Bandhan Small Cap Fund is an open-ended equity scheme that invests in small-cap companies with high growth potential. It follows a 3-pronged stock selection approach of Quality, Growth, and Reasonable Valuation, while focusing on absolute returns rather than benchmark comparisons. With sectoral diversification and controlled exposure, the fund aims to balance liquidity and fundamental risks. Ideal for long-term investors with a high-risk appetite seeking wealth creation.

- About the Bandhan Smallcap Fund

- Basic Details

- Classification Portfolio of the fund

- Fund Managers & Tenure of managing the Scheme

- Investment Details

- Returns Generated

- Risk Factors

- Investment Philosophy

- Taxability of Earnings

(A) About the Bandhan Small Cap Fund

The Bandhan Small Cap Fund follows a strategy of investing in high-potential small-cap companies through a disciplined approach of Quality, Growth, and Reasonable Valuation. Moreover, it focuses on building a diversified portfolio across sectors to balance liquidity and fundamental risks. In addition, the fund adopts an absolute return mindset rather than a benchmark-centric one, thereby aiming to deliver long-term wealth creation for investors with a high-risk appetite.

(B) Basic Details of Bandhan Small Cap Fund

| Fund House | Bandhan Mutual Fund |

| Category | Equity: Smallcap Fund |

| Launch Date | 03-Feb-2020 |

| Type | Open-ended |

| AUM | 14,062.19 Cr (As on 31 July 2025) |

| Available at NAV of | ₹45.723 (As on 27 Aug 2025) |

(C) Classification Portfolio of the fund

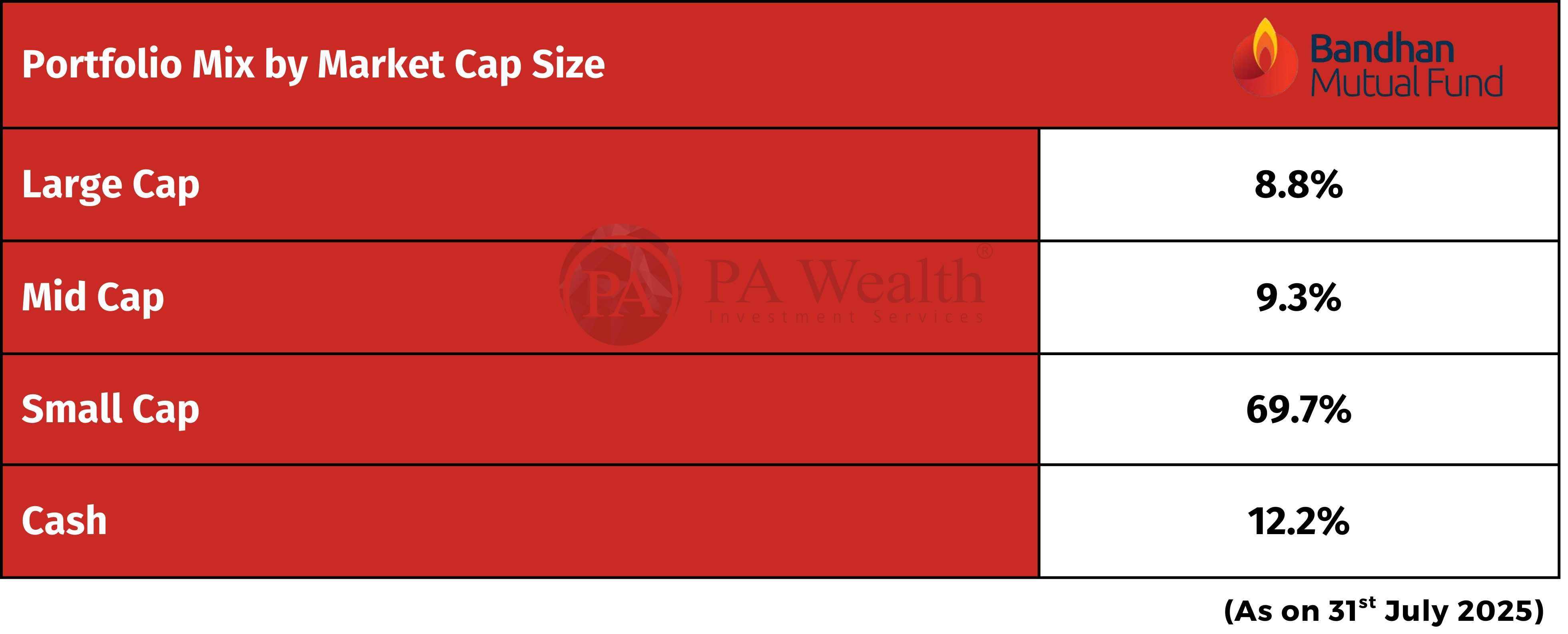

(i) Portfolio Mix by Market Cap Size

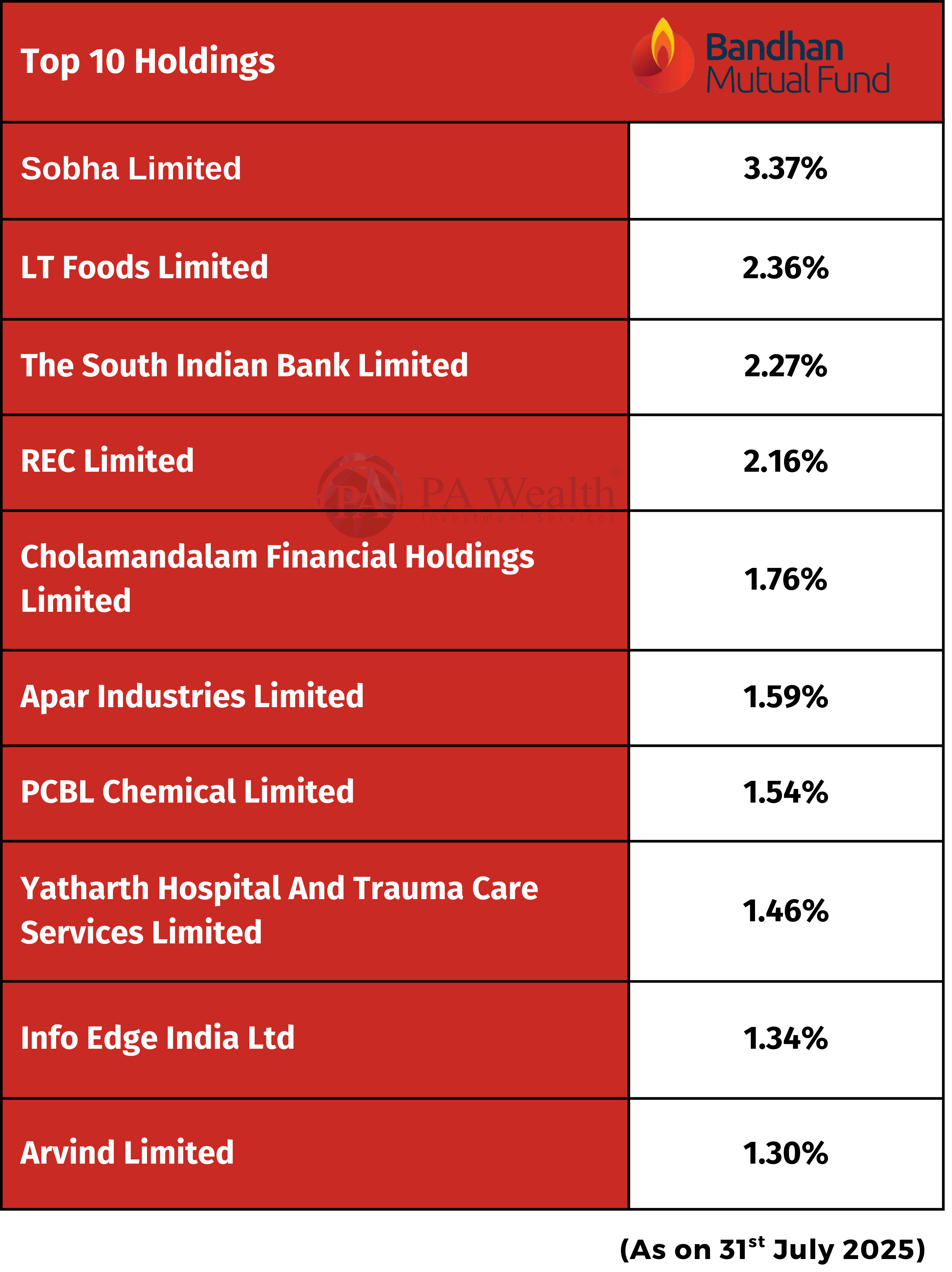

(ii) Top 10 Holdings of the Bandhan Small Cap fund

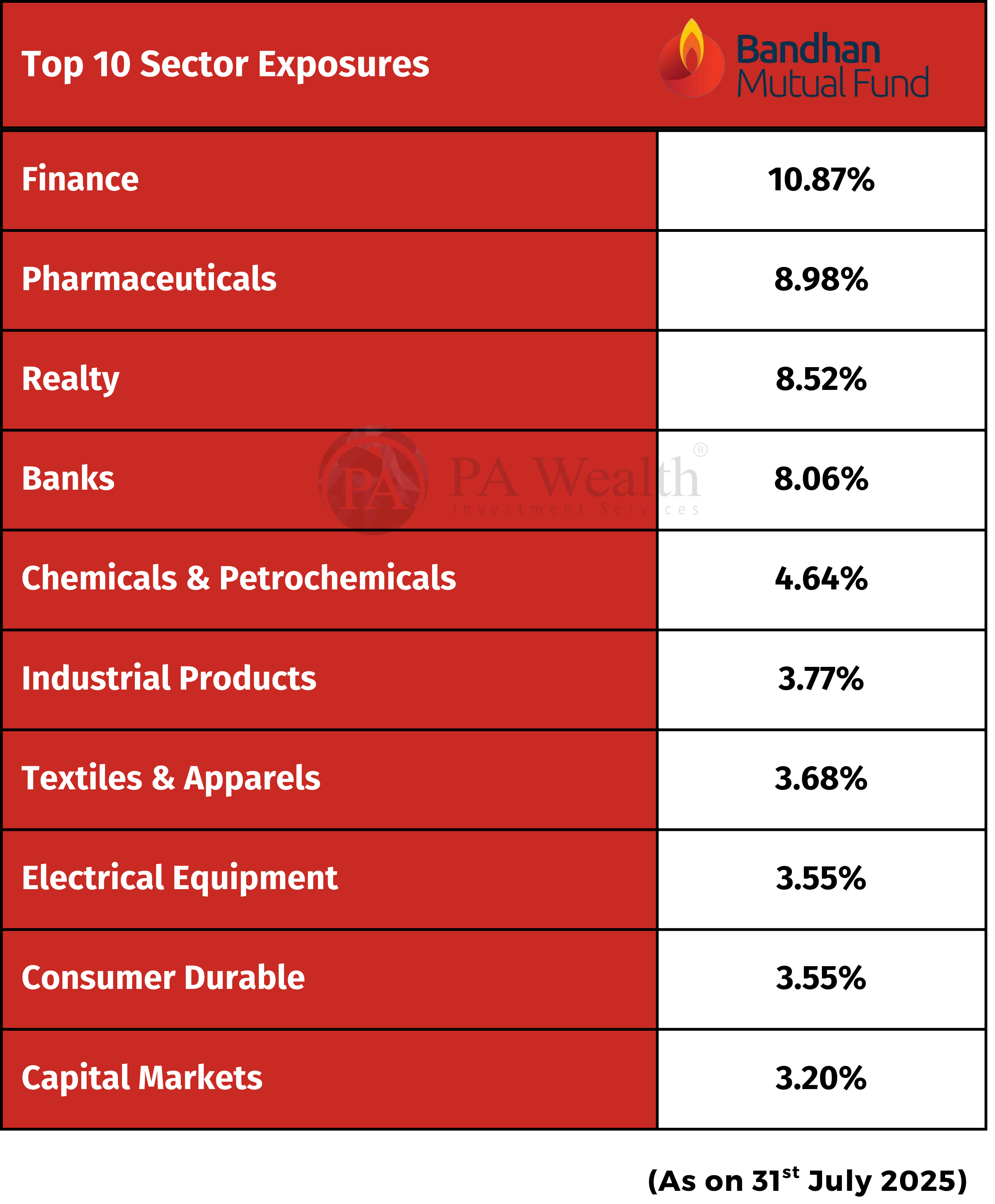

(iii) Top 10 Sectors Exposures of the Bandhan Small Cap Fund

(D) Fund Managers & Tenure of managing the Scheme

(E) Fund – Investment Details

| Bandhan Smallcap Fund | |

|---|---|

| Application Amount for fresh Subscription (Lumpsum) | ₹1000 |

| Min Additional Investment (SIP) | ₹100 |

| Exit load | 1%* |

| Lock In | No |

| Expense Ratio | 1.66% (As on 31 July 2025) |

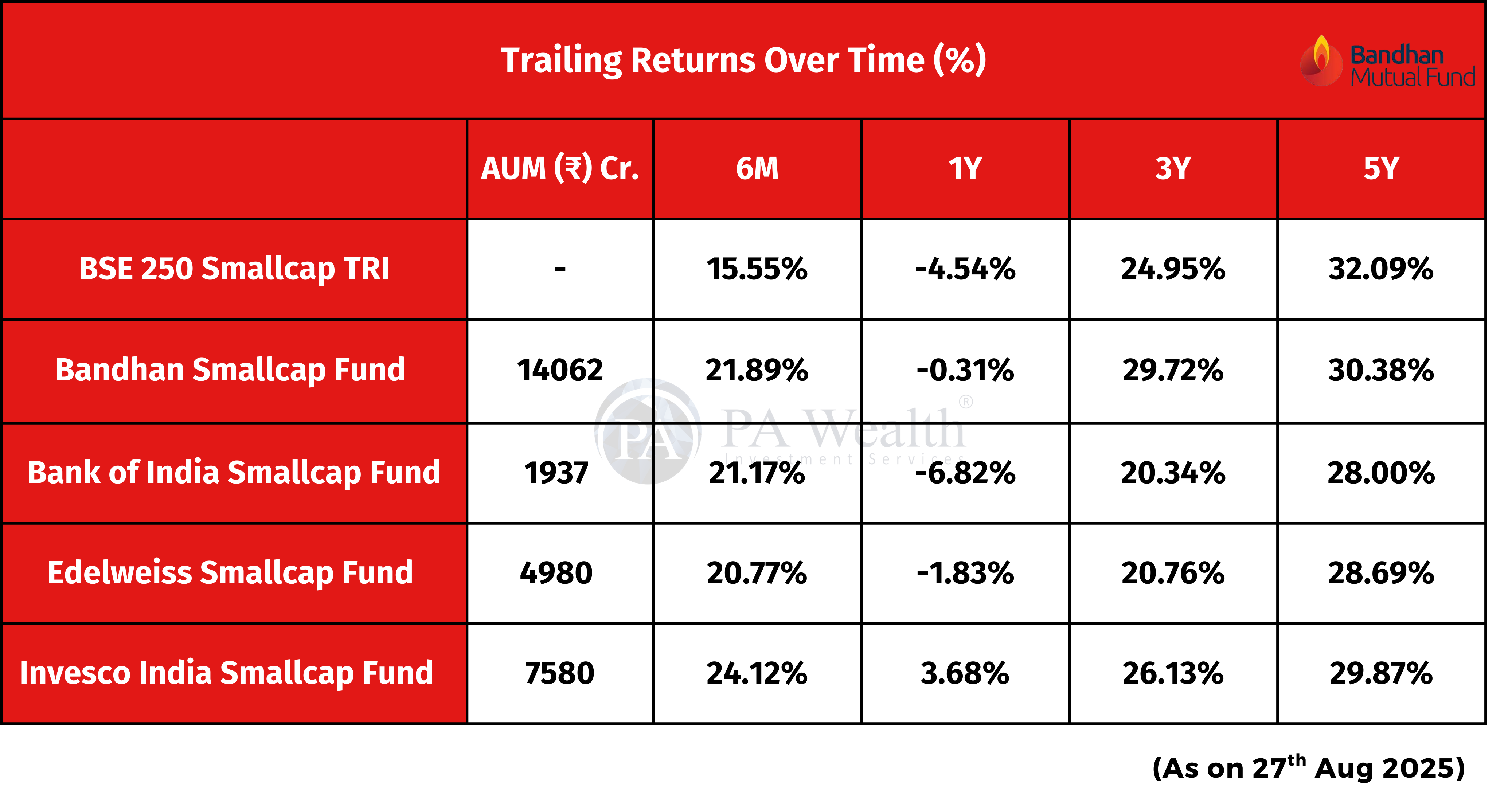

(F) Returns Generated By The Fund

(G) Risk Factors

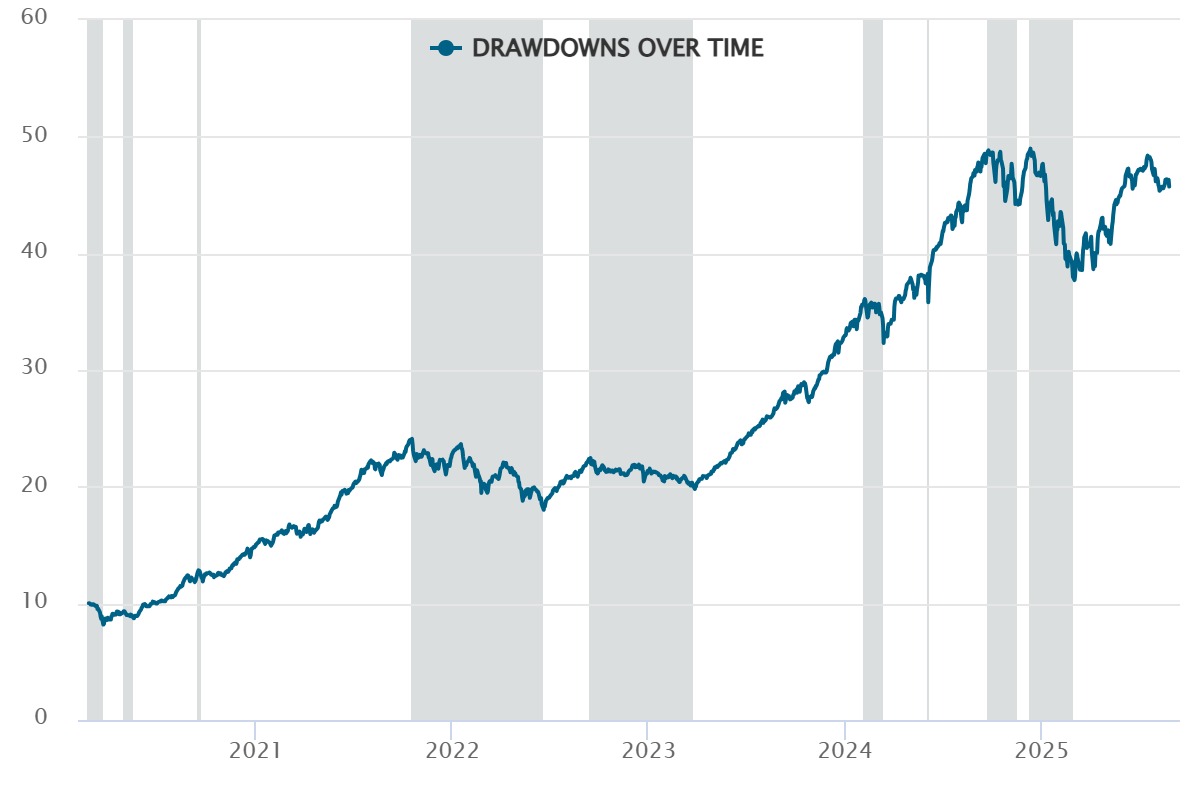

(i) Top Drawdowns

This chart illustrates the movements in the Bandhan Small Cap Fund’s value over time. While the fund has delivered impressive growth, it has also faced sharper periods of volatility. The shaded regions mark drawdowns—phases when the fund fell from its peak before regaining strength.

Most recently, since early 2024, the fund witnessed a decline of nearly 10% before showing signs of recovery. Such swings are typical in small-cap investing, where higher risk often accompanies the potential for higher long-term returns.

This chart, therefore, helps investors see how the fund has reacted during market stress and recovery phases.

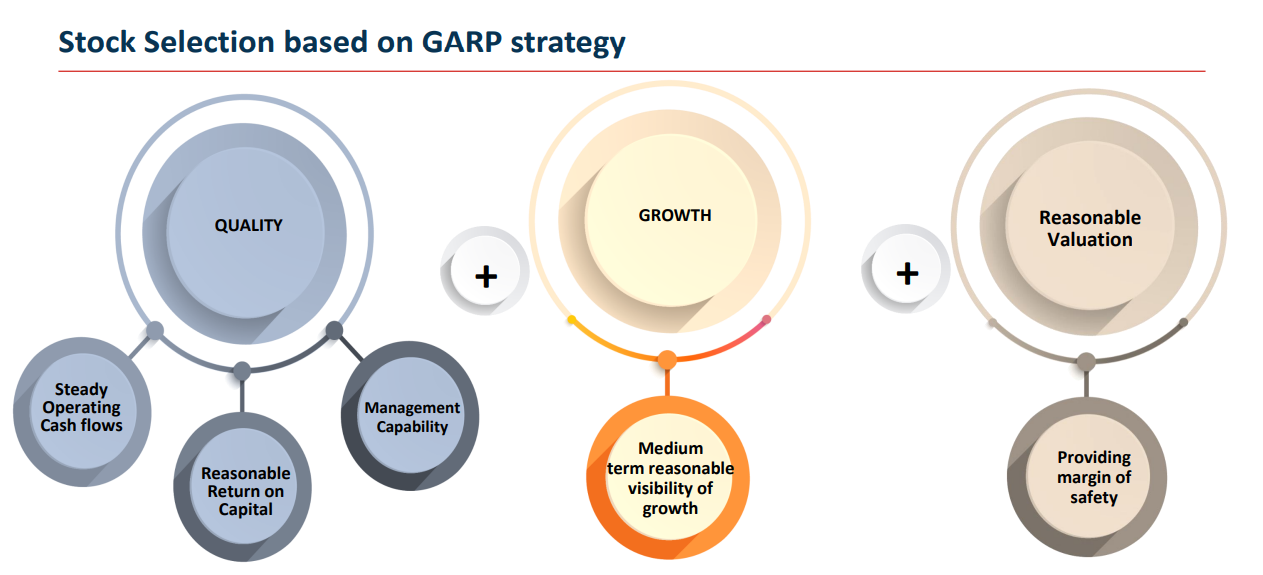

(H) Investment Philosophy

The Bandhan Small Cap Fund follows a disciplined 3-pronged stock selection approach based on Quality, Growth, and Reasonable Valuation

The fund aims to identify fundamentally strong small-cap companies with sustainable growth prospects, while ensuring investments are made at attractive valuations. This philosophy helps build a diversified portfolio designed to manage risks effectively and generate long-term wealth for investors.

(I) Taxability on earnings

Taxation

Capital Gains Taxation

- If you sell mutual fund units after 1 year of investment, gains up to ₹1.25 lakh in a financial year are exempt from tax, while gains above this are taxed at 12.5%.

- If you sell within 1 year of investment, the entire gain is taxed at 20%.

- No tax is payable as long as you continue to hold the units.

Dividend Taxation

- Dividends from mutual funds are taxed as per the investor’s income tax slab.

- If the dividend income exceeds ₹10,000 in a financial year, a 10% TDS is deducted by the fund house before payout.

Drop us your query at – info@pawealth.in or Visit pawealth.in

References: valueresearchonline.com, Industry’s Publications, News Publications, Mutual Fund Company.

Disclaimer: The report only represents personal opinions and views of the author. No part of the report should be considered as recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore

💡 Liked this analysis?

Stay updated with more market insights & wealth strategies from PA Wealth.

✉️ Contact Our Experts Today