Eicher Motors is the leading motorcycle brand in the 250cc-750cc midsize market in India, Korea, and the UK, while ranking second in Thailand, and third in France, Italy, and Australia. Let’s explore the company’s journey, its diversified business segments, financial growth, and strategic initiatives that have established its global presence.

- About

- Industry

- Journey

- Board of Director

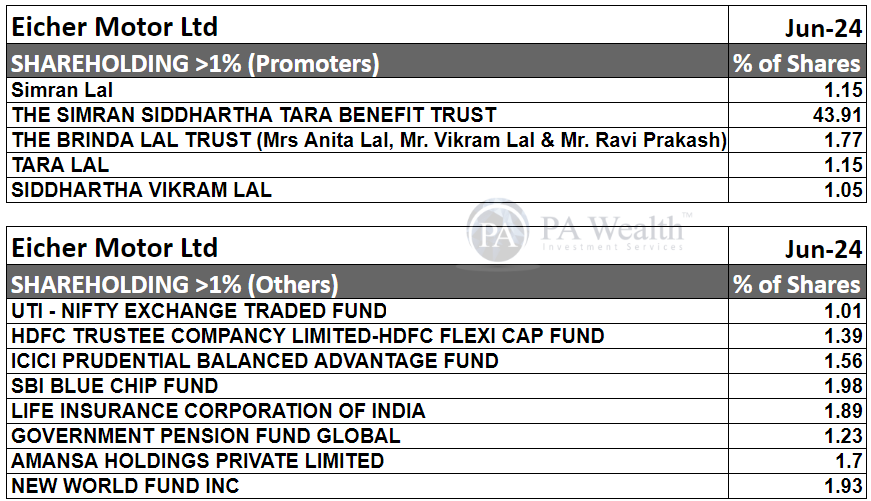

- Shareholding Pattern

- Business Classification

- Cost Structure

- Financials

- Management Discussion & Concall

- Strengths & Weaknesses

(A) About

Eicher Motors was incorporated in 1982, a leading player in the Indian automobile industry and the global leader in middle-weight motorcycles. Eicher has a JV with Sweden’s AB Volvo to create Volvo Eicher Commercial Vehicles Ltd (VECV).

The JV is engaged in EML’s truck and bus operations, auto components business and technical consulting services business, as well as in Volvo Group’s India truck sales and marketing functions, services and spare parts network for both Volvo trucks as well as buses.

(B) Industry

- As per SIAM data, 2W industry (domestic) recorded sales of 1,79,74,365 units in FY24 vs 1,58,62,087 units in FY23 and export sales of 34,58,416 units in FY24 as compared to 36,52,122 units in FY23.

- 2W EV industry sale reached 9.4 lakh units in FY24, a growth of 29% YoY.

- Commercial vehicle sales (domestic) in FY24 were 9,67,878 units as compared to 9,62,468 units in FY23.

- The long-term demand outlook appears positive for the commercial vehicle industry, supported by robust macroeconomic conditions, steady replacement demand for passenger vehicles, increased focus on infrastructure projects with higher budget allocations and improving freight demand.

- As per Niti Aayog’s report by 2030, the Indian government is aiming for EV adoption to reach 40% for buses, 30% for private cars, 70% for commercial vehicles and 80% for 2W.

Opportunities in Motorcycle Industries

The market share of >250cc motorcycles has been steadily increasing over the past decade, from 2.5% in FY14 to 8.1% in FY24.

- Demand for premium products is growing in India driven by rising aspiration levels and growing per capita income.

- Global mid-sized motorcycle is underserved with a few globally operational brands in the segment.

- Companies launch events and rides.

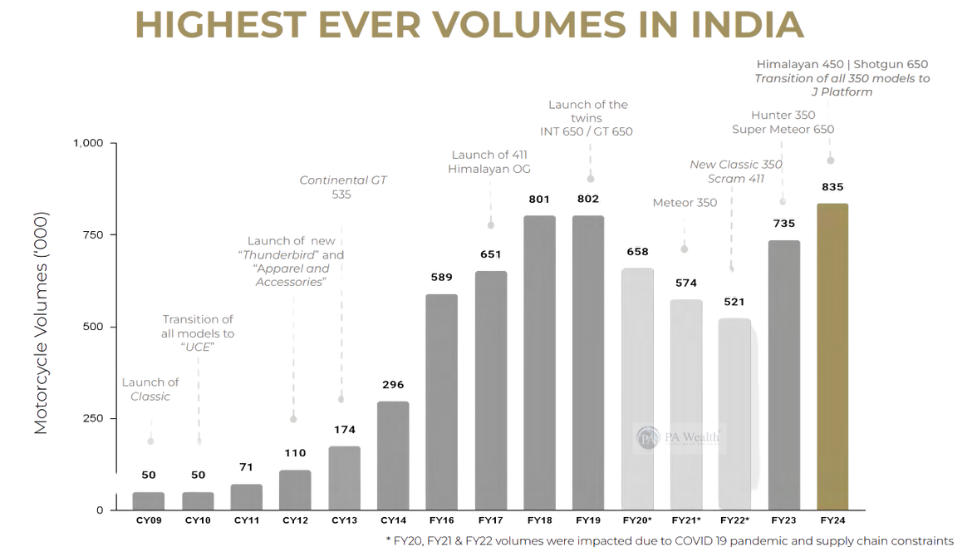

(C) Journey

(D) Board of Directors

(E) Shareholding Pattern

(F) Business Classification

(i) Royal Enfield (RE)

Royal Enfield is a brand which manufactures 2W mid-weight (250cc to 750cc) premium segment motorcycles which has had a presence since 1901. It currently operates in India and over 60 countries with five subsidiaries around the world. It has an 88.2% market share in India’s mid-size 250cc to 750cc mid-size motorcycle segment.

EML has a Non-Motorcycle business which includes selling Apparel (men and women); protective riding apparel, urban casual wear, and riding accessories.

(ii) VE Commercial Vehicles

VE Commercial Vehicles Ltd (VECV) is a JV between Eicher Motors Ltd and Volvo Group with a share of 54.4% and 45.6% respectively. In operation since July 2008, the company includes the complete range of Eicher branded trucks (Light, medium and heavy-duty vehicles) with GVW of 4.9-55T and buses (Seating capacity of 12-72) under Skyline and Starline brands.

VECV’s volume increased by 7.5% from FY’23 to FY’24, which is greater than the industry growth. This increase in volume increased VECV’s market share from 16.9% in FY23 to 17.5% in FY24.

(G) Cost Structure

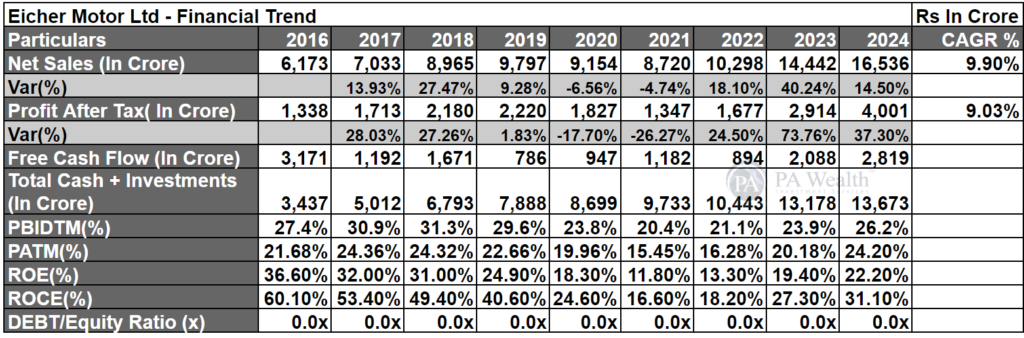

(H) Financials

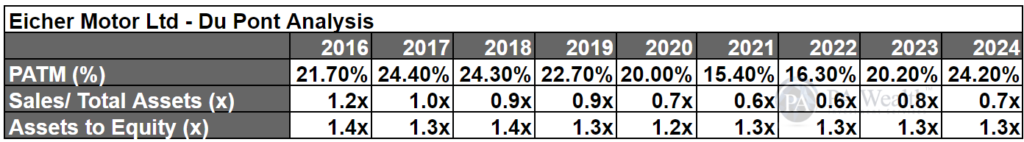

The company’s revenue has grown at a CAGR of 9.9% over the past 9 years, increasing from Rs 6173Cr in FY16 to Rs 16536 Cr in FY24. Subsequently, the company’s PAT has also shown growth, rising from Rs 1338 Cr in FY16 to Rs 4001 Cr. in FY24 at a CAGR of 9.03%.

(I) Management Discussion & Concall

- The company’s long-term goal is to establish itself as a global premium motorcycle brand based in India.

- The company is the best-selling motorcycle brand in the 250cc-750cc midsize market in India, Korea, and the UK, second in Thailand, and third in France, Italy, and Australia.

- In the EV market, the company has numerous ideas in advanced stages of testing and intends to introduce its first EV product in 2025.

Non-Motorcycle Performance

- The company provides a pure riding experience that includes rides, hassle-free ownership, personalization, and convenient and thorough motorcycle maintenance and care.

- The company’s apparel business grew by 19.5% in FY2023-24 over the previous year.

Americas

- It has been the largest market outside of India by sales volume over the last three fiscal years.

- Royal Enfield’s market share is roughly 7.8% in North America and 7.9% in Latin America.

Europe, Middle East and Africa (EMEA) Market

- The company gained the No.1 position in the UK with a 20.4% market share in the mid-size motorcycle segment.

- Furthermore, it is the 3rd largest player in the mid-size motorcycle segment in Europe.

Volvo Eicher Commercial Vehicles

- The company had its highest-ever annual sales of 85,560 units, representing a 7.5% gain.

- Annual parts sales reached a record of Rs 2118.46 crore, up 24% compared to FY23.

- It had a market share of ~10% in heavy-duty vehicles and 35.8% in light and medium-duty trucks.

Q4FY24 Concall Highlights

- During the year, 9,12,732 units were sold, up from 8,34,895 in FY23, representing a ~9% increase over the previous year.

- During the quarter, the company received a good reaction from both Indian customers and global markets.

- The company’s high prospective markets (with huge potential over the next 5-10 years) are Southeast Asia and Latin America.

- During the year, the company expands into Turkey. It has also established the fifth CKD (Completely Knocked Down) unit outside India, in Nepal.

- The company will soon launch a bike on the 450cc platform.

- The ASP (average selling Price) for the quarter increased due to a higher mix of higher cc motorcycles.

(J) Strengths & Weaknesses

Strengths

1. Established and niche brand positioning; continued leadership position in mid-weight premium sub-segment

Eicher Motors RE brand has over 90% market share in the greater-than-250cc displacement sub-segment of motorcycles (domestic) and has maintained its leadership position for over a decade.

2. Expanding product range and improving technical capability

Regular new launches and product variations underpin EML’s technical prowess. With the launch of its ‘Himalayan’ (early 2016), ‘the twins’ (FY2019), ‘Meteor’ (FY2021),‘Hunter’ and Super Meteor(FY2023) models, the company has demonstrated its capability to develop new models from the ground up, incorporating a new engine as well as platform.

Weaknesses

1. Lack of segment diversification and rising competition in the premium segment

Eicher Motors product portfolio is concentrated in the250–750cc sub-segment, which caters to a niche clientele. Despite YoY improvement over the years, the sub-segment constitutes only the total 2W market in India.

Drop us your query at – info@pawealth.in or Visit pawealth.in

References: Annual Reports, News Publications, Investor Presentations, Corporate Announcements, Management Discussions, Analyst Meets and Management Interviews, Industry Publications.

Disclaimer: The report only represents the personal opinions and views of the author. No part of the report should be considered a recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore