Rushil Decor has a robust network of over 460 distributors and 4,100 dealers domestically, while it exports to 51 countries internationally. It has recently done a capex for the production of jumbo-size laminates which would allow the company to further expand its presence in export markets such as the Americas, Europe and Oceania.

- About the company

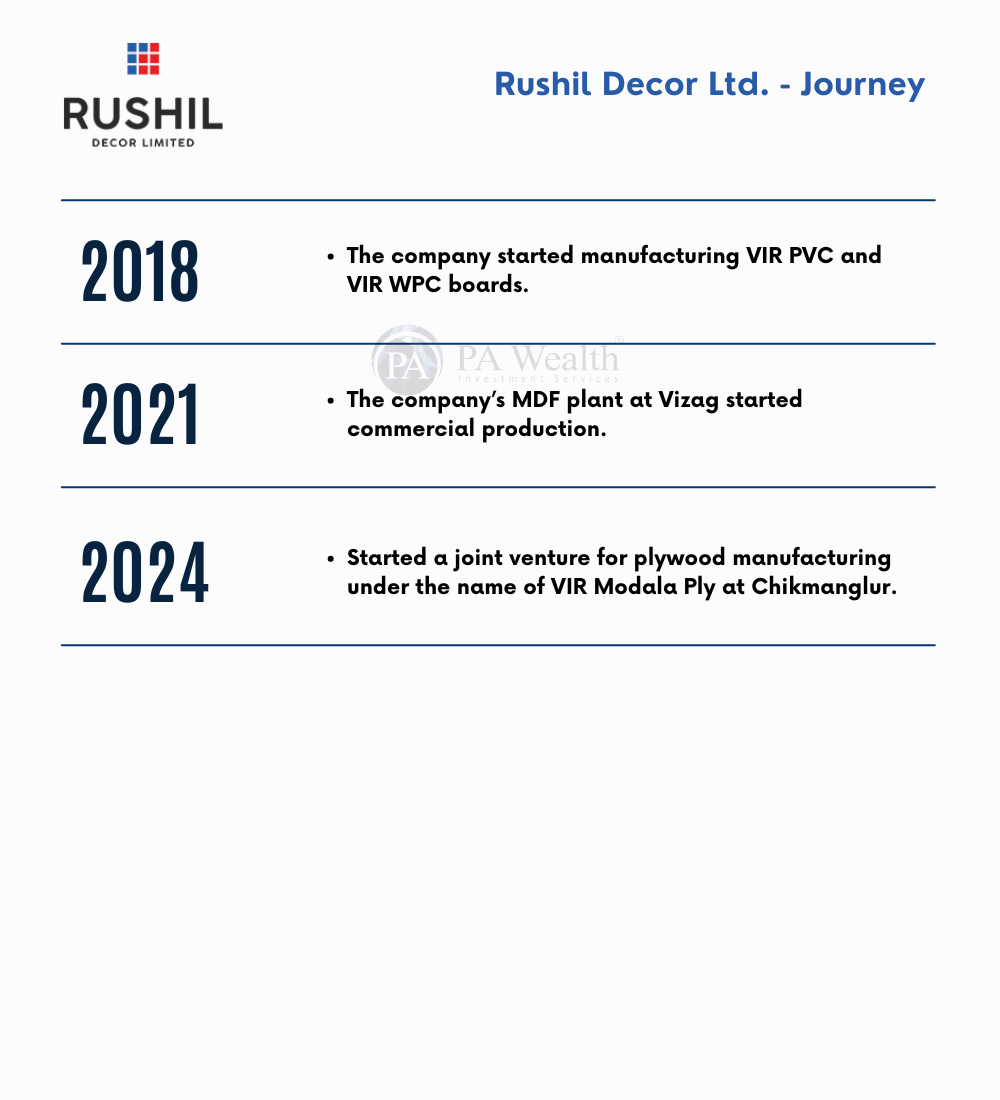

- Journey Since Inception

- Industry Landscape

- Board Members

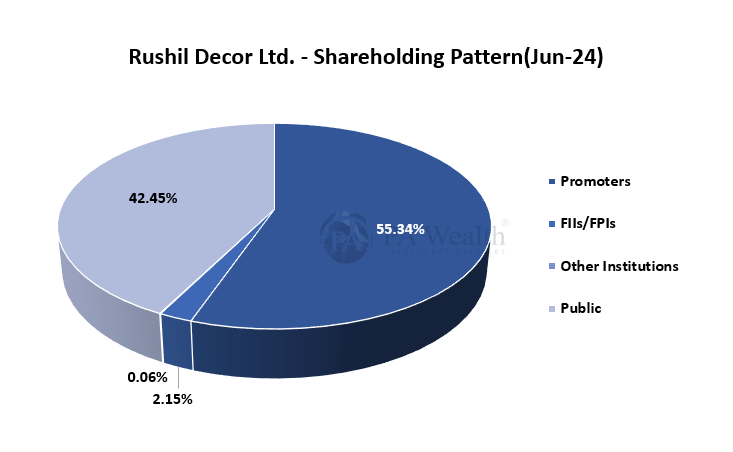

- Shareholding Pattern

- Business Segments

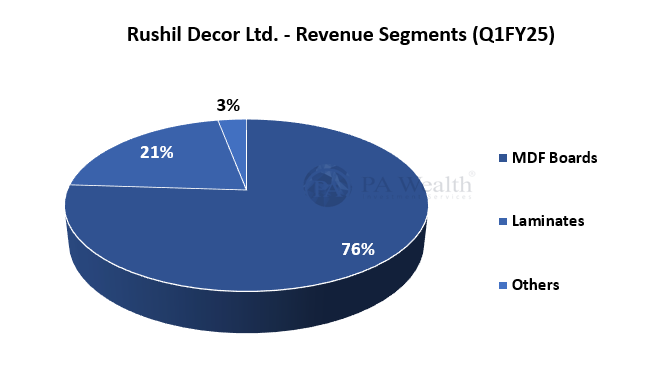

- Revenue Break up

- Peer Comparison

- Cost Structure

- Financial Parameters

- Management Key Highlights

- Strengths & Weaknesses

(A) About

Rushil Decor is a leading company in India’s Laminate and MDF panel sector. It has a strong presence in 51 countries globally. Founded in 1993, the firm has made an indelible imprint as a sought-after partner on a worldwide basis. Its product line encompasses decorative and industrial laminates for residential and commercial spaces. Additionally, Rushil Decor has a portfolio of over 1,200 designs in the laminates segment.

In the sphere of India’s MDF board production, it boasts the distinction of being the third-largest. Hence, The presence of four separate brands that strengthen its diverse portfolio reinforces this achievement. These Rushil decor brands are VIR Laminates, VIR MDF, VIR PVC, and VIR STUDDIO. Rushil decor stock price has grown at a CAGR of 20% for the last 5 years.

(B) Journey of Rushil Decor

(C) Industry Landscape

- The Indian Furniture market is expected to grow from $15.79 Billion in 2023 to $26.85 Billion in 2028 growing at a CAGR of 11.2%.

- The Market Size of Indian Wood Panel which includes Plywood, MDF, laminates, and particleboards. etc. of ₹ 43000 Crores in 2022-23, projected to reach ₹ 53000 Crores by 2025-26. growing at a CAGR of 7.2%.

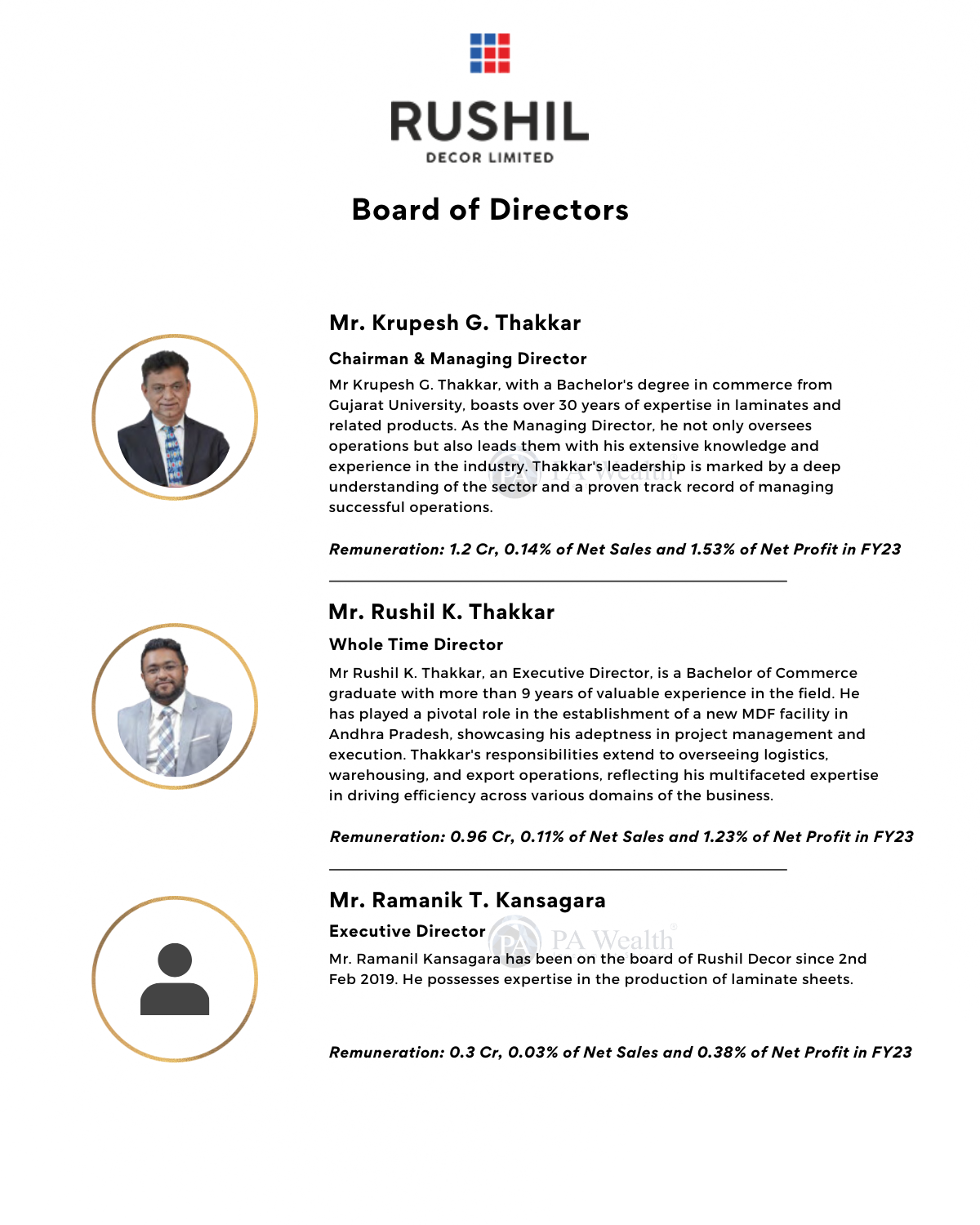

(D) Board of Directors of Rushil Decor

(E) Shareholding Pattern of Rushil Decor

(F) Business Segments

(i) MDF(Medium Density Fiberboard)

Medium-density fiberboard (MDF), is an engineered wood panel formed from coalescing wood fibre. It has a non-directional grain structure, ideal for cutting and machining without splinters. Further, Its advantages over plywood include smoothness, consistency, cost-effectiveness, and eco-friendliness, making it a favoured choice in various applications.

– Manufacturing Units: 2

– Installed Capacity: ~3.30 lac/Annum

– Uses: Residential and commercial furniture, wall panelling, architectural mouldings, industrial products, sports goods, display cabinets, CNC routing, flooring, doors, and partition cornices

(ii) Laminates

This segment focuses on laminates, thin decorative layers bonded to MDF, particleboard, or other base materials. Furthermore, The company’s product line encompasses Decorative and Industrial Laminates for Residential and Commercial Spaces. Additionally, It has a portfolio of over 1,200 designs in this segment.

– Manufacturing Units: 3

– Installed Capacity: ~3.49 million sheets/Annum

– Uses: Home furniture, cabinet doors, desktops, wardrobes, wall panelling, and commercial furniture

(G) Revenue Segments

(i) Segment Wise Revenue

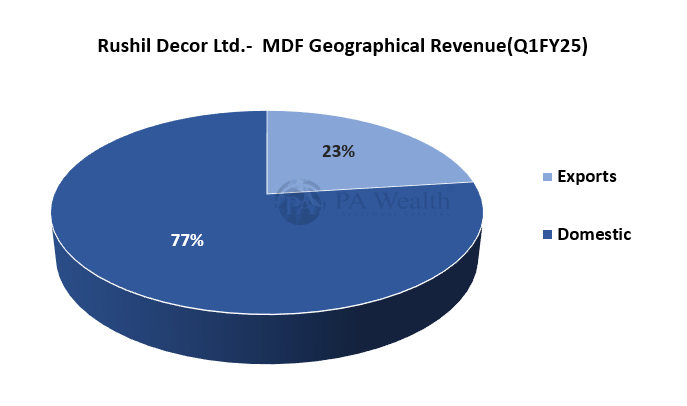

(ii) MDF Board Geography Wise Revenue

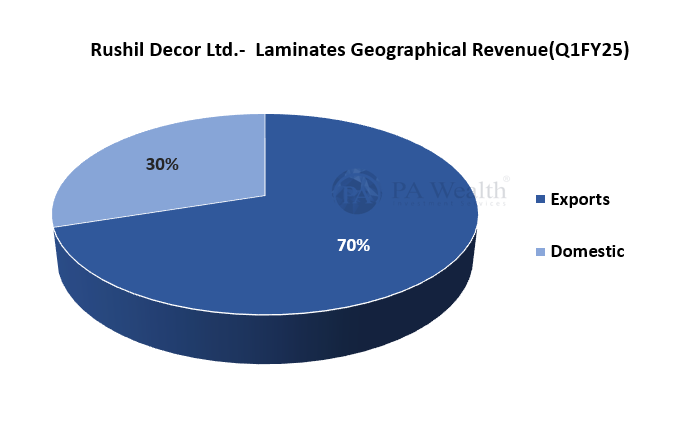

(iii) Laminates Geography Wise Revenue

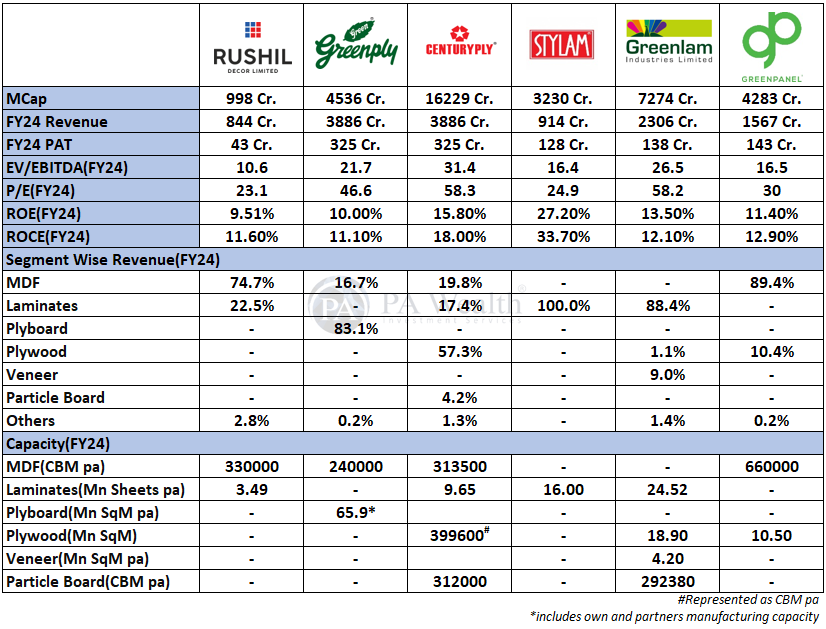

(H) Peer Comparison

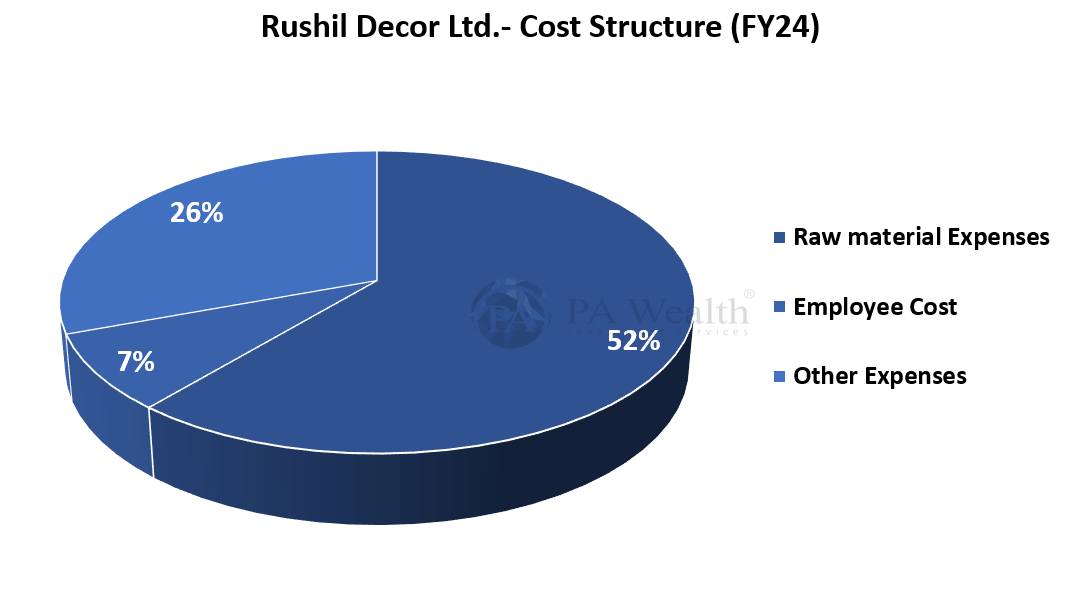

(I) Cost Structure of Rushil Decor

(J) Financials

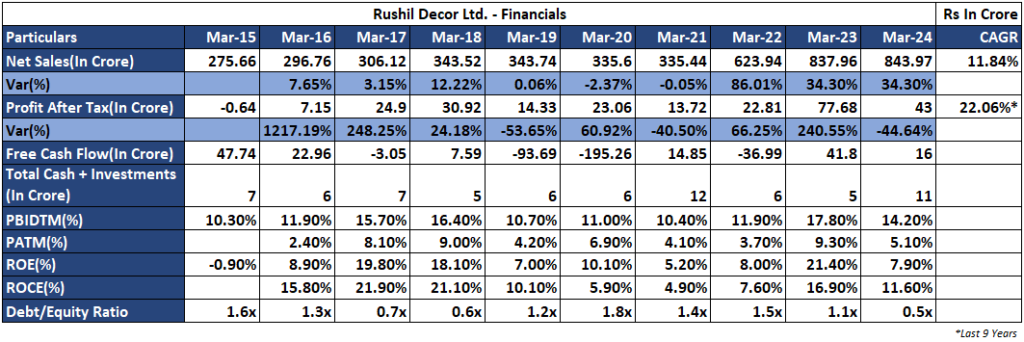

The company’s net sales have increased from Rs 275.66 Cr. in FY15 to Rs 843.97 Cr. in FY24 over the past 10 years at a CAGR of 11.84%. The company’s PAT has grown from Rs -0.64 Cr. in FY15 to Rs 43 Cr. in FY24. Further, The company’s ROE has improved from -0.9% in FY15 to 7.90% in FY24. Additionally, The company’s debt-to-equity has decreased from 1.6x in FY15 to 0.5x in FY24.

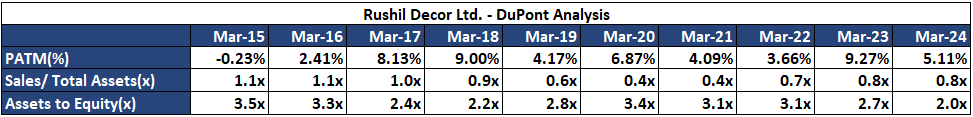

DuPont Analysis

Terms of Trade

(K) Management Discussion and Concall

Concall Q1FY25

- The MDF Sales volume stood at 74,079 CBM growing by 25% year on year for Q1FY25, while laminates sales volume stood at 7.64 Lakh growing by 25% for Q1FY25 year on year.

- The company is targeting to increase the proportion of value-added products to 55% in terms of value from the current proportion of 52% by the next quarter.

- The export volume of the laminate segment grew by 35.8% year-on-year, and the MDF segment showed a 26.1% increase year-on-year.

- The value-added MDF products contributed 45% of the total volume and 55% of the revenue.

- The company raised INR122.66 crores through preferential allotment on warrants. They have already received ₹48.76 crores, of which ₹32.78 crores has been utilized for the jumbo-sized laminate project, ₹1.28 crores for MDF operational capex and ₹3.32 crores for general corporate purpose. The new facility is set to commence operation by the Q3 of FY25.

- The company’s MDF segment grew by 15.3% in terms of revenue year on year for Q1FY25 while its laminates segment grew by 13.5% in terms of sales volume year on year.

- Targeting revenue of approximately INR 950 Crores for FY25, with potential for an additional INR 250-270 Crores from new projects in FY26.

- The company expects EBITDA margins to improve to around 14% for FY25 and be potentially higher in FY26 as new capacities come online and the value-added product mix increases.

Capacity Utilization

- The company plans to optimize its MDF Plant Capacity as well as increase its capacity utilization targeting 95% in FY25, from the current 91% in Q1FY25. Laminate segment capacity is currently at 88%-90% utilization, with the potential to reach 95% in FY25.

- In Q1FY25, The company’s Chikhamgaluru Plant in Karnataka had a capacity utilization of 113%.

Outlook

- The MDF industry from FY11 to FY23 grew at a CAGR of 11% to Rs 5000 Crores and expects it to grow to Rs 6000 Crores by FY25 with an expected volume growth of 20%.

- The Indian Laminates industry is currently valued at Rs 6500 Crores and is expected to reach Rs 9000 Crores at a CAGR of 11.5% by FY26 driven by increasing living standards and consumer preference shift for modern homes.

- The company reported revenue growth of 44% for the MDF Segment for FY23, whereas for the laminates segment revenue growth was 12% for FY23.

- MDF is approximately 30%-35% cheaper than Plywood and offers better moisture resistance whereas laminates are around 1x to 2x cheaper than veneer and offer better scratch-resistant properties as well as are waterproof.

- The company’s future strategy includes expanding its current market presence by adding more distributors and dealers for its products and also emphasizing premiumization by increasing the contribution of value-added products in its overall revenue.

- Increasing incomes, urbanization as well as online shopping trends will drive the Indian Furniture Market’s growth.

- Recently, Rushil Decor stock has split in the ratio of 1:10.

- The company plans to increase its turnover to Rs. 2500 Crores over the next five years.

(L) Strengths & Weaknesses

Strengths of Rushil Decor

(i) Experienced promoters and management team

RDL’s promoters bring extensive expertise in trading, manufacturing, and marketing of wood panel products. Founded by the late Mr. Ghanshyam Thakkar, with over three decades of industry experience, the company is currently led by Mr. Krupesh Thakkar, Managing Director, who boasts nearly two decades of experience in the wood panel industry. Additionally, Mr. Rushil Thakkar, son of Mr. Krupesh Thakkar, has also joined the company. Supported by a team of seasoned professionals, they effectively manage the company’s day-to-day operations.

(ii) Geographically diversified business operations

Exports contributed ~30% to the total sales in Q3FY24. Moreover, RDL has a presence in the export market in its laminates and MDF segments. Its major export destinations are Bangladesh, China, Middle East countries, the US and also European markets.

Weaknesses of Rushil Decor

(i) Susceptibility of operating margin to raw material price fluctuation

RDL’s production costs are largely influenced by raw material expenses, constituting approximately 50% of overall costs. While base paper and kraft paper are sourced locally for laminates, high-quality papers are imported from Europe and the US. Key chemicals like phenol and methanol, crucial for laminate production, are primarily imported from China and the USA, with their prices heavily impacting operational margins due to their variability as crude oil derivatives. Additionally, for MDF manufacturing, wood, resin, and wax are essential, with wood typically sourced from natural forests, posing a risk of price increases due to inadequate supply.

(ii) Intense competition and the cyclical nature of the wood-panel industry

The decorative laminate industry is highly competitive due to the presence of many unorganized players along with large established players. Further, the industry is also exposed to threats from cheap imports from China, Malaysia, Vietnam, and Indonesia. Moreover, the market is intensively competitive as larger players in the industry are quite aggressive in taking part in the demand.

Drop us your query at – info@pawealth.in or Visit www.pawealth.in

References: Rushil Decor Annual Report, News Publications, Investor Presentations, Corporate Announcements, Management Discussions, Analyst Meets & Management Interviews, Industry Publications.

Disclaimer: The report only represents the personal opinions and views of the author. No part of the report should be considered a recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore