LT Foods is a market leader in the Basmati rice segment with a 30+% market share in India & Northern Europe and 50+% Market share in USA

- About the company

- Journey Since Inception

- Board Members

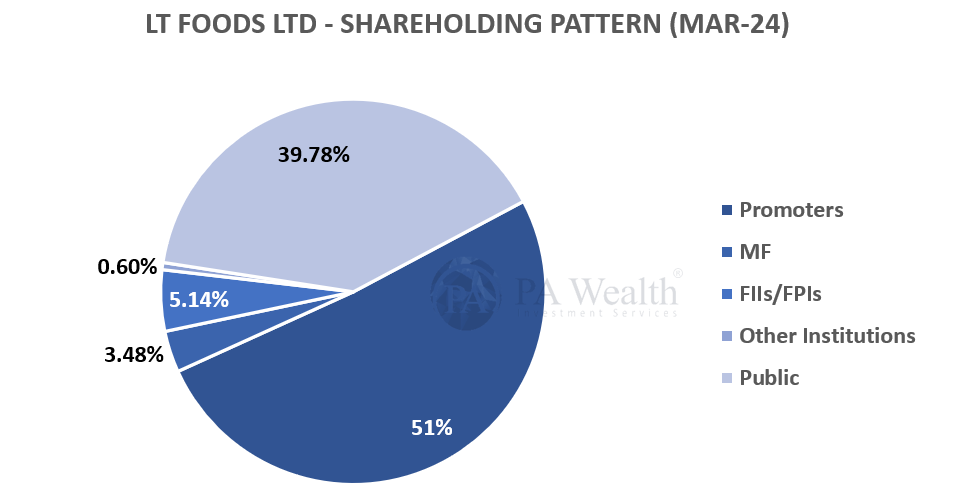

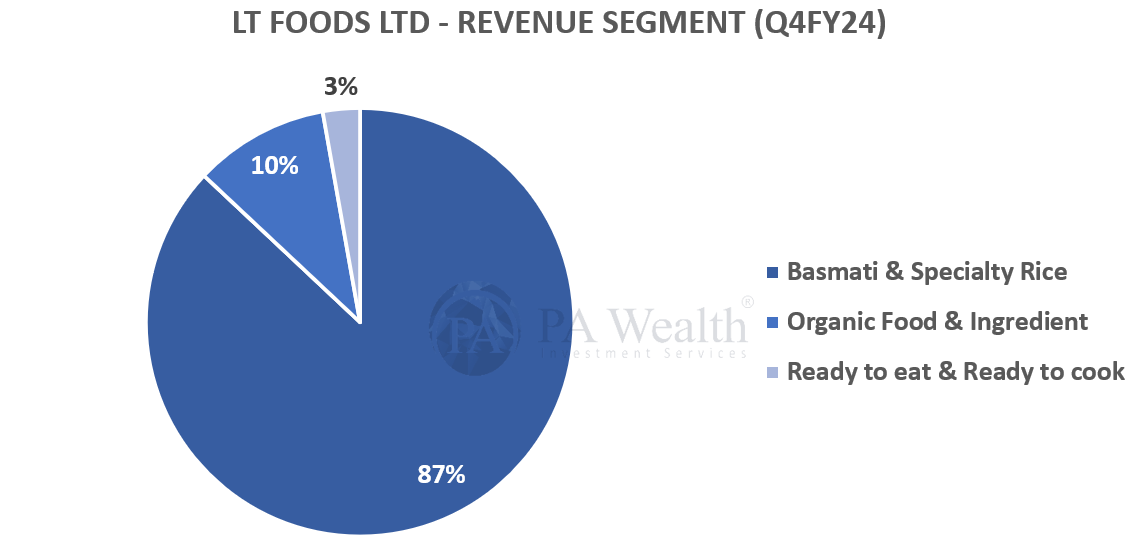

- Shareholding Pattern

- Business Segments

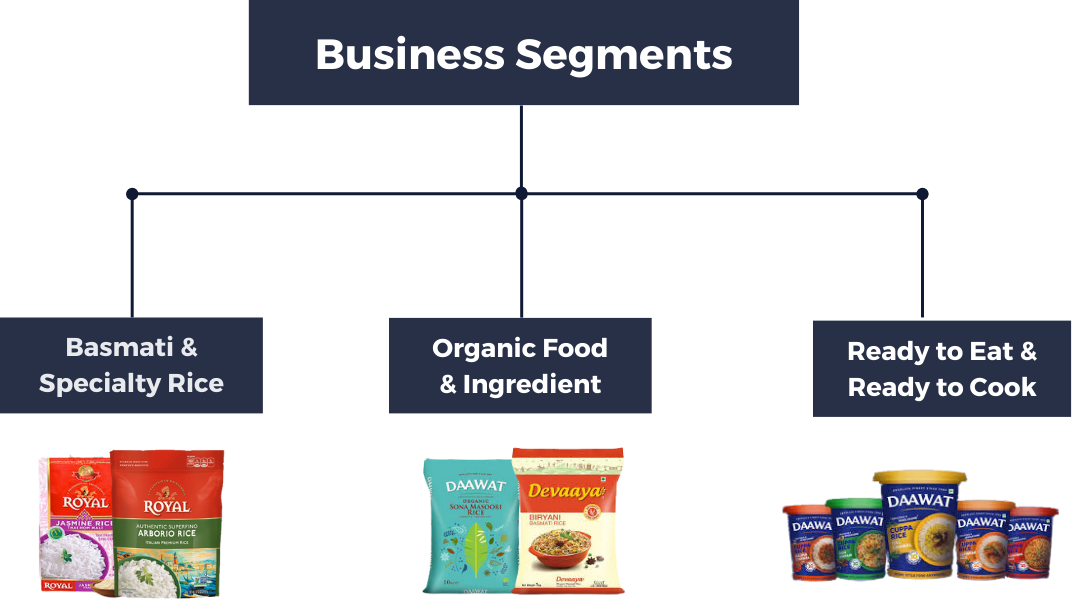

- Revenue Segments

- Cost Structure

- Financial Parameters

- Management Key Highlights

- Strengths & Weaknesses

(A) About

In 1965, in the village of Bhikihwind, Amritsar (Punjab, India), Raghunath Arora started as a small trading company. It has evolved from a commissioning agent to a partnership firm by 1977, known as Lalchand Tirathram Rice Mills.

It was incorporated as LT Foods Ltd in 1990, initially as a private limited company. Over the years, LT Foods Ltd. has become a leading Indian-origin global FMCG company in the consumer food space, has been a prominent player in the specialty rice and rice-based foods business for over 70 years, with a presence in more than 80 countries.

(B) Journey of LT Foods Limited

(C) Board of Directors of LT Foods Limited

(D) Shareholding Pattern of LT Foods Limited

(E) Business Segments

Basmati & Specialty Rice

In India and across the globe, LT Foods is a dealing in a diverse variety of specialty rice and rice-based food offerings. Its flagship brand, Daawat, acquired a market share of 29%+ in the Basmati market segment with a growth rate of 13%. The Company offers a range of specialty rice varieties, including jasmine rice, arborio rice, sona masoori and black rice, among others. To expand its market presence across diverse economies, the Company has acquired a 51% stake in Golden Star Trading Inc., which holds more then 10% share in jasmine rice category with the brand name Golden Star.

Organic Food & Ingredient

LT Foods offers a wide variety of organic rice, cereal grains, soya based meals, flour, pulses, oil and oilseeds, nuts, spices, herbs, millets and more. The Company has set up a stock and sell model in the USA and Europe which has enhanced the growth of its organic segment. Further expanding its procurement and production base, the Company has ventured into and set up a facility in Africa as well.

Ready to eat & Ready to cook

LT Foods identified two key trends that influence consumers when purchasing kitchen ingredients: convenience and health. Inspired by consumer insights, Daawat Quick Cooking Brown Rice is LT Foods’ first successful product in this segment. Following the success of Daawat Quick Cooking Brown Rice, the Company launched Daawat Sehat, the iron and vitamin-fortified rice, on the health platform, which is also well accepted by consumers. The share of convenience and health segment has grown from 2.5% to 2.8% during the FY 2023-24.

(F) Revenue Segments

(i) Segment wise Revenue

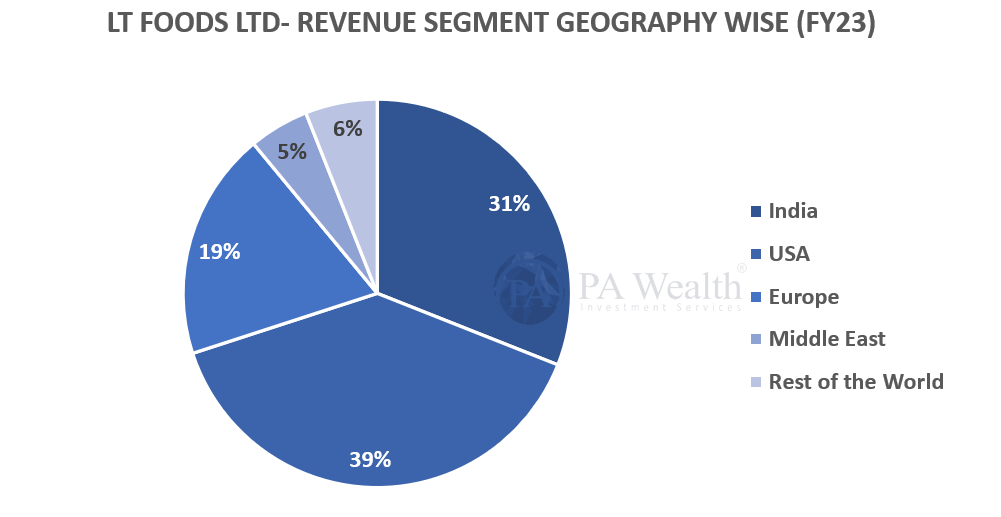

(ii) Geography Wise Revenue

(G) Cost Structure of LT Foods Limited

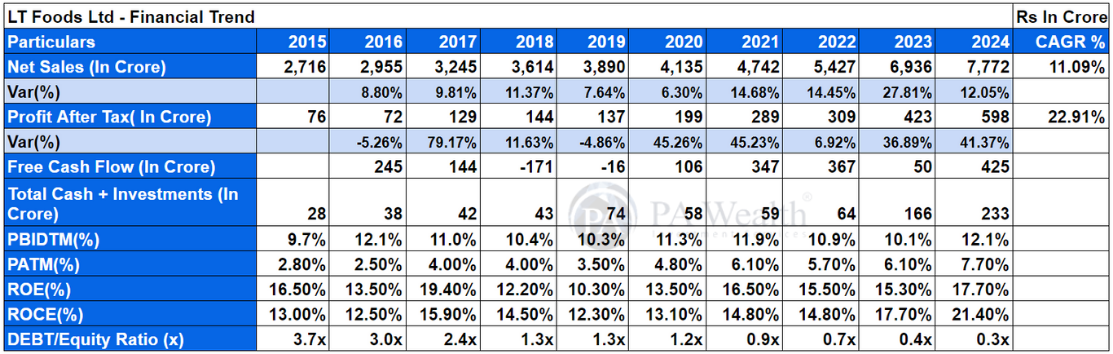

(H) Financials of LT Foods Limited

The company’s revenue has grown at a CAGR of 11.09% over the past 10 years, increasing from Rs 2,716 Cr. in FY15 to Rs 7,772 Cr. in FY24. Subsequently, the company’s PAT has also shown growth, rising from Rs 76 Cr. in FY15 to Rs 598 Cr. in FY24 at a CAGR of 22.91%. Furthermore, the company’s ROE has seen an increase from 16.50% in FY15 to 17.70% in FY24.

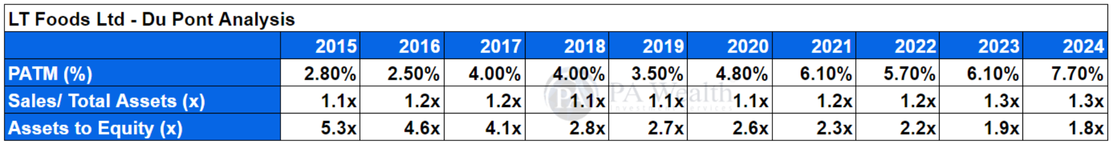

DuPont Analysis

(I) Management Discussion

- In US business, they have maintained a market share of 50%+ with their flagship brand, Royal. Royal RTH became the fourth largest brand in the ready-to-heat rice segment in the US.

- The Company has acquired a 51% stake in Golden Star Trading incorporated, which holds more than 10% share in jasmine rice category with the brand name Golden Star.

- In FY2022-23, they secured a Rs.455.5 Crore investment from SALIC, granting the Saudi Sovereign Fund a 9.22% equity share in LT Foods. This deal will boost their expansion and growth in the Middle East and Saudi Arabia.

- The convenience and health segment of the Company is expected to grow from Rs.300 Crore to Rs.860 Crore in next 5 years.

- The organic food market is predicted to reach USD 512.01 billion by 2027, at a CAGR of 14.8%.

- The global ready-to-eat food market is expected to be worth USD 250.31 million by 2029, with a CAGR of 5.50%.

- They installed a processing line of parboiled rice in Bahalgarh, Haryana, with a capacity of 80,000 MTPA.

- On July 20, 2023, the government prohibited the export of non-Basmati white rice, citing increasing domestic rice prices. Additionally, the Centre imposed a minimum export price (MEP) of USD 950 per ton for Basmati rice.

Concall Highlights- Q4FY24

- Basmati and other specialty rice grew by 17%, while ready-to-eat and ready-to-cook products gained traction with a 23% growth.

- Market share in India currently stands at 30.1% with an offtake volume growth of 11% for FY’24 compared to the category growth of 8.9%.The number of households consuming LT Foods products grew by 11% to reach 50 lakh-plus household in India.

- U.S., Royal, has grown by 20.6% as compared to category growth of 17%. Their brand Golden Star has also grown by 30.8% as compared to category growth of 11.6%. Golden Star currently has 15% market share in the Jasmine Rice segment in U.S.

- In Europe, our revenue grew by 11% year-on-year in FY’23/’24 whereas in the Middle East, revenue grew by 42%.

- The company sees a marginal impact on margins on account of Red Sea, freight issue, and investment on building digital capabilities.

- LT Foods are doubling the capacity in U.S.A. in the ready-to-eat and ready-to-cook business segment. It will be in the range of ₹200 crores. Digital capability investment expected to be around ₹45-₹50 crores.

- The antidumping duty challenged the organic business, but efforts to recover were made. Additionally, the Red Sea crisis impacted freight costs, potentially leading to margin pressure in the future.

- In India, the Basmati segment recorded a volume of 3,18,000 tons for the full year, while internationally it reached 3,30,000 tons.

Outlook

- The company has kept 10-20% of their consolidated profits for the dividends.

- Innovating and expanding product portfolio by introducing new products.

- Entering in new geographies and widening distribution channel.

- The Company wants to build a portfolio to meet diverse needs for all meal occasions.

- The company is focusing on its strategic goal of premiumization.

(J) Strengths & Weaknesses of LT Foods Limited

Strengths

(i) Established Market Position & Track Record:

LT Foods Ltd. has a five-decade track record in the rice industry, holding a top position in the domestic basmati rice market. Its extensive experience has led to significant revenue growth and a strong presence across various distribution channels.

(ii) Geographically Diversified Revenue Profile:

The company operates in 80 countries, reducing reliance on any single market. Strong branding, especially with Daawat domestically, acts as a barrier to entry. Expansion into organic and health foods diversifies its offerings.

(iii) Strong Financial Risk Profile:

LT Foods Ltd. exhibits a healthy financial profile with reducing debt and strong metrics, enhancing its resilience and growth potential.

Weaknesses

(i) High Working Capital Intensity:

Basmati rice business requires high working capital due to seasonal availability and inventory aging, leading to liquidity strain and increased financing costs.

(ii) Susceptibility to Raw Material Prices and Trade Policies:

Fluctuating raw material costs and changes in trade policies of key markets pose profitability risks, though the company has strategies to manage these challenges.

Drop us your query at – info@pawealth.in or Visit pawealth.in

References: Annual Reports, News Publications, Investor Presentations, Corporate Announcements, Management Discussions, Analyst Meets and Management Interviews, Industry Publications.

Disclaimer: The report only represents the personal opinions and views of the author. No part of the report should be considered a recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore