Garware Technical Fibres Ltd operates in technical textiles sector. The comapny is the flagship company of Garware Group.

Quick Links. Click to navigate to the detailed paragraph.

- Brief History of Garware Technical Fibres

- About the Executive Management of Garware

- Shareholding Pattern

- Products of Garware

- Revenue Segments & profit contribution

- Main raw materials used by Garware

- Cost Structure of Garware

- Garware Group Structure

- Competitive Advantage of Garware

- Technical Textiles Industry in India

- Opportunities & Risks/Concerns

- Future Course of Action

Founder of Garware

Bhalchandra Digamber Garware (fondly referred to as Abasaheb Garware) found the Group. He expired in November 1990. Further, his son, Mr. Ramesh Garware expanded the business ahead. Then, Mr. Vayu Garware, son of Mr. Ramesh Garware is the Chairman & Managing Director of the company.

Brief History

The Company mainly deals in fishing nets, sports nets and twines, yarns and ropes. Company’s products find their usage in sports, fisheries, aquaculture & shipping industry.

In 2017, Garware entered into MoU with Israel based Aero-T-Ink for mutual cooperation for manufacturing advanced aerostats for Indian defence. Aero-T-Ink is a subsidiary of Israel based RT LTA Systems.

In 2018, the company changed its name from Garware Wall Ropes Limited to Garware Technical Fibres Limited. This is because more than 60% of its revenue came from fibres business.

Moreover, during the year, in order to strengthen its presence, the company opened an exclusive dealer outlet at Veraval, Gujarat, in Gujarat trawl fishing segment.

About the Executive Management

Mr. Vayu R Garware – Chairman & Managing Director (Age 47):

Mr. Vayu is son of Late Mr. Ramesh Garware & grandson of Late Mr. Abasaheb Garware (Founder of Garware group). Mr. Vayu did B.Sc Economics (Specialization in Finance) from Wharton Business School of the University of Pennsylvania, U.S.A. Later, he joined the Company as a director in 1995; appointed as whole-time director in December 1996 & remained on this position till November, 2011. Then, he was appointed as Chairman & Managing Director. His remuneration for FY18 is INR 7.55 crore & in FY19 is INR 8.51 crore.

Mr. Mukesh Surana- Chief Financial Officer:

Mr. Mukesh is a Chartered Accountant by qualification. Mr. Mukesh was appointed as Chief Financial Officer of the Company with effect from 14th August, 2018. Prior to joining the company he served in organizations like ETG Group in Dubai, Kalpataru group & Asian Paints. His remuneration for the FY19 is INR 46.15 Lakhs.

Shareholding Pattern

The promoters’ holding in Garware Technical Fibres is 50.71%. 16.31% of the total shareholding is with Mr. Vayu R Garware & family. Mutual funds hold 1.95% of the total holding & foreign portfolio investors hold 6.61%.

Products of Garware Technical Fibres Ltd

(i) Fisheries:

Company is a leading fishing nets provider in India, ropes & twines. Company provides following products in the fishing category;

- Trawling: This further includes Braided Nets,Twisted Nets, Knotless Nets, Twines, Ropes.

- Gill Netting

- Dole Netting

- Purse Seine

(ii) Aquaculture:

Company has a strong presence in this field in Canada, USA, Norway, Scotland, Australia, New Zealand & Chile. Company’s key offerings include:

- Grow Out Cage

- Predator Cage

- Mooring & Vertical Ropes

- Lice shields

(iii) Shipping and Industrial:

Garware is largest player in India for providing industrial ropes & marine hawsers. Thus, company’s synthetic ropes are used in power transmission and marine hawsers for shipping. Category includes following products:

- Mooring

- Towing

- Single Point Mooring Systems

- Power Transmission

- Submersible Pumps

- Speciality Ropes

- Lifting & Material Handling

- Garfil Commercial Ropes – General Application

- Anti Bird Netting

- Safety Net

(iv) Yarn and Threads:

Garwre’s yarn & threads have application in various industries. For instance, portable bags, closing machines, port bagging thread & shoe stitching. Company also manufactures fibrillated bulk containers. The following products comes under this category;

- Bag Closing

- Shoe Stitching

- Doll Hair

- Woven Sack

- FIBC

- Jute Bag Stitching

- Weaving

- Reinforcements

(v) Sports:

Garware provides tennis nets, volleyball nets, basketball nets, skinets, cricket nets, badminton nets, soccer nets, handball nets etc. under ‘Sportiva’ brand name.

(vi) Coated Fabrics:

Company’s coated fabric is used in products ranging from truck tarpaulins to aquaculture solutions.

(vii) Agriculture:

Agriculture category includes agriculture shade nets, sericulture nets, insect nets, fencing nets, floriculture nets, crop support nets, grape nets, anti bird nets & staking cords.

(viii) Geosynthetics:

- Reinforced Soil Structures

- Hazardous Waste Landfill Design

- Coastal & River Protection Works

- Rockfall Protection

- Gabion Gravity Retaining Walls

- Geosynthetic Lining

- Erosion Control & Embankment Protection

- Railway Track Stabilization

Revenue Segments

(i) On the basis of Geography

Company exports its products to more than 75 countries. Scotland, Norway, Chile, UK, Canada & USA are main markets for the company. Also, Company’s export revenue as a percentage of total revenue is increasing from past few years. In FY18 revenue from India is INR 435.57 crore and this amount for FY19 is INR 429.41 crore. Export revenue is INR 449.92 crore in FY18 & in FY19 is INR 588.41 crore.

(ii) On the basis Business Segments

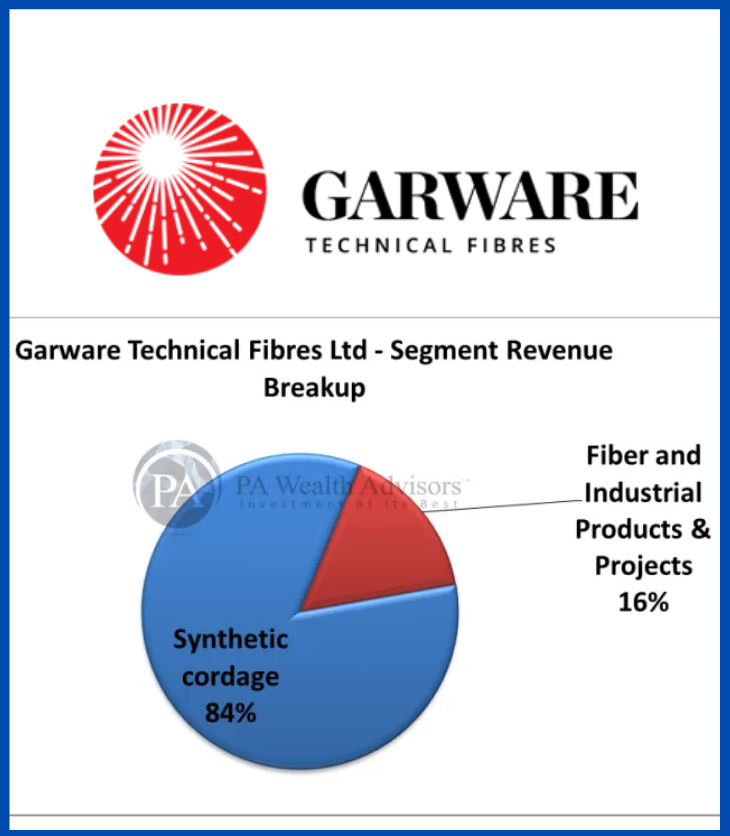

Garware Technical Fibres Ltd reports revenue in two segments: Synthetic Cordage & Fibre and Industrial products & projects. Synthetic cordage segment includes nettings, ropes & twines that is the major revenue contributor.

On the other hand, Fibre & industrial products & projects comprises of fibre, coated steel gabions, synthetic, fabric, yarn, secugrids, woven & non-woven textiles, Machinery & project. Revenue from synthetic cordage is INR 750.47 crore in FY18 and INR 855.15 crore in FY19. Secondly, Fibre and industrial products & projects revenue is INR 135.03 crore in FY18 and INR 162.67 crore in FY19.

(iii) Segment Results

Synthetic cordage segment’s profit (PBIT) is INR 152.37 crore in FY18 & INR 181.76 crore in FY19. Fibre and industrial products & projects segment’s profit (PBIT) is INR 19.70 crore in FY18 & INR 27.50 crore in FY19.

Raw Materials

Company’s main raw materials are crude derivatives. The key raw materials used by company include high density polyethylene, polypropylene, nylon, polyester yarn & G.I. wire.

In addition, some of the raw materials need to be imported from other countries Around 30% of the raw material purchase value accounts for outflow on raw material imports.

Cost Structure

Garware’s raw material consumption is 38% of the total expenditure. Other manufacturing expenses account for 25% which comprise processing charges, outsourced services & stores, spare parts & tools consumption.

Research & Development Spend

Group Structure

Also refer the article on group structure of Garware Group (Click to read)

Garware Technical Fibres Ltd has 1 subsidiary and 1 associate company:

Competitive Advantage of Garware

(i) Market Share:

Garware Technical Fibres Ltd has a dominant position in Indian fishnet industry. According to ICRA 2018 credit report, the company has 60-65% market share in organized domestic fishnets industry in India. Moreover, 30% share in global netting requirement in salmon aquaculture. And lastly, 17-18% in fishing segment.

(ii) Value added & differentiated products:

- Garware Technical Fibres Ltd is into B2B products.

- Value added products contribution to the portfolio is 65-70% in FY19 against 35% in past 3-4 years. Moreover, they contribute 70-75% of the profits.

- In addition, PBDIT margin increased to 18.9% in FY19 from 15% in FY15.

- Exports contribute 58% of the revenue of Garware.

In addition to above, the company has more than INR 350 crore in the form of cash and investment.

About Technical Textiles Industry in India

(i) Technical Textiles Industry Size:

In 2017-18, size of the industry is INR 1,16,217 crore approx. Currently, share of technical textiles in Indian textile value chain is around 13% . With the growth potential of various related sectors, technical textiles expect to grow at 18% CAGR during the period 2018-25.

(ii) Development in recent years:

Technical textile is a sub-set of the much larger textile sector, and has started gaining prominence only recently with evolving technology providing the means to enhance the functionality of textile products.

Therefore, all major players in India have started developing technical textiles products as they provide better margins in comparison to conventional textiles.

(iii) Import oriented:

Technical textile industry in India is import dependent. Many products, for instance, speciality fibres/yarns, medical implants, sanitary products, protective textiles, webbings for seat belts, etc. are mostly imported. However, technical textiles sector has registered impressive growth in the recent years.

(iv) Low penetration:

Despite showing impressive growth over the years, per capita consumption of technical textiles in India is very less (1.7 kgs) in comparison to other developing countries (10-12 kgs). This lower consumption in the Indian market is due to the fact that 41.6% of the technical textiles in India focuses on Packtech (Leno bags, soft luggage, jute hessian and sacks, shopping bags), which is primarily low-value low-technology product.

High value product segments such as

- Indutech (Conveyor belts, bolting cloth, coated abrasives, composites),

- Mobiltech (Tyre cord, seat belt webbing, airbag, insulation felts, seat covers),

- Sportech (Sport composites, artificial turfs, parachute fabrics, sleeping bags),

- Meditech (Diapers, wipes, surgical sutures, hernia mesh, artificial ligaments),

- Buildtech (Scaffolding nets, awnings, canopies, wall coverings) , etc.,

have low market penetration.

Opportunities & Risks/Concerns

Opportunities

(i) Largely untapped domestic institutional buyers for technical textiles:

Institutional buyers such as railways, defence forces, hospitals, etc., are still heavily dependent on imports for high-value technologically intensive technical textile products. However, in the recent past, some Indian technical textile manufacturers have started working with such institutional buyers, but most of the market is yet to be tapped.

(ii) Government Support

Ministry of Textiles, Government of India is actively working towards development of technical textiles in India. Thus, for the purpose, Government of India launched several programs (for investment promotion, subsidies, creation of infrastructure, stimulating consumption etc.).

Such as Scheme for growth & development of technical textiles (SGDTT), Technology mission on technical textiles (TMTT), Scheme for promoting usage of Agro-textiles in north east region, Scheme for promoting usage of geotechnical textiles in north east region, Technology up-gradation funds scheme (TUFS) & Scheme for integrated textile parks (SITP).

(iii) Growing economy fuelling demand for technical textiles:

India is among the fastest growing economies in the world. Thus, higher disposable income and increased awareness among young Indian population on functional products. Further, India’s economic growth has led to growth of various end user industries such as Automobiles, Healthcare, etc., resulting in increasing demand for technical textile products.

Risks/Concerns

(i) Change in Environment:

Garware Technical Fibres Ltd’s FY20 first half performance impacted by the cyclones & heavy rainfall. As these environmental changes effect the fishing sector.

(ii) Crude Oil Prices:

As most of the company’s raw materials include crude derivatives, so major change in the prices of crude oil have direct impact on the company and its margins.

(iii) Global Impact:

58% of the revenue of the company comes from exports as per FY19. Therefore, Uncertainty in global markets & foreign-exchange volatility can lead to impact on the Garware’s profitability.

Future Course of Action

- Management gave a vision to double company’s profit in the coming five years.

- Company is working on developing more & more value added products and their contribution to the company revenue.

- Company is seeking more orders from international business for its new products with V2 technology. Garware has delay in getting V2 technology orders because many of their aquaculture customers are testing their new innovative V2 technology.

- V2 reduces costs related to biofouling by 50%, and leads to a significant reduction in leaching of copper oxide into the marine environment.

Drop us a mail at – info@pawealth.in or Visit pawealth.in

References: Annual Reports, News Publications, Investor Presentations, Corporate Announcements, Management Discussions, Analyst Meets & Management Interviews, Industry’s Publications.

Disclaimer: The report only represents personal opinions and views of the author. No part of the report should be considered as recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

One Response