NRIs Pay Zero Tax on Indian Mutual Fund Gains: A New Era for Cross-Border Investing

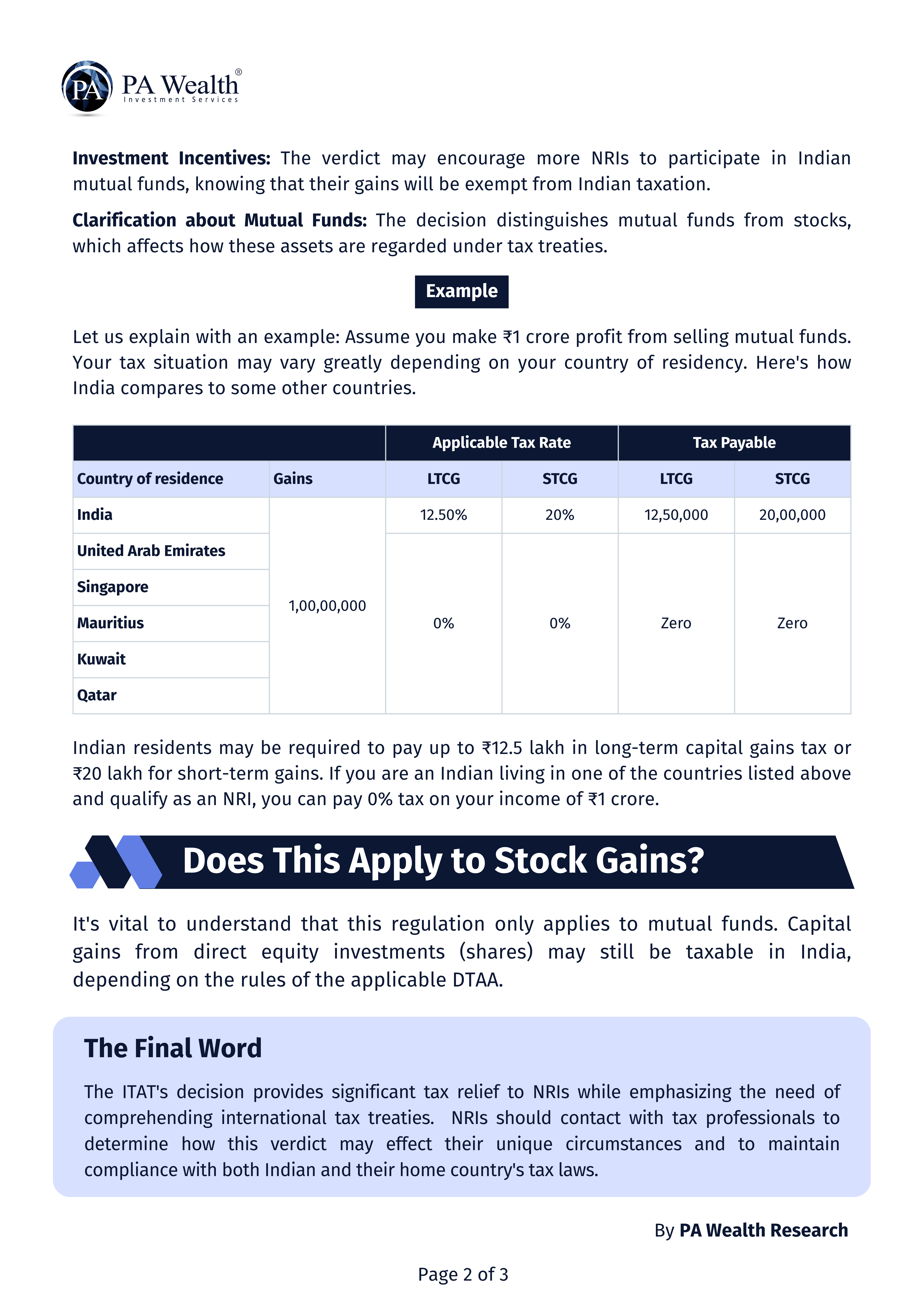

For many Non-Resident Indians (NRIs), investing in Indian mutual funds has always come with a layer of tax uncertainty and complexity. Now, a groundbreaking ruling from India’s Income Tax Appellate Tribunal (ITAT) has transformed the landscape, ensuring that NRIs living in countries with favorable tax treaties can enjoy tax-free gains on their Indian mutual fund investments. This decisive verdict separates mutual funds from stocks under tax laws, opening doors for NRIs to grow their wealth in India without the burden of capital gains tax back home. For global investors seeking to maximize returns while staying compliant, this ruling isn’t just a tax relief. It’s a powerful incentive to revisit India’s thriving mutual fund market.

Drop us your query at – info@pawealth.in or Visit pawealth.in

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore