In today’s volatile market, investors seek stability and diversification. Although Gold and Silver prices in India are hitting an all-time high. These Mutual Funds still offer a unique opportunity to achieve both and also have the potential to earn attractive returns. In this blog Let’s explore why you should consider adding these precious metals to your investment portfolio.

- About

- How it Works

- Advantages and Disadvantages

- Categories

- Returns

- Benefits of Investing in Mutual Funds

- Differences, Mutual Funds and ETFs

- List of top mutual funds

- Taxation

What is gold and silver mutual fund?

Gold and silver mutual funds invest directly or indirectly in these assets. These investment vehicles concentrate on gold and silver-related products such as bullion, coins, mining stocks, and Their exchange-traded funds. They are growing more popular in India due to their tax advantages, high liquidity, and low transaction costs.

“These funds, commonly structured as fund of funds (FOFs), invest in various gold and silver-related funds or ETFs. Their performance closely follows the market price of these commodities, appealing to investors seeking exposure to precious metals.

How it works

These mutual funds pool money from many participants to invest in gold and silver-related assets. A professional fund manager manages these investments, making decisions based on market trends and asset performance.

These mutual funds provide liquidity, allowing investors to buy or sell units at current market values with lower transaction fees than owning real gold and silver. Investing in these funds allows individuals to diversify their portfolios, buffer against inflation, and even profit from price appreciation in both metals.

Advantages and Disadvantages of Investing in Mutual Funds

Advantages

- Gold and silver mutual funds allow investors to diversify their holdings while reducing overall risk. These are frequently regarded as safe investments during stock market downturns.

- Qualified professionals manage these funds, making investment decisions based on market conditions, which can lead to higher returns than individual precious metal investments.

- Selling gold and silver jewellery or coins can be time-consuming and may result in losses due to processing fees or price differences between buy and sell prices and the mutual fund units, on the other hand, provide extreme liquidity and allow easy buying and selling.

Disadvantages

- Market volatility has an impact on gold and silver mutual funds since their value is directly related to their prices, which can fluctuate dramatically, resulting in big changes in the value of your investment.

- Expense ratios for these mutual funds often include management costs, which can diminish returns; excessive fees can balance the potential benefits from investing in Precious Metal, so it’s critical to compare various funds.

- Investing in these mutual funds requires you to give up control over specific investment decisions to the fund manager, which might be a drawback for individuals who prefer a more hands-on approach and prefer to select individual assets themselves.

Categories of mutual funds

There are 2 categories of Mutual Funds – FOFs & Actively managed fund

- Their Funds of Funds (FoFs) invest in other asset ETFs or mutual funds, adding an extra layer of management costs while diversifying across many underlying gold assets.

- In an Actively managed Fund, the Fund managers actively monitor gold and silver funds, buying and selling futures contracts, gold and silver mining company stocks, or a mix of both to outperform the prices of gold and silver.”

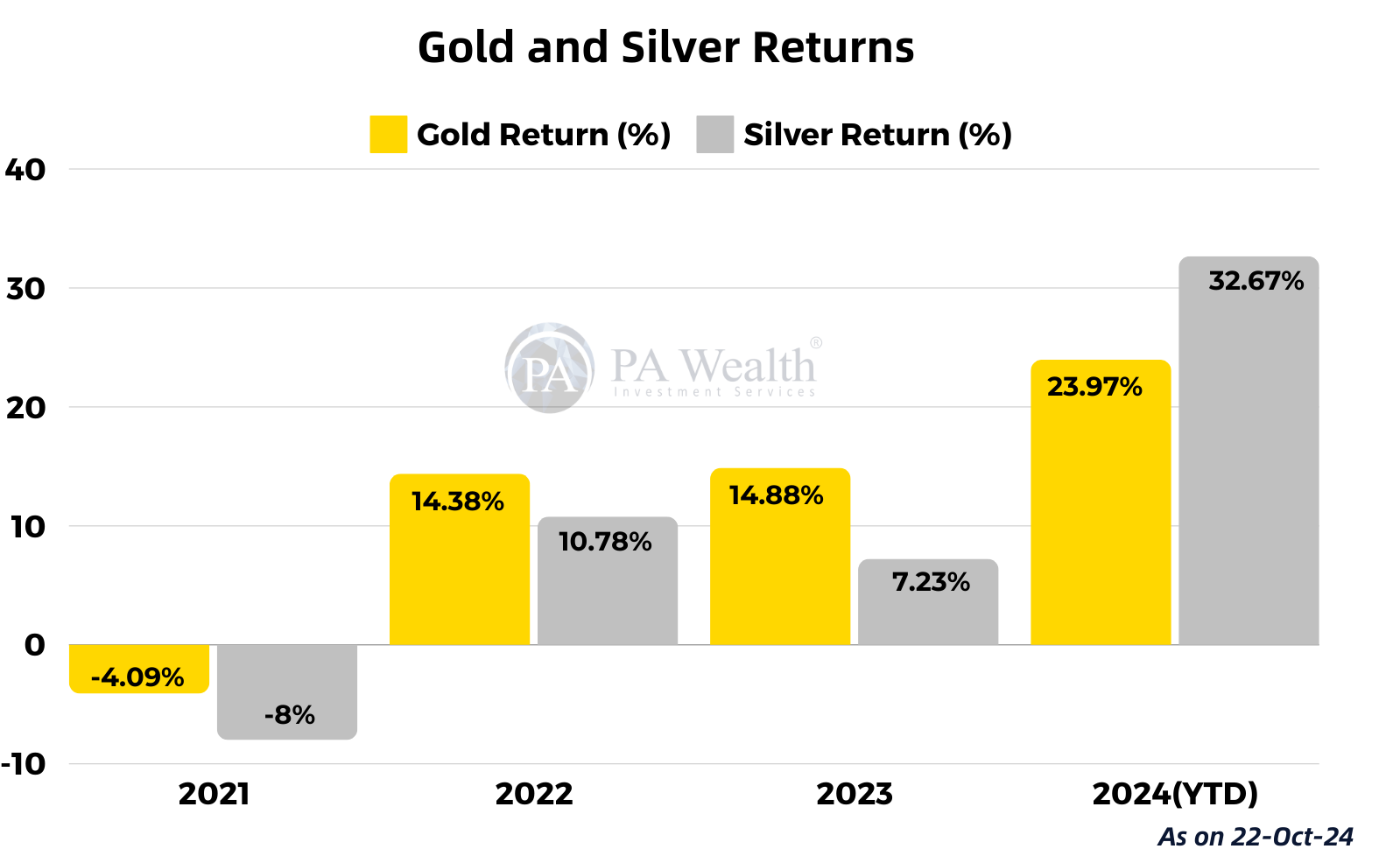

Gold and Silver Returns Over the Last Five Years

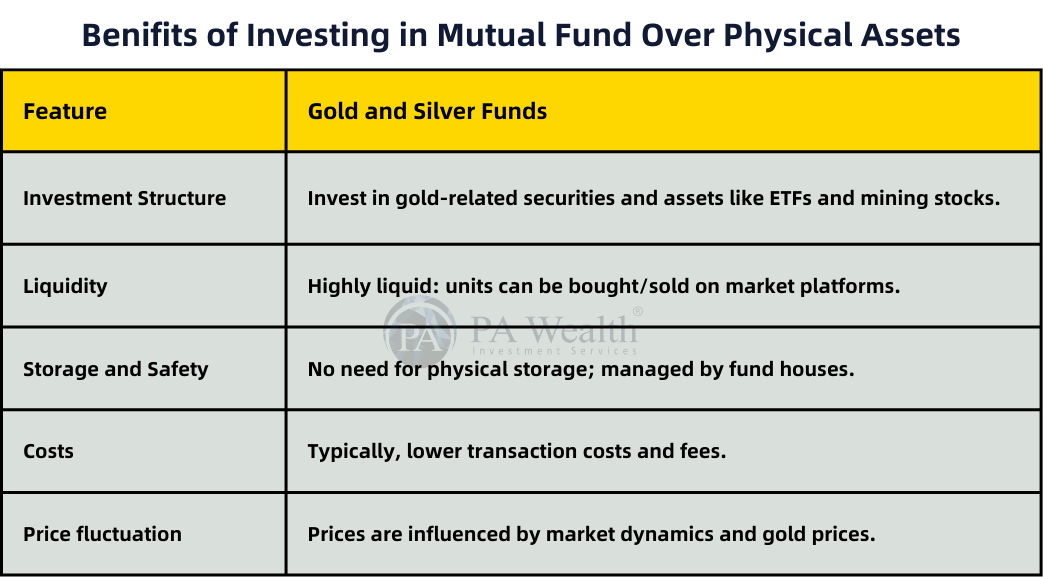

Benefits of Investing in Mutual Funds

Differences Between Gold Mutual Funds and Gold ETFs?

- Investment Method: Investors buy gold and silver ETFs on stock exchanges much like stocks, which necessitates a Demat account. In contrast, like other mutual funds, they can buy gold and silver funds directly from the fund company without the requirement for a Demat account.

- Transaction costs: Trading gold and silver ETFs often incurs no costs. If you redeem your units during the lock-in period, gold and silver mutual funds may charge you an exit load.

- “ETFs offer more liquidity since they are listed on stock markets. They do not impose exit loads, allowing you to buy and sell at any time during market hours. In contrast, you can redeem gold mutual fund units by selling them back to the fund at its current NAV.”

- Pricing: The pricing algorithms for gold and silver mutual funds, as well as their ETFs, are separate. The NAV determines the price of mutual fund units and is published at the conclusion of each trading day. In contrast, gold and silver ETFs trade on stock markets and provide real-time price information.

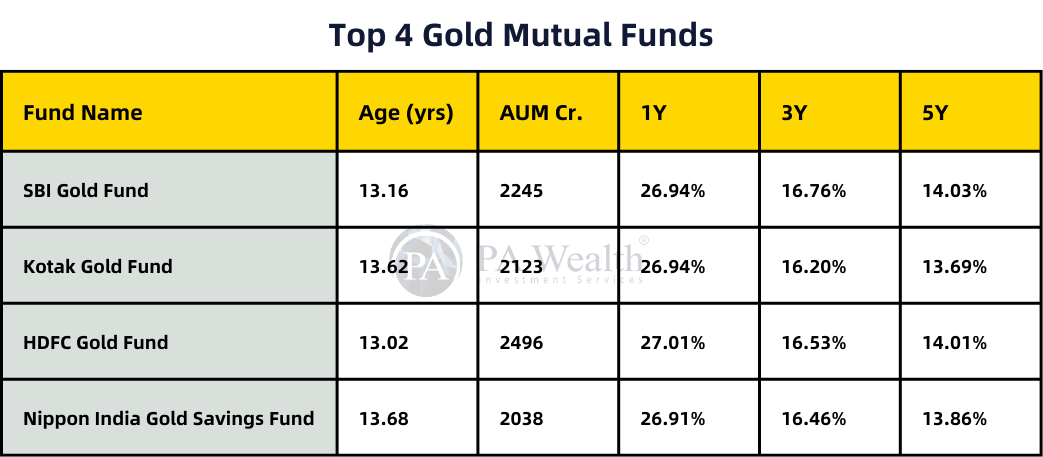

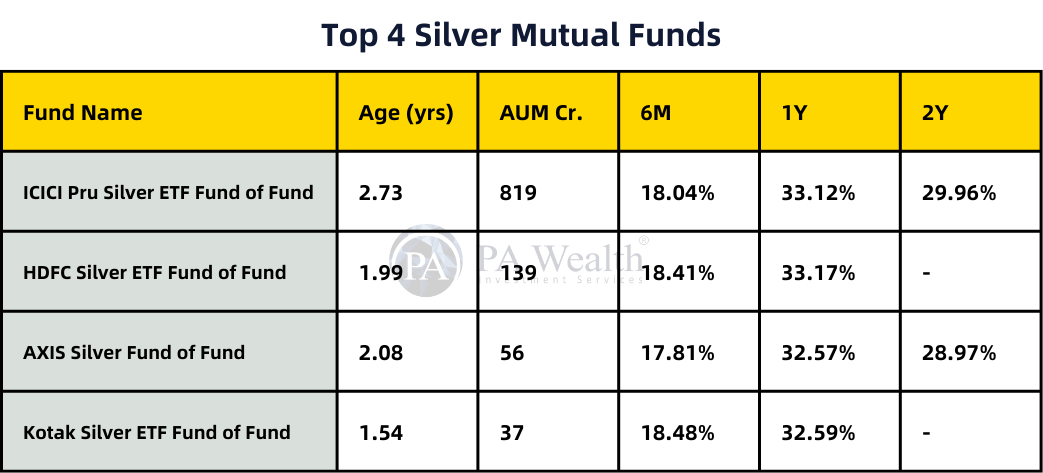

List of gold and silver mutual funds in India

Taxation

Old rule: Gold mutual fund units purchased before March 31, 2023, and sold after three years will be subject to long-term capital gains (LTCG) tax at a rate of 20%, along with the benefit of indexation.

If investors purchase gold mutual fund units after April 1, 2023, they will add the gains to their taxable income and pay tax according to the applicable income tax slab rates.

New rule: There is no special tax rate for investing in gold mutual funds during this interim period. If investors buy units between April 1, 2023 and March 31, 2025, they must include any gains in their taxable income and pay tax at their respective slab rates, regardless of the holding period. Investors who buy gold mutual fund units after March 31, 2025 and sell them after two years would pay a 12.5% tax on the profits, without the advantage of indexation.

Drop us your query at – info@pawealth.in or visit pawealth.in

References: valueresearchonline.com, Industry’s Publications, News Publications, Mutual Fund Company.

Disclaimer: The report only represents personal opinions and views of the author. No part of the report should be considered as recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore