Carnelian Shift Strategy’s QGARP approach combines growth potential with valuation discipline, focusing on quality companies with scalable models and robust cash flows for sustainable wealth creation and superior risk-adjusted returns.

- About

- Basic Details

- Investment Strategy

- Classification Portfolio of the fund

- Fund Managers & Tenure of Managing the Scheme

- Investment Details

- Returns Generated

- Risk Metrics

- Taxability of Earnings

(A) About the Carnelian

Carnelian Asset Advisors LLP, a boutique investment management firm founded in April 2019, manages USD ~1.3 billion. It aspires to build a best-in-class asset management platform renowned for its values, expertise, and best practices. Specializing in Indian equity investments, Carnelian caters to HNIs, family offices, institutions, and partners’ own capital across diverse strategies, market caps, and sectors. Its PMS emphasize long-term wealth creation through a research-driven approach focused on quality businesses, capital preservation, and compounding.

(B) Basic Details of Carnelian Shift Fund

| Fund Structure | Discretionary PMS |

| Launch & Start Date | Oct, 2020 |

| Type | Open-ended |

| AUM | ₹3373 Cr (As on 31st Dec, 2024) |

| Strategy | Small & Mid |

(D) Investment Strategy

- Strategy designed to capture structural decadal shifts presenting large opportunity in

– Manufacturing led by conducive regulatory and global environment

– Tech evolution empowered by digitalization globally - Concentrated QGARP (quality growth companies at a reasonable price) portfolio –

– Blend of mid & small cap listed companies

– niche core competence & large opportunity size

– proven track record

– impeccable management capabilities - Stock holding : 20-25 ; Benchmark against BSE 500 TRI

- Subjected to stringent Carnelian filters & forensic checks (CLEAR framework)

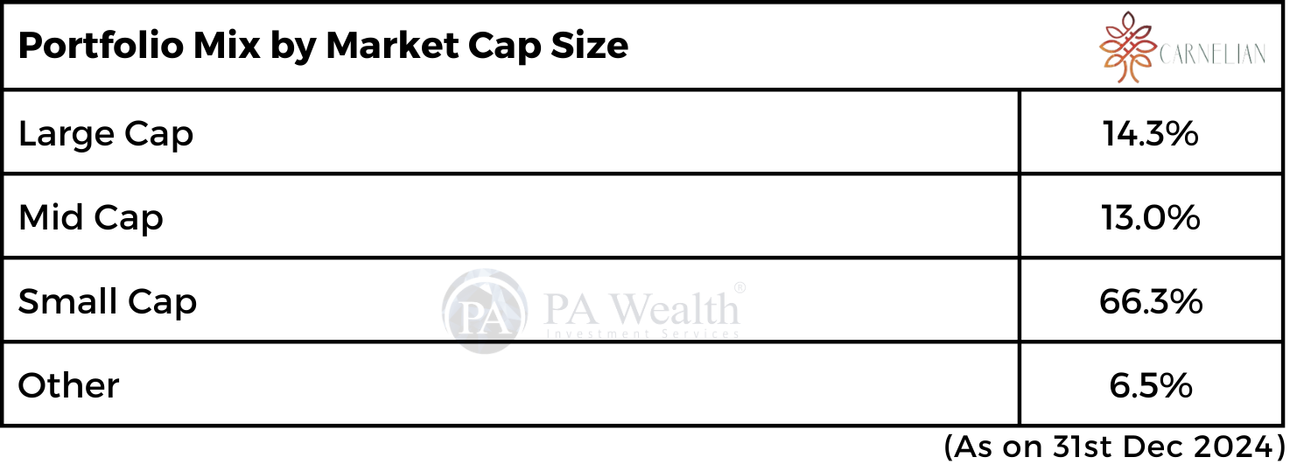

(E) Classification Portfolio of the Carnelian Shift Strategy

(i) Portfolio Mix by Market Cap Size

(ii) Top 5 Holdings of the fund

(iii) Top 5 Sectors Exposures

(D) Fund Managers & Tenure of managing the Scheme

(E) Carnelian Shift Strategy Fund – Investment Details

| Carnelian Shift Strategy Fund | |

|---|---|

| Minimum Investment | ₹ 50,00,000 (As on 31st Dec, 2024) |

| Exit load | 1 Year – 1% |

| Lock In | No |

| Expense Ratio | Fixed fee: 2.5% p.a. (As on 31st Dec, 2024) or Fixed AMC fee: 1.50% or 0.00% Hurdle: 8.00% Profit Sharing: 15% profit Sharing above 8% hurdle or 20% Profit Sharing above 8% Hurdle(with Catch up) |

(F) Returns Generated By Carnelian Shift Strategy Fund

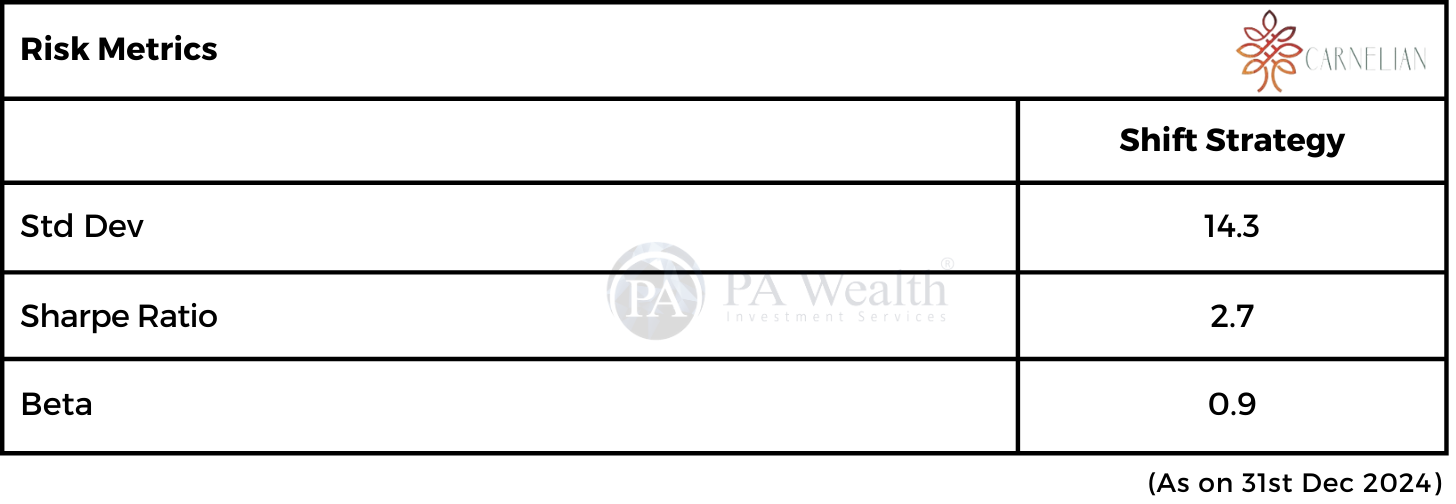

(G) Risk Metrics

(H) Taxability on earnings

Capital Gains Taxation

- If the stocks are sold after 1 year from the date of investment, gains upto Rs 1.25 lakh in a financial year are exempt from tax. Meanwhile, gains over Rs 1.25 lakh are tax at the rate of 12.5%.

- If the stocks are sold within 1 year from the date of investment, the entire amount of gain is taxed at the rate of 20%.

Dividend Taxation

Dividends are include in the income of the investors and taxed according to their respective tax slabs. Further, if an investor’s dividend income exceeds Rs. 5,000 in a financial year.

Drop us your query at – info@pawealth.in or Visit pawealth.in

References: PMS Bazaar, Industry’s Publications, News Publications, PMS Company.

Disclaimer: The report only represents personal opinions and views of the author. No part of the report should be considered as recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore