- What are Mutual Funds?

- How Do Mutual Funds Work?

- Common Mistakes to Avoid When Investing in Mutual Funds

Mutual funds are a popular investing choice for a reason. They provide a straightforward and accessible way to develop your wealth, but navigating the world of mutual funds may be difficult, particularly for novices. To assist you avoid frequent traps, let’s look at what mutual funds are, what they offer, how they operate, and, most importantly, what mistakes to avoid while investing in them.

What are Mutual Funds?

A mutual fund is a collection of funds that are strategically invested in a variety of assets, including stocks, bonds, and other financial instruments. Investors have the option to buy shares of a mutual fund, granting them partial ownership of the fund’s assets. Professional fund managers oversee the management of mutual funds and make investment decisions on behalf of the shareholders.

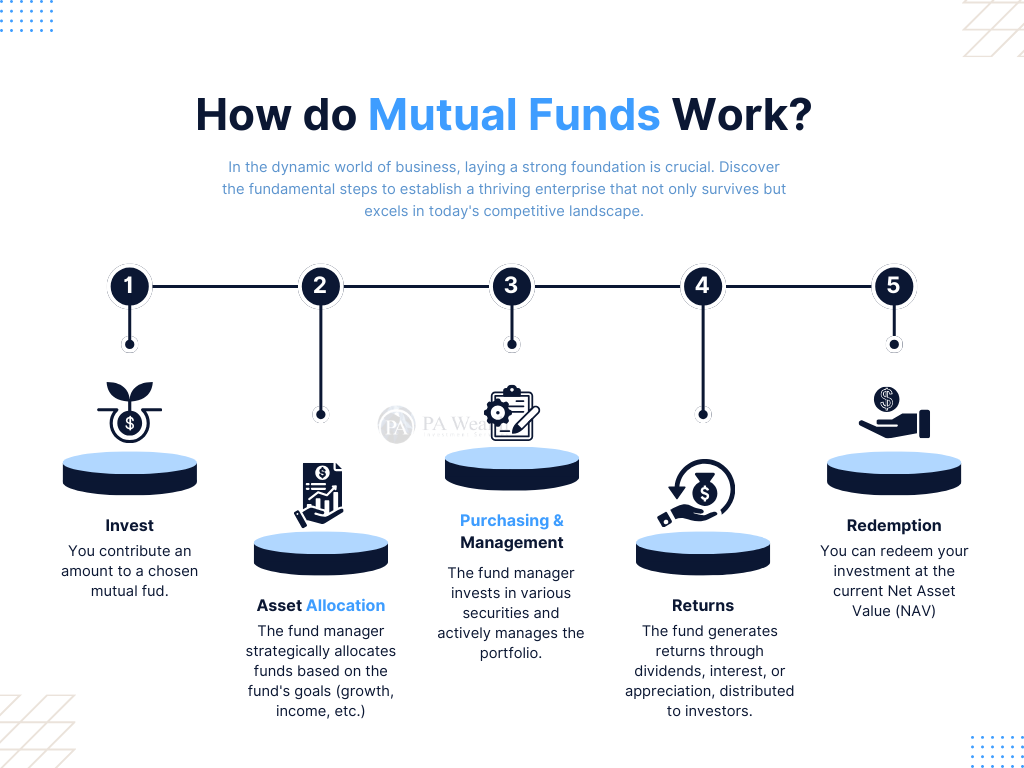

How Do Mutual Funds Work?

- Investment: You put a particular amount of money into a mutual fund. This money is combined with investments from other investors.

- Asset Allocation: The fund manager divides the pooled pool of funds among asset classes such as stocks, bonds, and money market instruments as well as into market capitalization such as Large Cap, Mid Cap and Small Cap based on the fund’s goal (growth, income, etc.).

- Purchasing and Management: The fund management invests the money in numerous securities. They constantly analyze and manage the portfolio in order to accomplish the fund’s objectives.

- Returns: The fund generates returns through stock dividends, bond interest, or capital appreciation. These returns are then dispersed to investors in proportion to the amount invested.

- Redemption: If you need to get your money back, you can redeem your units at the Net Asset Value (NAV), which is the market value of the fund’s underlying assets per unit.

Common Mistakes to Avoid When Investing in Mutual Funds

Insufficient research

Investing in mutual funds without thorough research can result in making unwise investment decisions. Understanding the fund’s investment strategy, the sectors it invests in, the track record of the fund manager, and the expense ratio is crucial. This information is valuable for choosing funds that are in line with your financial objectives and risk tolerance.

Disregarding Risk Tolerance

There is a significant variation in risk levels among different mutual funds. Some investments carry a higher level of risk and potential reward, while others are more cautious in nature. Investors often make the mistake of ignoring their risk tolerance and investing in funds that are too risky for their comfort level. Assess your risk tolerance before investing and choose funds that match your risk profile.

Overlooking Expense Ratios

Expense ratios can significantly impact your returns. High expense ratios can erode your investment gains over time. Compare the expense ratios of similar funds and opt for those with lower fees to maximize your returns.

Chasing Past Performance

One of the most common mistakes is choosing funds based solely on past performance. While historical performance can provide insights, it doesn’t guarantee future results. It’s crucial to look at the fund’s consistency, investment strategy, and the current market conditions rather than just past returns.

Lack of Diversification

Putting all your money into one mutual fund or one type of mutual fund can be risky. Diversification across different types of funds (equity, debt, hybrid, etc.) and sectors can help spread risk and enhance potential returns.

Ignoring the Time Horizon

Investing without considering your time horizon can lead to suboptimal decisions. For short-term goals, low-risk funds like debt funds might be more appropriate, whereas, for long-term goals, equity funds can offer higher growth potential. Match your investment choices with your financial goals and time horizon.

Frequent Trading

Frequent buying and selling of mutual fund units can incur transaction costs and taxes, eating into your returns. It’s generally better to adopt a long-term investment strategy and avoid the temptation to constantly tweak your portfolio based on short-term market movements.

Not Reviewing the Portfolio Regularly

While frequent trading is not advisable, it’s still important to review your portfolio periodically. Changes in market conditions, fund management, or your personal financial situation may necessitate adjustments to your investment strategy. Regular reviews ensure your portfolio remains aligned with your goals.

Ignoring Tax Implications

Different types of mutual funds are taxed differently. Equity funds and debt funds have different tax implications for both dividends and capital gains. Understanding these tax implications can help you make more tax-efficient investment decisions.

Investing in mutual funds can be an effective strategy for wealth accumulation, but it is critical to avoid common pitfalls. You can improve your chances of meeting your financial goals by conducting thorough research, understanding your risk tolerance, monitoring expense ratios, diversifying your investments, aligning with your time horizon, avoiding frequent trading, reviewing your portfolio on a regular basis, considering tax implications, and avoiding emotional investing. Always remember that a knowledgeable investor is a successful investor.

Drop us your query at – info@pawealth.in or Visit pawealth.in

References: Annual Reports, News Publications, Investor Presentations, Corporate Announcements, Management Discussions, Analyst Meets and Management Interviews, Industry Publications.

Disclaimer: The report only represents the personal opinions as well as views of the author. Also, No part of the report should be considered a recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram and also Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore