Silver has increased by around 34% year-to-date in 2024, from Rs 74,000 to Rs 1,000,000. Economic uncertainties and a weaker dollar have increased its safe-haven appeal, but its critical role in green energy, particularly for solar panels, is driving robust industrial demand. Let’s look at the variables driving the silver market and how you might potentially profit from these price swings.

(A) History

Silver mining has been going on for almost 5,000 years, starting approximately 3,000 BCE in Anatolia (modern-day Turkey) and spreading to Greece, Spain, and eventually the Americas after European explorers arrived. The Spanish conquest triggered a boom, with Bolivia, Peru, and Mexico generating more than 85% of global silver between 1500 and 1800.

Its mining grew globally throughout the 19th and early 20th century due to key discoveries and technological advances. New mining processes, such as steam drilling and ore separation, increased production dramatically. Today, yearly production approaches 800 million ounces, benefiting industries globally.

(B) Current Demand and Supply Scenario of Silver

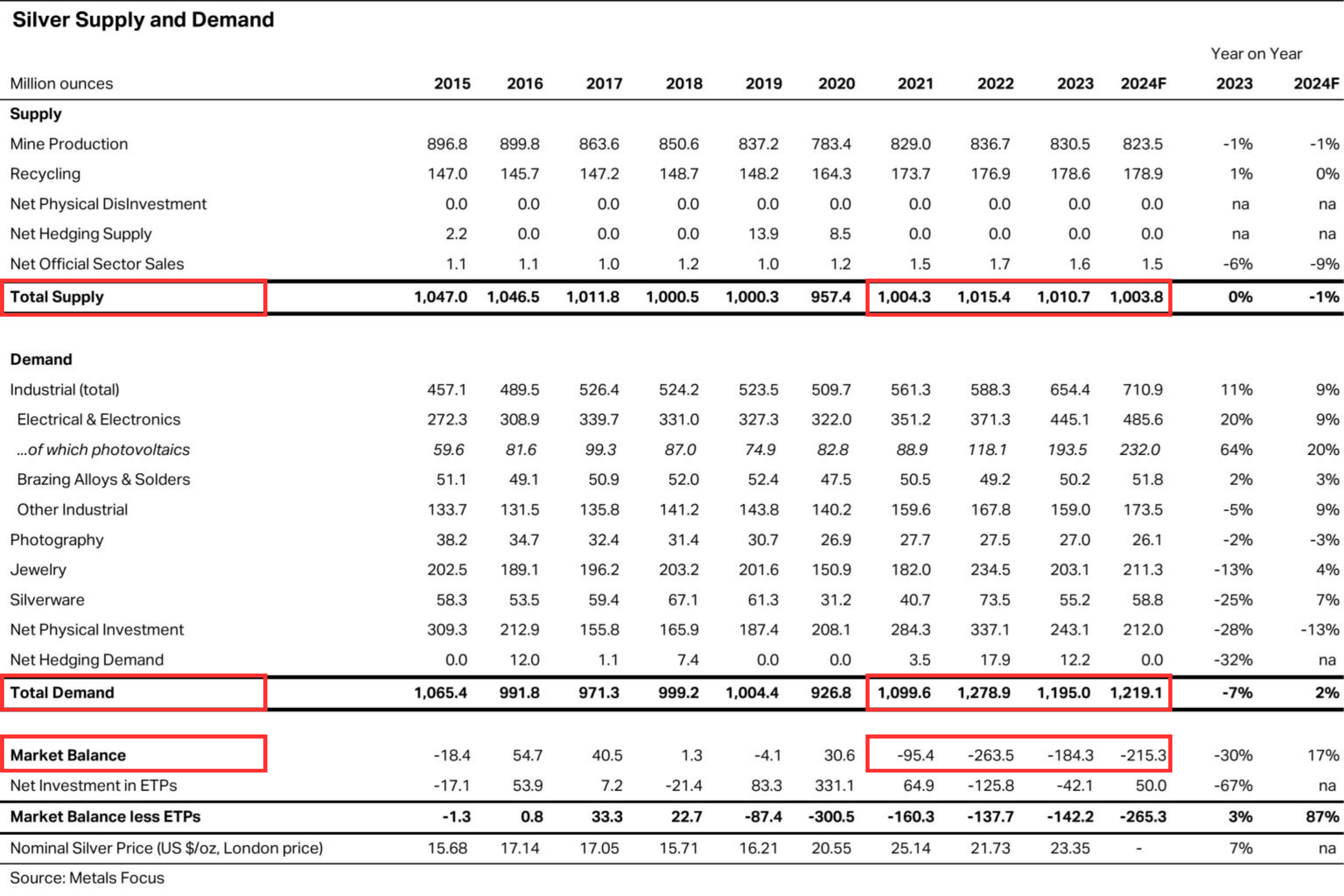

Since 2021, silver has been in constant deficit since demand is expanding twice as fast as supply. This shortfall increased to 184 million ounces in 2023, and it is expected to rise to 215 million ounces by 2024.

Over the three-year period from 2021 to 2023, the Silver Institute estimates that there has been a cumulative deficit of 543 million ounces, which is equivalent to 16,889 tonnes. This underscores the persistent imbalance between supply and demand in the silver market.

(C) Factors affecting demand of Silver

The demand for silver is influence by several key factors:

(i) Jewelry and Silverware

Silver’s appeal in jewelry and silverware remains strong, particularly in markets where it gets value for its beauty and affordability. Economic conditions and consumer spending habits directly impact this demand segment.

(ii) Solar Industry

The increase in solar panels and electric car production is a major source of silver demand. Silver’s excellent conductivity makes it an important material in photovoltaic (PV) cells, which are critical for renewable energy. Growing demand in solar technology has increased from approximately 5% in 2014 to roughly 14% by 2023. According to Bloomberg, each gigawatt of solar capacity requires approximately 12 tonnes of silver, and if current trends continue, silver demand in this sector may climb by 169% by 2030. This would amount to around 273 million ounces of silver, or one-fifth of predicted global demand, driven mostly by China’s dominance in solar panel installations.

(iii) Electronics Industry

Silver’s excellent electrical conductivity makes it an essential component in most electronic devices. Electronics and electrical demand just reached all-time highs, with the sector increasing by 20% to 445.1 million ounces last year. This includes a significant increase in PV use, up 64% from 118.1 million ounces in 2022 to 193.5 million ounces in 2023. Silver’s use in circuit boards, switches, television displays, RFID tags, and 5G technology demonstrates its essential position in electronics, with little room for substitute.

(iv) Medical Aplications

Silver’s antibacterial characteristics make it useful in healthcare applications such as wound dressings, medical equipment, and some medications. Its use in these sectors, as well as applications in electronics, demonstrates its growing demand and unique properties, particularly in industries where sterility and conductivity are critical.

(v) Automotive Industry

Over 60 million ounces of silver are used in the automotive industry each year, with silver-coated contacts playing an important role in electronic functions throughout vehicles. Silver switches are used to control features like power windows, seats, and safety systems. As cars grow more technologically equipped, its consumption expect to increase, reaching over 90 million ounces per year by 2025. The transition toward electric and hybrid vehicles, together with a favorable global transportation policy, is likely to boost its demand in the automotive industry.

(D) Is Silver set to Triple?

Some industry professionals and analysts have made big forecasts regarding the future of silver, with some expecting prices to reach $100.00 per ounce. While such projections may appear overly optimistic, supporters claim that many factors might propel silver to historic prices.

The anticipated supply deficit is one of the most compelling justifications for a significant increase in prices. As industrial demand rises and mine output struggles to keep up, some analysts also expect a substantial shortfall in supply. This mismatch may cause prices to rise as buyers battle for the limited supply of silver.

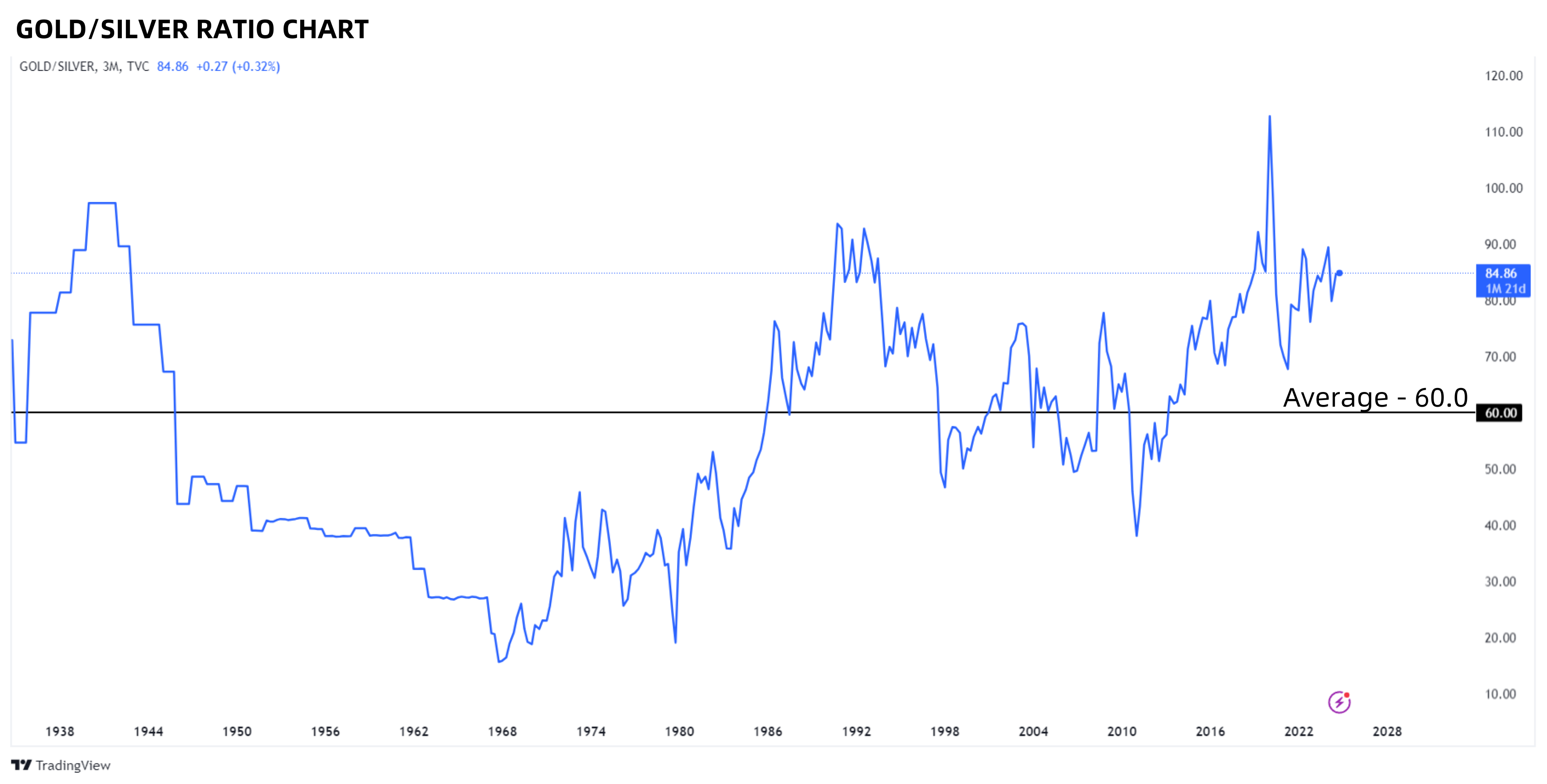

Another statistic commonly used by silver bulls is the gold-to-silver ratio. Historically, this ratio has been around 60:1, implying that it costs approximately 60 ounces of silver to purchase one ounce of gold. In recent years, this ratio has increased substantially, often exceeding 100:1. Proponents say that when this ratio normalizes, silver prices could rise significantly.

(E) Risks

While silver might be an appealing investment opportunity, it is critical to understand the risks and challenges connected with trading this precious metal. Understanding these characteristics might help you make better decisions and manage your money.

- Silver investing requires consideration of volatility. Price changes can cause large gains or losses quickly. Short-term traders and leveraged product users may struggle with this instability.

- Liquidity risk is another element to consider, especially for those buying in real silver or smaller mining businesses. In times of market crisis, selling these assets rapidly may result in large losses.

- Storage and security concerns are relevant for those holding physical silver. Proper storage solutions and insurance can add to the overall cost of investing in physical metal.

- Technological advancements in recycling and material substitution could also affect silver demand.

Before committing to any silver investment, it’s advisable to thoroughly research the market, understand your risk tolerance, and consider seeking advice from a financial professional. A well-informed approach can help you navigate the complexities of the market and make decisions aligned with your investment goals.

Drop us your query at – info@pawealth.in or Visit pawealth.in

Disclaimer: The report only represents the personal opinions and views of the author. No part of the report should be considered a recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

References: News Publications, Industry Publications, Silver Institute, Metal Focus

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore