- About the company

- Industry Overview

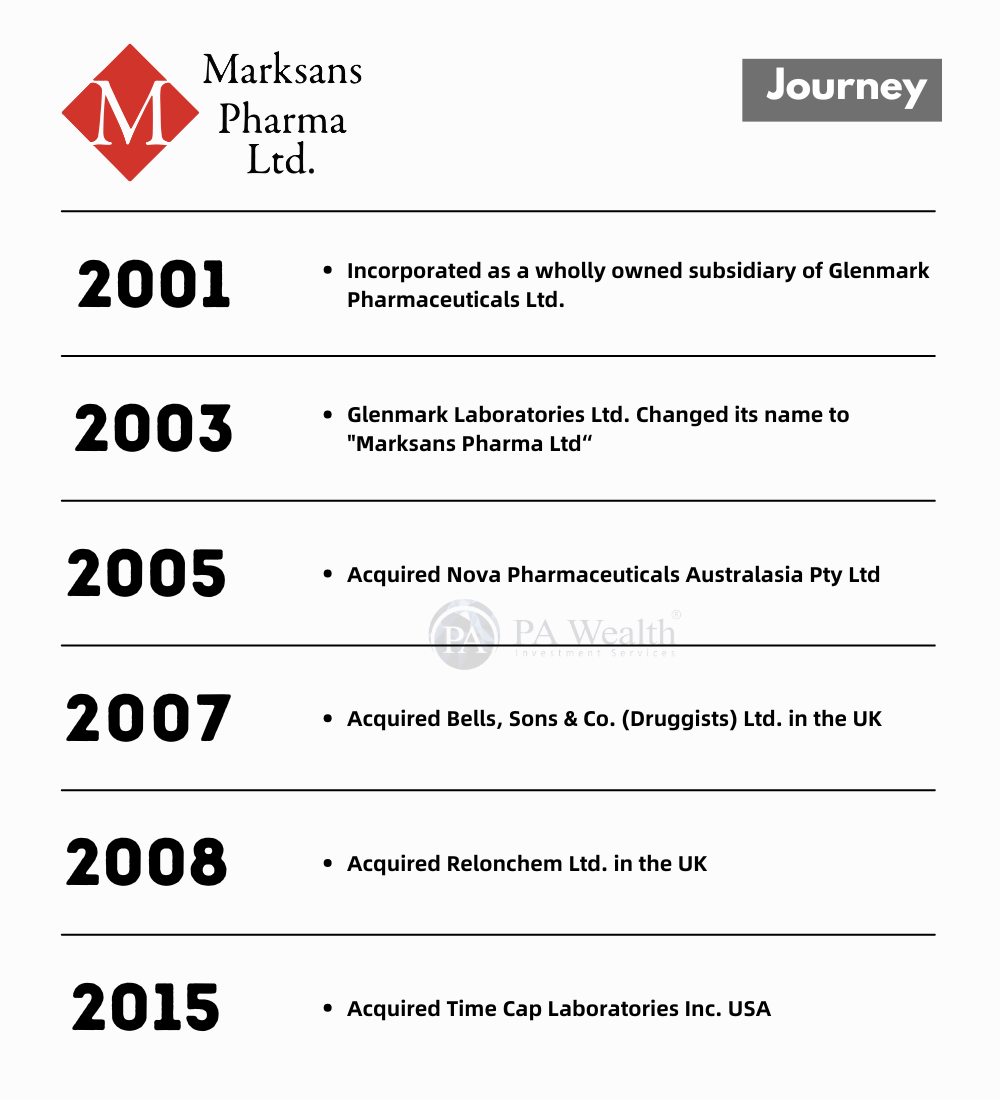

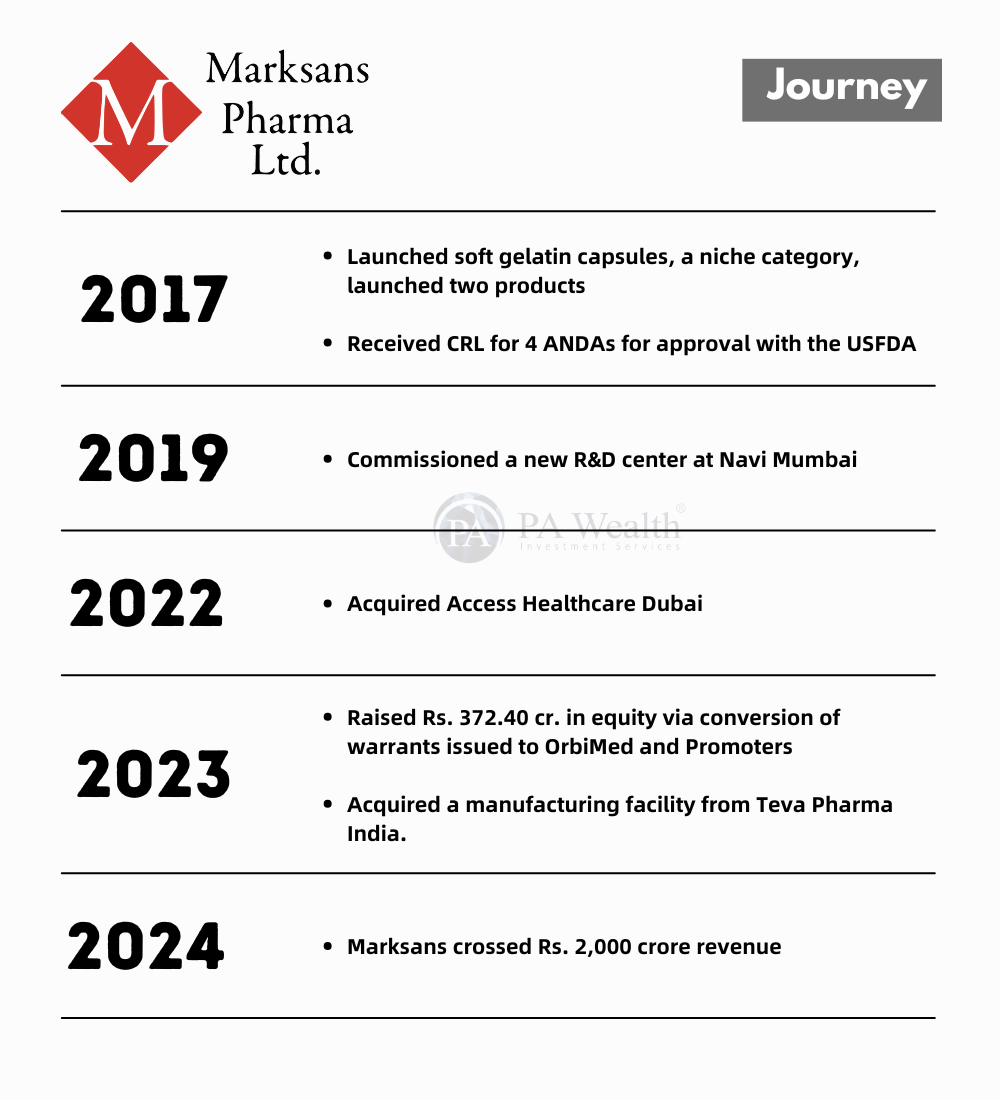

- Journey Since Inception

- Board Members

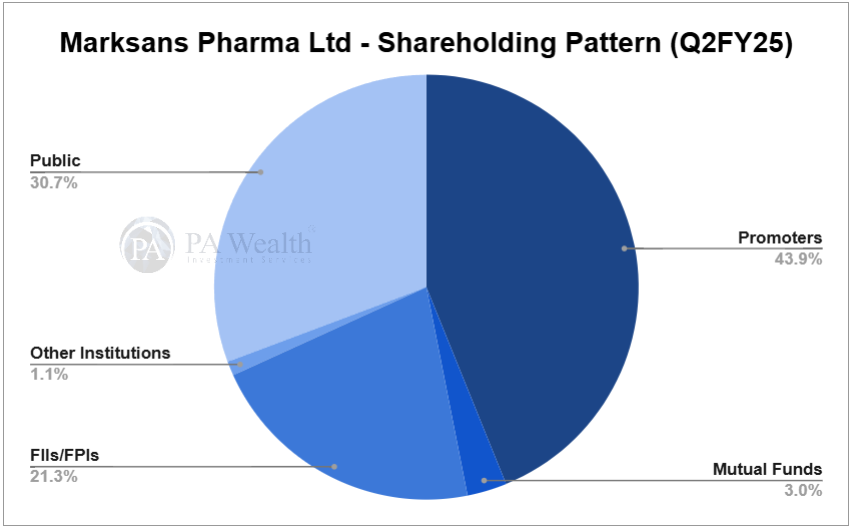

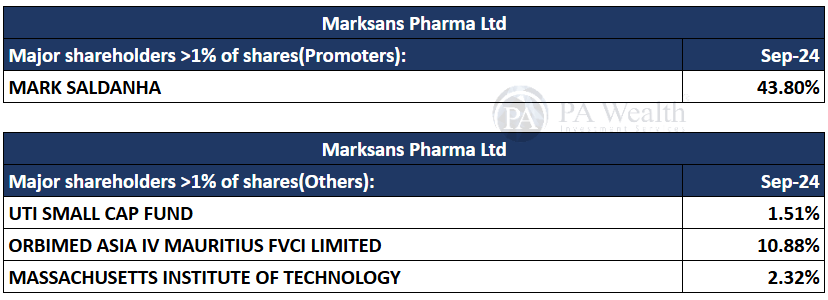

- Shareholding Pattern

- Business Segments

- Revenue Segments

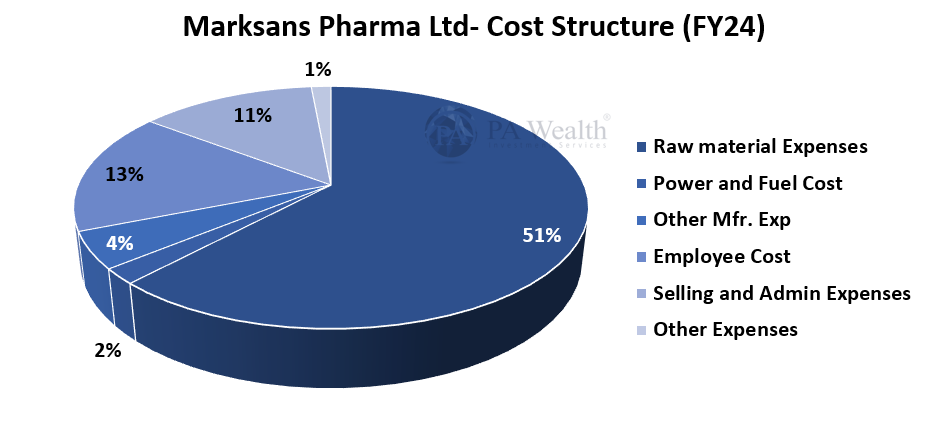

- Cost Structure

- Financial Parameters

- Management Key Highlights

- Strengths & Weaknesses

(A) About

Marksans Pharma Limited, incorporated in 2001, is engaged in the Business of Formulation of pharmaceutical products. Headquartered in Mumbai, the company is actively operating in over 50 countries worldwide.

Their key focus areas lie in the OTC & prescription drugs (Rx), that have wide-ranging applications across fields like, Cough and Cold, Digestives, Oncology, Gastroenterology, Antidiabetic, Antibiotics, Cardiovascular, Pain Management, Gynecology, among others.

(B) Industry Overview

- The global generics drugs market is anticipated to grow to $574.63 Bn by 2030, owing to the increasing application of robotic process automation, branded medicine patent expiries and rising prevalence of chronic diseases.

- The over-the-counter (OTC) drug market is estimated to grow to USD 163.10 Bn by 2029 from $137.39 billion in 2024. There will be a compound annual growth rate (CAGR) of 3.49% during 2024-2029.

- In FY 2024, the Indian Pharmaceutical industry accounted for USD 27.85 Bn of Drugs and pharmaceutical exports.

- The Pharmaceutical Industry has registered 8% growth in Q4 2023. Looking forward, the 2024 Indian Pharmaceutical industry is projected to reach $65 Billion by the end of this year and $130 Billion by 2030 at a CAGR of 22.4% in the future.

(C) Journey | Marksans Pharma Limited Analysis

(D) Board of Directors | Marksans Pharma Limited Analysis

(E) Shareholding Pattern | Marksans Pharma Limited Analysis

(F) Business Segments

Consumer Self-Care Products – OTC

In the OTC Business, Marksans manufactures store brands/private label manufacturing for retailers/customers, and manufactures OTC products through its own label as well. They develop pharmaceutical formulations for pain management, Upper Respiratory conditions, digestion, micronutrients, and skin care.

Prescription – Rx Therapeutic Segments

The company develops pharmaceutical solutions that address the diverse needs of individuals with cardiovascular conditions, neurological disorders, mental health conditions, cancer, diabetes, etc. Their portfolio includes state-of-the-art medications designed to support heart health, manage blood pressure, bacterial infections, among others.

(G) Revenue Segments

(i) Segment wise Revenue

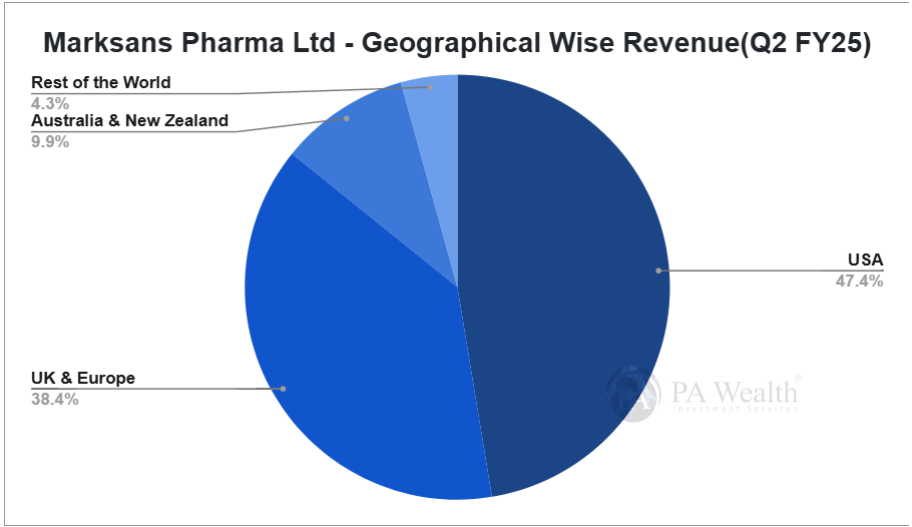

(ii) Global Generics Geography Wise Revenue

(H) Cost Structure | Marksans Pharma Limited Analysis

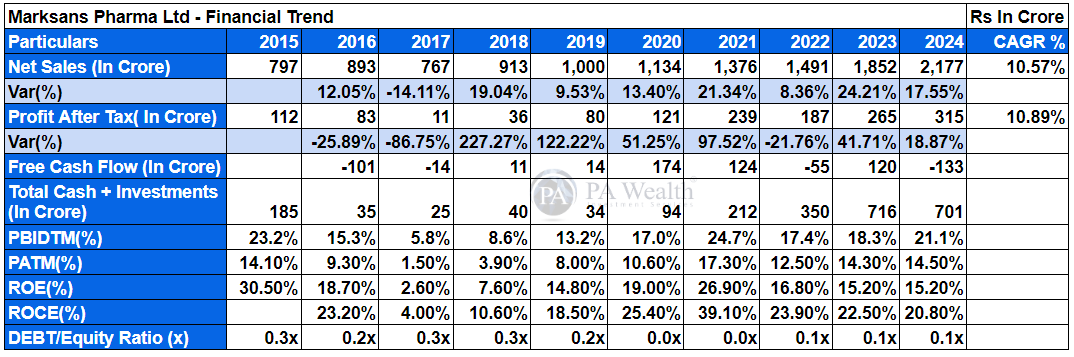

(I) Financials | Marksans Pharma Limited Analysis

The company’s revenue has grown at a CAGR of 10.57% over the past 10 years, increasing from Rs 797 Cr. in FY15 to Rs 2,177 Cr. in FY24. Subsequently, the company’s PAT has also shown growth, rising from Rs 112 Cr. in FY15 to Rs 315 Cr. in FY24 at a CAGR of 10.89%. Furthermore, the company’s ROE has seen a decrease from 30.50% in FY15 to 15.20% in FY24.

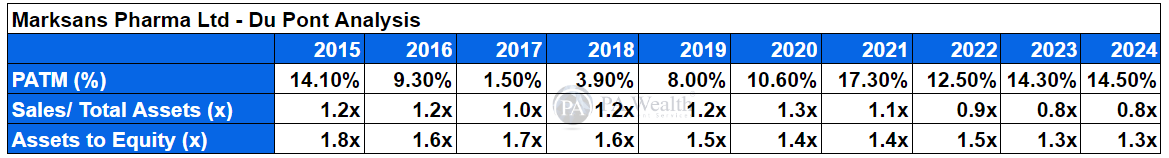

DuPont Analysis

(J) Management Discussion

US and North America

- Marksans Pharma has significantly expanded its presence in the US market by acquiring Time-Cap Labs (TCL), a facility specializing in the manufacture of solid-dose generic pharmaceutical products.

- Over the fiscal years 2017 to 2024, this segment exhibited a notable 18.5% increase, reaching INR 918 crores in revenue reflecting a CAGR of 12.8%.

Europe and UK

- Marksans Pharma continues to maintain its position in the region, with the help of two of its step-down subsidiaries, Bell, Sons and Co. (Druggists) Limited which specializes in delivering products across various therapeutic areas like analgesics, upper respiratory, pain relief, gastrointestinal, ear care and skin care, and Relonchem Limited.

- The formulation businesses in the UK and EU market grew by 22.9% year on year to INR 943 crores, recording a CAGR of 16.1% over the FY2017-24.

- Currently, their plan to submit 34 new filings over the next three years is still in the works. Added to this, 16 products are already filed and awaiting approval.

Australia and New Zealand

- Marksans acquired Nova Pharmaceuticals Australasia Pty Ltd. In 2005, making its entry into the Australasian markets. Presently, they make up the third largest portion of Marksans’ revenue.

- Through Nova, Marksans has secured around 100 Marketing Authorizations (MAs) and emerged as a major provider of generic products in the area.

- For FY24, the formulation market recorded a revenue of INR 218.8 crores, an increase of 4.4%, recording a CAGR of 9.5% over the FY2017-24. Going forward, the Company has 10 products lined up, to be developed and released in the next couple of years.

Rest of the World (RoW)

- Marksans has maintained its operations in other parts of the world, with notable presence in the Middle East. It has acquired Access Healthcare For Medical Products LLC in UAE .

- As of FY24, the RoW recorded a revenue of INR 97.4 crores, recording a CAGR of 17.9% over the FY2017-24.

- Currently, there are 124 approved products and 120 others awaiting approval. It also has 108 products in their pipeline.

Concall Highlights

- Gross profit increased by 37.7% year-on-year to INR 383.5 crores. And gross margin expanded by 732 basis points from 52.4% to 59.7%.

- Freight costs have seen a significant reduction, dropping from approximately $6,000 to around $3,600.

- The capex incurred during the FY24 was ₹208 crores. The capex mix comprised of ₹125 Cr. in Tevapharm facility, ₹30 Cr. in existing Goa facility, ₹31 Cr. in the US facility, ₹22 Cr. in the UK facility, ₹34.6 Cr. in the R&D representing 1.6% of the sales.

- The company is expecting 10-12% growth happening in the European & UK region in the upcoming quarters.

- The capacity utilization for the new acquired unit is 40%, which is expected to increase every month, and for the other facilities, the capacity utilization is 65%.

- Management is optimistic about growth prospects in the US and UK markets, with plans for future product launches and market penetration.

- The revenue generated by the Goa facility is in the range of ₹750-₹800 crores.

Outlook

- The company aims reach INR 3,000 crores of revenue within the next 2 years, with EBITDA margins expected to remain stable at around 22%.

- In the coming years, Marksans is expecting to diversify its product portfolio and therefore, it continues to launch new products. Along with this, the Company expects major contribution in its revenue from the US markets.

- In addition, it is also planning to expand into the growing markets and European regions through strategic acquisitions. Further to this, the Company plans to add 34 new filings over the next 3 years in UK and 32 products for the USA market.

- The company aims to double its revenue in the US & North America region, and reaching the top 5 private label OTC companies in the region.

- For the Tevapharm facility, the aim is to scale the manufacturing facility to 8 Bn units per annum in 3 phases. The phase 2 expansion to 6 Bn units per annum will be completed by the end of FY25.

(K) Strengths & Weaknesses of Marksans Pharma Limited

Strengths

(i) Growing scale of operations with healthy profitability:

The growth is supported by volume gains in the existing product portfolio, new product launches and an increase in share of business with existing customers and addition of new customers. With limited finance cost, profit after taxes (PAT) margin improved to 14.41% in FY24 (14.02% in FY23).

(ii) Comfortable solvency position:

The company expects its capital structure and debt coverage indicators to remain healthy in the near term, supported by steady profitability and the absence of debt-funded capex.

(iii) Experienced and qualified management with established track record of operations:

MPL is into manufacturing pharmaceutical formulations for over three decades and has been able to establish good relationship with its customers and suppliers. The company’s promoters have over three decades of experience in the pharmaceutical industry. The company’s MD & CEO, Mark Saldanha, is also the founder promoter. Prior to MPL, he was associated with Glenmark Pharmaceuticals Limited. (GPL) as a whole-time director.

(iv) Diversified geographical presence:

The company sells its product portfolio internationally in over 50 countries, with majority revenue generated from regulated markets. The USA and the UK account for ~42% and 43% of the revenue respectively. The company operates in Australia and New Zealand through its subsidiary. Geographically diversified nature of revenue reduces the company’s exposure towards adverse economic slowdown in a single geography.

Weaknesses

(i) Intense competition and exposure to regulatory risk:

The company faces intense competition in international markets. Increasing regulations and heightened sensitivity to product performance pose key challenges in the pharmaceutical industry. Governments worldwide heavily regulate the pharmaceutical sector due to its direct impact on public health. Patent laws and related regulations could hinder the company’s plans to launch new products and enter new markets.

(ii) Segment concentration risk with major presence in OTC segment:

The company is actively pursuing diversification in its therapeutic segments. However, the pain management segment is likely to remain the major contributor to total sales in the near-term reflecting segment concentration risk. MPL is mainly present in OTC segment, which is highly competitive and price sensitive.

(iii) Foreign exchange fluctuation risk:

The company operates in international markets and conducts most business transactions in various currencies. It generates the majority of its revenue from exports and imports raw materials from different regions. Its foreign currency exposure is primarily in USD and Euro. However, since its earnings in foreign currencies exceed its expenditures, the company mitigates this risk to some extent.

Drop us your query at – info@pawealth.in or Visit pawealth.in

References: Annual Reports, News Publications, Investor Presentations, Corporate Announcements, Management Discussions, Analyst Meets and Management Interviews, Industry Publications.

Disclaimer: The report only represents the personal opinions and views of the author. No part of the report should be considered a recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore