Triveni Engineering & Industries Ltd is an Integrated and diversified conglomerate in areas of sugar, ethanol and engineering. it is located strategically in sugarcane-rich western and central belt of UP. The company is among the Top 3 manufacturers in India for sugar & second highest supplier for ethanol.

- About

- Industry Overview

- Journey

- Board of Director

- Shareholding Pattern

- Business Segments

- Revenue Segments

- Cost Structure

- Financials

- Management Discussion & Concall

- Strengths & Weaknesses

(A) About Triveni Engineering & Industries Ltd. | Stock Analysis

Triveni Engineering & Industries Ltd is a diversified Indian conglomerate with a strong foothold in sugar manufacturing, ethanol production, and industrial engineering. The company follows a forward-integrated business model, combining sugar production with power co-generation and distillery operations to ensure stable and diversified revenue streams. In addition, Triveni continues to expand its footprint in water management and power transmission, reinforcing its commitment to sustainable industrial and environmental solutions.

With operations strategically located in sugarcane-rich regions, Triveni leverages its technological expertise and operational efficiency to maintain consistent production, optimize costs, and drive long-term profitability. By emphasizing innovation, diversification, and renewable energy, the company remains well-positioned to navigate the cyclical nature of commodity markets and sustain growth across its business segments.

(B) Industry Overview

1. Sugar Industry

- Boosting productivity: Triveni drives sugarcane output through robust varietal replacement programs, promoting high-yield, high-sucrose varieties and reducing dependence on Co 0238.

- Enhancing efficiency: The company applies advanced crop practices—like spaced row, trench, and autumn planting—while upgrading turbines to backpressure systems to raise crush rates, improve refined sugar output, and cut production costs.

- Expanding acreage: With favorable monsoon forecasts and early spring planting, sugarcane area is expected to grow in SS 2025-26.

- Stable pricing environment: FRP for SS 2025-26 rose 4% to ₹355/quintal, while UP’s SAP and sugar MSP remain unchanged, helping balance farmer income and industry margins.

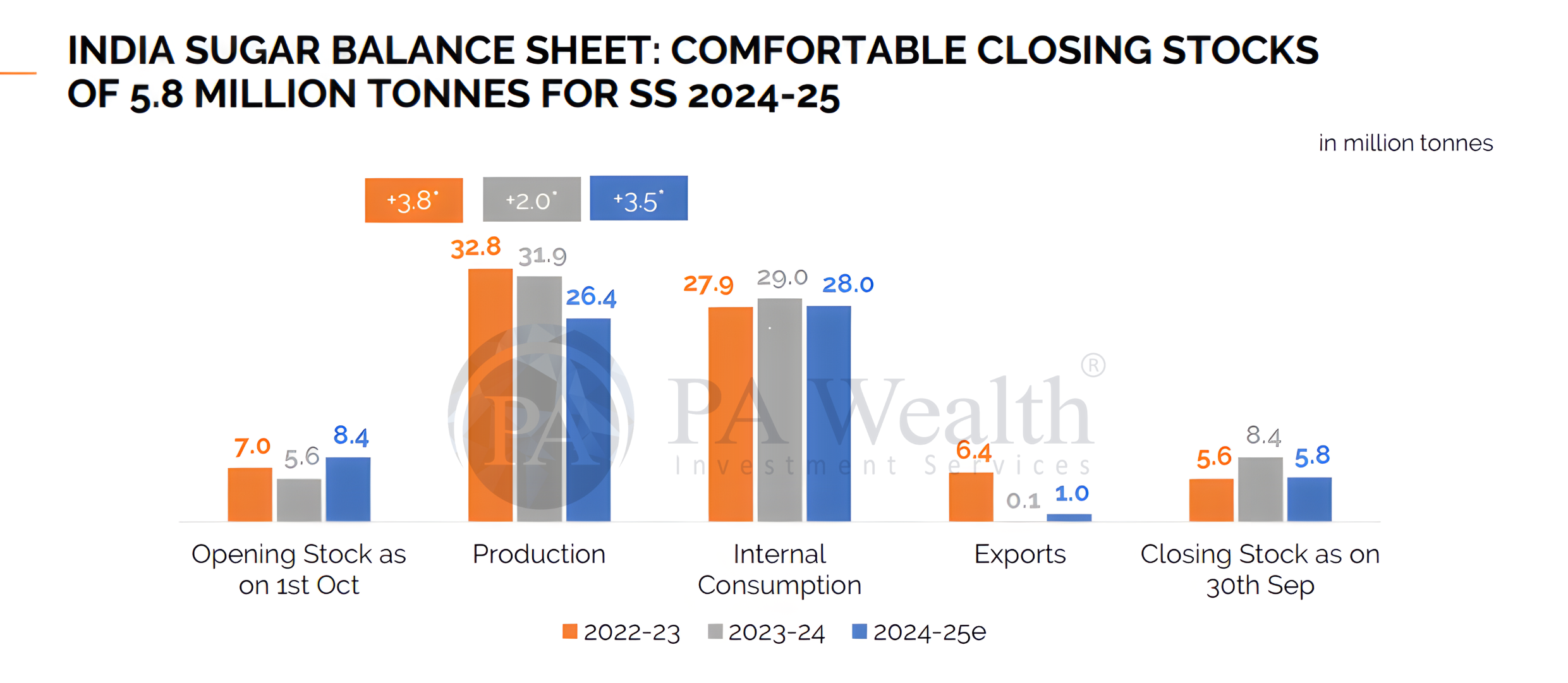

- Sustained industry support: Consistent government measures—steady cane prices, sugar MSP, and ethanol diversion—have curbed cyclicality, keeping operations resilient amid steady production of ~29.9 MT and healthy closing stocks of 5.8 MT for SS 2024-25.

2. Alcohol / Ethanol Industry

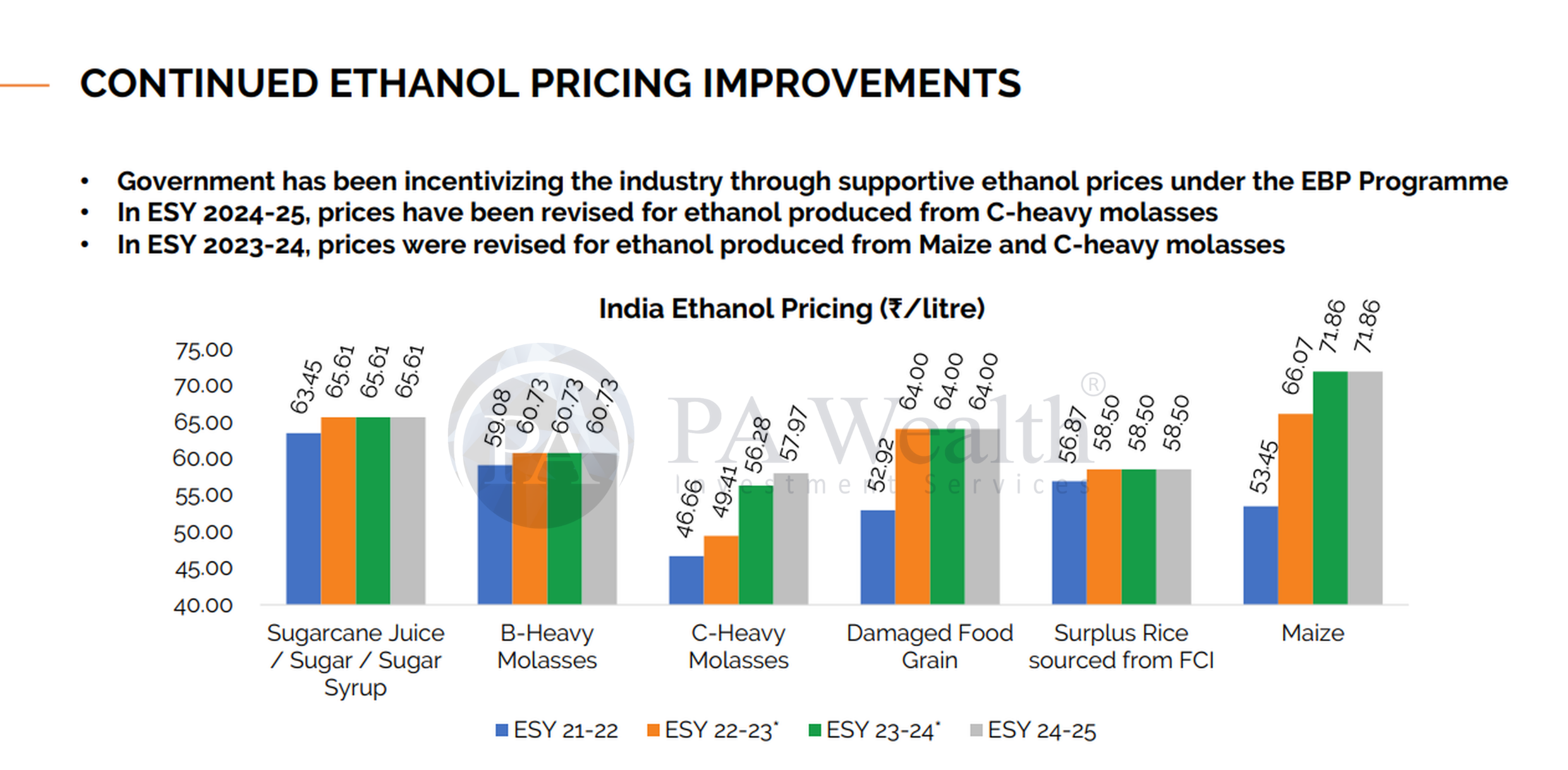

- Driving ethanol growth: Triveni plays a key role in India’s EBP programme, supporting self-reliance and sustainability as blending nears 20% in ESY 2024–25.

- Diversifying feedstocks: The company operates multi-feed distillation plants, reducing dependency risks and ensuring stable output under changing raw material conditions.

- Boosting profitability: Moreover, Triveni improves margins by optimizing feedstock sourcing, streamlining warehousing, and maintaining strict operational cost control.

- Strengthening liquor portfolio: Simultaneously, the company expands its IMIL and IMFL businesses through smart pricing, focused sales efforts, and a wider network.

- Delivering strong results: Consequently, ethanol supply contracts with OMCs rose ~48% YoY, led by grain-based feedstocks (66%), mainly maize (49%).

- Sustaining momentum: Additionally, ethanol blending reached 18.36% by March 2025, with monthly blending peaking at 19.8%, showing strong execution.

3. Water & Wastewater Industry

- Expanding capabilities: Triveni uses its strong financial base to invest in EPC and PPP projects, expanding its water and wastewater portfolio.

- Tapping rising demand: Growing need for recycling, reuse, and ZLD solutions in industrial and municipal sectors continues to drive growth.

- Leveraging government support: Initiatives like AMRUT, Jal Jeevan Mission (JJM), and NMCG create significant opportunities, which Triveni is actively capturing.

- Addressing water scarcity: India extracts more groundwater than China and the USA combined and treats only 28% of wastewater, highlighting urgent sustainability needs.

- Rising market potential: India’s water treatment market, worth USD 9.64 billion in 2024, could reach USD 18.63 billion by 2033 (7.6% CAGR), offering growth opportunities.

- Focus on sustainable solutions: Triveni emphasizes recycling, reuse, and ZLD projects to meet increasing demand and support long-term environmental sustainability.

- Expanding industrial reach: The company targets high-value projects in industrial and municipal segments to strengthen its water infrastructure presence.

4. Industrial Gears & Engineering

- Engineering excellence: Triveni excels in high-power, specialized gearbox solutions, including hybrid propulsion and vacuum tunnel balancing test rigs.

- Expanding global market: The industrial gearbox market may grow from USD 30.6B in 2024 to USD 47.5B by 2034 (4.6% CAGR).

- Growing Indian market: India’s gearbox market is projected to rise from USD 1.02B in FY25 to USD 1.09B in FY26 (6.24% CAGR).

- Diverse applications: Triveni supplies gearboxes for power, oil & gas, petrochemicals, CCUS, WHRS, and waste-to-energy sectors.

- Strong domestic momentum: Rising demand from STG and steel projects enabled deliveries of India’s highest power gearboxes, including 57MW compressors and 48MW API units.

- Aftermarket services: Triveni replaces leading OEM gearboxes across steel, cement, and fertilizer industries, strengthening service presence domestically.

- Global exports: The company secures large orders from Europe, Middle East, Japan, and South America, expanding international footprint and credibility.

- Technological edge: Triveni leverages advanced engineering expertise to deliver high-performance, reliable, and innovative gearbox solutions across sectors.

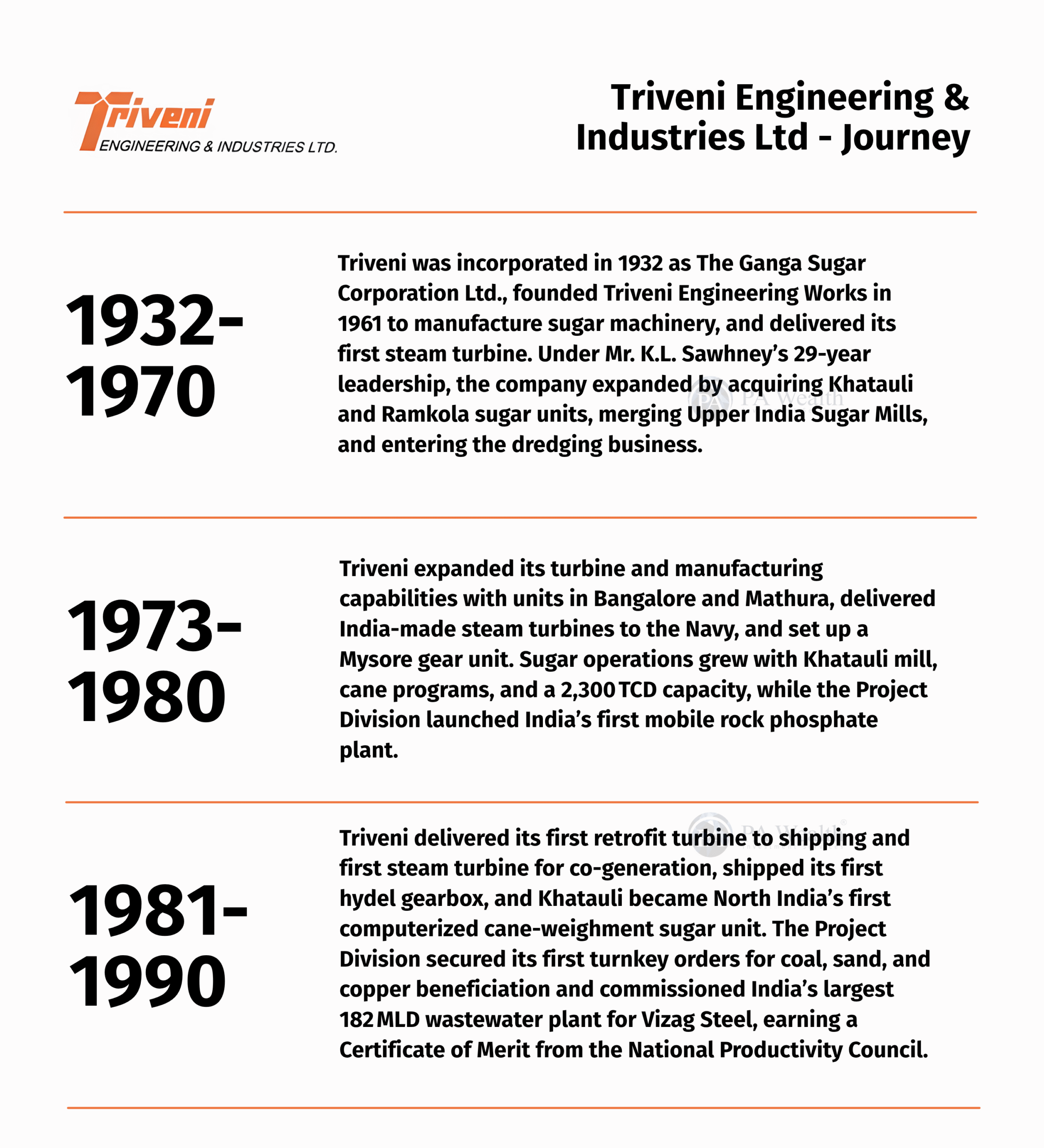

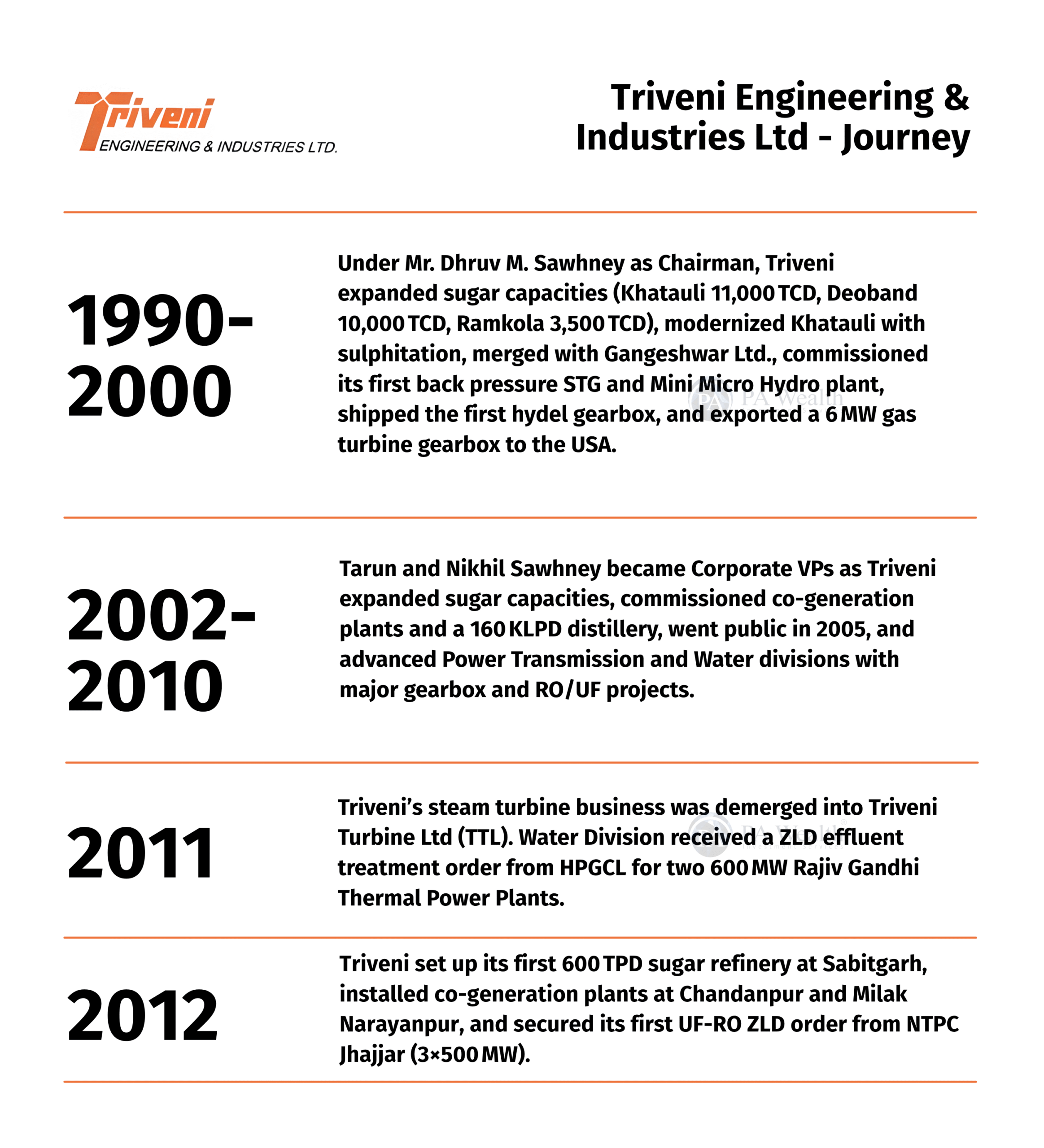

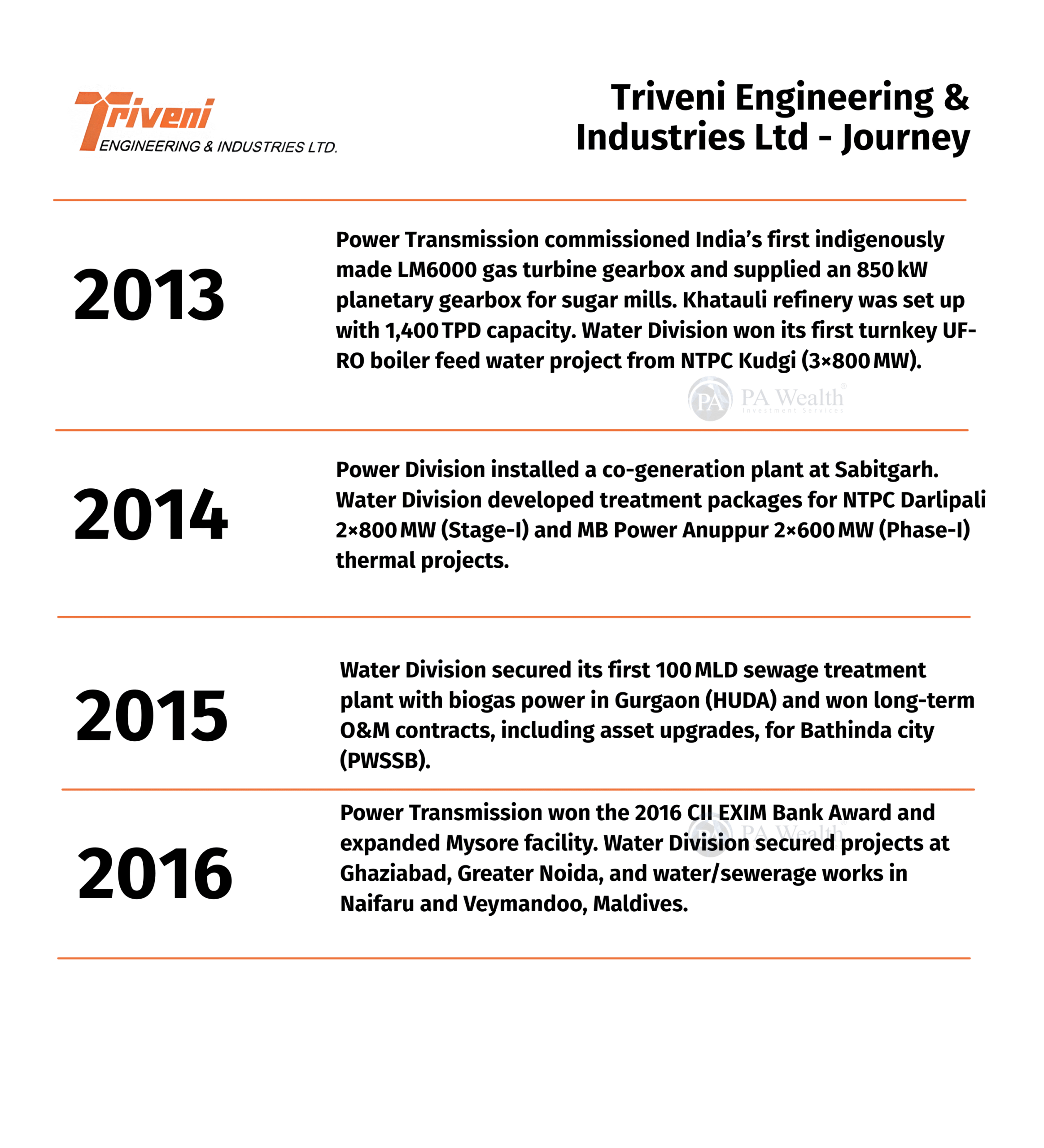

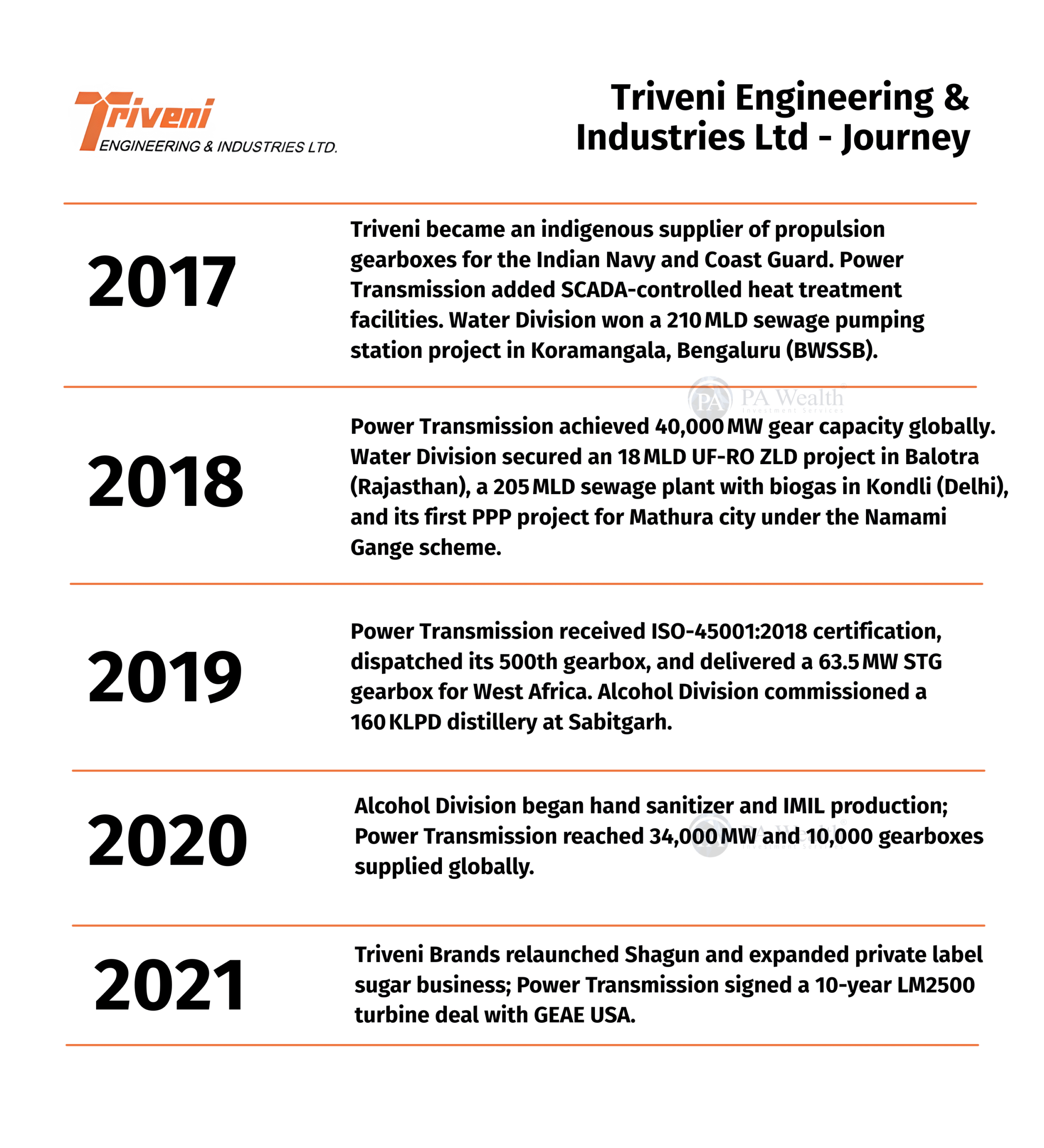

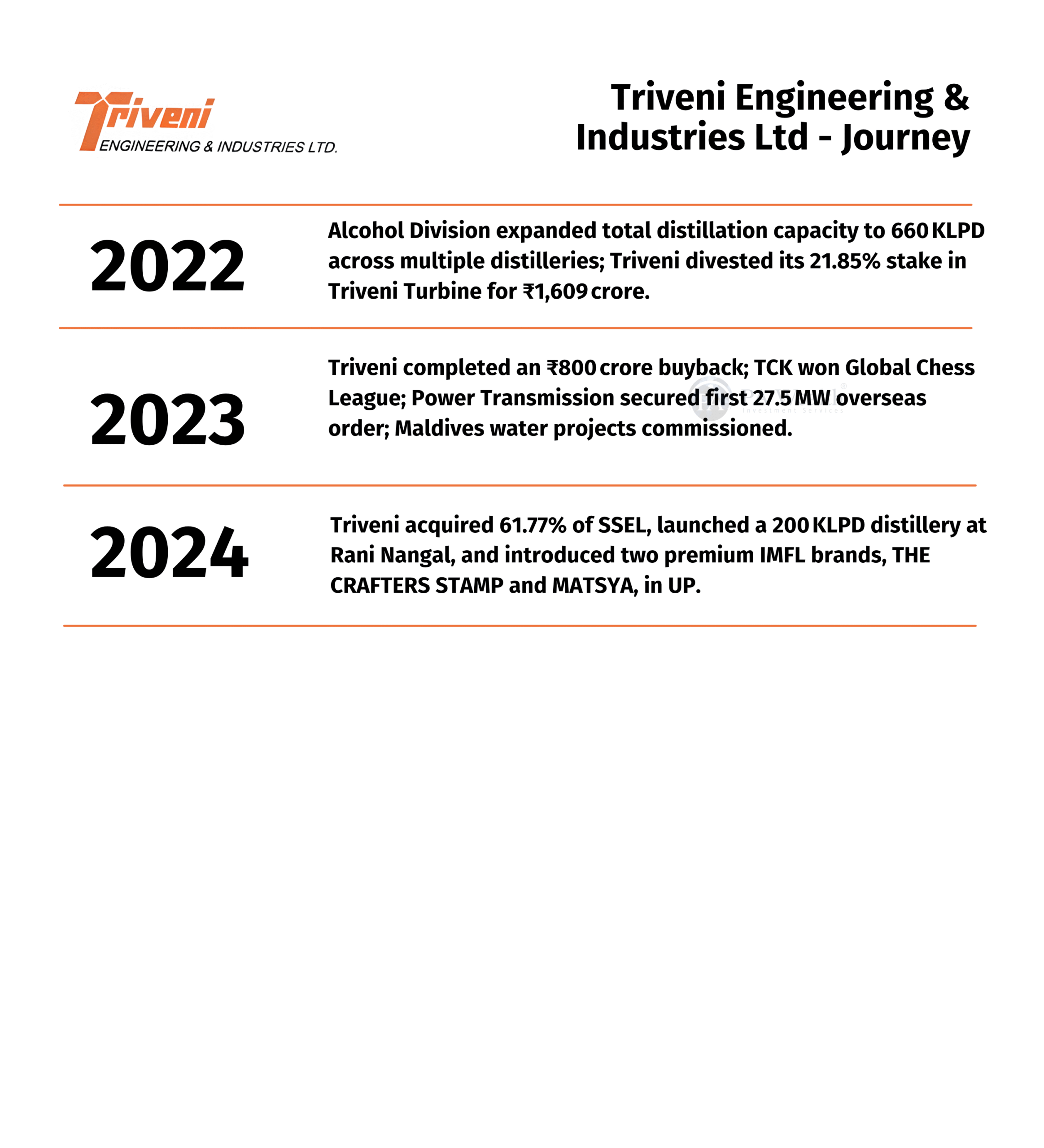

(C) Journey

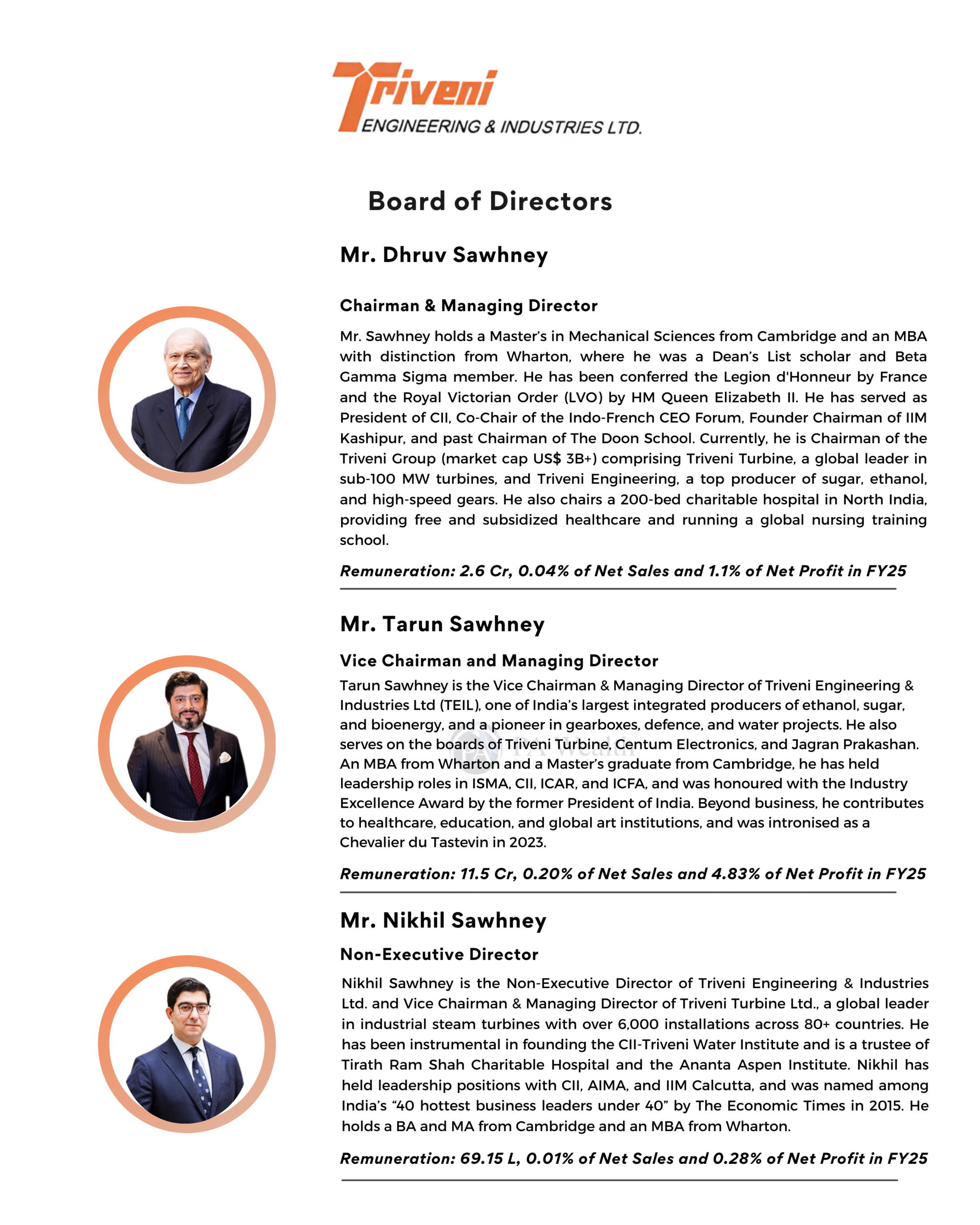

(D) Board of Directors of Triveni Engineering & Industries Ltd.

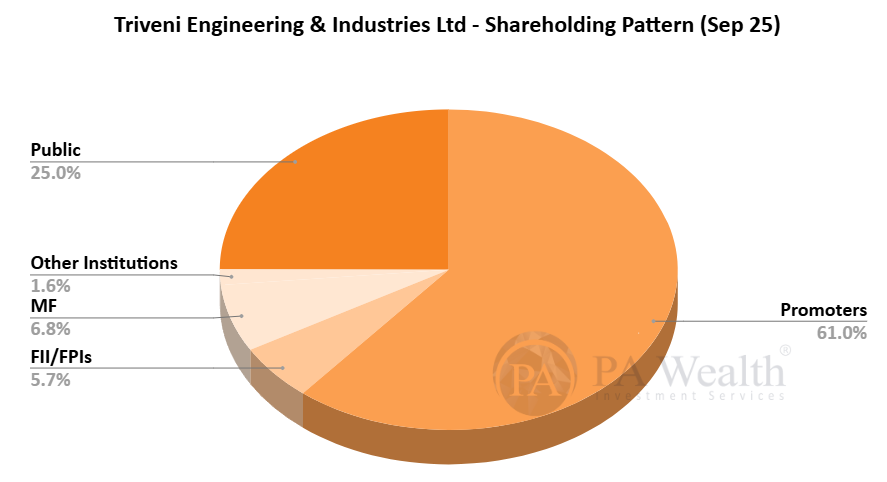

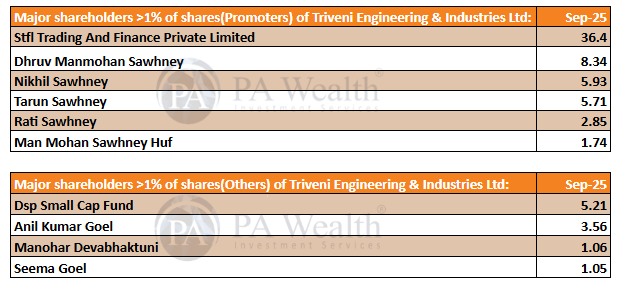

(E) Shareholding Pattern of Triveni Engineering & Industries Ltd.

(F) Business Segments of Triveni Engineering & Industries Ltd. | Stock Analysis

1. Sugar

In the sugar segment, Triveni enhances sugarcane productivity through varietal replacement, advanced planting techniques, and yield improvement measures. The company also invests in plant efficiency to lower energy consumption and production costs. Surplus sugarcane supports ethanol production, aligning the business with government initiatives and ensuring steady supply. Favorable monsoons and structured crop management further contribute to the sustainability and productivity of this segment.

2. Alcohol & Ethanol

Triveni Engineering produces ethanol for fuel blending under India’s Ethanol Blended Petrol programme and serves the liquor market through its IMIL and IMFL brands. Its distillation facilities can process multiple feedstocks, which reduces dependency risks. The segment focuses on profitability by optimizing feedstock procurement, improving warehousing, and expanding distribution channels. Rising ethanol blending targets and growing demand for liquor products provide strong growth opportunities for this segment.

3. Water & Wastewater

Triveni provides EPC and HAM solutions for municipal and industrial clients, focusing on water recycling, reuse, and Zero Liquid Discharge (ZLD) projects. Supported by government initiatives like AMRUT, Jal Jeevan Mission (JJM), and the National Mission for Clean Ganga, the company is expanding its presence in the growing water infrastructure sector. Strategic partnerships with municipal bodies, along with financing support from Exim Bank, enable Triveni to execute PPP projects efficiently. Additionally, the company actively pursues international opportunities across Asia and Africa, positioning itself for strong order inflows and sustained growth in FY26.

4. Industrial Gears & Engineering

The industrial gears and engineering segment supplies high-performance gearboxes for power, steel, oil and gas, petrochemical, and waste-to-energy sectors. Triveni serves both domestic and international markets, delivering specialized high-power solutions, aftermarket services, and innovative products such as test rigs and hybrid propulsion gearboxes. Its expertise in complex, high-capacity applications reinforces its reputation as a reliable partner for critical industrial projects.

The Scheme proposes amalgamating Sir Shadi Lal Enterprises Limited (SSEL) with TEIL, where TEIL holds a 61.77% stake.It also provides for the transfer of the PTB Undertaking from TEIL to its wholly-owned subsidiary, TPTL.This restructuring aims to streamline operations and consolidate the group’s business undertakings, improving efficiency and organizational clarity.

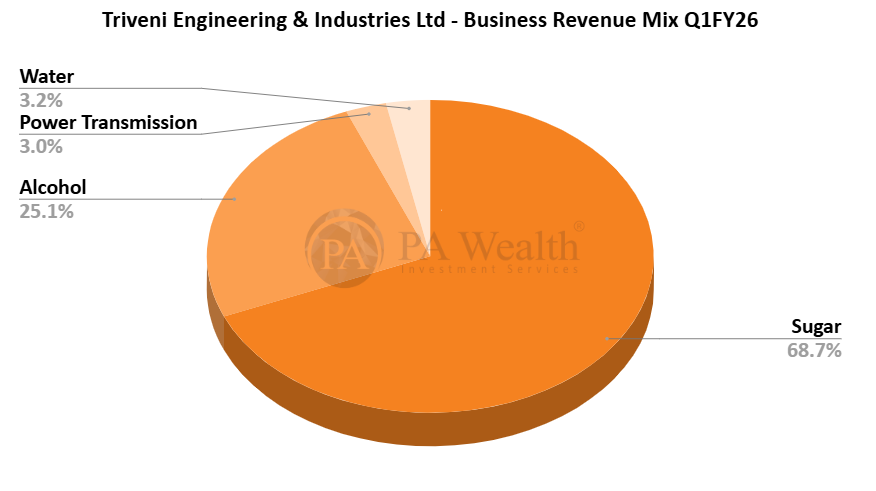

(G) Revenue Mix of Triveni Engineering & Industries Ltd. | Stock Analysis

(i) Business Revenue Mix

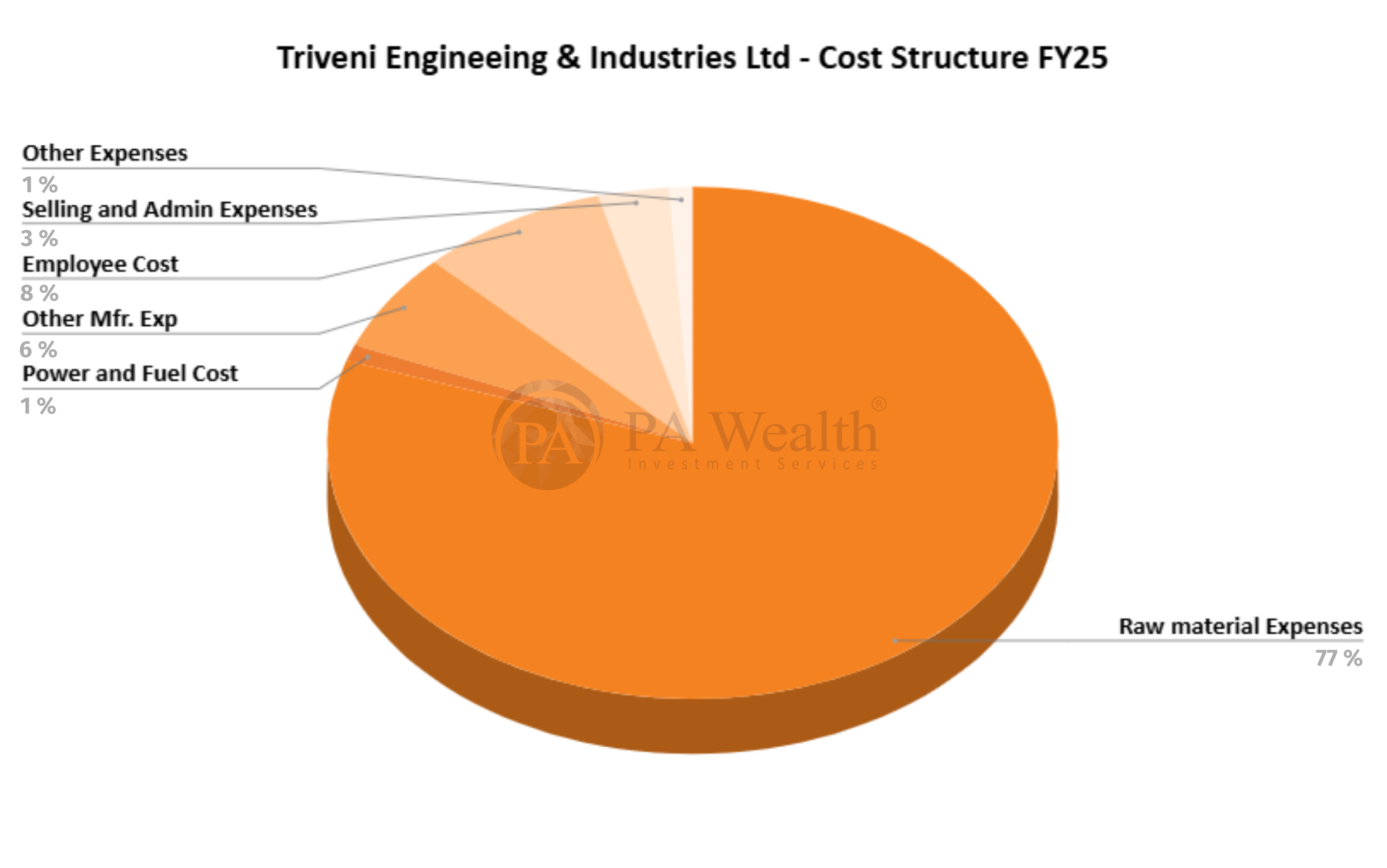

(H) Cost Structure of Triveni Engineering & Industries Ltd.

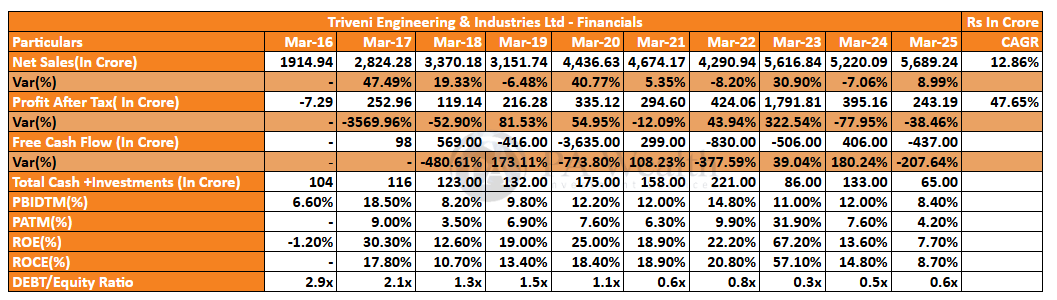

(I) Financials of Triveni Engineering & Industries Ltd.

- Net sales grew at a CAGR of 12.9%, demonstrating consistent revenue growth despite cyclical trends in the sugar industry.

- Meanwhile, PAT grew at a CAGR of 47.6%, reflecting strong profit recovery post-FY16, supported by better cost management and contributions from the ethanol business.

- In FY25, revenue rose 9% YoY, but PAT fell to ₹243 Cr, highlighting margin pressures.

- Consequently, PBIDT margin moderated to 8.4% in FY25 from a high of 18.5% in FY17 due to rising costs and softer realizations.

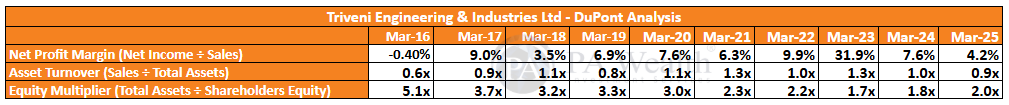

- Similarly, PAT margin dropped sharply to 4.2% from 9.9% in FY22; in FY23, PAT margins were 31.9% because of ₹1,509 Cr sales of stock in an associate company.

- ROE and ROCE contracted to 7.7% and 8.7%, reflecting lower profitability and higher working capital intensity.

- Free cash flow remained volatile, turning negative at ₹437 Cr in FY25, suggesting elevated capex or higher inventory levels.

- Additionally, cash and investments declined to ₹65 Cr, indicating tighter liquidity.

- On the positive side, the Debt/Equity ratio improved from 2.9x in FY16 to 0.6x in FY25, showing disciplined balance sheet management and strong deleveraging.

- However, DuPont analysis reveals weakening profitability drivers, with lower margins and asset turnover offsetting stable leverage.

- Overall, the company shows steady long-term growth, but short-term profitability and cash flow pressures persist, which is typical for a cyclical sugar and ethanol business.

(J) Management Discussion & Concall | Stock Analysis

- In the distillery business, power and fuel make up about 30–32% of total expenses, and to improve efficiency, the company is actively reducing its dependence on coal and petcoke.

- Looking ahead, Triveni targets a medium-term sugar capacity of around 15.5 mn MT, supported by better crop recovery and operational improvements.

- For the upcoming 2025–26 season, the FRP is set at ₹355/qtl for 10.25% recovery, with a ₹3.46/qtl premium for every 0.1% increase above that level.

- Meanwhile, expected sugar realizations remain in the range of ₹1,150–1,200/ton, and improving recovery rates are expected to help optimize costs and enhance margins.

- On the external front, export incentives will continue to depend on MSP and global market conditions.

- Furthermore, management remains confident about surpassing 15.5 mn MT in production, reflecting strong operational execution.

- Overall, the company maintains a sharp focus on cost efficiency, recovery improvements, and export opportunities to drive sustainable growth.

Growth Outlook

- Product mix enhancement: Triveni is increasing refined and pharma-grade sugar share to boost margins and improve price realization.

- Ethanol demand growth: Government’s 27% blending roadmap and E85 fuel network expansion provide long-term volume visibility.

- Maize-based ethanol: Normalizing feedstock costs and improved supply chain efficiency are expected to drive better contribution margins.

- IMIL growth: The country liquor segment is expected to sustain double-digit growth.

- IMFL potential: Premium liquor portfolio, in early launch, offers medium-term diversification and higher-margin opportunities.

- Power Transmission: Domestic industrial capex and defense orders, along with new products and exports to Europe, expand the addressable market.

- Defence gearboxes: Exclusive in-house technology positions the defence gearbox segment as a key growth lever, ramping up post-Mysore commissioning.

- Engineering CapEx: Investments will lift total capacity to ₹700 Cr turnover potential by FY27, enabling multi-year growth.

- Water business expansion: Triveni explores international opportunities and PPP models to strengthen project pipeline and improve returns.

- Operational efficiency: Focus on cost optimization, asset utilization, and export growth will enhance consolidated profitability over the medium term.

- Balanced growth strategy: The company targets sustainable growth across sugar, ethanol, engineering, and water, improving operating leverage and cash flows from FY27.

Q1 FY26 Concall Highlights

- Triveni’s standalone debt stands at ₹1,385 Cr (₹1,688 Cr consolidated), with a stable cost of funds at 7.3%, which is expected to decline following the credit rating upgrade.

- Meanwhile, exposure to sugarcane variety 0238 has been reduced to below 40% from 55% last year, and the company plans to further bring it down to 25%, supporting improved recovery in the next season.

- Additionally, ongoing investments in steam economies and bagasse savings are helping reduce operational costs and restore margins.

- On the corporate front, the company is awaiting SEBI, NSE, and BSE approvals for the Sir Shadi Lal amalgamation and Power Transmission demerger, which are expected to complete by Q1 FY27.

- Looking ahead, management expects near-term pressures to continue but anticipates improvement from Q2 onward, driven by better realizations, lower input costs, and a recovery in ethanol margins.

- In the water business, Triveni is seeing strong inquiries for recycling, reuse, and ZLD projects, backed by government funding, and is focusing on selective high-return opportunities.

- Finally, favorable monsoon conditions in UP have strengthened cane area and crop health, indicating better yields and recovery prospects for the upcoming sugar season.

(K) Strengths & Weaknesses

Strengths

- One of the largest sugar producers in India with efficient operations.

- Forward-integrated with distillery and co-generation capacities, providing alternative revenue streams and cushioning against sugar cyclicality.

- Diversified revenue base with contributions from sugar, ethanol, power transmission, and water businesses.

- Ongoing investments in operational efficiency and cost reduction.

- Favorable agro-climatic conditions in UP support cane yield and recovery.

- Positive government policies on ethanol and sugar provide stability.

Weaknesses

- Profitability vulnerable to government policies on cane pricing, sugar quotas, MSP, and ethanol pricing.

- Exposure to industry cyclicality and agro-climatic risks, including pests, diseases, and rainfall variability.

- Dependence on specific sugarcane varieties can affect yield and recovery.

- Social risk from shifting consumer preferences toward less sugar-intensive products.

- Planned demerger of power transmission business could impact credit profile.

Drop us your query at – info@pawealth.in or Visit pawealth.in

References: Annual Reports, News Publications, Investor Presentations, Corporate Announcements, Management Discussions, Analyst Meets and Management Interviews, Industry Publications.

Disclaimer: The report only represents the personal opinions and views of the author. No part of the report should be considered a recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore