- About

- Basic Details

- Investment Strategy

- Classification Portfolio of the fund

- Fund Managers & Tenure of managing the Scheme

- Investment Details

- Returns Generated

- Risk Factors

- Taxability of Earnings

(A) About the Stallion Assets

Stallion Asset is a SEBI-registered portfolio management firm that emphasis on high-growth equities investing. Furthermore, they follow a particular investment philosophy that combines growth, quality, and longevity, with the goal of creating wealth over time. With a proven track record, they also cater to investors looking for steady and higher returns in the equity market.

(B) Basic Details

| Fund Structure | Discretionary PMS |

| Launch & Start Date | 22-Oct-2018 |

| Type | Open-ended |

| AUM | ₹3890.85 Cr (As on 31st Dec, 2024) |

| Number of Clients | 2793 |

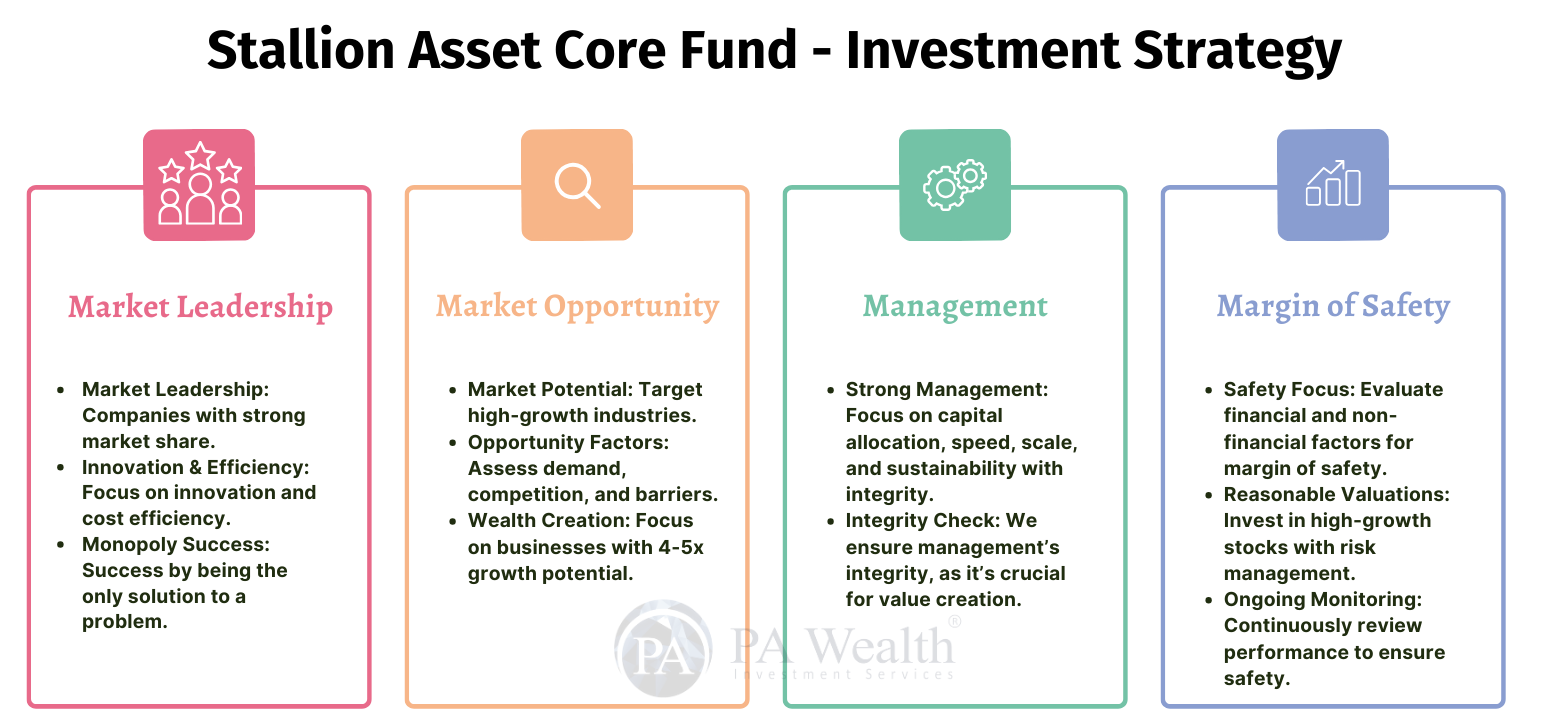

(D) Investment Strategy

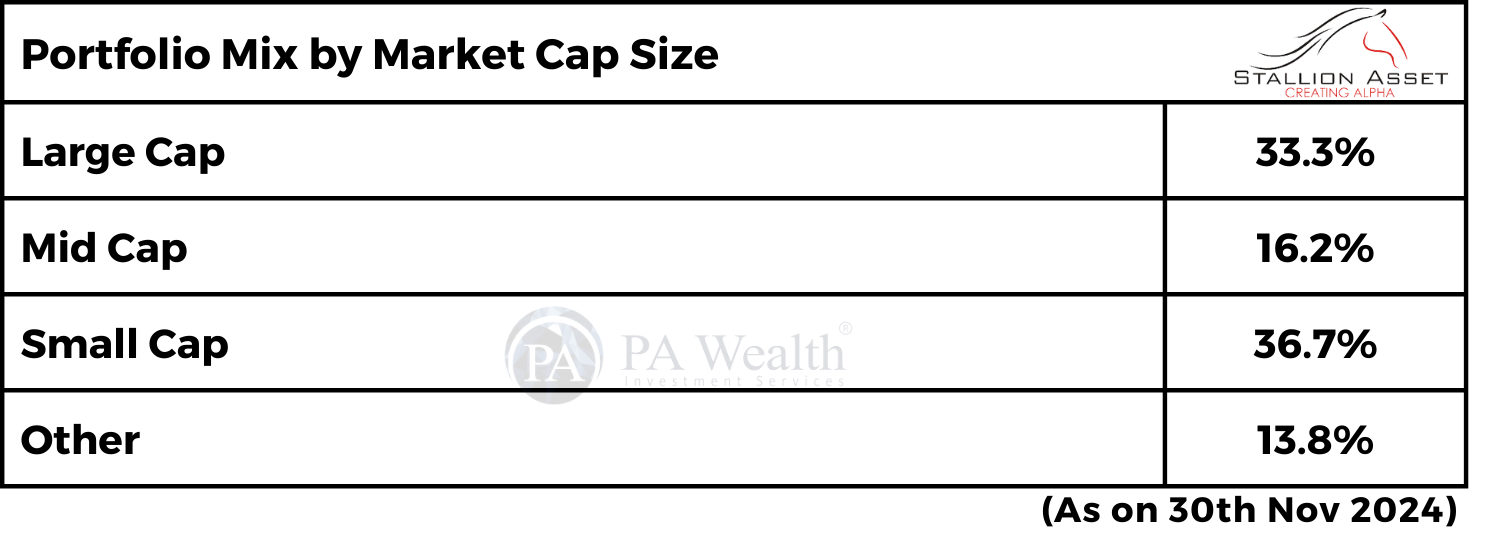

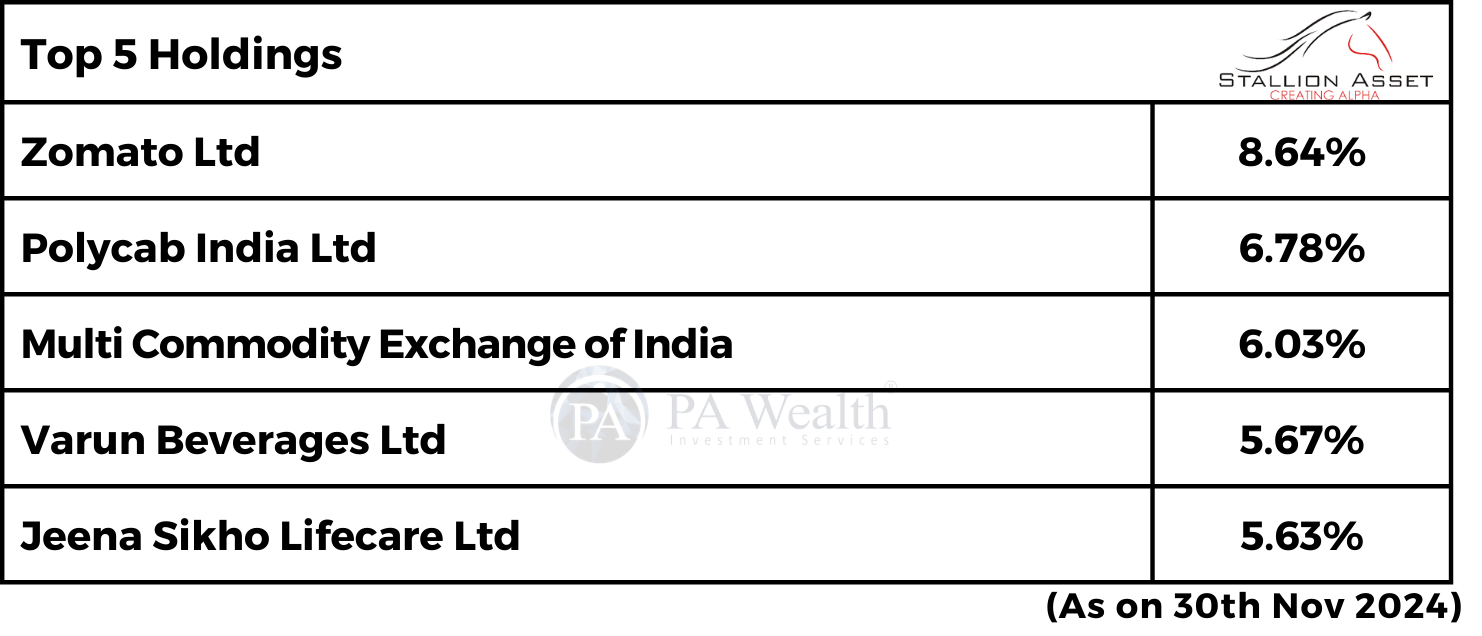

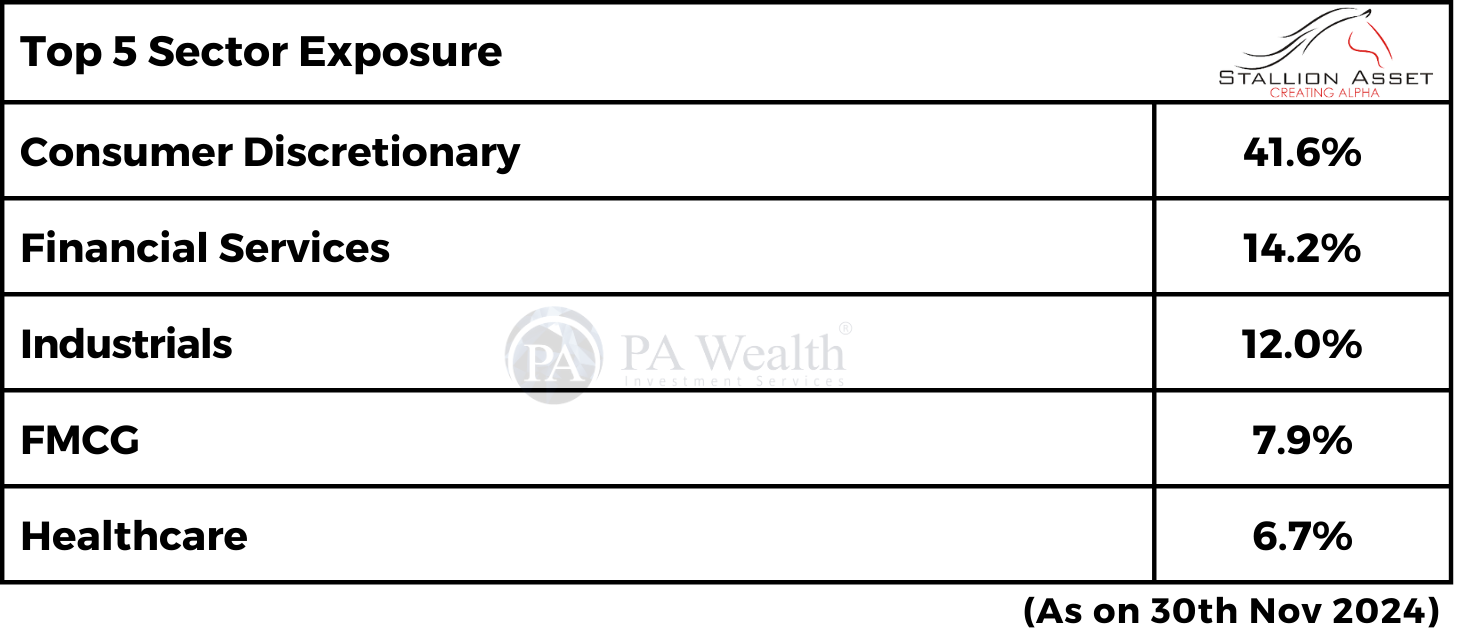

(E) Classification Portfolio of the fund

(i) Portfolio Mix by Market Cap Size

(ii) Top 5 Holdings of the fund

(iii) Top 5 Sectors Exposures

(D) Fund Managers & Tenure of managing the Scheme

(E) Stallion Asset Core Fund – Investment Details

| Stallion Asset Core Fund | |

|---|---|

| Minimum Investment | ₹ 50,00,000 (As on 31st Dec, 2024) |

| Exit load | 2% before 12 months |

| Lock In | No |

| Expense Ratio | Fixed fee: 2.5% p.a. (As on 30 Nov 2024) OR Fixed Fee of 1.5% p.a. and a performance fee of 15% above 10% Hurdle Rate (As on 30 Nov 2024) |

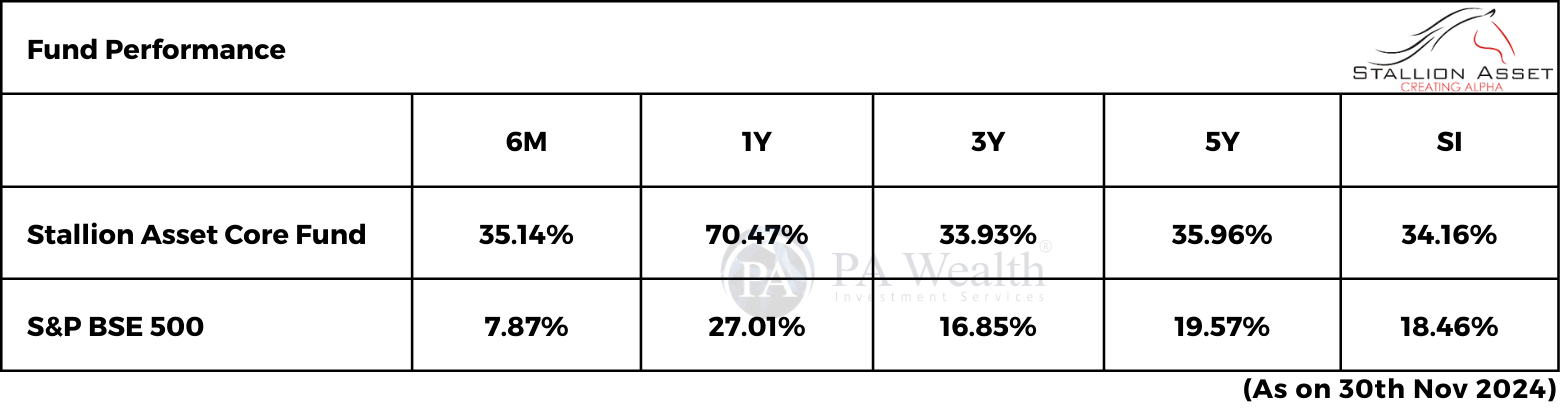

(F) Returns Generated By Stallion Asset Core Fund

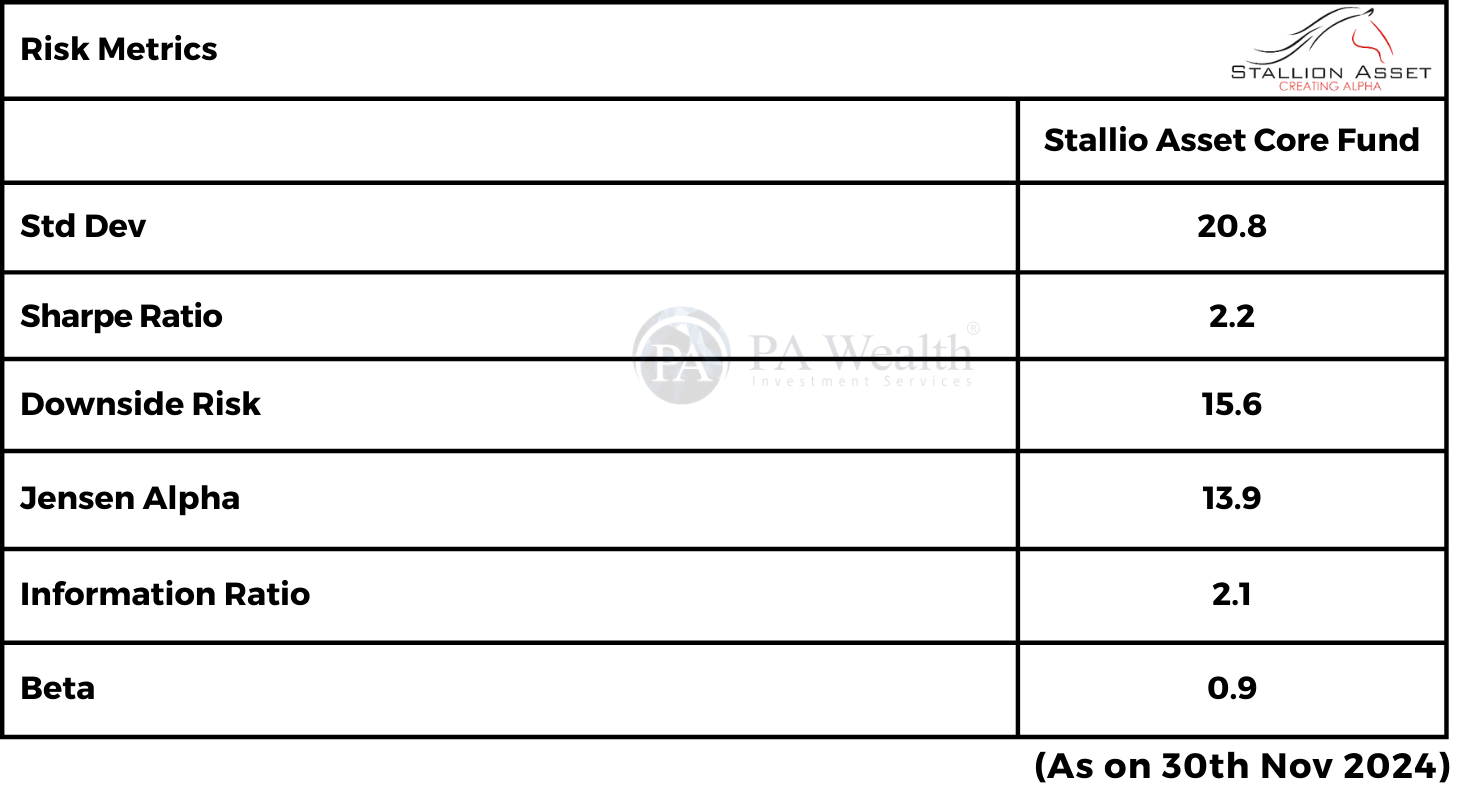

(G) Risk Factors

(I) Taxability on earnings

Capital Gains Taxation

- If the stocks are sold after 1 year from the date of investment, gains upto Rs 1.25 lakh in a financial year are exempt from tax. Meanwhile, gains over Rs 1.25 lakh are taxed at the rate of 12.5%.

- If the stocks are sold within 1 year from the date of investment, the entire amount of gain is taxed at the rate of 20%.

Dividend Taxation

Dividends are added to the income of the investors and taxed according to their respective tax slabs. Further, if an investor’s dividend income exceeds Rs. 5,000 in a financial year, the fund house also deducts a TDS of 10% before distributing the dividend.

Drop us your query at – info@pawealth.in or Visit pawealth.in

References: PMS Bazaar, Industry’s Publications, News Publications, PMS Company.

Disclaimer: The report only represents personal opinions and views of the author. No part of the report should be considered as recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore