IDCW vs SWP: Choosing the Right Path for Regular Income

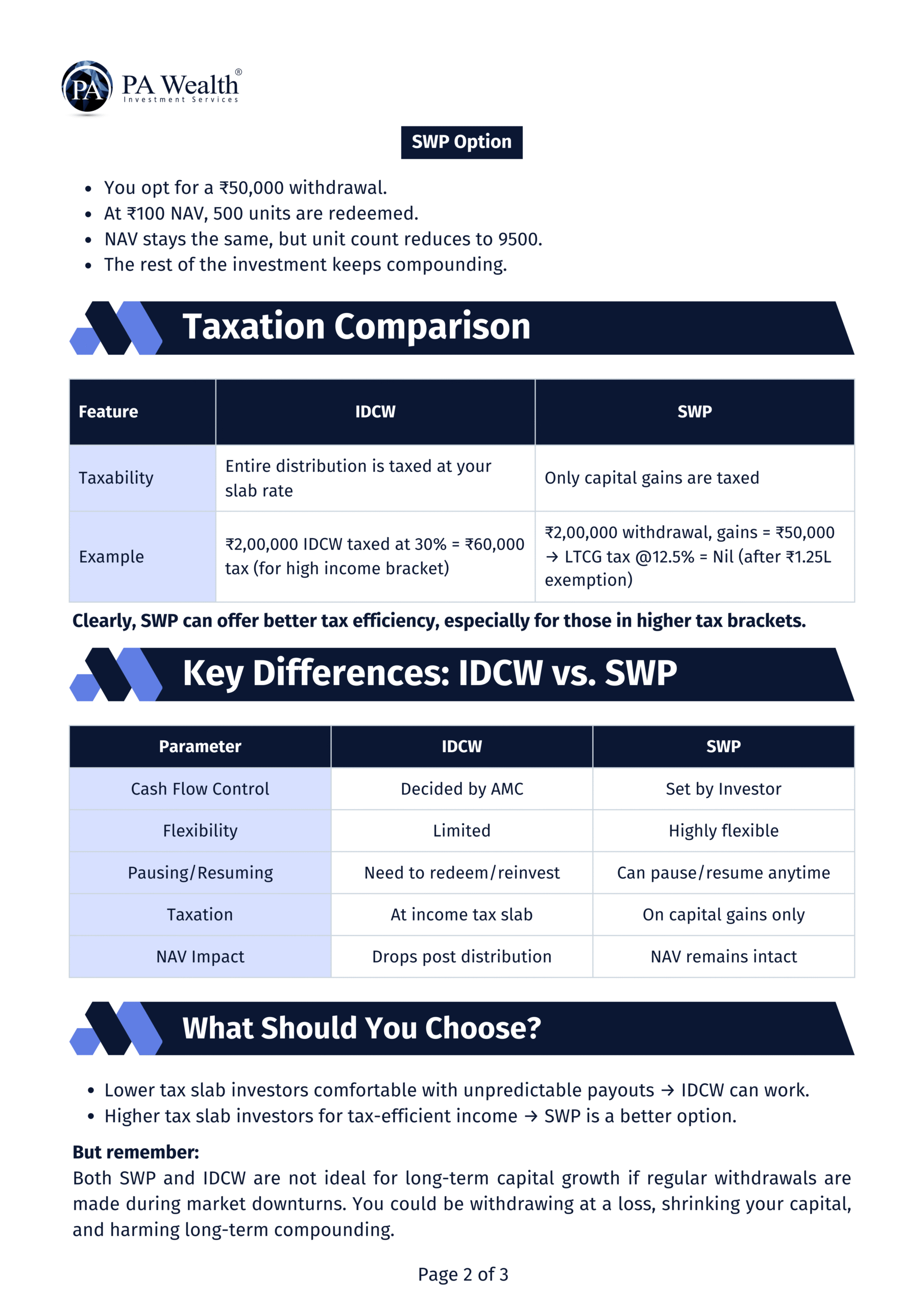

Most investors pick the Growth option to build long-term wealth, but those needing steady income often compare IDCW and SWP. While both provide payouts, they work very differently—IDCW depends on the fund house’s declaration, while SWP gives you predictable, self-controlled withdrawals. Understanding this difference helps you avoid irregular income, unnecessary taxes, and capital erosion. With the right choice, you can create a more stable and efficient income strategy from your mutual fund investments.

Drop us your query at – info@pawealth.in or Visit pawealth.in

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore

💡 Liked this analysis?

Stay updated with more market insights & wealth strategies from PA Wealth.

✉️ Contact Our Experts Today