Quick Links Click to Navigate directly to the paragraph in detail:

- About Company

- About Group

- Journey

- Board Members

- Shareholding Pattern

- Group Structure

- Revenue Segmentation

- Key Business

- New Businesses

- Cost Structure

- Financials

- Management Discussion & Concalls

- Strengths & Weaknesses

(A) About Grasim Industries Ltd

Grasim Industries Ltd, is a flagship company of the Aditya Birla Group. Incorporated in 1947, it started as a textiles manufacturer in India. It evolved into a leading diversified player with presence across many sectors.

Moreover, it is a leading global producer of Viscose Staple Fibre, the largest Chlor-Alkali, Linen, and Insulators player in India. Through its subsidiaries, UltraTech Cement and Aditya Birla Capital, it is also one of India’s largest cement producers and a leading player in financial services.

It has also announced a foray into the decorative Paints business.

(B) About Aditya Birla Group

The group was incorporated by Seth Shiv Narayan Birla in 1838

Aditya Birla Group businesses are global powerhouses across sectors such as metals, pulp, fiber, chemicals, textiles, carbon black, telecom and cement. Its overseas operations across North America, South America, Europe, Africa, and Asia account for 50% of the Group’s revenues.

(C) Journey

(D) Executive Management of the company

(i)Mr. Kumar Mangalam Birla (Chairman)

Mr. Kumar Mangalam Birla is the Chairman of the Indian multinational Aditya Birla Group, which operates in 36 countries across six continents. He is also a Chartered Accountant and holds an MBA degree from the London Business School.

Mr. Birla chairs the Boards of all major Group companies in India and globally including Novelis Inc., Birla Carbon, Aditya Birla Chemicals, Domsjö Fabriker, Terrace Bay Pulp Mill, Hindalco Industries Ltd., Grasim Industries Ltd., UltraTech Cement Ltd., Aditya Birla Fashion and Retail Ltd. and also in Aditya Birla Capital Ltd.

(ii)Mr. H.K. Agarwal (Managing Director)

Mr. H. K. Agarwal is currently Managing Director, Grasim Industries Ltd. He joined the Group in 1982 and after a five-year stint in India, joined the Group’s chemicals business in Thailand as President. In September 2009, he also became Chief Operating Officer, Pulp and Fibre Business – S.E.A. & China and Country Head, Group Affairs – Thailand.

Mr. Agarwal holds a bachelor’s degree in commerce from Jai Narayan Vyas University, India. He is also a Chartered Accountant from the Institute of Chartered Accounts of India and holds an Executive MBA from Sasin, Bangkok.

(E) Shareholding Pattern of Grasim Industries Ltd

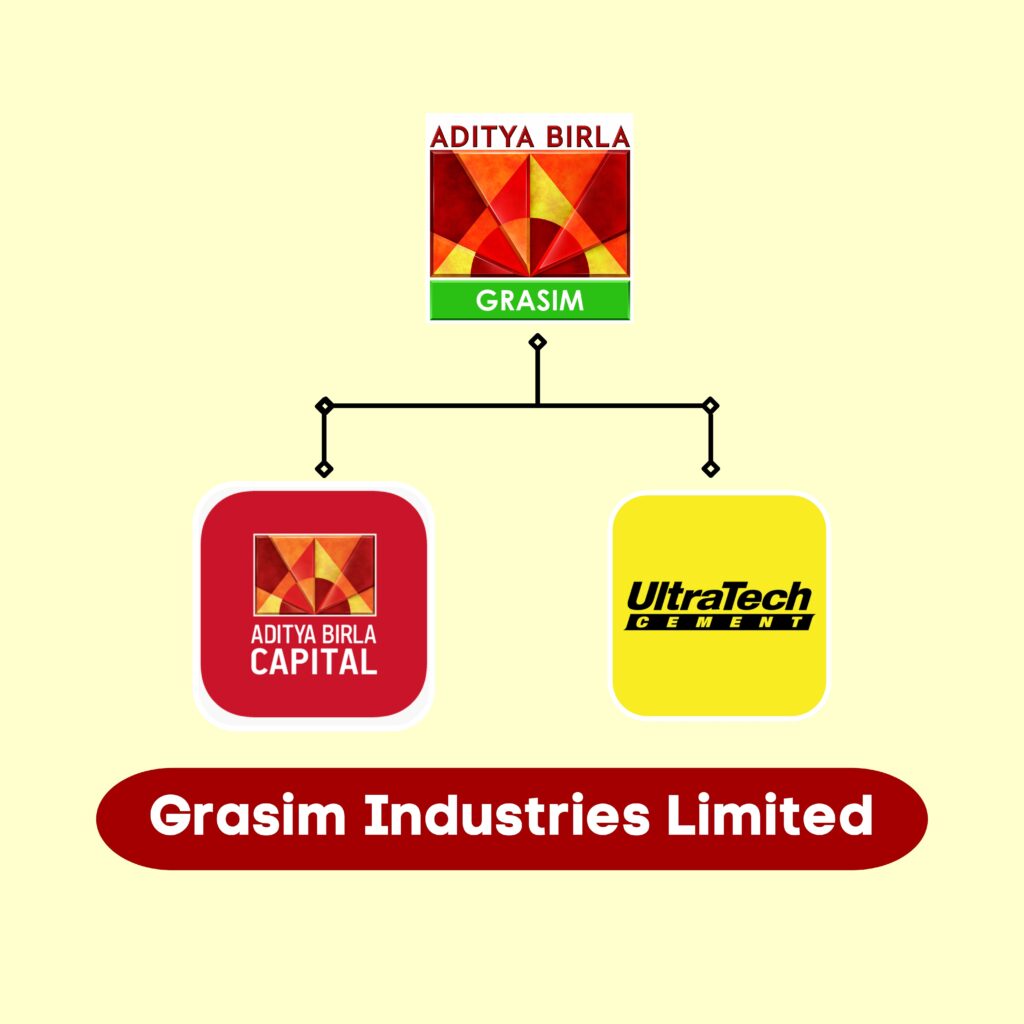

(F) Group Structure of Grasim Industries Ltd

(G) % Wise Revenue Segmentation

(H) Key Business of Grasim Industries Ltd

(i) UltraTech

UltraTech cement provides an array of products ranging from grey cement to white cement, from building products to building solutions, and an assortment of ready mix concretes catering to the varied needs as well as applications.

Currently, it has a capacity of 119.95MTPA of Grey cement.

In white cement Birla white plant with a capacity of 0.68MTPA as well as 2 Wall care putty plants with a combined capacity of 0.85MTPA.

a) Products

- Grey Cement Products

- Ordinary Portland Cement

- UltraTech Weather Plus

- Portland Pozzolana Cement

- UltraTech Super

- UltraTech Composite Cement

- Portland Pozzolana Cement

- UltraTech Slag

2. White Cement and Putty

- White Cement

- Wall care putty

- White cement-based products

3. RMC ( Ready mix concrete)

4. Building Solutions

- One-stop building solution for different stages of the construction life cycle.

- Partners with leading brands to provide quality construction products for individual home builders.

5. Building Products

It has a wide portfolio of building solution products such as

- Plasters mortars

- Adhesives and sealants

- Flooring

- Repair and rehabilitation

- Liquid Waterproofing

- Cementitious Waterproofing

b) Segment Wise Revenue(FY22)

In FY22 company Grey cement grew by 15%, Ready made cement by 50%, White cement by 10%, Export & other business by 15% and Grey cement (overseas) by 14% compared to last year.

c) Operational Presence

It is 3rd largest in the world excluding China and has 22 integrated manufacturing units, 27 grinding units, 6 bulk terminals, as well as 8 bulk packaging.

It has currently a network of 33,505 Dealers, 74,535 Retailers, as well as 2500+ USB outlets.

Sales Volume in Central and South Part of India increase due to increase in demand from government and commercial projects.

Meanwhile, volume in East and West decrease due to elections and unexpected rains in the regions, while sale in North remained same.

EBITDA margin of the company reduce from 27.5% in FY21 to 22.8% in FY22.

The company is facing cost pressure across the board including energy cost which was raised by 48% on a YoY basis due to an increase in the prices of pet coke.

Meanwhile, logistics cost was up by 4% YoY driven by higher diesel prices. Raw material cost was up by 7% YoY basis driven by the high price of fly-ash, bauxite, gypsum, and HSD.

d) Cost Structure

Due to rise in commodity prices it’s power and electricity cost as % of Net Sales increase from 18.63 in FY21 to 23.08 in FY22.

Its distribution expenses raise in FY22 due to increase in crude oil prices as transportation become costlier.

e) Competitors of UltraTech

UltraTech is the largest cement producer in India having a capacity of 119.95MTPA.

(ii) Aditya Birla Capital

Aditya Birla Capital has a strong presence across Protecting, Investing, and Financing solutions, It also provides a universal financial solutions group catering to the diverse needs of its customers across their life stages. It has more than 30,500 employees, with 1,048 branches and more than 2,00,000 agents.

Services offered by Aditya Birla Capital

(i) NBFC – It offers financing as well as wealth management solutions to a wide range of customers across the country.

(ii) Housing Finance – It offers a comprehensive range of housing finance solutions, such as Home loans, Home Extension Loans, Plot & Home Construction Loans, Home Improvement Loans, Loans Against Property, Construction Financing, Commercial Property Purchase loans, and Property Advisory Services.

(iii) AMC – It caters to a wide range of customers from individuals to institutions through the provision of a variety of investment solutions that focus on goals such as regular income, wealth creation, tax savings, and savings solutions.

(iv) Life insurance – It is currently one of India’s leading private life insurance companies.

(v) Health Insurance – It is engaged in the business of health insurance and also offers wide services like incentivized wellness with an Industry-first 100% return of premium along with a differentiated health and wellness framework.

(vi) Others – It also offers General Insurance broking, Stock & Securities broking along with Stressed Asset Platform.

(iii) Grasim Industries

a) Viscose

Viscose business has been ranked No. 1 Globally.

- Viscose Staple Fiber–

It is a biodegradable fiber that is emerging as a sustainable alternative to cotton.

The company is currently having a capacity of 810KTPA.

- Viscose Filament Yarn-

It is a versatile textile raw material that is high on softness & comfort.

Its VSF is growing at a CAGR of 8.7% p.a, which is the highest among all the fibers.

Moreover, the company has launched anti-microbial fiber and non-woven products under the brand name “Birla Purocel-Eco Flush”.

Launched brand ‘Navyasa created by Liva’ for a range of fluid sarees.

VAP (Value added product) share in the overall portfolio increased from 22% in FY21 to 26% in FY22.

Currently, the company has 4 fiber plants and 1 pulp plant in India, they also have 4 International pulp & fiber Joint ventures.

Margin of the viscose business decreased from 16.9% in FY21 to 14.12% in FY22.

This was due to the impact of rising input costs (Pulp, Caustic soda, Coal, and other raw materials).

Demand in the overseas market paused due to the war between Ukraine and Russia, as Russia is a major importer of textiles.

b) Chemicals

It is one of India’s largest caustic soda producers and is a market leader in the chlor-alkali segment, and also offers a wide range of products from chlorine derivatives to epoxy and Hydrochloric acid, Sodium Hypo Chloride and Fertilizers.

With it’s application in hygiene & Sanitizer, Pharma, disinfectant and home care products.

Chlor-alkali

The business uses cost-effective membrane cell technology and is largely self-sufficient in power. The business has a portfolio of chlorine derivatives.

Meanwhile, the company is currently having a capacity of 1264KTPA and is planning to expand its capacity to 1530KTPA by FY2024.

Epoxy

It has a products range from basic products like liquid epoxy resins to value-added products like formulated resins, reactive diluents, as well as hardeners. It has a manufacturing capacity of 123 KTPA.

Further, the company plans to double the epoxy capacity to 246 KTPA by FY2024.

The epoxy business has grown, driven by the strong demand from the end-user segment( Auto and Wind power).

Margin from chemical segment increase from 12.87% in FY21 to 19.44% in FY22.

Moreover, the Chlorine consumption in VAPs increased from 27% in Q4FY21 to 30% in Q4FY22 with double-digit growth in the chlorine consumption.

The global demand for Caustic soda was heavily impacted due to weakness in the demand from end-user industries like paper and textile and reduce from 279KT to 273KT on quarter on quarter basis.

c) Textiles

Grasim is No. 1 in premium fabric.

Through Jaya Shree Textiles. It is one of India’s leading linen and wool manufacturer. It has four strategic business units (SBUs) i.e., linen spinning, linen fabric, wool combining, and worsted spinning.

Its operating profit improved from Rs -53 Cr in FY21 to Rs 203 Cr in FY22.

d) Insulators

It is India’s largest manufacturer of electrical insulators, and top 4 globally have a capacity of 56,400 tonnes p.a with specialization in both ceramic & composite insulators.

Meanwhile, in insulators, it is one of the largest exporters of ceramic insulators globally operating across 58 countries.

Further, it produces a wide range of insulators having a capacity of up to 1,200kV voltage, it is currently having 2 manufacturing facilities with a capacity of 54,400 TPA and have a joint venture with MR GmbH of Germany.

Margin of the Insulator business increase from 5.96% in FY21 to 7.17% in FY22.

The performance of insulators business improved driven by demand from the overseas markets while the domestic demand remained subdued.

(I) Foray into the paints business

Grasim targets to capture the second spot in the domestic paints industry. The company further plans to invest Rs 10,000 Cr, which can help it to create a capacity of 1,332MLPA. Meanwhile, the company has disclosed five locations – Ludhiana (Punjab), Panipat (Haryana), Mahad (Maharashtra), Cheyyar (Tamil Nadu), and Chamrajangar (Karnataka) – to set up its manufacturing plants. Further, it has already spent Rs 250 Cr on land acquisition across plant locations.

With this capacity expansion, it will become the No. 2 player for decorative paints in terms of capacity, unless Berger Paints becomes aggressive for capacity additions.

It has Well spread dealer network and a strong brand recall of Birla White & Putty should also help them to get the fast distribution of their product.

(J) Cost Structure of Grasim Industries Ltd

(K) Financial Parameters of Grasim Industries Ltd

Due to COVID-related lockdowns and the Russian-Ukrain war, there is not much growth in revenue from 2019 to 2022. As there is not much growth in Viscose and Chemical segment.

Meanwhile, company has reduced its debt/equity ratio from 1.46 in 2019 to 1.17 in 2021.

The company’s revenue increased from Rs 76,404.29 Cr in FY21 to Rs 95,701.13 Cr in FY22. Meanwhile, its margin was reduced due to an increase in raw material prices.

In total revenue segment in FY22 Cement contribute 54.16%, Chemicals 8.12%, Financial Services 22.75, Viscose 12.57% and other contribute 2.39%.

(L) Management Discussion & Concalls

Outlook

- In viscose business demand trend in the overseas textile sector remain marginally muted, with COVID-related restrictions in China and due to Russia- Ukraine war as Russia is the major importer of textiles.

- Global demand for Caustic soda was impacted due to weakness in the demand from end-user industries like paper and textile.

- The performance of the Insulator business improved driven by demand from the overseas markets while the domestic demand remained subdued.

- Further company chlorine integration stood at 28% in FY21 which company is likely to improve to 40% in FY2024-25 with the launch of value-added products. Meanwhile, the company is maintaining a strict cost discipline and was able to reduce the fixed cost by 15% YoY.

- Meanwhile, cement demand growth is expected to remain strong considering the government’s plan for road development, housing, and rural infrastructure.

Acquisition

The company acquired a majority stake in a company called RAK White Cement in UAE. The company is listed on the Abu Dhabi and Kuwait Stock Exchange. It is also the market leader in the GCC region and synergies with Birla White and helps in boosting its market leadership.

Capex

The company has decided to double its capex for its paint segment from Rs 5,000 Cr to Rs 10,000 Cr to accelerate its capacity commissioning plan.

UltraTech plan to invest Rs 12,886 Cr to add 22.6MTPA of grey cement to its overall capacity.

Concalls Highlights

- The company’s paint plant commissioning is expected to begin from Q4 of FY25 with a capacity eventually reaching 1,332MTPA.

- Its VSF business reported a sales volume increase of 30% YoY in FY22.

- Moreover, the company would like to increase the market share of its saree segment from 1% to 7% in the next 5 years.

- Meanwhile, its VSF business was impacted by rising cost pressure across all raw materials right from pulp, caustic, and other input costs.

- The company holds the capacity expansion plan of white cement in India which was about Rs 978 Cr since they have access to RAK White Cement company.

- The cement market in India is growing at a rate of 7%.

Cases

On March, 2020

The Competition Commission has imposed a penalty of Rs 302 Crore on Grasim Industries Ltd, for allegedly abusing its dominant position in the market for supply of viscose staple fiber (VSF).

(M) Strengths & Weaknesses

Strengths

(i) Leadership position in the VSF and chemical businesses

Grasim is the largest producer of VSF and also has a sizeable share in the global man-made fiber market. Operations are highly integrated, with a pulp plant and caustic soda capacity in India. The company is also a leader in the caustic soda and epoxy resin segments in India. Captive application of caustic soda and the presence of leading paint companies and electrical machinery manufacturers as clients benefit the epoxy resin segment.

(ii) Healthy financial risk profile

The company has a robust capital structure with a standalone net worth of Rs 48,221 crore and net debt of around Rs 1,428 crore, as of December 31, 2021 (lower by Rs 665 crore compared to December 31, 2020). Any change in this stance will be a key monitorable. Grasim plans to incur a capex of around Rs 2,604 crore in fiscal 2022 (excluding paints capex), of which Rs 1,476 was spent during the first nine months. While debt is expected to increase to fund the proposed capex, steady cash flows from the key business segments and a strong balance sheet will keep the financial risk profile healthy.

(iii) Financial flexibility derived from being a holding company

Grasim is the holding company for two large, listed investments of the Aditya Birla group – UltraTech and ABCL. UltraTech is the largest cement producer in India, and ABCL houses the financial services businesses. Both are growing businesses and strategic to the Aditya Birla group, making Grasim a key entity within the group. Grasim’s 57.27% stake in UltraTech has been valued at around Rs 1,00,983 crore as of May 17, 2022. Grasim receives annual dividends from UltraTech, which has a healthy dividend track record.

Weaknesses

(i) Exposure to cyclicality in the VSF and chemical businesses

Demand for VSF remains susceptible to economic downturns. Benign input prices helped margins in fiscal 2021 (operating margin: 17.0%), despite a dip in volume amid the pandemic. Further, during the first nine months of fiscal 2022, margins stood at 17.4%.

The chemicals business also saw the operating margin decline. This was due to weak electrochemical unit (ECU) realizations on the back of declining domestic prices (in line with global prices), led by the capacity overhang and slow down because of the pandemic. Profitability in the chemicals segment is susceptible to an increase in capacities. Similarly, any reversal in realization, on account of the global overcapacity of VSF, could restrict profitability. Nevertheless, the company’s strong market position and backward integration of operations will help manage any downturn effectively.

Drop us your query at – info@pawealth.in or Visit pawealth.in

References: Annual Reports, News Publications, Investor Presentations, Corporate Announcements, Management Discussions, Analyst Meets & Management Interviews, Industry Publications.

Disclaimer: The report only represents the personal opinions and views of the author. No part of the report should be considered a recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore