Dixon Technologies (India) Limited (Dixon) is Electronic Manufacturing Services (EMS) provider in India. Dixon manufactures products as Original Equipment Manufacturer (OEMs) & Original Design Manufacturer (ODM).

Quick Links. Click to read the detailed paragraph.

- History of Dixon

- Shareholding Pattern

- Executive Management of Dixon Technologies

- Product Categorization of Dixon

- Revenue Segmentation of Dixon

- Manufacturing Facilities

- Manufacturing Capacity

- Cost Structure of Dixon

- Group Structure of Dixon

- Market Share of Dixon Technologies

- Competitive Advantage of Dixon Technologies

- Competitors of Dixon

- Recent Financial Performance of products of Dixon

- Significant Ratios

- Dixon's Management Discussion Highlights

- Opportunities & Risk/Concerns

- Attributes of Indian EMS Industry

Many national & international brands are associated with company. Therefore, Dixon is a leading Original Design Manufacturer (ODM) of lighting products, LED TVs & semi-automatic washing machines in India. In ODM the company develops & designs products in-house at its R&D center. Dixon supplies its products to well-known companies which sell under their own brands. Mr. Sunil Vachani is the founder & Executive Chairman of the company.

A. History & Major Company Events

1993:

Dixon Technologies (India) Limited incorporated as `Weston Utilities Ltd’ at Alwar, Rajasthan on January 28, 1993. Then, on July 14, 1993 company’s name changed to `Dixon Utilities and Exports Limited'.

1994:

The Company commenced manufacture of color televisions.

1996:

Further, the Company established its manufacturing facility at Noida.

2002:

The Company converted to a private limited company & the name of the Company changed to `Dixon Utilities and Exports Private Limited'.

2006:

Name of the company changed to ‘Dixon Technologies (India) Private Limited' on January 3, 2006 to emphasize the relevance of technology in the operations of the company.

2007:

Dixon commenced manufacturing of LCD TVs.

2008:

The company entered the lighting products vertical with manufacture of CFL products. Moreover, the company commenced Reverse logistics operations.

2009:

Then, company's subsidiary ‘Dixon Bhurji Moulding Private Limited’ (DBMPL) commenced commercial manufacturing in the metal sheet & moulding segments.

2010:

Dixon commenced manufacturing of LED TVs. Also, Dixon Appliances Private Limited (DAPL) started manufacturing of washing machines.

2014:

Company achieved more than Rs. 10,000 million of revenue from operations on a standalone basis.

2015:

The Company acquired remaining shareholding of its subsidiaries DAPL & DBMPL. Thus, they became wholly owned subsidiaries of the company.

2016:

Dixon started manufacturing of LED products. During the year under review the company's joint venture Padget Electronics Private Limited (PEPL) commenced manufacturing of mobile phones.

2017:

Dixon converted into public limited company on May 2, 2017. Dixon shares listed on BSE & NSE on 18 September 2017. IPO oversubscribed by 117.11 times.

2017:

Two wholly owned subsidiaries of Dixon ‘DAPL’ and ‘DBMPL’ amalgamated with the company. Also, Dixon entered into a joint venture named, ‘AIL Dixon Technologies Private Limited’ (ADTPL) with Aditya Infotech Limited for manufacture of security systems including CCTVs & Digital Video Recorders (DVRs).

2017:

Dixon Technologies entered into Design, Manufacture & Supply agreement with Flipkart India Private Limited for designing & manufacturing of televisions, washing machines & other electrical appliances.

2018:

The company started production of Liquid Crystal Module (LCM) line at Tirupati, Andhra Pradesh facility in order to help the company in backward integration. Dixon & Xiaomi India entered into agreement for manufacturing of LED TVs for Xiaomi – Mi LED TV. Thus, Dixon shall manufacture Mi TVs for Xiaomi from its Tirupati facility. Dixon Technologies commenced its local production of Mi LED TVs with Mi LED Smart TV 4A 80cm (32”) & Mi LED Smart TV 4A 180cm (43”) for now.

2019:

Company acquired the remaining 50% stake of Joint Venture Padget Electronics Private Limited (PEPL). Thus, PEPL became a wholly owned subsidiary of company.

B. Shareholding Pattern

As on 30th September 2019, Promoters & Promoter Group shareholding in company is 38.89%. 37.05% of the total shareholding is with Mr. Sunil Vachani. In public shareholding, Institutional & Non-Institutional shareholding is 29.76% and 31.35% respectively.

Shareholders holding more than 1%

C. About the Executive Management

Mr. Sunil Vachani - Executive Chairman

Mr. Sunil Vachani is the founder of the company. He holds a degree of Associate of Applied Arts in business administrations from the American College in London.

Adding further, his age is 50 years. He has a 23 years old son & daughter of the age of 20 years. His remuneration for FY19 is Rs. 3.39 crore which is 5.35% of the consolidated Net Profit for the year & 0.11% of revenue.

Mr. Atul B. Lall - Managing Director

He holds a master’s degree in management studies from the Birla Institute of Technology and Science, Pilani. Mr Atul is associated with the company since inception. He is responsible for company’s overall business operations. His remuneration for FY19 is Rs. 2.76 crore which is 4.36% of the consolidated Net Profit for the year & 0.09% of revenue.

D. Products of Dixon Technologies

The principal businesses contributing more than 10% to the revenue of the company are Televisions, LED Bulbs & Washing Machine. Revenue contribution of Televisions, LED Bulbs & Washing Machine are 44.16%, 25.91% and 14.82% respectively in FY19 and 44.99%, 18.01% and 12.65% in FY18.

(a) Consumer Electronics

The segment includes LED TV, Home Theatres, FPD, & Smart TVs. The main product of the segment is LED TVs. Company’s backward integration includes backlight units, plastic moulding, circuits, LCM (liquid crystal monitor) & SMT (surface mount technology).

Adding further, Dixon has capacity of LEDs to cover 26% of Indian market needs. The major customers in this segment include Xioami, Panasonic, Llyod, Flipkart, Philips, Koryo. Moreover, in Q2FY19, the company started SMT line for LED TV PCB with capacity of 1 lac per month. Xiaomi emerged as anchor customer for company.

(b) Lighting

The major customers in this segment are Philips, Bajaj, Wipro, Panasonic, Syska, Jacquar, C&S, Polycab. The company has acquired in-house capabilities for designing LED lighting solutions from 0.5W to 50W. This includes main electronic board designing, mechanical, light source & packaging designing. In addition, backward integration includes sheet metal, plastic moulding & wound components. Thus, Dixon is an ODM player in this segment. Adding further, almost 90% of the revenues in this segment today come from own design solutions. The company's capacity is for ~50% of the total organized market of lighting in India.

(iii) Home Appliances

Dixon manufactures semi-automatic washing machine ranging from 6.0 kg to 9.0 kg. Company supplies washing machines to brands like Samsung, Panasonic, Godrej, Marq, Koryo. Company has more than 140 models in this category. Moreover, the company has in-house capabilities for designing the complete range of semi-automatic washing machines.

(iv) Mobile Phones

Dixon manufactures both feature & smart phones. Company is supplying feature phones to Global brand ‘Samsung’. Moreover, Dixon commenced SMT Line for mobile phone PCBA Manufacturing in Nov 2018. PCB is one of the most important components of the smart phone & which constitutes nearly 50% of the value add of the phone.

(v) Security Systems

Company manufactures CCTV Cameras & DVRs through joint venture with Aditya Infotech Ltd. Aditya Infotech owns 'CP Plus' & also a distributor for Chinese brand ‘Dahua Technology’, one of the largest surveillance brands globally.

(vi) Reverse Logistics

This business segment of the company involves repair & refurbishment of set top boxes, LED TV panels & mobile phones. This business is more strategic in nature. In other words, purpose is to enhance the stickiness with the customers & provide them end-to-end solution.

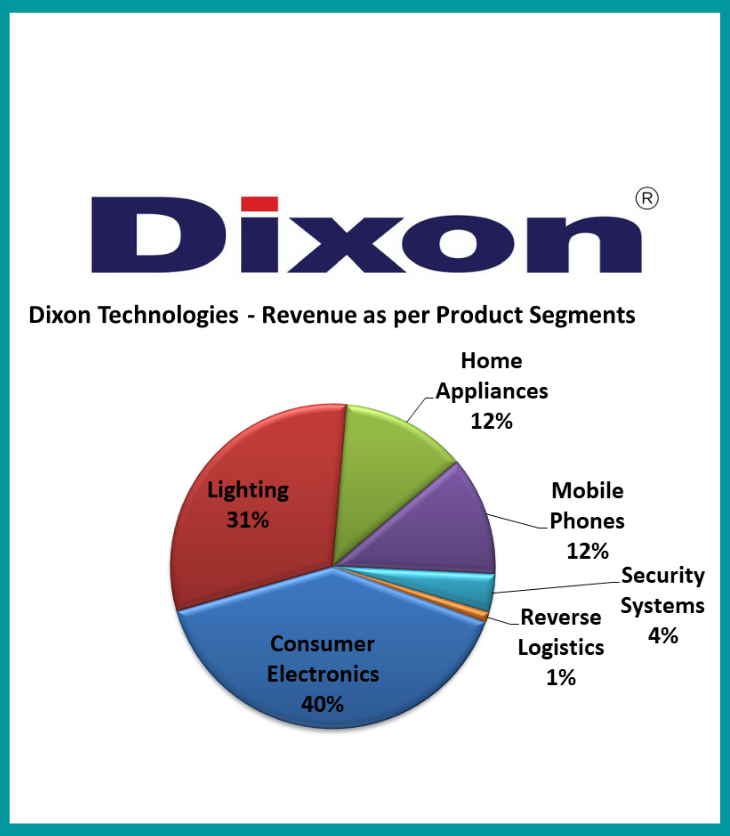

E. Revenue Segments

Revenue Classification for segment reporting

ODM Share

ODM (Original Design Manufacturer) means manufacturing products which are designed by the company. Thus, the company does research to develop & innovate a product. ODM share in the different products' revenue:

F. Manufacturing Facilities

Dixon has ten manufacturing facilities across the states of Uttar Pradesh, Uttarakhand & Andhra Pradesh.

- Four facilities in Noida, Uttar Pradesh for manufacture of mobile phones, LED lamps & drivers.

- Four units in Dehradun, Uttarakhand for manufacture of electronic ballasts, LED TVs, washing machines, LED lamps & drivers.

- And then, two in Tirupati, Andhra Pradesh for production of LED TVs & Security systems.

- Moreover, company has 3 R&D centers. 2 R&D centers located in India & 1 R&D center in China.

G. Manufacturing Capacity

H. Cost Structure

I. Group Structure

J. Market Share

- In overall EMS Industry, the company secures market share of around 9.2%.

- In TV segment, the company secures more than 15% market share. As per management, the company holds 50% market share in FPD TV segment.

- Dixon accounts for around 34% of domestic volumes of LED Lighting.

- In addition, the company commands 27% market share in Washing Machine.

- Moreover, 25% market share in Mobile Phones segment.

K. Competitive Advantage

(i) Addition of clients & products:

Company is supplying products to big brands. Brands like Panasonic & Phillips are connected with company from past some years. Company has also added new brands like Xiaomi, Samsung & Bajaj among others. Thus, with entry into security system & reverse logistics, the company has more diversified business.

Dixon's derives higher revenue share from anchor customers, however its constant endeavour is to acquire new customers through new segments & increase offerings within existing segments (in Lighting segment its anchor customer Philips now contributes ~45% to the segment revenues vs. ~90% earlier.

(ii) Focusing more to increase ODM share:

Company’s ODM share increased from ~15% in FY17 to 38% in FY19 owing to its focus on developing value added products. ODM business fetches ~200-300 bps higher margins than OEM business. In Home Appliances ODM share continues to be 100%, in lighting its ODM revenue stood at 71% (vs. 40% in FY18), and Consumer Electronics ODM share is 9% (vs. 6% in FY18) which is likely to improve further as Dixon converted large customer Panasonic from prescriptive mode to ODM mode.

(iii) Backward integration Focus. Thus, improving cost efficiencies.

L. Competitors

There are many global & local competitors of Dixon. Global competitors are Foxconn, Flex, Sanmina & Wistron.

Then the Indian competitors include NTL, SFO Techno, ELIN, PG Group, Kaynes, Hical Tech, SGS Tekniks & Amara Raja Electronics.

The competition with these entities is in distinct product segments.

M. Performance Highlights

Segment wise performance in the recent quarter of FY19-20

N. Significant Ratios

O. Management Discussion Highlights

- The company reduced its net debt to Rs 52 crore as on 30 September 2019 against Rs. 96 crore as on 31 March 2019.

- In washing machine segment, the management is in process of tying up with two large MNC brands. As a result, this will consume almost 70% of capacities.

- In addition, a new customer is added for semi-automatic washing machine of 1 lac units per year which is 11-12% of company capacity. This contract is for Indian market only.

- In Q3, a higher proportion of Xiaomi sales is expected with new increased capacity. Because of higher sales of LED TV to Xiaomi the company sales will not decline as much as of the market as during post Diwali time.

- Washing machine operating margin guidance is 10%-10.5%

- Raw material consumed cost as percentage of sales has increased from 84% to 90% YoY because of change in sales mix. Consumer electronics business margins are lower as compare to other business.

- Then in consumer electronics segment, company is in discussion with a large global brand which dominates Indian & Global market. The update will be given in January end.

- Capacity utilization for lighting, TV, home appliance is 75-80% for all. Capacity utilization of mobile phone is low but expected to increase with supply to Samsung.

- AC supply to Daikin is growing and profitable for the company. Company can achieve 25-30% growth YoY.

- Lastly, 15-20% growth is expected in next year in lighting business .

Capital Expenditure Guidance

Capex in first 6 months is around INR 35-36 odd crore & similar number is expected in balance part of year. In effect, the company bought a land in Tirupati for fully automatic machine & production is to be started in Q2-Q3 next financial year with anticipated capex of INR 45-50 crore to be split in H2FY20 & H1FY21. Then, some capex on expansion of capacities in LED TV segment. Capex guidance is INR 65-70 crore for this year as well as for next year.

Also, Dixon is expanding its SMT capacity from current 1 million to 2.4 million by end of fiscal year 2019-20.

The company expanded capacity in phase I in batons from 250K a month to 800K per month. Then, in phase II that is by Q1 next fiscal this will be expanded to 1.5 million. So, the total Indian requirement we understand is around 5 million a month, Dixon will be almost at 30%.

Also, Dixon plans to add 10 Kg washing machine in its portfolio by Q1 of next fiscal year.

In addition, 'fully automatic washing machine' capacity on which the company is working is to be 600K annually.

Moreover, the company has setup new capacity for mobile phones in Noida, the combined capacity now for smart phones is going to be around 1 million per month. Earlier it was 300K per month.

P. Opportunities & Risks/Concerns

Opportunities

(i) Low penetration of consumer durables in India:

Penetration of consumer durables is low in India as compared to global. Further, easy availability of credit, increasing urbanization & increase in income will lead to higher demand for the products.

(ii) Increasing localization:

Many of the products are imported by the companies. Thus, Make in India campaign & inherent cost advantage will lead to increase in localization of products. In addition, Cut in duty of Open Cell to 0% from 5% shall promote local manufacturing of LED TV’s. Customs duty hike on Washing Machines (less than 10 kg) from 10% to 20% will make domestic production competitive. Customs duty also increased on CCTV cameras /DVR’s to 20% from 15%.

Risks/Concerns

(i) Raw Material prices

Dixon imports various types of raw materials required the production. Prices of these materials are very volatile in international market. Thus, any unfavorable change in price can badly hit the margins of the company. As foreign deals are done in foreign currency, the currency prices also effect the company.

(ii) Competition

Company faces competition from various domestic & overseas players. For instance, companies like Foxconn have a large R&D team & fund for the development of product catering to the changing needs of customers.

(iii) In-house manufacturing:

Brands which are outsourcing their production & receiving supply from the company can also resort to in-house manufacturing. This can happen if Dixon increases the prices of its products. When companies feel that in house manufacturing is more profitable to them compared to outsourcing then they can set their own unit.

(iv) Government Policies

Any unfavorable change in government policies like change in import duty & custom duty can impact the business of the company. As duties/taxes are quite impacting factors for the company.

Q. EMS Industry Attributes

- OEM’s preference for strategic tie-up with EMS players like Dixon to meet domestic demands will lead Indian EMS/ODM market to grow at robust 32.4% during FY19-21E.

- India’s EMS market is just 0.6% of the global EMS market and is expected to reach 1.6% by CY2021, aided by

a. Rising per capita income and affluent middle class

b. Increasing nuclear families

c. Enhanced features and availability of finance leading to early

d.adoption of consumer electronics

e.Make In India thrust

f. Rationalisation of duties & taxes - Low cost of production in India will incentivize brands to manufacture locally/depend on domestic manufacturers.

All in all, the EMS industry is a well growing industry with vast opportunities. The industry is also characterized by many competitive players.

Drop us a mail at - info@pawealth.in or Visit pawealth.in

References: Annual Reports, News Publications, Investor Presentations, Corporate Announcements, Management Discussions, Analyst Meets & Management Interviews, Industry's Publications.

Disclaimer: The report only represents personal opinions and views of the author. No part of the report should be considered as recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Thanks for sharing.

We are from Ossywud Technologies Pvt Ltd

Ossywud is one of the fastest growing Consumer Electronics Brand.

We are Manufacturers of LED TV’s and we are also into Multimedia Speakers, DJ Speakers, Trolley Speakers, Tower Speakers, Bluetooth Speakers etc

Thank you.

Wooww. A well analysed and detailed article. Useful for my project preparation. Thank you.

Thank you !! Keep reading & sharing our upcoming blog posts.