RKFL formed a joint venture, “Ramkrishna Titagarh Rail Wheels Limited,” with Titagarh Rail Systems Limited to manufacture and supply forged railway wheels. The company secured an order worth Rs. 270 crores for 32 sets of Vande Bharat Train Sets. Let’s delve into the company’s journey, operational capacity, its diversified business segments, financial growth, and strategic initiatives shaping its future in the Forgings industry.

- About

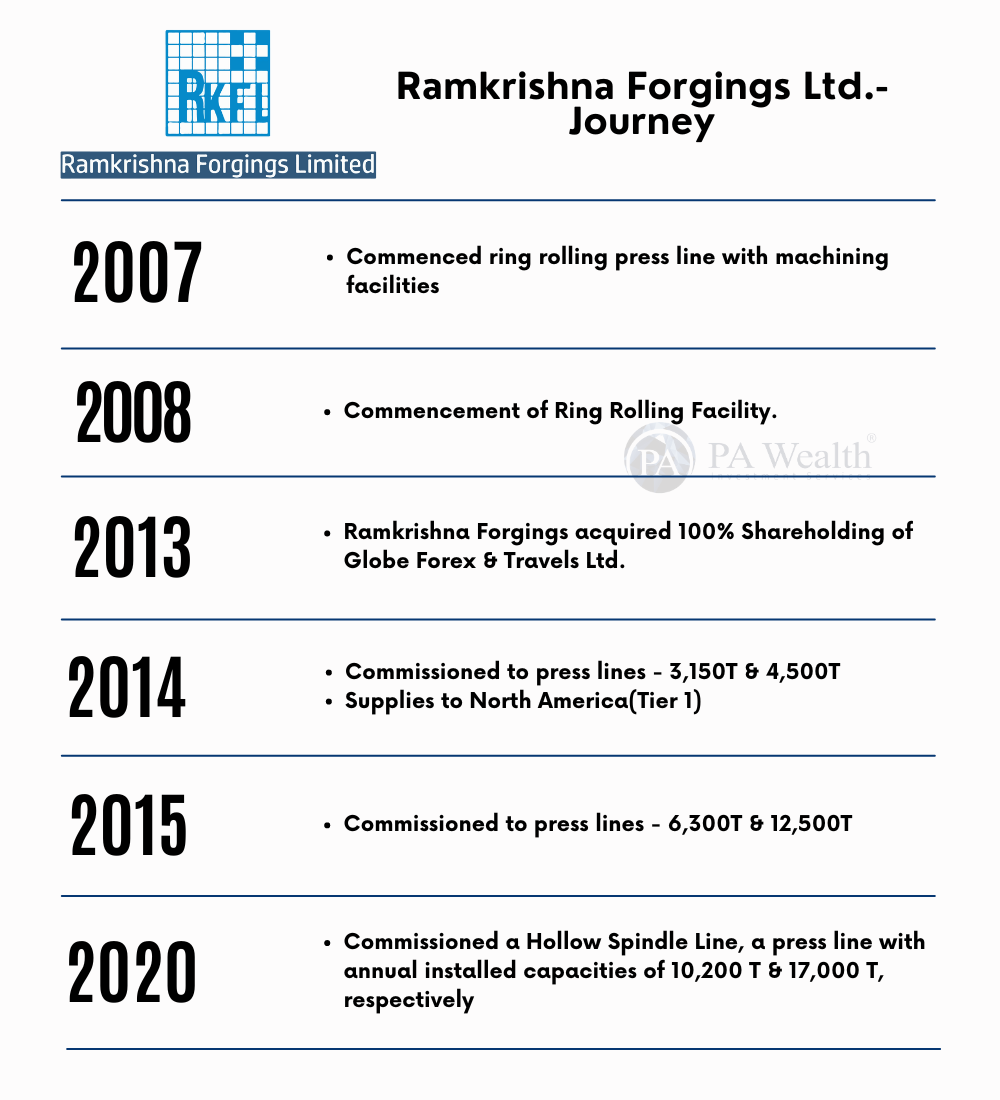

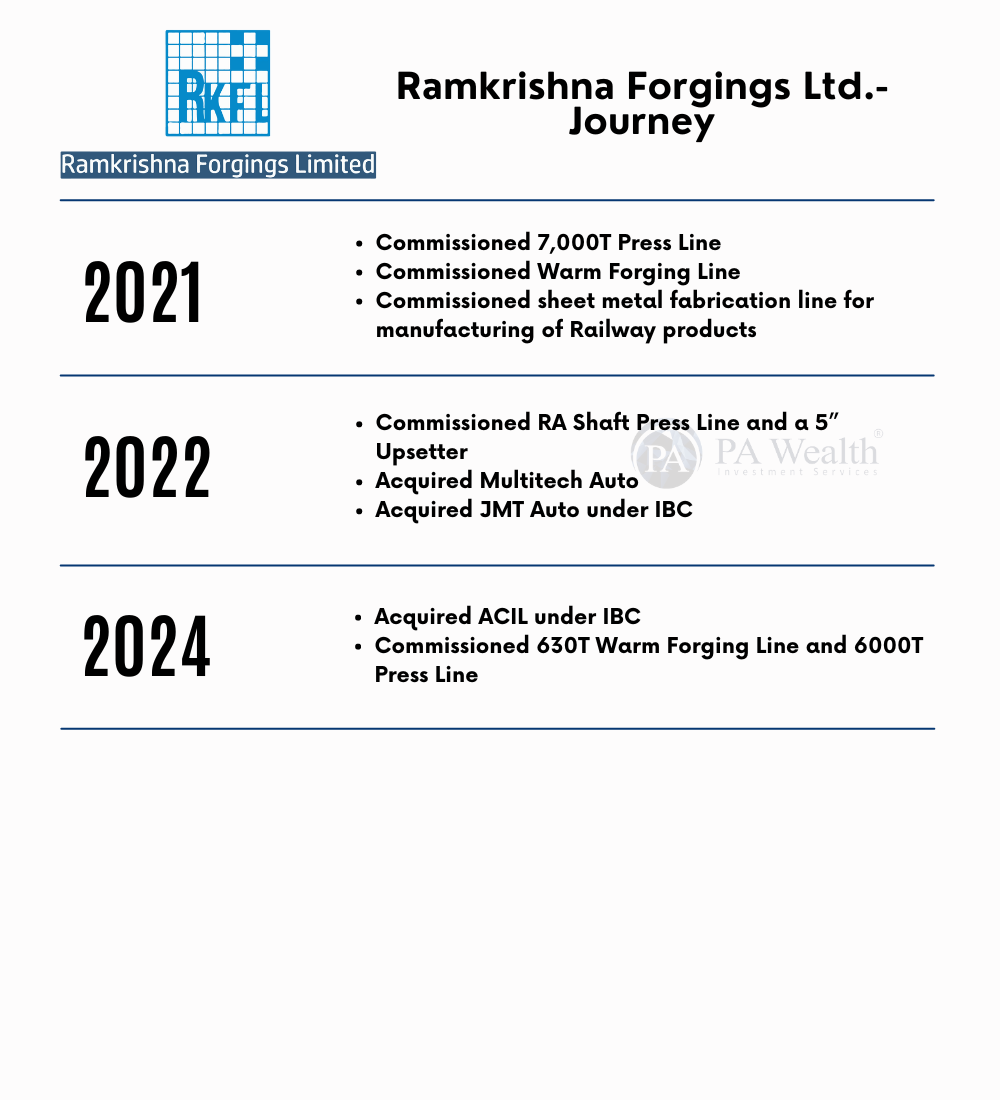

- Journey

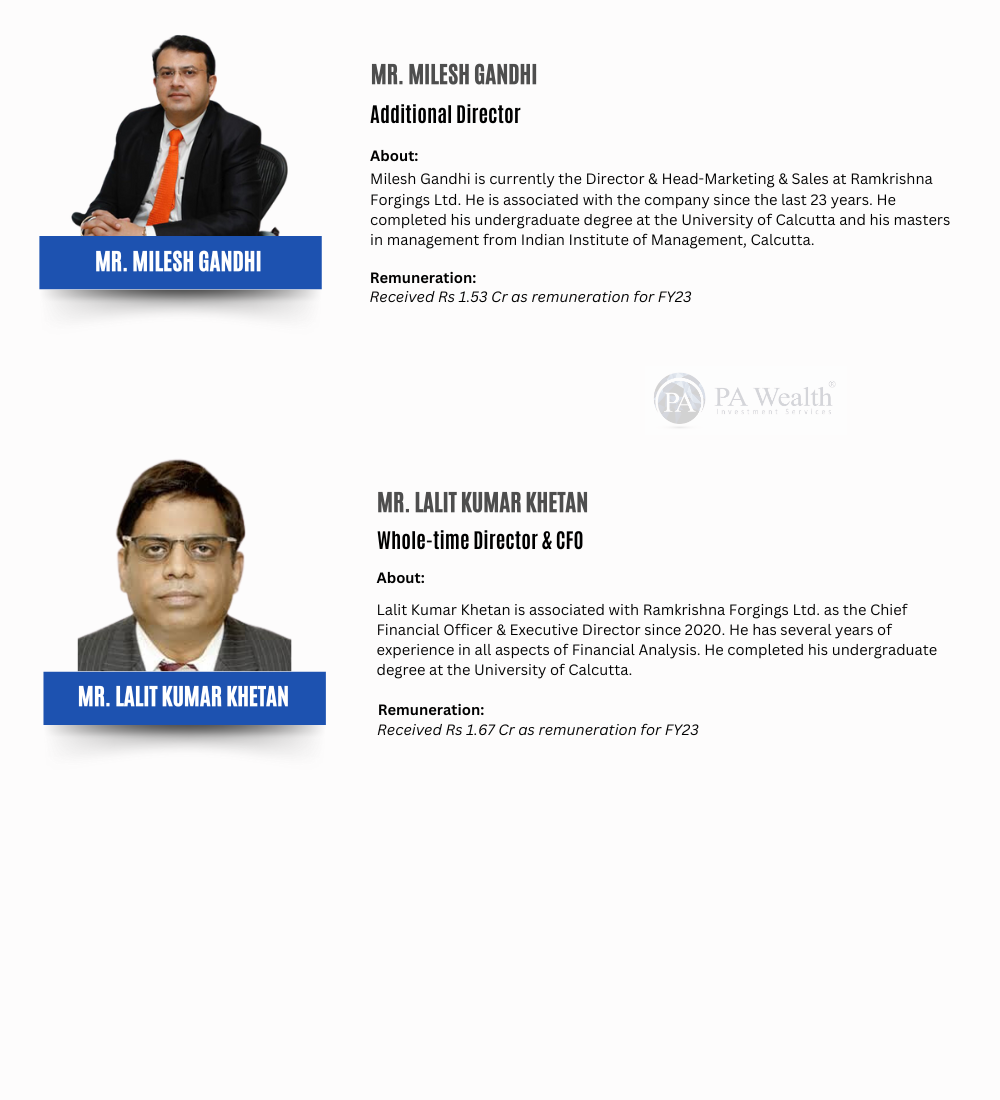

- Board of Directors

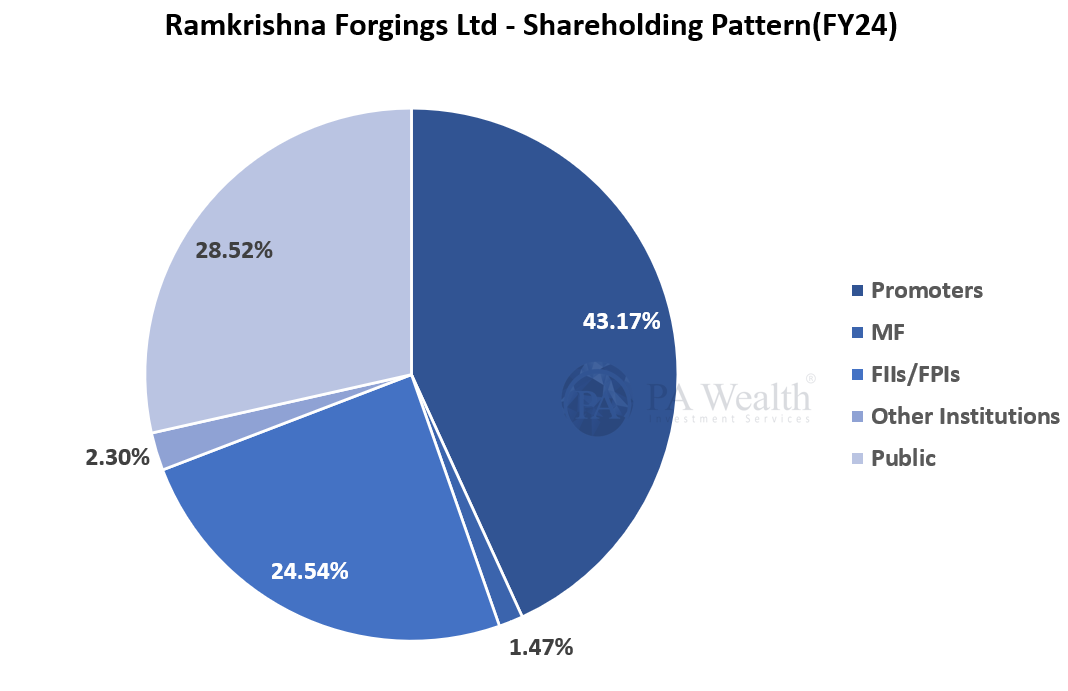

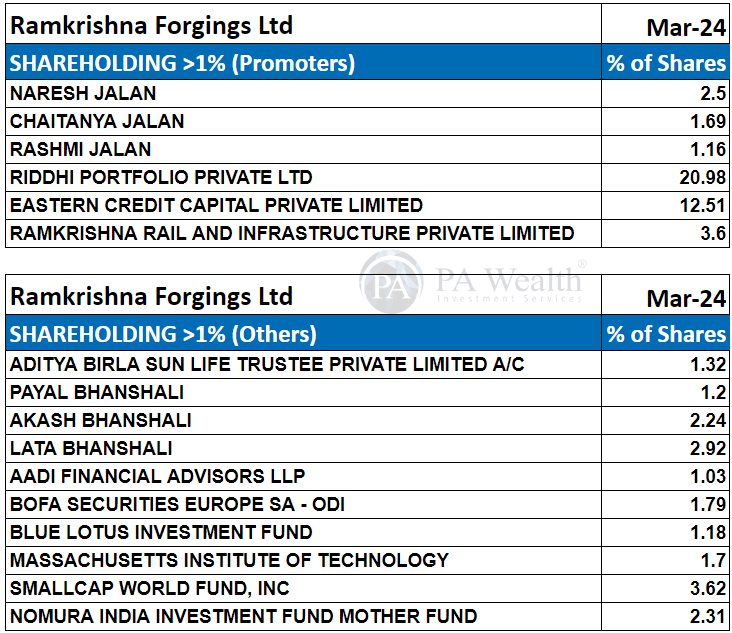

- Shareholding Pattern

- Sector Outlook

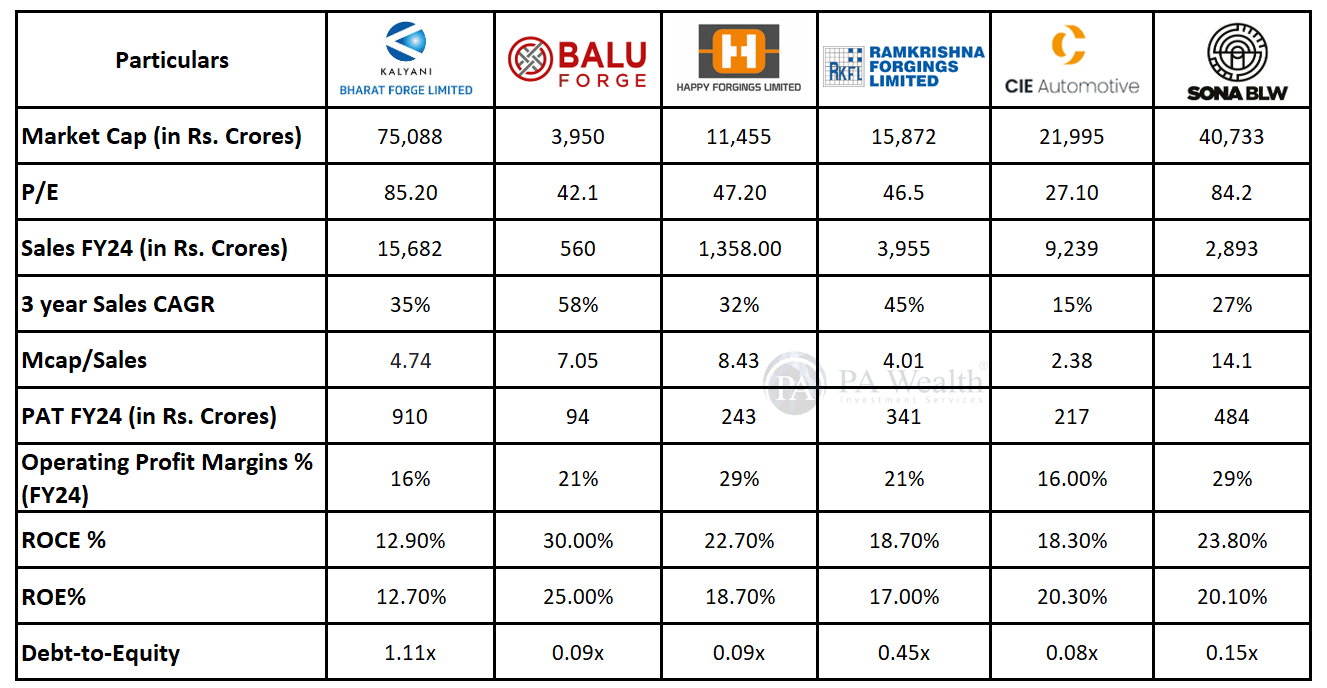

- Peer Comparison

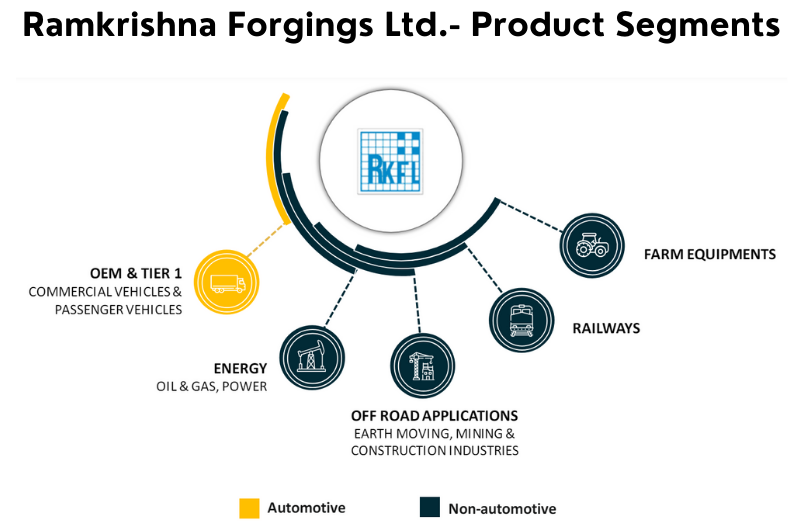

- Business Classification

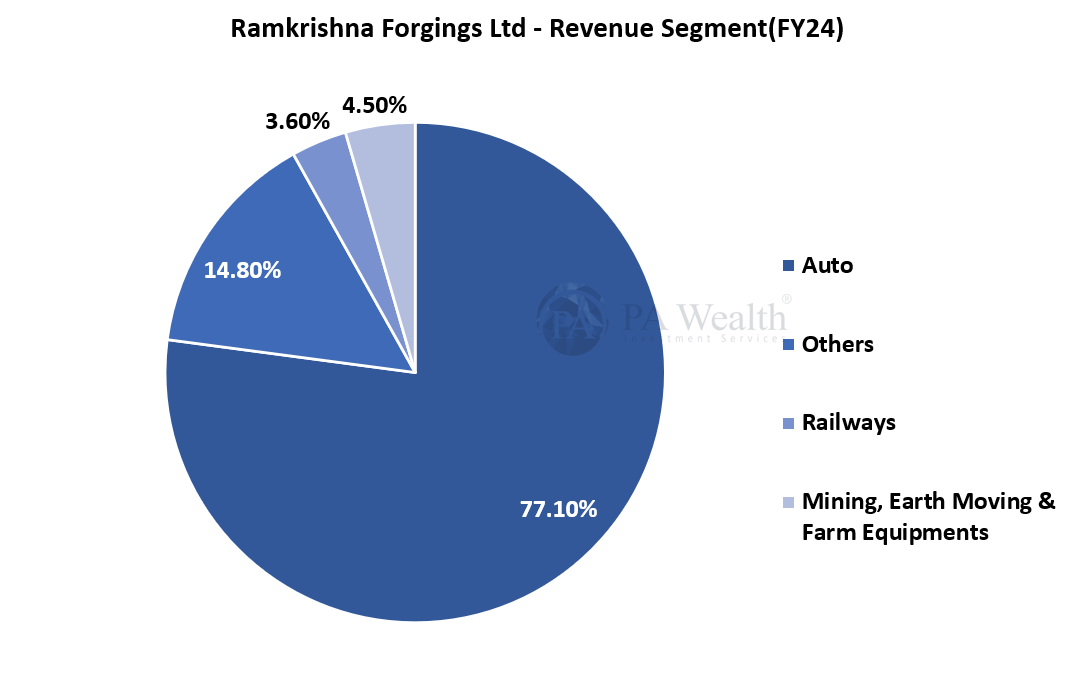

- Revenue Segments

- Operational Capacity

- Cost Structure

- Financials

- Management Discussion & Concall

- Strengths & Weaknesses

(A) About

Ramkrishna Forgings, established on November 12, 1981, is primarily involved in the manufacturing and sale of forged components for automobiles, railway wagons and coaches, and various engineering parts. It stands as the second-largest forging company in India.

Based in India, Ramkrishna Forgings Ltd specializes in producing forgings and metal products. Its diverse product portfolio includes engine components, front and rear axle components, transmission components, crown wheels, and bell crank assemblies, among others. These forgings are utilized across various industries and sectors such as automotive, earthmoving and mining, farm equipment, general engineering, railways, and steel plants. The company serves both domestic and international markets.

(B) Journey

(C) Board of Directors of Ramkrishna Forgings

(D) Shareholding Pattern of Ramkrishna Forgings

(E) Sector Outlook

- The Indian commercial vehicle market is primarily focused on the domestic market, with 87% to 92% demand coming from the domestic market

- Production of CVs in India is expected to increase at 4% to 5% CAGR between Fiscal 2024 and 2029.

- The government is expected to increase its focus on infrastructure, leading to anticipated growth of MHCV goods production at 2.5% to 3.5%, driven by improving industrial activity and steady agricultural output.

- Impact of increasing EV penetration on auto component players remains about less than 5% of revenue from traditional automotive components, especially in the engine components, drive transmission and exhaust management segments. But that will be offset by new components such as battery, motor, and controller.

- The semiconductor shortage issue impacted the order book in the past few months, though global demand for trucks remains buoyant.

- While the demand remains stronger for both medium-duty and heavy-duty vehicles, the industry’s ability to tackle that backlog has been affected by issues such as semiconductor/chip shortage, steel output, and plastic resin availability.

- Most global OEMs and auto component suppliers maintain a positive outlook for the CV industry.

(F) Peer Comparison

(G) Product Segments of Ramkrishna Forgings

(1) Automotive

(i) OEM and TIER 1

RKFL is one of the largest manufacturers of auto components in India. It includes commercial and passenger vehicles. It manufactures front axle and steering components, axle components, suspension, transmission & engine components.

(2) Non-Automotive

(i) Energy

RKFL Manufactures critical components for the Oil & Gas & Power Sector.

(ii) Railways

RKFL started off by supplying undercarriage and safety-critical parts like screw coupling and hangers for bogie bolsters for conventional coaches. Today RKFL is supplying to all divisions of the Indian Railways and enjoys approval status for critical components like Bogie Bolsters and Bogie Frames.

(iii) Farm Equipment

Farm Equipment is one of the Key customers for the Forging Industry. RKFL Manufactures critical components for the tractor and farm equipment industry. RKFL is expanding to more critical engine and rear axle parts in this segment.

(iv) Off-Road Applications

It includes Earthmoving, Mining & Construction Industries. RKFL supplies Durable & Reliable Products for the Mining & Construction Sector.

(H) Revenue Segments

(i) Segment Wise Revenue

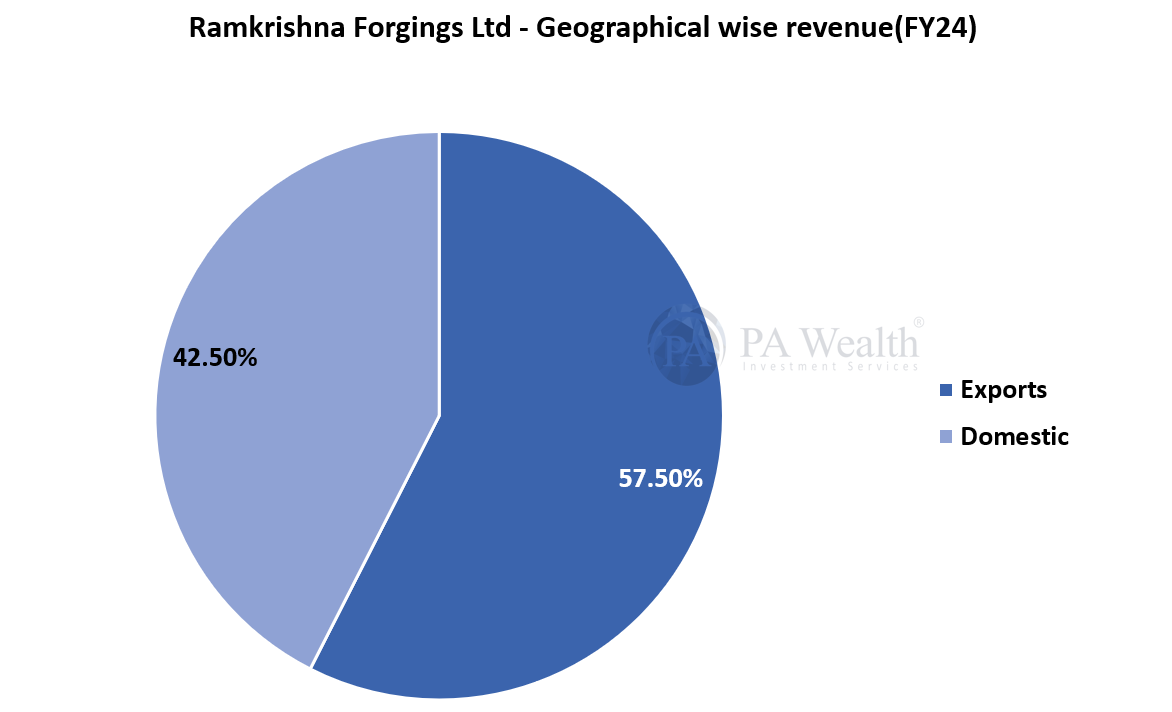

(ii) Geography Wise Revenue

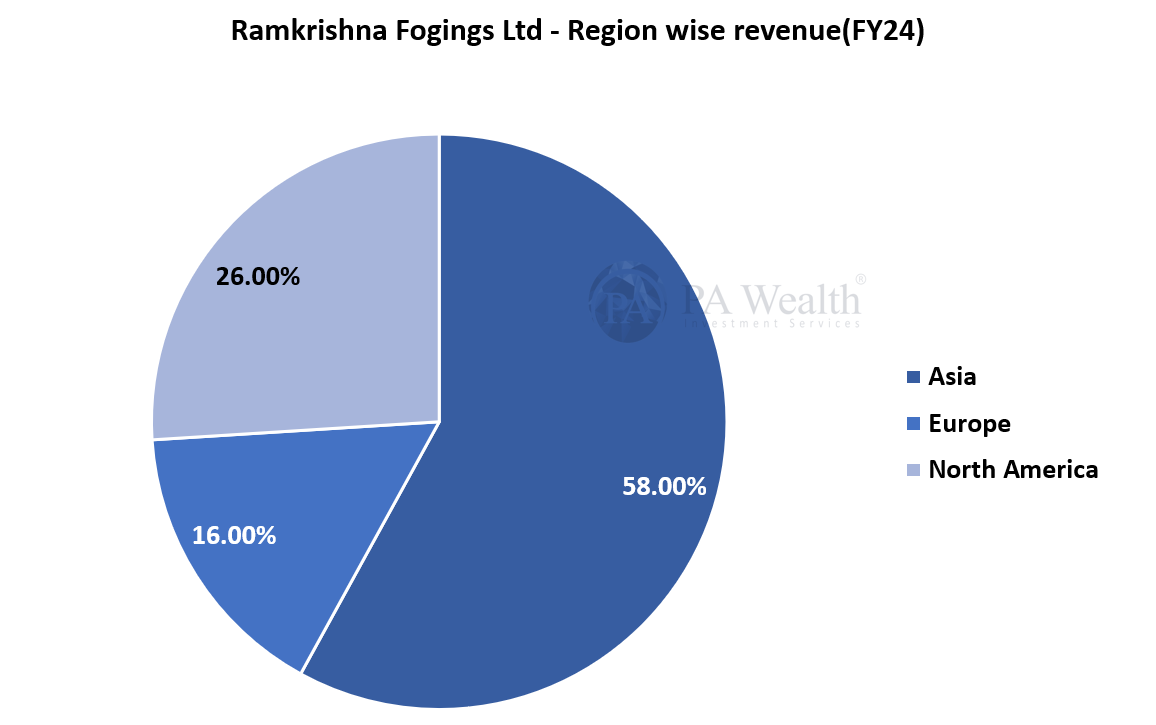

(iii) Region Wise Revenue

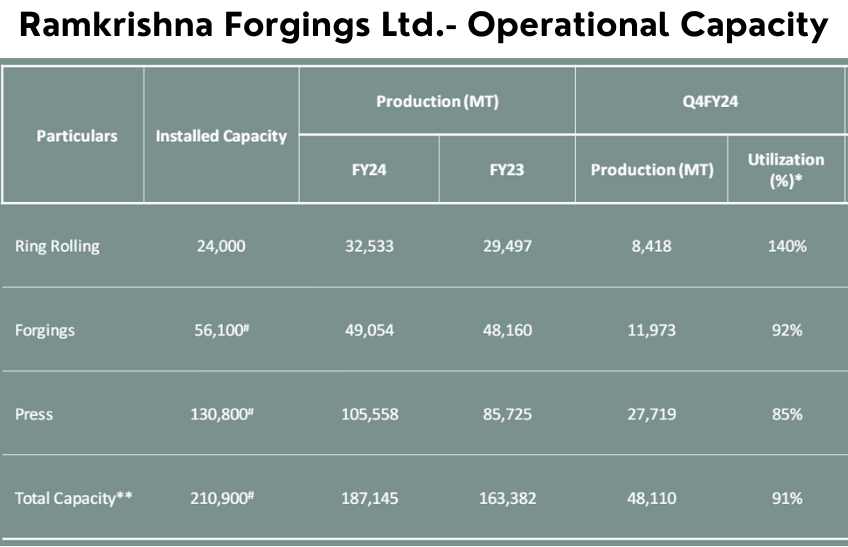

(I) Operational Capacity of Ramkrishna Forgings

(i) Capacity Utilization

- The installed capacity as of Q1FY25 was 229,510T (210,900T as of FY24) which include: Ring Rolling- 24,000T, Forging – 56,100T and Press – 1,30,800T. The capacity utilization stood at 91% for FY24.

- The company plans to commission a new 8000T forging press line in December 2024 at a total cost of approximately Rs. 80 crores. This will further increase the company’s capacity by 65,000 tonnes.

- The OEM has commissioned the Cold Forging Press line at 100% capacity, booking it for approximately Rs. 125 crores, with a contract valid for 7 years starting from Q1FY25.

- The company is in the process of adding a capacity of 14,250T consisting of up-setter forgings.

#Capacity increased for Forging Facility from 46,000 MT to 56,100 MT on July 18, 2023, Capacity increased for Press Facility from 117,100 MT to 130,800 MT on July 18, 2023 . The total capacity increased from 187,100 MT to 210,900 MT on July 18, 2023;

**Total Capacity has increased from 210,900 MT to 229,150 MT from April 03, 2024

(ii) Global Presence

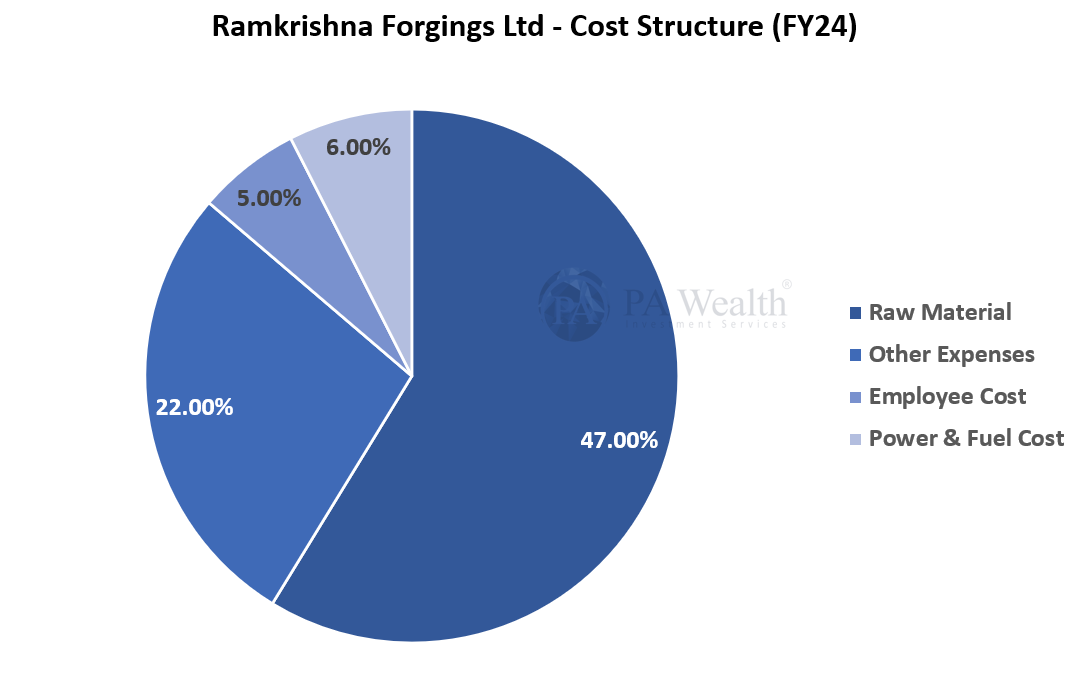

(J) Cost Structure

(K) Financials

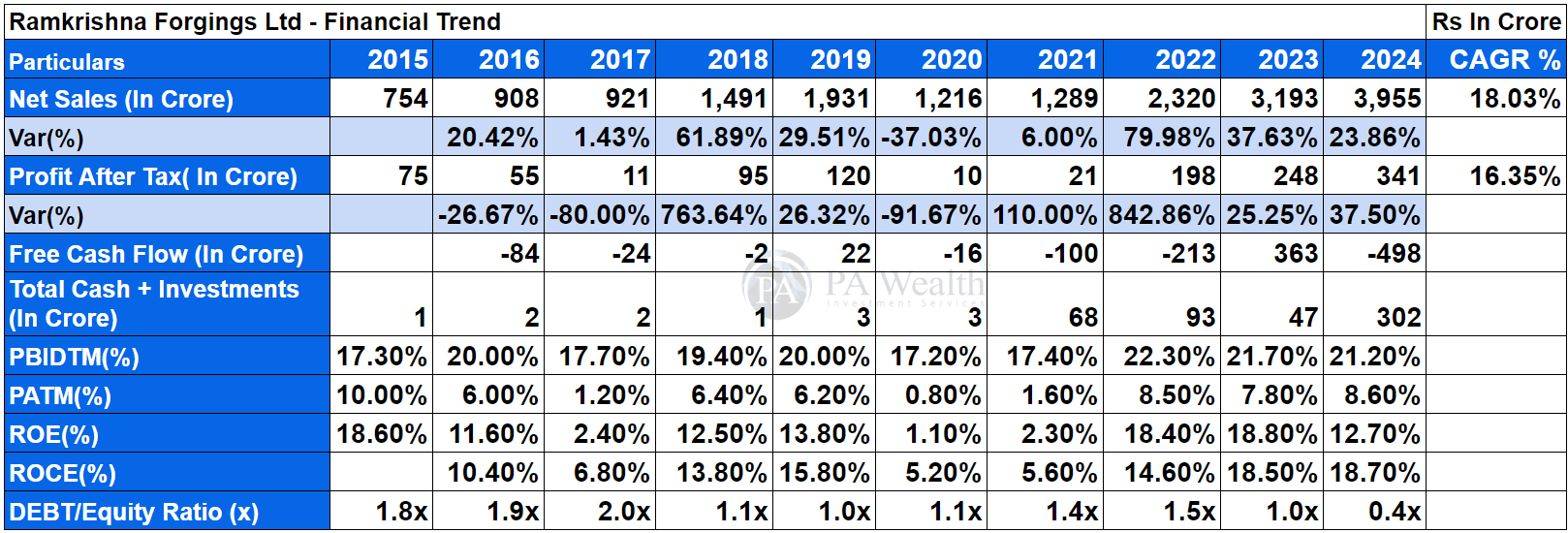

The company’s revenue has grown at a CAGR of 18.03% over the past 10 years, increasing from Rs 754 Cr in FY15 to Rs 3,955 Cr in FY24. Subsequently, the company’s PAT has also shown growth, rising from Rs 75 Cr in FY15 to Rs 341 Cr. in FY24 at a CAGR of 16.35%.

(L) Management Discussion & Concall

Outlook

- Considering the business visibility, the management guided for a sustainable export revenue performance in coming quarters.

- Incorporated a Joint Venture(JV) “Ramkrishna Titagarh Rail Wheels Limited” with Titagarh Rail Systems Limited to manufacture and supply forged railway wheels.

- Through this JV, they intend to set up a manufacturing plant in India for the production of 228,000 forged wheels per annum and the same is expected to start its operations by FY26.

- The Company is focusing on increasing revenue share of its EV business as well as continuing the diversification strategy with increasing focus on nonautomotive categories.

- RKFL is expecting a 15-20% volume growth on a consolidated basis in the near term.

- The production of LCV goods is expected to grow at a 5% to 6% CAGR over the same period.

- Currently, the PV segment contributes 2-2.5% to its topline. Management expects PV’s share of revenue to expand to double digits in the next two years.

- The company anticipates generating approximately ₹250 crores in revenue from its Cold forging facility starting from FY26.

- The company plans to expand forging capacity with a warm forging press, upset forgings, a 6,000 MT press line, and a new cold forging setup at its Seraikela-Kharsawan, Jharkhand plant.

Subsidiary performance

- JMT is looking for an 80% capacity utilization in JMT in FY26.

- MAPL has clocked a revenue of Rs 90 cr and an EBITDA margin of 16.5% in Q4FY24.

- ACIL reported revenue of Rs 9 cr with nil EBITDA margin in Q4FY24.

Acquisitions

On August 23, 2023, RKFL acquired 100.00% of the fully paid-up equity share capital of Multitech Auto Private Limited and its wholly-owned subsidiary Mal Metalliks Private Limited.

In addition, the company is in the process of acquiring JMT Auto Limited and ACIL Limited.

Q4FY24 Concall Highlights

- The expanding e-commerce sector is driving demand for light and medium-duty vehicles, fueling the growth of the global CV market by 4% in volume and 6% in value from FY’23 to FY ’29.

- The development of smart cities and infrastructure projects like highways will fuel the demand for heavy-duty vehicles.

- Capacity utilization in Q4FY24 stood at 91% compared to 96% in Q3FY24.

- The Mexico plant is expected to generate a revenue of Rs 8-10 crore in FY25.

- For FY24, the domestic markets generated ₹198,485 lakhs in revenue, while export markets contributed ₹147,140 lakhs. Other Income & Export Incentives added ₹5,669 lakhs to the total.

- The EBITDA margin for FY24 has increased to 22.7% from 22.3% in FY23.

- The Red Sea issue impacted Q4FY24’s performance, causing a revenue impact of Rs 20.75 crore and increasing freight costs by Rs 17 crore.

- The company has secured an order worth Rs. 270 crores for 32 sets of Vande Bharat Train Sets, with a timeline of 2 years for completion.

- The management has set standalone capex targets of Rs 400 cr for FY25 and Rs 350 cr for FY26.

(M) Strengths & Weaknesses

Strengths

1. Strong Market Position

RKFL, with over four decades in the auto components industry, has established robust relationships with leading OEMs, enhancing its understanding of market dynamics.

2. Healthy Operating Profitability

The group, a major Indian manufacturer of forged automotive components, has diversified into non-automotive sectors like energy, construction, and railways. Operating margin averaged 22-23% until fiscal 2024, with recent acquisitions boosting revenue by Rs 335 crore. Despite higher expenses from acquisitions, the operating margin in H2 2024 dipped to 21% from 22% in H2 2023. Future prospects include sustained profitability of over 21%, driven by scale benefits and effective cost management.

Weaknesses

1. Exposure to revenue concentration risk, cyclicality in the automotive industry and change in government regulations:

RKFL faces significant revenue concentration risk with 50-55% of revenue coming from its top five customers. It heavily relies on exports to Europe and North America (over 40% of revenue), exposing it to cyclicality in the automotive industry and regulatory changes in government policies. Diversifying into non-automotive segments and expanding geographically are crucial strategies to mitigate these risks.

2. Working capital-intensive operations:

The company’s operations are highly capital-intensive. They have to maintain a high level of inventory for extended periods, including raw materials and goods for export. As a result, this has constrained its return on capital employed.

Drop us your query at – info@pawealth.in or Visit pawealth.in

References: Annual Reports, News Publications, Investor Presentations, Corporate Announcements, Management Discussions, Analyst Meets and Management Interviews, Industry Publications.

Disclaimer: The report only represents the personal opinions and views of the author. No part of the report should be considered a recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore