JSW Cement is one of India’s leading green cement manufacturers, known for its rapid growth and sustainable practices. With a strong presence in blended cement and GGBS, it ranks among the top 10 players in the industry. Moreover, it holds an 84% market share in GGBS and continues to innovate in eco-friendly production. As a result, its CO₂ emissions are significantly lower than both Indian and global averages.

- About

- Industry Overview

- Journey

- Board of Director

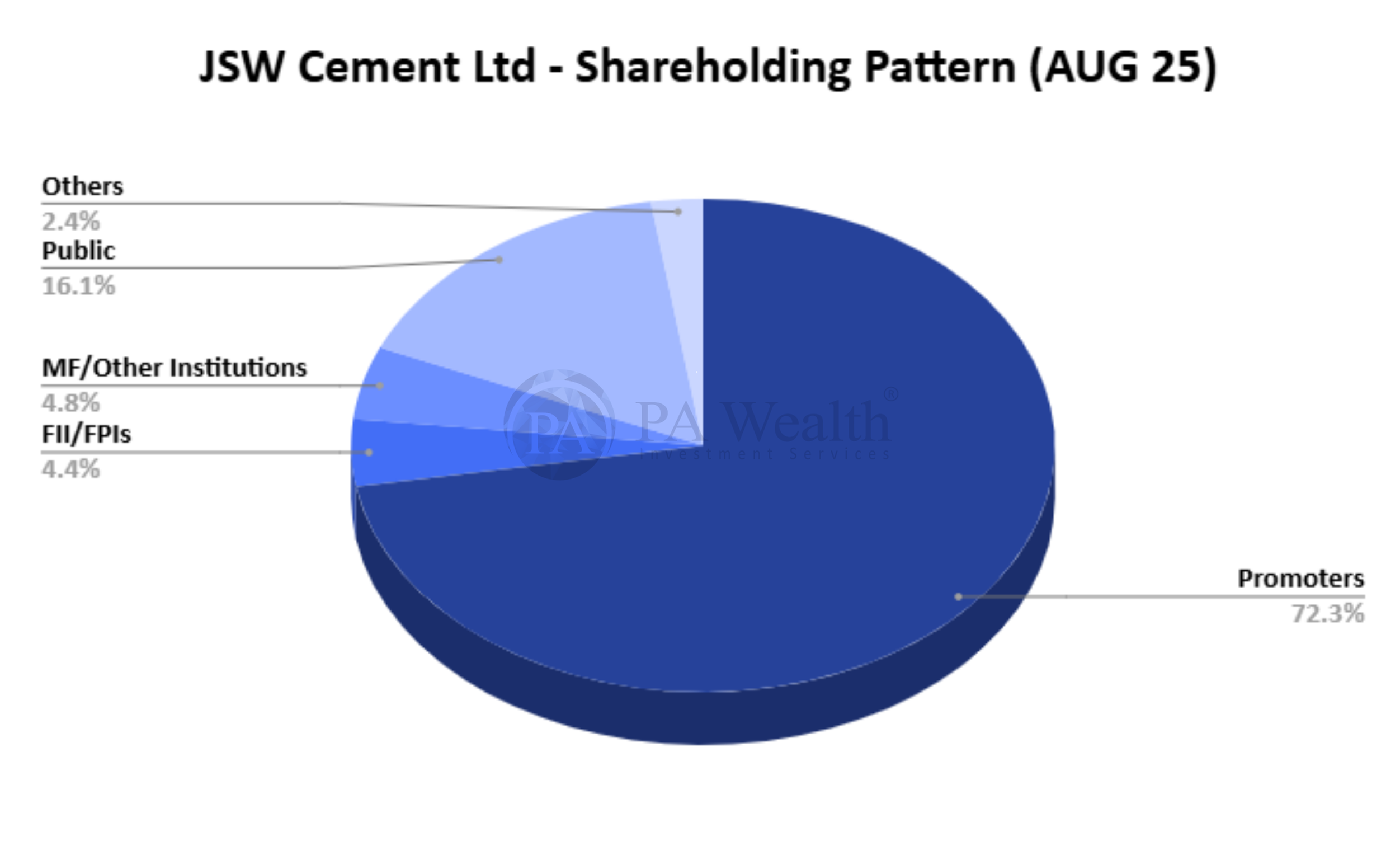

- Shareholding Pattern

- Business Segments

- Revenue Segments

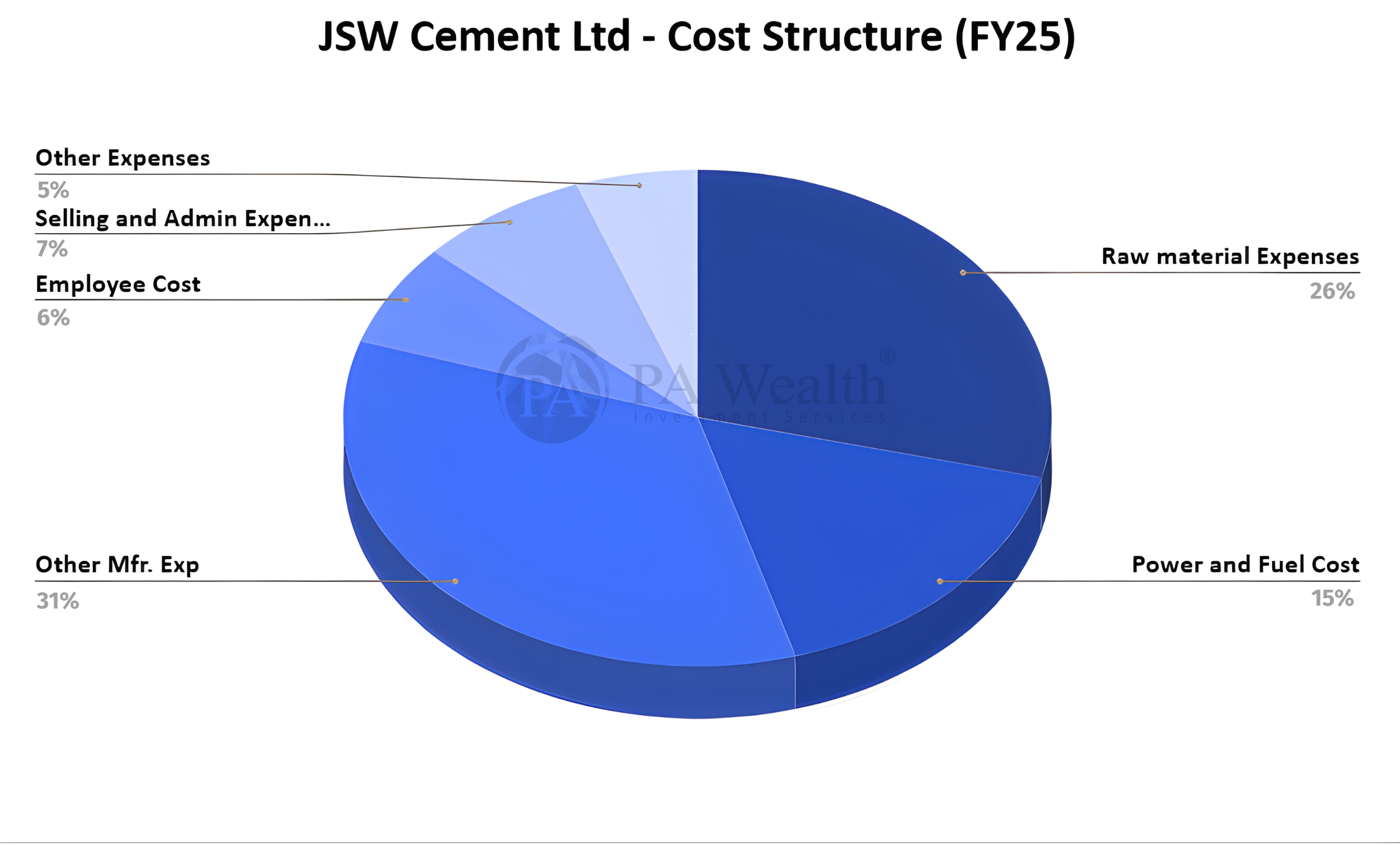

- Cost Structure

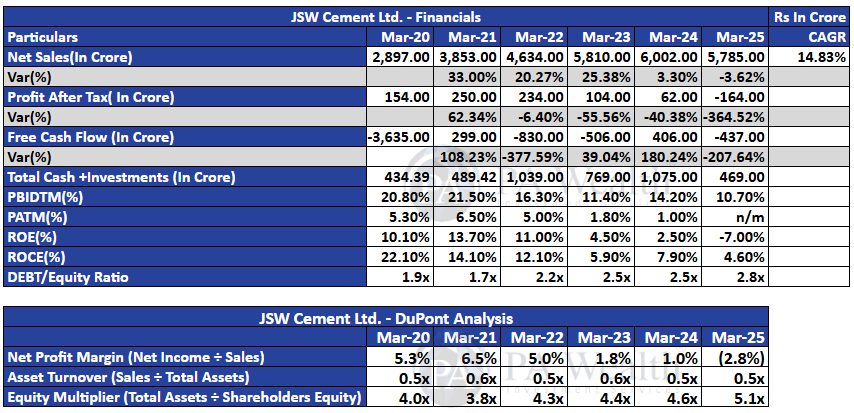

- Financials

- Management Discussion & Concall

- Strengths & Weaknesses

(A) About JSW Cement Ltd. | Stock Analysis

JSW Cement Limited, a part of the JSW Group, is one of India’s fastest-growing cement companies, committed to producing sustainable and high-performance building materials. Established with a vision to drive eco-friendly growth, the company offers a diverse portfolio including cement, ground granulated blast furnace slag (GGBS), and premium blended products that deliver strength, durability, and lower carbon footprint. With state-of-the-art manufacturing facilities, a strong focus on cost efficiency, and industry-leading green practices, JSW Cement is empowering infrastructure development while shaping a sustainable future for the construction sector in India and abroad.

(B) Industry Overview

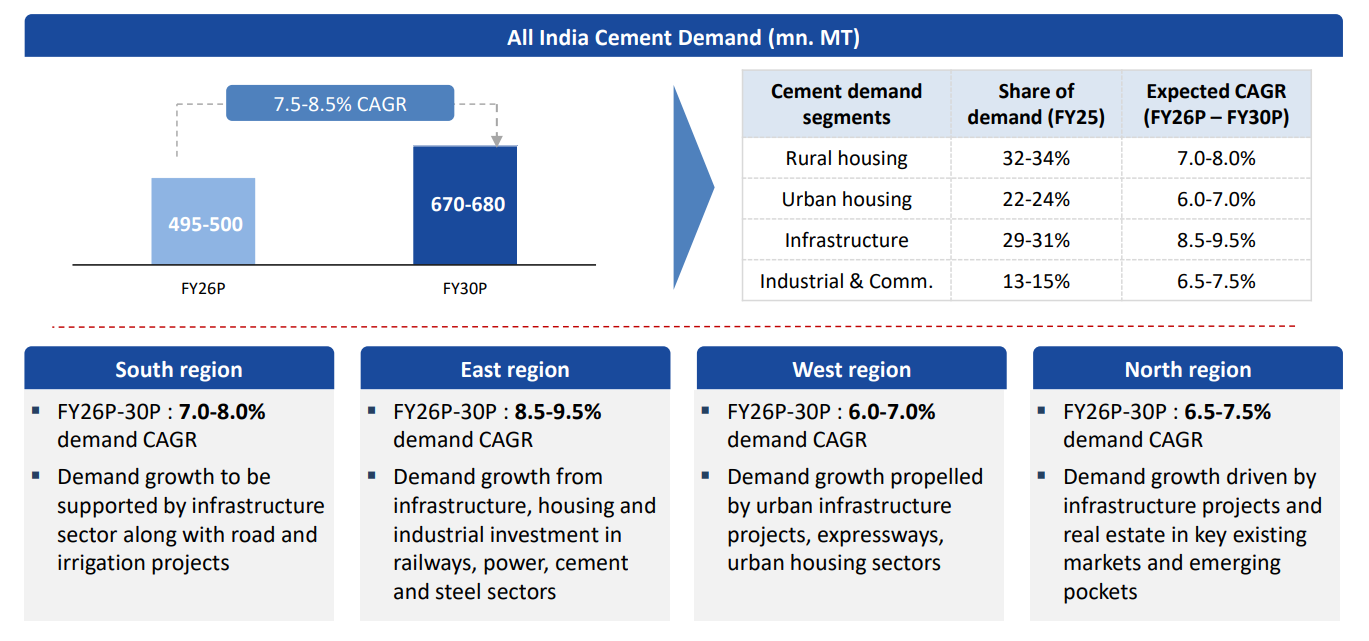

- To begin with, India’s cement demand is projected to grow from 495–500 mn MT in FY26 to 670–680 mn MT in FY30, implying a 7.5–8.5% CAGR.

- Moreover, demand is well-diversified across segments – rural housing (32–34%), urban housing (22–24%), infrastructure (29–31%), and industrial & commercial (13–15%).

- Importantly, infrastructure leads the way with the highest CAGR of 8.5–9.5%, supported by government spending on roads, railways, and power.

- In addition, rural housing demand is expected to grow at 7–8% CAGR, driven by improving affordability and housing schemes.

- On the other hand, urban housing is set for steady growth at 6–7% CAGR, reflecting rising urbanization and real estate activity.

- At the same time, industrial & commercial demand is projected to grow at 6.5–7.5% CAGR, supported by capacity additions in core industries.

- Region-wise, the east is expected to witness the fastest growth (8.5–9.5% CAGR) on the back of infrastructure, housing, and industrial investments.

- Meanwhile, the south is projected to grow at 7–8% CAGR, aided by road and irrigation projects.

- In comparison, the west is likely to expand at 6–7% CAGR, driven by urban infrastructure and expressways.

- Finally, the north region will grow at 6.5–7.5% CAGR, supported by infrastructure projects and real estate in both existing and emerging markets.

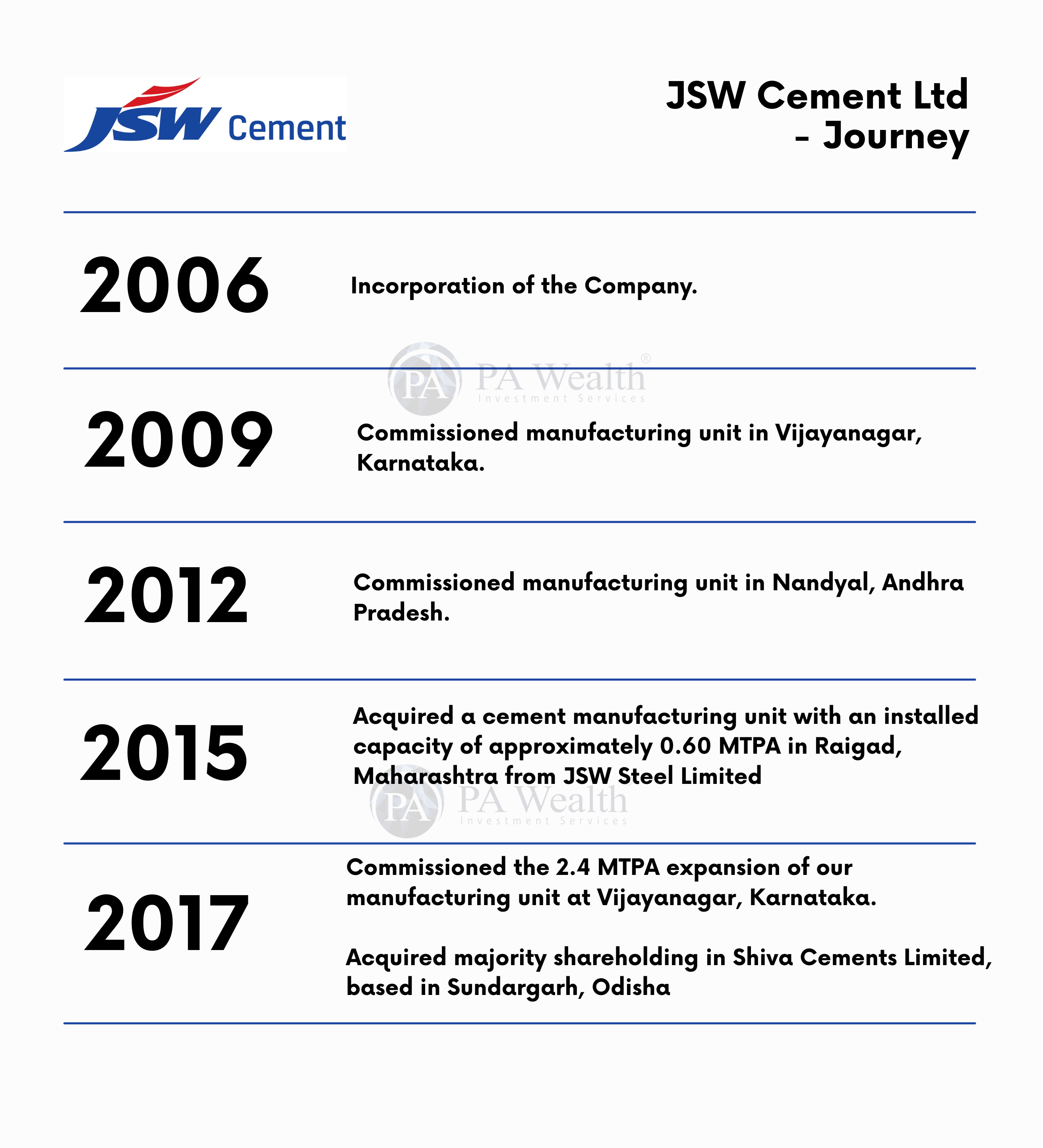

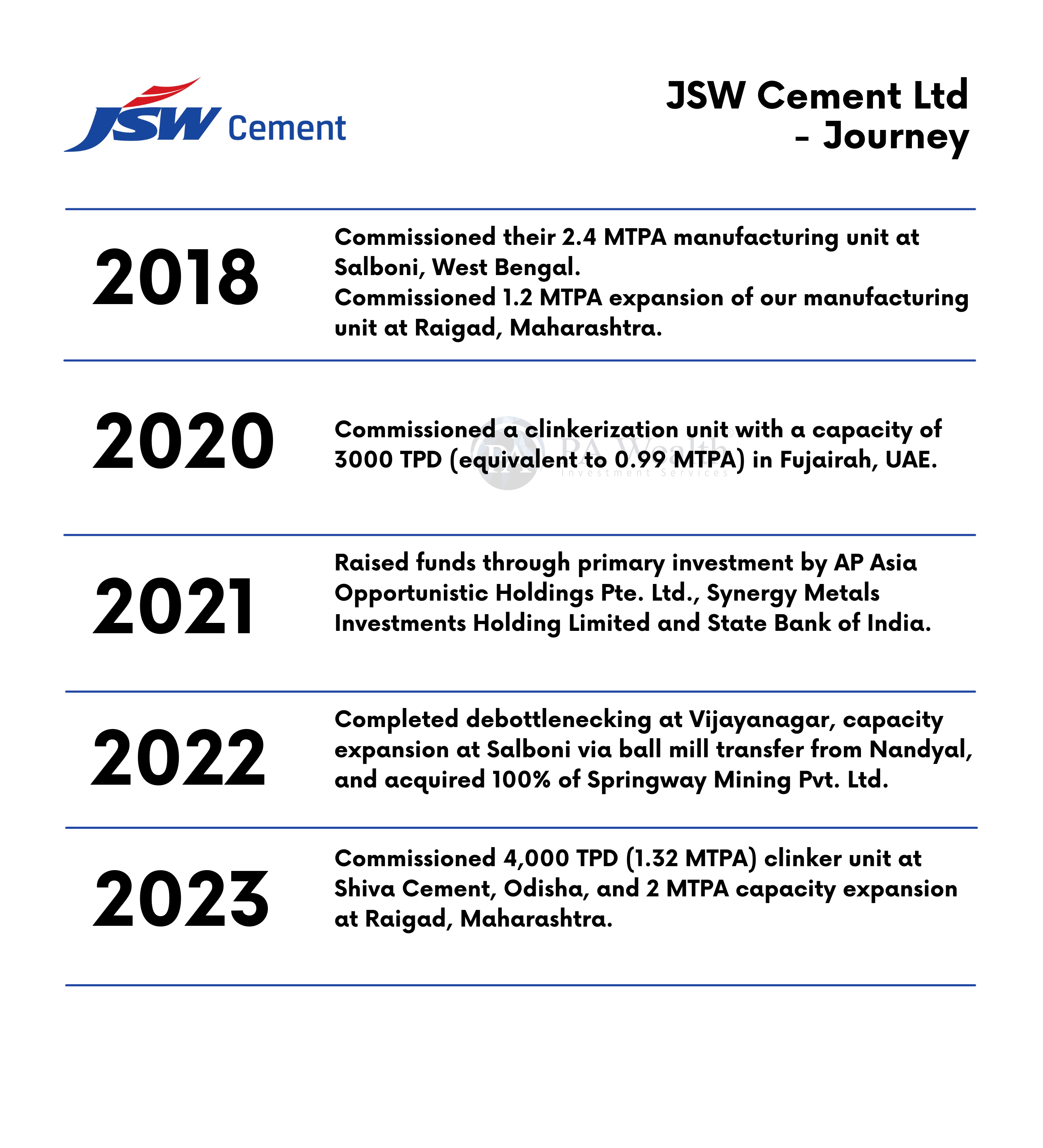

(C) Journey

(D) Board of Directors of JSW Cement Ltd.

(E) Shareholding Pattern of JSW Cement Ltd.

(F) Business Segments of JSW Cement Ltd. | Stock Analysis

1. Cement

JSW Cement produces a wide range of blended cements, including Portland Slag Cement (PSC), Portland Pozzolana Cement (PPC), and Ordinary Portland Cement (OPC). These products are designed to deliver superior strength, durability, and sustainability. Cement continues to be the company’s largest revenue contributor, catering to residential, commercial, and large-scale infrastructure projects

2. Ground Granulated Blast Furnace Slag (GGBS)

Derived from JSW Steel’s blast furnace operations, GGBS is a high-quality cementitious material used both as a standalone product and in blended cements like PSC and PCC. By improving the strength, workability, and durability of concrete, GGBS has become increasingly popular in Ready-Mix Concrete (RMC) and infrastructure projects. It also supports JSW Cement’s mission of promoting eco-friendly construction.

3. Clinker

JSW Cement manufactures clinker by burning limestone and clay at high temperatures, which is then ground to produce cement. Clinker serves as a critical intermediate product and is a backbone of the company’s production process. Its efficient clinker-to-cement ratio is among the lowest in the industry, reinforcing JSW Cement’s leadership in sustainability and cost efficiency.

4. Allied Cementitious Products

The company also offers a growing range of allied products, including Ready-Mix Concrete (RMC), screened slag, and construction chemicals. These value-added solutions expand JSW Cement’s portfolio beyond traditional cement, enabling it to meet the evolving needs of builders and contractors while creating additional revenue streams.

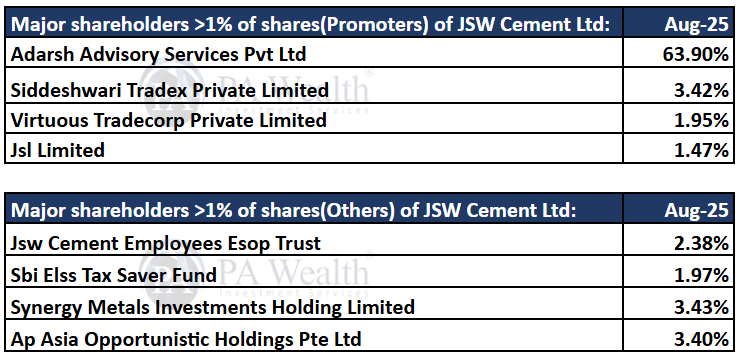

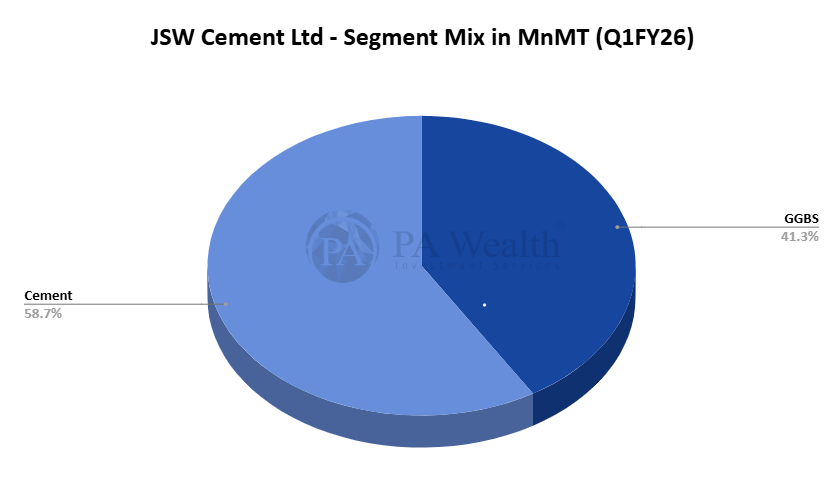

(G) Revenue Segments of JSW Cement Ltd. | Stock Analysis

(i) Segment Wise Revenue

(ii) Cement & GGBS Realization

(H) Cost Structure of JSW Cement Ltd.

(I) Financials of JSW Cement Ltd.

- To start with, JSW Cement’s sales grew at a strong 14.8% CAGR (FY20–FY25), but profitability weakened, turning into a net loss of ₹164 crore in FY25.

- Moreover, margins declined, with PBIDTM falling from 20.8% in FY20 to 10.7% in FY25, reflecting sustained cost pressures.

- At the same time, rising capex led to negative free cash flows and higher leverage, with the debt-to-equity ratio increasing to 2.8x.

- Consequently, ROE dropped from 20.2% in FY20 to -6.8% in FY25, driven by weak margins despite steady sales growth.

(J) Management Discussion & Concall | Stock Analysis

- Cost optimization: Targeting ₹400/ton savings over two years, with half already achieved via renewable energy, AFR, and logistics efficiencies.

- Premiumization focus: Higher-value cement products and GGBS adoption drive better realizations.

- Efficiency leadership: Clinker-to-cement ratio at 51%, among the lowest in the industry, supporting sustainability.

- Strengthening the balance sheet: Post-IPO debt reduction plans aim to bring net debt-to-EBITDA to 2–2.5x.

- Sustainability at the core: Lowest CO2 emission intensity (277 kg/ton) among Indian and global peers.

- Infrastructure and Housing Push: Rising government spending on housing schemes like PMAY-G and large infrastructure projects such as roads, railways, and metros is boosting cement demand, with eastern India expected to grow 6.5–7.5% in FY26 and southern India at a 7–8% CAGR till FY30.

- Growing demand for GGBS: Demand for GGBS, used to enhance concrete strength and durability, is projected to rise from 6.2 million tonnes in FY25 to 11.9–12.5 million tonnes by FY30, growing at a 14–15% CAGR, driven by higher adoption in southern and western India.

- Proposed capacity expansion: The company plans to increase installed grinding capacity by 103.16% from 20.60 MMTPA to 41.85 MMTPA and clinker capacity by 102.48% from 6.44 MMTPA to 13.04 MMTPA through a mix of greenfield and brownfield projects across multiple regions, including Rajasthan, Punjab, Odisha, Karnataka, Maharashtra, Madhya Pradesh, and Uttar Pradesh, adding 6.60 MMTPA of clinker and 21.25 MMTPA of grinding capacity.

Growth Outlook

- Capacity expansion is central: Grinding to reach 41.85 MTPA and clinker 13.04 MTPA by 2028, boosting scale and market share.

- Strong demand prospects: Cement consumption expected to grow 6.5–7.5% CAGR, led by infrastructure, housing, and industrial segments.

- Premium products add resilience: RMC, screened slag, and construction chemicals support higher margins.

- Green leadership is a key advantage: Eco-friendly solutions appeal to customers and satisfy regulatory requirements.

- Strategic combination for growth: Scale, efficiency, premiumization, and sustainability position JSW Cement for long-term success.

Q1 FY26 Concall Highlights

- Volumes rose 7.8% YoY to 3.31 MT, led by cement (+10%) and GGBS (+5%), outperforming regional industry growth.

- Revenue grew 8% YoY to ₹1,560 crore, while EBITDA jumped 39% YoY to ₹323 crore, driven by better realizations and cost savings.

- Trade mix and utilization: Trade mix at 52%, premium share 57%, clinker utilization 87%, and grinding utilization 62%.

- Capacity expansion underway: Sambalpur grinding unit to start in Q2 FY26; Nagaur integrated unit later this fiscal, boosting near-term growth.

- Profit metrics: Adjusted PAT at ₹100 crore; reported PAT impacted by a non-cash CCPS fair value adjustment.

- Management has provided a medium-term profitability guidance of Rs 1,150–1,200 per tonne and is optimistic about surpassing 15.5 million tonnes in volume.

(K) Strengths & Weaknesses

Strengths

1. Vertical Integration with JSW Group

JSW Cement benefits from its affiliation with the JSW Group, gaining access to raw materials like slag from JSW Steel and power from JSW Energy. This integration provides cost advantages and input stability, enhancing operational efficiency.

2. Leadership in Green Cement Production

As India’s largest producer of Ground Granulated Blast Furnace Slag (GGBS), JSW Cement commands an 84% market share in FY25. Its commitment to sustainability is evident, with a clinker-to-cement ratio of 51% and CO₂ emissions of 258 kg/tonne, both among the lowest in the industry.

3. Strategic Capacity Expansion

Grinding capacity is set to reach 41.85 MTPA and clinker 13.04 MTPA by 2028, significantly boosting scale, market share, and growth potential.

Weaknesses

1. R&D Risk

High R&D spend (₹0.34 crore in FY25) may not yield cost reduction; success depends on alternate fuel availability.

2. IT & Cybersecurity Risk

Systems are vulnerable to outages, hacks, or data breaches, affecting operations and reputation.

3. Contingent Liabilities

Unprovided liabilities (₹111.33 crore in FY25) from taxes, duties, or royalties could impact finances. finances.

4. Forex & Acquisition Risk

Exchange rate fluctuations and integration of acquisitions may increase costs or disrupt operations.

Drop us your query at – info@pawealth.in or Visit pawealth.in

References: Annual Reports, News Publications, Investor Presentations, Corporate Announcements, Management Discussions, Analyst Meets and Management Interviews, Industry Publications.

Disclaimer: The report only represents the personal opinions and views of the author. No part of the report should be considered a recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore

💡 Liked this analysis?

Stay updated with more market insights & wealth strategies from PA Wealth.

✉️ Contact Our Experts Today