Edelweiss Small Cap Fund is an open-ended equity scheme that invests in India’s small-sized companies with strong growth potential. The fund follows a disciplined approach to identify scalable businesses at reasonable valuations, backed by sound governance and management quality. With this strategy, it seeks long-term capital appreciation by capturing opportunities in the small-cap space. Therefore, it is suitable for investors with a high-risk appetite aiming for wealth creation over the long term.

- About the Edelweiss Small Cap Fund

- Basic Details

- Classification Portfolio of the fund

- Fund Managers & Tenure of managing the Scheme

- Investment Details

- Returns Generated

- Risk Factors

- Investment Philosophy

- Taxability of Earnings

(A) About the Edelweiss Small Cap Fund

The Edelweiss Small Cap Fund aims to generate long-term capital growth by investing predominantly in small-cap companies, many of which are often under-researched and under-owned. Furthermore, it follows a style-agnostic framework, blending both value and growth opportunities, while also focusing on clean, robust, and scalable businesses.In addition, the fund maintains a well-diversified portfolio across sectors and ensures rigorous risk management. Therefore, it is best suited for long-term investors with a high-risk appetite, who are willing to ride out short-term volatility for the potential of superior returns.

(B) Basic Details of Edelweiss Small Cap Fund

| Fund House | Edelweiss Mutual Fund |

| Category | Equity: Smallcap Fund |

| Launch Date | 18-Jan-2019 |

| Type | Open-ended |

| AUM | ₹4921 Cr (As on 31 August 2025) |

| Available at NAV of | ₹43.67 (As on 10 Oct 2025) |

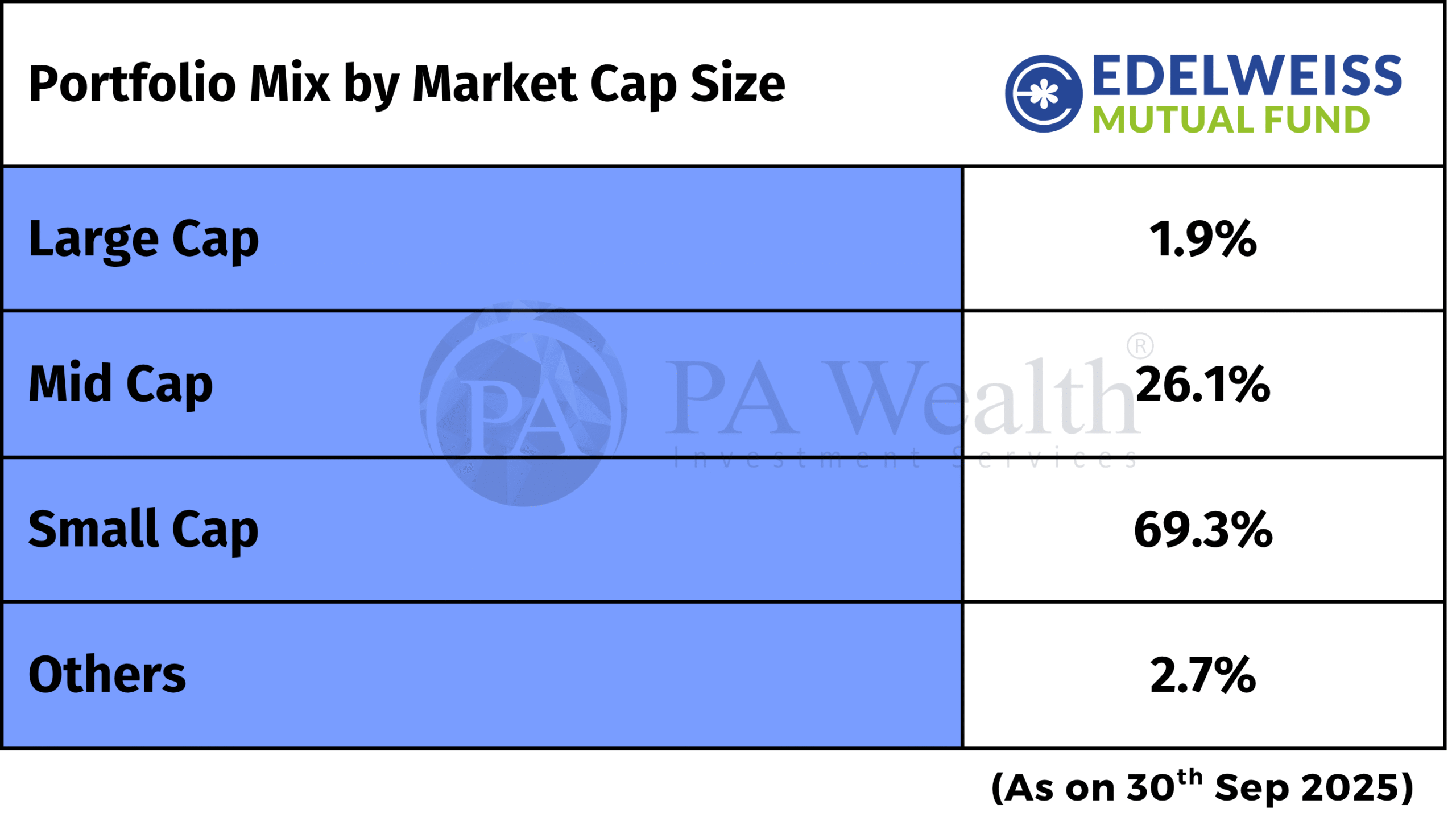

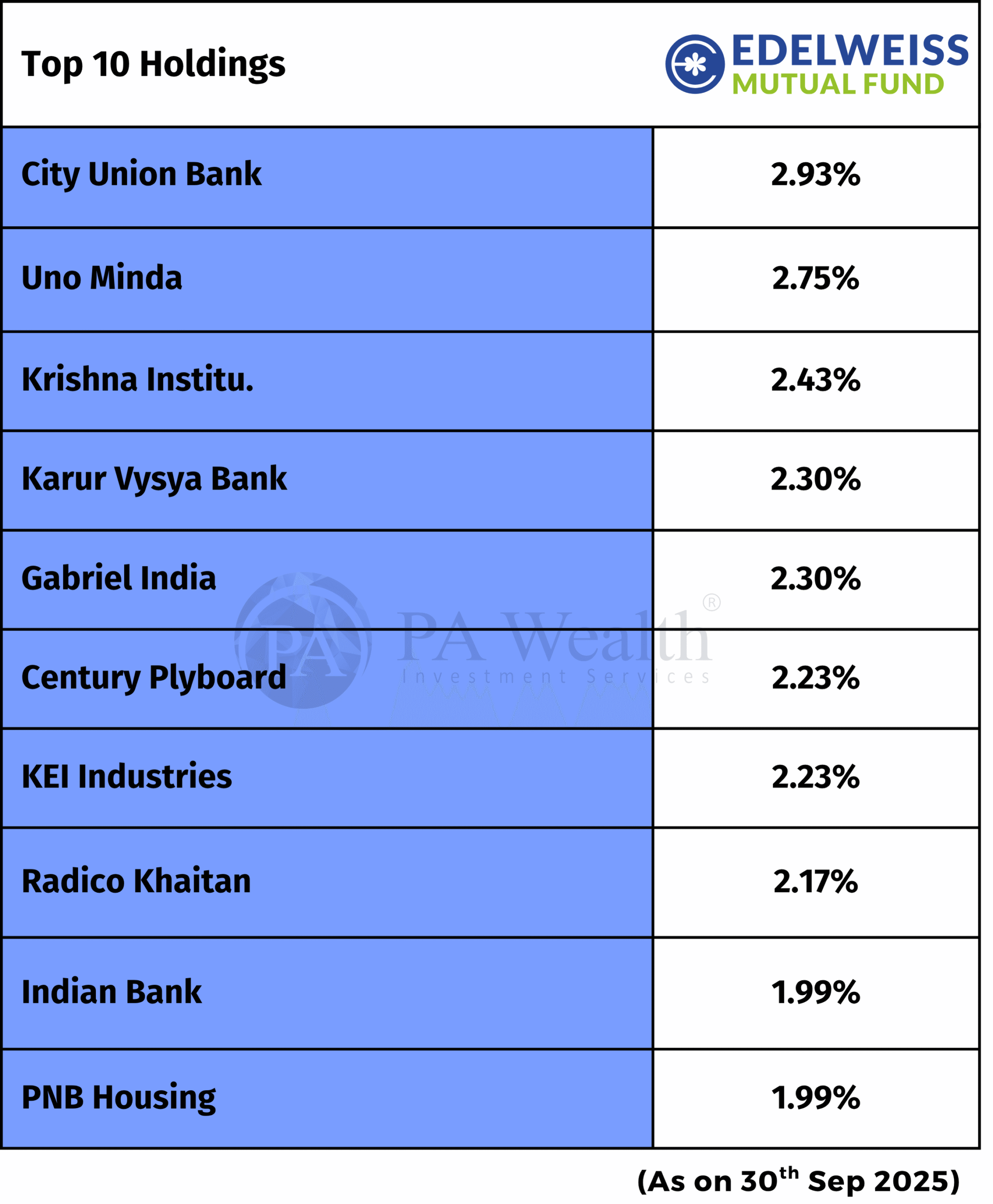

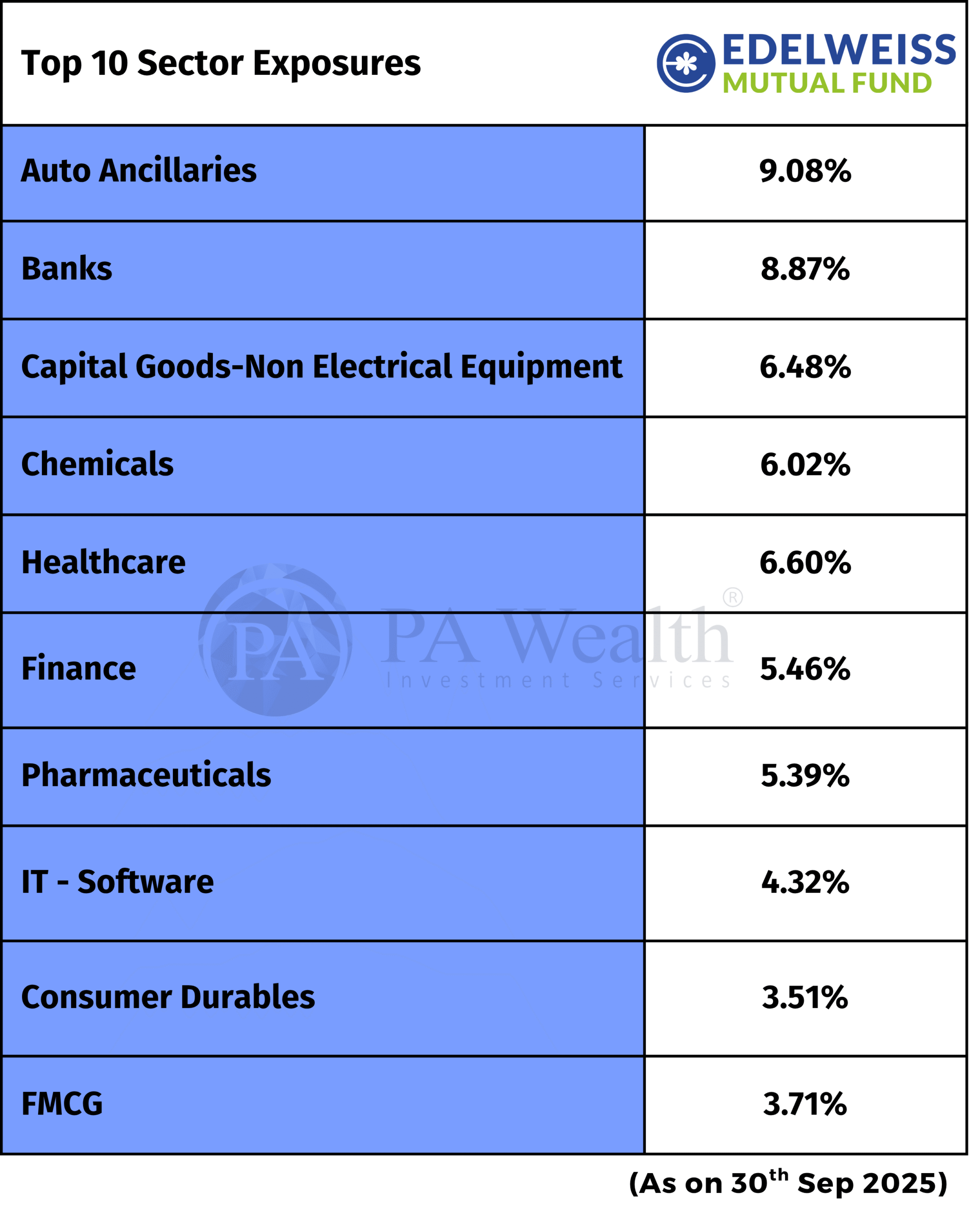

(C) Classification Portfolio of the fund

(i) Portfolio Mix by Market Cap Size

(ii) Top 10 Holdings of the Edelweiss Small Cap Fund

(iii) Top 10 Sectors Exposures of the Edelweiss Small Cap Fund

(D) Fund Manager & Tenure of managing the Scheme

(E) Fund – Investment Details

| Edelweiss Small Cap Fund | |

|---|---|

| Application Amount for fresh Subscription (Lumpsum) | ₹100 |

| Min Additional Investment (SIP) | ₹100 |

| Exit load | 1%* |

| Lock In | No |

| Expense Ratio | 1.82% (As on 30th Sep 2025) |

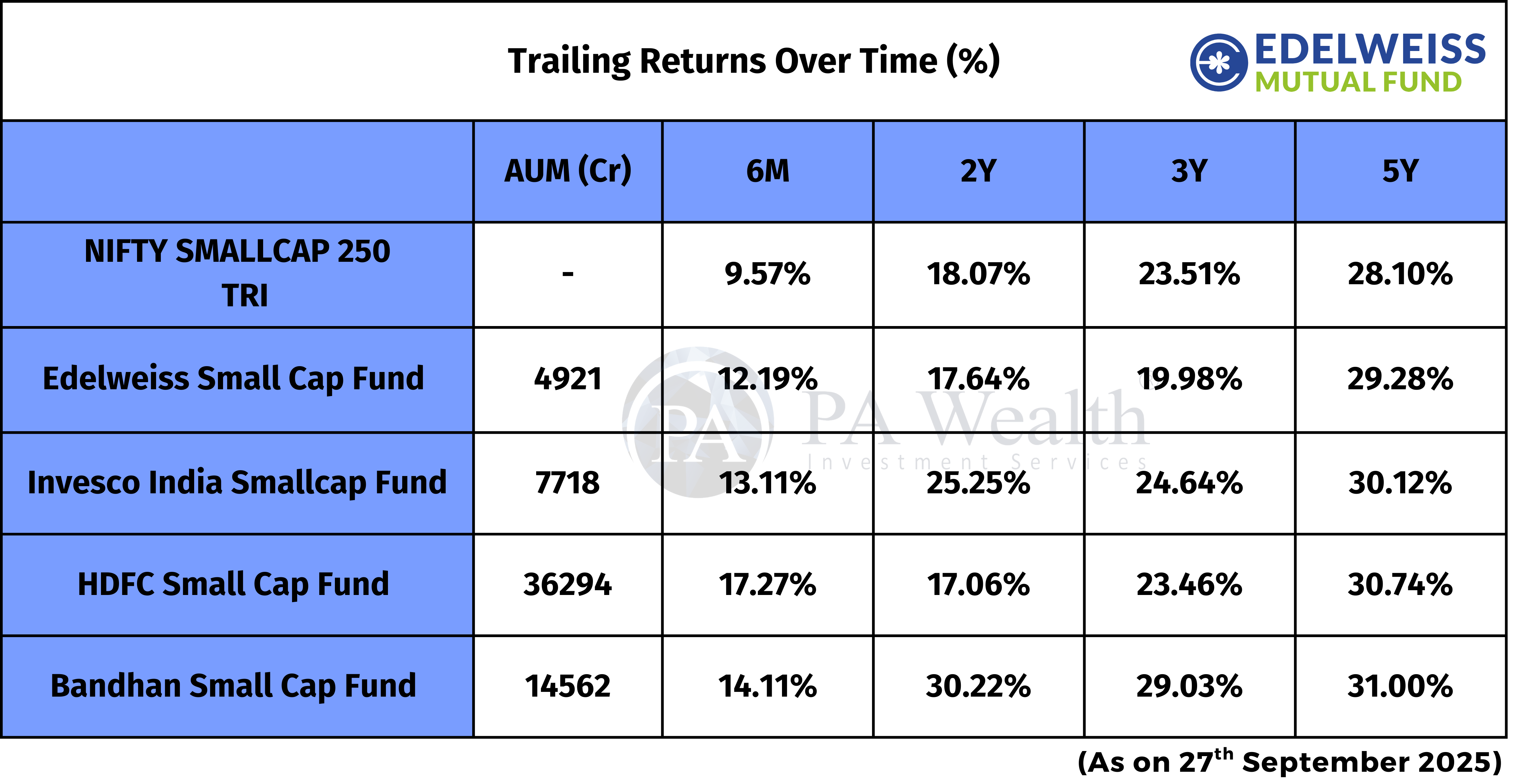

(F) Returns Generated By The Fund

(G) Risk Factors

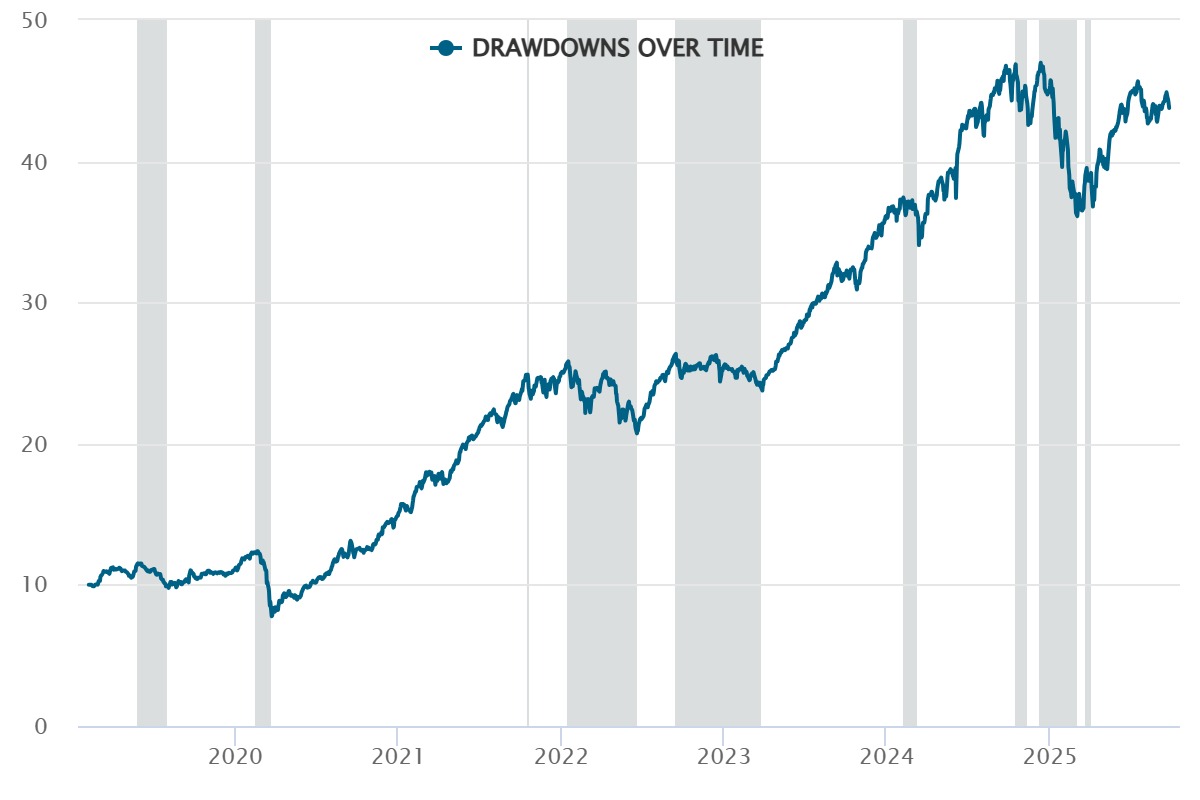

(i) Top Drawdowns

The Edelweiss Small Cap Fund has experienced several drawdowns since inception, with the sharpest fall of -37.18% occurring during the Covid-19 market crash (Feb–Mar 2020). However, it recovered from this decline in just 110 days by August 2020.

In addition, other notable declines include a -23.11% correction from December 2024 to March 2025, which remains in recovery, as well as a -19.74% fall in 2022 that took around two months to bounce back.

Meanwhile, smaller drawdowns such as -15.11% in 2019, -9.86% in late 2022, and -9% in early 2024 were recovered within weeks to months, thereby highlighting the fund’s resilience.

Overall, while the fund has faced periods of short-term volatility, its history of consistent recoveries underscores the importance of staying invested for long-term wealth creation.

(H) Investment Philosophy

The Edelweiss Small Cap Fund follows the fair Framework:

Robustness – Preference for scalable businesses with strong return on capital employed (ROCE) and ability to sustain earnings growth.

Forensics – Rigorous checks on accounting quality, governance, ownership, and management integrity to ensure only clean businesses enter the portfolio.

Acceptable Price – Focus on businesses available at fair valuations, avoiding overpaying even for quality companies.

Investment Style Agnostic – Combines value and growth approaches by balancing discounted opportunities with consistent compounders.

Taxation

(I) Taxability on earnings

Capital Gains Taxation

- If you sell mutual fund units after 1 year of investment, gains up to ₹1.25 lakh in a financial year are exempt from tax, while gains above this are taxed at 12.5%.

- If you sell within 1 year of investment, the entire gain is taxed at 20%.

- No tax is payable as long as you continue to hold the units.

Dividend Taxation

- Dividends from mutual funds are taxed as per the investor’s income tax slab.

- If the dividend income exceeds ₹10,000 in a financial year, a 10% TDS is deducted by the fund house before payout.

Drop us your query at – info@pawealth.in or Visit pawealth.in

References: valueresearchonline.com, Industry’s Publications, News Publications, Mutual Fund Company.

Disclaimer: The report only represents personal opinions and views of the author. No part of the report should be considered as recommendation for buying/selling any stock. In summary, the report and its references are presented to offer readers an informational overview of the discussed industry.

Overall, the report and accompanying references serve an informational purpose, helping readers better understand the stated industry.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore

💡 Liked this analysis?

Stay updated with more market insights & wealth strategies from PA Wealth.

✉️ Contact Our Experts Today