HDFC Focused Fund is an open-ended equity scheme that invests in a concentrated portfolio of up to 30 high-conviction companies across market capitalisations. The fund follows a disciplined, bottom-up investment approach, emphasizing business quality, sustainable earnings, strong balance sheets, and prudent valuations. By maintaining a focused portfolio, the scheme aims to generate long-term capital appreciation. It is therefore suitable for investors with a moderate-to-high risk appetite and a long-term investment horizon.

- About the HDFC Focused Fund

- Basic Details

- Classification Portfolio of the fund

- Fund Managers & Tenure of managing the Scheme

- Investment Details

- Returns Generated

- Risk Factors

- Investment Philosophy

- Taxability of Earnings

(A) About the HDFC Focused Fund

The HDFC Focused Fund aims to create long-term wealth by investing in a select set of fundamentally strong businesses with durable competitive advantages and consistent cash-flow generation. The fund adopts a flexi-cap strategy, allowing it to allocate capital across large, mid, and select small-cap stocks based on prevailing opportunities.

Alongside equity investments, the fund may selectively use debt instruments, derivatives for hedging, and other permitted avenues to manage risk and enhance portfolio efficiency. Given its concentrated structure, the fund may experience short-term volatility; however, it is well suited for patient investors seeking superior risk-adjusted returns over full market cycles.

(B) Basic Details of HDFC Focused Fund

| Fund House | HDFC Mutual Fund |

| Category | Equity: Focused Fund |

| Launch Date | 17-Sep-2004 |

| Type | Open-ended |

| AUM | ₹26230 Cr (As on 30 November 2025) |

| Available at NAV of | ₹237.93 (As on 26 Dec 2025) |

(C) Classification Portfolio of the fund

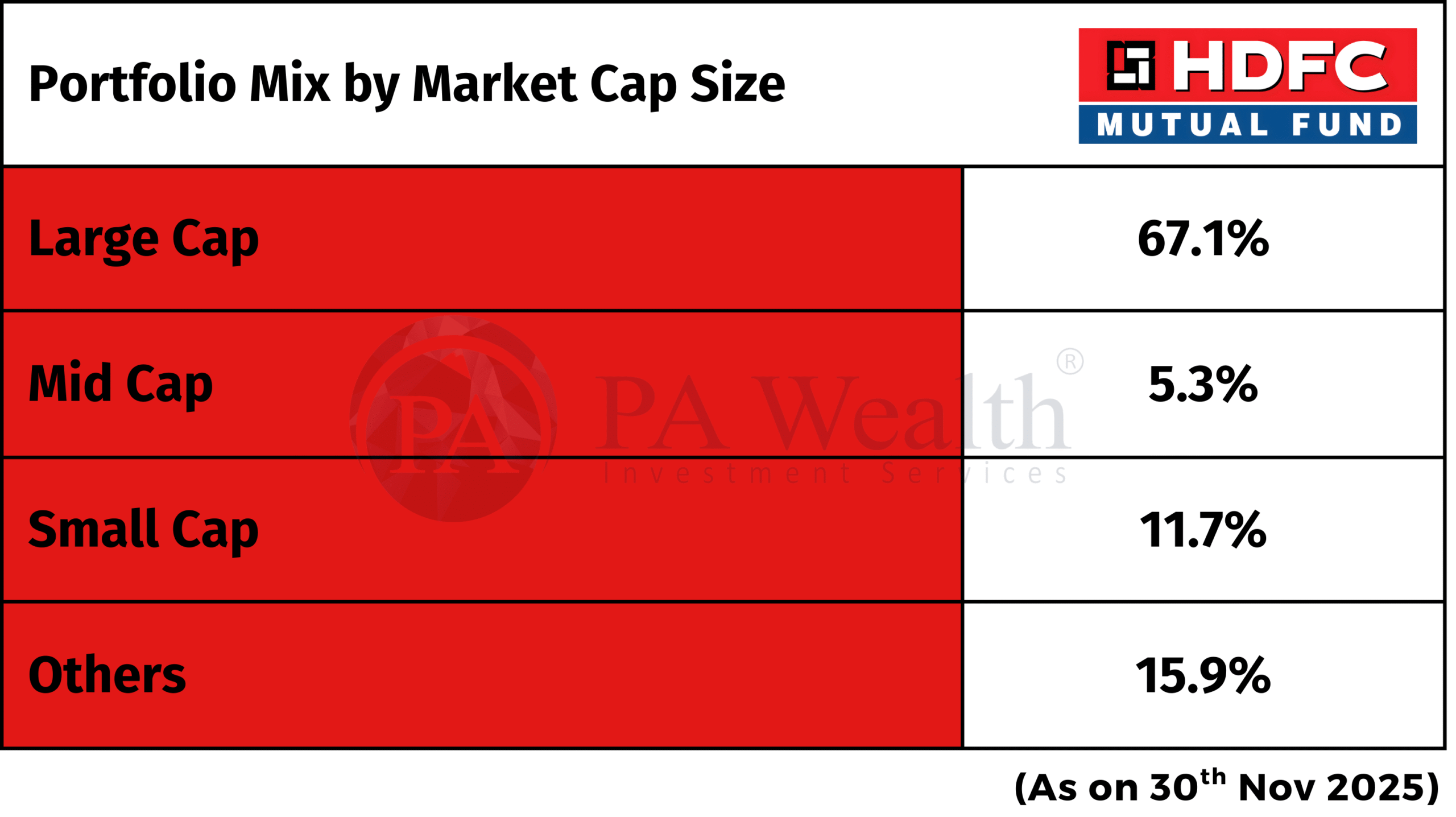

(i) Portfolio Mix by Market Cap Size

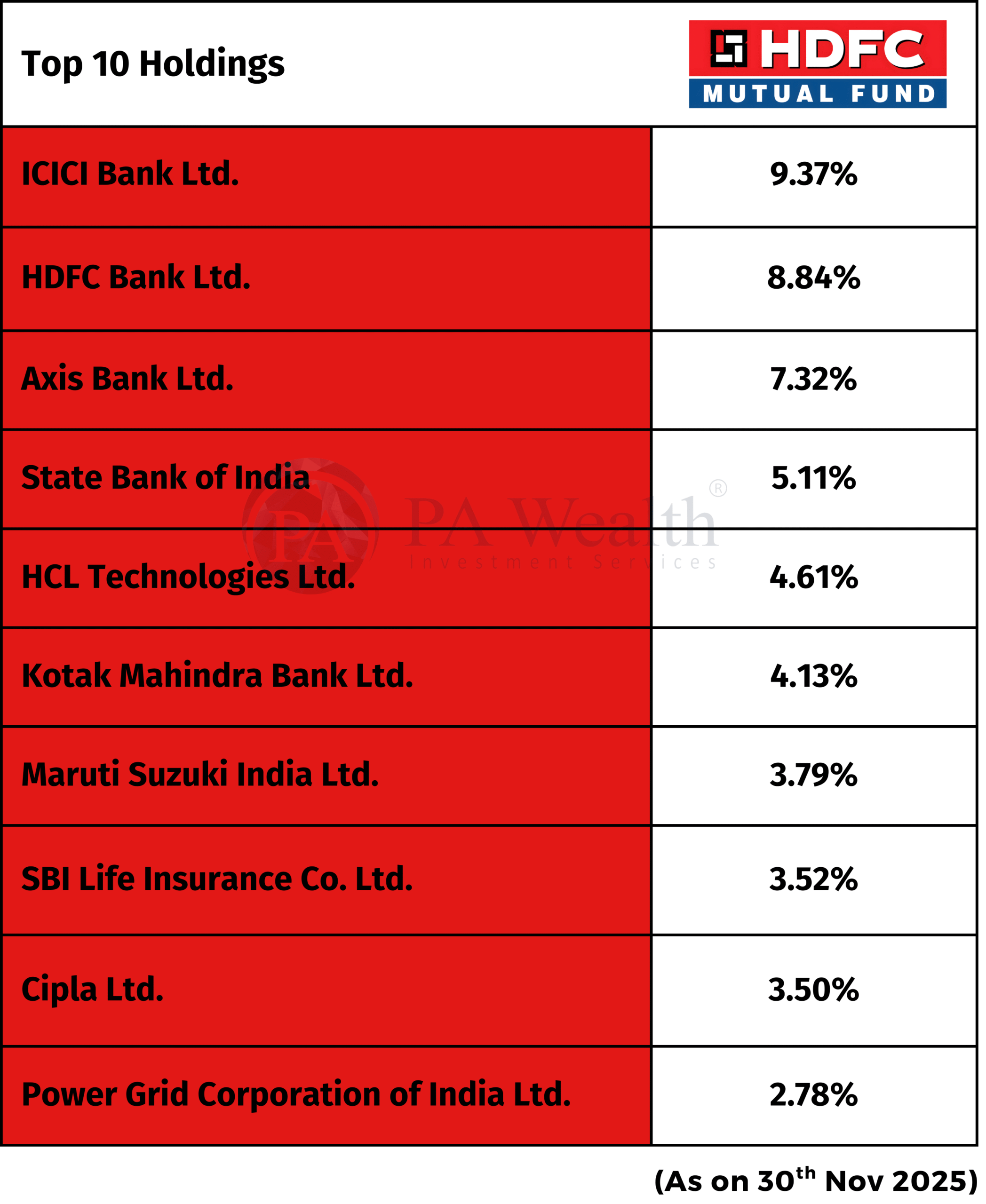

(ii) Top 10 Holdings of the HDFC Focused Fund

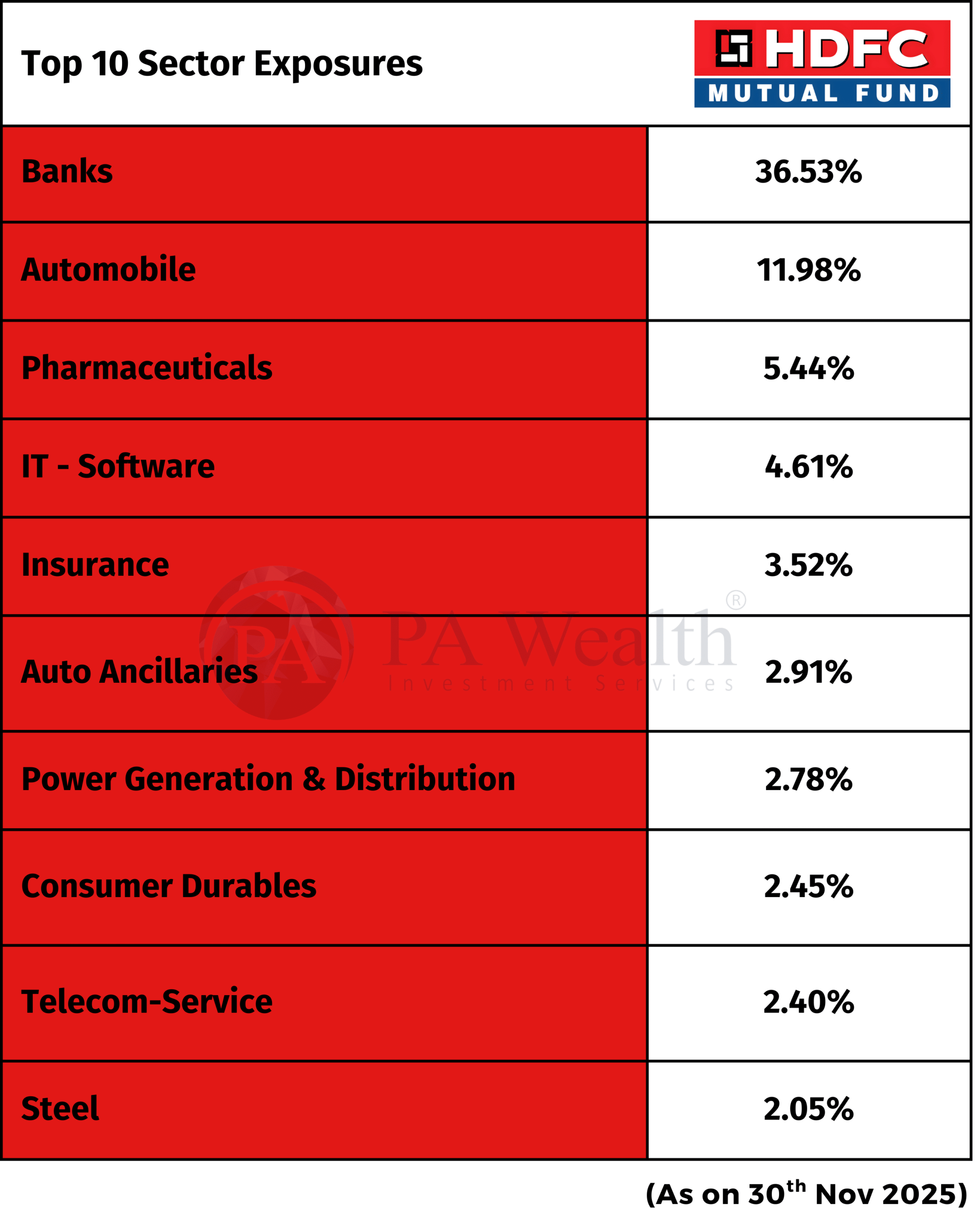

(iii) Top 10 Sectors Exposures of the HDFC Focused Fund

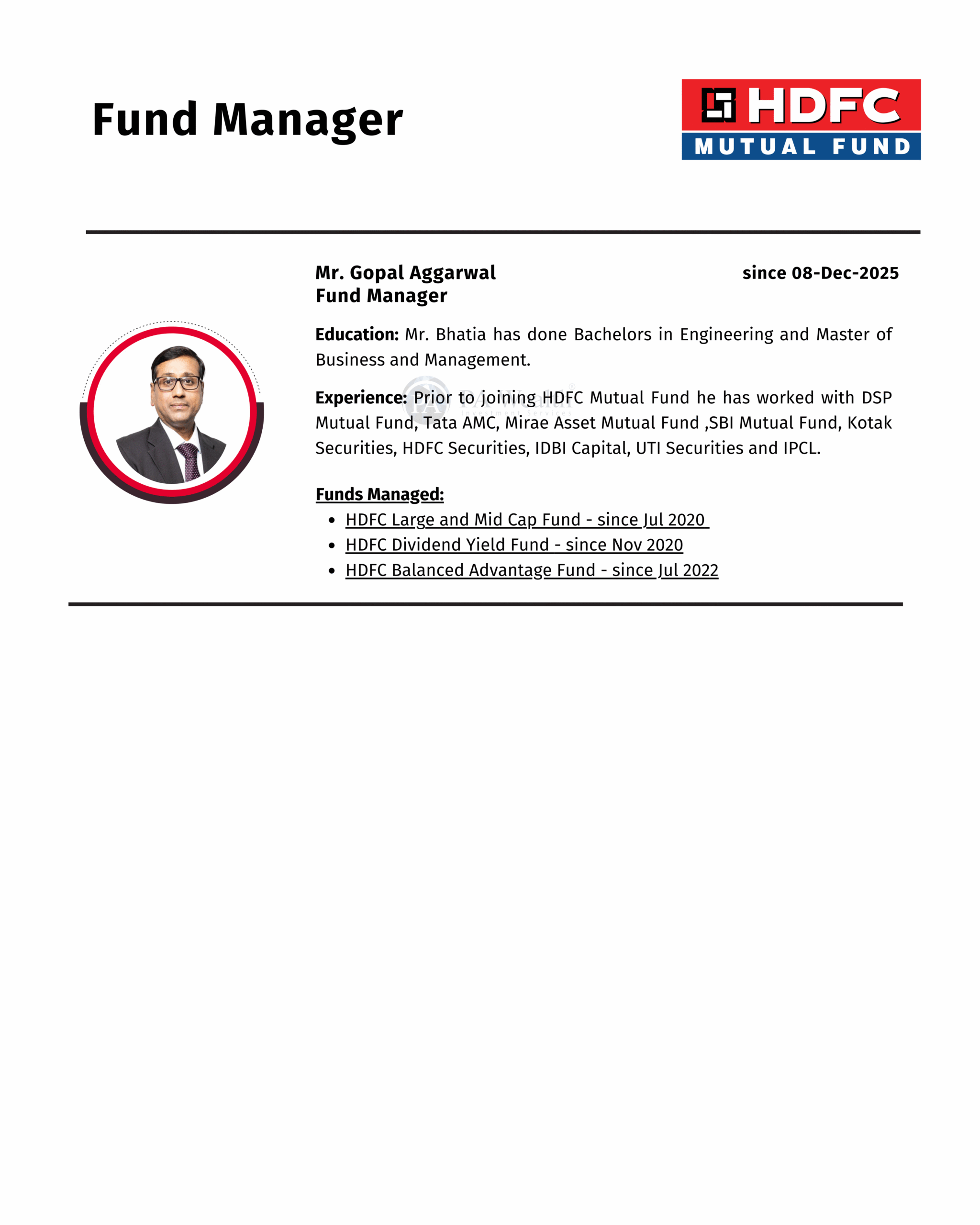

(D) Fund Manager & Tenure of managing the Scheme

(E) Fund – Investment Details

| HDFC Focused Fund | |

|---|---|

| Application Amount for fresh Subscription (Lumpsum) | ₹100 |

| Min Additional Investment (SIP) | ₹100 |

| Exit load | 1%* |

| Lock In | No |

| Expense Ratio | 1.61% (As on 30th Nov 2025) |

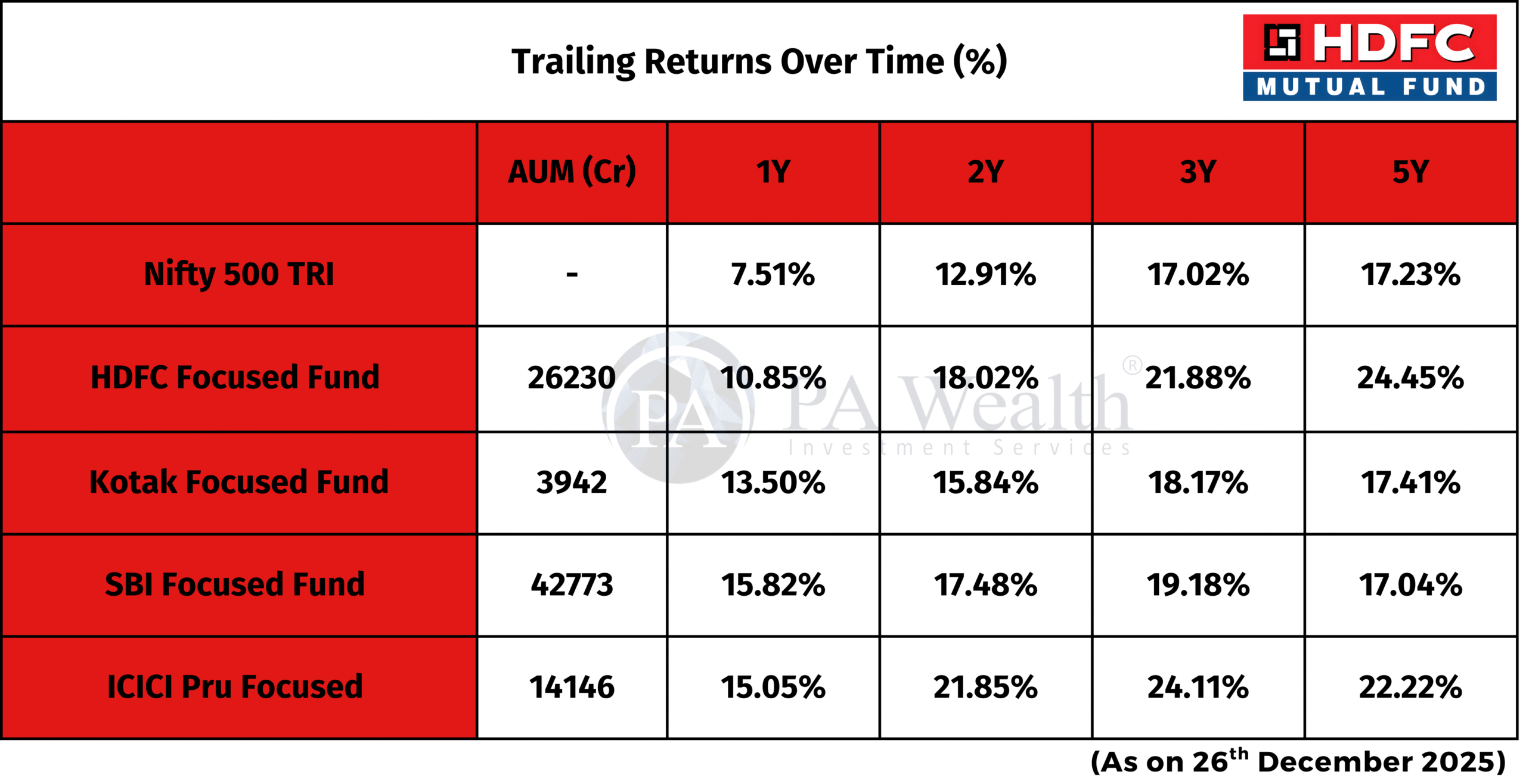

(F) Returns Generated By The Fund

(G) Risk Factors

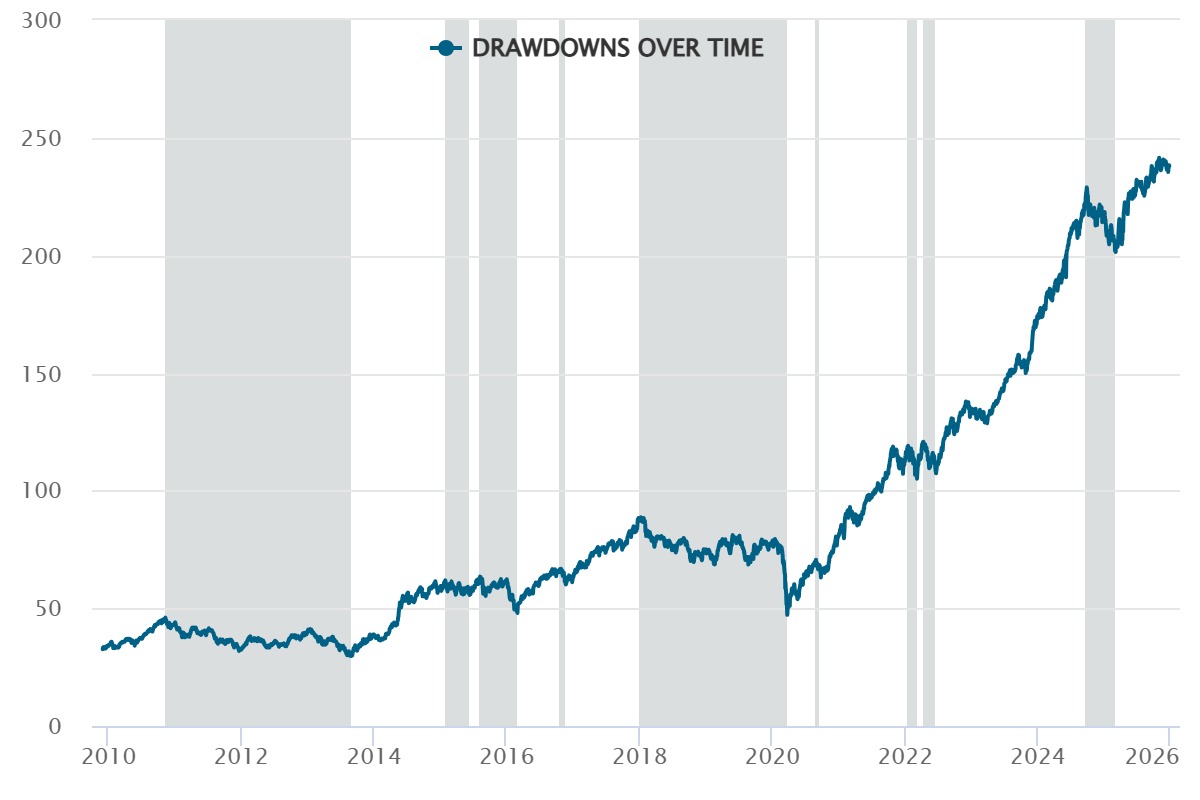

(i) Top Drawdowns

HDFC Focused Fund has witnessed multiple drawdowns over its investment journey, with the sharpest decline of ~46.7% during the January 2018 to March 2020 period, coinciding with the COVID-led market crash. Despite the severity of this fall, the fund recovered in about 229 days, demonstrating strong rebound potential.

Other meaningful corrections include a ~35% drawdown between 2010 and 2013, which recovered within six months, and a ~24% fall in 2015–16 that saw recovery in roughly three to four months. More recent drawdowns in the 10–12% range during 2020, 2022, and 2024–25 were relatively short-lived, with recoveries ranging from a few weeks to around three months.

Overall, while HDFC Focused Fund has experienced periodic short-term volatility due to its focused portfolio, its consistent recovery pattern highlights the importance of patience and a long-term investment horizon for investors.

(H) Investment Philosophy

HDFC Focused Fund follows a disciplined, high-conviction investment framework:

Focus & Conviction – Invests in a concentrated portfolio of up to 30 high-quality businesses with strong competitive advantages and long-term growth visibility.

Quality First – Preference for companies with robust balance sheets, sustainable earnings, strong cash flows, and prudent capital allocation.

Valuation Discipline – Emphasis on investing at reasonable valuations, avoiding excessive pricing even for high-growth businesses.

Flexi-Cap & Risk-Aware – Invests across market capitalisations with selective use of debt, derivatives (for hedging), and other instruments to manage downside risk while enhancing portfolio stability.

Taxation

(I) Taxability on earnings

Capital Gains Taxation

- If you sell mutual fund units after 1 year of investment, gains up to ₹1.25 lakh in a financial year are exempt from tax, while gains above this are taxed at 12.5%.

- If you sell within 1 year of investment, the entire gain is taxed at 20%.

- No tax is payable as long as you continue to hold the units.

Dividend Taxation

- Dividends from mutual funds are taxed as per the investor’s income tax slab.

- If the dividend income exceeds ₹10,000 in a financial year, a 10% TDS is deducted by the fund house before payout.

Drop us your query at – info@pawealth.in or Visit pawealth.in

References: valueresearchonline.com, Industry’s Publications, News Publications, Mutual Fund Company.

Disclaimer: The report only represents personal opinions and views of the author. No part of the report should be considered as recommendation for buying/selling any stock. In summary, the report and its references are presented to offer readers an informational overview of the discussed industry.

Overall, the report and accompanying references serve an informational purpose, helping readers better understand the stated industry.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore

💡 Liked this analysis?

Stay updated with more market insights & wealth strategies from PA Wealth.

✉️ Contact Our Experts Today