Sharda Motor Industries Ltd. is steering innovation with strategic ventures in EV battery systems, lightweight solutions, and technical collaborations. With a growing focus on exports, compliance with evolving emission norms, and robust M&A plans, the company aims to outpace industry growth while expanding its footprint in domestic and international markets.

- About

- Industry Overview

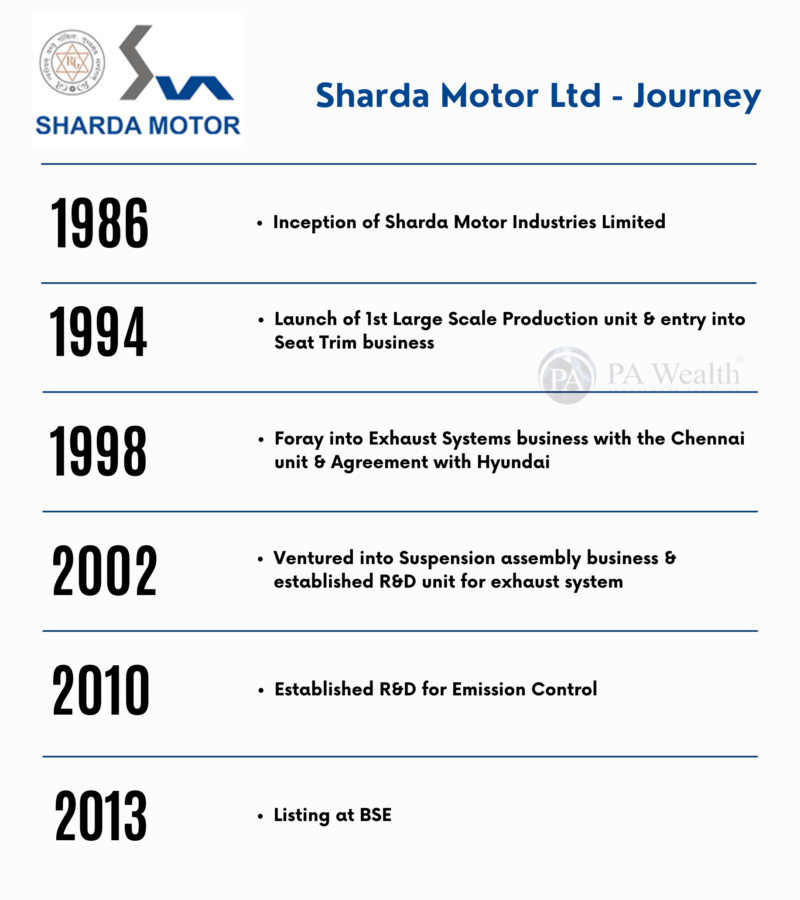

- Journey

- Board of Director

- Shareholding Pattern

- Product Segments

- Revenue Segments

- Cost Structure

- Financials

- Management Discussion & Concall

- Strengths & Weaknesses

(A) About Sharda Motor Industries Ltd. | Stock Analysis

Sharda Motor, incorporated in 1986, is the manufacturer of Exhaust System, Catalytic Converter, Independent Suspension, Seat Frames, Seat Covers (Two Wheelers & Four Wheelers), Soft Top Canopies, and Pressed part- White goods products.

The Company serves as a ‘Tier I’ vendor for some of the major Automobiles and Electronics

Original Equipment Manufacturers (OEMs). ). It has got 10 manufacturing facilities, 3 sales offices, and 1 R&D center across various locations in 4 states of India.

(B) Industry Overview

- It is projected that the EV market will grow by 36% by FY26, and auto components exports are expected to grow & reach US $80bn by FY26 .

- In Q1 FY25, the passenger vehicle segment saw a growth of 5% in sales volume compared to the same period last year, reaching to a total of 12 lakh units.

- Utility Vehicle experienced a significant 20.10% rise, while vans segment grew by 8.6%.

- In the Commercial Vehicle segment, sales grew modestly at 3.8%, reaching to a total of 2.4 lakh units.

- The 2-wheeler segment saw significant growth with sales increasing by 19.8%, reaching to a total of 60 lakhs units.

(C) Journey

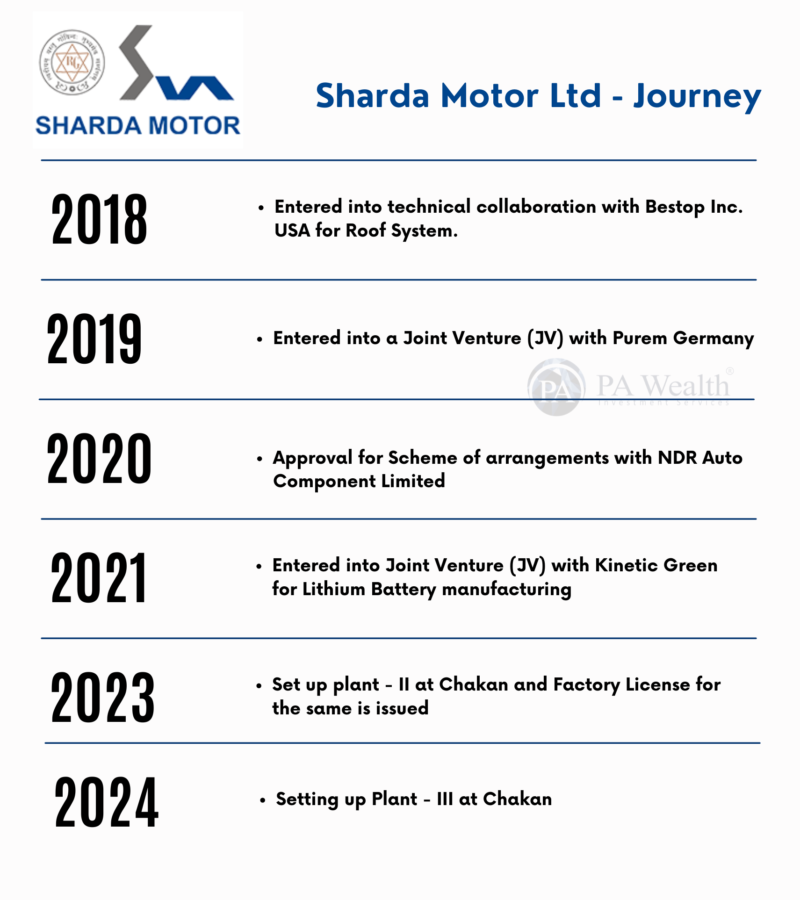

(D) Board of Directors of Sharda Motor Industries Ltd.

(E) Shareholding Pattern of Sharda Motor Industries Ltd.

(F) Product Segments of Sharda Motor Industries Ltd. | Stock Analysis

(i) Exhaust Systems

This segment serves PV, CV and Off-road segment and catering to most of the OEM’s in PV segment. The company has an Indian Market Share of ~30% for passenger vehicle segment. With an annual production of ~1 million units, the company is catering to both, Domestic & International customers.

SMIL caters to major tractor manufacturers like Escorts, TAFE, Kubota, etc., and CV players like Tata Motors, Ashok Leyland, Force Motors, etc.

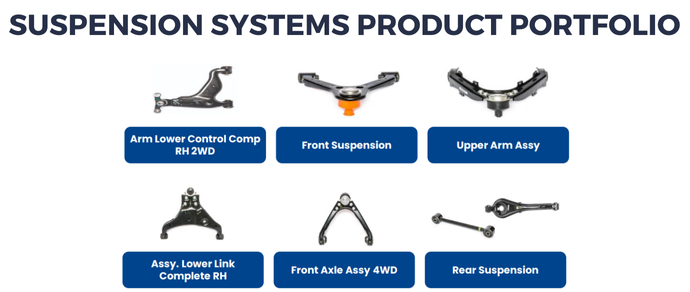

(ii) Suspension Systems

SMIL manufactures suspension systems for the Passenger Vehicles, Commercial Vehicles, and the Off-road segments. The suspension segment has a market share of ~10% in control arms for passenger vehicle segment with two manufacturing units at Nashik and Pune. The company has an annual production of ~1.8 lakh units.

(iii) Rooftops

This is a niche category and SMIL entered this market with a technical collaboration with Bestop Inc. SMIL does convertible canopy and soft top canopy in this segment. This is only a minor contributor to SMIL’s revenues.

(G) Revenue Segments of Sharda Motor Industries Ltd.

(H) Cost Structure of Sharda Motor Industries Ltd.

(I) Financials of Sharda Motor Industries Ltd.

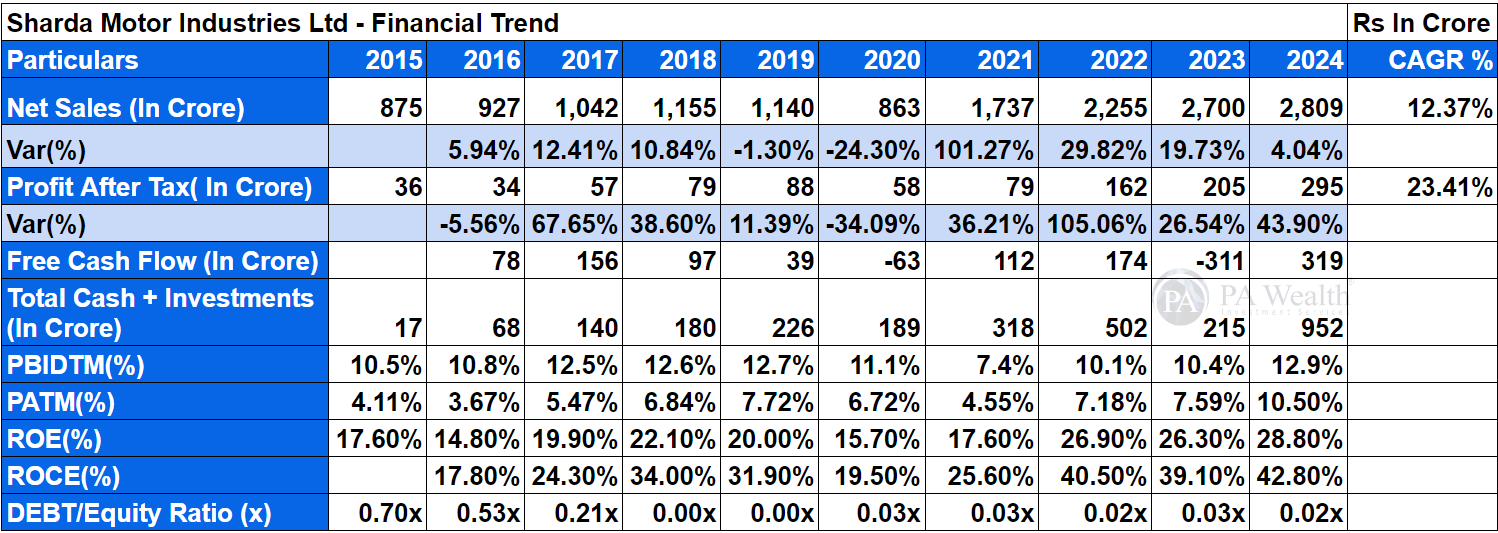

The company’s revenue has grown at a CAGR of 12.37% over the past 10 years, increasing from Rs 875 Cr in FY15 to Rs 2,809 Cr in FY24. Subsequently, the company’s PAT has also shown growth, rising from Rs 36 Cr in FY15 to Rs 295 Cr. in FY24 at a CAGR of 23.41%.

(J) Management Discussion & Concall | Stock Analysis

- The company’s foray into EV space through a JV with Kinetic Green for developing Battery Packs with Battery Management Systems (BMS) has reached the testing phase and the company expects to begin commercial production in the coming quarters.

- They are planning to partner with the OEMs already in sales of EVs, assuring ready market and technology.

- Sharda Motors has entered a technical collaboration with Bestop Inc., USA for the manufacturing of roof systems.

- SMIL and Purem (formerly known as Eberspaecher) has entered a JV to manufacture commercial vehicle exhaust systems in India.

Outlook

- TREM V norms for construction equipment vehicles and all tractors are scheduled to be implemented from April 1, 2026. With the applicability of new emission norms, the Off Highway addressable market for the company will become equivalent or larger than the current Commercial Vehicle market.

- In the PV segment BS-VI RDE norms have been implemented from April, 2023 requiring cars to achieve emission targets even in real world conditions, as opposed to just a laboratory environment. The applicability of RDE norms would increase the content per vehicle by 10-15% for SMIL.

- Company is focused on the US and European markets for exports. Exports currently contribute less than 5% of sales, but management expects substantial growth in this area over the next 3-5 years.

- Over the period of 5 years, SMIL is planning to outperform the industry.

Q2 FY25 Concall Highlights

- Sharda has bought back 10,27,777 equity shares at Rs.1,800 per share, totaling to Rs.185 crores.

- The management’s first preference for cash reserves is M&A focused on powertrain agnostic products.

- Estimated EV Penetration by 2028 in CV will be 1-8% & in Farm Equipment it will be 0-1%.

- In lightweighting vertical, a new plant would be coming up by Q3 FY25, focusing on lightweighting and suspension systems. Approximately ₹50 crores investment will be made on the plant.

- TREM V market (tractors) and off-highway exports, which currently contribute under 5% of sales but are expected to grow significantly.

- 2-wheeler and 3-wheeler segments showed robust performance, while passenger and commercial vehicle segments faced declines.

- The company is focused on expanding its export business and developing new customer relationships, particularly in the construction equipment market.

- The company has a strong customer interest in new product launches in the suspension business, with a new plant expected to commence operations in Q4 FY ’25.

(K) Strengths & Weaknesses

Strengths

1. Established market position and strong customer base:

Experience of around three decades in manufacturing exhaust systems has enabled the promoters to develop heathy relationships with OEMs such as Mahindra and Mahindra Ltd, for which SMIL is the preferred supplier of independent front suspension systems. It also caters to various models of Hyundai Motor India Ltd and Tata Motors Ltd. Apart from exhaust systems, SMIL manufactures and supplies various suspension systems and trades in catalytic convertors for its customers.

2. Debt free company with strong cash generation:

SMIL is a debt-free company with low capital expenditure requirements. It can meet increasing customer demands with minimal incremental capex, which it plans to fund through its strong operating cash flow. Management aims to use the generated cash for inorganic opportunities in powertrain-agnostic products or to return it to shareholders through higher dividend payouts.

Weaknesses

1. Customer concentration

The top 3 customers account for ~75-80% of revenue. Loss of any of these customers could have a substantial impact on the company’s financials.

2. Susceptibility to increase in raw material prices and pricing pressure from OEMs:

The company has limited bargaining power with OEMs, which periodically revise prices based on their financial standing and willingness. As such, any benefit in operating margin comes with a lag. SMIL has strong market position and niche product profile which enables it to pass on price increases, although with a lag, supported by healthy and sustained EBITDA margin.

Drop us your query at – info@pawealth.in or Visit pawealth.in

References: Annual Reports, News Publications, Investor Presentations, Corporate Announcements, Management Discussions, Analyst Meets and Management Interviews, Industry Publications.

Disclaimer: The report only represents the personal opinions and views of the author. No part of the report should be considered a recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore