It is widely expected that the US Federal Reserve will reduce interest (repo) rates in September 2024, with the majority of experts predicting a 25-basis point cut. However, a smaller group believes the Fed might implement a larger reduction of 50 basis points. This move is expected to influence the Reserve Bank of India’s decision to lower rates in the following quarter. Let’s see how this scenario will impact the return of debt funds.

(A) Impact of Rising Interest Rates on Debt Funds

Interest rate changes can affect many investments, but it impacts the value of bonds and other fixed-income securities most directly. Bondholders, therefore, carefully monitor interest rates and make decisions based on how interest rates are perceived to change over time.

When interest rates rise, bond prices fall. This happens because existing bonds with fixed rates become less attractive compared to new bonds offering higher rates. For example, if a bond pays 6% interest but market rates increase to 7% or 8%, investors will prefer the new, higher-yielding bonds. To compensate for the less appealing return of the old bonds, their prices must drop. Essentially, the bond’s price adjusts downward to match the new, higher interest rates available elsewhere.

(B) Debt Fund Performance with Declining Interest Rates

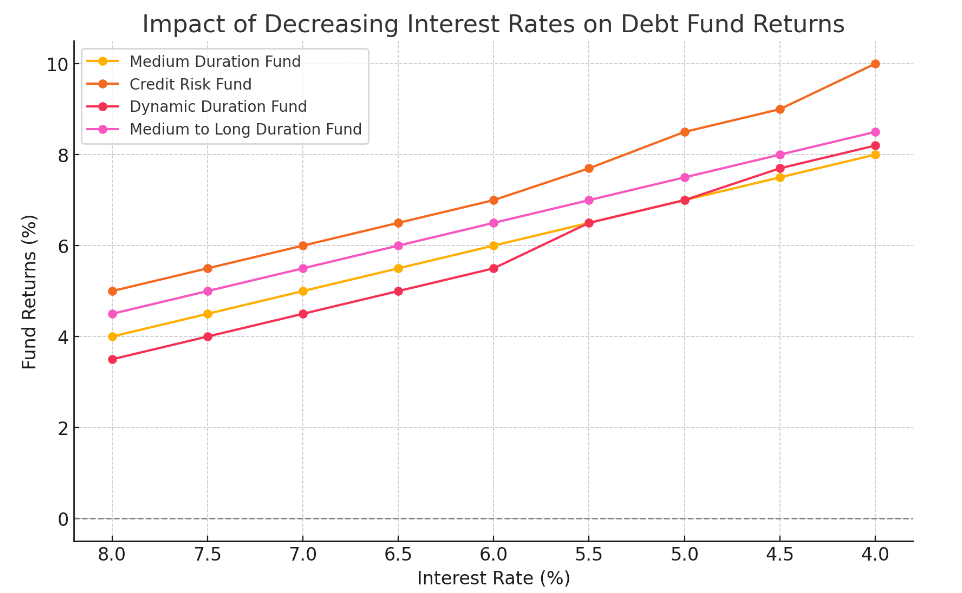

The graph shows how different types of debt funds (Medium Duration, Credit Risk, Dynamic Duration, and Medium to Long Duration) perform as interest rates decrease. As interest rates decline, fund returns (Y-axis) generally increase, highlighting the inverse relationship between interest rates and debt fund returns.

Let’s now discuss it with the help of an example.

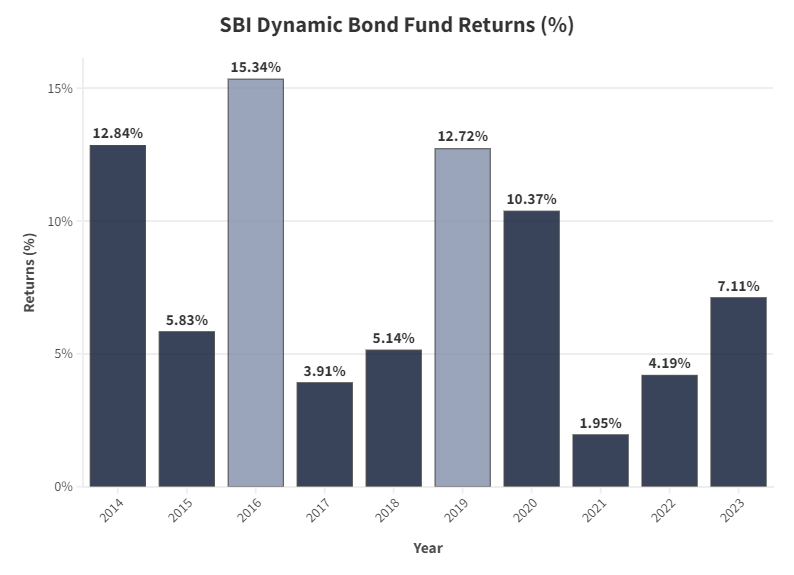

In 2016, India’s repo rate dropped from 7.75% in 2015 to 6.3%, creating a favorable environment for bond prices. The SBI Dynamic Bond Fund took advantage of this situation, delivering an impressive return of 15.34%, significantly higher than the 5.83% return from the previous year. This surge in returns largely stemmed from the favorable interest rate environment.

Likewise, In 2019, the repo rate sharply dropped from 6.5% in 2018 to 5.2%. The SBI Dynamic Bond Fund responded to this positive market shift, generating a strong return of 12.72%, compared to the 5.14% return in 2018. This sharp rise in performance reflects the fund’s ability to leverage the declining interest rates, which made the bond market more lucrative.

(D) Conclusion

When interest (repo) rates drop, debt funds often benefit with improved returns. This happens because lower rates make existing bonds with fixed interest rates more valuable. Funds with longer durations or higher risk profiles usually see a bigger boost. So, if you’re looking to invest in debt funds, this environment could offer attractive returns, potentially around 10% or more. However, it’s always a good idea to consult with an investment professional to tailor your strategy to your specific financial goals and risk tolerance.

Drop us your query at – info@pawealth.in or Visit pawealth.in

References: valueresearchonline.com, Industry’s Publications, News Publications, Mutual Fund Company.

Disclaimer: The report only represents personal opinions and views of the author. No part of the report should be considered as recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore