Avoiding Costly Mistakes by Understanding Recency Bias

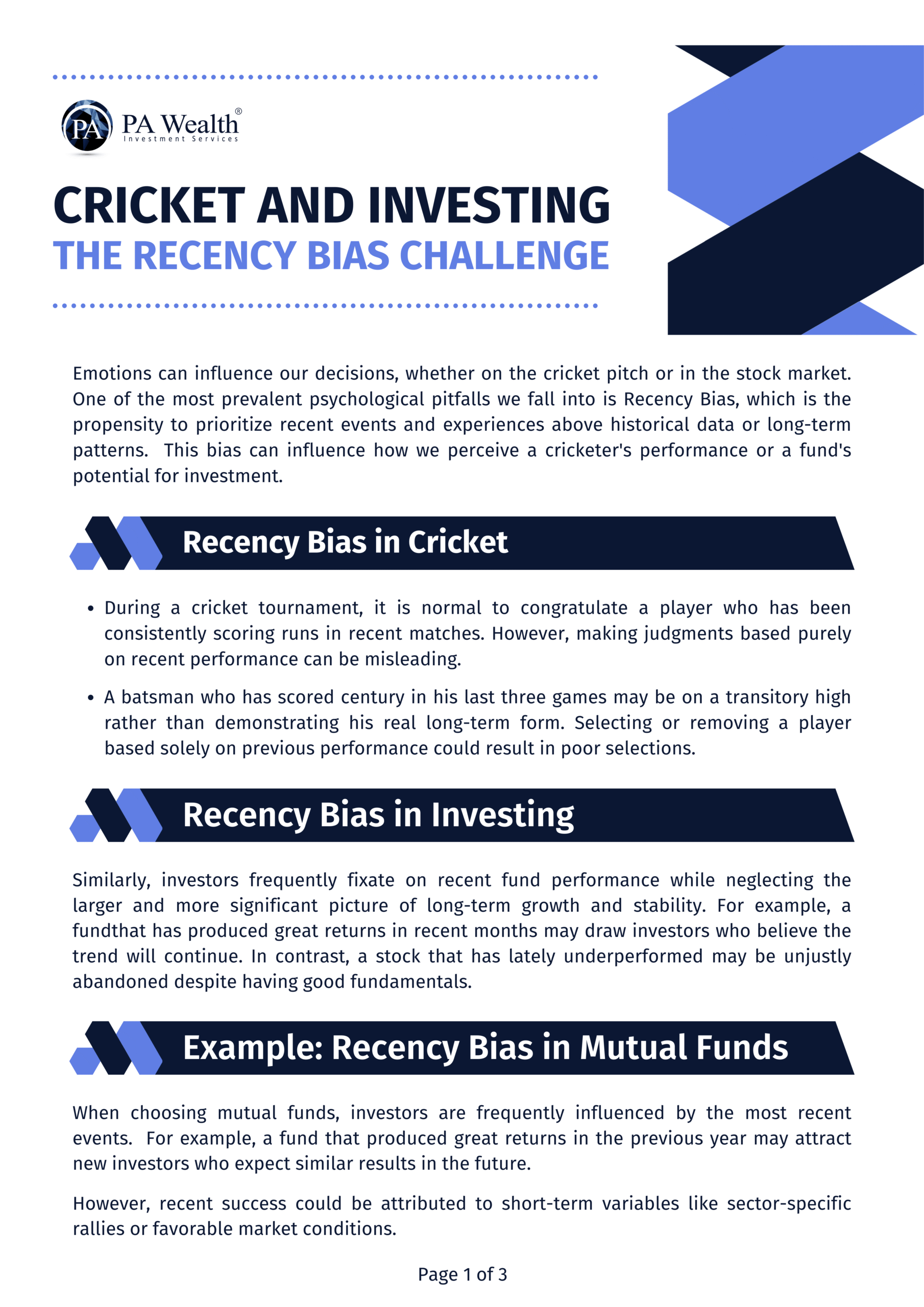

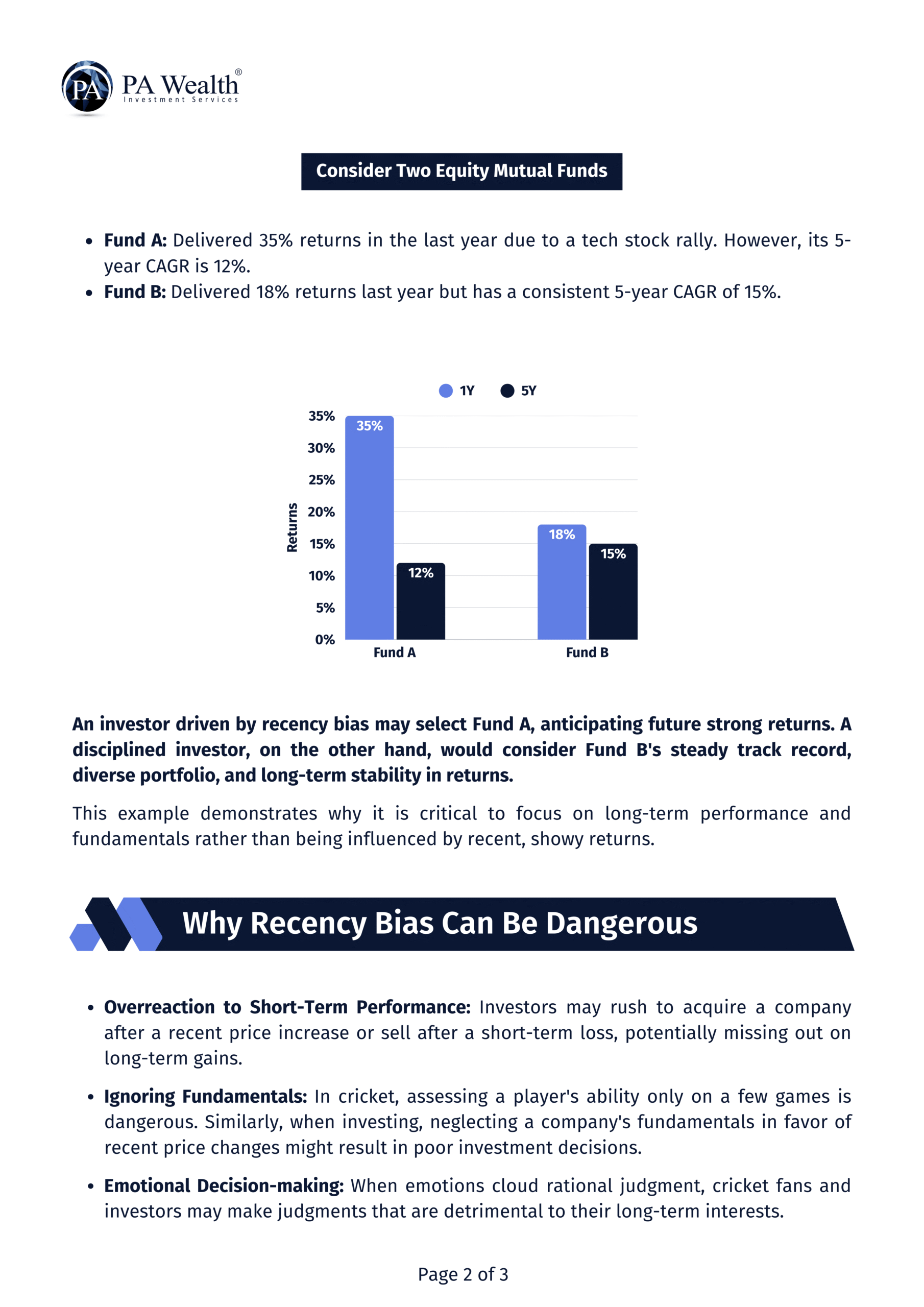

In both cricket and investing, recent performance often captures our attention more than it should, leading to decisions driven by emotion rather than logic. This tendency, known as recency bias and can cause investors to chase short-term winners, overlook long-term consistency, and misjudge the true potential of an investment. Just as a cricketer’s temporary hot streak doesn’t guarantee lasting form, a fund or stock delivering impressive short-term returns may not sustain the momentum. By recognising and managing recency bias, investors can make more rational, disciplined choices, stay focused on long-term fundamentals, and build a stronger, more resilient wealth-creation strategy.

Drop us your query at – info@pawealth.in or Visit pawealth.in

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore

💡 Liked this analysis?

Stay updated with more market insights & wealth strategies from PA Wealth.

✉️ Contact Our Experts Today