- About the Quant Flexi Cap Fund

- Basic Details

- Portfolio Classification of the fund

- Fund Managers & Tenure of managing the Scheme

- Investment Details

- Returns Generated

- Risk Factors

- Investment Philosophy

- Taxability of Earnings

(A) About the Quant Flexi Cap Fund

The Quant Flexi Cap Fund is an open-ended equity scheme. This is a flexi-cap fund where the fund management team has complete freedom to invest in companies of different sizes, depending on where it expects maximum gains. This versatility makes flexi-cap funds most suitable for equity fund investors, as the job of stock selection is left completely to the fund manager, which is the very idea of investing in a mutual fund.

(B) Basic Details of Quant Flexi Cap Fund

| Fund House | Quant Mutual Fund |

| Category | Equity: Flexi Cap |

| Inception Date | 17-October-2008 |

| Type | Open-ended |

| AUM | ₹6,885 Cr (As on 28 June 2024) |

| Available at NAV of | ₹106.5651 (As on 01 July 2024) |

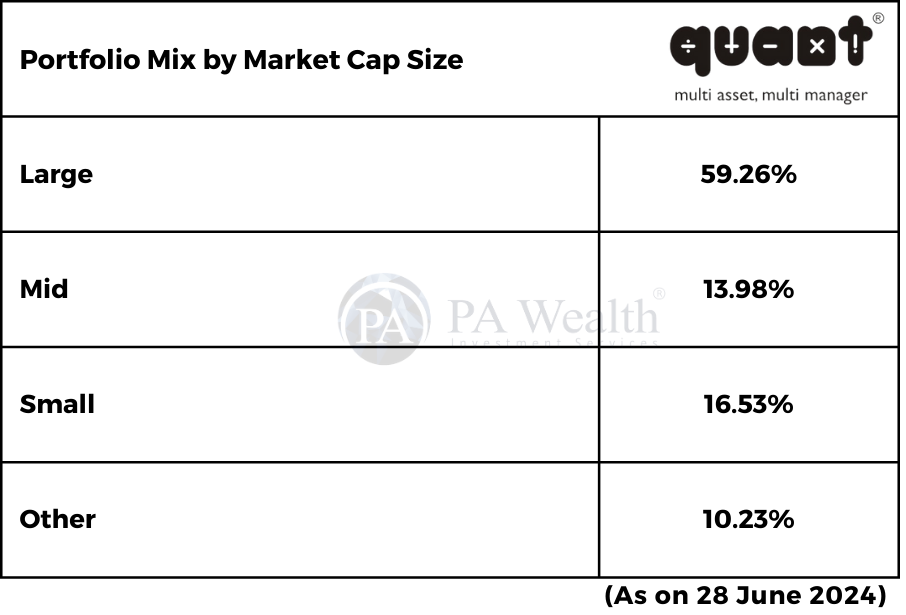

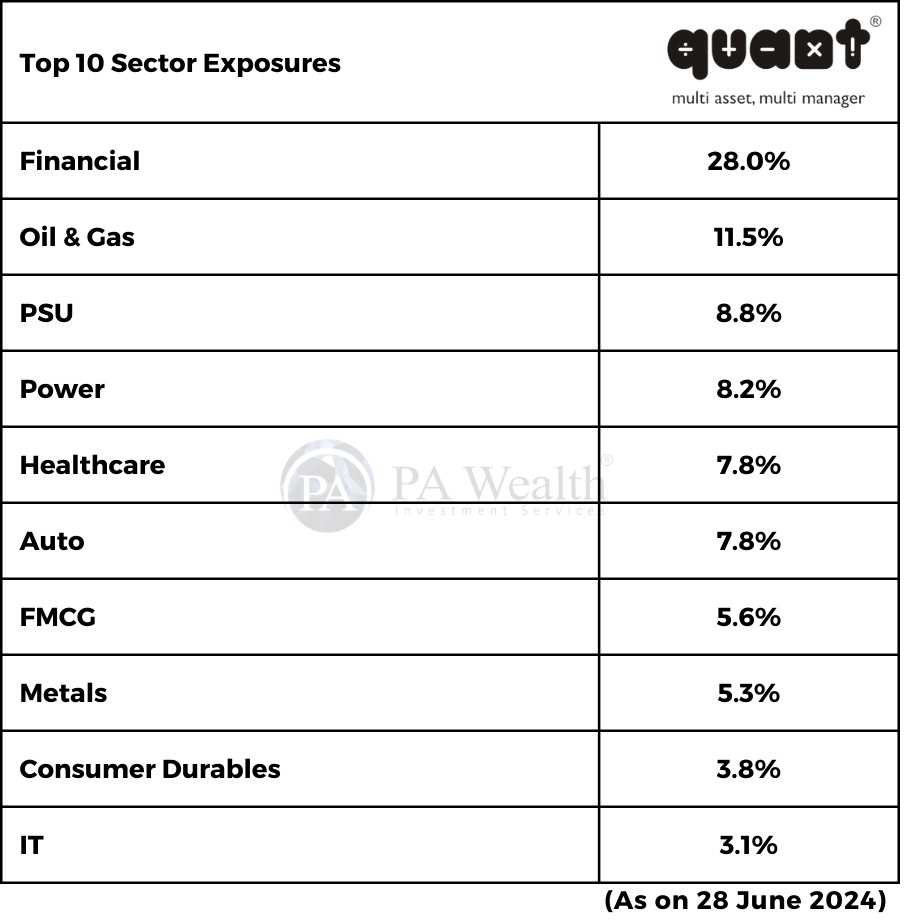

(C) Portfolio Classification of the fund

(i) Portfolio Mix by Market Cap Size

(ii) Top 10 Holdings of the fund

(iii) Top 10 Sectors Exposures

(D) Fund Managers & Tenure of managing the Scheme

(E) Investment Details

| Bank of India Small Cap Fund | |

|---|---|

| Application Amount for fresh Subscription (Lumpsum) | ₹5,000 |

| Min Additional Investment (SIP) | ₹1,000 |

| Exit load | 1%* |

| Lock In | No |

*An exit load of 1% is payable if units are redeemed within 15 days.

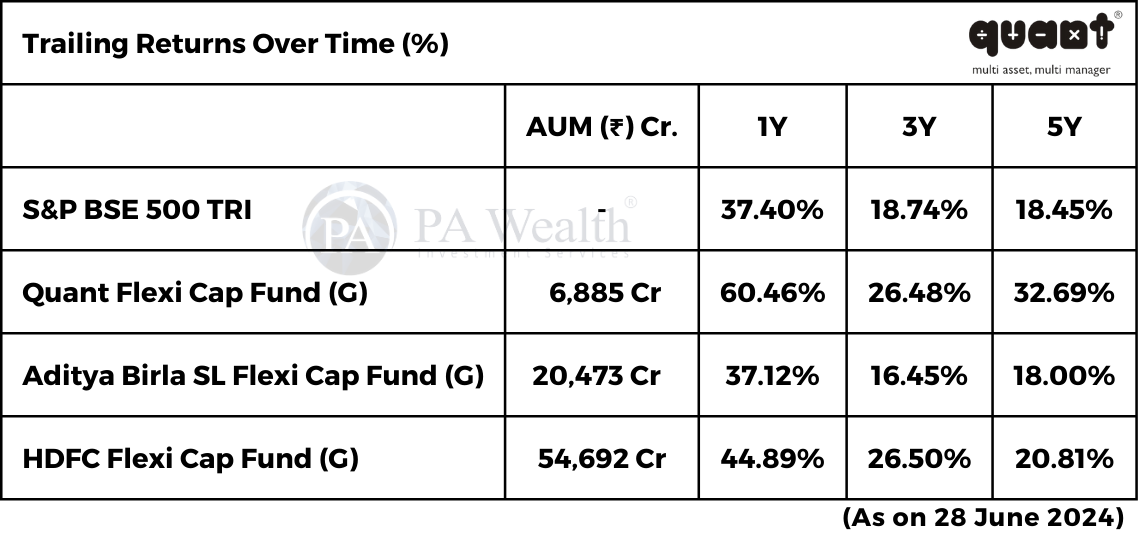

(F) Returns Generated By The Fund

(G) Risk Factors

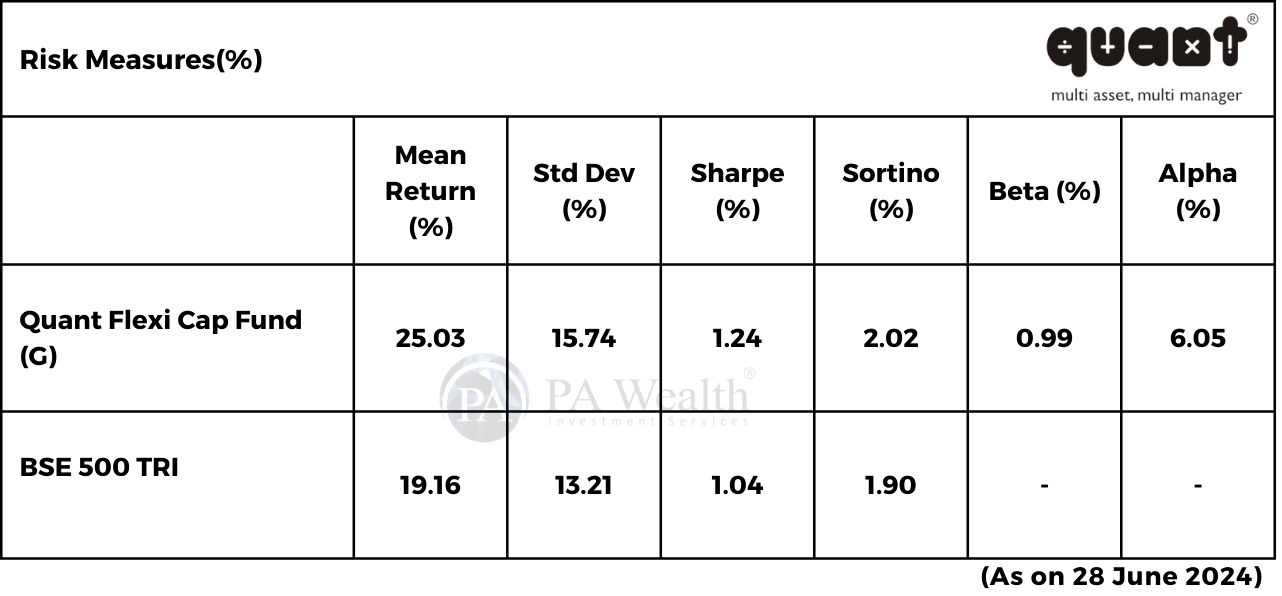

(i) Valuation Measures

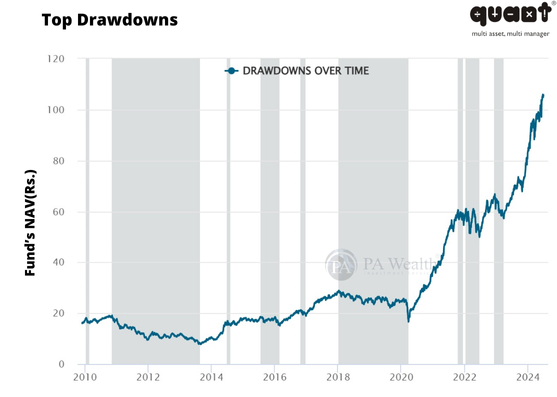

(ii) Top Drawdowns

This chart shows the ups and downs of a fund's value from 2010 to now. When the fund's value drops from its peak, it's called a drawdown. The shaded area shows how long the fund stayed in a drawdown.

This chart helps investors understand how the fund has reacted to big events in the economy.

(H) Investment Philosophy

- The primary investment objective of the scheme is to seek to generate consistent to generate consistent returns.

- The scheme seeks to generate consistent returns by investing in portfolio of Large Cap, Mid Cap and Small Cap Companies.

- The fund will invest in stocks from a universe of NIFTY 500 TRI selected on the basis of a Quant Model.

(I) Taxability on earnings

Taxation

Capital Gains Taxation

- If the mutual fund units are sold after 1 year from the date of investment, gains up to Rs 1 lakh in a financial year are exempt from tax. Gains over Rs 1 lakh are taxed at the rate of 10%.

- If the mutual fund units are sold within 1 year from the date of investment, entire amount of gain is taxed at the rate of 15%.

- No tax is to be paid as long as you continue to hold the units.

Dividend Taxation

- Dividends are added to the income of the investors and taxed according to their respective tax slabs. Further, if an investor's dividend income exceeds Rs. 5,000 in a financial year, the fund house also deducts a TDS of 10% before distributing the dividend.

Drop us your query at – info@pawealth.in or Visit pawealth.in

References: valueresearchonline.com, Industry’s Publications, News Publications, Mutual Fund Company.

Disclaimer: The report only represents personal opinions and views of the author. No part of the report should be considered as recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore