NFIL intends to drive growth with the introduction of new molecules every year and expanding its offerings while increasing the capex for multiple Multi-Purpose plants and high-performance plants. Now, Let’s take a closer look at the company:

- About the company

- Journey Since Inception

- Board Members

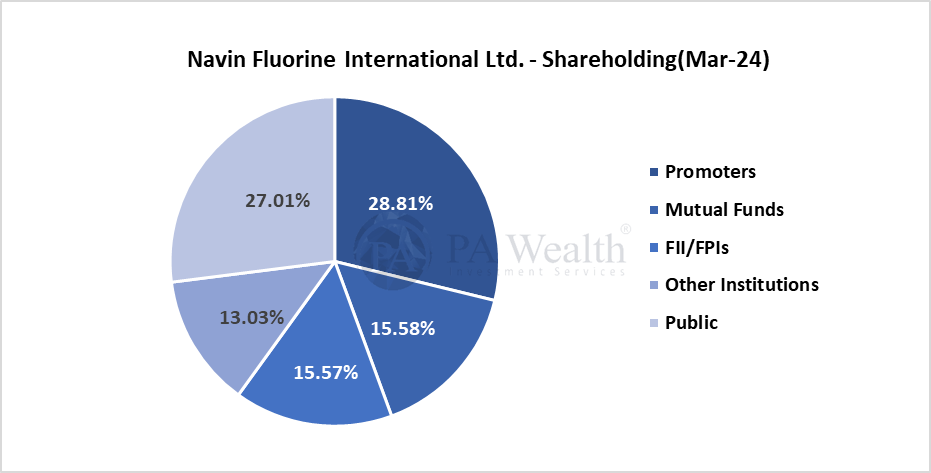

- Shareholding Pattern

- Business Segments

- Revenue Segments

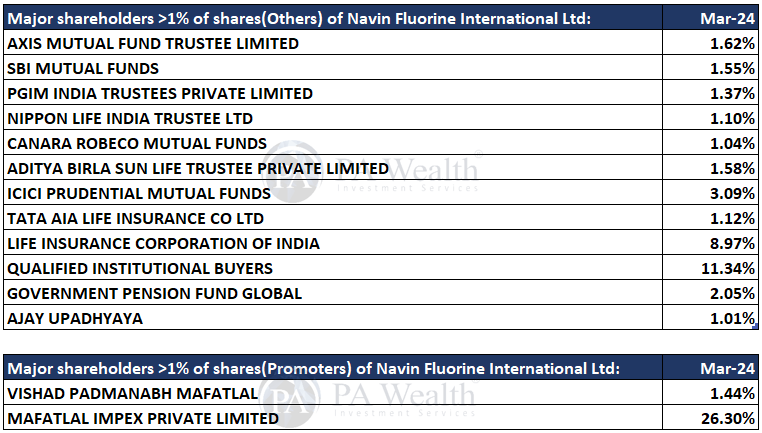

- Cost Structure

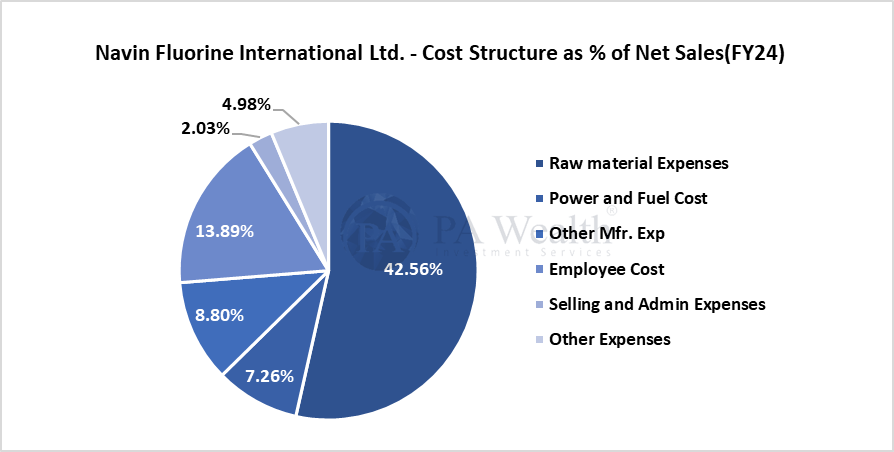

- Financial Parameters

- Management Key Highlights

- Strengths & Weaknesses

(A) About Navin Fluorine

Founded in 1967, Navin Fluorine International Limited (NFIL) is India’s biggest maker of specialty fluorochemicals. They are part of the Padmanabh Mafatlal Group and manage one of India’s largest integrated fluorochemical facilities in Surat and Dahej, Gujarat, as well as Dewas, Madhya Pradesh. Surat also houses its R&D facility, the Navin Research Innovation Centre.

NFIL specializes in fluorination and synthesis, making it a significant supplier of intermediate chemicals to the pharmaceutical and agricultural sectors. Subsequently, They have three primary business segments: high-performance products (HPP), contract development and manufacturing organization (CDMO), and specialty chemicals. Their products are sold both domestically and worldwide, having operations in Europe, the United States, Southeast Asia, and the Middle East.

Over the last 3 years, Due to global headwinds, The Navin Fluorine share has been in a consolidation phase.

(B) Journey of Navin Fluorine

(C) Board of Directors of Navin Fluorine

(D) Shareholding Pattern of Navin Fluorine

(E) Navin Fluorine Business Segments

Contract Development and Manufacturing Organization (CDMO)

This is the company’s fastest-growing segment. It manufactures chemicals for pharmaceutical companies to assist them to design and manufacture drugs. The company has gained from a trend in which pharmaceutical corporations shift some production to India rather than China. Navin Fluorine focuses on complex intermediate chemicals rather than finished drugs and is working to establish confidence with potential customers by having their facilities upgraded to meet the guidelines or standards required by international producers.

The company has launched ‘Navin Molecular’ for its CDMO Business serving the pharmaceutical market for clinical and commercial drug development.

High-Performance Products

This segment includes refrigerants, used in air conditioners and refrigerators, and inorganic fluorides, used in various industries. Navin Fluorine is a major producer of these products in India and they were the first Indian company to produce both R22 refrigerant gas and HFO (Hydrofluoroolefin) refrigerant.

The Company’s refrigerants are sold under the ‘Mafron’ brand and it has become a generic name for refrigerants, in India and overseas. It has emerged as the preferred choice for leading OEMs, service technicians, and equipment owners.

Specialty Chemicals

This segment focuses on developing and manufacturing chemicals for use in agriculture (crop science) and new materials (performance materials). Furthermore, They are targeting partnerships with companies that are innovating in these areas. Also, The specialty chemicals market is expected to grow rapidly in India, and Navin Fluorine believes they are well-positioned to be a leading supplier.

(F) Revenue Segments

(G) Cost Structure of Navin Fluorine

(H) Financials of Navine Fluorine

The company’s revenue has grown at a CAGR of 13.32% over the past 10 years from Rs 591.51 Cr. in FY15 to Rs 2065.01 Cr. in FY24. Subsequently, The company’s PAT has grown from Rs 58.25 Cr. in FY15 to Rs 270.51 Cr. in FY24 at a CAGR of 16.60%. Furthermore, The company’s ROE has increased from 9.91% in FY15 to 270.51% in FY24.

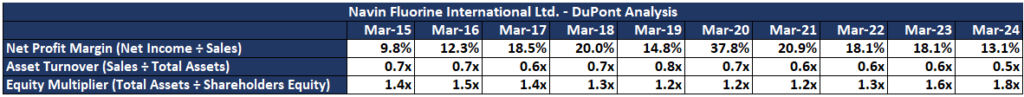

DuPont Analysis

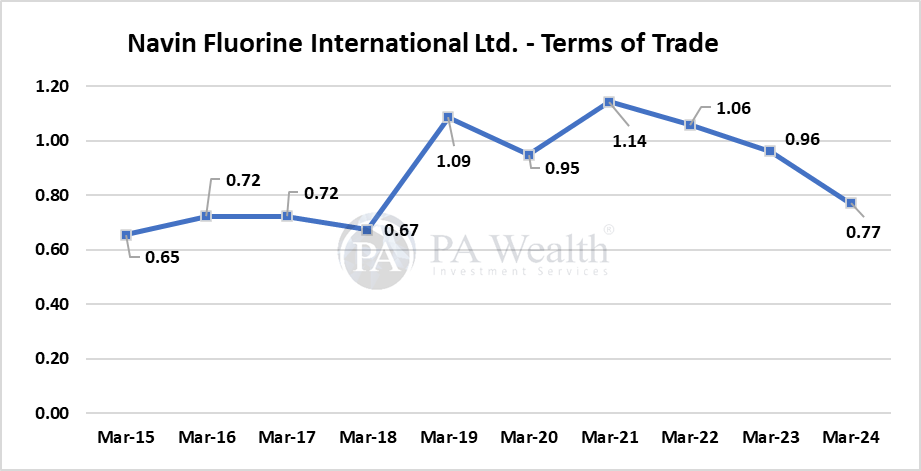

Terms of Trade of Navin Fluorine

(I) Management Discussion

Specialty Chemicals

- In Q4FY24, The vertical reported a 26% year-over-year increase in sales to Rs. 257 Cr. due to higher utilization and the addition of new molecules (one molecule at the Dahej plant and two molecules at the Surat plant).

- The agro specialty capex done earlier initiated a chemical charge while firm orders are in place for the capacity. Additionally, a capex of Rs 30 Cr. has been done for the development of a new capability in Surat, which will generate revenue in FY25.

High Performance Products(HPP)

- In Q4FY24, This vertical reported a year-over-year sales increase of 3% to Rs. 297 Cr., which also reflects sales from the commissioned R32 capacity. However, this increase was offset by lower export realization and reduced HFO sales.

- The refrigerant gas market has started recovering, while operations at the HFO plant, which were previously facing issues, have stabilized and provided higher sales than in the previous three quarters.

- The AHF (Anhydrous Hydrofluoric Acid) capex is on schedule to be commissioned by late FY25 or early FY26. Further, the additional R32 capacity, with a capex of Rs. 84 Cr., is also on schedule and expected to be commissioned by February 2025.

Contract Development and Manufacturing Organisation(CDMO)

- In Q4FY24, this vertical reported a decline of 78% in sales to Rs. 48 Cr., which the company attributed to the deferral of molecules.

- Order visibility from existing MSA with European CDM major for FY25 stands at 50% with orders in hand. Additionally, a new customer, a UK Pharma Major, has been added by the company.

- Purchase orders are in hand for 2 RSMs for delivery in CY25 for a drug recently approved by the FDA for commercial launch for a US Major.

- The board approved a cGMP4 capex amounting to Rs. 288 Cr. . Phase 1 outlay of Rs. 160 Cr. on track to commission by the end of CY2025.

Concall Highlights

- The HPP and Specialty business provided robust performance with 7.8% and 14.1% year-over-year growth, respectively, despite global headwinds, while the CDMO business lagged as it declined by 41.5% year-over-year.

- In the HPP Business, The company worked with Honeywell International Inc. to ramp up a plant at Dahej and the operations have been stabilized. The company’s R22 and R32 plants continued to run at full capacity during the quarter.

- The company is witnessing a positive trend in the domestic pricing of R32. Current weather condition

and growth in the home appliance industry should drive growth in the refrigerant gas business. - In the Specialty business, Aggressive measures for inventory reduction by global Agchem majors, coupled with dumping by Chinese players, have impacted Agchem demand. However, the company reported that it was better placed to weather the headwinds due to long-term take-or-pay contracts for dedicated plants. Furthermore, its strategy to launch three to four new molecules every year provides a pipeline of opportunities to our MPP assets.

- The company’s strategy for the specialty segment includes launching 3-4 Molecules every year.

- In the CDMO Business, the company reported that a few early-stage molecules of customers did not get validated, which led to a decline in the vertical’s performance. Moreover, the company’s strategy for this segment includes securing the right mix of late-stage molecules and having a strong baseload of early-stage molecules to create a pipeline for future growth.

Capex

- The company initially allocated a capex of Rs. 1800 Cr. for greenfield projects for the Specialty and HPP Segments, which was increased to Rs 2200 Cr. due to the addition of new projects. This increase was funded by a Bank Term Loan of Rs 1450 Cr. and internal accruals.

- NFASL, a subsidiary of the company was allocated capex at the Navin Fluorine Dahej Plant to launch new products in agrochemicals & speciality chemicals by setting up 5 plants: 3 High Performance Products plants and 2 Multi-Purpose Plants(MPP has commenced operations.

- Capex for a new HF plant with a capacity of 40000 MTPA was also included in this which is also being set up and will mainly cater to the captive requirements of the company. It is in the initial stage, and

completion of the plant is expected in FY26.

Outlook

- The company signed a 7-year contract with Honeywell International Inc. for the manufacturing of HPP, which required a capex of Rs. 440 Cr. This was commissioned in FY23.

- The global fluorochemicals industry is expected to grow to $29.61 billion by 2027 at a CAGR of 5.06%. The growing production of aluminium, semiconductors, batteries, and electronic components could lead to a huge demand for high-value fluorochemicals.

- The company’s revenue for FY24 declined by 0.6% to Rs 2,065 Cr, while its operating EBITDA declined by 28% year-over-year to Rs 398.3 Cr. The company’s operating EBITDA margin dropped by 720 basis points year-over-year to 19.3%.

(J) Strengths & Weaknesses of Navin Fluorine

Strengths

(i) Well-established position in the fluorochemical industry and experienced promoters

NFIL, a part of the Padmanabh Mafatlal group, has been present in the fluorochemical industry since 1967. NFIL’s product portfolio comprises more than 60 fluorinated compounds, developed over the years. The products manufactured by NFIL find application in various industries, including agrochemicals, pharmaceuticals, aluminium smelting, refrigeration, metal processing, abrasives, glass and ceramics. The company is currently headed by second-generation entrepreneur, Vishad Mafatlal, who has over 25 years experience in textile and chemical sectors.

(ii) Healthy profitability margins

Over the past few years, to diversify the business and improve profitability levels, NFIL increased its focus on CDMO and speciality chemicals businesses which are highly margin accretive in nature. However, NFIL’s product mix may considerably change over the medium term, driven by high growth from specialty chemicals and CRAMS segments as well as new high-performance products being added to its portfolio.

Weaknesses

(i) Vulnerability of operating margins to fluctuations in raw material prices

Fluorspar, chloroform and sulphur are the major raw materials for NFIL. The price of fluorspar which accounts for over 40% of its overall raw material cost is highly volatile. China is the key global supplier of fluorspar. However, NFIL has entered into long-term supply contracts with certain South African miners for the supply of fluorspar and has thus partially de-risked itself from China. While NFIL has been able to pass on an increase in raw material prices to its customers, it happens with a certain lag.

(ii) Large size of its debt-funded capex

NFIL is investing ₹2,200 crores in new plants (including an HF plant) to expand into specialty chemicals and HPP. This debt-funded project is expected to be completed by FY26. The company has secured long-term offtake agreements for these products and debt repayment starts in FY25. Timely completion, regulatory approvals, and good returns are crucial for NFIL’s financial health.

Drop us your query at – info@pawealth.in or Visit pawealth.in

References: Navin Fluorine Annual Report, News Publications, Investor Presentations, Corporate Announcements, Management Discussions, Analyst Meets and Management Interviews, Industry Publications.

Disclaimer: The report only represents the personal opinions and views of the author. No part of the report should be considered a recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore