- About

- What are Global Asset Funds

- Basic Details

- Investment Strategy

- Classification Portfolio of the fund

- Fund Managers & Tenure of managing the Scheme

- Investment Details

- Returns Generated

- Risk Factors

- Investment Philosophy

- Taxability of Earnings

(A) About the Aryabhata Global Assets Fund

The Aryabhata Global Asset Fund is a component of the Aryabhata Global Assets Funds ICAV, an Irish collective investment vehicle regulated by the Central Bank of Ireland under UCITS rules. Additionally, the Aryabhata India Fund focuses on Indian equities, having a diverse portfolio that includes financial services, technology, and industrials. The fund, managed by skilled professionals such as Sunil Singhania, aims to provide capital appreciation as well as income. It is available to both retail and institutional investors and offers a variety of share classes with features such as income reinvestment and distribution.

(B) What are Global Asset Funds?

Global asset funds allow foreign citizens to invest in markets of other countries, such as India, using dollar-denominated investments. These funds are typically available internationally and accept investments in dollars or other foreign currencies. Investors don’t need to worry about currency conversion, as the fund manages the process of converting dollars into Indian rupees to invest in Indian markets. Any returns or income generated from these investments are converted back into dollars and credited to the investor’s account, making the entire process simple and convenient.

(C) Basic Details

| Fund Structure | An open-ended Article 8 UCITS sub-fund of Aryabhata Global Assets Funds ICAV |

| Launch & Start Date | 03-Aug-2023 |

| Reference currency | USD, GBP, EURO, CHF, JPY, AUD, SGD, AED |

| Type | Open-ended |

| AUM | $ 78.6 Mn (As on 29 Nov 2024) |

| Available at NAV of | $ 14.9 (As on 29 Nov 2024) |

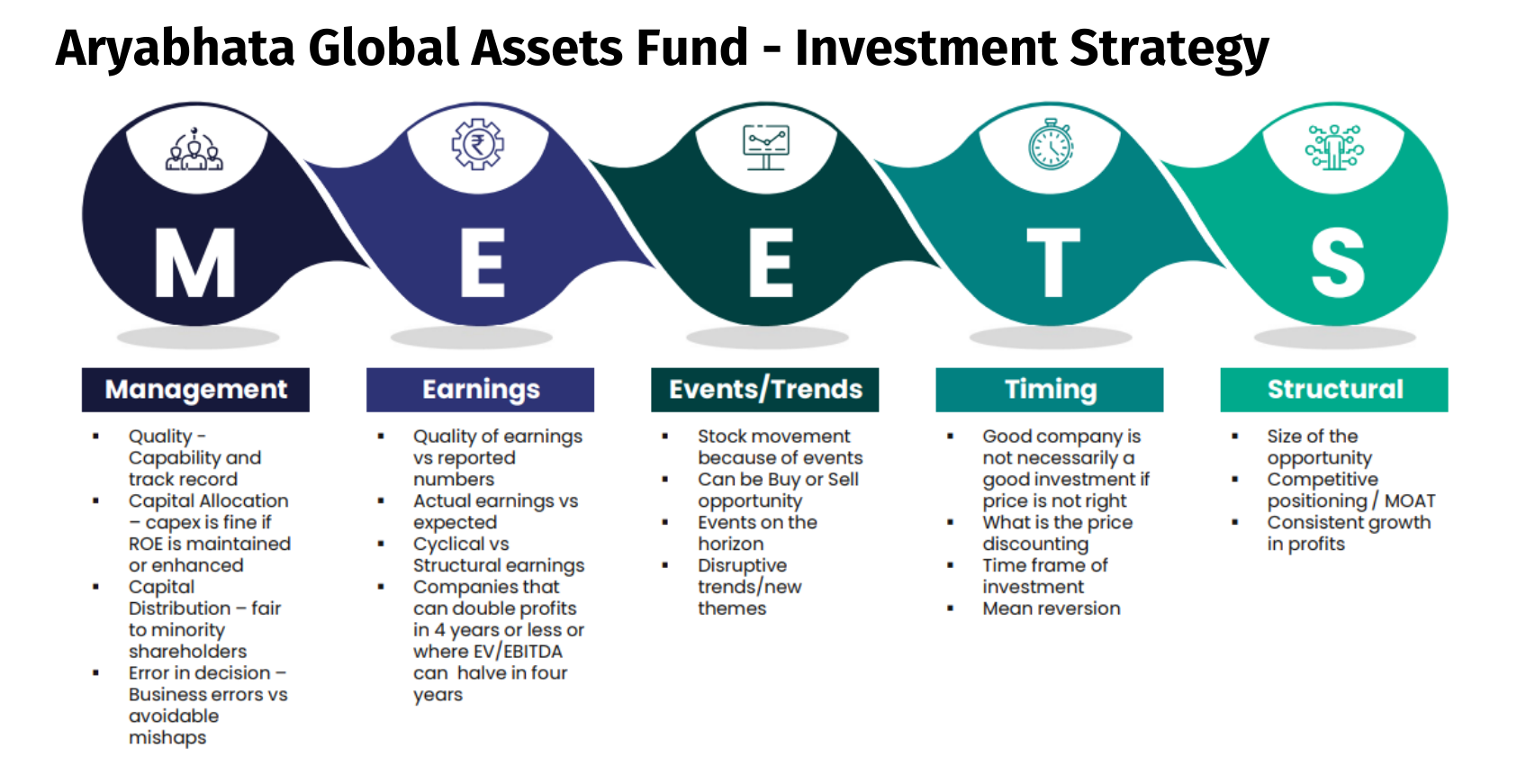

(D) Investment Strategy

(E) Classification Portfolio of the fund

(i) Portfolio Mix by Market Cap Size

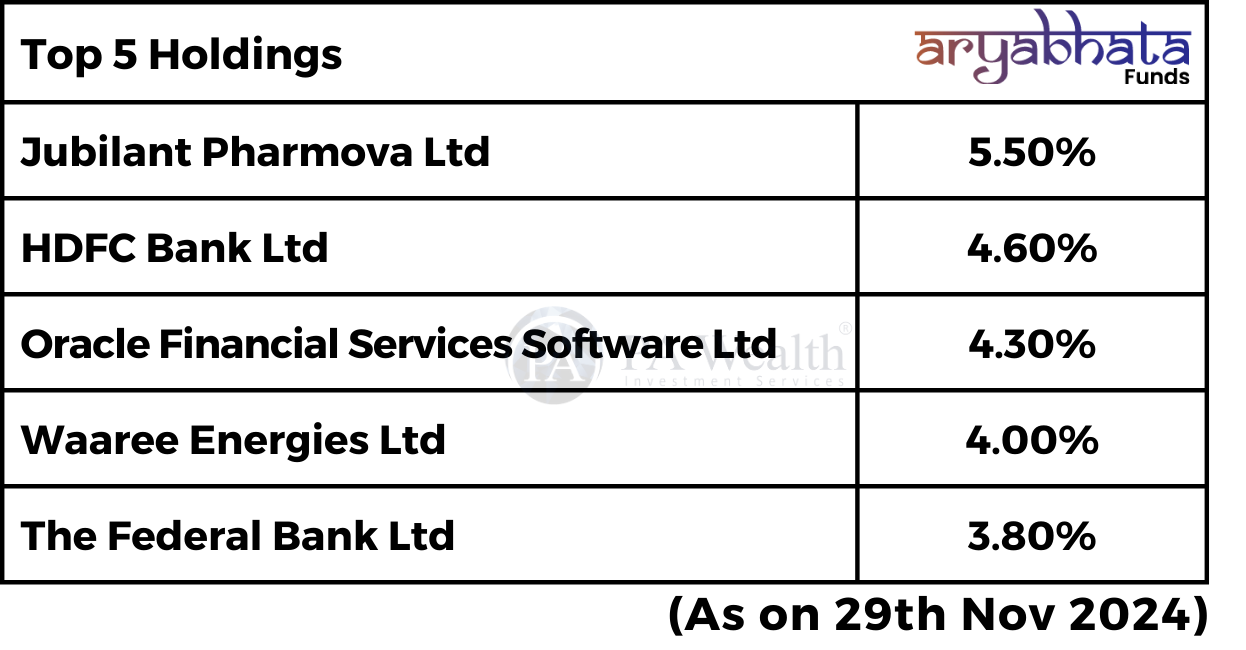

(ii) Top 5 Holdings of the fund

(iii) Top 5 Sectors Exposures

(D) Fund Managers & Tenure of managing the Scheme

(E) Aryabhata Global Assets Fund – Investment Details

| Aryabhata Global Asset Fund | |

|---|---|

| Application Amount for fresh Subscription (Lumpsum) | $150K USD |

| Exit load | No |

| Lock In | No |

| Expense Ratio | 1.5% p.a. (As on 29 Nov 2024) |

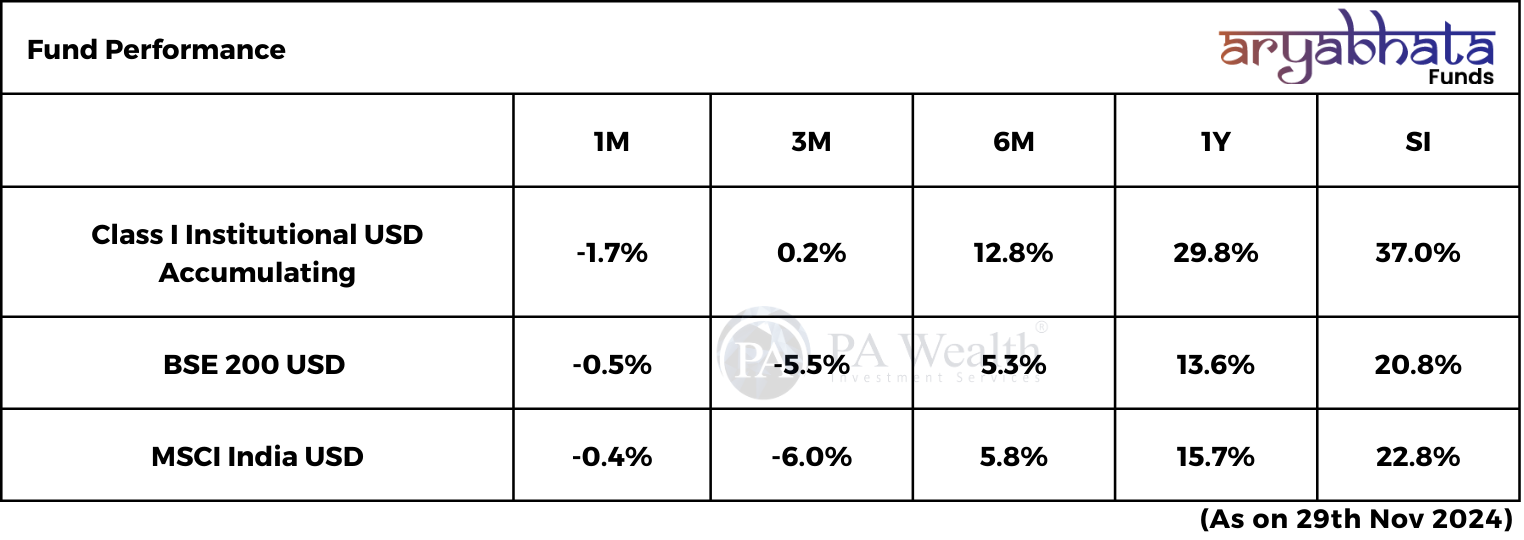

(F) Returns Generated By Aryabhata Global Assets Fund

(G) Risk Factors

(H) Investment Philosophy of Aryabhata Global Assets Fund

- Value-conscious long-only style of investing in Indian equities having robust business models and earnings growth.

- Aryabhata India Fund aims to achieve returns through capital appreciation and/or income from equity holdings of Indian companies.

(I) Taxability on earnings

Taxation

Taxation for overseas funds depends on the investor’s home country, with applicable rates based on their domestic tax laws.

Drop us your query at – info@pawealth.in or Visit pawealth.in

References: valueresearchonline.com, Industry’s Publications, News Publications, Mutual Fund Company.

Disclaimer: The report only represents personal opinions and views of the author. No part of the report should be considered as recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore