Arvind Fashions’ USPA is the top casuals brand in India, followed by Tommy Hilfiger and Calvin Klein in the super-premium casuals category.

Quick Links Click to navigate directly to the relevant paragraph in detail:

- About the company

- Journey Since Inception

- Industry Landscape

- Board Members

- Shareholding Pattern

- Licensed and Owned Brands

- Revenue Break up

- Cost Structure

- Financial Parameters

- Management Key Highlights

- Strengths & Weaknesses

(A) About

Arvind Fashions is a leading Indian fashion company that designs, sources, markets, and also sells a wide range of branded apparel, footwear, innerwear, and accessories for men, women, and kids. The company has a strong portfolio of renowned brands, both international and indigenous, such as US Polo Assn., Arrow, Tommy Hilfiger, Calvin Klein, Flying Machine, and Sephora.

Arvind Fashions distributes and sells its products through a variety of channels, including exclusive brand outlets, multi-brand outlets, large format stores, and also e-commerce platforms.

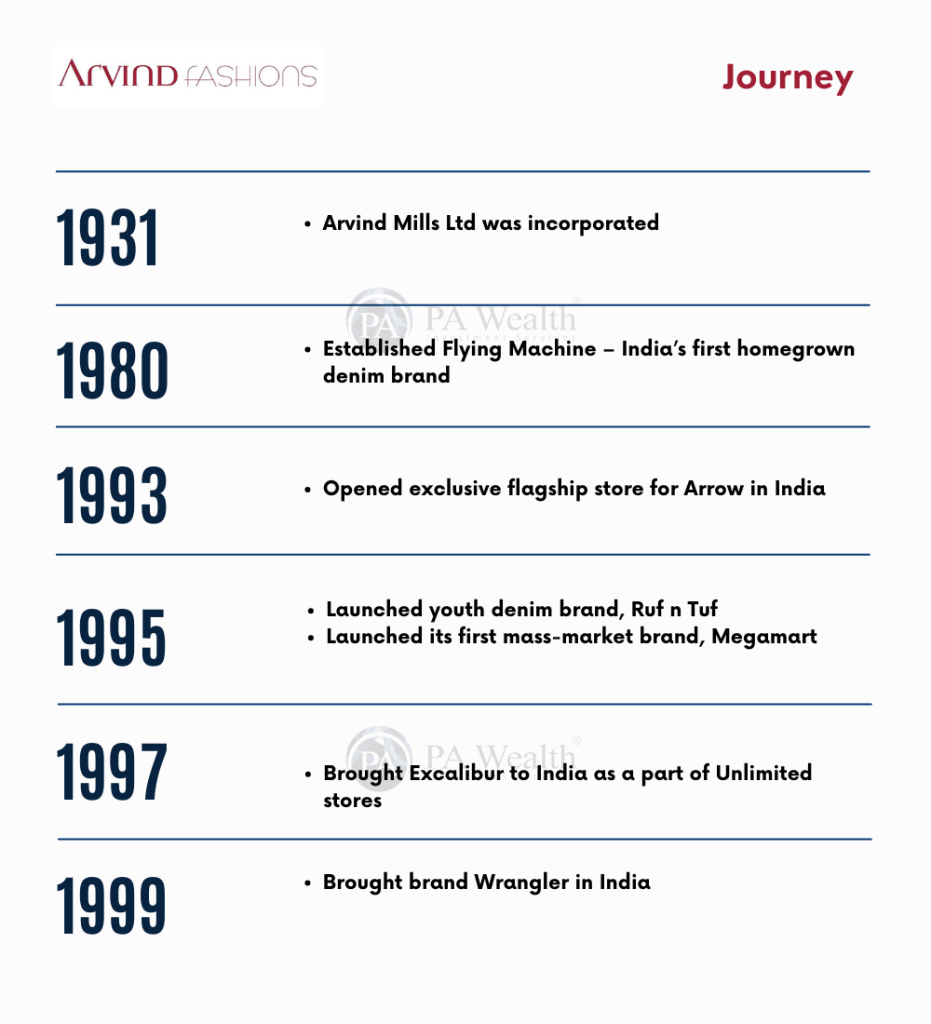

(B) Journey of Arvind Fashions

(C) Industry Landscape

Digital is the channel of choice for the Indian fashion market, with GMV expected to surpass $350 billion by 2030. Social media is also pivotal for marketing and engagement.

Footwear potential is high, as consumer preference shifts towards bold, fashionable, and also casual footwear. Subsequently, AFL is well-positioned to capitalize on this trend with its strong design language and portfolio of brands.

Local sourcing and manufacturing are on the rise, as brands and retailers seek to reduce emissions, empower communities, and also to gain control over the manufacturing process.

Lastly, Formal wear is being reinvented, with a focus on comfort along with versatility. Also, Designers are incorporating stretch fabrics into formal attire, creating unique and innovative styles.

(D) Board Members of Arvind Fashions

(E) Shareholding Pattern of Arvind Fashions

(F) Arvind Fashions Licensed and Owned Brands

US Polo Assn. is the number one casuals brand, Flying Machine is among the top three denim brands, While, Arrow is among the top three formalwear brands, Tommy Hilfiger is the number one in super premium casuals. Also, Calvin Klein is the number two brand in super premium casuals, and Sephora is the number one prestige beauty retailer.

AFL has sold the rights for the Premium beauty retail brand “Sephora” to Reliance Retail, a subsidiary of Reliance Industries for Rs. 99 Cr. in November 2023.

Brand-Wise Store Count

AFL had 1104 stores of its main brands in FY19 while the count reduced to 1077 stores in FY23.

(G) Revenue Segment

(H) Cost Structure of Arvind Fashions

(I) Financials

The company’s net sales have increased from Rs 1292.19 Cr. in FY17 to Rs 4421.08 Cr. in FY23 over the past 7 years at a CAGR of 22.76%, While the company’s PAT has grown from Rs 15 Cr. in FY17 to Rs 86.96 Cr. in FY23 at a CAGR of 34.05%. Further, The company’s ROE has improved from 2.28% in FY17 to 9.56% in FY23. However, The company’s debt-to-equity has increased from 0.9x in FY17 to 1.4x in FY23. Meanwhile company has planned to get its ROCE to more than 20%.

DuPont Analysis

Terms of Trade

(J) Management Discussion & Concall Highlights

Concall Highlights

- The company has provided guidance of opening around 200 stores this fiscal year, It had added 186 stores in FY23. Further, The company want to add these stores in 2-tier and 3-tier Cities to capitalize on the increasing demand. It also will provide better delivery times for online shoppers as most of these stores would be omnichannel.

- AFL will be expanding into more categories such as Innerwear, Footwear, kidswear and leather goods with the power brands to capitalize on the brand equity of these brands.

- The company will Expand into new markets and satellite towns of big metros for growth and increase its market presence.

- The company will be also focusing on digitalization, with a focus on growing the B2C part of online and linking stores with Omnichannel business reach.

- The company’s profitability is the top priority, over scale or growth and also it is targeting a 100 basis point increase in EBITDA margin. The pricing will be stable in the current market conditions, with minor adjustments at the entry price point. The company will focus on differentiated products to premiumize its brands. Premium products will be priced right for the product quality, MRP, and competition.

- During Q1FY23, The Company achieved a positive ROCE taking the number to double digits. It is looking to achieve 20%+ ROCE in the medium term.

Outlook

- The company registered revenues from operations of Rs 4421.1 Crore in FY23 compared to Rs 3056.04 Crore in FY22. The Company delivered a growth rate of 45%, driven by its multi-channel performance and also aided by a strong bounce back in the offline consumer demand coupled with the Company’s continued investments in adjacent categories such as footwear, kids wear, innerwear etc.

- Application of analytics-driven approaches to optimize discounts and markdowns. This would allow the company to reduce the irrelevant discounts as well as streamline its pricing strategy.

- The company is on track to become debt free in the next 2 to 3 years.

(K) Strengths & Weaknesses

Strengths of Arvind Fashions

- Strong brand portfolio of own and licensed international apparel brands: The company completed the closure of most of its loss-incurring brands and has decided to focus on its six key brands (Tommy Hilfiger, US Polo, Arrow, Flying Machine, Calvin Klein and also Sephora) with an aim to improve its profitability. Moreover, The licenses of these existing international apparel brands are long term/perpetual in nature.

- Wide distribution network with presence across multiple sales channels: AFL has a strong distribution network with 1,077 exclusive brand outlets (EBOs), most of which are omnichannel. AFL’s brands are sold through multiple sales channels such as its retail store network, wholesale to Multi Brand Outlets (MBO) and large departmental stores as well as through online retailers like Flipkart, Myntra and Amazon in addition to its own website NNNOW.com.

Weaknesses of Arvind Fashions

- Arvind Fashions Ltd.’s profitability margins and return ratios are below its peers due to underperforming brands. Store expansion is key to improving profitability and returns.

- The branded apparel retail industry in India is highly competitive, with pressure on profitability margins due to large expansion and private label brands. However, AFL’s strong brand portfolio could help it manage this competition.

Drop us your query at – info@pawealth.in or Visit pawealth.in

References: Annual Reports, News Publications, Investor Presentations, Corporate Announcements, Management Discussions, Analyst Meets & Management Interviews, Industry Publications.

Disclaimer: The report only represents the personal opinions and views of the author. No part of the report should be considered a recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore