- About

- Basic Details

- Classification Portfolio of the fund

- Fund Managers & Tenure of managing the Scheme

- Fund – Investment Details

- Returns Generated

- Risk Factors

- Investment Philosophy

- Taxability of Earnings

(A) About

Quant Flexi Cap Fund is mandated to invest at least 65 per cent of its assets in equity stocks at all times. Flexi cap funds have complete freedom to invest in companies of different sizes, depending on where the fund management team expects maximum gains.

(B) Basic Details

| Fund House Quant Mutual Fund | |

| Category Flexi Cap | |

| Launch & Start Date 15-Oct-2008 | |

| Type Open-ended | |

| AUM ₹7,912 Cr (As on 30-Sep-2024) | |

| Available at NAV of ₹105.13 (As on 18-Oct-2024) |

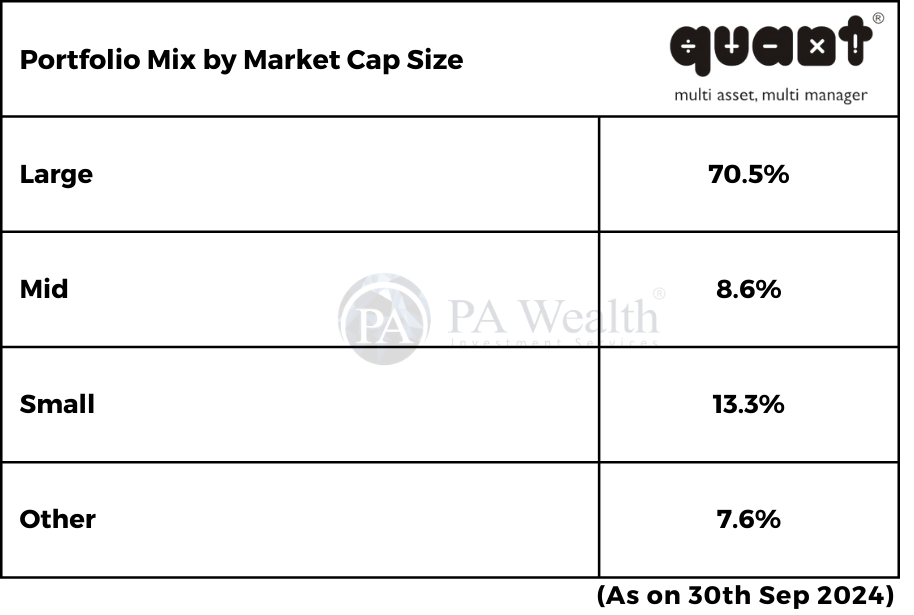

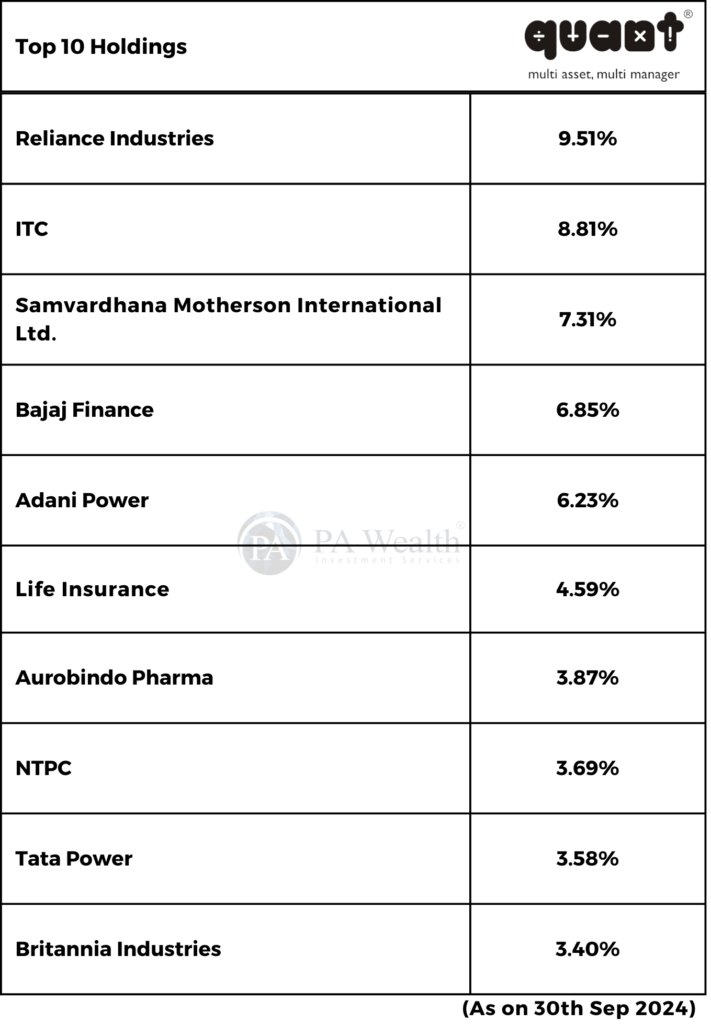

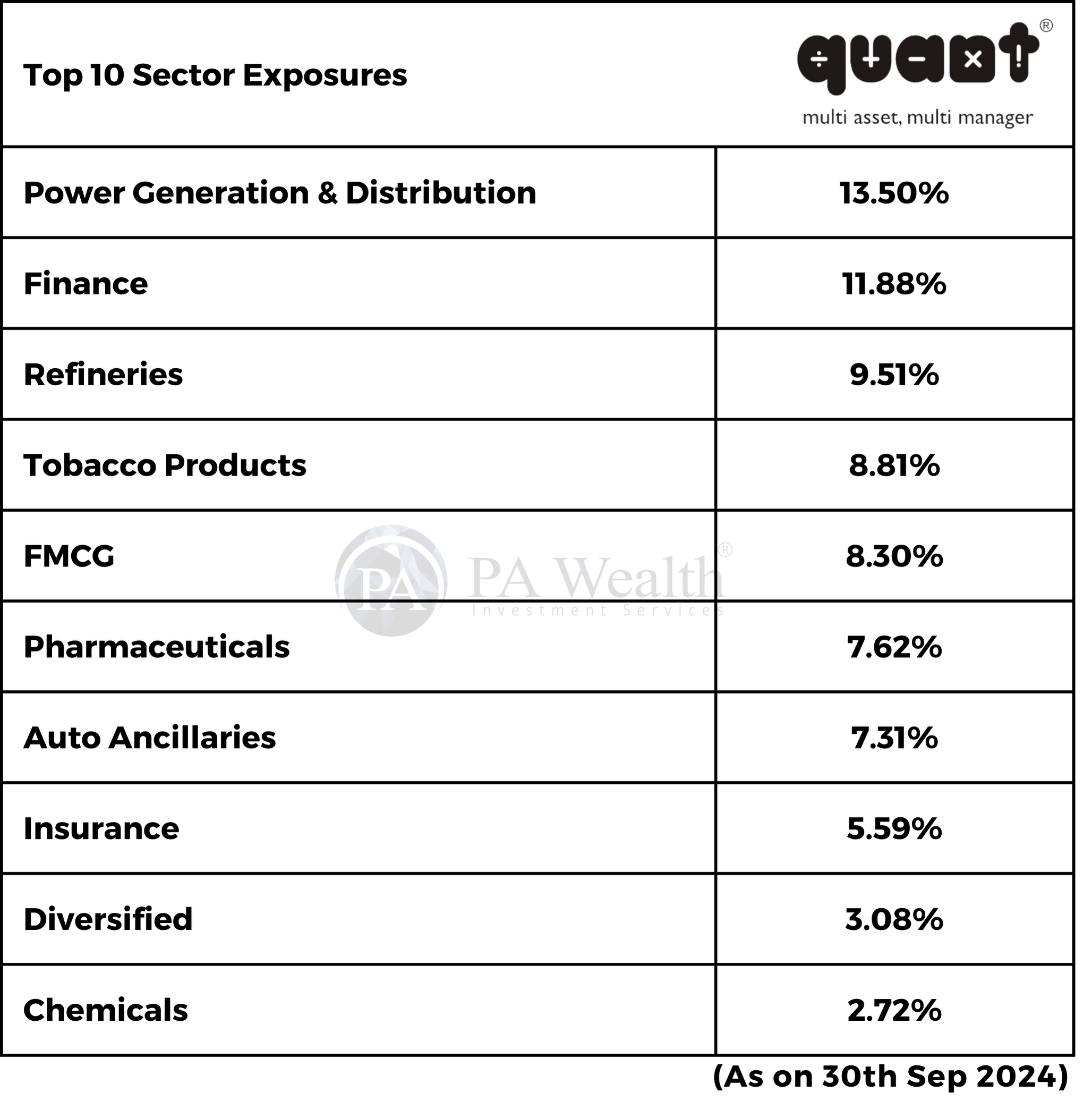

(C) Classification Portfolio

(i) Portfolio Mix by Market Cap Size

(ii) Top 10 Holdings

(iii) Top 10 Sectors Exposures

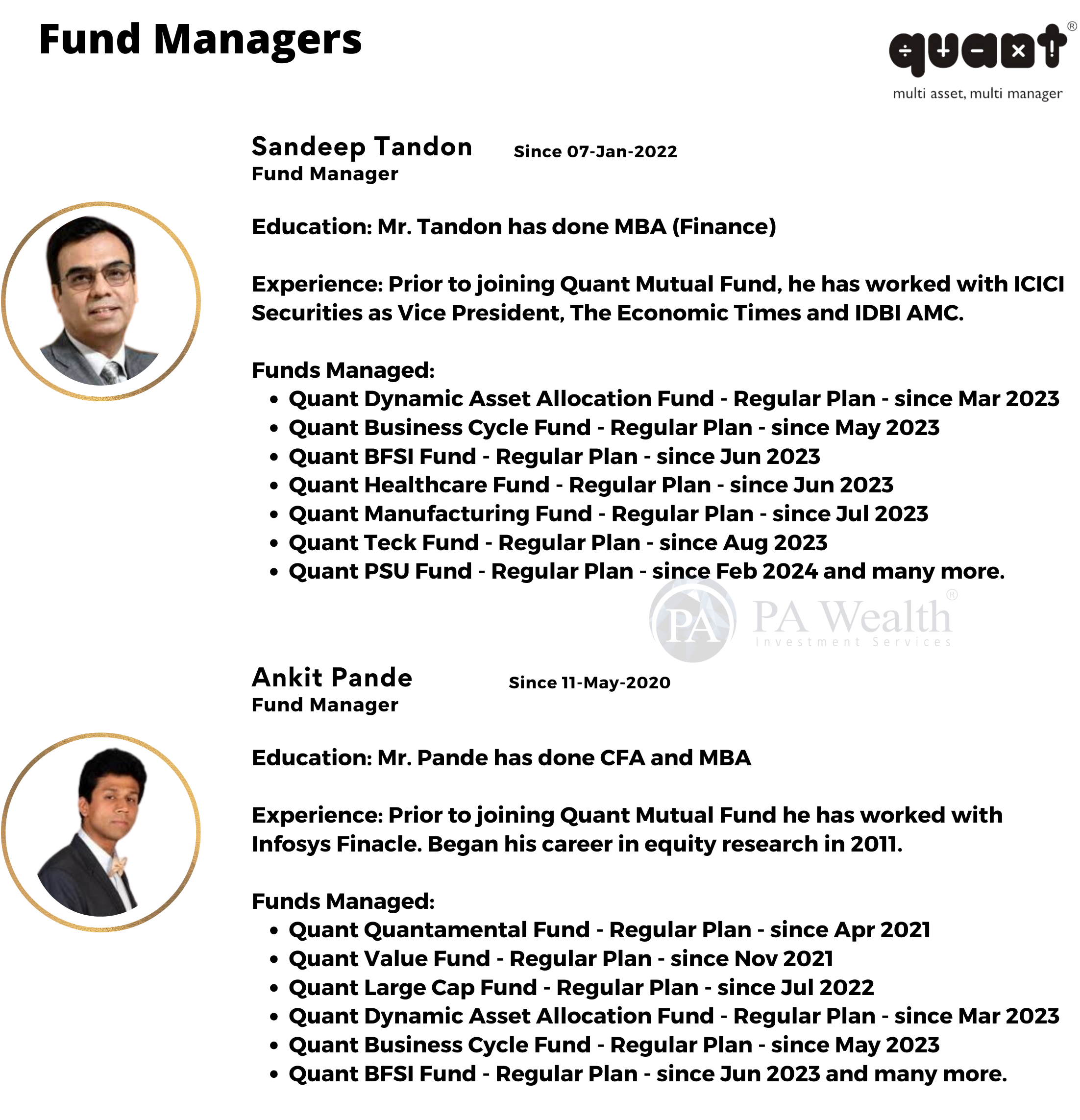

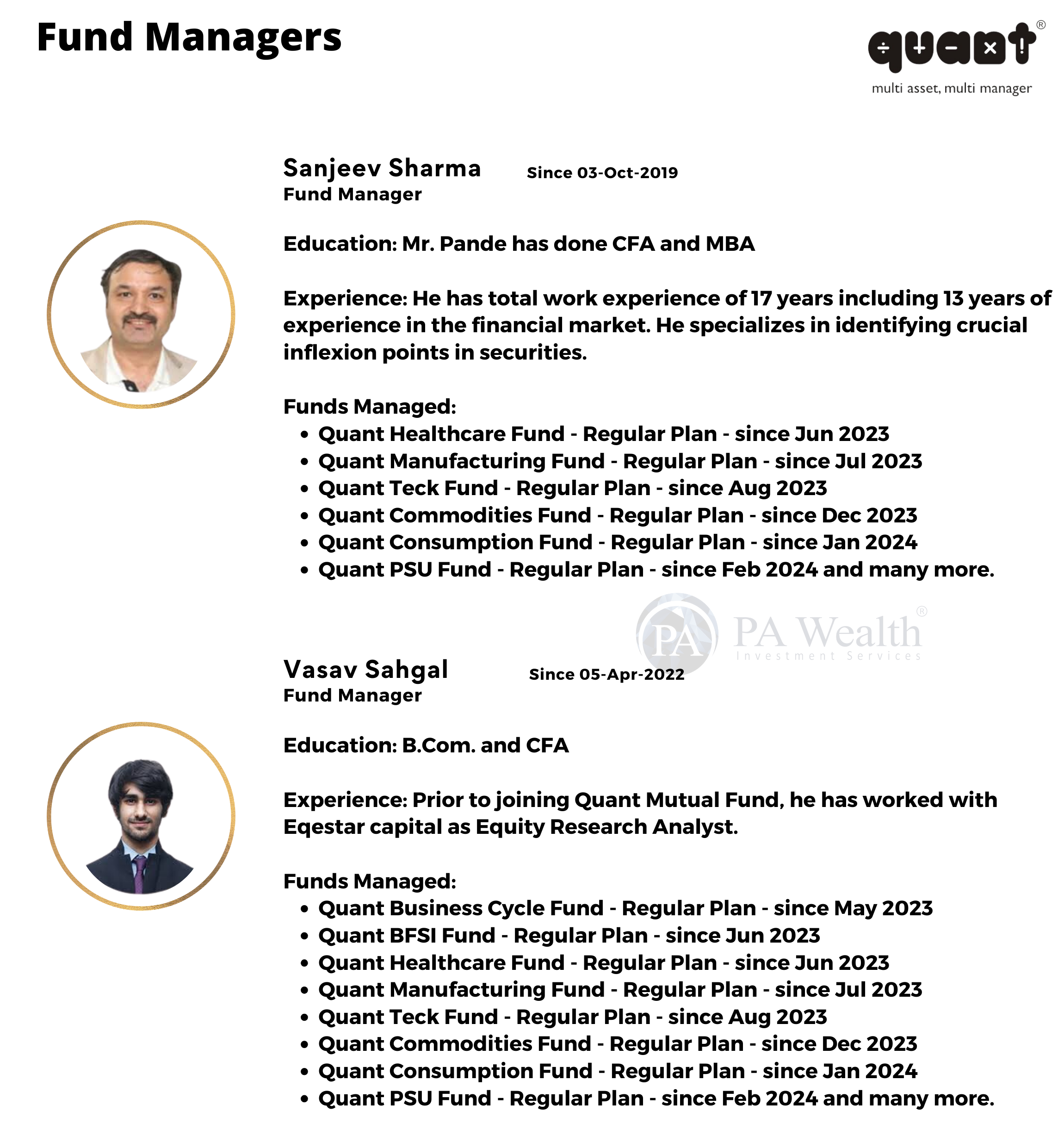

(D) Fund Managers & Tenure of managing the Scheme

(E) Investment Details

| Quant Flexi Cap Fund | |

| Application Amount for fresh Subscription (Lumpsum) | (₹) 5000 |

| Min Additional Investment (SIP) | (₹) 1000 |

| Exit load | 1% Redemption within 15 days. |

| Lock In | NA |

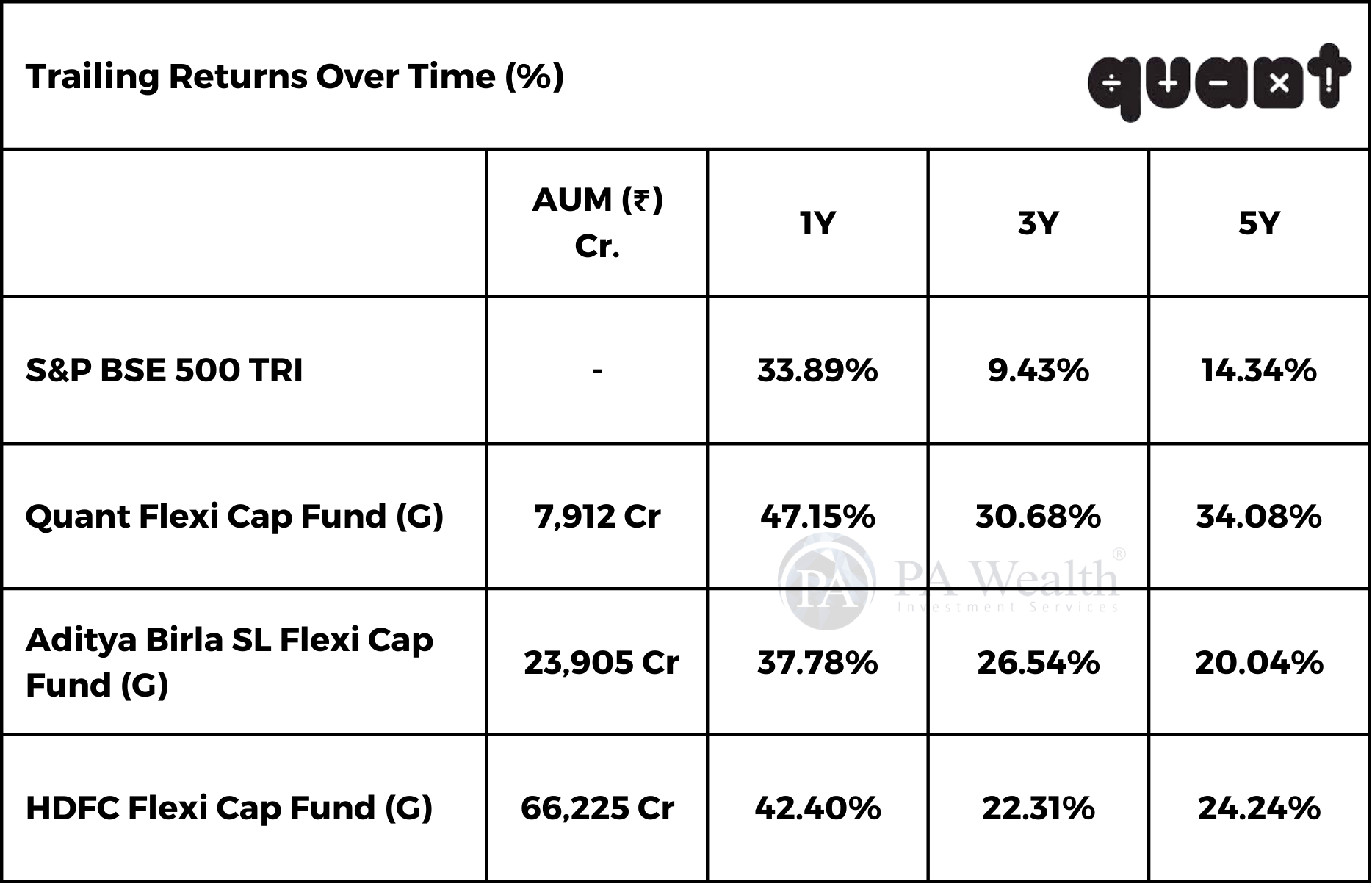

(F) Returns Generated By The Fund

(G) Risk Factors

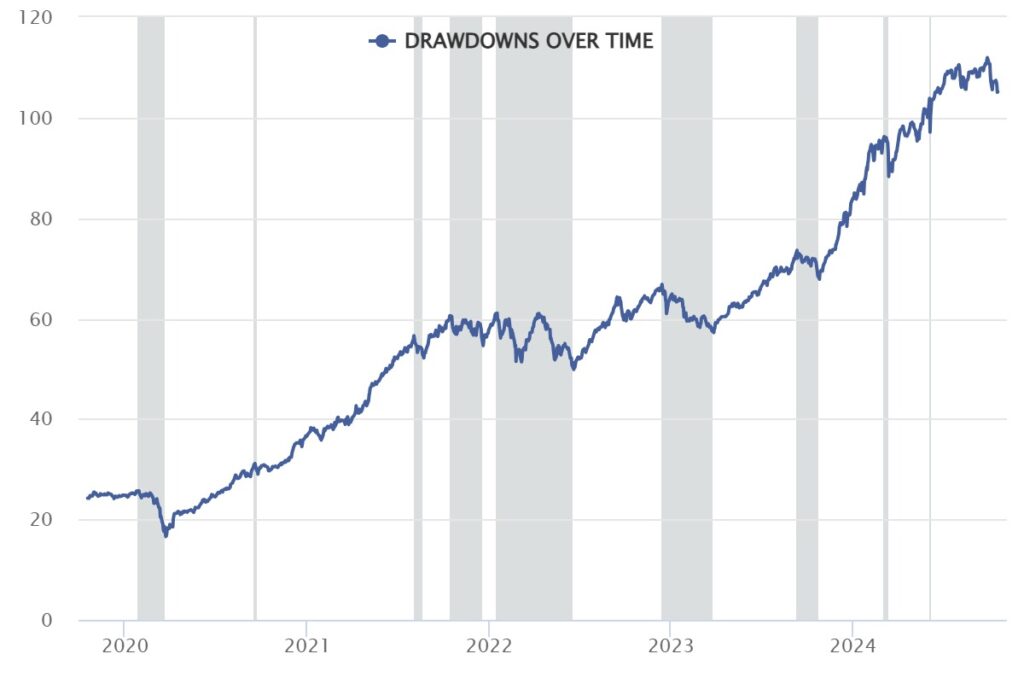

This chart shows the ups and downs of a fund’s value from 2019 to now. Consequently, The shaded area shows how long the fund stayed in a drawdown.

This chart helps investors understand how the fund has reacted to big events in the economy.

(H) Investment Objective

The investment objective of the fund is that the scheme seeks to generate consistent returns by investing in portfolio of Large Cap, Mid Cap and also in Small Cap Companies.

(I) Taxability of earnings

Capital Gains Taxation

If the mutual fund units are sold after 1 year from the date of investment, gains upto Rs 1.25 lakh in a financial year are exempt from tax. Gains over Rs 1.25 lakh are taxed at the rate of 12.5%.

However, If the mutual fund units are sold within 1 year from the date of investment, entire amount of gain is taxed at the rate of 20%.

Dividend Taxation

Addition, Dividends are included to the income of the investors and taxed according to their respective tax slabs. Further, if an investor’s dividend income exceeds Rs. 5,000 in a financial year, the fund house also deducts a TDS of 10% before distributing the dividend.

Drop us your query at – info@pawealth.in or visit pawealth.in

References: valueresearchonline.com, Industry’s Publications, News Publications, Mutual Fund Company.

Disclaimer: The report only represents personal opinions and views of the author. No part of the report should be considered as recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore