Thematic funds, designed to capitalise on specific economic, technological, or social developments, have received substantial attention among investors. These funds provide the appeal of matching investments with captivating storylines and burgeoning sectors. However, it’s necessary to approach them with a well-informed strategy as they are inherently cyclical in nature and may lead to inconsistent returns for the overall portfolio.

(A) Understanding Thematic Funds

Unlike sector funds concentrating on a single industry, thematic funds invest across multiple sectors unified by an overarching theme. For instance, a consumption-themed fund might include holdings in FMCG, consumer durables, pharma, and leisure industries. This broader scope aims to leverage long-term trends that span various facets of the economy.

(B) Recent Trends in India

Recently, The Indian market hosted over 130 sector and thematic fund schemes. In 2024 alone witnessed inflows of over ₹1.4 Lakh crores into the thematic and sector funds category, spurred by multiple new fund launches focusing on diverse themes such as healthcare, defence, infrastructure and logistics, quant strategies, innovation, and manufacturing. These new funds collectively attracted Lakhs of Crores, indicating robust investor interest.

(C) The Challenges of Timing and Selection

Investing in thematic funds requires precision in several areas:

- Identifying a Viable Theme: Investors must discern whether a theme is not only current but also sustainable in the long term.

- Selecting the Right Fund: It’s essential to choose a fund with a portfolio that effectively captures the potential of the chosen theme.

- Timing Entry and Exit: Determining the optimal moments to invest and divest is critical, as thematic funds can exhibit significant volatility.

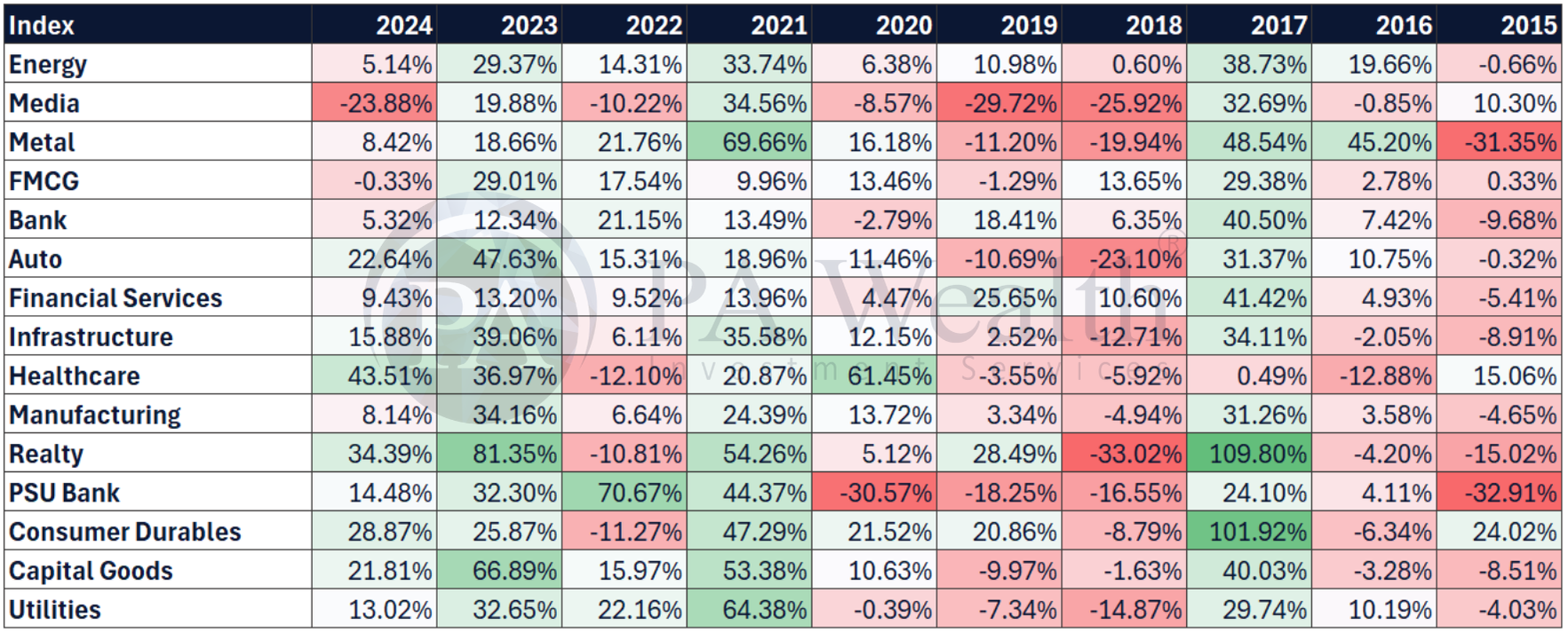

Historical data underscores these challenges. For example, the Realty Index in India delivered a remarkable 109% return in 2017, attracting substantial investments. However, the next year it declined by 33% in 2018. While there was a rebound in 2019, returns in the following years were inconsistent, highlighting the volatility in such investments.

(D) Considerations for Investors

For Investors contemplating thematic funds, it’s advisable to:

- Limit Exposure: Allocate a modest portion of the portfolio to thematic funds to mitigate potential volatility.

- Conduct Thorough Research: Assess the fund’s portfolio, expense ratios, and alignment with the chosen theme.

- Define an Exit Strategy: Establish clear criteria for exiting the investment, whether based on target returns or changes in the thematic landscape.

- Prepare for Volatility: Recognize that thematic funds can experience significant fluctuations and be prepared for potential downturns.

(E) Conclusion

While thematic funds offer the potential for substantial returns by tapping into emerging trends, they come with heightened risks and require astute investment strategies. Investors should approach these funds with caution, ensuring they complement a well-diversified portfolio and align with their overall investment objectives.

Drop us your query at – info@pawealth.in or Visit pawealth.in

References: valueresearchonline.com, Industry’s Publications, News Publications, Mutual Fund Company.

Disclaimer: The report only represents personal opinions and views of the author. No part of the report should be considered as recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore