Hindustan Copper Limited (HCL) is a Government of India-owned Miniratna PSU and the only vertically integrated copper mining company in India, with operations spanning copper ore mining and beneficiation. Incorporated in 1967, the company plays a strategic role in the domestic copper ecosystem through its captive mining assets and copper concentrate production, which is primarily used by India’s copper smelters and refiners.

- About

- Industry Overview

- Journey

- Board of Directors

- Shareholding Pattern

- Business Segments

- Expansion Plan

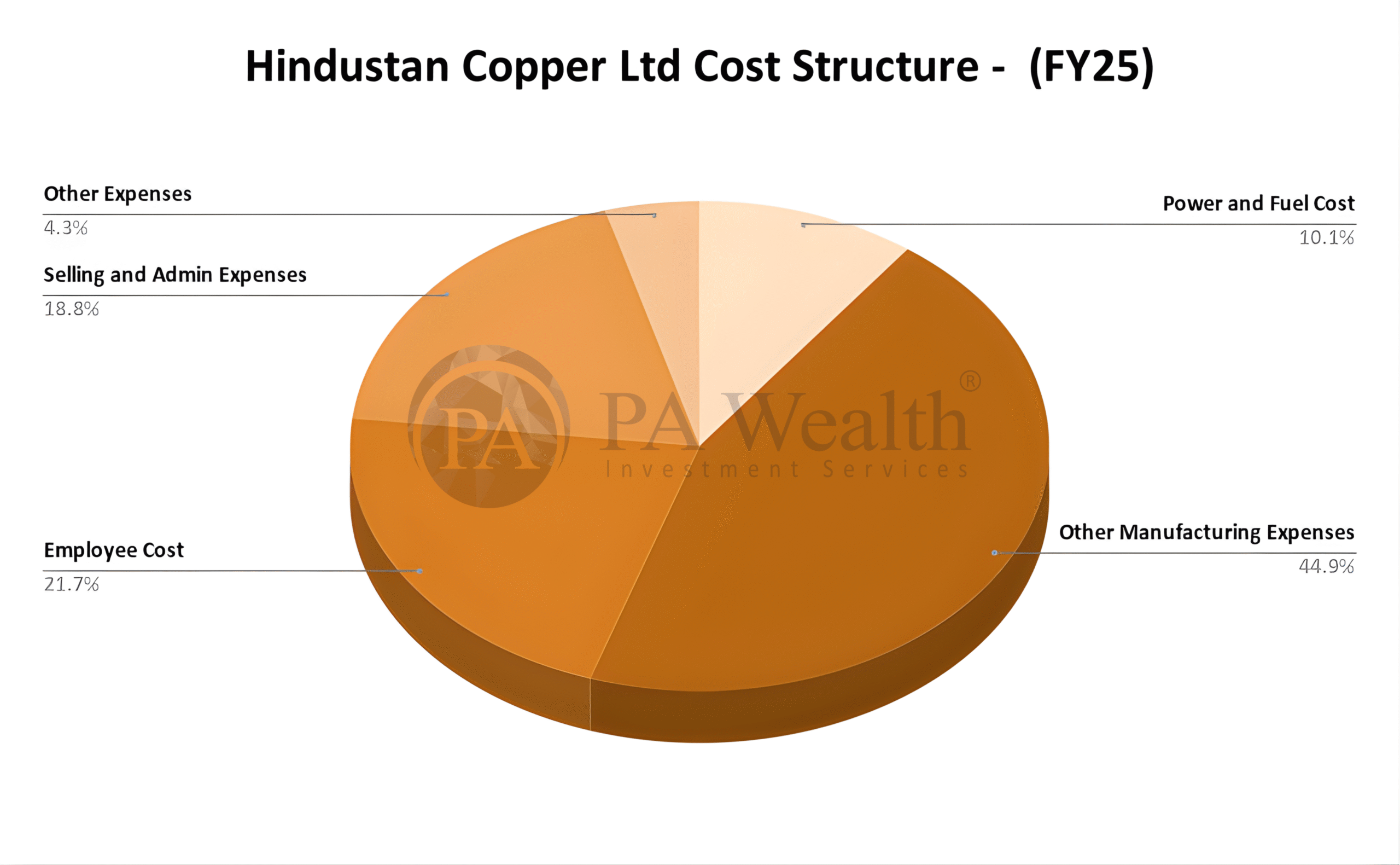

- Cost Structure

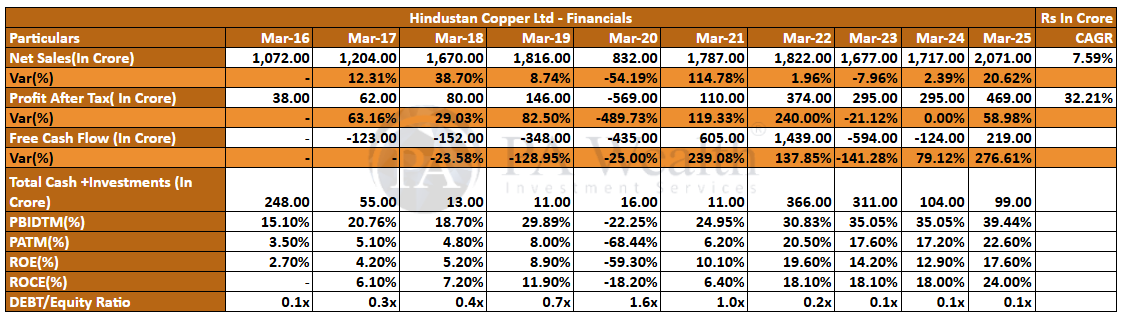

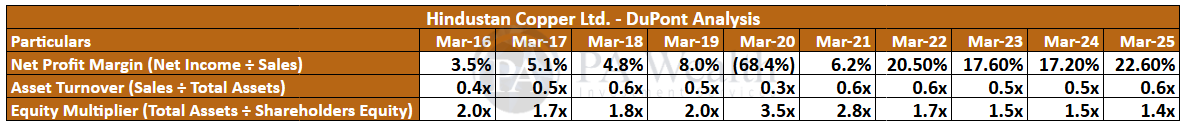

- Financials

- Management Discussion & Concall

- Strengths & Weaknesses

(A) About Hindustan Copper Ltd. | Stock Analysis

Hindustan Copper Limited (HCL) was incorporated in 1967 and is India’s first public sector enterprise in the copper industry. It is also the only vertically integrated copper producing company in the country, meaning it operates across the copper value chain—from copper ore mining to processing and converting it into market-ready products.

The company works under the administrative control of the Ministry of Mines and holds a unique position as the only company in India engaged in copper ore mining, with operating mining leases across the country. HCL’s key operations are spread across major mining locations such as Malanjkhand, Khetri, and Ghatsila, supported by downstream facilities that strengthen its overall copper ecosystem.

With a legacy spanning decades, HCL continues to play an important role in India’s domestic copper supply chain through its focus on exploration, mining, and ore beneficiation, backed by long-standing operational expertise and a strong national presence.

(B) Industry Overview

- India’s copper industry is structured around two key segments: domestic copper mining and custom smelting/refining. On the mining side, Hindustan Copper Limited (HCL) holds a unique position as the only copper ore mining company in India, making it a critical player in the country’s upstream copper supply chain.

- On the other hand, India has multiple large-scale custom smelters and refiners such as Hindalco (Birla Copper), Vedanta (Sterlite Copper), and the Adani Group (Kutch Copper). These players primarily operate in the downstream part of the value chain, where copper concentrate is processed into refined copper. Since domestic copper concentrate availability is limited, these industries largely depend on imported copper concentrate to meet production requirements. Many of these facilities are strategically located near ports, helping them reduce logistics costs for importing raw material and exporting finished products, while also supporting efficient extraction of valuable by-products.

- In terms of demand linkage, HCL’s copper concentrate is largely consumed by domestic primary copper producers, supporting India’s refining ecosystem. Additionally, the sector is witnessing further capacity developments, with new projects and expansion plans announced by major players, reflecting continued long-term interest in strengthening India’s copper processing capabilities.

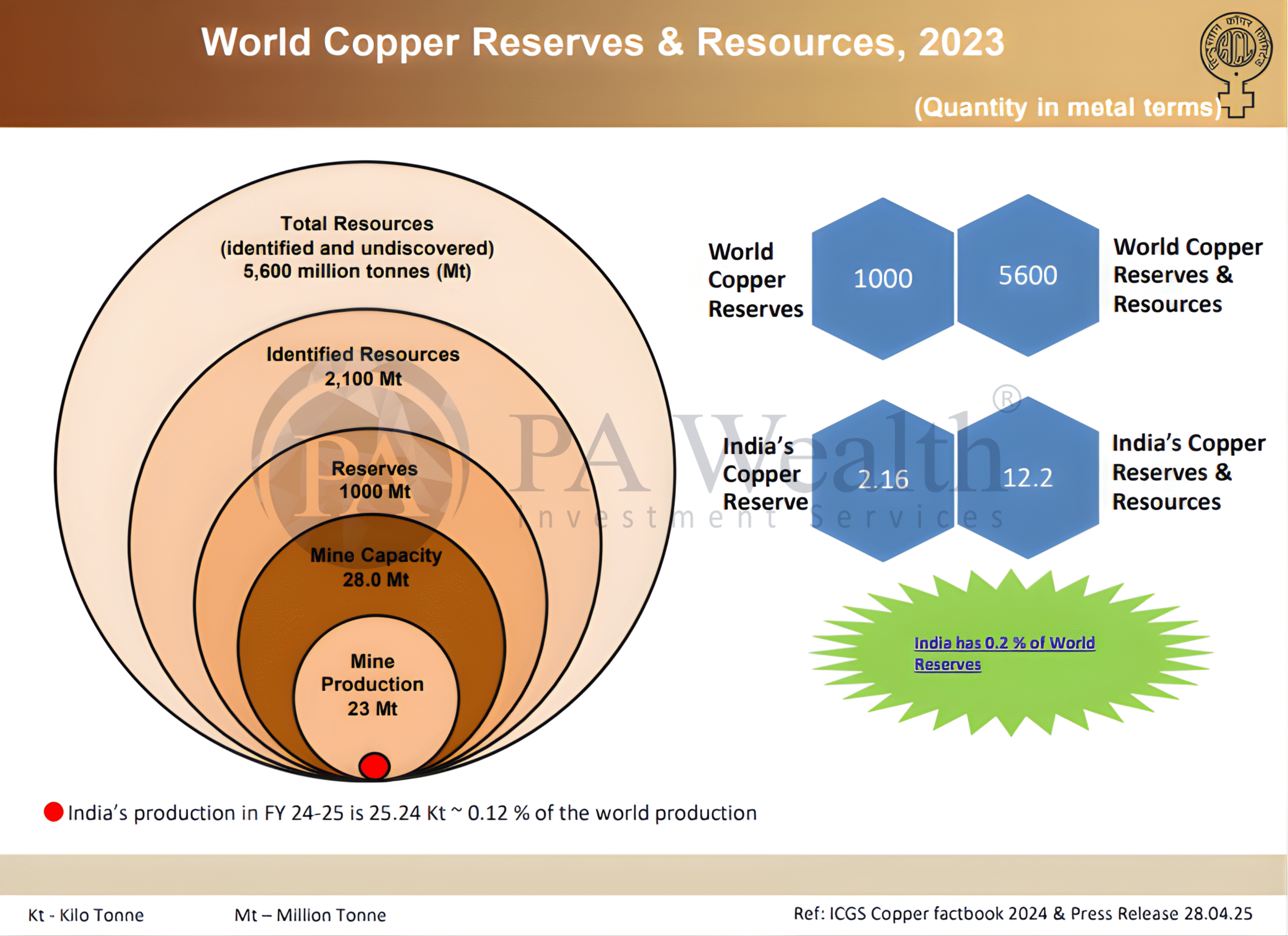

- From a resource perspective, India has a sizeable base of copper ore reserves and resources, with Rajasthan leading the country’s copper ore availability, followed by Madhya Pradesh and Jharkhand—highlighting the regional concentration of India’s copper belt and its importance in supporting the overall industry.

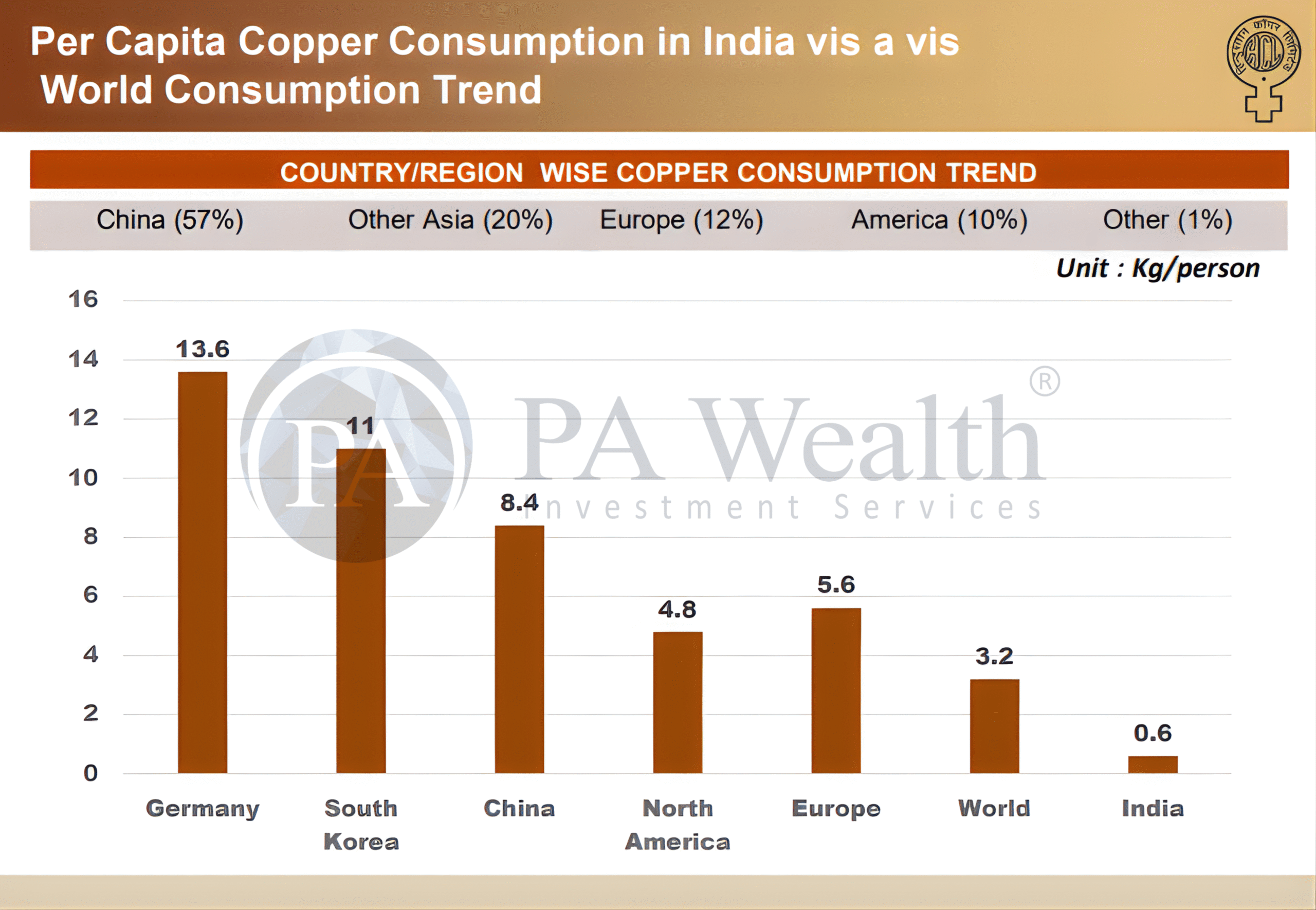

- Copper is widely regarded as a critical industrial metal, given its extensive usage across power transmission, construction, manufacturing, electronics, renewable energy, and electric mobility. While global copper consumption is dominated by Asia—led by China—India’s copper demand profile is still at a relatively early stage when compared to developed economies.

- A key structural indicator is India’s low per capita copper consumption versus global benchmarks, which highlights the significant headroom available for demand expansion as the economy progresses through higher levels of urbanisation, electrification, and infrastructure build-out. With policy focus and private sector investments accelerating in areas such as power grid strengthening, renewable integration, EV ecosystem development, and industrial capacity creation, copper consumption is expected to rise steadily over the medium to long term.

- On the supply side, India’s copper resource base remains limited in the global context, with the country accounting for only a small fraction of world copper reserves and resources. This imbalance between growing domestic demand and constrained local availability structurally increases India’s reliance on imported copper concentrate and refined copper, thereby making copper a strategically important commodity from a supply security and self-reliance perspective. Over time, this is expected to strengthen the relevance of domestic copper mining, exploration efforts, and capacity additions across the value chain.

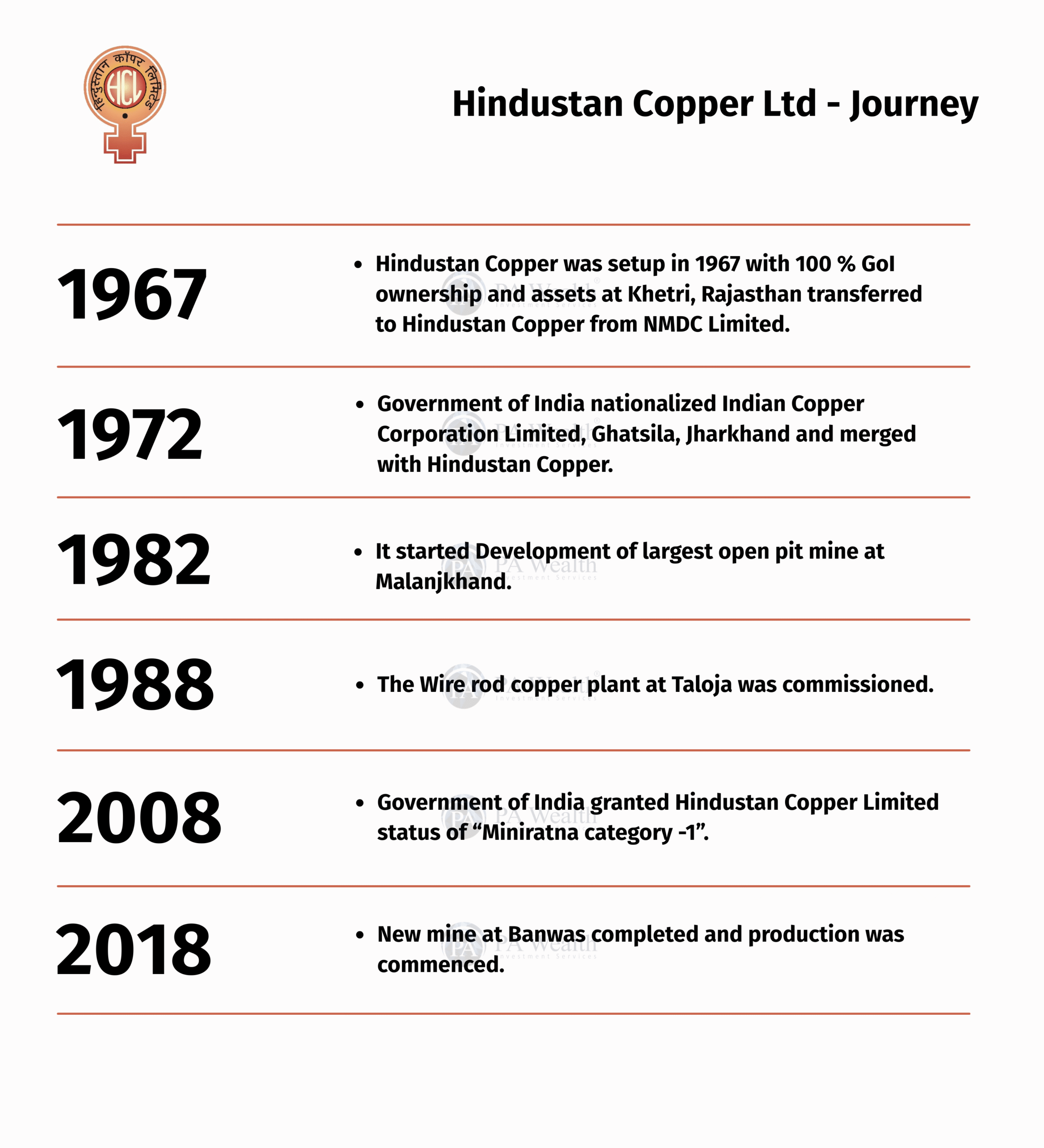

(C) Journey

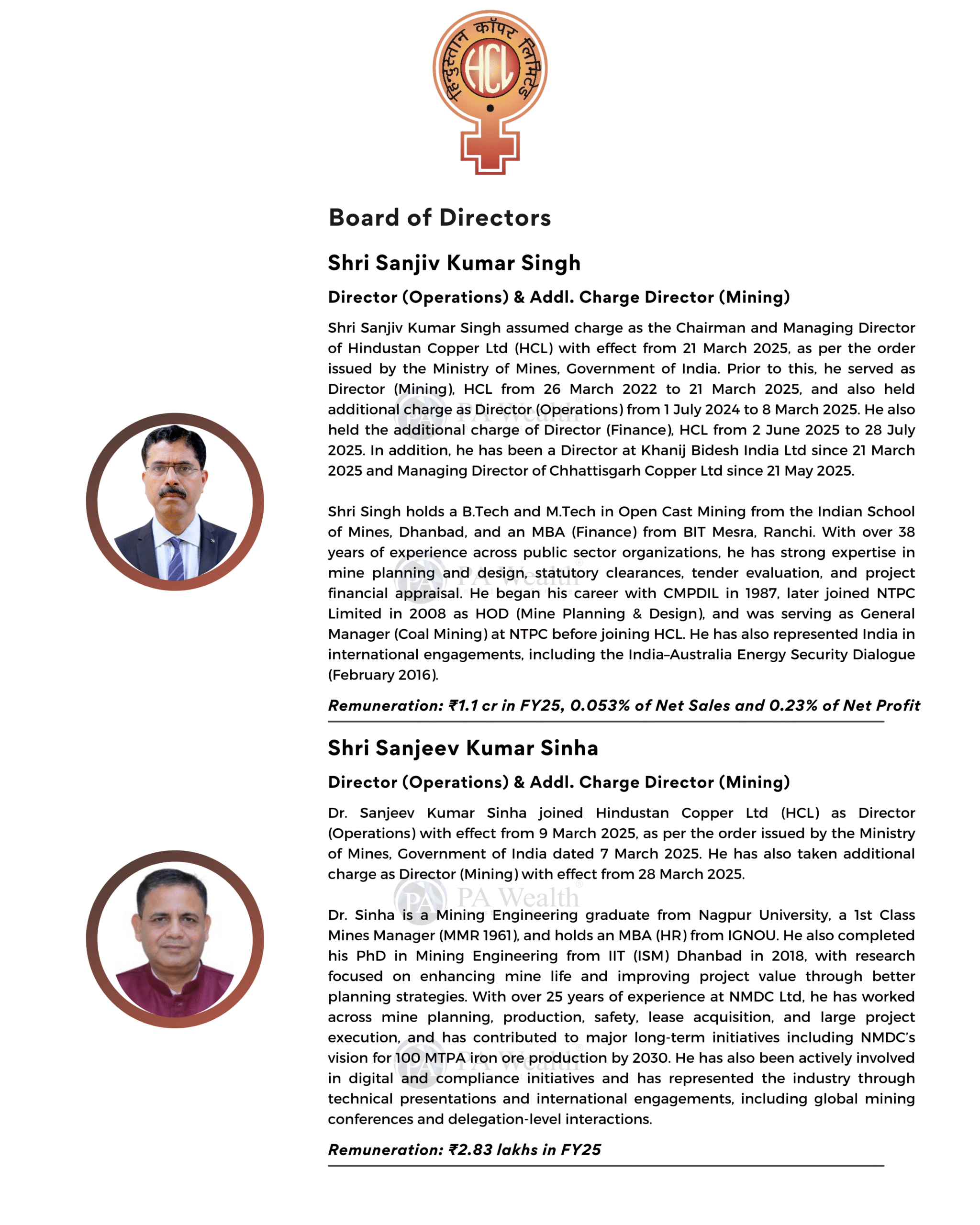

(D) Board of Directors of Hindustan Copper Ltd

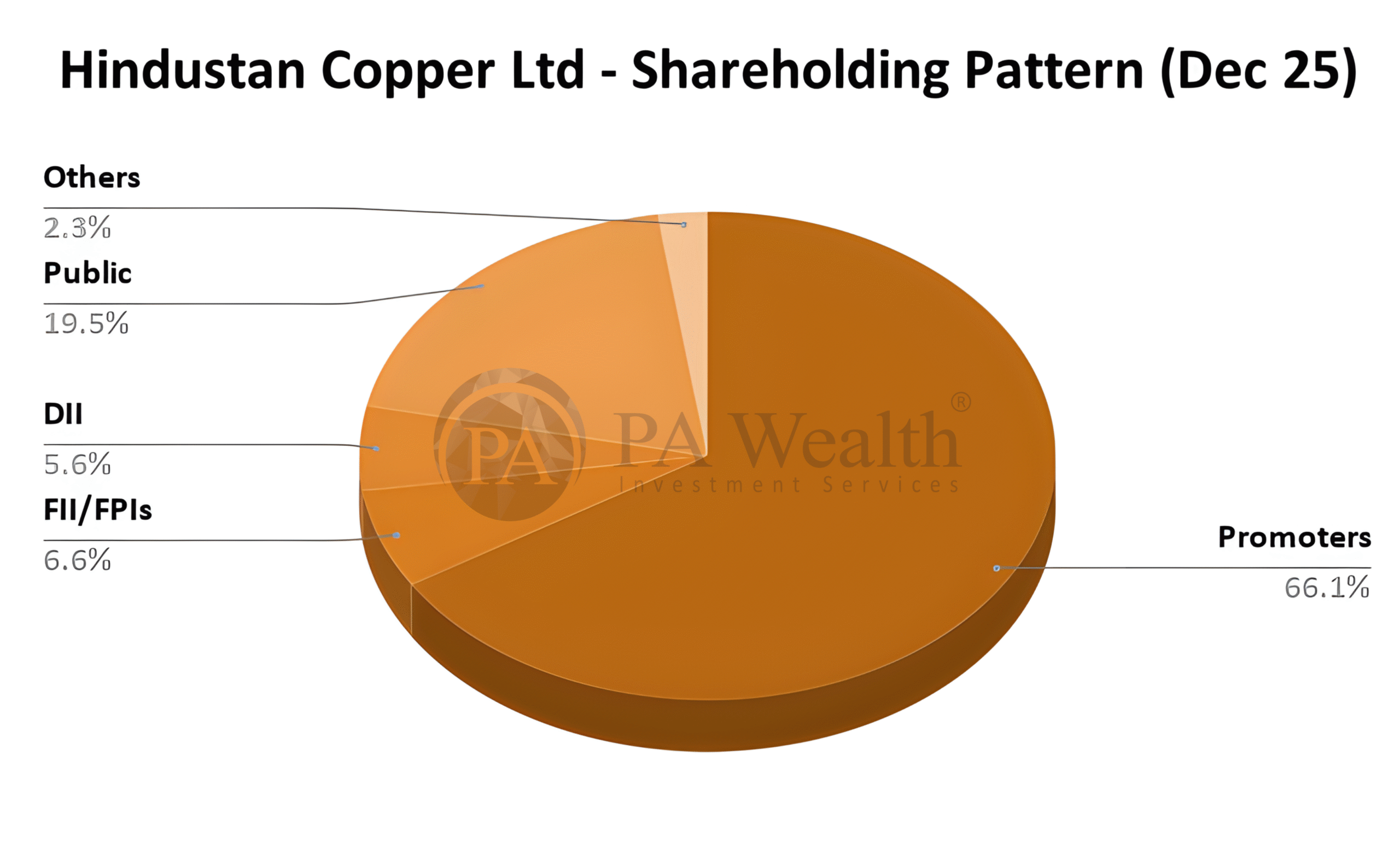

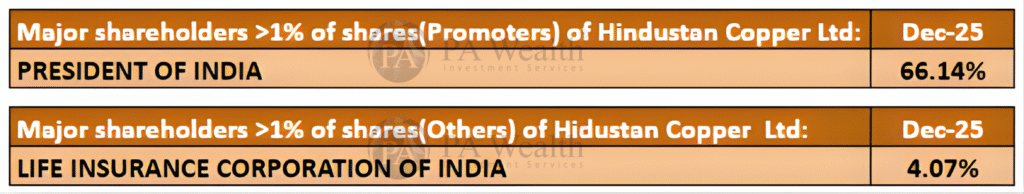

(E) Shareholding Pattern of Hindustan Copper Ltd.

(F) Business Segments of Hindustan Copper Ltd. | Stock Analysis

-

Copper Concentrate (Grade: 17%–26%)

Hindustan Copper’s core business is the production and sale of copper concentrate, which is primarily used as a key input for the smelting and refining of copper into finished products.

-

Copper Products – Continuous Cast Wire Rod (Tolling Operations)

The company also has a presence in copper value-added products through its continuous cast copper wire rod operations. It manufactures wire rods in multiple diameters (8 mm, 11 mm, 12.5 mm, 16 mm and 19.6 mm with ±0.50 mm tolerance), which are widely used in winding wires, strips, and other electrical applications.

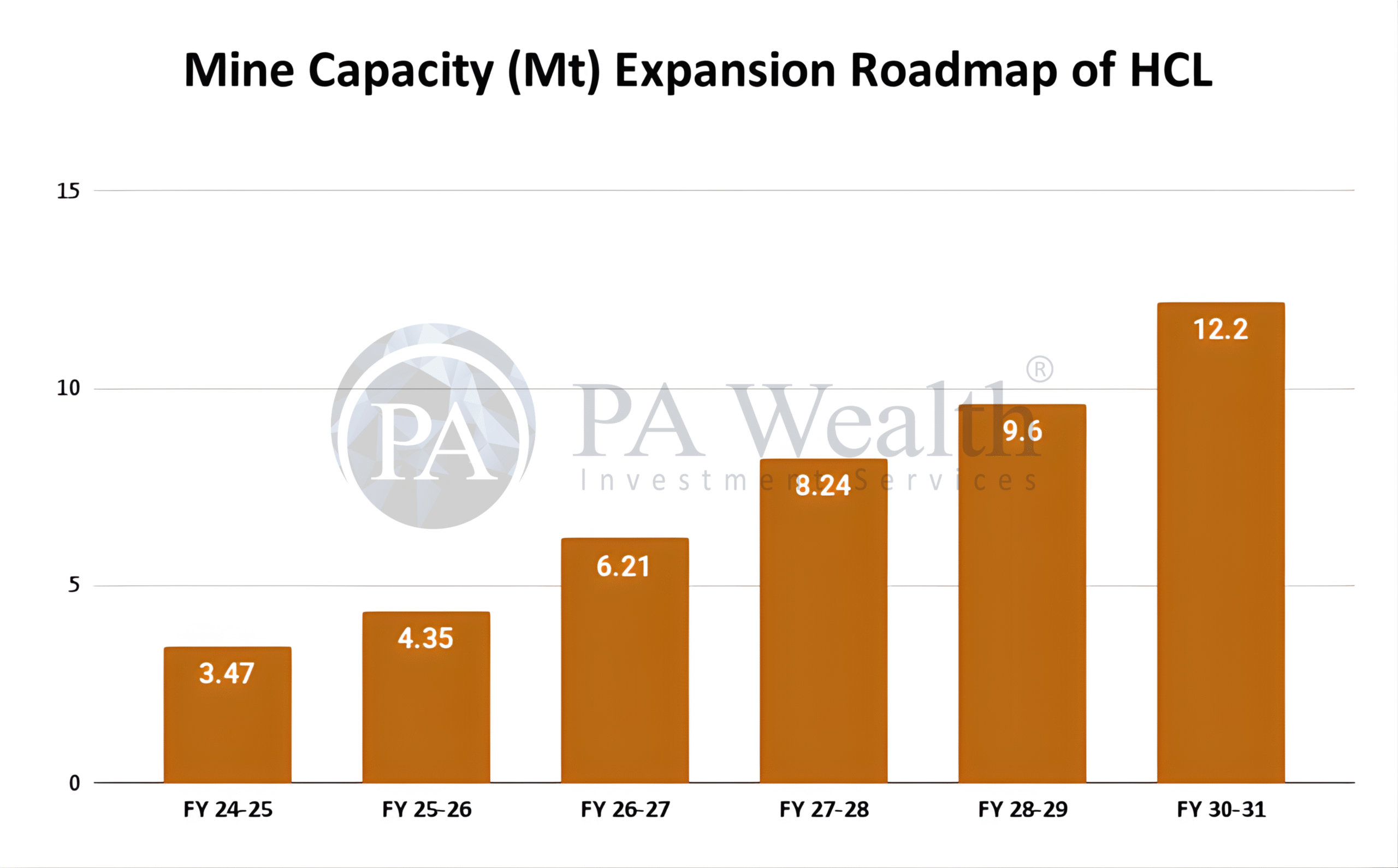

(G) Mine Capacity Expansion Roadmap of Hindustan Coppper Ltd. | Stock Analysis

(H) Cost Structure of Hindustan Copper Ltd.

(I) Financials of Hindustan Copper Ltd.

(J) Management Discussion & Concall | Stock Analysis

-

FY25 unfolded amid a challenging geopolitical environment, yet copper demand stayed resilient, supported by long-term global trends such as clean energy transition, electrification, and digital infrastructure growth.

-

India’s copper demand outlook remains closely linked to the country’s economic expansion, with the IMF projecting 6.4% GDP growth for both 2025 and 2026, reinforcing the strength of the domestic growth environment.

-

India continues to face a structural gap in copper availability, as it holds only ~0.2% of global copper reserves, contributes just ~0.12% of global mine production, while refined copper production stands at ~2% of global output, resulting in heavy reliance on imports.

-

In this context, Hindustan Copper’s positioning becomes important, as it holds nearly two-fifth of India’s copper ore reserves/resources, strengthening its relevance in the domestic copper supply chain.

-

The company’s long-term direction remains focused on scaling mining capacity and restarting key assets, aligned with India’s broader objective of improving self-reliance in strategic minerals.

-

Alongside growth plans, the company is also pushing sustainable mining practices through initiatives such as paste fill technology (tailings reuse) and enhanced safety systems.

-

ESG efforts continue to remain in focus, with visible progress in areas like water conservation, afforestation, and community development programs, supporting more inclusive and responsible growth.

Growth Outlook

-

Global copper demand is expected to remain strong, supported by structural drivers such as the shift towards clean energy, expansion in digital infrastructure, rising EV adoption, growth in AI data centres, and increasing use in advanced manufacturing.

-

In India, copper consumption is expected to rise in line with the country’s push towards infrastructure development, green transition, manufacturing growth, and digitisation, making copper an increasingly important industrial input.

-

Copper is also expected to play a strategic role in India’s long-term vision of Viksit Bharat @2047, supporting national priorities like energy security and self-reliance.

-

Since India has limited copper reserves and remains highly dependent on imports, strengthening domestic mining capacity becomes critical for improving supply security over the long term.

-

Against this backdrop, Hindustan Copper is aiming to scale its mining capacity from ~4 MTPA to 12 MTPA by FY31, driven by a mix of expansion at existing mines, re-opening of closed mines, and development of new mining assets.

-

The Malanjkhand Copper Project (MCP) remains one of the key growth drivers, where underground mining expansion is expected to increase capacity from 2.5 MTPA to 5.0 MTPA.

-

The company is also targeting growth at the Khetri Copper Complex (KCC), where expansion plans are expected to raise ore production from 1.0 MTPA to 3.0 MTPA.

-

In addition, the company is working on reopening and developing mines under the Indian Copper Complex (ICC), including Rakha and Kendadih, which strengthens visibility on future output expansion.

-

Beyond copper, the company is also evaluating opportunities in critical and strategic minerals, aligning its longer-term direction with India’s broader critical minerals mission.

Q2 FY26 Concall Highlights

-

Hindustan Copper continues to invest in digitalisation and automation, with a focus on improving mine productivity and strengthening safety standards across operations.

-

The Malanjkhand underground mine delivered ore production of 27.252 lakh tonnes in FY25, marking a ~7% YoY increase, reflecting steady improvement in mining output.

-

To further support underground mining efficiency, a 3.0 MTPA Paste Fill Plant at Malanjkhand Copper Project (MCP) was commissioned in Feb 2025, aimed at improving ore recovery, enhancing mine safety, and enabling better waste management through tailings reuse.

-

In the Indian Copper Complex (ICC), Jharkhand, Surda mine operations resumed on 05.10.2024, strengthening operational traction in the region and supporting production continuity.

-

The company has progressed on restarting the Rakha mine through an MDO-led execution model, with a Mining Services Agreement signed on 06.01.2025 with South West Mining Ltd. The scope includes re-opening Rakha mine, underground development at Chapri, and commissioning of a matching concentrator plant, under an initial contract tenure of 20 years, extendable by 10 years.

-

In Rajasthan, exploration at the Kolihan mine (KCC) indicates a potential ore body extension up to (-) 300 mRL, and validation drilling has confirmed continuity, improving confidence on resource potential at deeper levels.

-

Operational upgrades are also underway at Khetri, where the conversion from track mining to trackless mining is in progress, supporting higher output and improved mining flexibility.

-

On the strategic front, Hindustan Copper signed an international MoU with CODELCO (Chile) in April 2025, focused on exchange of technical expertise and strengthening capabilities in exploration and mineral processing.

-

The company also signed an MoU in Feb 2025 with Madhya Pradesh State Mining Corporation and the Directorate of Geology & Mining, MP, to explore critical minerals including copper, aligning with the country’s broader critical minerals agenda.

-

To strengthen long-term capabilities across the value chain, Hindustan Copper has entered into MoUs with leading PSUs such as Coal India, IOCL, GAIL, and RITES, aimed at collaboration in exploration, extraction, refining, and production activities in India and overseas.

-

The company has also expanded its R&D ecosystem through MoUs with institutions like IIT (ISM) Dhanbad and CSIR-IMMT Bhubaneswar, supporting innovation in areas such as deep mining, beneficiation, and sustainable mining practices.

-

Reflecting its execution and performance momentum, Hindustan Copper has been rated “Excellent” by the Department of Public Enterprises (DPE) for FY24 performance against MoU parameters.

(K) Strengths & Weaknesses

Strengths

-

Financial performance is expected to remain healthy in FY26, supported by resilient copper prices, with LME copper averaging ~$9,663/MT (FY26 YTD) versus ~$9,367/MT (end-March 2025).

-

The balance sheet has strengthened significantly through deleveraging, with total debt reducing to ₹166.5 Cr (Mar’25) from ₹1,137.4 Cr (Mar’21).

-

Debt protection metrics remain very comfortable, with interest cover of 102.7x, total debt/OPBITDA of 0.2x, and DSCR of 14.2x in FY25.

-

HCL holds a unique strategic position as the only copper miner in India, with captive mines and integrated infrastructure such as beneficiation and rod manufacturing facilities.

-

The company has a strong long-term resource base of 755.32 Mn tonnes (as on April 1, 2024) and is targeting an increase in ore production capacity from ~4 MMT to ~12 MMT, which can support economies of scale over time.

Weaknesses

-

Profitability and cash flows remain exposed to the global copper price cycle, leading to volatility during downcycles.

-

The company has a large capex plan of ~₹2,000 Cr over the next 4–5 years, and the execution pace along with funding strategy remains a key monitorable.

-

Smelting and refining operations remain suspended due to cost disadvantages, and MIC sales volumes have stayed range-bound at ~24,000–26,000 MT over the last four years, making volume expansion important.

Drop us your query at – info@pawealth.in or Visit pawealth.in

References: Annual Reports, News Publications, Investor Presentations, Corporate Announcements, Management Discussions, Analyst Meets and Management Interviews, Industry Publications.

Disclaimer: The report only represents the personal opinions and views of the author. No part of the report should be considered a recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore