Coromandel International is part of the Muruguppa group which has presence in multiple businesses like financial services, engineering and agriculture related products.

Quick Links. Click to navigate directly to detailed paragraph of fundamental analysis:

- Brief History

- Shareholding Pattern of Coromandel International

- Executive Management of Coromandel

- Product Variants of Coromandel

- Revenue Classification of Coromandel

- Recent segment performance of Coromandel

- Sales Volume of Coromandel

- Coromandel Manufacturing Capacity

- Cost Structure of Coromandel

- Key raw materials used by Coromandel

- Group Structure of Coromandel International

- Other significant players

- Coromandel Concall Highlights

Mr M.M. Muruguppan, Chairman of the Muruguppa Group, is the chairman of the company. EID Parry Limited (Muruguppa Group Company) is the holding company of the Coromandel.

Coromandel International Limited (CIL) is engaged in the business of Fertilizers, Specialty Nutrients and Crop Protection.

(A) Brief History

1961:

Coromandel Fertilisers Ltd was started by two companies EID Parry Ltd and US based Chevron Chemical Company & International Minerals & Chemicals Corporation.

2003:

EID Parry India Ltd’s Farm Inputs Division which includes fertilizers & chemical businesses merged with the company.

2004:

Coromandel, through a competitive bidding process acquired 25.88% shares of Godavari Fertilisers and Chemicals Ltd from the Government of Andhra Pradesh. Another 14.93% acquired by way of public offer.

2005:

Coromandel then entered into Business Assistance Agreement with Foskor Pty Limited of South Africa for providing technical and managerial assistance to Foskor for three years.

2006:

Further, the company entered into a Share Purchase Agreement for acquiring 50.27% of the equity capital of FICOM Organics Limited from their promoters. FICOM had manufacturing facility at Ankleshwar, Gujarat for Technical Grade Pesticides.

Also, Coromandel set up a joint venture ‘Tunisian Indian Fertilisers S.A’ at Tunisia with Groupe Chimique Tunisien Campagnie Des Phosphates De Gafsa and Gujarat State Fertilisers & Chemicals Ltd for manufacturing phosphoric acid.

Moreover, FICOM Organics Ltd and its wholly owned subsidiary company Rasilah Investments Limited merged with Coromandel.

2007:

Godavari Fertilisers and Chemicals Ltd amalgamated with Coromandel. In addition, Coromandel set up 20 Rural Retail Centres in the name of ‘Mana Gromor Centres’ in various District Head Quarters of Andhra Pradesh for selling Fertilisers, Pesticides & other products to the rural customers & providing Technical Training Soil Testing Facilities.

2008:

Company formed a joint venture Coromandel Getex Phosphates Pte Ltd in Singapore with Getex Ocean Trades Pte Ltd, Singapore.

2010:

Coromandel International acquired 100% stake in Pasura Biotech Pvt. Ltd. Pasura is engaged in formulation of Pesticides and has a Plant in Jammu.

Also, the company entered into License Agreement with Shell Research Ltd (affiliate of Royal Dutch Shell plc. London) for employing Shell Thiogro technology to manufacture Sulphur Enhanced Fertilisers (SEF) at its Visakhapatnam plant.

2011:

Coromandel acquired 67.75% of Sabero Organics Gujarat Limited. This includes 36.75% from promoters & 31% from open offer. Thus, Coromandel & its subsidiary company’s aggregate shareholding became 69.10%.

2013:

Company acquired Liberty Urvarak Limited (LUL) and Liberty Phosphate Limited (LPL) of Liberty Group.

Moreover, Coromandel commissioned Complex Fertilser Plant (C Train) at Kakinada & production of fertilisers has also started at this plant. The Plant manufactures all grades of complex fertilisers marketed in the brand name of Gromor.

In addition,Company’s joint venture`Tunisian Indian Fertilisers (TIFERT)’ in Tunisia commissioned its phosphoric acid plant. TIFERT Plant capacity is 3,60,000 tons of phosphoric acid annually.

2014:

Coromandel’s subsidiaryLiberty Phosphate Ltd (LPL) and wholly owned subsidiary Liberty Urvarak Limited (LUL) merged with the company. Sabero Organics Gujarat Ltd also amalgamated into the company.

Company also entered into Joint venture agreement with Yanmar Co. Limited. & Mitsui & Co. (Asia Pacific) Pte. Ltd for manufacture and marketing of Yanmar branded rice transplanters and harvesters. The share in joint venture is 40% of Coromandel, 40% of Yanmar and 20% of Mitsui.

2017:

Coromandel incorporated a subsidiary ‘Coromandel International (Nigeria) Limited’ (CINL) in Nigeria for the purpose of marketing of agrochemicals. In addition, Company acquired Bio-Pesticides business from EID Parry (India) together with its wholly owned subsidiary Parry America Inc. USA through a slump sale valued at INR 338 crore. Bio-Pesticides business includes manufacture and marketing of Neem based Azadirachtin, Technical and Formulations Plant extract based Bio-stimulants micronutrients Microbials etc. Bio pesticides turnover is INR 123 crore & operating profit of INR 24 crore in FY17.

2019:

Fire accident took place in the company premises at Sarigam, Gujarat on January 28 2019. Gujarat Pollution Control Board (GPCB) issued notice to company to close the operations of plant because of pollution caused by the incident. Company resumed plant’s operations in June 2019. The incident affected the company’s crop protection business.

Further, Coromandel proposed amalgamation of ‘Dare Investment Ltd’ and Liberty Pesticides and Fertilisers Ltd with the company.

2020:

Coromandel acquired 50% stake of Coromandel SQM Ltd, a joint venture between company and Soquimich European Holdings BV.Coromandel SQM Limited is into manufacturing and sale of water soluble fertilizer (WSF).

(B) Shareholding Pattern

Under promoters’ holding, 60.53% of the total shares is held by E.I.D. Parry India Ltd. Under Institutional holding, Mutual Funds hold 14.63% of the total shares of company. Foreign Portfolio Investors hold 3.54% of the total shares.

(C) Executive Management

(i) Mr. M. M. Murugappan – Chairman (Age 62 yrs)

Mr. MM Murugappan is a fourth-generation member of the Murugappa family. Mr. MM Murugappan is also the chairman of Murugappa Group. He holds a Master degree in Chemical Engineering from the University of Michigan, USA. His son, Mr Muthu Murugappan is currently Business Head – Nutraceuticals at EID Parry (India) Ltd. Mr. MM Murugappan receives sitting fee and commission as remuneration. He received Rs 2.01 crore for FY19.

(ii) Mr. Sameer Goel – Managing Director (Age 54 yrs):

Mr. Sameer started his career with GlaxoSmithKline Consumer Healthcare (GSK) in 1987 as Area Sales Manager. He was working as Country Head – India of Cipla Limited before joining Coromandel. Mr. Sameer Goel holds a Post Graduate Diploma in Management from Indian Institute of Management, Ahmedabad, and Bachelor’s degree in Economics from St. Stephens College, New Delhi. His remuneration is INR 4.72 crore for FY19 and INR 3.96 crore for FY18.

Other member of Murugappa family, Mr. M M Venkatachalam is also part of the board as Non-Executive Director. He is 59 yrs old; holds a graduate degree from the University of Agricultural Sciences, Bangalore & a Master’s degree in Business Administration from George Washington University, USA. He is also the Chairman of Coromandel Engineering Company Ltd, Ambadi Enterprises Ltd & Parry Agro Industries Ltd.

(D) Products

Click to enlarge the image

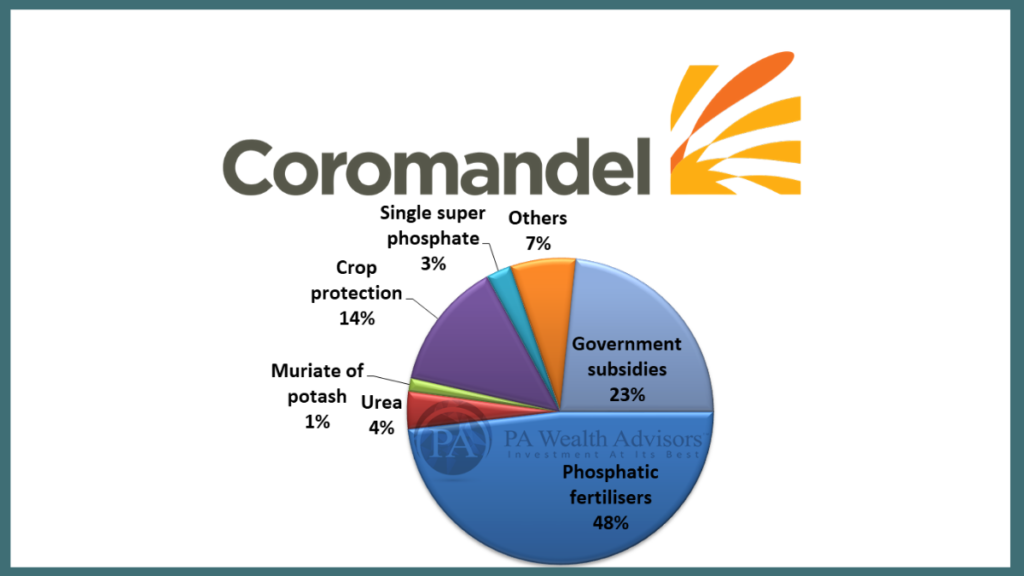

Main business categories of the company are fertilizers and crop protection. Fertilizers revenue contribution is 82% in FY18 and 81% in FY19. Pesticides revenue contribution is 14% in FY18 and 13% in FY19.

Fertilisers of the company come under the Gromor brand. Company also started providing fortified fertilizer which provides secondary and micro nutrients. Unique grade products contribution to the overall fertilizer product portfolio is 38% in FY19.

Coromandel exports Crop protection products to more than 62 countries. Specialty nutrients are those nutrients which cater to the special need of the soil.

(E) Revenue Segments

Nutrient & other allied business includes all the fertilizers and specialty nutrients. Nutrient & other allied business revenue is INR 11,505.29 crore in FY19 and INR 9,602.36 crore in FY18. Revenue from crop protection is INR 1,801.91 crore in FY19 and INR 1,662.76 crore in FY18. Hence, Revenue growth rate for Nutrient & other allied business and Crop protection is 20% and 8% respectively.

(F) Segment Performance

Nutrient & allied business profit (EBIT) for FY19 is INR 1,180.32 crore and for FY18 is INR 1,014.43 crore. Crop protection segment profit (EBIT) is INR 283.15 crore for FY19 and INR 268.67 crore for FY18. Nutrient & allied business and Crop protection results grew by 16% and 5% respectively.

Click to enlarge the image

Click to enlarge the image

(G) Sales Volume

(H) Manufacturing Capacity

Company’s current manufacturing capacity is 4.5 million tons. Coromandel’s phosphatic capacity is equal to the 22% of the domestic manufacturing capacity of phosphatic fertilisers. In Crop protection company manufacturing capacity is more than 80,000 tons per annum. Company has also manufacturing capacity of 4.5 lakh tones of phosphoric acid. Company is a leading marketer of neem based ‘Azadirachtin’. Fertilisers’ capacity utilization is 85% in FY19 and 83% in FY18.

(I) Cost Structure

R&D

(J) Raw Materials

Phosphoric acid is used for the production of Phosphatic Fertilizers. Some of the phosphoric acid is produced by the company and some is imported from Tunisia. Rock phosphate, ammonia and sulphur are the other major raw materials of the company. Rock phosphate is needed for the production of phosphoric acid. Raw material cost is major component in the cost structure of the company.

(K) Group Structure

(L) Key Markets

- Andhra Pradesh

- Telangana

- Tamil Nadu and

- Maharashtra are the key markets of the company

(M) Other major players

- With around 19% market share in Urea and around 29% market share in complex fertilisers (P2O5 terms), IFFCO is India’s largest fertiliser manufacturer.

- Indian Farmers Fertiliser Cooperative Limited (IFFCO) is a Multi-state cooperative society engaged in manufacturing and marketing of fertilizers.

- Other major listed entities in the industry include –

| Gujarat State Fertilizers & Chemicals Limited |

| Chambal Fertilizers and Chemicals Limited |

| Paradeep Phosphates Limited |

| Rama Phosphates Limited |

(N) Concall Highlights

From the concall for the quarter ended 31 Dec 2019:

Fertilizers

- Industry performance in nine months is up by 7%. Complex and DAP are increased by 7% and 9% respectively.

- Raw materials prices for Q4 fixed at $590 per metric tonne compared to Q1 price of $625 per metric tonnes.

- Overall MRP is down by 15%. DAP MRP reduced to 25,000 per metric tonnes from 29,500 per metric tonnes. This is due to reduction in raw material cost.

- Company’s manufactured phosphate fertilizer volumes are up by 43% and overall phosphate volumes are up by 28%. Total volume of the company remained same because of reduction in Urea volumes by 42%.

- Company’s unique grade share remained unchange at 39%.

- Phosphatic fertilizer Capacity utilization is at 93% as compared to 83% in last year.

- Single Super Phosphate (SSP) sales up by 8%. Company continues to be market leader and market share is at 14.1% as against 13.8% last year. SSP production is up by 20%.

- EBITDA per ton on the manufactured phosphate fertilizer is INR 3800 per ton.

Crop Protection

Sarigam plant is stabilized. Revenue in the quarter is up by 4%. Pyrazosulfuron plant successfully commissioned at Sarigam and production commenced at WDG facility for Mancozeb at Dahej. Launched a new insecticide ASTRA Pymetrozine and this makes them the only company in the country to have production of both technical and formulation for Pymetrozine. Received EPA registration for neemazal granule product.

Capacity utilization for Mancozeb stands at 65-70%.

Subsidy

Subsidy outstanding is at INR 1,670 crore as against INR 2,020 crore in last year. This includes INR 630 crore for pending PoS acknowledgement and INR 639 crore claimed and pending with government. Subsidy released amount is INR 972 crore in the quarter as compared to INR 1,269 crore in last year.

New Products

Till date company has launched 4 new products – Mythri, Arithri, Fornax and Astra. Astra is what is referred as Pymetrozine. One more product to be launched is pyrazosulfuron. In FY19, 3 products are launched and in FY21 3-4 more products shall be launched. New generation molecules to be launched, will help in domestic B2B & B2C business and international B2B business.

Capex

Capex is estimated at around INR 400-450 crore. Completed Pymetrozine facility at Ankleshwar, Pyrazosulfuron at Sarigam and WDC facility at Dahej. Nearly INR 250 crores are added to fixed assets. Next year estimated capex will be INR 450-500 crore and soon will be finalized.

Most recently, company’s growth elements have been its focus on unique grade products and increasing backward integration. Management also gave a guideline for achievable EBITDA per ton as INR 3500 for next year. This is after consideration of 10-11% subsidy cut and improved capacity utilization efforts targeted by the company.

Drop us your query at – info@pawealth.in or Visit pawealth.in

References: Annual Reports, News Publications, Investor Presentations, Corporate Announcements, Management Discussions, Analyst Meets & Management Interviews, Industry’s Publications.

Disclaimer: The report only represents personal opinions and views of the author. No part of the report should be considered as recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Quite detailed analysis !!