Negen Undiscovered Value Fund focuses on special situations, anchor book investments, and pre-IPOs, aiming to capitalize on high-growth opportunities. Through disciplined research and strategic value creation, the fund seeks to deliver superior risk-adjusted returns while investing in businesses undergoing transformation, restructuring, or early-stage growth before public listing.

- About

- Basic Details

- Investment Framework

- Classification Portfolio of the fund

- Fund Managers & Tenure of Managing the Scheme

- Investment Details

- Returns Generated

- Taxability of Earnings

(A) About the Negen Capital

Negen Capital, founded by Neil Bahal, is a Mumbai-based investment firm specializing in Portfolio Management Services (PMS) and Alternative Investment Funds (AIFs). The firm focuses on sustainable value creation through growth investing and special situation investing, particularly in small-cap and mid-cap segments.

(B) Basic Details of Negen Undiscovered Value Fund

| Fund Structure | AIF CAT III |

| Launch & Start Date | May, 2023 |

| Type | Open-ended |

| Current Pre-Tax NAV (For Class A1) | ₹199.56 (As on 31st Dec, 2024) |

| Min. Investment | ₹1 Cr (As on 31st Dec, 2024) |

| AUM | ₹544.04 Cr (As on 31st Dec, 2024) |

| Strategy | Special Situation, Pre-IPOs |

(D) Investment Framework

- Special Situations Investments: The Fund seeks investment opportunities in special situations such as management change, spin-offs, distressed assets, turnaround opportunities, and restructuring scenarios which often offer the potential for value creation and attractive risk-adjusted returns.

- Anchor Book Investments: The fund actively looks to participate in the anchor book portion of IPOs. These are generally subscribe to a lesser extent than the Non-Institutional Investor (NII) and Retail Individual Investor (RII) portions. This provides them the access to new issuances and allow the fund to potentially benefit from price appreciation when the shares are listed on the stock exchange.

- Pre-IPOs: The fund looks for opportunities to invest in the SME-Pre IPOs, which allows them to participate in the growth potential of companies before they become publicly listed. By identifying promising companies at this growth stage, aims to capture the value appreciation that may occur upon their IPOs.

- Other Investment Strategies: In addition, the fund will also do regular value investing from time to time where it looks to buy good quality businesses below their perceived fair value.

(E) Classification Portfolio of the Negen Undiscovered Value Fund

(i) Portfolio Exposure

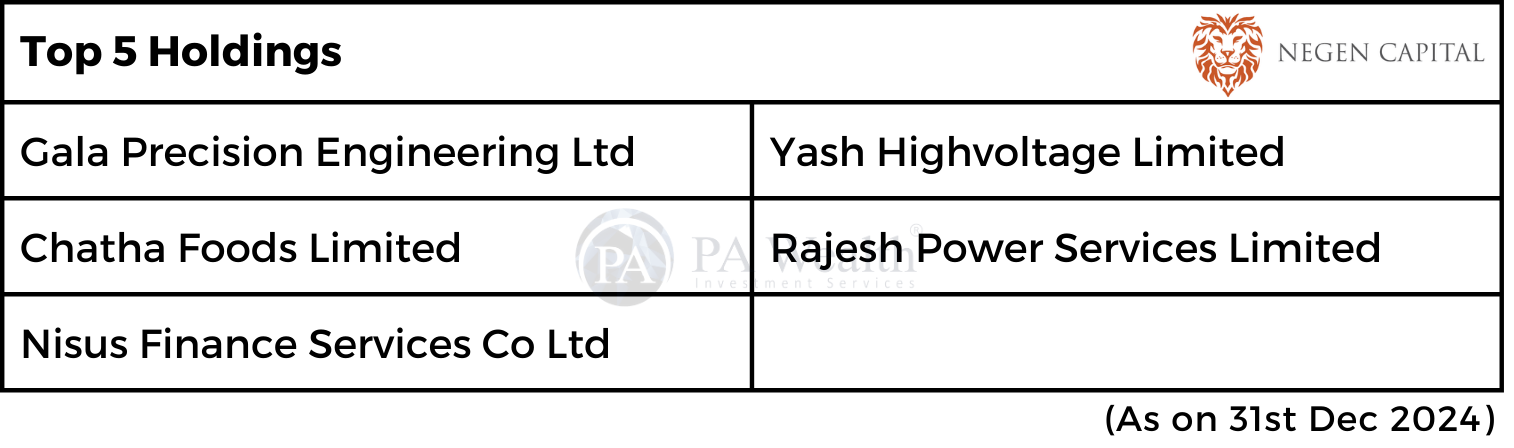

(ii) Top 5 Holdings of the fund

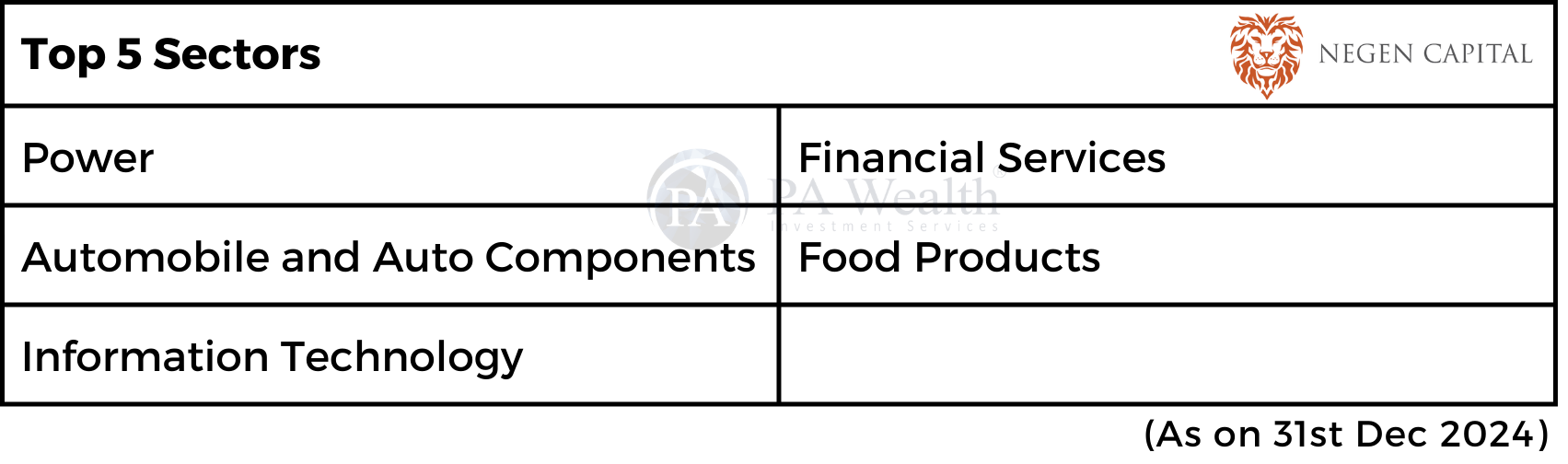

(iii) Top 5 Sectors Exposures

(D) Fund Managers & Tenure of managing the Scheme

(E) Negen Undiscovered Value Fund – Investment Details

| Fee Structure | |

|---|---|

| Investment Management Fee | 1.1%* p.a. of Avg Daily NAV |

| Performance Fee (Profit Sharing) | 11%* p.a. on Pre-tax NAV with Highwater Mark |

| Fund Expenses | ~0.15%-0.20% of Contributed Value |

| Lock in Period & Exit Load | |

|---|---|

| Within 12 months | Locked In |

| Between 12 months to 24 months | 1% |

| Between 24 months to 36 months | 0.5% |

| After 36 months | Nil |

(F) Returns Generated By Negen Undiscovered Value Fund

(G) Taxability on earnings

In CAT III AIF taxation is paid at the Fund level.

Drop us your query at – info@pawealth.in or Visit pawealth.in

References: PMS Bazaar, Industry’s Publications, News Publications, PMS Company.

Disclaimer: The report only represents personal opinions and views of the author. No part of the report should be considered as recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore