Anant Raj is entering the high-growth, high-yield Data Centre sector, aiming to achieve an IT load capacity of 307MW over the next 4-5 years. They are also forming partnerships with crucial government entities such as TCIL and RailTel. Let's delve into the company's journey, its diversified business segments, financial growth, and strategic initiatives shaping its future in the dynamic real estate landscape.

- About the company

- Journey Since Inception

- Board Members

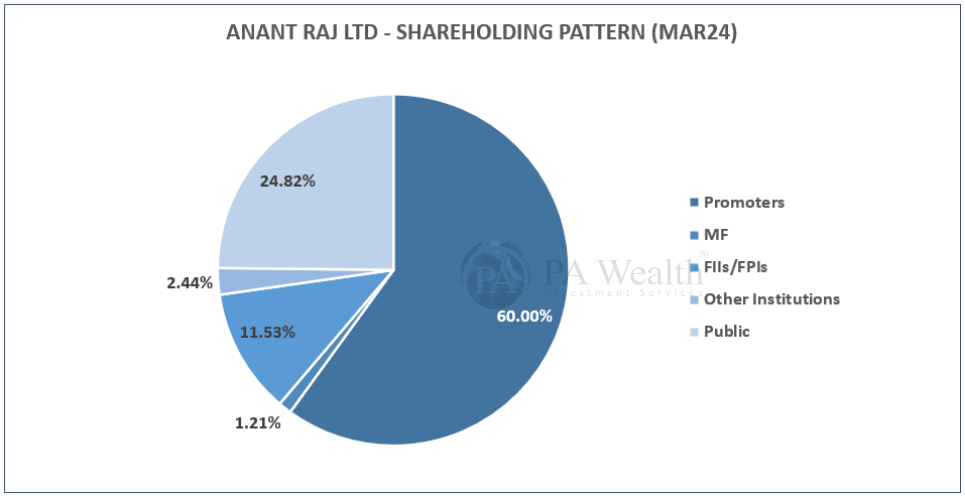

- Shareholding Pattern

- Business Segments

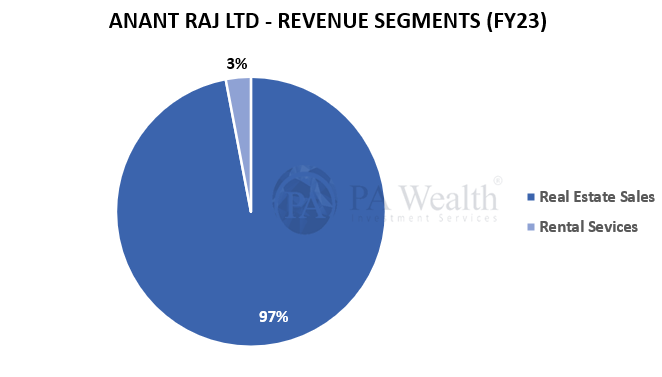

- Revenue Segments

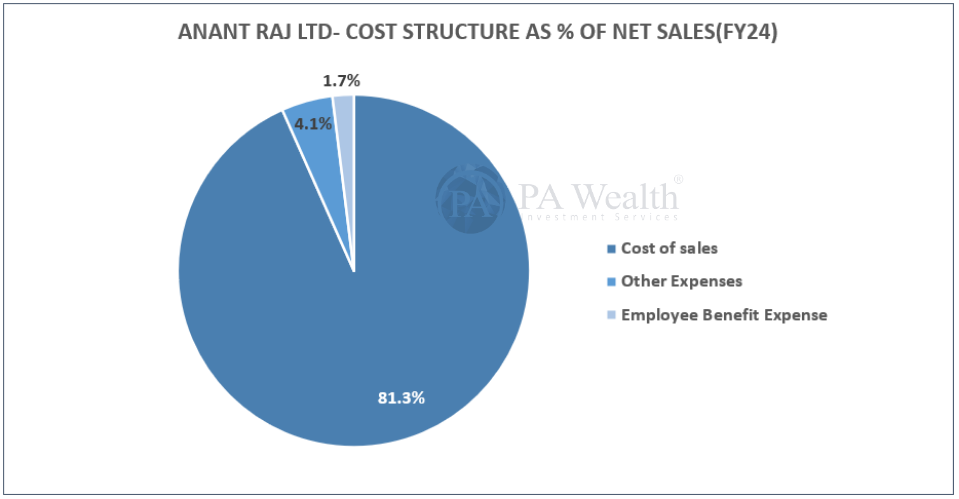

- Cost Structure

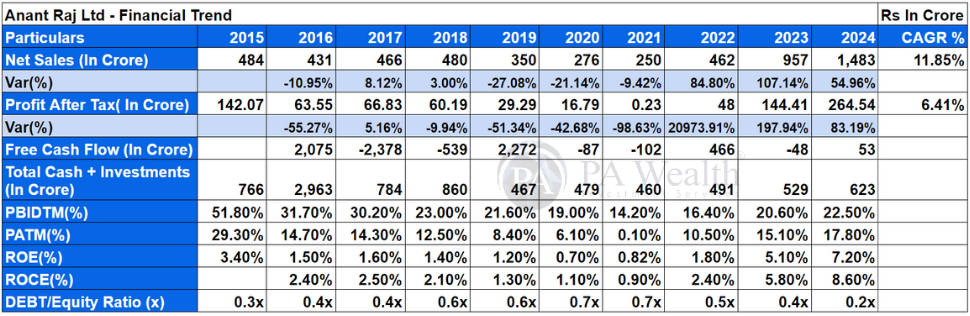

- Financial Parameters

- Management Key Highlights

- Strengths & Weaknesses

(A) About

Anant Raj Ltd, incorporated in 1985 by Ashok Sarin as Anant Raj Clay Products, primarily focuses on the development and construction of IT parks, hospitality projects, SEZs, office complexes, shopping malls, and residential projects in Delhi, Haryana, Andhra Pradesh, Rajasthan, and NCR.

To date, the company has delivered more than 20 million sq. ft. of residential real estate projects. Furthermore, it has developed over 5 million sq. ft. of commercial space and owns over 240 acres in prime locations across NCR. It has a comprehensive portfolio of residential townships, group housing projects, commercial developments, data centers, and hospitality developments spread across Delhi, Gurugram, and NCR.

(B) Journey of Anant Raj Limited

(C) Board of Directors of Anant Raj Limited

(D) Shareholding Pattern of Anant Raj Limited

(E) Business Verticals

(i) Residential Portfolio Mix (Ongoing & Upcoming)

Group Housing

The company plans to launch a group housing project under its own brand, outside of its JV with Birla Estates. The project is expected to be spread over two phases.

The first phase, with a saleable area of ~1mn sq. ft. and a Gross development value of~INR1,800cr, is expected to be launched in November. The project will be spread over 5.43 acres and consists of 250 units of 4 & 5 BHK apartments.

Villas/Floors/Plots

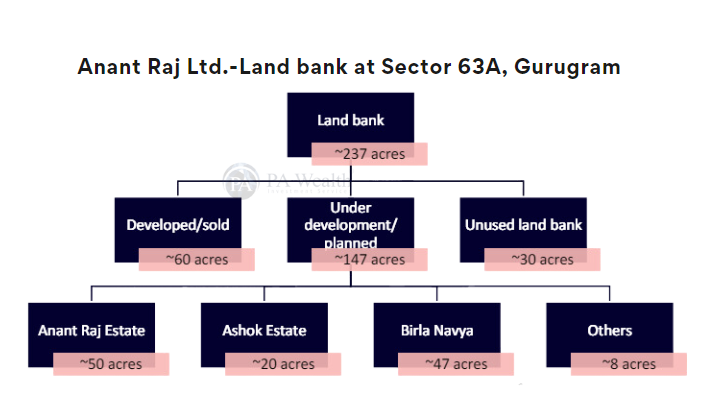

ARCP entered a 50:50 JV with Birla Estates for development of 764 luxury floors, spread over 47 acres, in Sector 63A.

ARCP has secured approvals to extend its ongoing plotted development by an additional 0.72 mn sq. ft, increasing the project size to approximately 1 mn sq. ft. The company already owns the land and has obtained the necessary approvals to convert it into plots for sale.

Anant Raj Ashoke Estate DDJAY Plots

Ashok Estate is spread over 20.14 acres, or ~97,478 sq. yards. Of this, 56,495 sq. yards are on sale.

Affordable Housing

The company will launch Phase II of its Tirupati housing project in November following strong demand for Phase I. The project will be spread over 1.19mn sq. ft. and have an estimated GDV of INR315cr.

(ii)Commercial Portfolio Mix (Ongoing & Upcoming)

Retail

It is adding an office asset in Gurugram with 0.16 million sq. ft. of leasable area and an estimated monthly rental value of INR 90 per sq. ft. The office asset is expected to launch in FY24 and become operational by June 2025. ARCP anticipates steady-state annual rentals of INR 17–18 crore once fully occupied.

Hospitality

The company's hotel projects in New Delhi, each spanning 5 to 7.5 acres in prime hospitality and convention districts, include hotels like Stellar and Bel-LA Monde, which are operated by third parties on long-term leases.

Data Center

- The company is converting commercial properties with a potential leasable area of 5.66 MSF into 300 MW data centers.

- Company has tied up with key government agencies. In FY23, the company operationalized 3 MW of the total 300 MW data center capacity at Manesar, with an additional 50 MW expected to become operational in the coming years.

Commercial

- IT Park, Manesar, Gurugram: The Company has completed its IT Park situated at Manesar, Haryana which is operational and generating revenues.

- IT Park, Panchkula, Haryana: The Company is developing an IT Park with space of 1.6 million sq. feet on land area of 9.23 acres through its subsidiary Company, Rolling Construction Private Limited. Phase-I has been completed.

- IT SEZ Rai, Haryana: Total developable area in Rai building is 5.10 million sq. feet on 25 acres of the land allotted to it by HSIIDC (Haryana State Industrial and Infrastructure Development Corporation).

(F) Revenue Segments

(G) Cost Structure of Anant Raj Limited

(H) Financials of Anant Raj Limited

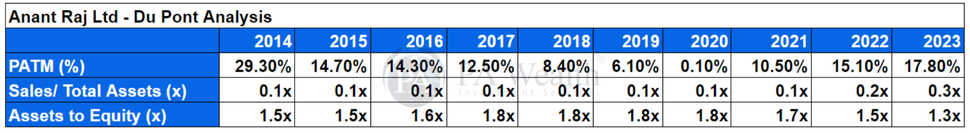

The company's revenue has grown at a CAGR of 11.85% over the past 10 years, increasing from Rs 484 Cr. in FY15 to Rs 1,483 Cr. in FY24. Subsequently, the company's PAT has also shown growth, rising from Rs 142.07 Cr. in FY15 to Rs 264.54 Cr. in FY24 at a CAGR of 6.41%. Furthermore, the company's ROE has seen an increase from 3.40% in FY15 to 7.20% in FY24.

DuPont Analysis

(I) Management Discussion

Data Centers

Anant Raj has entered into Strategic Partnerships with RailTel and TCIL, both PSUs under Government of India in FY23. It has commenced Data Center strengthening work in Panchkula for an initial 7MW IT Load.

Commercials and Hospitality

- ARCP owns a fully leased Grade A commercial property in Panchkula, Chandigarh (0.65 mn sq. ft.), and a mixed-use asset in Gurugram (0.15 mn sq. ft.). Combined rental income from both is INR91 crore annually.

- Three hospitality assets, each 0.1 million sq. ft., in Delhi and Manesar operate under revenue-sharing lease contracts. Bel-LA Monde and Stellar Resorts generate a combined annual minimum guarantee of INR 14 crore.

Residentials

- Anant Raj has accumulated approximately 230 acres in Gurugram and about 80 acres in regions like Najafgarh and Mehrauli in Delhi. Over the next 7-8 years, developers plan to convert roughly 140 acres into 8 million square feet of saleable area, valued at INR 12,000 crores.

- Anant Raj and Birla Estates, in a 50:50 JV, developed luxury floors spanning 47 acres in Sector 63A. They launched three phases totaling 1.11 million sq. ft. across 537 units in FY23, with a sales potential of INR 1,495 crore. By September, they fully booked all units and plan to launch the final phase by FY24's end, delivering the first phase in Q4FY24.

Concall Highlights- Q4FY24

- ~INR 15,000crs of revenue potential in next 4 to 5 years from residential sales in Sector 63A, Gurugram

- Scale up to 307 MW IT Load Data Center within the next 4 to 5 years. Commenced Data Center strengthening work in Panchkula for an initial 7MW IT Load.

- The company is converting a 5.66 msf commercial property into a 157 MW Data Centre. Additionally, there are plans for a 150 MW expansion in Rai and Panchkula. Upon full operationalization of the 307 MW, expected rentals are projected to reach INR 3,300 crores.

- In January 2024, Anant Raj completed its QIP, raising approximately ₹500 crores. The company intends to utilize this capital for retiring debt and other general purposes. Moreover, the company projects that by December 2024, it will become a net debt-free company.

- Revenue from operations has grown 51% YoY, reaching INR1,521 crores FY24 and achieved a 51% growth in EBITDA, totaling ₹371 crores.

- Data Centers generate ₹90 lakhs in revenue per MW every month, with ₹15 lakhs for running expenses.

- They plan to complete data centers with a total capacity of 300MW in the next 4 years, with a total capex of ₹8000-10,000 cr. Furthermore, They expect to source this largely by monetizing Sector 63A. In event of a shortfall, they will resort to lease rental discounting.

(J) Strengths & Weaknesses of Anant Raj Limited

Strengths

(i) Seasoned leadership:

Led by the experienced Sarin family, particularly Mr. Amit Sarin, Anant Raj boasts over 25 years in real estate. Their successful track record over four decades showcases expertise and reliability.

(ii) Dynamic project portfolio:

Anant Raj actively engages in 8 ongoing projects across residential and commercial sectors in Gurgaon and Tirupati, showcasing its commitment to project execution and market presence.

(iii) Strategic location advantage:

With projects strategically positioned in Gurgaon and Tirupati, Anant Raj leverages proximity to essential facilities and commercial hubs, enhancing the appeal and marketability of its ventures.

Weaknesses

(i) Group-related financial exposure:

Anant Raj's investments in subsidiaries and loans to related entities pose inherent financial risks, potentially impacting its overall stability and performance.

(ii) Regional market dependency:

Focusing solely on the Haryana real estate market exposes Anant Raj to regional economic volatility and uncertainties, challenging its sales and revenue prospects.

(iii) Industry vulnerabilities:

Despite its strengths, Anant Raj operates in a real estate sector prone to cyclical fluctuations and intense competition. External factors such as regulatory changes and market dynamics pose ongoing challenges to sustained growth and profitability.

Drop us your query at – info@pawealth.in or Visit pawealth.in

References: Annual Reports, News Publications, Investor Presentations, Corporate Announcements, Management Discussions, Analyst Meets and Management Interviews, Industry Publications.

Disclaimer: The report only represents the personal opinions and views of the author. No part of the report should be considered a recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore