Styrenix Performance Materials is experiencing a rapid transformation under new leadership, with a particular emphasis on capacity development and manufacturing debottlenecking. The company has also expanded its product portfolio by diversifying its offerings.

- About the company

- Journey Since Inception

- Board Members

- Shareholding Pattern

- Product Portfolio

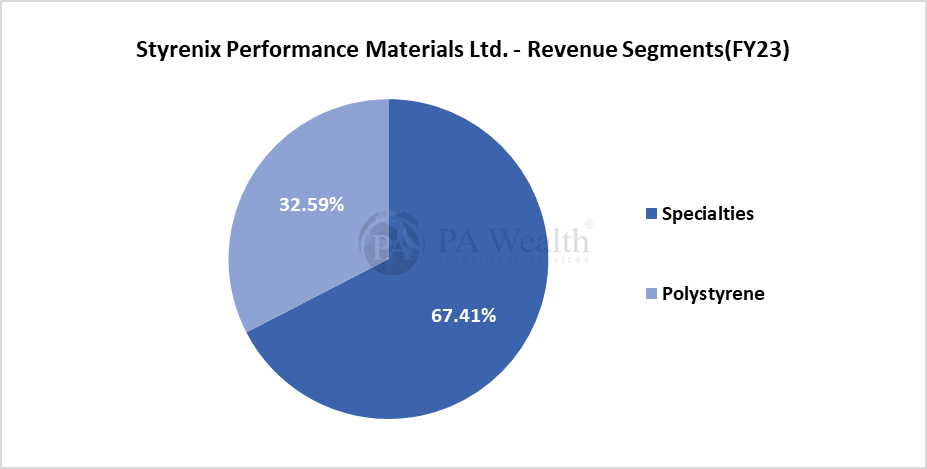

- Revenue Segments

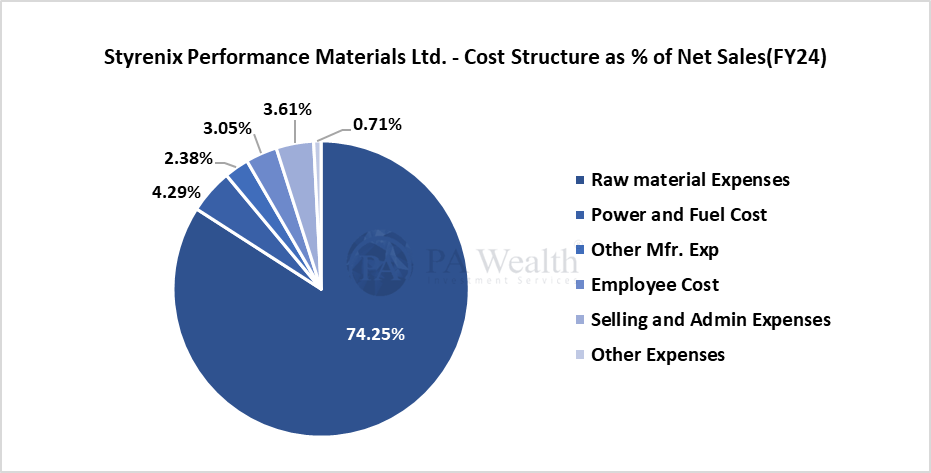

- Cost Structure

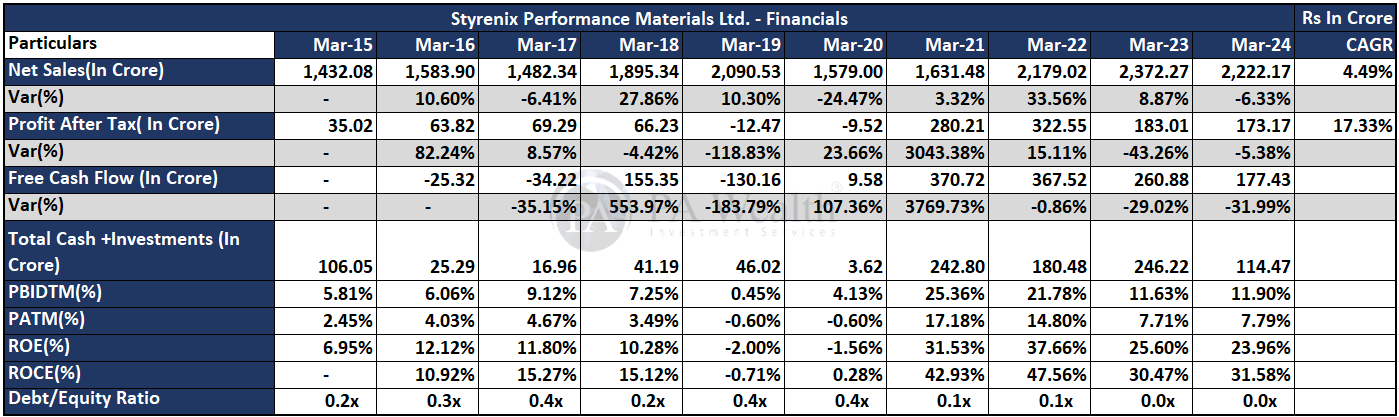

- Financial Parameters

- Management Key Highlights

- Strengths & Weaknesses

(A) About

Styrenix Performance Materials Limited (SPML), based in Gujarat, is a major manufacturer of ABS, SAN, and polystyrene. Originally incorporated as ‘ABS Plastics Ltd.’ on December 7, 1973, by Rakesh Agarwal, the company has seen multiple ownership changes among different international chemical groups over the years.

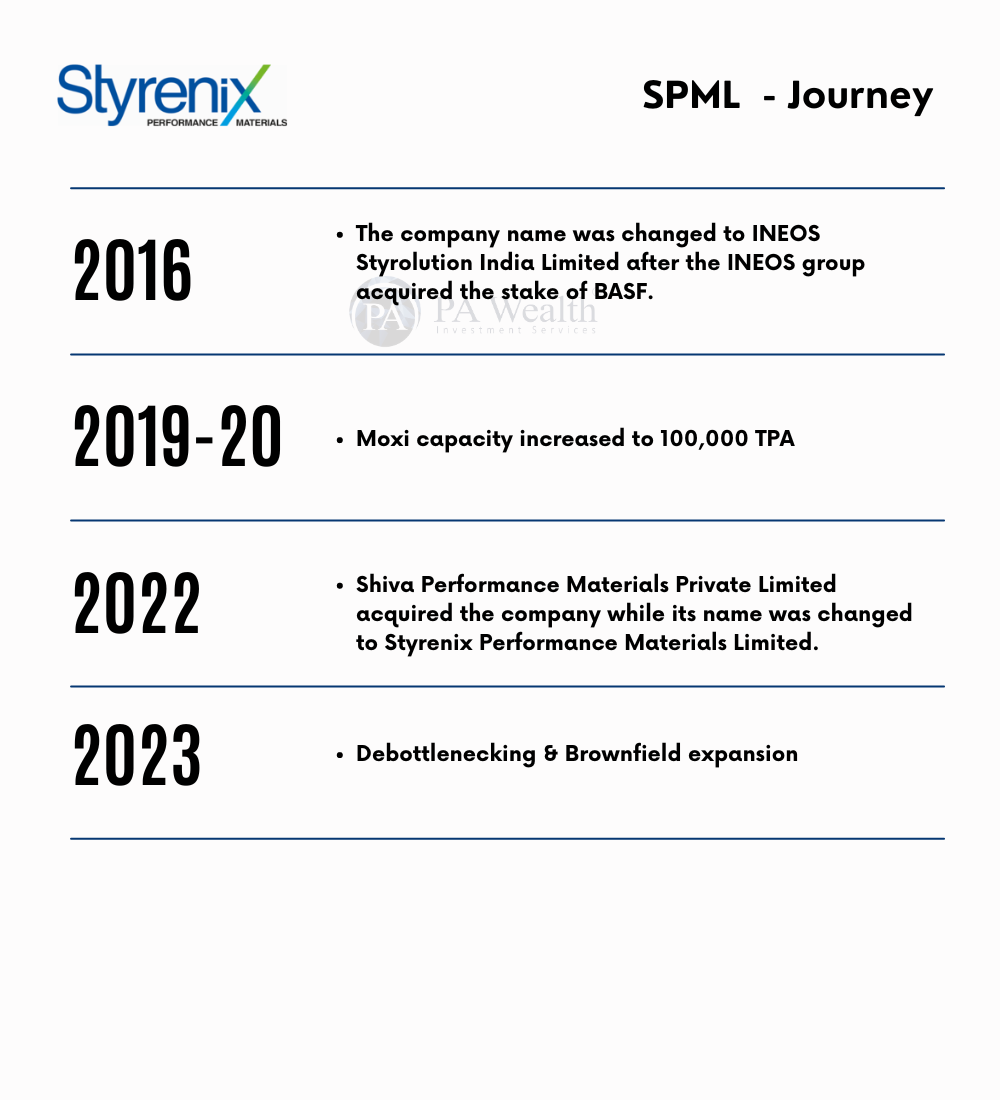

On August 1, 2022, Shiva Performance Materials Private Limited, owned by Rakesh Agarwal and his family, went into a share purchase agreement with INEOS Styrolution India Ltd. As part of this agreement, SPMPL acquired ISAPL’s full 61.19% equity stake in SPML. Additionally, in November 2022, SPMPL further grew its stake by acquiring another 1.54% of the company through an open offer.

Formerly known as INEOS Styrolution India Limited, Styrenix Performance Materials Limited is the main producer of Absolac (ABS) and Absolan (SAN) in India. With 45 years of pioneering experience, SPML has established itself as the most preferred supplier to its customers.

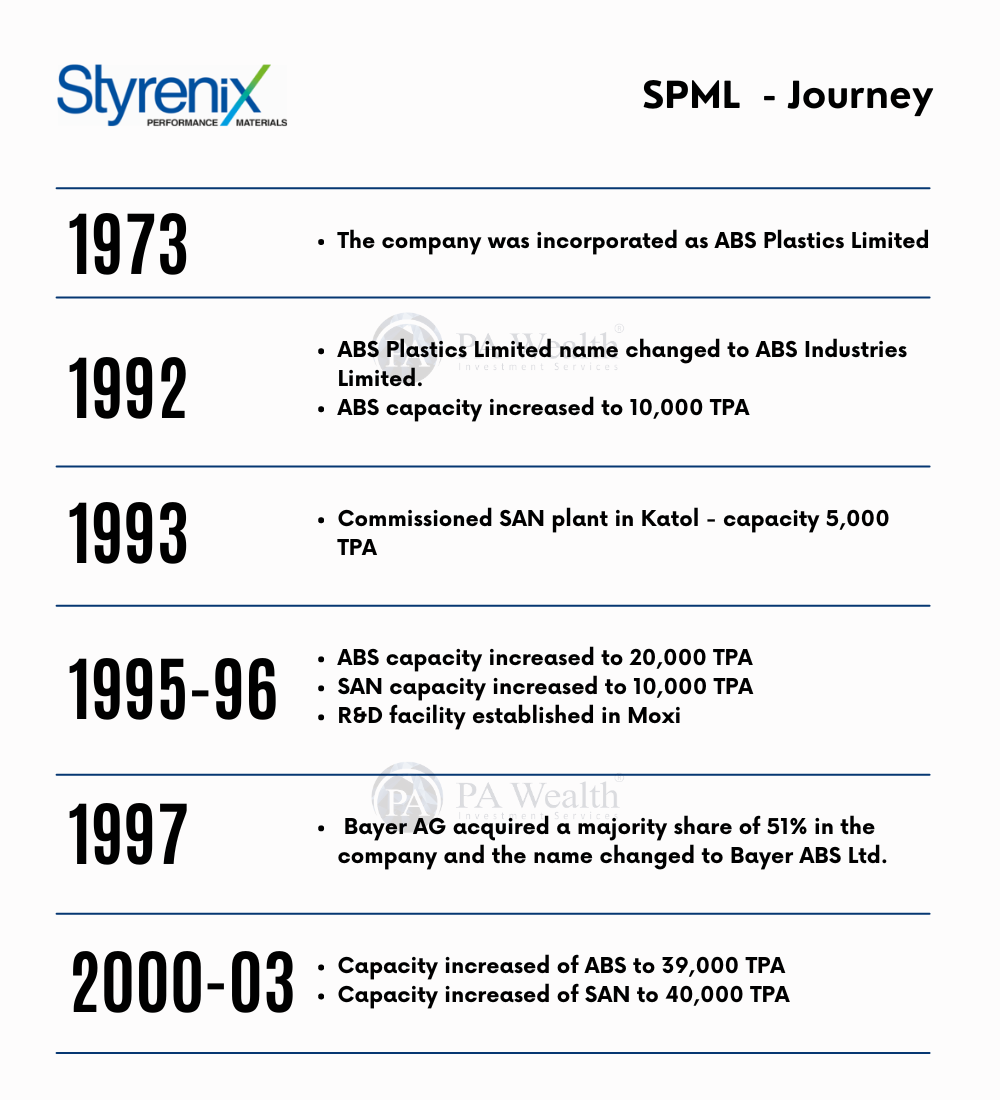

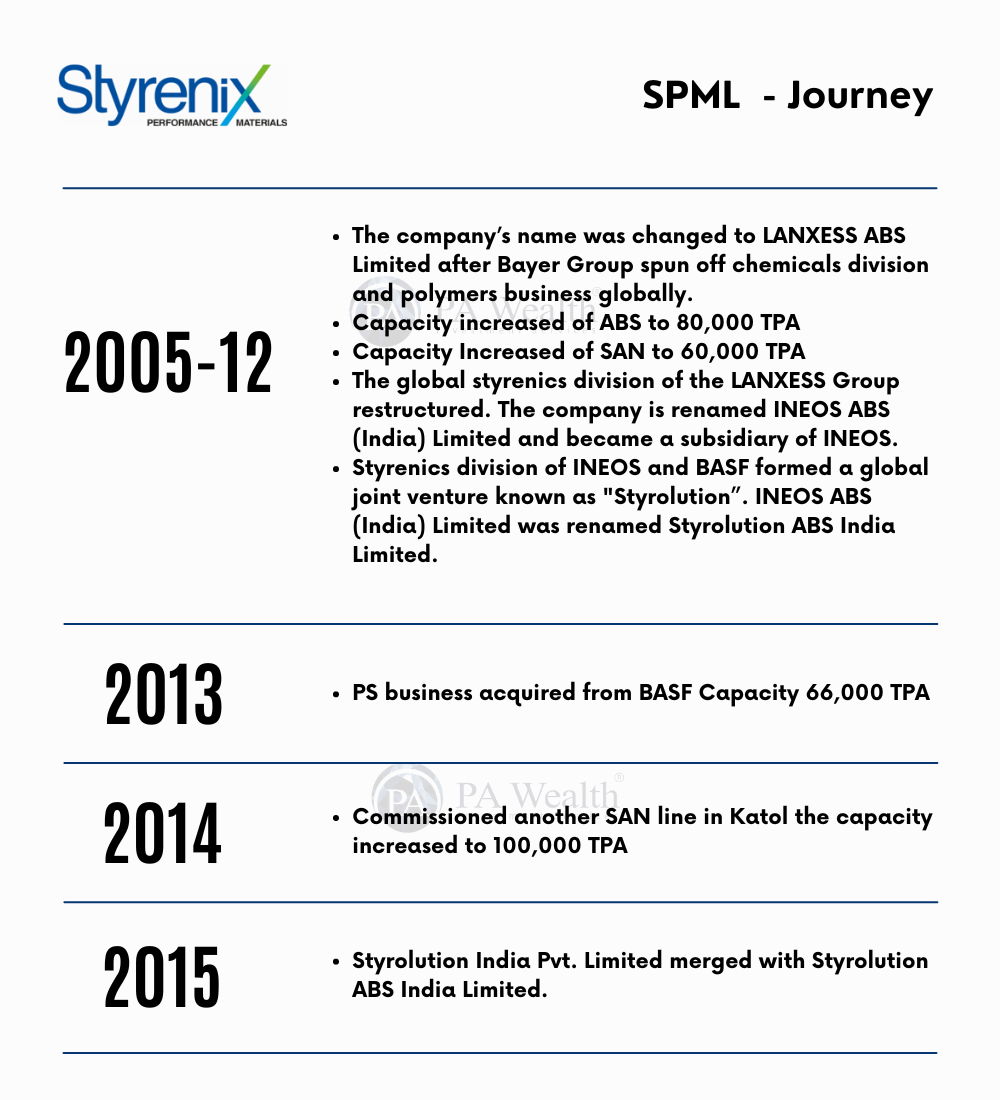

(B) Journey of Styrenix Performance Materials

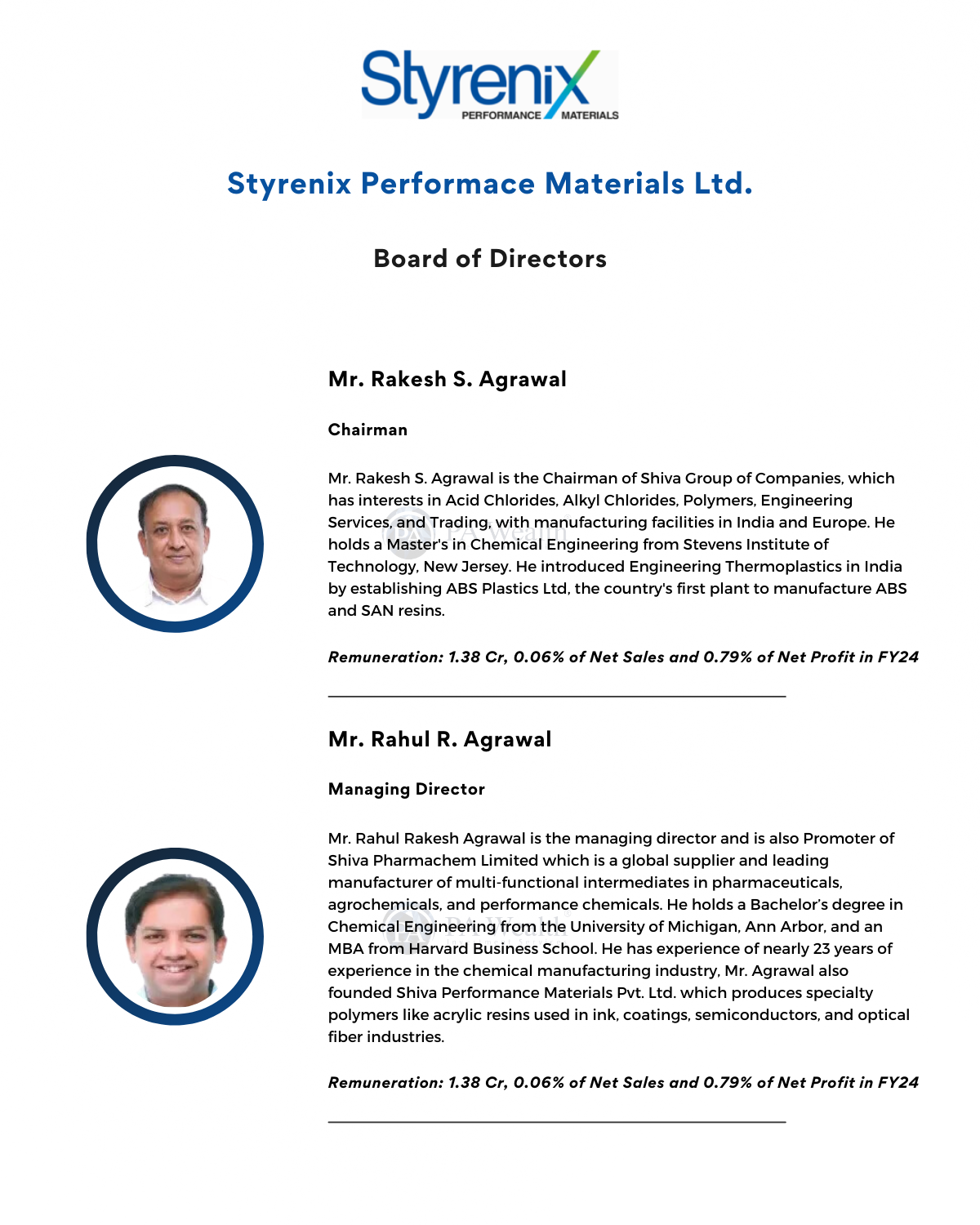

(C) Board of Directors of Styrenix Performance Materials

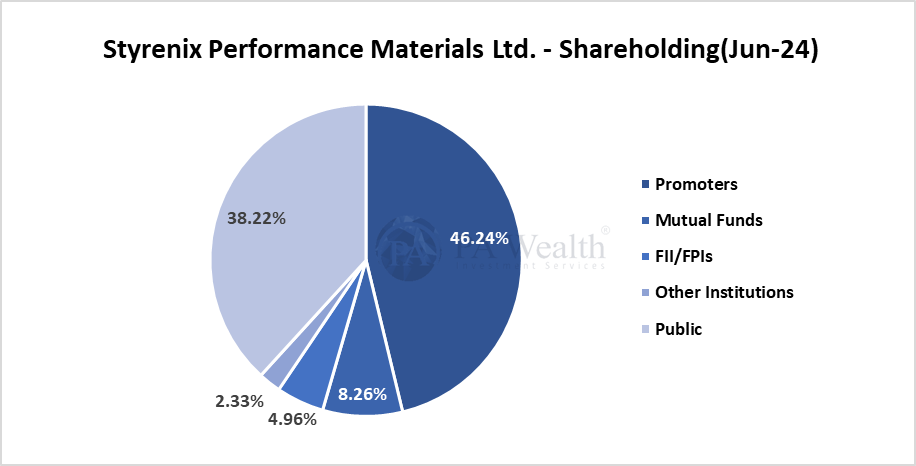

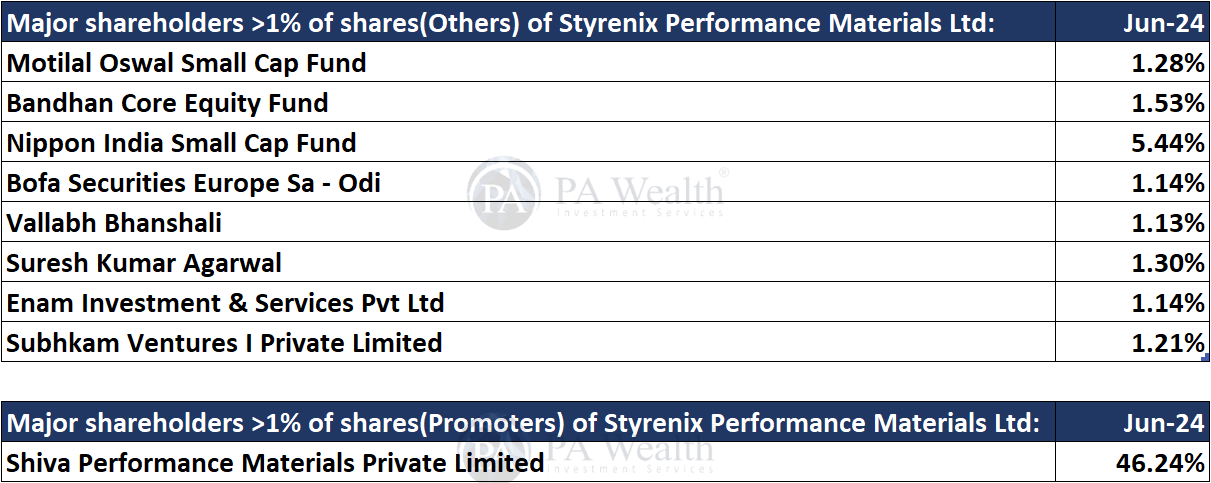

(D) Shareholding Pattern of Styrenix Performance Materials

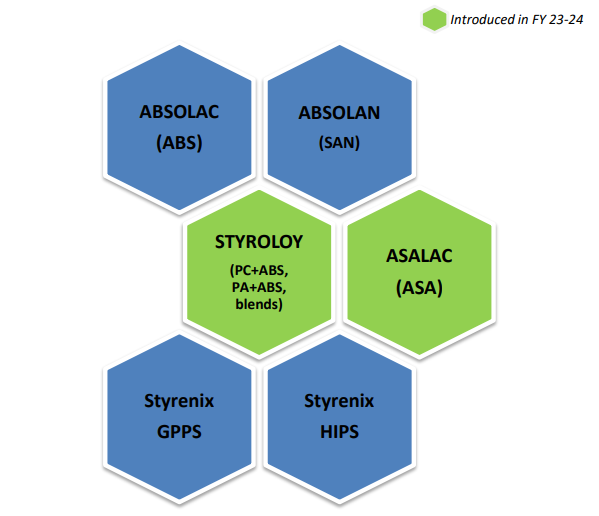

(E) Product Portfolio

ABSOLAC (ABS): Acrylonitrile Butadiene Styrene (ABS) is a popular thermoplastic polymer used in injection moulding applications. ABS is known for its good mechanical qualities and ease of processing. It has applications in automotive, large home appliances etc.

ABSOLAN (SAN): Styrene Acrylonitrile (SAN) is another thermoplastic polymer that offers better thermal resistance and rigidity compared to ABS. SAN is often used in applications which need these qualities, such as in certain consumer goods and industrial components.

Styroloy (PC+ABS, PA+ABS, blends): Styroloy is a name which was introduced by the company in FY24 and represents blends of ABS with other polymers like Polycarbonate (PC) and Polyamide (PA). These blends combine the qualities of the constituent polymers to achieve a balance of toughness, heat resistance, as well as impact resistance.

ASALAC (ASA): Acrylonitrile Styrene Acrylate (ASA) is a thermoplastic polymer similar to ABS but with better weather resistance. Its general use includes outdoor applications as well as Automotive where exposure to UV light and weathering is a concern.

Styrenix GPPS: General Purpose Polystyrene (GPPS) is a clear, hard, and brittle plastic. Furthermore, It is widely used in plastic cutlery, stationary, and disposable laboratory ware applications.

Styrenix HIPS: High Impact Polystyrene (HIPS) is a polystyrene resin modified with rubber to improve its impact strength. Additionally, HIPS is widely used in goods like refrigerator liners, food packaging, and toys.

(F) Revenue Segments

(G) Cost Structure of Styrenix Performance Materials

(H) Financials of Styrenix Performance Materials

The company’s revenue has grown at a CAGR of 4.49% over the past 10 years from Rs 1432.08 Cr. in FY15 to Rs 2222.17 Cr. in FY24. Subsequently, The company’s PAT has grown from Rs 35.02 Cr. in FY15 to Rs 173.17 Cr. in FY24 at a CAGR of 17.33%. Furthermore, the company’s ROE increased from 6.95% in FY15 to 23.96% in FY24.

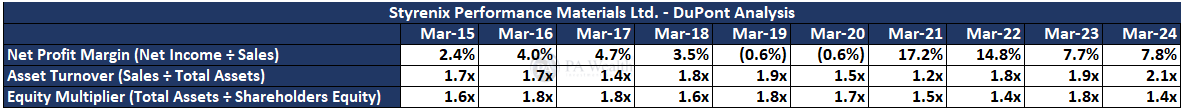

DuPont Analysis

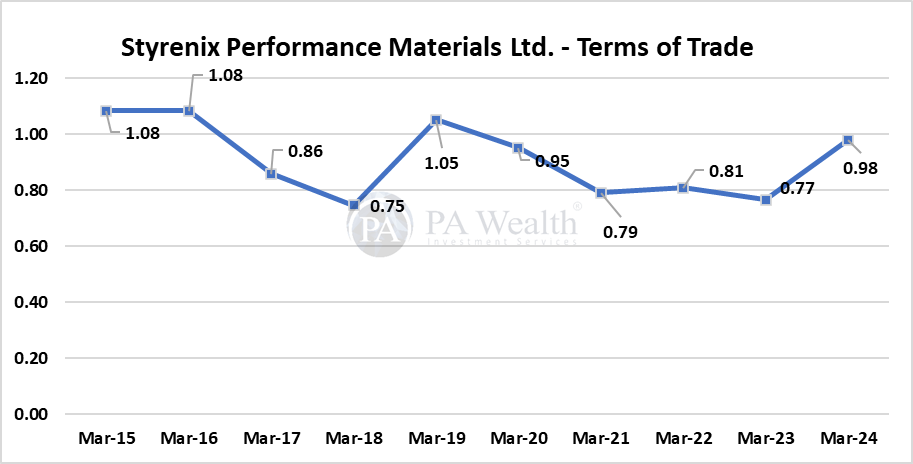

Terms of Trade of Styrenix Performance Materials

(I) Management Discussion

Outlook

- Customers of the company’s products are becoming more cost-conscious as well as are seeking creative solutions, putting pressure on producers to adapt and deliver.

- The company expects considerable growth prospects in India, driven by an expanding population, a developing middle class with rising disposable income, and an equal demand for consumer items and packaging materials.

- Government programs such as “Make in India” and “Smart Cities Mission” are accelerating the market for polymer-based products used in construction, transportation, and other industries that have traditionally been the company’s target markets.

- India’s reliance on imported polymer resins to supply domestic demand puts pressure on local manufacturers, potentially reducing pricing and profits.

- The company aims to strengthen its position in specialities while maximising its margins through product mix and the addition of New grades and blends to the product portfolio.

- The company is focusing on maximizing its business value. Its strategy includes Debottlenecking and brownfield expansion, portfolio expansion and cost optimisation.

- The company’s addressable market for the new blends is estimated to be around 40,000 to 50,000 tons in India. This market includes various blends, such as PS, ABS, ASA, and PA blends, which are expected to see high growth.

Concall Highlights

- Sales volume increased by 8.6% compared to Q4 FY24 and 21% compared to Q1 FY24. Revenue increased by 16.7% compared to Q4 FY24 and 28.5% compared to Q1 FY24. Profit after tax was 8.7%, better by 0.5% compared to Q4 FY24 and by 2.8% compared to Q1 FY24.

- The company reported Q4 FY24 revenue of Rs. 599 crores while FY24 revenue is Rs. 2,222 crores down from Rs. 2,372 crores in FY23. Further Q4FY24 EBITDA stands at Rs. 74 crores while FY24 EBITDA stands at Rs. 273 crores down from INR 290 crores in FY23. EBITDA margins stayed stable at 12.4% for Q4 and 12.2% for FY24.

- The company’s sales volume grew by 10.7% Year on Year to 165 kt for FY24 while it increased by 25% compared to the last quarter Q3FY24.

- The company witnessed lower volumes in Oct to Dec Quarter due to demand drop post-festival season which always tends to bounce back in Q1FY25.

- Revenue and Margins which were higher from the Covid period and then geopolitical tensions have normalized from Q2FY23, this led to an impact on the company’s top line and margins despite growth in sales volume.

- The company is increasingly focusing on increasing production capacity and improving product margins. It emphasises sustaining growth through operational efficiencies, cost reductions, and strategic market positioning.

- SMPL focuses on capturing the domestic market due to its strong brand presence and demand in India. Export opportunities will be considered strategically as additional capacities become available.

- The company is targeting volumes of over 205 KT or 210 KT per annum over the next few years at an annual growth rate of over 15%.

- The company has increased its share of ABS and PS from ~30% and ~20% respectively, from ~27% and ~17% last year.

New Products

- The company introduced two new products STYROLOY which is for blends and ASALAC (ASA) an import substitute. Subsequently, These will allow the company to increase its market presence and revenue streams.

- The company’s income spreads were affected by operational disruptions during the current fiscal which stabilised soon. Future spreads are expected to improve with new product segments and capacity expansions.

Capex

- The company plans to increase ABS annual capacity to 210 kt by FY 2028. The estimated capex for the expansion projects is around INR 600-650 crores, with detailed studies underway to refine these estimates. Furthermore, A contract has been awarded to M/s. Mott MacDonald Private Limited for engineering consultancy.

- ABS capacity is set to rise from 85 kt to 105 kt, and Polystyrene(PS) capacity from 66 kt to 105 kt through ongoing debottlenecking projects. No significant capex is expected for FY ’25 beyond ongoing debottlenecking efforts.

(J) Strengths & Weaknesses of Styrenix Performance Materials

Strengths

(i) Market leader in ABS and SAN business in India which has diversified application

The company, SPML, has been a pioneer in the production of ABS under the brand name ‘Absolac’ and SAN under the brand name ‘Absolan’, the Market leader in both product groups in India. ABS and SAN are versatile engineering thermoplastic material and their high-impact, ignition-resistant etc. meet the application requirements across a broad range of market segments. ABS finds application across industries such as electrical and electronics, automotive, domestic consumer durables, information technology, etc., while SAN is mostly used in the stationery, makeup, packaging, toys and extrusion segments.

(ii) Diversified clientele

SPML caters to the ABS needs of leading automobile manufacturers in India on a contractual basis. It benefits from its presence in the specialty grade of ABS where it gets relatively less competition from imports. Apart from the automobile sector, SPML caters to the demand from home consumer durable applications along with demand for the other commodity grades of ABS, which in turn results in a large and diverse customer base.

Weaknesses

(i) Pledge of entire promoter group holding in SPML

The entire 62.73% equity stake of the new promoter group in SPML is pledged for debt availed for the acquisition of this stake in favour of the lenders of this debt which limits the financial flexibility. This debt availed at the promoter level is without any recourse to SPML, and accordingly, no obligation for servicing of this debt is expected to be on SPML in any way, as articulated by the management.

(ii) Volatility associated with prices of crude-linked raw materials and foreign exchange rate fluctuations

Acrylonitrile and styrene are the main raw materials used in the manufacturing of ABS, SAN and polystyrene. Moreover, These basic materials are derivatives of crude oil and thereby prone to the risk of inherent volatility in global crude oil prices. Raw material imports generally constituted 70%-80% of its entire raw material requirement. Since SPML has negligible export revenues, it is also exposed to foreign exchange rate fluctuations on its imports.

Drop us your query at – info@pawealth.in or Visit pawealth.in

References: Annual Reports, News Publications, Investor Presentations, Corporate Announcements, Management Discussions, Analyst Meets and Management Interviews, Industry Publications.

Disclaimer: The report only represents the personal opinions and views of the author. No part of the report should be considered a recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore