Deepak Fertilisers and Petrochemicals Corporation Ltd. is a top manufacturer of industrial chemicals in India, specializing in Nitric Acid, Iso Propyl Alcohol (IPA) in both pharmaceutical and industrial grades, as well as food-grade Liquid Carbon Dioxide. Moreover, in addition to manufacturing, the company imports and supplies IPA and other chemicals within the country. The company is actively involved in the production, trading, and sale of bulk chemicals, along with ventures in value-added real estate.

- About the company

- Journey Since Inception

- Board Members

- Shareholding Pattern

- Business Segments

- Revenue Segments

- Cost Structure

- Financial Parameters

- Management Key Highlights

- Strengths & Weaknesses

(A) About

Deepak Fertilisers and Petrochemicals Corporation Ltd. Deepak Fertilisers is a leading Indian producer of fertilizers and industrial chemicals, established in 1979 as an Ammonia manufacturer. The company offers a diverse range of products including industrial chemicals, specialty fertilizers, farming solutions, technical ammonium nitrate, and real estate, featuring India’s first major home interiors retail destination.

With manufacturing units in Maharashtra, Andhra Pradesh, Haryana, and Gujarat, Deepak Fertilisers uses advanced technologies to ensure top-quality products. Focused on growth, the company continues to expand its portfolio and drive value in an evolving global market.

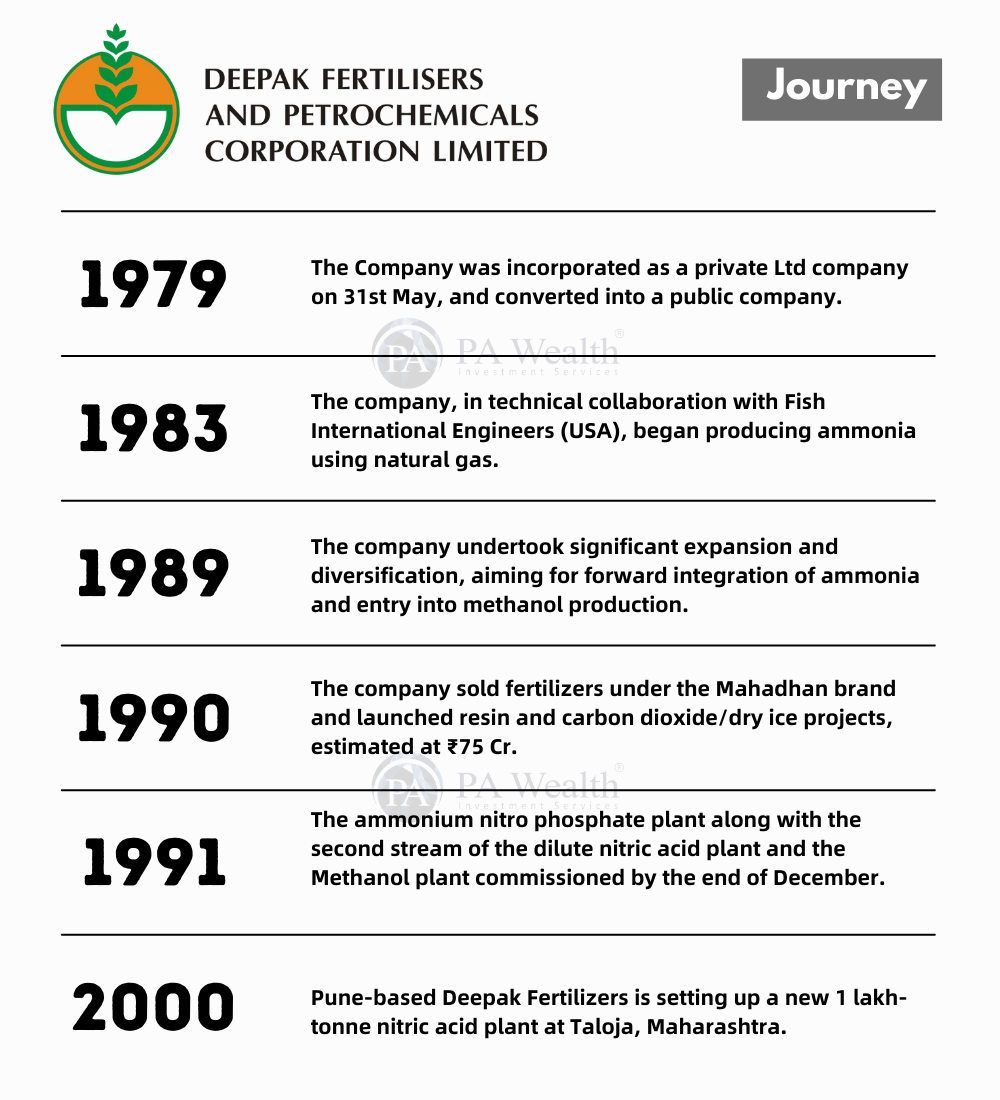

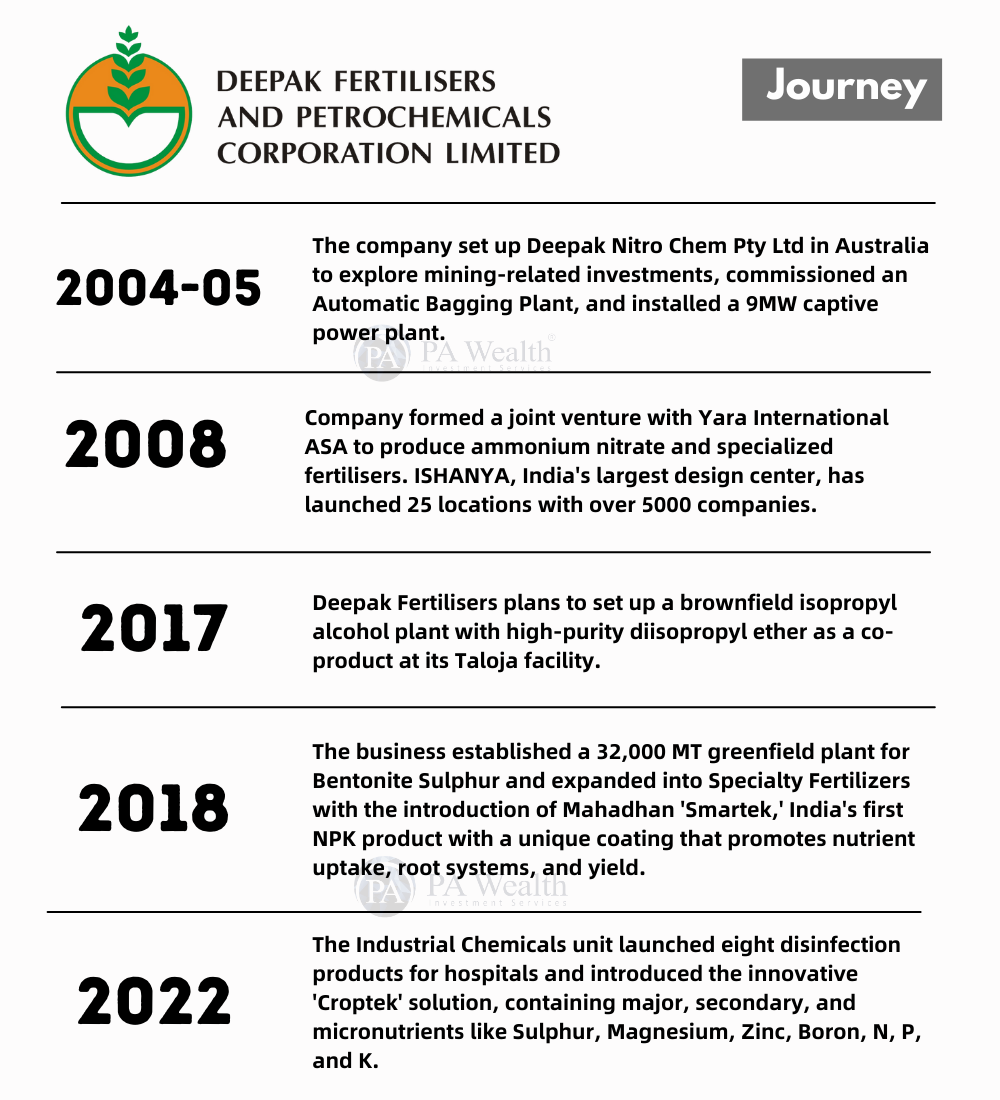

(B) Journey of Deepak Fertilisers & Petrochemicals Corp Ltd.

(C) Board of Directors of Deepak Fertilisers & Petrochemicals Corp Ltd.

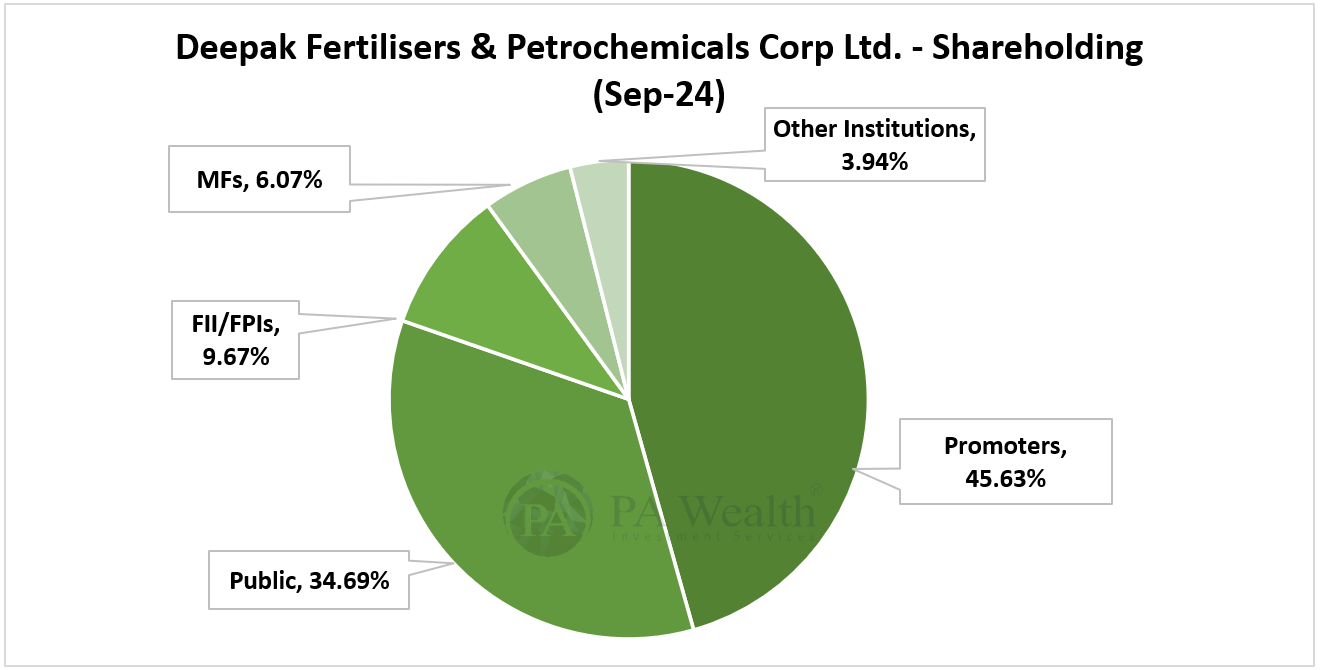

(D) Shareholding Pattern of Deepak Fertilisers & Petrochemicals

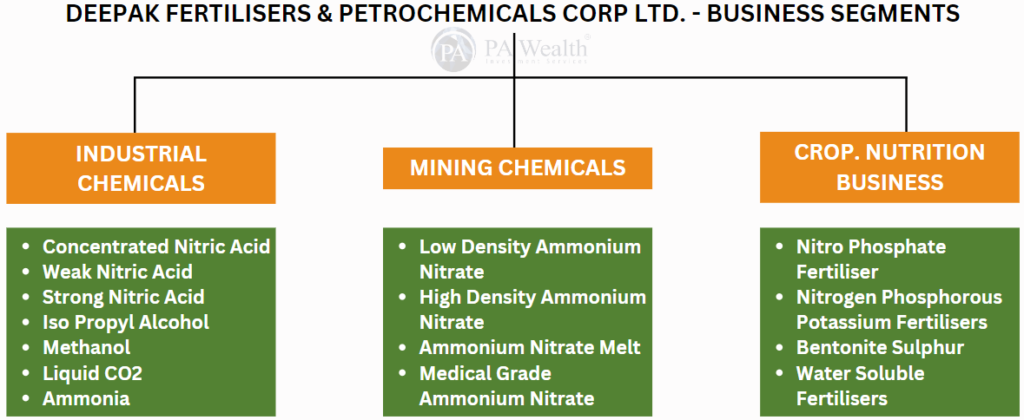

(E) Business Segments

(i) Industrial Chemicals (IC)

The firm is a market leader in industrial chemicals, with a focus on several grades of Nitric Acid, such as Dilute Nitric Acid (DNA), Concentrated Nitric Acid (CNA), and Strong Nitric Acid. It also sells isopropyl alcohol (IPA) in a variety of grades, including medicinal, food, cosmetic, and standard. Furthermore, the firm produces ammonia and liquid carbon dioxide, broadening its range of industrial chemicals.

Iso Propyl Alcohol (IPA)

It is a leading manufacturer of high-purity Iso Propyl Alcohol (IPA) in India, catering mainly to the pharmaceutical sector with its “PUROSOLV” brand. With demand for IPA set to grow annually by 6%, Deepak Fertiliser is positioned to support the pharmaceutical, chemical, and cosmetics industries.

Nitric Acid

Nitric acid is an important chemical with several industrial applications. It manufactures nitrate-based fertilizers, ammonium nitrate, and nitroaromatics (such as nitrobenzene and nitrotoluene) and serves industries such as steel, dairy, chemical intermediates, and rocket propellants.

The majority of the nitric acid generated is utilized to create TAN and ANP, while the remainder is delivered in various grades. In addition, the firm imports and converts nitric acid to satisfy client and market demands.

Specialty Chemicals

As part of its strategic shift, the firm is prioritizing bespoke specialist solutions to develop long-term client relationships. Notably, it introduced PICKBRITE, an environmentally friendly stainless steel pickling solution that solves ESG issues. Furthermore, as Electronic Grade IPA gains traction and Cororid expands into disinfection, the company’s industrial presence grows across many industries.

Liquid Carbon Dioxide and Methanol

It is a leading supplier of Liquid Carbon Dioxide (LCO2) with a capacity of 72,000 MTPA at its Taloja facility. Certified food-grade, LCO2 is used in dry ice production, beverage carbonation, and as a shielding gas in welding. By converting CO2 into useful products, it contributes to reducing greenhouse gas emissions and supports environmental sustainability. The company also has a methanol production capacity of 100 KMT annually, but adverse market conditions and economic factors affect operations.

(ii) Mining Chemicals (TAN)

Deepak Fertilizer produces High Density Ammonium Nitrate (HDAN), Low Density Ammonium Nitrate (LDAN), Ammonium Nitrate Melt (AN Melt), and Medical Grade Ammonium Nitrate. It is the only producer of explosives-grade LDAN in India. The company also manufactures Medical Grade Ammonium Nitrate, used in the production of nitrous oxide for anesthetic and analgesic purposes.

Moreover the business has developed holistic mining solutions through Total Cost of Ownership (TCO) projects for India’s mining and infrastructure sectors. These solutions enhance productivity across the mining value chain, from drilling to blasting, loading, hauling, and crushing.

(iii)Crop Nutrition Business (CNB)

The CNB product portfolio includes 48 products, featuring enhanced efficiency NPK fertilizers (Smartek), crop-specific balanced nutrient fertilizers (Croptek), crop and stage-specific water-soluble fertilizers (Solutek), bentonite sulphur (Bensulf Super-Fast), and other specialty fertilizers under the flagship brand ‘Mahadhan.’

The company’s shift from a commodity-focused to a specialized player highlights its emphasis on tailored, crop-specific nutrient solutions, setting it apart in the market. It is the only producer in India of crop-specific NPK fertilizers enriched with secondary and micronutrients, supported by Nutrient Unlock Technology (NUT). A strong R&D team, including 14 PhDs and agriculture doctorates, drives innovation to create unique solutions.

(iv) Value added real estate.

Deepak Fertilisers VARE business focuses on its lifestyle retail center, Creaticity, in Pune. Creaticity hosts around 100 furniture and home décor brands, along with restaurants, entertainment, and co-working spaces.

The firm is actively transitioning its VARE division from a space enabler to a complete solution supplier. In FY24, it deliberately introduced “Creaticity Branded Interiors” to serve as a one-stop interior solutions destination. The firm plans to expand its furniture and interiors products by using its varied variety, physical and digital experiences, and specialized services. In addition, over 10 well-known brands were added, strengthening its position as the region’s top multi-branded home interior destination.

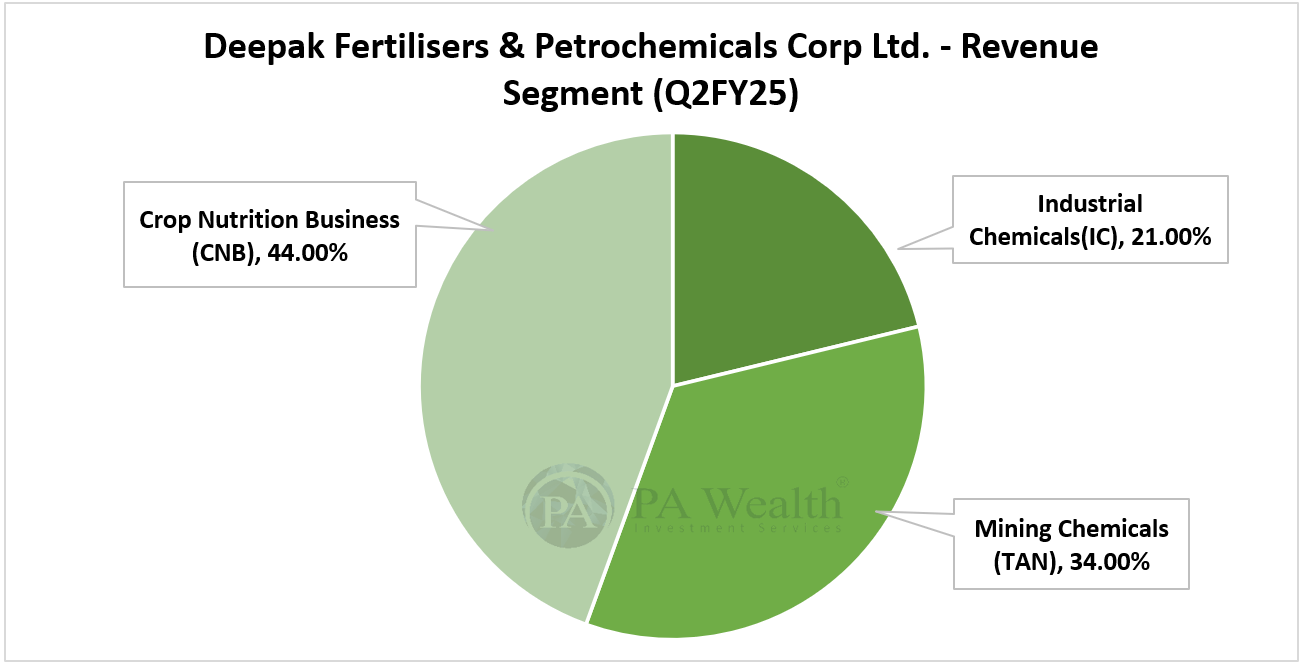

(F) Revenue Segments of Deepak Fertilisers & Petrochemicals

(G) Cost Structure of Deepak Fertilisers & Petrochemicals

(H) Financials of Deepak Fertilisers & Petrochemicals

The company’s revenue has grown at a CAGR of 8.61% over the past 10 years from Rs 3,808.30 Cr. in FY15 to Rs 8,696.69 Cr. in FY24. Subsequently, The company’s PAT has grown from Rs 67 Cr. in FY15 to Rs 457 Cr. in FY24 at a CAGR of 21.25%. Furthermore, the company’s ROE increased from 4.5% in FY15 to 8.5% in FY24.

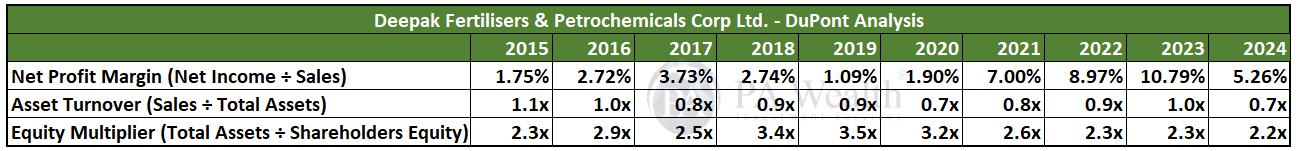

DuPont Analysis

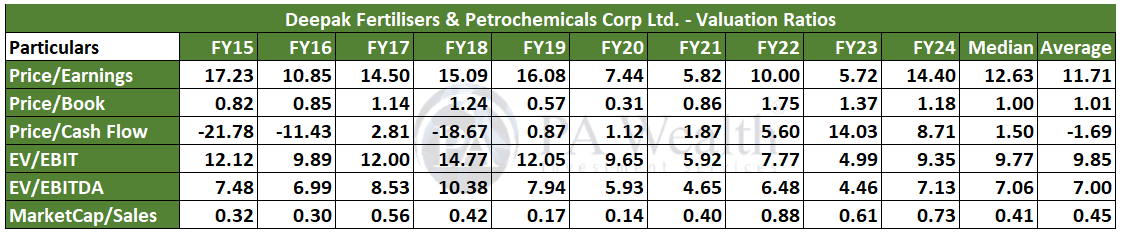

Valuation Ratios

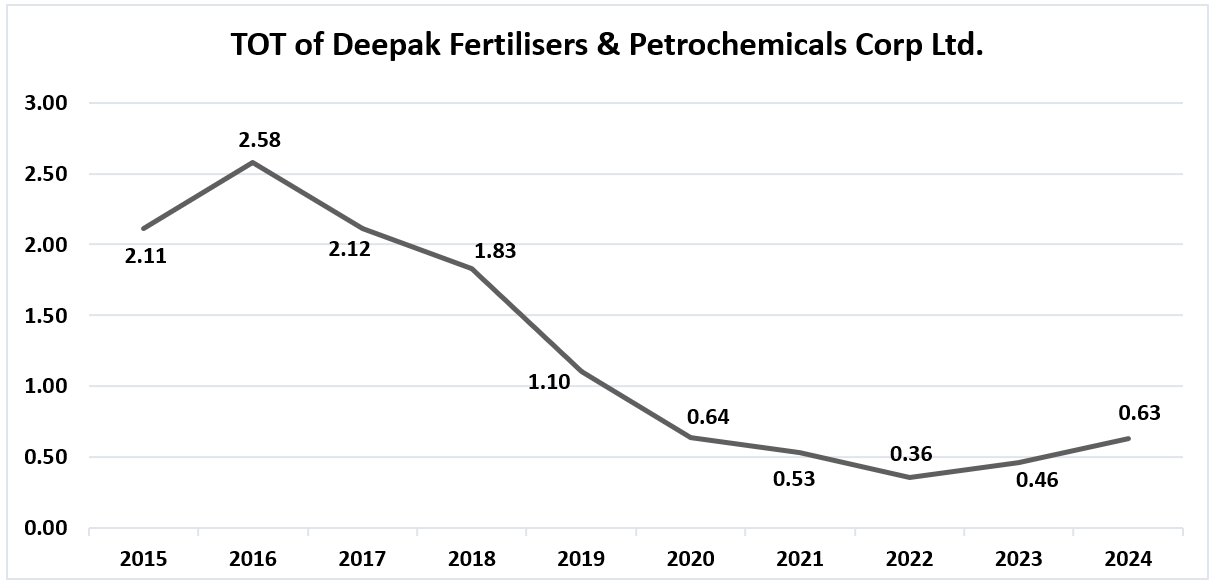

Terms to Trade

(I) Management Discussion

Outlook

Industrial Chemicals (IC)

- The leading producer of nitric acid in South Asia.

- India’s only manufacturer of medical-grade ammonium nitrate.

- The Management is working on capturing untapped markets in Southern India while expanding its portfolio with new products to meet customers’ growing needs.

- Pioneered the launch of pure Di Isopropyl Ether in India, designed for high-grade applications in the pharmaceutical industry.

- Witness excellent response in export volume of IPA in international market which grew by 246% as compared to FY24.

Mining Chemicals (TAN)

- India’s only manufacturer of prilled technical ammonium nitrate solids.

- Increased the licensed capacity of brownfield TAN manufacturing plants to 629 KTPA, up from 487 KTPA in FY23.

- Initiated forward integration by supplying specialized bulk explosives to a major private coal mining company.

Crop Nutrition Business (CNB)

- India’s only manufacturer of nitric phosphorus prill 24:24:0 fertilizer and the sole producer of crop-specific nutrient solutions containing nitrogen, phosphorus, potassium, micronutrients, and nutrient unlock technology.

- India’s largest manufacturer of Bentonite sulphure.

- Market leader in speciality & water-soluble fertilisers in india.

- Successfully launched Croptek grade for soybean and Solutek grade for bananas, and established Solutek grades for tomatoes, and pomegranates.

- Onboarded 23,000 Sathie farmers onto the Mahadhan App and developed the “Saarthie Laabh” loyalty module within the app.

Value added Real Estate.

- Deepak fertiliser’s Value Added Real Estate (VARE) business focuses on its lifestyle retail center, Creaticity, in Pune, Maharashtra. Creaticity offers around 100 brands in furniture and home décor, along with restaurants, banquet halls, and entertainment options like a trampoline park and go-karting. The upper floors also include commercial and co-working spaces.

- The Company transformed its VARE segment from a space enabler to a comprehensive solutions provider with the launch of “Creaticity Branded Interiors” in FY24. By leveraging its strengths in selection, physical presence, digital experience, and specialized services, it aims to enhance its furniture and interiors offerings. This year, over ten renowned national and international brands were onboarded, positioning the segment as a top multi-branded home interior destination in the region.

(J) Concall Q2FY25

- The company’s new ammonia factory helps to lessen dependency on imports and price instability, particularly in the face of global events such as those in the Middle East. It is also evolving away from commodities and toward niche items, owing to excellent R&D and customer insights.

- The company is expanding its facilities at Gopalpur for TAN and Dahej for nitric acid, with project timelines set for the second half of FY26. Initial production is expected to ramp up to 70% to 80%, eventually reaching around 90% to 100%.

- The management thinks that imposing an anti-dumping tariff on IPA will benefit both the top and bottom lines of the industrial chemicals industry, therefore promoting margin sustainability.

- The company plans to demerge its businesses and list them as separate entities, allocating debt according to each business unit associated with its respective projects. Post-demerger, each business will be able to focus on its core competencies and growth opportunities without being constrained by the performance or priorities of other segments within the conglomerate.

Capex

By the conclusion of the fiscal year, the firm had a total debt of INR 4,150 crore, principally to fund its ammonia facilities in Gopalpur and the nitric acid facility in Dahej, with a 10- to 12-year term. It also intends to spend roughly INR 2,200 crore on the Gopalpur project and another INR 2,000 crore on Dahej. So far this year, it has spent almost INR 1,500 crore, showing its strong investment in these key initiatives.

(K) Strengths & Weaknesses

Strengths of Deepak Fertilisers & Petrochemicals Corp Ltd.

- Established position in domestic industrial chemical and TAN markets: deepak Fertiliser is the market leader in the domestic industrial chemical sector, being the largest manufacturer of nitric acid and the second largest of IPA, with over 50% and 25% market shares, respectively, in fiscal 2023. Additionally, it holds about 40% of the TAN market. Leadership is expected to strengthen with planned expansions in nitric acid and TAN capacities.

- Improving profitability and product mix: The group aims to shift 30% of its industrial chemicals portfolio to specialized, higher-margin products like steel and solar nitric acid, and pharma-grade IPA. In the TAN business, it’s the sole producer of LDAN, used in ANFO explosives. The group has implemented a TCO model for improved mine productivity and higher margins. In the fertilizer segment, it focuses on unique NPK products with better margins, like water-soluble fertilizers. Overall, consolidated margin has increased from less than 15% to 15-20% (excluding one-time impact in the first nine months of fiscal 2024).

Weaknesses of Deepak Fertilisers & Petrochemicals Corp Ltd.

- Exposure to structural limitations and cyclicality in commodity prices: The company’s profitability is impacted by commodity price cycles and its reliance on imported natural gas and fertilizer inputs. To reduce risks, it has diversified its suppliers and signed long-term gas contracts, including one with Equinor. Managing product mix and margin swings will be critical to achieving consistent profitability.

- Exposure to regulatory risk in the fertiliser industry: The government’s emphasis on food grain self-sufficiency makes the fertilizer business crucial, but highly controlled. Companies face risks from regulatory changes and subsidy delays, which increase their reliance on working capital debt. Any subsidy deferral or regulatory changes are significant rating concerns.

Disclaimer: The report only represents the personal opinions and views of the author. No part of the report should be considered a recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

References: Annual Reports, News Publications, Investor Presentations, Corporate Announcements, Management Discussions, Analyst Meets and Management Interviews, Industry Publications.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore