Poly Medicure Ltd (POLYMED) operates in the healthcare industry & engaged in the development, manufacturing and marketing of Disposable Medical Devices. The company manufactures medical devices used in Infusion therapy, blood management, gastroenterology, surgery & wound drainage, anesthesia and urology. Polymed is one of the largest exporters of the medical devices from India.

Quick Links. Click to read the detailed paragraph.

- Executive Management of Polymed

- Shareholding Pattern of Poly Medicure

- Brief History of Polymed

- Products of Polymed

- Revenue classification of Poly Medicure

- Manufacturing Facilities & Capacity of Polymed

- Cost Structure of Poly Medicure

- Group Structure of Polymed

- Competitive Advantage of Polymed

- Competitors of Polymed

- Issues/Lawsuits of Poly Medicure

- Key Raw Materials used by Poly Medicure

- Distribution Network of Poly Medicure

- Polymed Research & Development

- Recent Financial Performance of Poly Medicure

- Brief on Medical Devices Industry in India

About the Executive Management

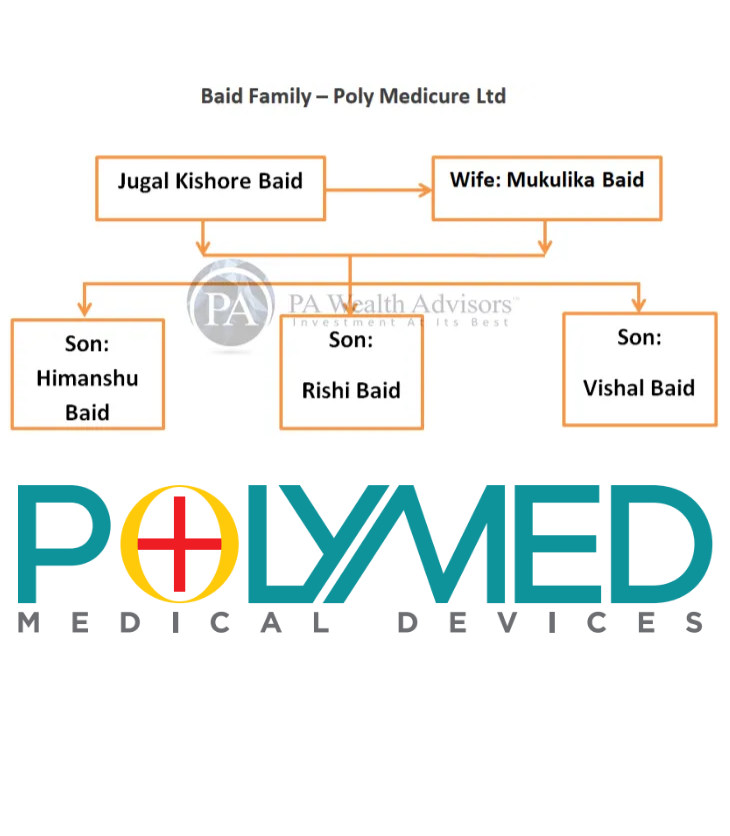

Mr. Jugal Kishore Baid, Mr. Himanshu Baid, Mr. B R Mehta and Mr. Rishi Baid incorporated Poly Medicure Ltd in the year 1995.

- Mr. Jugal Kishore Baid - Non Executive Director (Age 77 years): one of the promoters of the company. He is B.Sc in Mechanical Engineering from Birla Institute of Technology, Mesra, Ranchi.

- Mrs. Mukulika Baid - Non Executive Director (Age 69 years): Ms. Mukulika holds a bachelor degree in arts from Jodhpur National University and she is on the company board from July 30, 2014.

- Mr. Himanshu Baid - Managing Director (Age 51 years): Mr. Himanshu holds a bachelor’s degree in engineering (electronics and communication) from Karnatak University, Dharwad. His remuneration for FY19 is INR 4.43 crore with an increase of 7% over FY18. He is also a chairman of CII Medical & Technology Division.

- Mr. Rishi Baid - Executive Director (Age 47 years): Mr. Rishi holds a Bachelor of Science degree in mechanical engineering and a master’s degree of science in mechanical engineering from West Virginia University, USA. His remuneration is INR 4.32 crore for FY19, an increase by 6% from FY18.

- Mr. Vishal Baid – President – Sales/Marketing (Age 69 years): Mr. Vishal is a Chartered Accountant by Qualification. He is withdrawing salary of INR 53.04 Lakhs.

- Mr. Devendra Raj Mehta - Chairman (Age 82 years): He is also the chairman of JMC Projects India Ltd. and on the board of 13 other companies.

Click to enlarge the image

Shareholding Pattern

Promoters of the company ‘Baid Family’ hold the main stake in company promoter category. Institutional holding comprises foreign portfolio investors holding 3.68% of shares. Click to enlarge the image.

Brief History

1995:

Mr. Jugal Kishore Baid, Mr. Himanshu Baid, Mr. B R Mehta & Mr. Rishi Baid incorporated Poly Medicure Ltd.

1996:

Poly Medicure made a public issue of 22,50,000 equity shares.

1997:

Poly Medicure started manufacturing at Faridabad plant.

2002:

Company entered into a Joint Venture in Egypt.

2004:

Company set up a 100% EOU & commercial production started the same year.

2006:

Poly Medicure acquired 75% stake in US Safety Syringes Inc.

2007:

Commencement of commercial production at Haridwar plant with installed capacity of the plant of 180 lakh units of health care disposables.

2008:

Company set up a subsidiary in China. Moreover, the company received supply order from UN for supply of blood bags of worth INR 7.4225 crore.

2009:

The company established a plant in China & commercial production also started in the year.

2011:

Received an order of single blood bags of INR 12.93 crore from Ministry of Health & family Welfare through Rites Ltd.

2014:

Shares of the company split from INR 10 per share to INR 5 per share. Also, company's Jaipur plant started production.

2017:

Company issued bonus shares in the ratio of 1:1.

2018:

During the year, company's operations started at IMT, Faridabad Plant. Wholly owned subsidiary of the company, Poly Medicure B.V., Netherlands, entered into a Share Purchase Agreement to acquire 100% shares of Plan1 Health s.r.l. Company immediately acquired 82%. This acquisition helped the company in Oncology and Vascular access devices.

2019:

Company acquired the remaining stake of Plan1 Health and it became indirect wholly owned subsidiary of the Poly Medicure.

Products Cassification

Infusion Therapy products and Blood management & blood collection system are the two main products of the company. Infusion therapy contributed around 68.60% to the turnover of the company in FY19. Blood management & blood collection system contributes 11.48% to FY19 revenue. There are more than 125 products in the portfolio of the company. Click to enlarge the image.

Revenue Breakup

Poly Medicure exports products to more than 110 countries. Company is supplying their products to Europe, Middle East and Latin America. Company's major revenue is from exports. Click to enlarge the image.

IV Cannula (Comes under Infusion Therapy category) contribution to the revenue of the company is 28%. Product wise revenue breakup: Click to enlarge the image.

Manufacturing Facilities

Polymed has 8 manufacturing facilities – 5 in India and 3 Overseas. In India, manufacturing facilities are located at Faridabad (3 Units), Jaipur (1 Unit) and Haridwar (1 Unit). Company has two wholly owned subsidiaries overseas - one in China and one in Italy. Poly Medicure has also one joint venture in Egypt.

Manufacturing Capacity

Company has capacity to produce 3 million medical devices per day. Company is planning to add another 0.5 million devices capacity per day in start of calendar year 2020.

Cost Structure

Click to enlarge the image.

Group Structure

Click to enlarge the image.

Competitive Advantage

- Company is doing business in this field for more than 20 years.

- Company has developed a good portfolio of products.

- At present company has 125 products in its portfolio.

Acquisition of Plan1 Health SRL:

With the acquisition of Plan1 health s.r.l., an Italy based manufacturing company. As a result, Polymed now has access to new technology in Oncology and Vascular Access devices and opens more opportunities with the acquired company’s worldwide customer base. Plan1 Health products adhere to the highest quality standards in Europe and are synergetic with the Company’s product portfolio.

Focus on R&D and innovation:

Polymed has developed the technology to create moulds internally with strong R&D team comprising of 50+ engineers and 30+ engineers in process engineering. The company operates a research and development centre at Faridabad, Haryana, which is approved by Department for Scientific & Industrial Research and by the Ministry of Science & Technology, Government of India. R&D is primarily focused on developing new products within existing as well as new critical care product verticals and further improving existing processes and productivity. Thus, company’s focus is on increasing its R&D. Also, Polymed plans to increase R&D spend to 5% of revenue & commercializing new innovative products.

Due to COVID-19 - Coronavirus pandemic, companies like Poly Medicure Ltd can have increase in demand ahead due to increased health issue cases.

Competitors

- Company faces competition from the global players in International market.

- Global players in this field include Baxter, Becton Dickinson, B Braun and Boston Scientific.

- In Domestic market, there are players like Lars Medicure (in IV Cannula and Medical Disposable Devices), SPM Medicare, JIMIT Medico Surgical, Hindustan Syringes & Medical Devices Ltd.

- There is also lot of competition from other unorganized players.

- Moreover, 70% of the devices are imported from other countries.

Issues/Lawsuits

- Company won a patent fight with B. Braun Melsungen in June 2017 which started in 2009. The issue is over IV Catheters. Poly medicure claimed that their product is different from the B. Braun. European Patent Office (EPO) rejected the B. Braun claim. This could help Poly Medicure gain a firmer foothold European market.

- The promoter of the company is also involved in land case in Bikaner, Rajasthan. Robert Vadra, brother-in-law of Congress President Rahul Gandhi is mainly involved in the case.

- Company entered into a job work contract with Vitromed Healthcare in which promoters of the company are partners. Company gave that maximum amount of contract shall be INR 60 crore in FY19, INR 75 crore in FY20 and INR 90 crore in FY21. In FY19 the job work charges (related to Vitromed Healthcare) amount to 7.2% of sales of the company.

Raw Materials

- Key raw materials of the company include plastic granules, PVC sheet, SS tube and some other items.

- Plastic granules include PP, HDPE, LDPE, PC, SAD, PA, ABS and K. Resin.

- These are all crude derivatives.

- Moreover, majority of the raw materials of company are imported from other countries.

Distribution Network

Polymed has 25 super distributors, 10 authorized agents and more than 1300 dealers. Sales, marketing and product management team of the company has over 250 persons. Poly Medicure has also tie up with distributors in over 105 countries.

Research & Development

Click to enlarge the image.

Poly Medicure plans to increase its R&D spend to 5% of revenue.

Recent Performance

Click to enlarge the image.

Medical Devices Industry in India

We also published a detailed report on Medical Devices Industry in India, Click to Read - Medical Devices Industry in India : Sizeable & Scalable

- Medical devices industry in India has the potential to grow at 28% p.a. to reach $ 50 bn by 2025.

- There are 750–800 domestic medical devices manufacturers in India, with an average investment of $ 2.3–2.7 mn and an average turnover of $ 6.2–6.9 mn. Around 65% of the manufacturers are mostly domestic players operating in the consumables segment and catering to local consumption with limited exports.

- Diagnostic imaging, dental products, and consumables are expected to grow at a CAGR of 7.1%, 7.4% & 7.1%, respectively during 2015-20.

- Lastly, Orthopaedic prosthetics and patient aids segments to be the two fastest-growing verticals by 2020 and are projected to grow at a CAGR of 9.6% and 8.8%, respectively.

- Due to current outbreak of COVID-19 - Coronavirus pandemic, overall impact (negative or positive) on Indian healthcare industry is yet to unfold.

Drop us a mail at - info@pawealth.in or Visit pawealth.in

References: Annual Reports, News Publications, Investor Presentations, Corporate Announcements, Management Discussions, Analyst Meets & Management Interviews, Industry's Publications.

Disclaimer: The report only represents personal opinions and views of the author. No part of the report should be considered as recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Medical Devices industry is very expandable in future but much of it is dependent on imports today. Insightful article though.

Indeed it is and Thanks. Keep reading & sharing our blogs !