Mrs. Bector’s, a producer of premium biscuits, bread, and buns, is poised for strong growth, fueled by shifting consumer preferences and advancements in technology. The expansion of organized retail, along with e-commerce and q-commerce platforms, is expected to enhance distribution and accessibility across both urban and rural markets.

- About the company

- Journey Since Inception

- Board Members

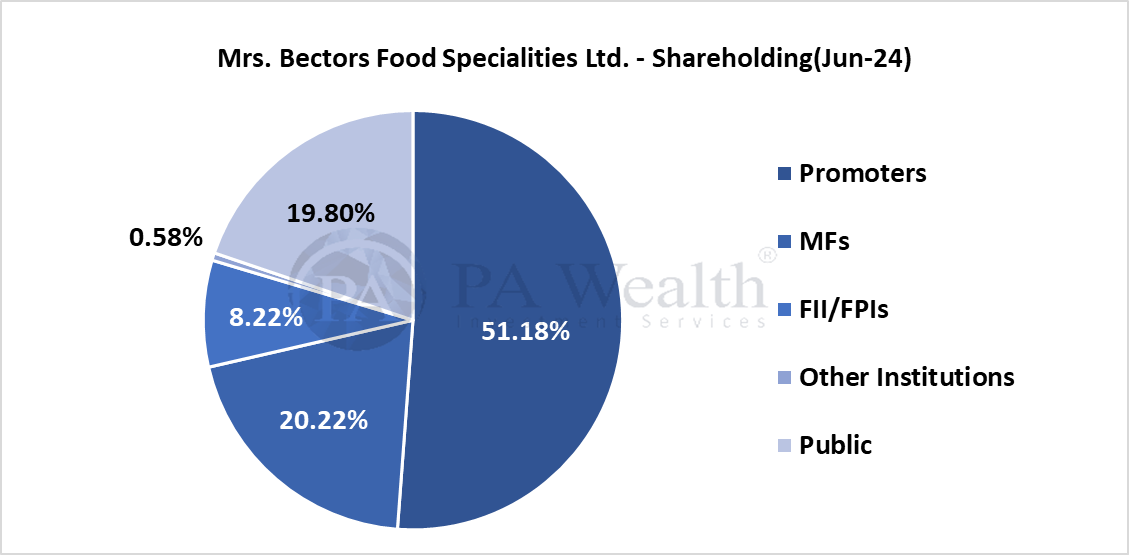

- Shareholding Pattern

- Business Segments

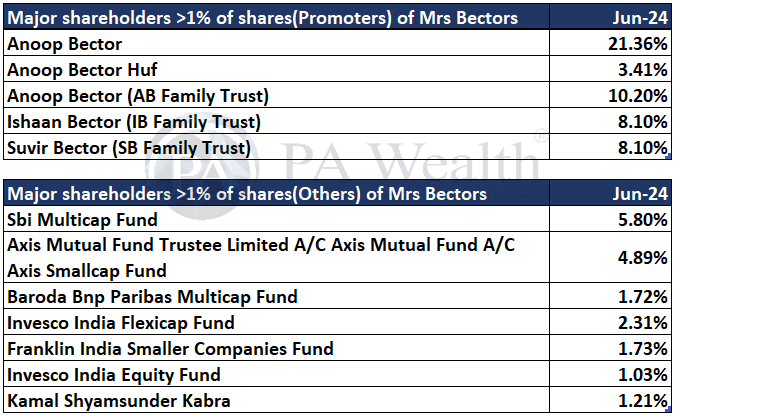

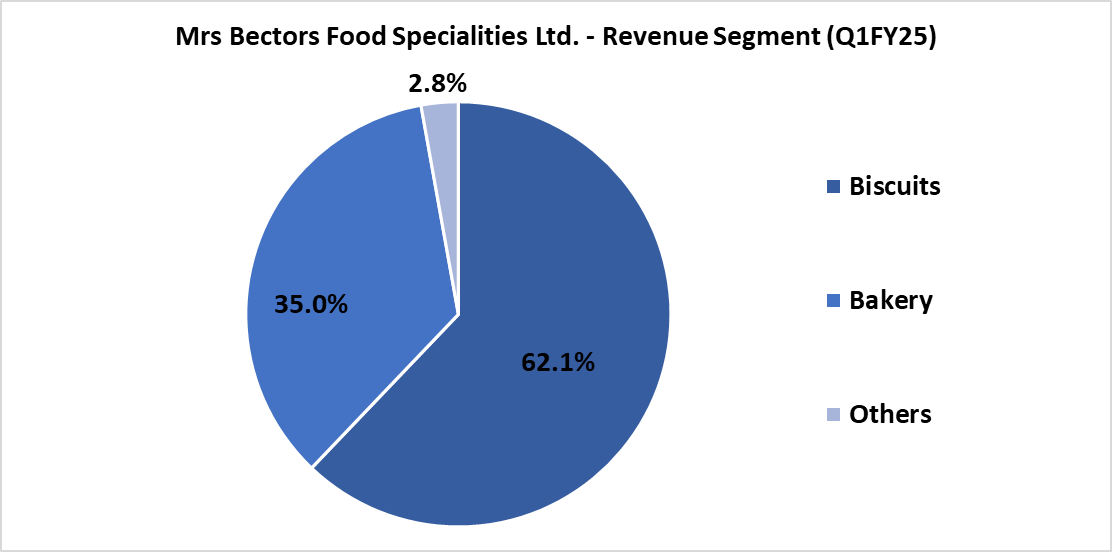

- Revenue Segments

- Cost Structure

- Financial Parameters

- Management Key Highlights

- Strengths & Weaknesses

(A) About

Mrs. Bector’s Food Specialities Ltd, originally incorporated as Quaker Cremica Foods Private Limited in 1995, produces biscuits and bakery products under the brands Mrs. Bector’s Cremica and Mrs. Bector’s English Oven.

The enterprise was founded by Mrs. Rajni Bector in 1978, starting with ice creams, bread, and biscuits. Promoted by Mr. Anoop Bector, who has over 25 years of industry experience and serves as the Managing Director. MBFSL is a leading player in the premium and mid-premium biscuits and bakery segments in North India. It is also a preferred supplier for major QSR franchises, cloud kitchens, and multiplexes in India.

The company’s headquarters are located in Punjab and Bector Family are the promoters of the company.

(B) Journey of Mrs Bector’s Food and Specialities

(C) Board of Directors of Mrs Bector’s Food and Specialities

(D) Shareholding Pattern of Mrs Bector’s Food and Specialities

(E) Business Segments

Biscuits Product

One of the largest players in the premium and mid-premium biscuit segment in North India and offering domestic and export sales, as well as sales through the CSD channel. The domestic range includes cookies, creams, digestives, Marie biscuits, and crackers. Subsequently, the export range consists of crackers, cookies, and creams, reaching over 70 countries.

Bakery Product

As one of India’s top premium bakery players, this company offers a range of breads, bakery, and gourmet products, with dedicated lines for desserts, pizzas, garlic breads, croissants, and more. It has also ventured into frozen foods, including frozen burger buns, flaky laminated products, dessert spreads, and filled snacks. The business serves both retail and institutional customers, including leading QSRs like McDonald’s, KFC, Burger King, Subway, and Domino’s.

(F) Revenue Segments of Mrs Bector’s Food and Specialities

(G) Cost Structure of Mrs Bector’s Food and Specialities

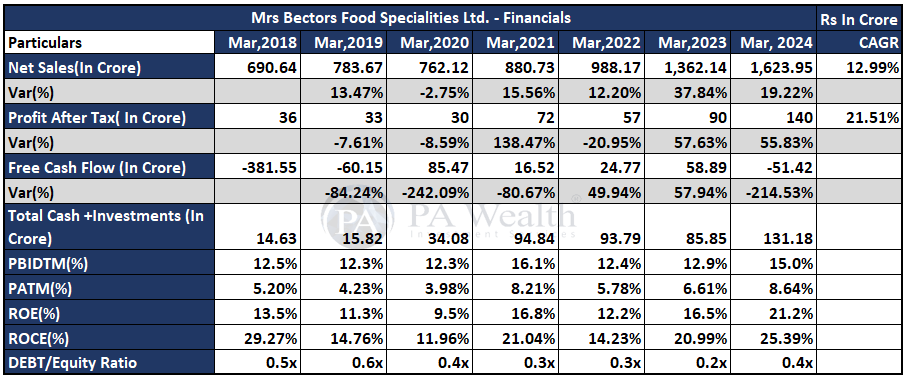

(H) Financials of Mrs Bector’s Food and Specialities

The company’s revenue has grown at a CAGR of 12.99% over the past 7 years from Rs 690.64 Cr. in FY18 to Rs 1623.95 Cr. in FY24. Subsequently, The company’s PAT has grown from Rs 36 Cr. in FY18 to Rs 140 Cr. in FY24 at a CAGR of 21.51%. Furthermore, the company’s ROE increased from 13.5% in FY18 to 21.2% in FY24.

DuPont Analysis

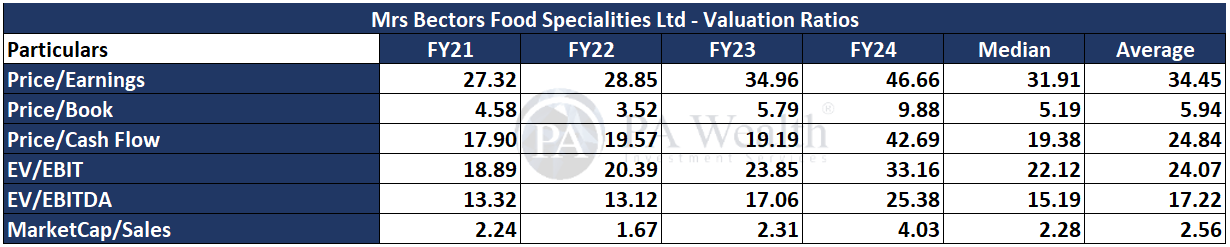

Valuation Ratios

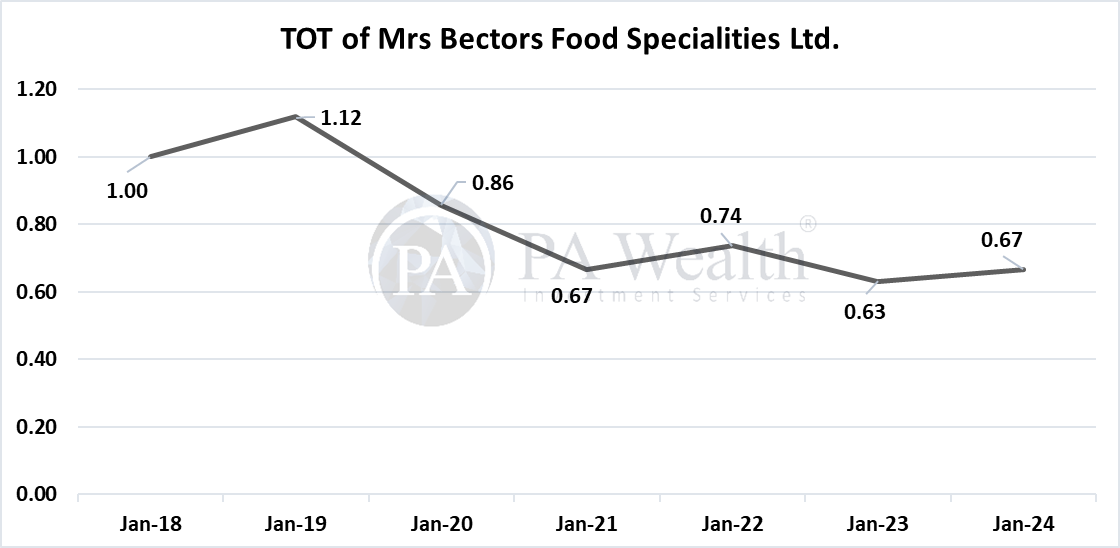

Terms to Trade

(I) Management Discussion

Outlook: Biscuits

- India’s biscuit and bakery industry will grow from Rs 57,000 Cr to Rs 77,000 Cr by FY26 a growth of 10.5% CAGR.

- Biscuits and bakery snacks like rusk, wafers, and tea cakes make up 90% of the market, worth over Rs 51,300 Cr. Bread products, including buns and loaves, account for Rs 5700 Cr or 10%.

- In 2022, the Indian biscuit market was valued at USD 3.19 billion. It’s expected to grow at 4.13% annually, reaching around USD 4 billion by 2029.

- Rising consumer preferences and disposable income will increase the popularity of branded cookies. Market growth is driven by demand for clean-label, gluten-free, low-calorie, low-fat, and high-fibre biscuits.

- India’s biscuit market will grow from ₹40,000 Cr to ₹62,000 Cr by FY25 (9% CAGR). Per capita consumption is 2.5 kg/year, lower than other countries but increasing rapidly.

Outlook: Bakery

- Bread and bakery market in India has grown at a CAGR of 5% till 2024. Additionally, Retail bread and buns which stands at Rs 6200 Cr in FY24 will to grow to 10,300 Cr at a CAGR of 11% by FY29.

- In 2015, India’s per capita bread consumption was 1 kg, rising to 1.75 kg by 2023. However, it remains low compared to major economies like China, the US, UK, and Germany, indicating potential for growth.

- In FY24, branded bread sales will reach Rs 4000 crore (64% of the market). Demand is highest in Delhi NCR and Mumbai, with growing interest in premium and healthier options. Sales are projected to reach Rs 6500 crore.

- Mid-premium bread sales will grow by 16% annually, and premium plus sales will grow by 20%. Niche premium plus includes specialty breads like protein bread, footlongs, and flavored varieties.

Growth Drivers

- The company is focusing on Premium quality biscuits and large pack size.

- In addition to traditional biscuits, better-for-you (BFY) options, such as biscuits that are lower in calories, enhance fibre intake, and have a low glycemic index (GI), are available.

- Its Packaging innovation not only enhance product appeal but also extend product self-life.

- The increasing presence of organised retail and E-commerce platforms is expected to fuel continued Expansion in both urban & rural market.

- As disposable income rise, there is a trend towards urbanisation & a surge in the market for quick-to-eat & handy food items.

(J) Concall Q1FY25

- Biscuit sales are growing 23% domestically and internationally. With new capacity, turnover could reach INR 2,800-2,900 crore.

- The team is expanding exports by partnering with global retailers, targeting North America, South America, and the Middle East, all experiencing strong growth.

- Last year, the gross margin was 46.7%. This quarter marks the highest in 14 quarters, driven by premiumization and a more favourable export-focused business mix.

- The company’s goal is to increase from 7 lakh to 1 million outlets, a target that will take a few more years to achieve, but it’s companies next milestone.

- The Companies cash flow remains strong, with a low debt-to-equity ratio of just 0.36%. It has sufficient cash flow to fund future capital expenditures planned for 2026 and 2027.

- Two years ago, premiumization in biscuits was around 27-28%. Last year, it reached 37%, and in the last two quarters, it’s at 39%. On the bakery side, premiumization by volume stands at nearly 56%.

- On the frozen side, The Managment has performed exceptionally well. Management remains optimistic about frozen desserts as a category, seeing significant potential in it due to its ability to excite and attract new customers.

- For consumer promotions and marketing of its brands and products in the B2C segment, The Company allocate around 3% to 3.5% of their spend on advertising.

(K) Capex

- The Company has done a capex of INR 350 crore allocated for two specific greenfield plants: one in Indore, Madhya Pradesh for biscuits, and the other in Khopoli, Maharashtra, near Mumbai. The Khopoli plant is a larger facility, with room to add more production lines in the future.

(L) Strengths & Weaknesses

Strengths of Mrs Bector’s Food and Specialities Ltd.

- The company generates 80% of its domestic biscuit revenue from north and northwest India, with a presence in 28 states, 5 union territories, and a network supplying 700,000 retail outlets and 4,000 preferred outlets.

- To expand its product range, the company is focusing on high-margin biscuits like cookies, creams, and crackers, while simultaneously reducing dependency on low-margin glucose biscuits. In addition to this, bakery sales contributed 35% of revenue in FY24, with English Oven as a leading premium brand. Furthermore, new lines and products, including premium breads, croissants, and buns, are set to drive growth in the medium term.

Weaknesses of Mrs Bector’s Food and Specialities Ltd.

- Modest market share in the intensely competitive biscuit industry: MBFSL is a smaller player in the biscuit industry, with revenue of Rs 1,620 crore in FY24, of which biscuits contributed ~61%. While its Cremica brand is strong in North and Northwest India, it has limited presence elsewhere. The biscuit industry is highly competitive, with major players like Britannia, ITC, Mondelez, and Unibic intensifying the competition across categories.

- Despite its growth, profitability is vulnerable to raw material price swings and forex fluctuations, especially in the price-sensitive biscuit segment, which contributes 61% of FY24 revenue. Price hikes are passed to consumers with a delay.

Disclaimer: The report only represents the personal opinions and views of the author. No part of the report should be considered a recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

References: Annual Reports, News Publications, Investor Presentations, Corporate Announcements, Management Discussions, Analyst Meets and Management Interviews, Industry Publications.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore