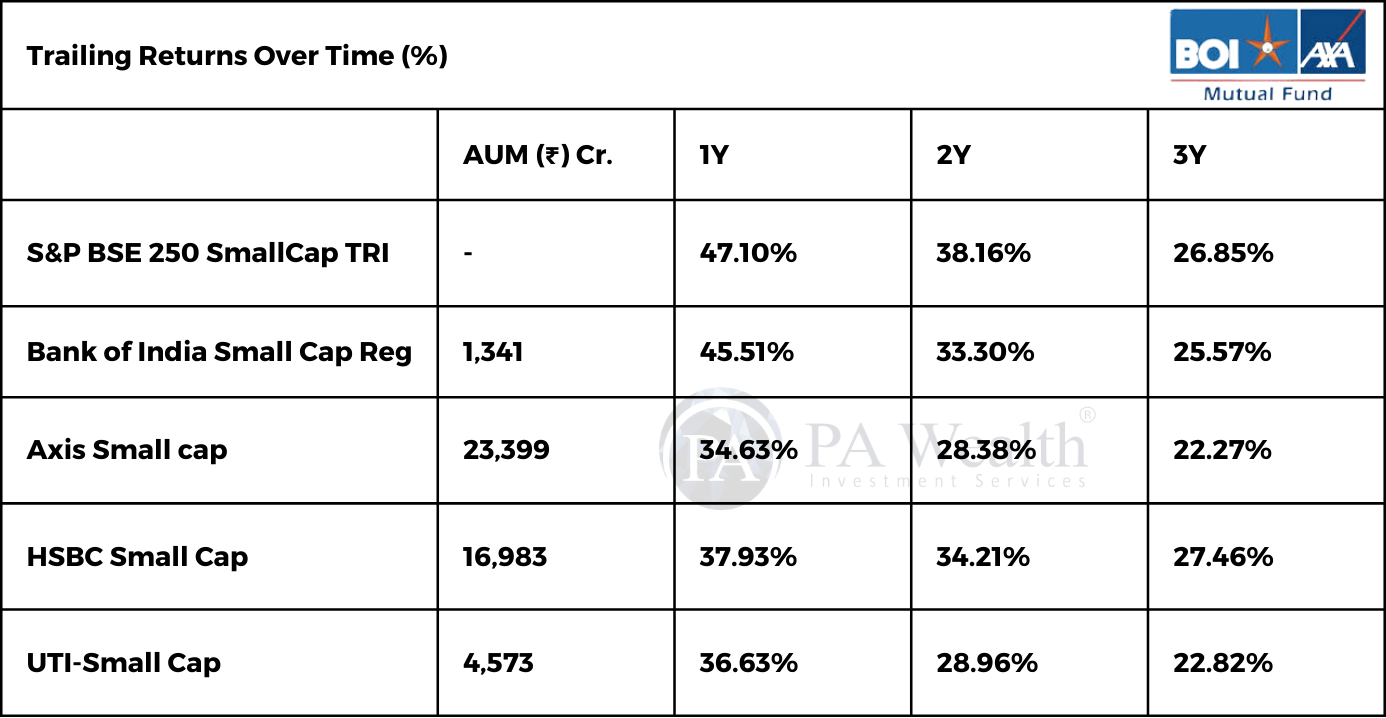

(F) Returns Generated By The Fund

(G) Risk Factors

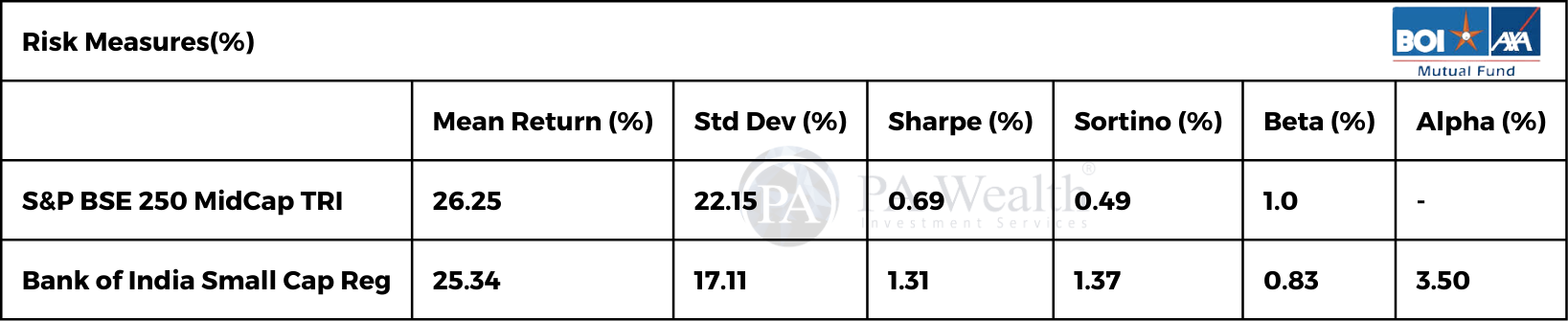

(i) Valuation Measures

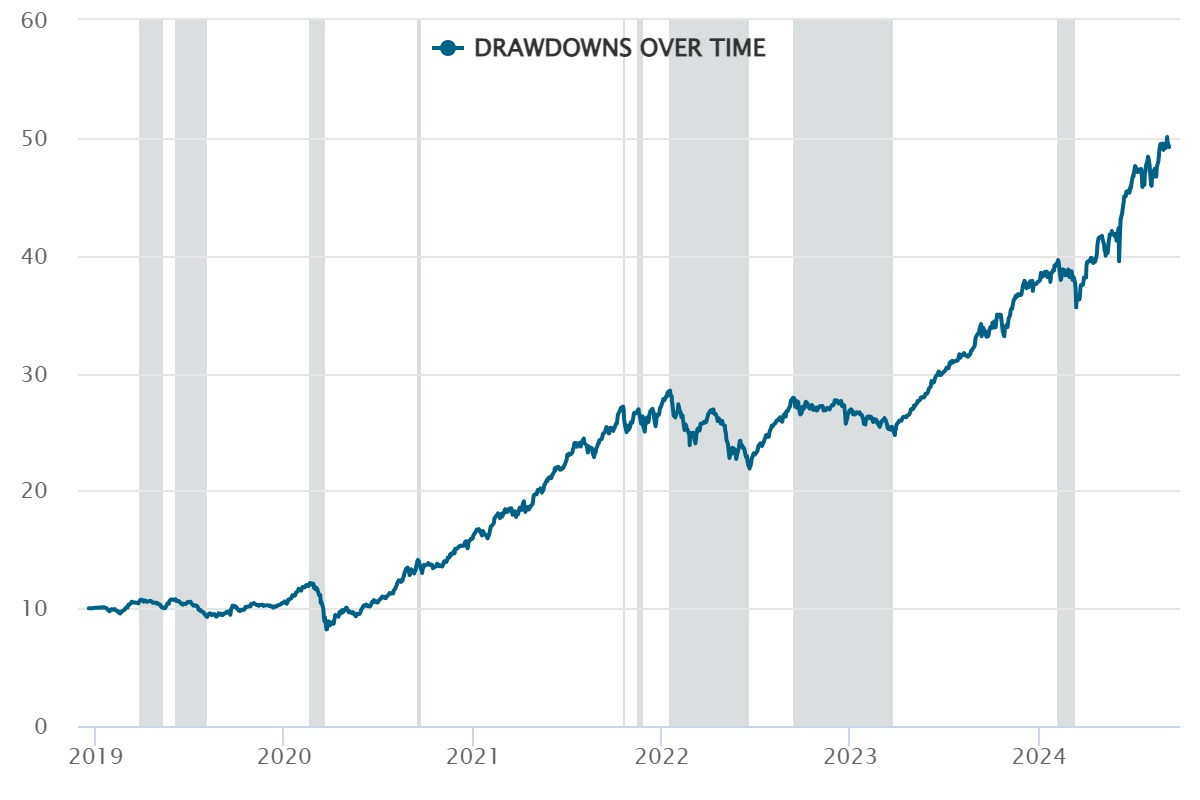

(ii) Top Drawdowns

This chart shows the ups and downs of a fund’s value from 2019 to now. When the fund’s value drops from its peak, it’s called a drawdown. The shaded area shows how long the fund stayed in a drawdown.

This chart helps investors understand how the fund has reacted to big events in the economy.

(H) Investment Philosophy

- Bank of India Small Cap Fund invests predominantly in equity and equity related securities of small cap companies.

- Under normal market conditions, the fund will invest 65% to 100% of assets in a diversified portfolio constituting equity and equity related instruments of small cap companies with sustainable business models, and potential for capital appreciation.

- The fund has the flexibility to invest up to 35% of its assets in equity and equity related instruments of companies other than small cap companies.

- This is a fund that invests in smaller companies. Compared to those that invest in larger companies, such funds tend to fall more when stock prices fall. So while you can expect higher returns in the long term, there will be more severe ups and downs along the way.

(I) Taxability of earnings

Taxation

Capital Gains Taxation

- If the mutual fund units are sold after 1 year from the date of investment, gains upto Rs 1.25 lakh in a financial year are exempt from tax. Gains over Rs 1.25 lakh are taxed at the rate of 12.5%.

- If the mutual fund units are sold within 1 year from the date of investment, entire amount of gain is taxed at the rate of 20%.

- No tax is to be paid as long as you continue to hold the units.

Dividend Taxation

- Dividends are added to the income of the investors and taxed according to their respective tax slabs. Further, if an investor’s dividend income exceeds Rs. 5,000 in a financial year, the fund house also deducts a TDS of 10% before distributing the dividend.

Drop us your query at – info@pawealth.in or Visit pawealth.in

References: valueresearchonline.com, Industry’s Publications, News Publications, Mutual Fund Company.

Disclaimer: The report only represents personal opinions and views of the author. No part of the report should be considered as recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore