Hindware Home Innovation, as a part of Somany group, has around six decades of presence in the sanitaryware segment. It is also one of the largest sanitaryware and faucet players in the domestic market.

(A) About

Hindware Home Innovation is a newly created corporate entity which was demerged from HSIL Ltd. Company is a leader in Building Products and is the fastest-growing player in the Indian Consumer Appliances segment. Company focused on servicing consumers and is involved in manufacturing, branding, marketing, sales & distribution, and service of various product categories.

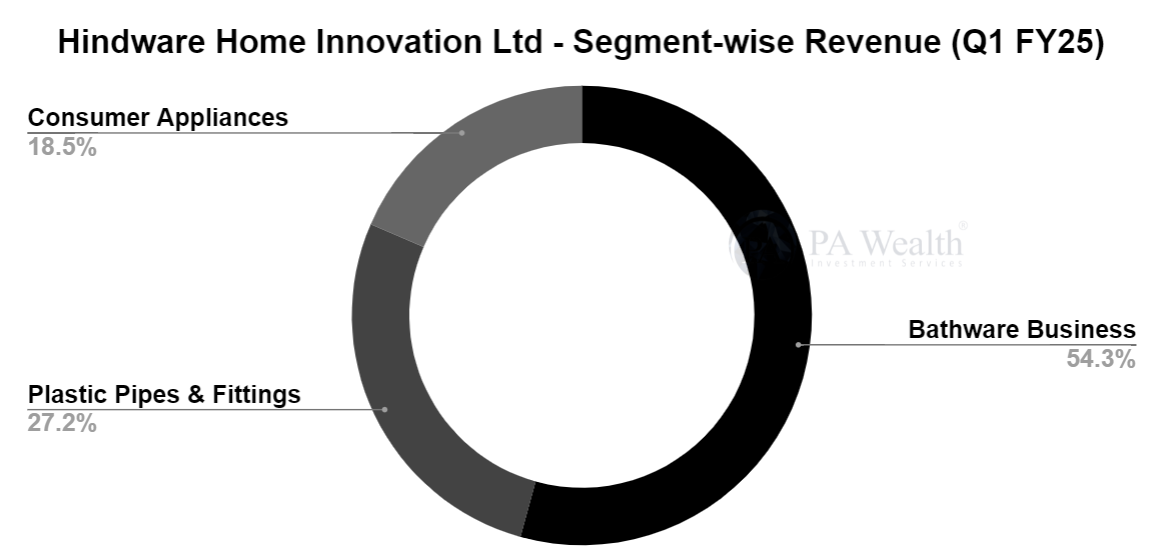

The company is in the business of bathware, Plastic pipes & fittings, and Consumer Appliances.

(B) Journey

In 1960, Dr. RK Somany started a sanitary ware industry in Delhi. Through technological collaboration with Twyfords, UK, Dr. Somany founded Hindustan Twyfords Ltd to introduce Chinese tiles to India and set up the first manufacturing plant in Bhadurgarh, Haryana. Thereafter in 1969, the company was renamed to Hindustan Sanitaryware and Industries ltd (HSIL), after which in 1981, it expanded the business to manufacturing glass.

In 1991, the company introduced the brand Hindware and ventured into a range of industries from dealing with pipes, bathroom fittings, water conservation products, faucets, home interior fashion, kitchen appliances, and also into other consumer appliances category.

However, in 2017 Hindware demerged and ventured into consumer products space through kitchen and home appliances products to form Somany Home Innovation Ltd, which is now known as one of India’s leading home appliances companies.

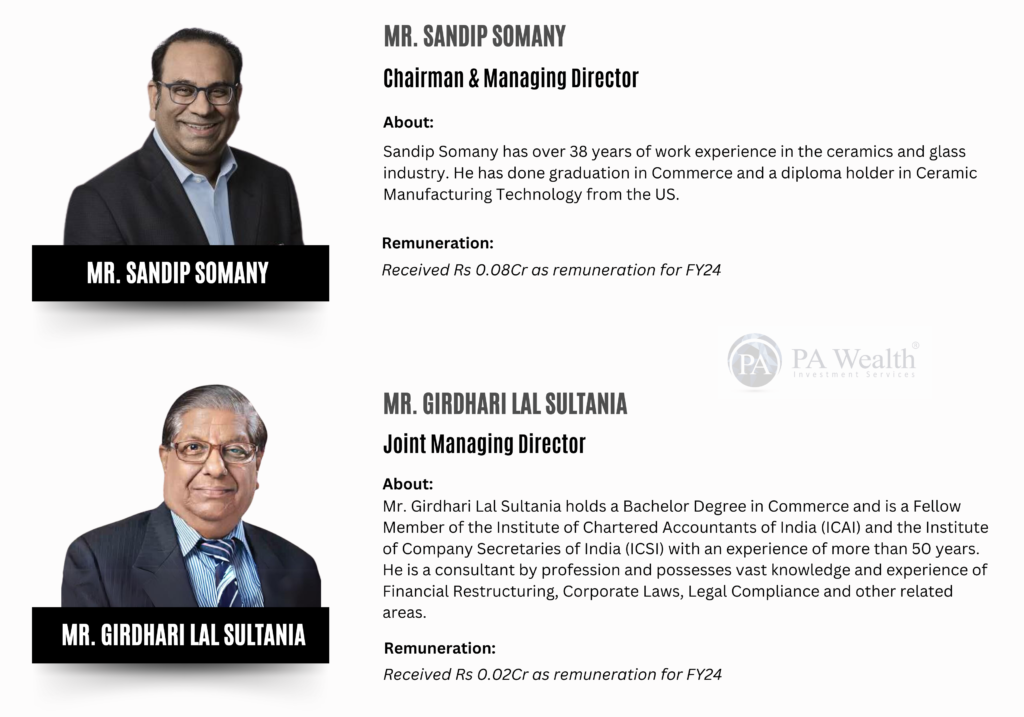

(C) Board Of Directors

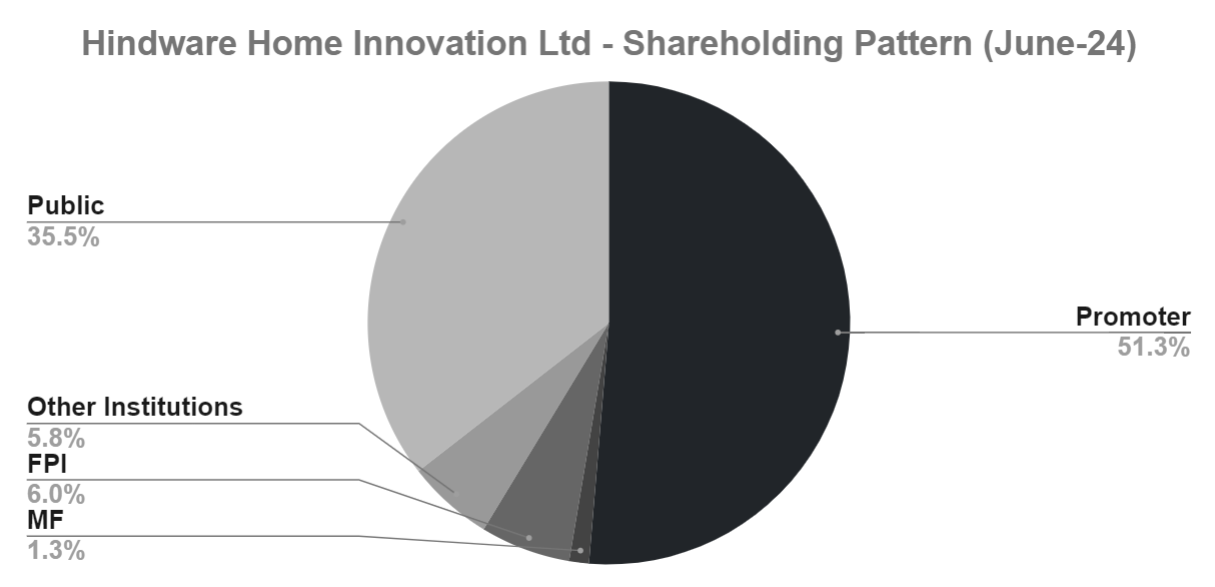

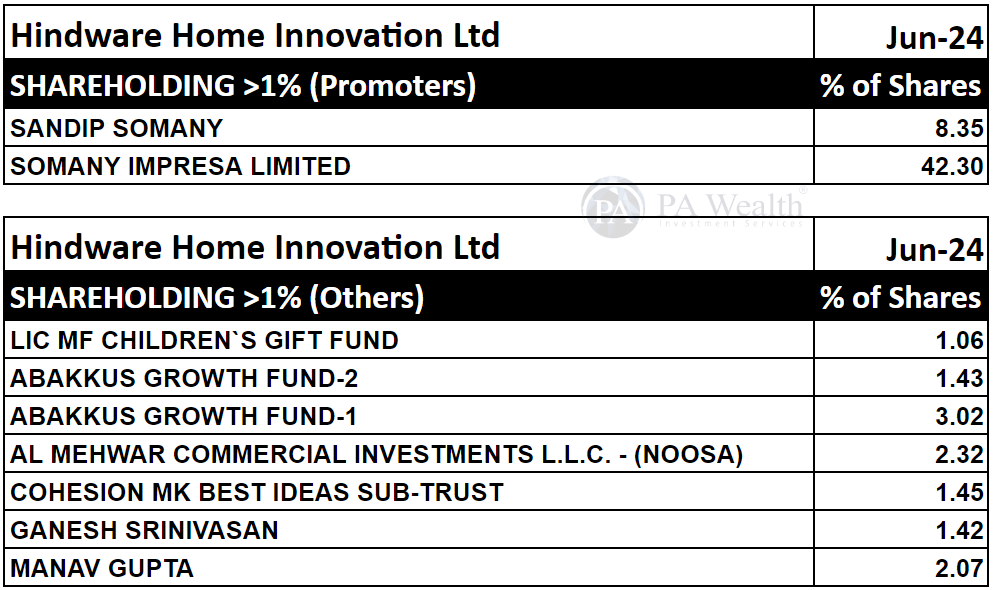

(D) Shareholding

(E) Business Segment

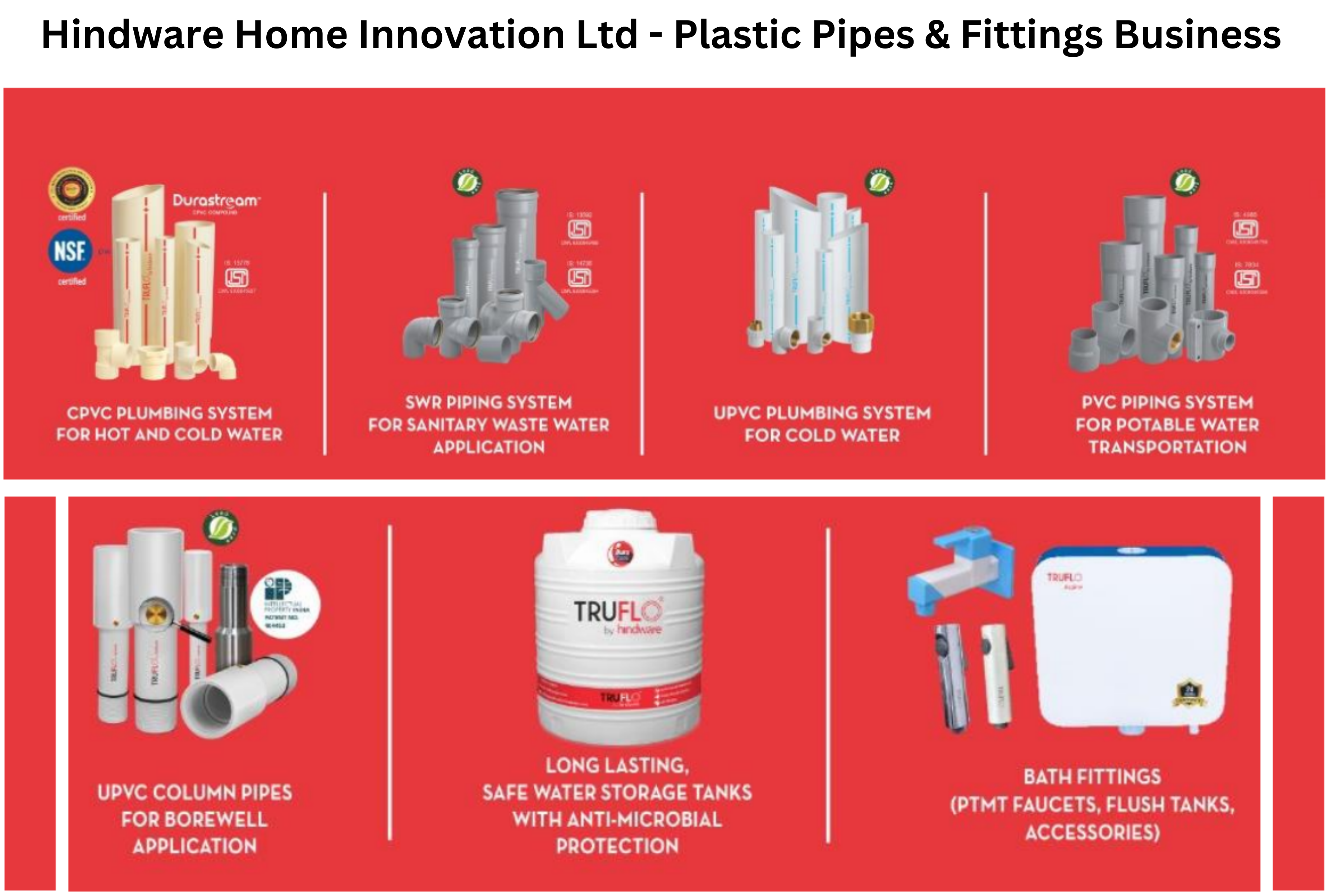

(i) Building Products

The building product segment comprises sanitaryware, faucets, wellness products, tiles, and other bathware products, whereas the pipe & fitting segment comprises water storage containers, CPVC, UPVC, and PVC, among other things.

(ii) Consumer Appliances

The consumer appliances business of Hindware encompasses a range of innovative products, such as kitchen sinks and appliances, air conditioners, fans, water purifiers, room heaters, and water heaters.

(iii) Retail

The company also offers specialty home interior products through 2 company owned display and sales stores in Delhi & Faridabad and a string and dedicated network of 30+ franchise stores across the country, under the brand “EVOK”. It also has a presence on prominent market places such as Pepperfly, Urban Ladder, Flipkart and Amazon.

The company discontinued this business segment in FY24.

(F) Revenue Segment

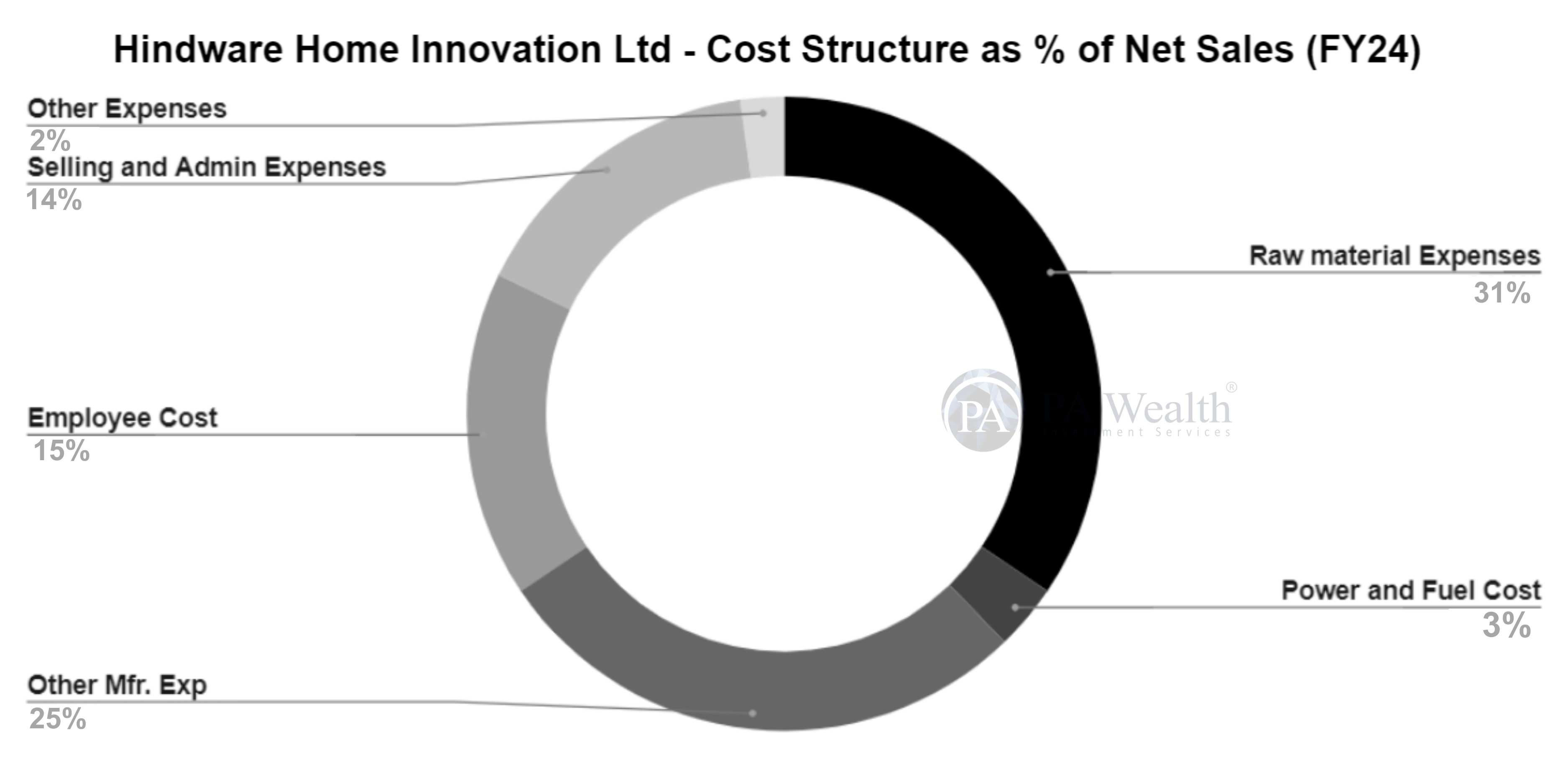

(G) Cost Structure

(H) Key Clients

Hindware has foster a strong and long-standing relationships with its dealers and distributors, leading to a robust business network. Furthermore, within the Sanitaryware and faucets segment ~70% of company’s business comes from B2C. Moreover in B2C segment company serves over 1200 clients.

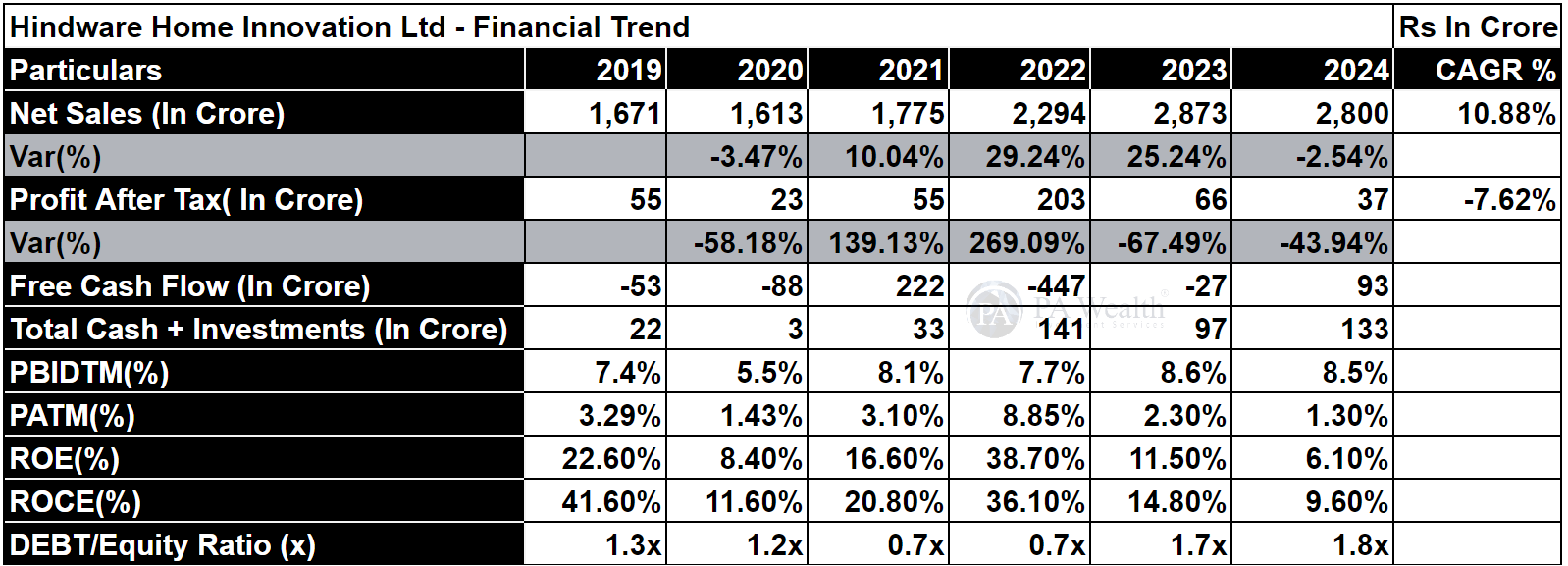

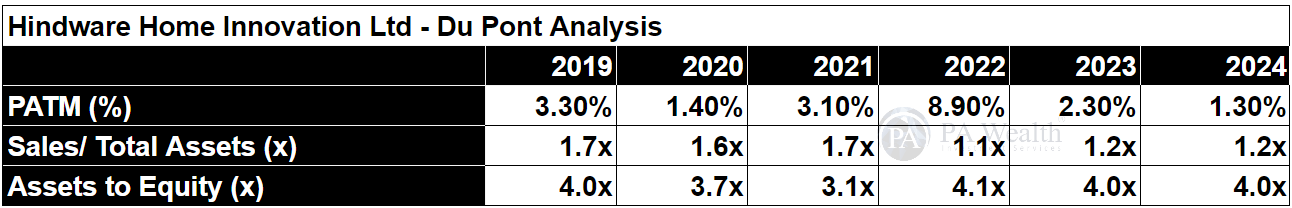

(I) Financials

The company’s revenue has grown at a CAGR of 10.88% over the past 6 years from Rs 1671 Cr. in FY19 to Rs 2800 Cr. in FY24. Subsequently, The company’s PAT has decreased from Rs 55 Cr. in FY19 to Rs 37 Cr. in FY24. Furthermore, The company’s debt to equity has increased from 1.3x in FY19 to 1.8x in FY24.

(J) Management Discussion & Concall Highlights

Bathware

- Demand landscape has been subdued for bathware segment, resulting in muted revenue.

- In Q1 FY25 our Bathware division generated a revenue of about INR 326 crores with an EBITDA of INR 42 crores.

- Furthermore, bathware revenue is targeted to grow in double digits, with EBITDA margin expanding to 18% over the next 2years.

Pipe & Fitting

- The Pipes Business delivered a volume growth of 24% YoY, 5% YoY increase in revenue and an EBITDA margin of 6.7%.

- Management aims to achieve volume growth of more than 15% in FY25, an EBITDA margin of 10-12% over the next two years, and pipe revenue of Rs 20bn over the next five years.

- The Roorkee, Uttarakhand plant is on track and expected to be operational by Q3 FY25.

- The Company has also launched composite (plastic and metal) faucets & pipes and plans to introduce underground drainage pipes in Q1FY25 and DWC (double wall corrugated) pipe & fire sprinkler systems in Q3FY25.

Consumer Appliances

- Consumer Appliances business delivered ₹111 crores in revenue, and an EBITDA margin of 2.7%.

- Management plans to expand its kitchen appliance range and exit from non-performing small appliances, which would help enhance the margin profile over the next 2-3 quarters.

- The company also plans to aggressively enter into kitchen fittings due to a common distribution network and healthy product margins.

Capex

The company plans to spend Rs 1.8bn on the Uttarakhand pipe plan. Meanwhile, in the bathware segment capex is estimated at Rs 0.7bn-0.8bn for FY25.

(K) Strengths & Weaknesses

Strengths

(i) Long track record of operations with a recognised brand name in the sanitaryware and consumer product segment

Hindware Home Innovation, as a part of Somany group, has around six decades of presence in the sanitaryware segment. It is also one of the largest sanitaryware and faucet players in the domestic market. Meanwhile, the group’s sanitaryware brand ‘Hindware’ is one of the oldest and well-known brands. Furthermore over the years, the company has expanded its segment profile to cater to various segments from the low to premium section.

(ii) Diversified product offerings and established marketing and distribution network

The company offers various bathroom solutions that include sanitaryware, faucets, plastic pipe and fittings, wellness products, and other allied products. These include products such as water closets, wash basins, pedestals, squatting pans, urinals, cisterns, bidets, showers, bathroom faucets, kitchen faucets, bathtubs, shower panels.

Weaknesses

(i) Susceptibility of the company to volatility in raw material prices

The volatility in fuel prices (primarily natural gas) and also of other key raw materials (various types of clay, brass, and chrome plating) directly impacts the cost of production for the company.

(ii) Linkages to the cyclical real estate sector and presence in a competitive industry

The demand for HHIL’s products is linked to the cyclical real estate sector. The demand for ceramics has risen in the recent past owing to the initiatives under the Swachh Bharat Abhiyan (SBA) and the Pradhan Mantri Awas Yojana (PMAY) along with higher replacement demand.

Drop us your query at – info@pawealth.in or Visit pawealth.in

References: Annual Reports, News Publications, Investor Presentations, Corporate Announcements, Management Discussions, Analyst Meets and Management Interviews, Industry Publications.

Disclaimer: The report only represents the personal opinions and views of the author. No part of the report should be considered a recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore